03 Nov 2023 Market Close & Major Financial Headlines: Wall Street Opens Moderately Higher, Dow Rises 300 Points After Quirky Jobs Report, Nasdaq Closes Sharply Up

Summary Of the Markets Today:

- The Dow closed up 222 points or 0.66%,

- Nasdaq closed up 1.38%,

- S&P 500 closed up 0.94%,

- Gold $1,999 up $5.40,

- WTI crude oil settled at $81 down $1.49,

- 10-year U.S. Treasury 4.570% down 0.099 points,

- USD Index $105.11 down $1.020,

- Bitcoin $34,492 down 1.20%,

- Baker Hughes Rig Count: U.S. -7 to 618 Canada unchanged at 196

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for November 2023

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

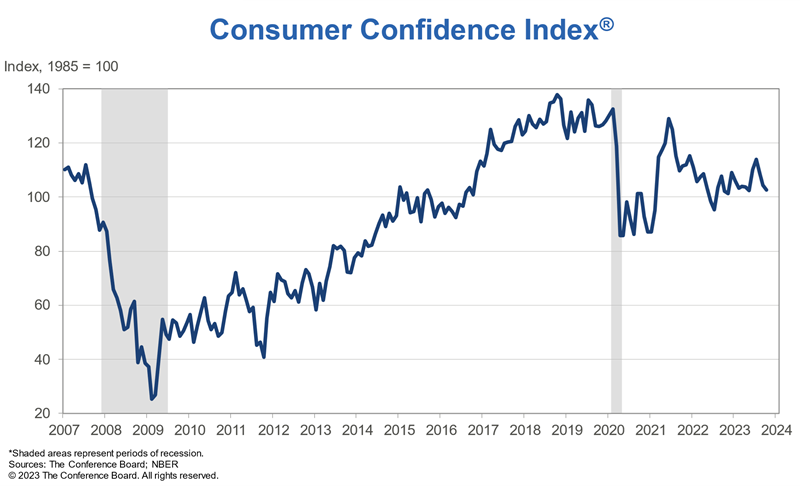

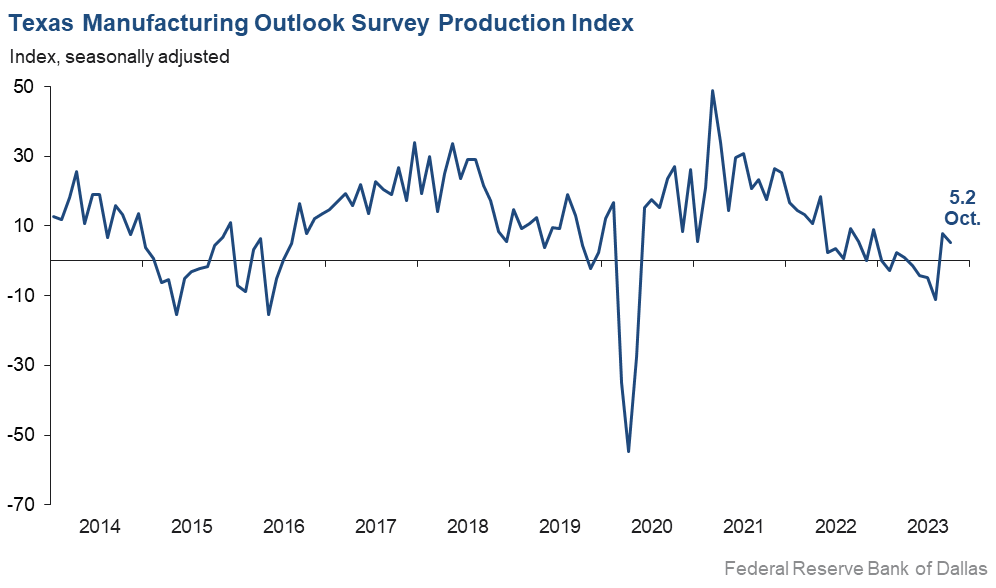

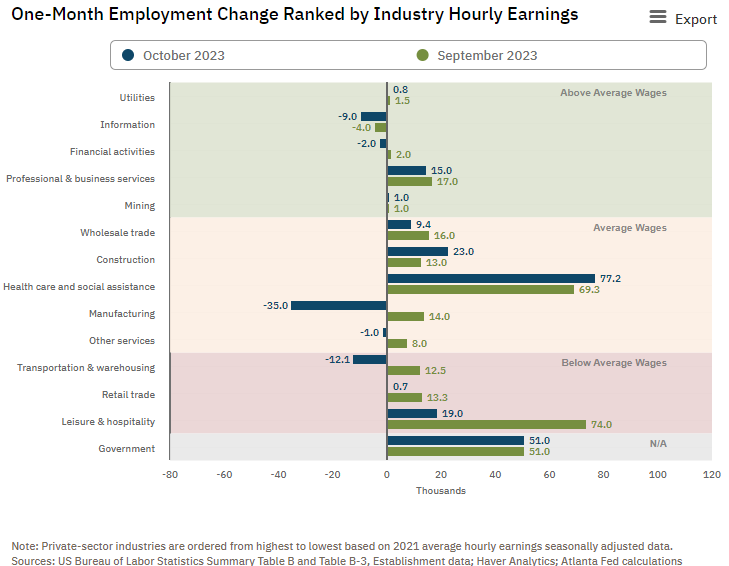

Total nonfarm payroll employment in the establishment survey increased by 150,000 in October 2023, and the unemployment rate (determined by the household survey) changed little to 3.9%. An employment gain of 150,000 is generally considered the minimum employment growth needed to support population growth. Job gains occurred in health care, government, and social assistance. Employment declined by 33,200 in manufacturing due to strike activity which is over now – so the real employment growth of the establishment survey should be +183,200. BUT the household survey says employment declined by 348,000 in October. This is a significant disconnect between the household and establishment surveys – and quite honestly, both numbers should be considered suspect. As far as the unemployment rate is concerned – the household survey says an additional 146,000 people were considered unemployed – and this is completely disconnected from the weekly BLS initial unemployment report which shows only 100,000 unemployment growth in October. Stepping back by analyzing year-over-year changes, regardless of data-gathering issues this month, employment growth continues to trend lower. The bigger surprise is that employment growth was 1.9% year-over-year (red line on the graph below) whilst weekly hours worked only gained 0.9% year-over-year (blue line on the graph below). The weak growth of hours worked suggests a very soft labor market.

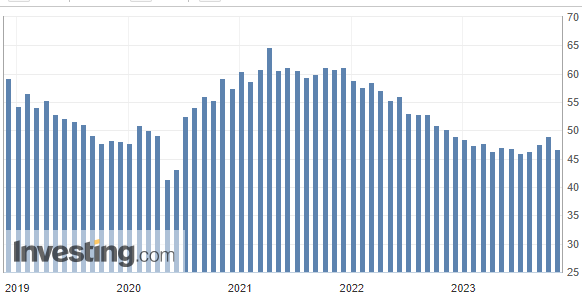

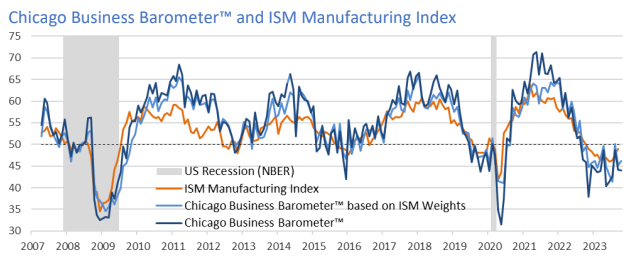

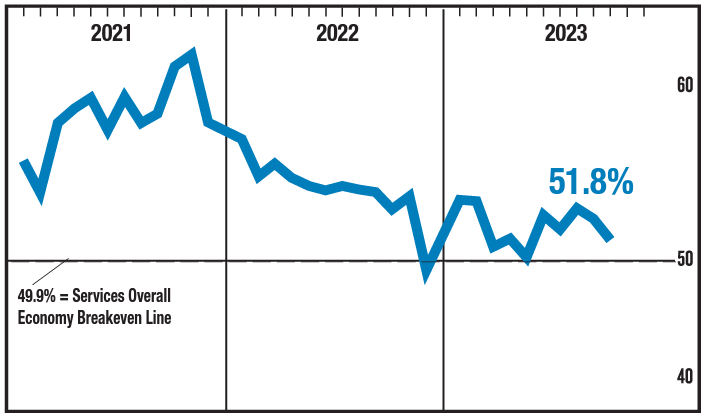

In October 2023, the ISM Services PMI registered 51.8%, 1.8 percentage points lower than the September reading of 53.6 percent. The Business Activity Index registered 54.1%, a 4.7-percentage point decrease compared to the reading of 58.8% in September. The bottom line here is that any number under 55% COULD be indicative of an impending recession.

Here is a summary of headlines we are reading today:

- Canada’s Trans Mountain Pipeline Faces New Delays

- U.S. Rig Count Takes A Dive

- Copper’s Shifting Significance: From Economic Health To Green Energy

- Solar Stocks Shaken By High Interest Rates And Supply Chain Issues

- Dow pops more than 200 points on Friday to cap the best week for stocks so far this year: Live updates

- UAW has Tesla, Toyota in its sights after contract wins at Detroit automakers

- Wall Street will try to maintain momentum next week after a strong start to November

- The Party’s Over: Atlanta Fed Slashes Q4 GDP Estimate From 2.3% To 1.2%

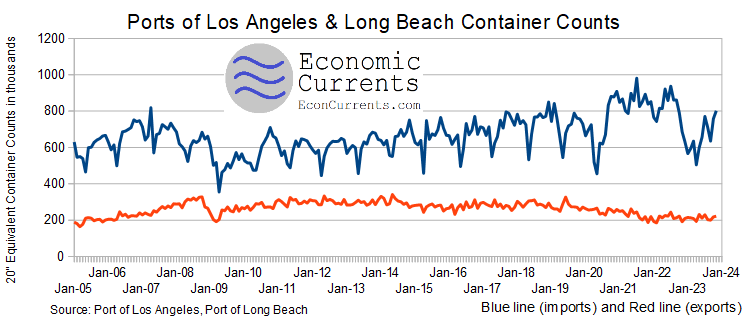

- Maersk cuts 10,000 jobs as shipping demand falls

- Earnings Results: DoorDash shares rally after earnings beat, helped by expansion beyond restaurants

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.