15 AUG 2024 Market Close & Major Financial Headlines: Wall Street Markets Gap Up At The Opening Bell, Continue To Trend Upward Pushing The Dow Over 550 Points, Indexes Closing Sharply Higher

Summary Of the Markets Today:

- The Dow closed up 555 points or 1.39%,

- Nasdaq closed up 2.34%,

- S&P 500 closed up 1.61%,

- Gold $2,493 up $13.30,

- WTI crude oil settled at $78 up $1.00,

- 10-year U.S. Treasury 3.919 up 0.097 points,

- USD index $103.03 up $0.46,

- Bitcoin $57,053 down $1,637 or 2.79%,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Highlights:

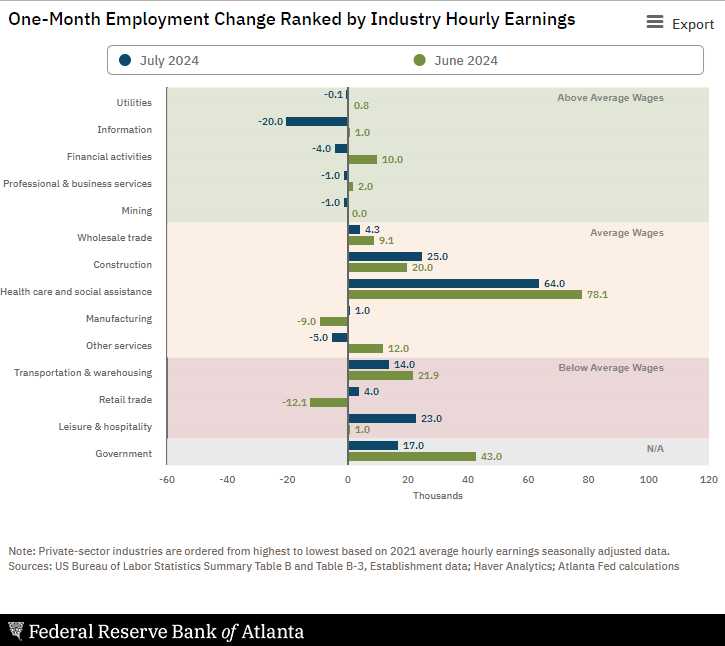

Stocks surged on Thursday as Wall Street reacted to positive signals regarding the U.S. consumer and labor market. Key factors influencing the market included Walmart’s earnings report, government retail sales data, and jobless claims updates. Walmart’s Performance: Walmart’s stock jumped over 6% following a strong earnings report that exceeded expectations for both earnings and revenue. The company also raised its full-year outlook, projecting sales growth between 3.75% and 4.75% and adjusted earnings per share between $2.35 and $2.43. Retail Sales and Jobless Claims: Retail sales for July rose by 1%, significantly surpassing Wall Street’s 0.4% estimate, indicating a resilient U.S. consumer base. Additionally, weekly jobless claims fell to 227,000, defying expectations of an increase and contributing to the positive market sentiment. Market Recovery: After a challenging start to August, stocks have rebounded, driven by cooling recession fears. The S&P 500 and Nasdaq have recovered from earlier losses, with the S&P 500 up nearly 7% and the Nasdaq more than 8% since the sell-off on August 5. The Information Technology sector, led by companies like Nvidia, has been a significant driver of this recovery.

Click here to read our current Economic Forecast – August 2024 Economic Forecast: New Recession Flag

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

Industrial production fell to -0.2% year-over-year in July 2024 – down from 1.1% gain year-over-year in June. Components manufacturing was up 0.1% year-over-year (down from 0.6%), utilities declined 0.1% year-over-year (down from 7.9%), and mining declined 1.5% year-over-year (from -1.2% in June). Capacity utilization moved down to 77.8 percent in July, a rate that is 1.9 percentage points below its long-run (1972–2023) average. The authors claim that Hurricane Beryl impacted industrial production by 0.3% which seems to ring true. However, these are not numbers that I would be bragging about as they indicate a very weak industrial sector. Note that the problem is not only in the U.S. as China’s factory output slowed for a third straight month in July.

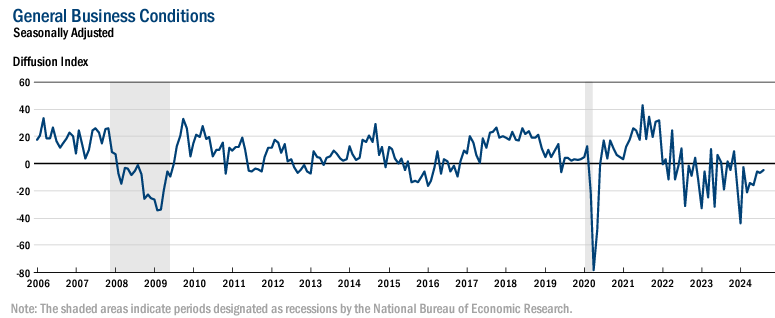

The August 2024 Philly Fed Manufacturing Business Outlook Survey shows that manufacturing activity in the region softened overall. The survey’s indicators for current general activity, new orders, and shipments all declined, with the former turning negative. The employment index suggests declines in employment overall. The diffusion index for current general activity fell from 13.9 to -7.0, its first negative reading since January. The indexes for new orders and shipments also declined but remained positive for the second consecutive month: The new orders index decreased 6 points to 14.6, and the shipments index fell 19 points to 8.5. Poor growth data in the manufacturing sector continues.

Business activity edged slightly lower according to the August 2024 New York Fed Empire State Manufacturing Survey. The headline general business conditions index was little changed at -4.7. New orders declined modestly, while shipments held steady. There is little good news in the manufacturing sector.

Job seekers’ relocating for new jobs rose to 2.7% in the second quarter, up from 2.1% in the first quarter* and 2.4% in the same quarter last year. While the rate is rising after falling to historic lows in 2023, it is still not at levels seen pre-pandemic. Andrew Challenger, Senior Vice President and economic expert for Challenger, Gray & Christmas added:

The rise in the relocation rate suggests finding jobs close to home is becoming a bit more difficult. With more companies mandating time in the office, job seekers are beginning to recognize the need to move to where the jobs are.

Prices for U.S. imports ticked up to 1.6% year-over-year in July 2024 from 1.5% the previous month. Export prices likewise rose from 1.0% year-over-year in June to 1.4% in July. Import price increases affect retail prices.

Retail trade sales were up 2.6% year-over-year in July 2024 – and increase from June’s flat sales. Nonstore retailers were up 6.7 percent (±1.4 percent) from last year, while food services and drinking places were up 3.4 percent (±2.1 percent) from July 2023. The data in many sectors was weak but the non-store retailers (say Amazon) were the bright spot of this report. However, I was personally surprised by the strength of this data – and this should work against those who believe the economy is weakening and therefore the Fed should cut the federal funds rate.

In the week ending August 10, the advance figure for seasonally adjusted initial unemployment claims 4-week moving average was 236,500, a decrease of 4,500 from the previous week’s revised average. The previous week’s average was revised up by 250 from 240,750 to 241,000. There is little indication in unemployment claims that the economy is weakening.

Here is a summary of headlines we are reading today:

- Russia Expands ‘Dark Fleet’ to Evade LNG Sanctions

- The Real Reason Iran Hasn’t Retaliated Against Israel

- Supply Chain Woes Worsen After Chinese Port Closure

- Oil Prices Climb 2% as Gaza Ceasefire Talks Begin

- U.S. Set to Slowly Refill SPR as Crude Buys Extend Into 2025

- Stocks close higher, S&P 500, Nasdaq notch six-day winning streak as comeback rally gains steam: Live updates

- Ex-Google CEO Eric Schmidt sees Nvidia as big AI winner: ‘You know what to do in the stock market’

- Here’s the deflation breakdown for July 2024 — in one chart

- Meta CEO Mark Zuckerberg receives letter from lawmakers concerned about illicit drug ads on Facebook and Instagram

- Walmart says prices are coming down — except in one key area

- US Inflation falls to 3-year low, clearing the way for Fed to begin cutting rates

- 2-year Treasury yield jumps by most in 4 months on positive retail-sales data

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.