09 DEC 2024 Market Close & Major Financial Headlines: Nasdaq Recorded A New Historic High, But Markets Slid Sharply Lower, Closing Deep In The Red

Summary Of the Markets Today:

- The Dow closed down 241 points or 0.54%,

- Nasdaq closed down 123 points or 0.62%, (New Historic high 19,873, Closed at 19,737)

- S&P 500 closed down 37 points or 0.61%,

- Gold $2,680 up $20.70 or 0.78%,

- WTI crude oil settled at $68 up $0.95 or 1.41%,

- 10-year U.S. Treasury 4.195 up 0.042 points or 1.011%,

- USD index $106.14 up $0.09 or 0.06%,

- Bitcoin $94,440 down $4,911 or 5.20%, (24 Hours),

*Stock data, cryptocurrency, and commodity prices at the market closing

Today’s Highlights

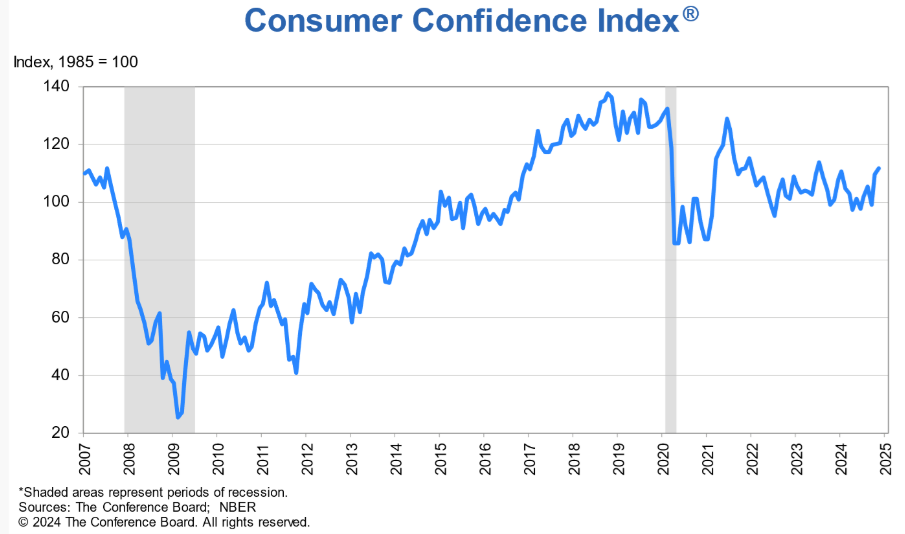

U.S. stock markets experienced a pullback on Monday, with major indices declining amid several key developments: Nvidia shares slid more than 2.5% after China’s State Administration of Market Regulation launched an antitrust investigation into the chipmaker. The probe focuses on Nvidia’s 2020 acquisition of Mellanox and potential anti-monopoly law violations. Investors are preparing for Wednesday’s November Consumer Price Index (CPI) data which will be crucial in shaping expectations for the Federal Reserve’s potential interest rate cut on December 18. Despite the day’s pullback, there’s underlying optimism about the market’s trajectory. Oppenheimer’s chief investment strategist set a year-end 2025 S&P 500 target of 7,100, the highest among tracked strategists. U.S.-listed Chinese stocks saw gains after hints of potential monetary stimulus from Beijing. Geopolitical events like the situation in Syria have not significantly impacted market sentiment Sectors like Consumer Discretionary and Information Technology continue to lead market returns.

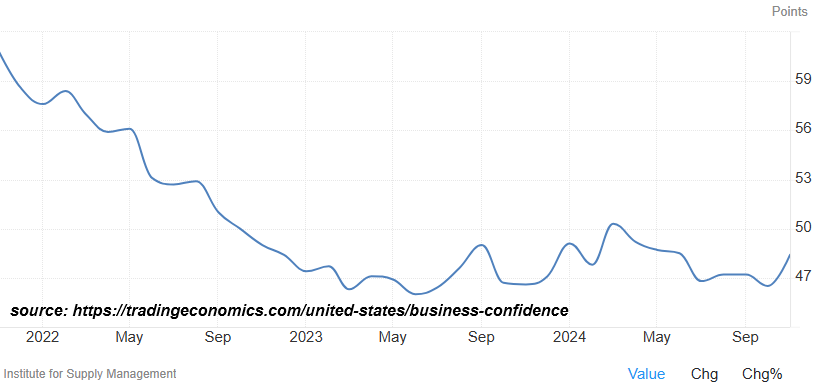

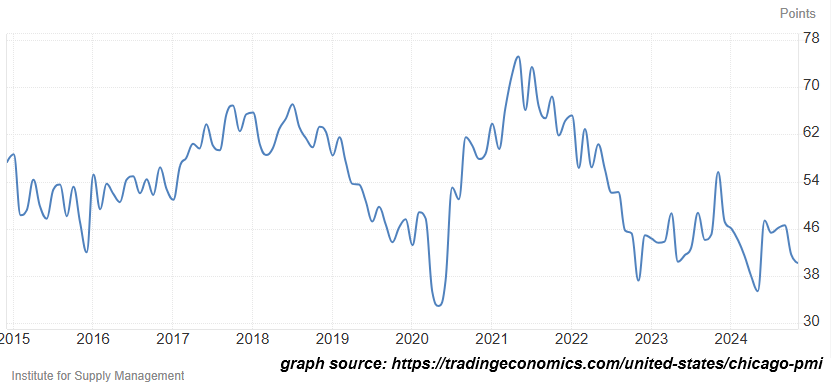

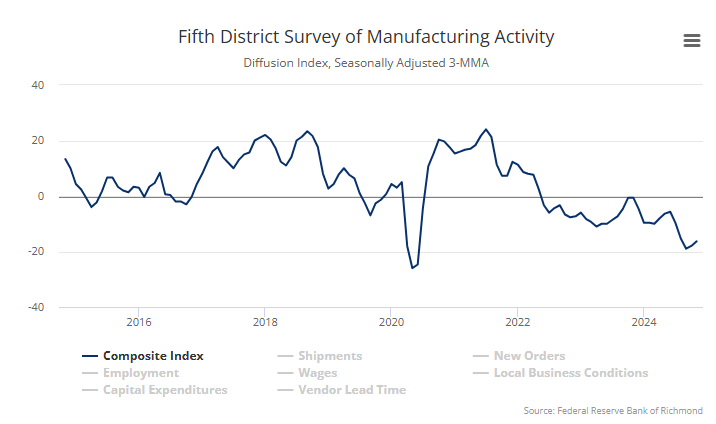

Click here to read our current Economic Forecast – December 2024 Economic Forecast: Insignificant Improvement And Still Indicating a Weak Economy

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

October 2024 sales of merchant wholesalers were up 0.9% from the revised October 2023 level. Total inventories of merchant wholesalers were up 0.9% from the revised October 2023 level. The October inventories/sales ratio for merchant wholesalers was 1.34. The October 2023 ratio was 1.34. As I have stated, I do not think one can understand the economy from wholesale data as the supply chains continue to be in a state of flux and it is hard to compare today’s wholesale with past wholesale data.

Here is a summary of headlines we are reading today:

- National Gasoline Prices Fall Below $3 Per Gallon

- U.S. Manufacturing Power Wanes as China’s Influence Soars

- Challenges Mount in California’s Fuel Market

- Oil Prices Rise After China Vows to Ramp Up Monetary Stimulus

- Iran’s Uranium Enrichment Surge Sparks International Concern

- Nuclear Power Wouldn’t Be a Cost-Effective Solution for Australia

- UnitedHealthcare CEO killing: Luigi Mangione ID’d as person of interest, arrested on gun charge

- Dow drops more than 200 points, S&P 500 pulls back from record as Nvidia slides: Live updates

- Nvidia shares fall after China opens investigation over possible violation of antimonopoly law

- A Florida ‘condo cliff’ is coming as owners deal with fallout from 2021 Surfside collapse

- Bitcoin retreats from $100,000 as falling Nvidia shares weigh on risk assets: CNBC Crypto World

- Zelensky Rejects Trump’s Demand For Ukraine Peace After Paris Meeting

- How investors can position for bond ‘vigilantism’ and a growing U.S. debt load, according to Pimco

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.