12 Mar 2023 Market Close & Major Financial Headlines: Markets Opened Higher, Dipped Once Into The Red, Trended Higher, Closing Near Session Highs

Summary Of the Markets Today:

- The Dow closed up 236 points or 0.61%,

- Nasdaq closed up 1.54%,

- S&P 500 closed up 1.12%,

- Gold $2,162 down $26.90,

- WTI crude oil settled at $78 down $0.15,

- 10-year U.S. Treasury 4.155% up 0.051 points,

- USD index $102.94 up $0.070,

- Bitcoin $71,382 up $615 (0.85%), New Historic high 72,960.46

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our current Economic Forecast – March 2024 Economic Forecast: A Modest Improvement In Our Index Predicting Little Change In Main Street Growth

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

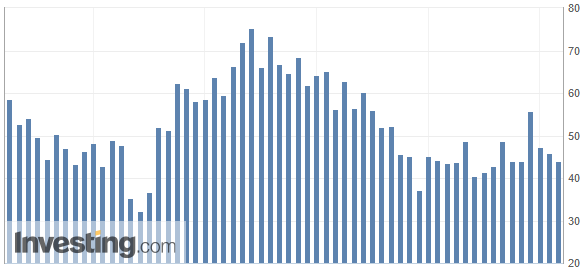

The Consumer Price Index for All Urban Consumers (CPI-U) increased 3.2% year-over-year in February 2024 before seasonal adjustment – this is up from 3.1% the previous month. The all items less food and energy index rose 3.8% over the last 12 months – slightly down from the 3.9% of the previous month. Note that the Federal Reserve uses the PCE price index as its primary measure of inflation – and this index will be released later this month. My position is that there are forces that will not allow inflation to fall further toward the Federal Reserve’s target rate of 2.0%. Indexes that increased in February include shelter, airline fares, motor vehicle insurance, apparel, and recreation. The index for personal care and the index for household furnishings and operations were among those that decreased over the month.

Here is a summary of headlines we are reading today:

- U.S. Driving Activity to Reach All-Time Highs But Gasoline Consumption Seen Flat

- EIA Raises Crude Oil Price Outlook

- AI, Bitcoin And Clean Energy Boom Are Straining U.S. Power Supply

- Oil Markets Await a Shift in Sentiment

- Inside the organized crime rings plaguing retailers including Ulta, T.J. Maxx and Walgreens

- Dow jumps more than 200 points, S&P 500 pops 1% for new closing high as Nvidia resurges: Live updates

- Boeing’s Max problems shift growth plans at major airline customers

- Here’s the inflation breakdown for February 2024 — in one chart

- Bitcoin hits another record as volatility hovers at 2024 high: CNBC Crypto World

- More than a fifth of adults not looking for work

- Boeing whistleblower found dead in US

- Treasury yields end at one-week highs after February’s CPI inflation report

- Boeing’s February deliveries slow down amid Max uncertainty

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.