26 Mar 2023 Market Close & Major Financial Headlines: Markets Opened Fractionally Higher, Traded Mostly Sideways In The Green, Then Like A Waterfall, The Markets Fell Sharply During The Last Hour Of Today’s Session

Summary Of the Markets Today:

- The Dow closed down 31 points or 0.08%,

- Nasdaq closed down 0.42%,

- S&P 500 closed down 0.28%,

- Gold $2,200 up $1.70,

- WTI crude oil settled at $82 down $0.43,

- 10-year U.S. Treasury 4.232% down 0.021 points,

- USD index $104.33 down $0.150,

- Bitcoin $69,889 down $966 (1.33%), – Historic high 73,798.25

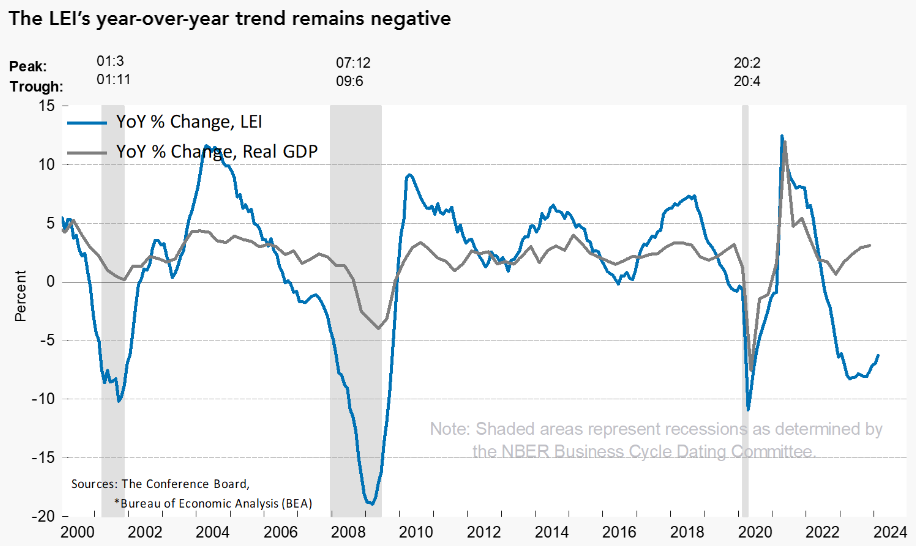

Click here to read our current Economic Forecast – March 2024 Economic Forecast: A Modest Improvement In Our Index Predicting Little Change In Main Street Growth

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

New orders for manufactured durable goods in February 2024 improved and is up 2.6% year-over-year – but is down 1.6% year-over-year inflation-adjusted. Negative growth in durable goods is not a sign of a growing economy.

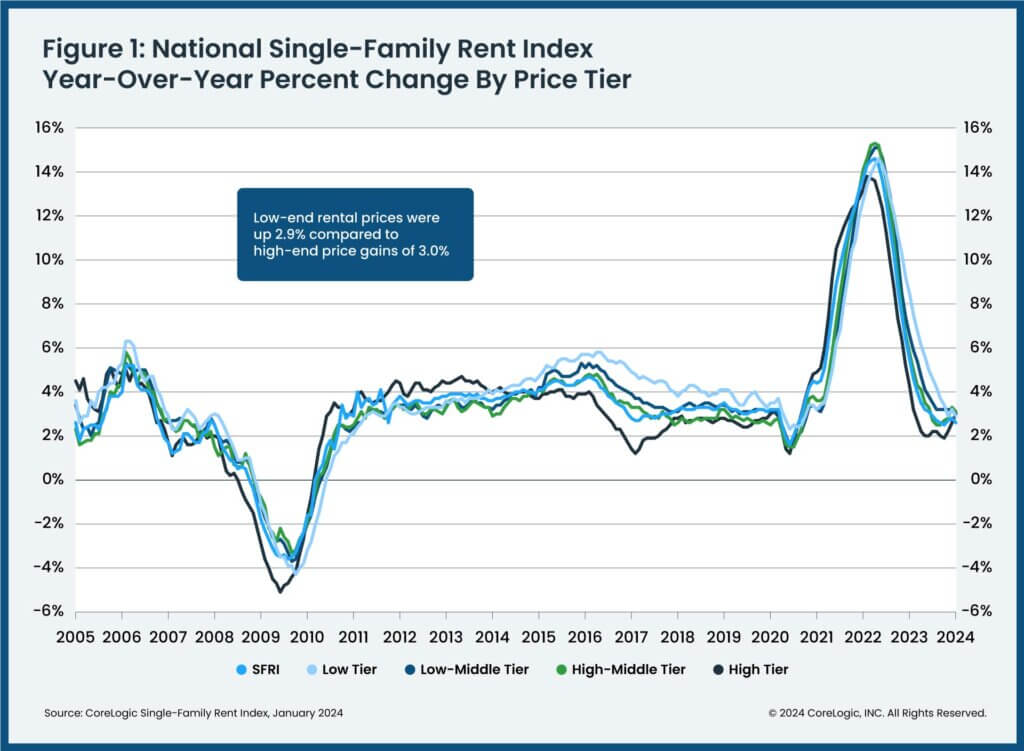

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index 20-City Composite posted a year-over-year increase of 6.6% in January 2024, up from a 6.2% increase in the previous month. Brian D. Luke, Head of Commodities, Real & Digital Assets at S&P Dow Jones Indices stated:

We’ve commented on how consistent each market performed during 2023 and that continues to be the case. While there is a large disparity between leaders such as San Diego versus laggards such as with Portland, the broad market performance is tightly bunched up. This is also true of high and low tiers. The average annual gains between high and low tiers across cities tracked by the indices is just 1.1%. Low price tiered indices have outperformed high priced indices for 17 months. Homeowners most likely saw healthy gains in the last year, no matter what city you were in, or if it was in an expensive or inexpensive neighborhood. No matter which way you slice it, the index performance closely resembled the broad market.

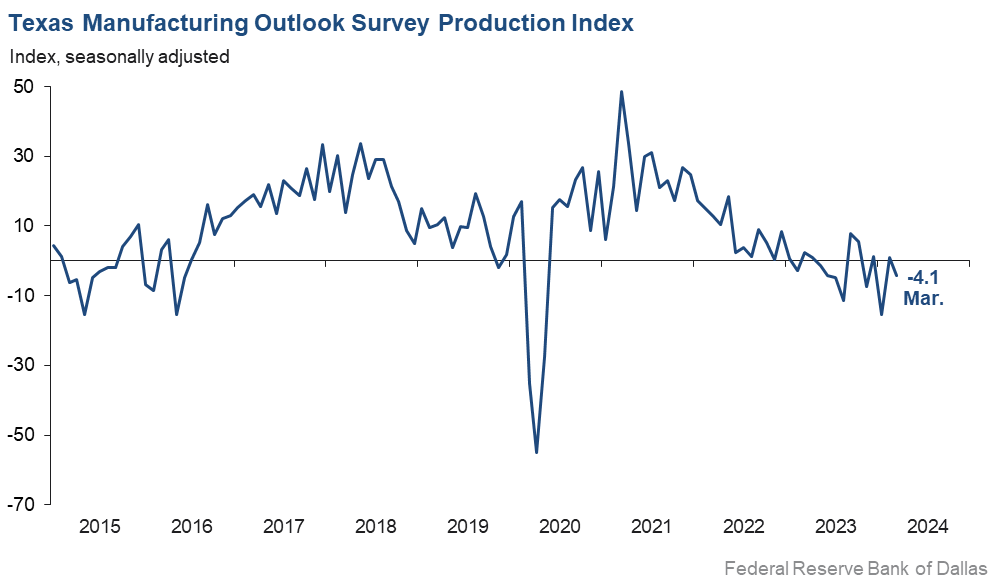

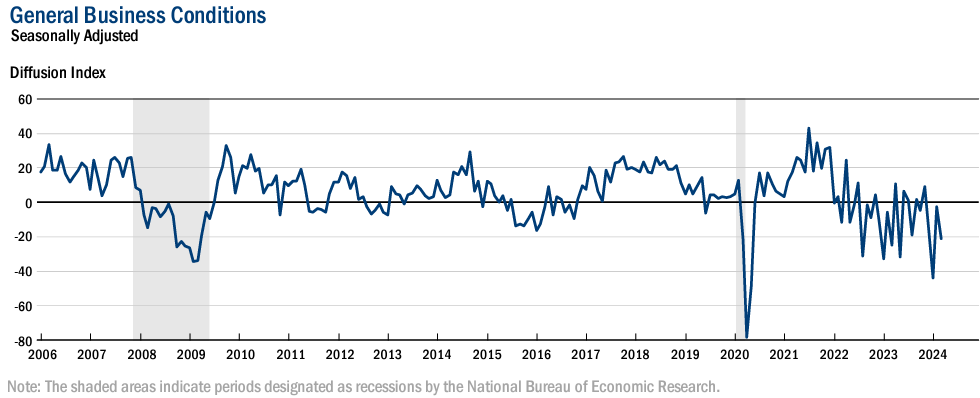

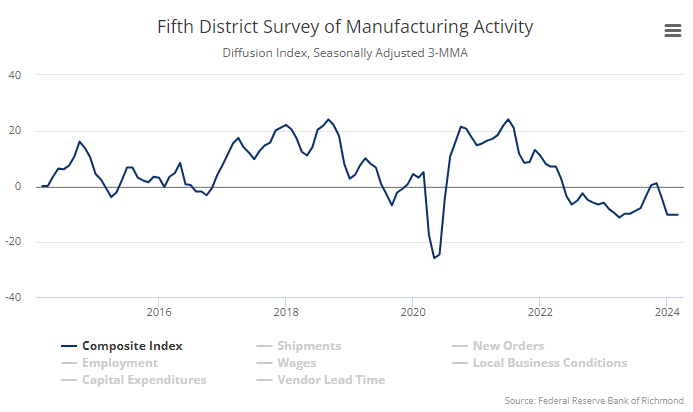

The Richmond Fed manufacturing activity slowed in March 2024. The composite manufacturing index decreased from −5 in February to −11. Of its three component indexes, shipments remained solidly negative at −14, new orders fell from −5 to −17, and employment fell from 7 to 0. Manufacturing remains in a recession in the U.S.

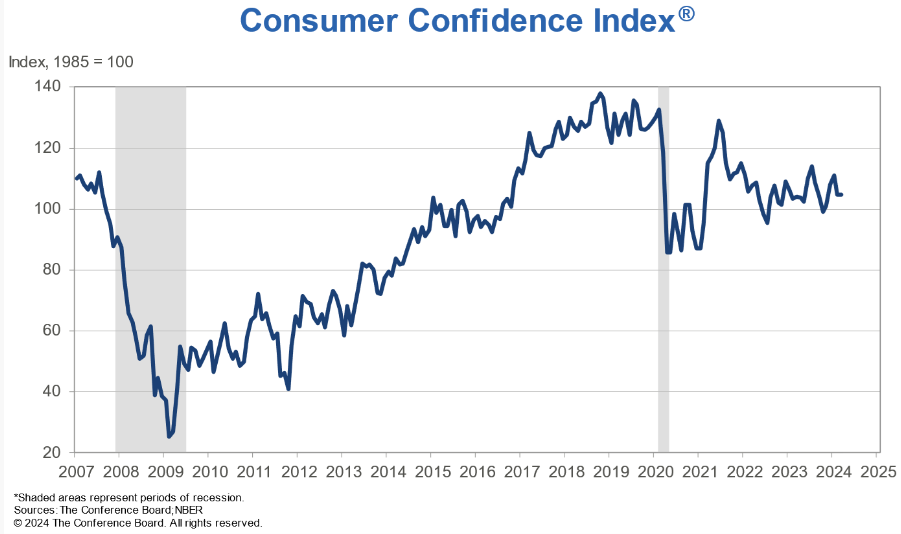

The Conference Board Consumer Confidence Index® was 104.7 (1985=100) in March, essentially unchanged from a downwardly revised 104.8 in February. Dana M. Peterson, Chief Economist at The Conference Board added:

Consumers’ assessment of the present situation improved in March, but they also became more pessimistic about the future. Confidence rose among consumers aged 55 and over but deteriorated for those under 55. Separately, consumers in the $50,000-$99,999 income group reported lower confidence in March, while confidence improved slightly in all other income groups. However, over the last six months, confidence has been moving sideways with no real trend to the upside or downside either by income or age group.

Here is a summary of headlines we are reading today:

- South Africa Won’t Ditch Coal Anytime Soon

- OPEC: Oil Industry Needs $11 Trillion in Upstream Investment by 2045

- Subsidy Investigation Sent China’s EV Exports to the EU Plunging by 20%

- Bullish Sentiment Brings $90 Oil Within Reach

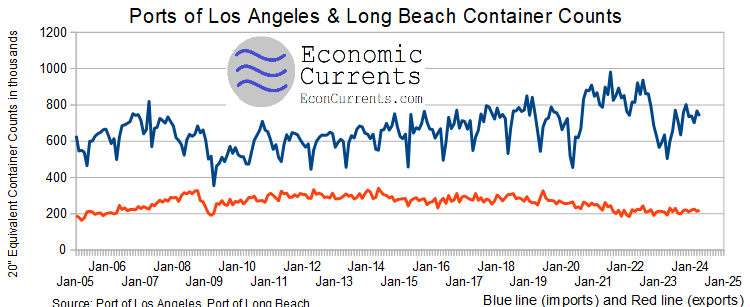

- Logistics companies scramble after bridge collapse closes Port of Baltimore until further notice

- S&P 500 closes lower for a third straight session as market rally cools: Live updates

- Stocks trade near records, but chances are your portfolio isn’t sufficiently protected from a fall

- Bitcoin maintains $70,000, and KuCoin charged with anti-money laundering violations: CNBC Crypto World

- Tesla Cooperates With CATL On Faster-Charging Battery Technology

- Donald Trump media firm soars in stock market debut

- Treasury yields hold steady as traders eye February inflation data at end of week

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.