27 Feb 2023 Market Close & Major Financial Headlines: Roller Coaster Trading Sends Indexes Back And Forth Along The Unchanged Line Finally closing Mixed

Summary Of the Markets Today:

- The Dow closed down 97 points or 0.25%,

- Nasdaq closed up 0.37%,

- S&P 500 closed up 0.17%,

- Gold $2,040 up $0.03,

- WTI crude oil settled at $79 up $1.12,

- 10-year U.S. Treasury 4.309% up 0.010 points,

- USD index $103.83 down $0.01,

- Bitcoin $56,970 up $2,5246 (4.64%),

*Stock data, cryptocurrency, and commodity prices at the market closing.

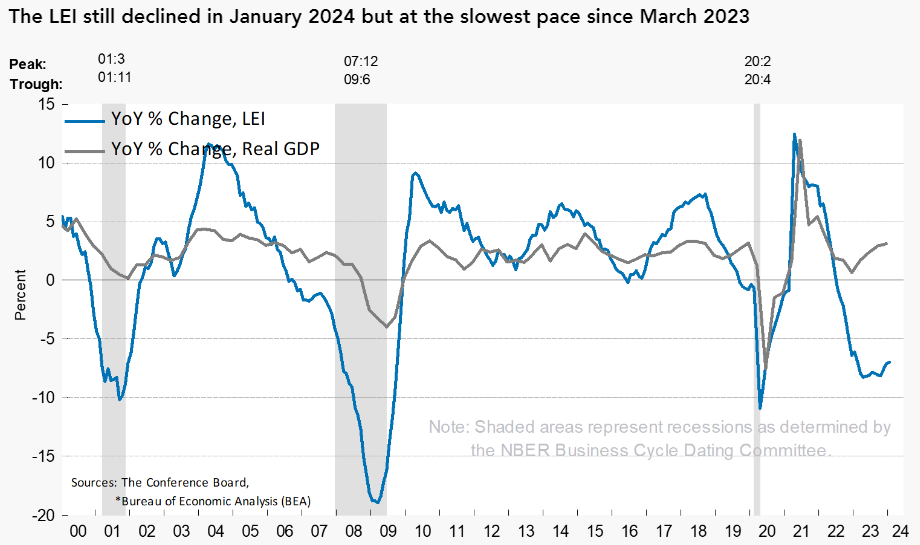

Click here to read our current Economic Forecast – February 2024 Economic Forecast: Index Again Modestly Declined But Remains Well Above Levels Associated With Recession

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

The number of CEO changes at U.S. companies hit 194 to start 2024, down 5% from the 204 CEO exits recorded in December 2023. It is a 73% increase from the 112 CEO exits that occurred in the same month one year prior.

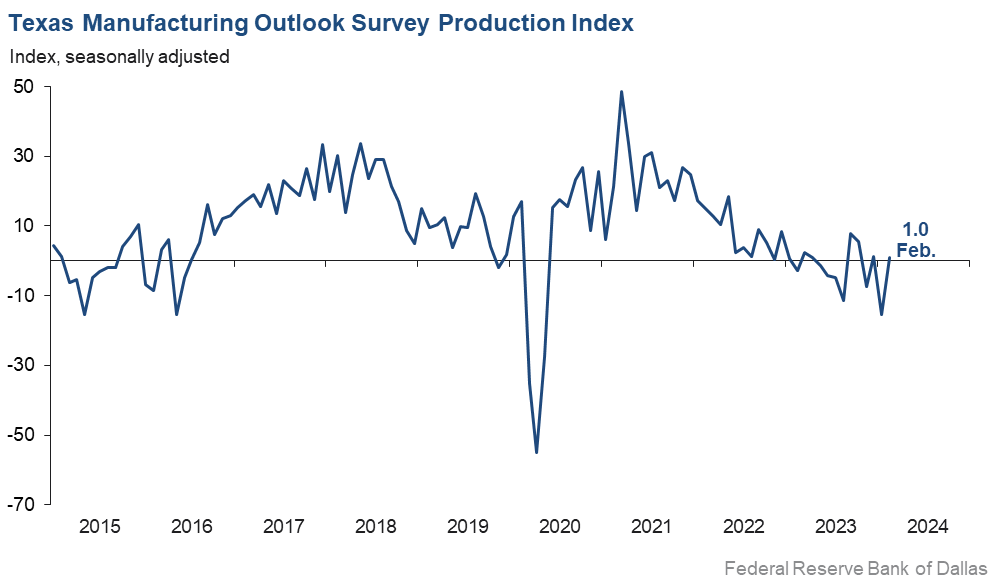

New orders for manufactured durable goods in January 2024 declined 0.8% year-over-year. There was a general weakness across the board with the worst performance in civilian aircraft. As I continue to point out, there is a recession underway in the manufacturing sector.

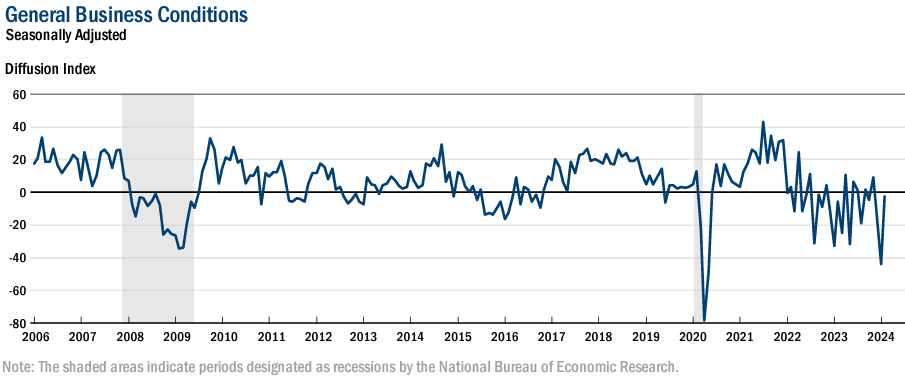

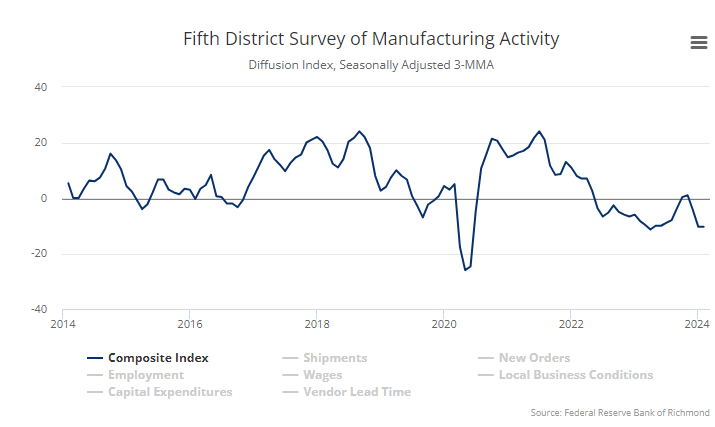

Richmond Fed Manufacturing Survey increased from −15 in January to −5 in February 2024. Of its three component indexes, shipments remained solidly negative at −15, new orders increased from −16 to −5, and employment rose notably, from −15 to 7. More evidence of a recessionary manufacturing sector.

The S&P CoreLogic Case-Shiller 20 cities composite home price index shows a 6.1% increase year-over-year in December 2023. CoreLogic Chief Economist Dr. Selma Hepp added:

While CoreLogic S&P Case-Shiller National Index rose by 5.5% year over year, the stress of high mortgage rates at the end of 2023 continued to depress prices, which were down 0.4% compared to November – the second month of lower prices. Nevertheless, Miami and Las Vegas – joined by Los Angeles – continued to see strengthening of home prices despite higher rates. Miami overall ranked as the strongest appreciating market in 2023, up 6% for the year, compared to national appreciation of 2%. In 2022, Tampa and Miami were the strongest appreciating markets at almost 30% increase in home prices. In contrast, markets in the West – San Francsico, Seattle, Las Vegas, Phoenix, and Portland – are still catching up with 2022 price peaks. But with strong recent price rebounds in Las Vegas and Phoenix in 2023, these two markets are likely to see annual appreciation in 2024.

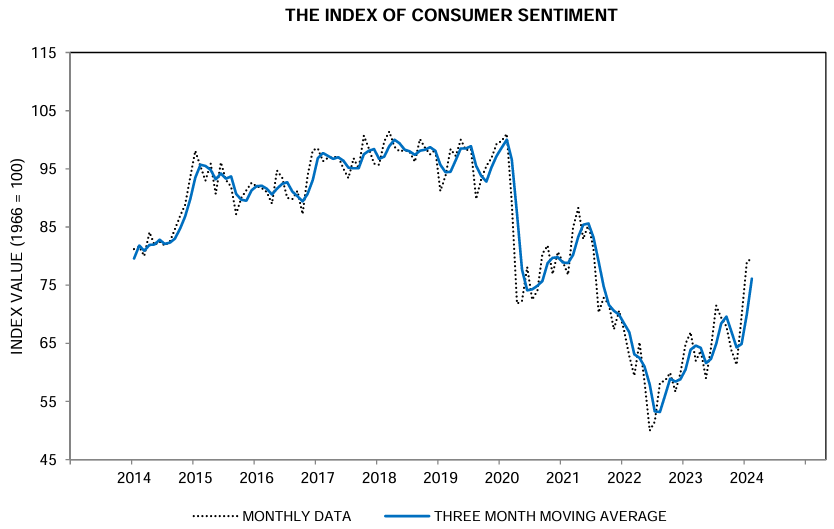

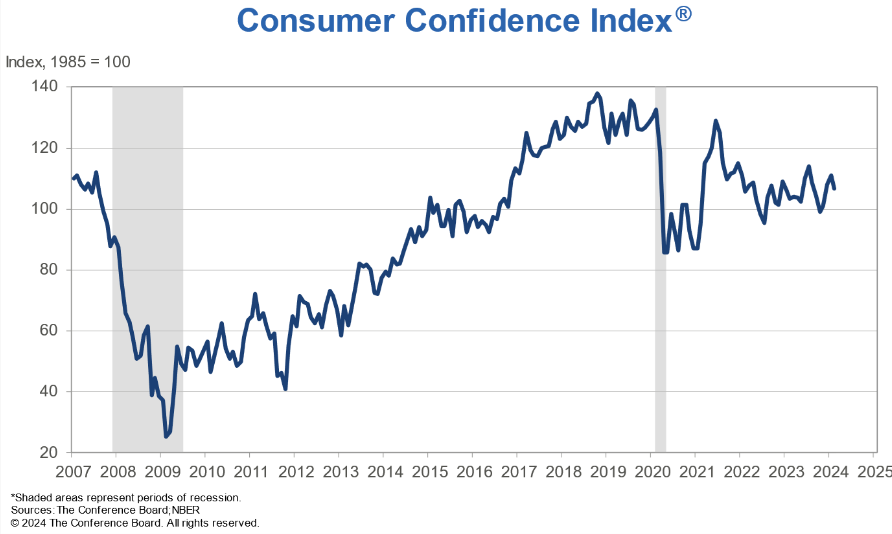

The Conference Board Consumer Confidence Index fell in February to 106.7 (1985=100), down from a revised 110.9 in January. February’s decline in the Index occurred after three consecutive months of gains. However, as January was revised downward from the preliminary reading of 114.8, the data now suggest that there was not a material breakout to the upside in confidence at the start of 2024. Dana Peterson, Chief Economist at The Conference Board stated:

The decline in consumer confidence in February interrupted a three-month rise, reflecting persistent uncertainty about the US economy. The drop in confidence was broad-based, affecting all income groups except households earning less than $15,000 and those earning more than $125,000. Confidence deteriorated for consumers under the age of 35 and those 55 and over, whereas it improved slightly for those aged 35 to 54.

Here is a summary of headlines we are reading today:

- Simulated Star Collision Leads to Breakthrough in Nuclear Waste Treatment

- Supply Chain Woes Could Derail Biden’s Electric Vehicle Agenda

- Kremlin Warns of Escalation if NATO Troops Fight in Ukraine

- Short Sellers in Trouble As Physical Oil Market Defies Data

- Red Sea Disruptions Spark Oil Tanker Shortfall

- S&P 500, Nasdaq Composite close higher on Tuesday: Live updates

- Warner Bros. Discovery halts merger talks with Paramount Global, sources say

- Bitcoin’s all-time high is in sight after the crypto breached $57,000, chart analysts say. Here’s what to expect

- Bitcoin surges past $57,000 to highest level since December 2021: CNBC Crypto World

- For Black workers, progress in the workplace but still a high hill to climb

- Stock Bull Market Might Just Be Getting Started, But…

- Are U.S. stocks in a bubble? History says no.

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.