Headlines:

Markets Turmoil Amid ‘Russia Invades’ Reports & Bullard’s Bond Bloodbath.

Despite Turmoil, Stocks Seeing Largest Ever Inflows In 2022.

Inflation worries will continue to haunt investors next week, say, analysts.

Biden sends 3,000 more troops to Poland amid the Russia-Ukraine crisis.

Oil Prices Spike (WTI 91.77) On Rumors Russia Is Preparing To Invade Ukraine. Oil prices are soaring after media outlets began to report that a Russian invasion of Ukraine is imminent. PBS has said that according to officials, the U.S. believes Putin has decided to invade Ukraine and communicated those plans to the Russian military.

U.S. Rig Count See Massive Climb On Higher Oil Prices. The number of active drilling rigs in the United States rose by 22 this week, the 16th straight weekly increase to the number of oil and gas rigs in the United States, and the largest single-week rise since February 2018.

Oil jumps amid escalating tensions between Russia and Ukraine. Oil prices jumped amid escalating tensions between Ukraine and Russia, with the U.K. advising British nationals to leave Ukraine immediately.

NASDAQ closes down sharply at 2.8%, while the S&P 500 closes down 1.9% on fears of a Russian attack on Ukraine. The red equities trading volume is fractionally higher than yesterday.

As usual, we have included below the headlines and news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

OPEC Production Problems Push Oil Prices HigherNews of an ‘imminent’ nuclear deal with Iran sent oil prices lower this week, but the reality of OPEC underproduction soon shifted sentiment and sent prices higher on Friday.Friday, February 11th, 2022Wherever you looked this week, it seemed that Iran was at the center of all oil market news. The prospect of a breakthrough in the nuclear deal, a breakthrough that was assumed to be imminent by several participants, drove oil prices lower over the week after last weeks bull run to mid $90s. The fact that Irans crude would take several Read more at: https://oilprice.com/Energy/Energy-General/OPEC-Production-Problems-Push-Oil-Prices-Higher.html |

|

Oil Prices Spike On Rumors Russia Is Preparing To Invade UkraineOil prices are soaring after media outlets began to report that a Russian invasion of Ukraine is imminent. PBS has reported that according to officials, the U.S. believes Putin has decided to invade Ukraine and communicated those plans to the Russian military. Six U.S. and Western officials have reportedly told PBS that they expect a Russian invasion to begin next week, with defense officials expecting a horrific, bloody campaign that begins with two days of bombardment and electronic warfare, followed by an invasion, with Read more at: https://oilprice.com/Energy/Oil-Prices/Oil-Prices-Spike-On-Rumors-Russia-Is-Preparing-To-Invade-Ukraine.html |

|

Big Oil Books Biggest Cash Flow Since 2008The worlds five supermajors booked $37 billion in combined cash flows for the fourth quarter as disciplined spending combined with rallying oil prices to take Big Oils cash flow to the highest since 2008. ExxonMobil, Chevron, BP, Shell, and TotalEnergies also booked combined adjusted net earnings of $31 billion for Q4 2021the highest for any quarter in more than nine years, according to Bloombergs estimates. All supermajors reported very strong earnings and cash flows for Q4 and 2021, as oil and gas prices rallied and Read more at: https://oilprice.com/Latest-Energy-News/World-News/Big-Oil-Books-Biggest-Cash-Flow-Since-2008.html |

|

Europes Dependence On Natural Gas Imports Hits 80%The European Union and the UK have seen their dependence on natural gas imports jump to 80 percent in 2020 from 65 percent in 2010, as regional production plunged, the U.S. Energy Information Administration (EIA) said on Friday. The high dependence on gas imports and the low levels of gas in storage have played the main role leading up to the gas and power crisis in Europe, where energy costs have soared over the past few months. In 2020, pipeline natural gas imports into the EU plus the UK region accounted for 74 percent of all natural gas Read more at: https://oilprice.com/Latest-Energy-News/World-News/Europes-Dependence-On-Natural-Gas-Imports-Hits-80.html |

|

U.S. Rig Count See Massive Climb On Higher Oil PricesThe number of active drilling rigs in the United States rose by 22 this weekthe 16th straight weekly increase to the number of oil and gas rigs in the United States, and the largest single-week rise since February 2018. The total rig count now sits at 635 as the price of a WTI barrel slipped this week from its multi-year highs. Baker Hughes reported this week that the total active rig figureoil, gas, and miscellaneousis 238 rigs higher than the rig count this time in 2021. Oil-directed rigs rose 19 to 516, while gas-directed Read more at: https://oilprice.com/Energy/Energy-General/US-Rig-Count-See-Massive-Climb-On-Higher-Oil-Prices.html |

|

Italian Cities Turn Off Lights On Landmarks To Protest High Energy BillsSome of the biggest historical monuments and tourist attractions in thousands of Italian cities had their lights shut off for half an hour in the evenings this week as mayors and local authorities call for government relief over soaring energy bills for municipalities. Landmarks in Rome, Milan, Venice, Florence, Bologna, Naples, and thousands of other big cities and small towns were not illuminated for up to an hour in the evenings as part of a campaign organized by the association of Italian municipalities, ANCI, to draw the attention of the government Read more at: https://oilprice.com/Latest-Energy-News/World-News/Italian-Cities-Turn-Off-Lights-On-Landmarks-To-Protest-High-Energy-Bills.html |

|

Netflix is going to do a series on accused bitcoin hack money launderers busted in biggest DOJ forfeiture caseThe Netflix series on the alleged bitcoin money laundering scheme was announced three days after the arrest of Ilya “Dutch” Lichtenstein and Heather Morgan Read more at: https://www.cnbc.com/2022/02/11/netflix-will-do-series-on-accused-bitcoin-hack-money-launderers.html |

|

Netflix to remove ‘Daredevil,’ other Marvel shows, from streaming platform March 1Netflix’s suite of Marvel-branded television shows will be leaving the streaming service. Read more at: https://www.cnbc.com/2022/02/11/netflix-to-remove-daredevil-other-marvel-shows-from-service.html |

|

National Football League has been lobbying the SEC on blockchain technologyThe National Football League has been lobbying the Securities and Exchange Commission on blockchain technology. Read more at: https://www.cnbc.com/2022/02/11/nfl-lobbies-the-sec-on-blockchain-technology.html |

|

Oil jumps amid escalating tensions between Russia and UkraineOil prices jumped amid escalating tensions between Ukraine and Russia, with the U.K. advising British nationals to leave Ukraine immediately. Read more at: https://www.cnbc.com/2022/02/11/oil-jumps-amid-escalating-tensions-between-russia-and-ukraine.html |

|

Investing Club: Lots of Club stock earnings next week — here’s what Cramer hopes to hearCNBC’s Jim Cramer offers his outlook on Investing Club names that report earnings next week, including Devon Energy, Nvidia and Wynn Resorts. Read more at: https://www.cnbc.com/2022/02/11/investing-club-stock-earnings-devon-energy-wynn-nvidia-walmart-cisco.html |

|

Celebrities, humor and a huge dose of nostalgia will dominate Sunday’s Super Bowl adsWith the average 30-second Super Bowl ad costing about $6.5 million, companies look to reach key age demographics and provide an oasis from Covid concerns. Read more at: https://www.cnbc.com/2022/02/11/2022-super-bowl-ads-gm-meta-and-frito-lay-are-leaning-into-nostalgic-themes-.html |

|

Pfizer delays its FDA application to expand its Covid vaccine to kids under 5 until AprilPfizer and BioNTech said they needed more data “because rates of infection and illness remain high in children of this age” due to the omicron variant. Read more at: https://www.cnbc.com/2022/02/11/pfizer-delays-its-application-to-the-fda-to-expand-its-covid-vaccine-to-kids-under-5.html |

|

The risks and rewards of investing in the metaverse real estate boomEarly speculators and celebrities are buying up land that doesn’t even exist in the real world. They are investing in metaverse real estate, a concept mind-boggling to most people. Here’s how the metaverse land rush happened, and what’s next for the fast-growing industry. Read more at: https://www.cnbc.com/2022/02/11/the-risks-and-rewards-of-investing-in-the-metaverse-real-estate-boom.html |

|

Furniture mogul ‘Mattress Mack’ sets legal sports-betting record with $5 million wager on Cincinnati BengalsJim McIngvale, better known as “Mattress Mack,” has made a $5 million wager on the Cincinnati Bengals, the single-largest legal sports bet ever. Read more at: https://www.cnbc.com/2022/02/11/mattress-mack-sets-legal-sports-betting-record-with-5-million-on-cincinnati-bengals.html |

|

Canadian leader declares state of emergency over bridge blockade, plans to arrest protestersThe blockade, now in its fifth day, has brought travel over the Ambassador Bridge between Detroit and Windsor, Ontario, to a halt. Read more at: https://www.cnbc.com/2022/02/11/canadian-leader-declares-state-of-emergency-over-bridge-blockade-plans-to-arrest-protesters.html |

|

Expedia CEO says the metaverse doesn’t pose a threat to what he calls ‘real-verse’ travel“I think for the foreseeable future, we feel pretty good about people wanting to be out in the world,” Expedia’s Peter Kern told CNBC on Friday. Read more at: https://www.cnbc.com/2022/02/11/expedia-ceo-peter-kern-says-metaverse-doesnt-pose-a-threat-to-real-verse-travel.html |

|

Omicron is fading, but nobody knows when the pandemic will finally endThe future course of the pandemic remains uncertain because new variants may emerge as people’s immunity to the virus wanes. Read more at: https://www.cnbc.com/2022/02/11/covid-no-one-knows-when-the-pandemic-will-end-after-omicron-upended-most-hope.html |

|

Under Armour earnings top estimates, but shares fall as supply chain issues hurt growthUnder Armour shares are falling despite the retailer reporting fiscal fourth-quarter earnings and sales ahead of analysts’ estimates. Read more at: https://www.cnbc.com/2022/02/11/under-armour-uaa-q4-2021-earnings-.html |

|

Markets Turmoil Amid ‘Russia Invades’ Reports & Bullard’s Bond BloodbathMarkets Turmoil Amid ‘Russia Invades’ Reports & Bullard’s Bond BloodbathA sudden slap to the face seemed to shock investors from their multi-month stupor, waking to the reality that The Fed is serious this time about raising rates and withdrawing liquidity. That realization, considering US equity valuations have never been higher (combined with a collapse in US consumer confidence) have many wondering just where (or if) these two lines will ever converge…

Source: Bloomberg The awakening sent rate-hike odds soaring this week. Even with today’s attempt to walk back Jim Bullard’s hawkishness, the market is now pricing in a 60% chance of 7 rate-hikes this year, a 70% chance of a 50bps hike in March, and even a 25% chance that The Fed will surprise with an inter-meeting hike before March (note that there is an unscheduled Fed meeting on Monday)… Read more at: https://www.zerohedge.com/markets/markets-turmoil-amid-russia-invades-reports-bullard-bombshell |

|

Despite Turmoil, Stocks Seeing Largest Ever Inflows In 2022Despite Turmoil, Stocks Seeing Largest Ever Inflows In 2022Something odd is happening in the market: while stocks are tumbling, pushing most tech names into a deep bear market amid the worst turmoil for markets in years, inflows into stocks – both institutional and retail – are soaring. According to EPFR data compiled by Bank of America, cumulative equity flows YTD in 2021 have hit a record $153bn, exceeding the pace of early-2021 (when the year started with $151bn in inflows, ahead of a record year of more than $1tn inflows). How can this be? Well, the catalyst behind this unprecedented scramble for risk is that despite falling prices, investors are bailing on other even more impacted securities, and with a record outflows from money markets/cash as well as huge capital flight out of bond funds, this money has to go somewhere, and that “somewhere” is stocks for now, even though if the Fed is indeed set to hike 7 times this year and drain $2+ trillion from its balance sheet, the pain for stocks is only just starting. Here are the weekly fund flow details: Huge $46.6bn inflow to global equities, $0.3bn into gold, $10.5bn from bonds, $47.5bn outflow from cash. largest 4-week outflow from cash/MMF ever (-$35.2bn, Chart 3) – this despite soon-to-be-inverted yield curve encouraging reallocation from long-end to short-end; largest 4-week outflow from corporate bonds since Apr’20 (-$8.6bn Chart 4); Read more at: https://www.zerohedge.com/markets/despite-turmoil-stocks-seeing-largest-ever-inflows-2022 |

|

Veteran Bankers Are Taking Up Jobs In RenewablesVeteran Bankers Are Taking Up Jobs In RenewablesBy Tsvetana Paraskova of OilPrice.com, Veteran bankers who have advised mega-deals in oil and gas are starting to take up jobs as advisers of mergers and acquisitions in renewables as the energy industry globally is increasingly focused on growing low-carbon businesses.

The global push toward cleaner energy and net-zero emissions has created a kind of transition dilemma for bankers, too. Some have moved from advising oil and gas firms on multi-billion deals to working with customers on smaller-scale renewables deals. While the total value of deals in the clean energy sector has jumped over the past few years, it is still just a fraction of the value of the mega-deals in the oil and gas industry. On the other hand, the growing net-zero emissions and ESG trends are promising much … Read more at: https://www.zerohedge.com/energy/veteran-bankers-are-taking-jobs-renewables |

|

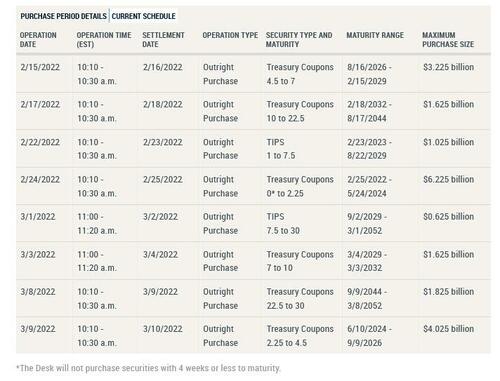

Fed Publishes Final POMO Schedule, Killing Expectations For An Intermeeting Rate HikeFed Publishes Final POMO Schedule, Killing Expectations For An Intermeeting Rate HikeEarlier today we observed that amid speculation of an intermeeting, or emergency rate hike, all eyes were on today’s final POMO schedule release from the Fed due at 3PM to see whether there would be any notable changes to the Fed’s QE plans, or whether the Fed would even end QE prematurely today. Well, a few minutes after 3PM ET, the Fed effectively killed any speculation for an early rate hike when it published what will be its final (for now) POMO schedule, which sees $20 billion in Treasury bonds purchased across 8 operations over the next month, with the final purchase of $4 billion taking place on March 9, in line with expectations, and one week before the March 16 FOMC meeting when the Fed will hike 50bps… and just one day before the February CPI print is released and the ECB’s next decision.

And while Feb Fed Fu … Read more at: https://www.zerohedge.com/markets/fed-publishes-final-pomo-schedule-killing-expectations-intermeeting-rate-hike |

|

Cost of pasta and tinned tomatoes jumps as shop prices riseResearch for the BBC suggests the price of 15 food staples across four supermarkets has risen 8% in a year. Read more at: https://www.bbc.co.uk/news/business-60290236?at_medium=RSS&at_campaign=KARANGA |

|

Spain relaxes Covid restrictions for UK teenagersFrom Monday, unvaccinated British 12-to-17 year-olds will be allowed into Spain with a negative test. Read more at: https://www.bbc.co.uk/news/business-60335735?at_medium=RSS&at_campaign=KARANGA |

|

The challenges of running a business in Ukraine’s second cityThere is a sense of déjà vu among the business community in Kharkiv, 26 miles from the Russia border. Read more at: https://www.bbc.co.uk/news/business-60261804?at_medium=RSS&at_campaign=KARANGA |

|

Inflation worries will continue to haunt investors next week, say analystsThe buying during the week was due to a surprising decision by the Reserve Bank of India. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/inflation-worries-will-continue-to-haunt-investors-next-week-say-analysts/articleshow/89509044.cms |

|

Market movers: Why Sapphire Foods jumped 17%The firm acknowledged that the third wave of the Covid pandemic has again resulted in some operational disruptions in January and February in few markets Read more at: https://economictimes.indiatimes.com/markets/stocks/news/market-movers-why-sapphire-foods-jumped-17/articleshow/89506035.cms |

|

Tech View: Nifty forms bearish candle; support seen at 17,250-300 levelsNifty50 has given up almost all the gains of the last two trading sessions. In this process, it also filled the bullish gap placed in the zone of 17,339-306 level Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-forms-bearish-candle-support-seen-at-17250-300-levels/articleshow/89503510.cms |

|

Market Extra: Investors pull $15.8 billion from U.S. junk-bond funds to start year, worst outflows since 2010: Goldman SachsFunds that specialize in U.S. high-yield or ‘junk bonds’ are reckoning with their worst outflows to start a year since 2010, according to a tally by Goldman Sachs research. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7931-45B5C222F404%7D&siteid=rss&rss=1 |

|

: Russia could invade Ukraine during Olympics, says Biden adviser SullivanA Russian invasion of Ukraine could begin “any day now,” White House national-security adviser Jake Sullivan said Friday, telling reporters that Moscow is in position to mount a “major military action” and an attack could come during the Olympics. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7933-4C580EFF57F6%7D&siteid=rss&rss=1 |

|

Living With Climate Change: How ‘green’ is this Super Bowl? Ocean-friendly straws and Nikola’s hydrogen beer truck try to lower the NFL championship’s carbon footprintDitching disposable plastic is one step that SoFi Stadium in Los Angeles, the Super Bowl host, is taking as pro sports sync up with changing consumer habits. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7931-52483DC8752C%7D&siteid=rss&rss=1 |