17 Jan 2023 Market Close & Major Financial Headlines: Another Down Day On Wall Street With Markets Opening Sharply Down, But recovering Enough To Close Moderately In The Red

Summary Of the Markets Today:

- The Dow closed down 94 points or 0.25%,

- Nasdaq closed down 0.59%,

- S&P 500 closed down 0.56%,

- Gold $2,009 down $21.20,

- WTI crude oil settled at $73 up $0.30,

- 10-year U.S. Treasury 4.100% up 0.034 points,

- USD index $103.36 up $0.37,

- Bitcoin $42,585 down $523 (1.271%),

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our current Economic Forecast – January 2024 Economic Forecast: Our Index Turns Slightly Negative

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

U.S. import prices declined 1.6% year-over-year in December 2023, after declining 1.5 percent in November. Prices for U.S. exports fell 3.2% year-over-year in December following a 5.2% decline the previous month. For all of 2023, it was cheaper to buy an imported product.

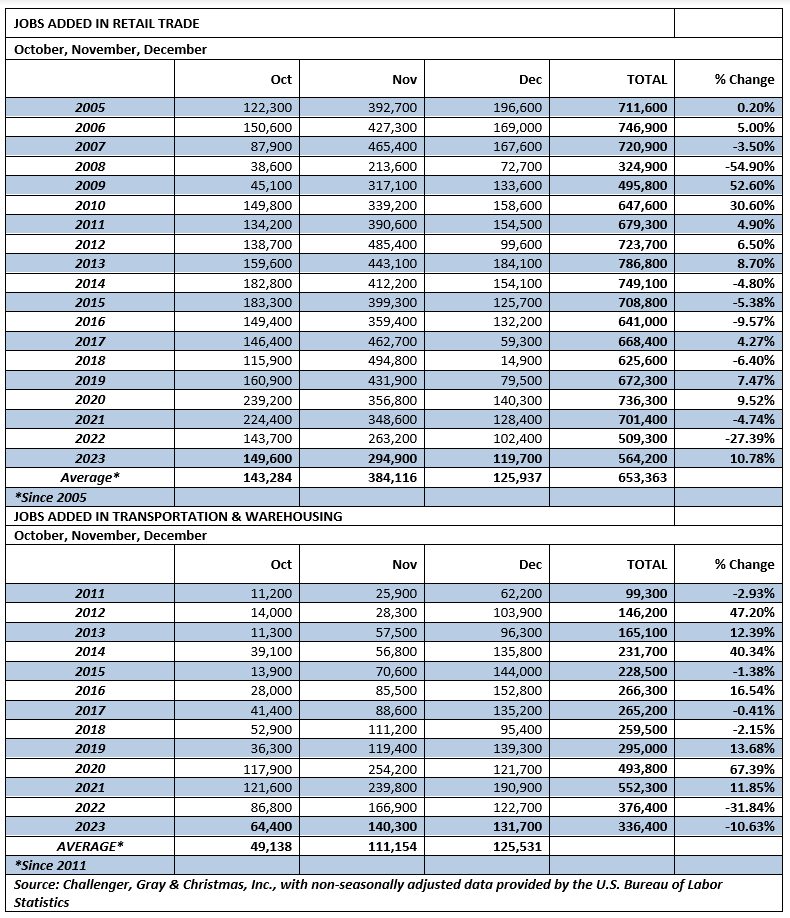

Advance estimates of U.S. retail and food services sales for December 2023 were up 5.6% above December 2022 – 2.2% inflation-adjusted. Retail sales have been gradually improving since May 2023.

Industrial production improved 1.0% year-over-year in December with components manufacturing up 1.2% year-over-year, mining up 4.3% year-over-year, and utilities down 4.9% year-over-year. This is the first month since February 2023 that manufacturing has grown year-over-year. Is the manufacturing recession over?

According to the Federal Reserve’s January 2024 Beige Book:

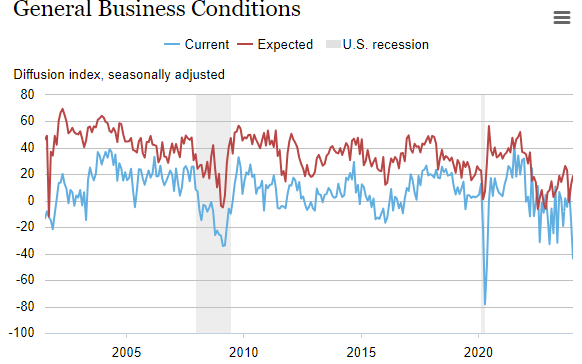

A majority of the twelve Federal Reserve Districts reported little or no change in economic activity since the prior Beige Book period. Of the four Districts that differed, three reported modest growth and one reported a moderate decline. Consumers delivered some seasonal relief over the holidays by meeting expectations in most Districts and by exceeding expectations in three Districts, including in New York, which noted strong holiday spending on apparel, toys, and sporting goods. In addition, seasonal demand lifted airfreight volume from ecommerce in Richmond and credit card lending in Philadelphia. Several Districts noted increased leisure travel, and a tourism contact described New York City as bustling. Contacts from nearly all Districts reported decreases in manufacturing activity. Districts continued to note that high interest rates were limiting auto sales and real estate deals; however, the prospect of falling interest rates was cited by numerous contacts in various sectors as a source of optimism. In contrast, concerns about the office market, weakening overall demand, and the 2024 political cycle were often cited as sources of economic uncertainty. Overall, most Districts indicated that expectations of their firms for future growth were positive, had improved, or both.

Here is a summary of headlines we are reading today:

- China Hits 5.2% Growth Target Despite Population Challenges

- U.S. Gasoline Prices End 2-Week Losing Streak

- Europe’s Nuclear Power Renaissance

- Tennessee Valley Authority Asks Customers To Conserve Power Amid Cold Spell

- ran’s Strike in Pakistan Adds to Middle East Tensions

- Jamie Dimon warns ‘all these very powerful forces’ will impact U.S. economy in 2024 and 2025

- Dow closes lower Wednesday, notching third straight losing session as bond yields rise: Live updates

- Samsung announces new Galaxy S24 lineup with AI-powered photo editing, search features

- Trump says ‘I would love it’ when judge threatens to kick him out of E. Jean Carroll trial

- Beige Book Finds “LIttle Or No Change” In Economic Activity But Optimism Rises On Hopes Of Lower Rates

- 10-, 30-year Treasury yields hit five-week highs after December retail sales data

- Tesla could be staring down a year of ‘growing pains,’ analyst cautions

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.