18 July 2024 Market Close & Major Financial Headlines: The Dow Made Another New High, Then Plunged Downward Falling Over 550 Points Matching The Small Caps 1 Percent Dip Into The Red

Summary Of the Markets Today:

- The Dow closed down 533 points or 1.29%, (Closed at 40,665, New Historic high 41.376)

- Nasdaq closed down 0.70%,

- S&P 500 closed down 0.78%,

- Gold $2,446 down $14.30,

- WTI crude oil settled at $82 down $0.61,

- 10-year U.S. Treasury 4.197 up 0.052 points,

- USD index $104.19 up $0.44,

- Bitcoin $63,589 down $502 or 0.78%,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our current Economic Forecast – July 2024 Economic Forecast: One Recession Flag Removed But Little Indication The Economy Is Strengthening

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

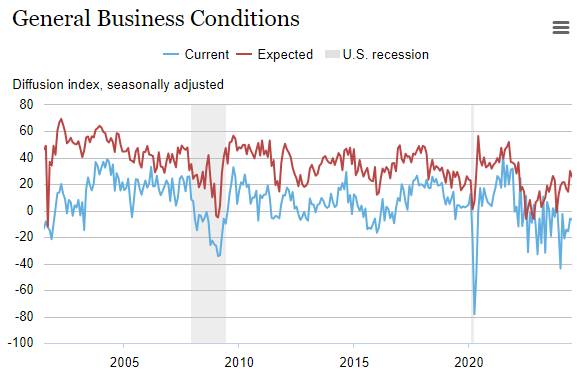

The July 2024 Philly Fed Manufacturing Business Outlook Survey‘s indicator for general activity rose 13 points to 13.9, and the indexes for shipments and new orders turned positive. The employment index also turned positive, suggesting an overall increase in employment levels. Both price indexes continued to indicate overall price increases. Most future activity indicators rose, suggesting more widespread expectations for overall growth over the next six months. If you are a fan of surveys, then you gotta believe manufacturing activity is growing. I am a skeptic as I see retail sales flat and imports rising – these as significant headwinds to manufacturing.

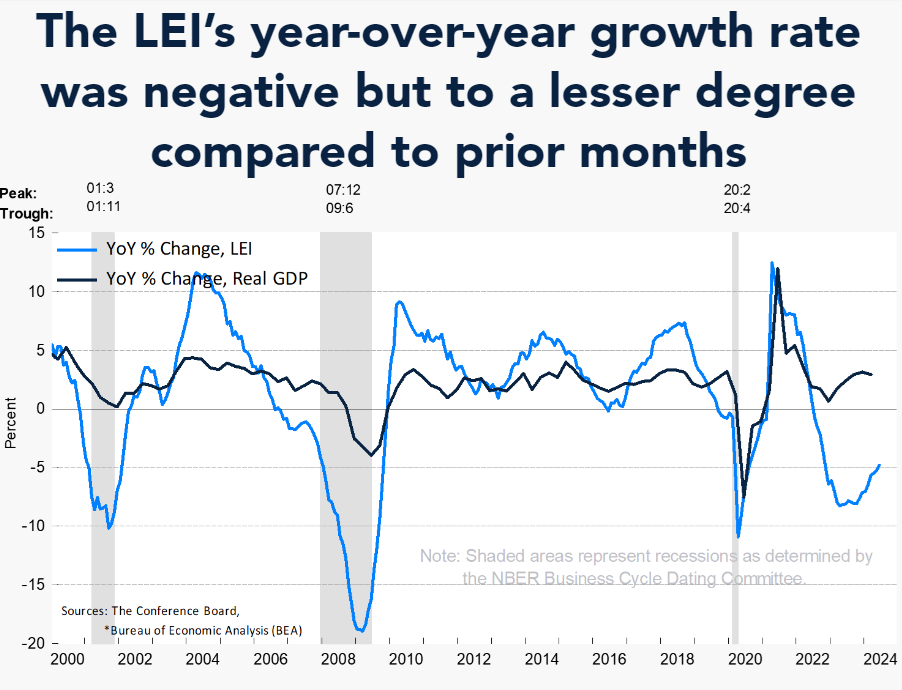

The Conference Board Leading Economic Index® (LEI) for the U.S. declined by 0.2 percent in June 2024 to 101.1 (2016=100), following a decline of 0.4 percent (upwardly revised) in May. Over the first half of 2024, the LEI fell by 1.9 percent, a smaller decrease than its 2.9 percent contraction over the second half of last year. Note that The Conference Board lately has been providing the doomiest view of the economy. An explanation by Justyna Zabinska-La Monica, Senior Manager, Business Cycle Indicators, at The Conference Board:

The US LEI continued to trend down in June, but the contraction was smaller than in the past three months. The decline continued to be fueled by gloomy consumer expectations, weak new orders, negative interest rate spread, and an increased number of initial claims for unemployment. However, due to the smaller month-on-month rate of decline, the LEI’s long-term growth has become less negative, pointing to a slow recovery. Taken together, June’s data suggest that economic activity is likely to continue to lose momentum in the months ahead. We currently forecast that cooling consumer spending will push US GDP growth down to around 1 percent (annualized) in Q3 of this year.

In the week ending July 13, the advance figure for seasonally adjusted initial unemployment claims 4-week moving average was 234,750, an increase of 1,000 from the previous week’s revised average. The previous week’s average was revised up by 250 from 233,500 to 233,750. Although initial claims are modestly trending up, it is well within the values expected in a growing economy.

CoreLogic’s US Annual Rental Price Growth Rate for single-family rents rose by 3.2% year over year in May 2024, the highest rate of growth since April 2023. May’s annual rent growth was generally in line with numbers recorded over the decade before the pandemic.

Here is a summary of headlines we are reading today:

- SunPower Shares Crash Nearly 40% On Work Stoppage

- China’s Grip on Rare Earth Industry Tightens as Prices Drop

- Oil Prices Hold Gains As US Jobs Data Appears to Support Rate Cuts

- Can the U.S. Avoid an Energy Crisis?

- China’s Surging Commodity Exports Suggest Weak Domestic Demand

- Netflix beats estimates as ad-supported memberships rise 34%

- Bye-bye bitcoin, hello AI: Texas miners leave crypto for next new wave

- New multi-billion dollar deal adds to rising trend of bitcoin miners moving to AI: CNBC Crypto World

- NBA sends media terms to Warner Bros. Discovery, officially starting five-day match period

- OpenAI debuts mini version of its most powerful model yet

- ‘Inflationary’ tariffs by U.S. could upset expectations for multiple Fed rate cuts

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.