29 AUG 2024 Market Close & Major Financial Headlines: Markets Open Higher, Dow Reaches New Historic High, The S&P 500 And Nasdaq Close Lower As Nvidia Sheds Over 8%

Summary Of the Markets Today:

- The Dow closed up 244 points or 0.59%, (Closed at 41,335, New Historic high 41.578)

- Nasdaq closed down 0.23%,

- S&P 500 closed flat 0.00%,

- Gold $2,555 up $17.20,

- WTI crude oil settled at $76 up $1.43,

- 10-year U.S. Treasury 3.867 up 0.026 points,

- USD index $101.38 up $0.28,

- Bitcoin $59,482 up $379 or 0.64%,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Highlights

The Dow Jones Industrial Average closed at a new record high marking its third record close this week. Key factors were:

Nvidia Earnings

-

- Nvidia’s quarterly profit and revenue guidance topped estimates, but fell short of high expectations.

- This raised questions about whether the AI boom has peaked.

- Nvidia shares ended down around 6% despite Wall Street remaining bullish on the stock.

You will find more infographics at Statista

Economic Data

-

- Q2 GDP growth was revised up to 3% annualized, higher than the previous 2.8% estimate.

- Weekly jobless claims came in at 231,000, lower than expected.

Other Earnings

-

- Salesforce shares rose after beating earnings expectations.

- Best Buy shares jumped up to 17% on better-than-expected results.

- Dollar General shares plunged 30% after cutting its full-year outlook.

The mixed market performance reflects investors assessing Nvidia’s earnings alongside stronger-than-expected economic data, as they also consider the Federal Reserve’s future interest rate decisions.

Click here to read our current Economic Forecast – September 2024 Economic Forecast: One Recession Flag Removed With Three Remaining

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

The number of CEO changes at U.S. companies fell 36% to 149 in July from 234 in June. It is down 24% from 197 CEO exits recorded in the same month last year. Andrew Challenger, Senior Vice President of Challenger, Gray & Christmas, Inc. stated:

The labor market is softening, and companies are finding ways to lower costs. Companies have made leadership changes in response to AI, the political landscape, and international events causing substantial impacts on business conditions.

The second estimate of real gross domestic product (GDP) increased at an annual rate of 3.1% year-over-year in the second quarter of 2024. Using a year-over-year metric, there was no change in growth between the advance and second estimates in 2Q2024. In the first quarter, real GDP increased at 2.9% year-over-year. The increase in real GDP primarily reflected increases in consumer spending, private inventory investment, and nonresidential fixed investment. Imports, which are a subtraction in the calculation of GDP, increased . The price index for gross domestic purchases increased 2.6% year-over-year in the second quarter – up from the 2.4% year-over-year in 1Q2024.

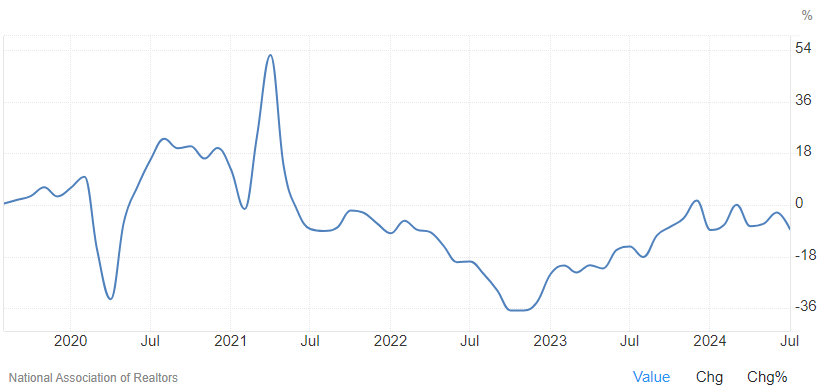

Pending home sales (a forward-looking indicator of home sales based on contract signings) slipped to 70.2 in July, the lowest reading since the index began tracking in 2001. Year over year, pending transactions were down 8.5%. An index of 100 is equal to the level of contract activity in 2001. The existing home market remains depressed – but note that it is not a component of GDP. NAR Chief Economist Lawrence Yun added:

A sales recovery did not occur in midsummer. The positive impact of job growth and higher inventory could not overcome affordability challenges and some degree of wait-and-see related to the upcoming U.S. presidential election.

In the week ending August 24, the advance figure for seasonally adjusted initial unemployment claims 4-week moving average was 231,500, a decrease of 4,750 from the previous week’s revised average. The previous week’s average was revised up by 250 from 236,000 to 236,250. There is little evidence of a potential recession in this data.

Here is a summary of headlines we are reading today:

- Beijing and Washington Clash Over Russia Sanctions

- UK Plans New Environmental Guidance for North Sea Oil and Gas Firms

- How China is Circumventing Sanctions to Buy Iranian Oil

- CNOOC Expects Oil Prices to Remain Rangebound Between $75 and $85

- Traders Concerned About Near-Term Risks for European Gas Supply

- Dow rises 200 points for fresh record close, Nasdaq falls as Nvidia shares tumble: Live updates

- The Fed’s preferred inflation indicator is out Friday. Here’s what to expect

- Disillusioned crypto investors are struggling behind bitcoin’s ETF success

- Nvidia shares fall despite earnings beating estimates

- Bitcoin drifts back to $60,000, trimming the week’s losses: CNBC Crypto World

- Apple, Nvidia Eye Investments In OpenAI As ChatGPT Hits $100 Billion Valuation

- Treasury yields rise after latest batch of U.S. economic data

- With earnings season behind us, the stock market is aiming at new all-time highs

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.