30 Jan 2023 Market Close & Major Financial Headlines: Nasdaq Takes A Waterfall Dive At The Opening Bell While The Dow And S&P 500 Make New Highs Then Closing Mixed

Summary Of the Markets Today:

- The Dow closed up 134 points or 0.35%,

- Nasdaq closed down 0.76%,

- S&P 500 closed up 0.06%,

- Gold $2,054 up $9.60,

- WTI crude oil settled at $78 up $1.11,

- 10-year U.S. Treasury 4.045% down 0.046 points,

- USD index $103.41 down $0.02,

- Bitcoin $43,560 up $477 (1.11%),

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our current Economic Forecast – February 2024 Economic Forecast: Index Again Modestly Declined But Remains Well Above Levels Associated With Recession

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

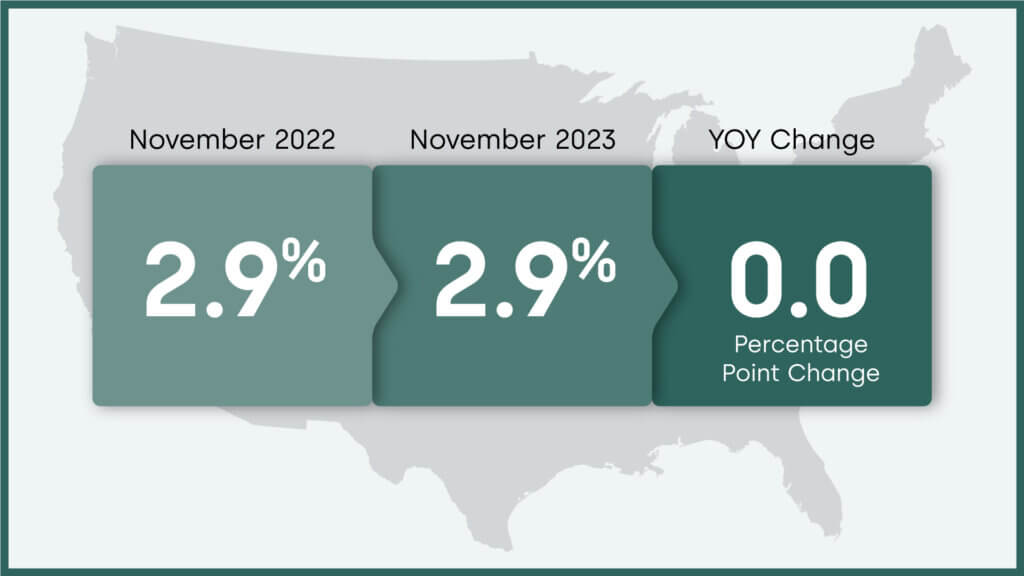

The S&P CoreLogic Case-Shiller U.S. National Home Price 20-City Composite posted a year-over-year increase of 5.4%, up from a 4.9% increase in the previous month. CoreLogic Chief Economist Dr. Selma Hepp stated;

The CoreLogic S&P Case-Shiller Index continued to press higher with home prices increasing by 5.1% year over year in November. Surging mortgage rates in late 2023 started to impact prices in November which declined from the month before, down 0.2% – in contrast to a slight increase seen prior to the pandemic at this time of the year. That suggests pivoting of annual gains over the next few months. Still, home price gains remained resilient in many affordable markets (Detroit) as well as areas with warmer weather and outdoor amenities (Miami and Tampa) – something households seek in winter months. More recent decline in mortgage rates along with continued imbalance between pent-up demand and lacking supply suggest home prices will continue to rise in 2024.

The Conference Board Consumer Confidence Index rose in January to 114.8 (1985=100), up from a revised 108.0 in December. The reading was the highest since December 2021, and marked the third straight monthly increase. Dana Peterson, Chief Economist at The Conference Board stated:

January’s increase in consumer confidence likely reflected slower inflation, anticipation of lower interest rates ahead, and generally favorable employment conditions as companies continue to hoard labor. The gain was seen across all age groups, but largest for consumers 55 and over. Likewise, confidence improved for all income groups except the very top; only households earning $125,000+ saw a slight dip. January’s write-in responses revealed that consumers remain concerned about rising prices although inflation expectations fell to a three-year low. Buying plans dipped in January, but consumers continued to rate their income and personal finances favorably currently and over the next six months. Consumers’ Perceived Likelihood of a US Recession over the Next 12 Months continued to gradually ease in January, consistent with an Expectations Index rising above 80.

The number of job openings changed little at 9.0 million on the last business day of December. Over the month, the number of hires and total separations were little changed at 5.6 million and 5.4 million, respectively. We should expect little upward pressure on job growth based on current correlations.

Here is a summary of headlines we are reading today:

- BP Taps Cutting-Edge 4D Seismic Tech to Survey Azerbaijani Oil Field

- Volkswagen Still Seeking Investor for Battery Unit Despite Slower EV Growth

- Tesla Battles to Maintain Market Share in Growing EV Industry

- Economic Concerns and a Strong Supply Outlook Hold Oil Prices Back

- Global Oil Demand Remains Robust Despite Bearish Sentiment

- Trans Mountain Pipeline Hits Yet Another Delay

- Launch of new ETFs may not affect bitcoin the same way they did gold, Citi says. Here’s why

- PayPal will cut about 2,500 jobs, or 9% of global workforce

- UPS announces 12,000 job cuts, says package volume slipped last quarter

- Sky to cut 1,000 jobs in move towards digital

- Number of companies going bust hits 30-year high

- Treasury yields hold steady ahead of Wednesday’s Fed interest-rate policy update

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.