Headlines:

Consumer goods giant Unilever will raise prices again as the cost of raw materials climbs.

Bond Report: Aggressive Treasury selloff gives 2-year rate its biggest daily gain since 2009 and lifts 10-year yield above 2%.

U.S. consumer prices have risen at the fastest rate since 1982.

There are whispers of an emergency FED rate hike as soon as tomorrow that spooked investors, inspiring today’s selloff on fears the Fed will be more aggressive to contain surging inflation. With the punditry obsessing over the March FOMC meeting, where odds earlier today hit 100% of a 50bps rate hike before easing modestly (and more than six hikes for all of 2022).

WSJ markets alert: 10-year Treasury yield touches 2% for the first time since 2019. After hot ‘Blowout’ inflation data, inflation has soared to its highest rate in four decades. U.S. inflation leads traders to largely price in a half-point March rate hike by the Fed.

Kellogg may raise prices again in 2022 as it sees ‘double-digit cost inflation,’ says CEO. “Our goal is to cover all of those input costs with pricing and productivity, and we think we’re in very good shape to do that,” the Kellogg CEO said Thursday.

Inflation eroded pay by 1.7% over the past year. Workers have seen their hourly pay jump at about the fastest clip in 15 years. But high annual inflation has eaten into those raises.

Bullishness across commodity markets is overwhelming. Goldman’s Jeffrey Currie summed it up earlier this week by saying, “This is a molecule crisis. We’re out of everything, and I don’t care if it’s oil, gas, coal, copper, aluminum. You name it; we’re out of it.”

As usual, we have included below the headlines and news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Puerto Ricos Ambitious Clean Energy PlanNearly five years ago, Puerto Rico declared bankruptcy. Or rather, it declared the closest thing to bankruptcy that a state or territory can declare when it announced in 2017 that it would not be able to repay its debts on the heels of a devastating hurricane that left the island in desperate condition. Now, just last week, a United States federal judge finally approved a deal to get Puerto Rico out of bankruptcy and help the territory to take significant steps toward becoming financially solvent. The restructuring plan will reduce Read more at: https://oilprice.com/Energy/Energy-General/Puerto-Ricos-Ambitious-Clean-Energy-Plan.html |

|

OPEC Sees Bright Prospects For Global Oil Demand This YearStronger economic growth and the easing of COVID restrictions make the near-term prospects for global oil demand bright, with an upside potential, OPEC said on Thursday, keeping its forecast that consumption will exceed pre-pandemic levels in 2022. In its closely-watched Monthly Oil Market Report (MOMR), the organization revised up slightly, by 10,000 bpd, its annual oil demand estimate for 2022 to 100.8 million bpd, up from 100.79 million bpd in last months report. Estimates for the third and fourth quarter of 2022 were revised up by 30,000 Read more at: https://oilprice.com/Latest-Energy-News/World-News/OPEC-Sees-Bright-Prospects-For-Global-Oil-Demand-This-Year.html |

|

Outlook For Utility-Scale Renewables Sours After Record YearNew utility-scale renewables capacity is set to break records in 2022, hitting an all-time high of 220 gigawatts (GW) globally with investments surpassing $300 billion for solar and wind combined, Rystad Energy research indicates. However, a slowdown of capacity additions could be around the corner as construction start-ups of large-scale projects are expected to stall. Utility-scale renewable capacity additions are expected to increase by 38 GW in 2022 compared with last year, boosted by the array of government targets and policies announced in Read more at: https://oilprice.com/Alternative-Energy/Renewable-Energy/Outlook-For-Utility-Scale-Renewables-Sours-After-Record-Year.html |

|

Is BP Providing A Blueprint For Big Energy?By bolstering a select few oil operations and pumping funds into renewable energy projects, BP is already emerging stronger in the early days of its transition. This week, BP reported its highest profits in 8 years as the company says it is performing while transforming. BP announced that it has experienced a huge full-year net profit, supported by high commodity prices. The British energy firm has reported an underlying replacement cost profit of $12.8 billion for 2021, following a net loss of $5.7 billion in 2020. Bernard Read more at: https://oilprice.com/Energy/Energy-General/Is-BP-Providing-A-Blueprint-For-Big-Energy.html |

|

Political Chaos In Libya Threatens Oil Production, AgainLibyas Parliament based in the east named on Thursday a new prime minister, while the incumbent refuses to step down and was reportedly a target of an assassination attempt earlier today, in yet another political rift in the OPEC oil producer. The renewed political chaos, after a failed election scheduled for end-December 2021, threatens to bring back chaos to Libyas divided institutions and raises the prospect of renewed conflict and blockades of oil ports and other energy infrastructure. The east-based Parliament on Thursday named Read more at: https://oilprice.com/Latest-Energy-News/World-News/Political-Chaos-In-Libya-Threatens-Oil-Production-Again.html |

|

Why Canadian Crude Producers Arent Sending More Oil To The U.S.Canadian oil producers are not rushing to raise supply too much because of the countrys perennial problem with limits to the pipeline takeaway capacity, thus not reaping the benefits of $90 oil prices, according to Capital Economics. Due to pipeline capacity constraints, there is little supply response to rising prices, with oil production still stuck near 2018 levels. With export capacity out of their hands, producers have been using their income to pay down debt rather than invest, Stephen Brown, senior Canada economist at Read more at: https://oilprice.com/Latest-Energy-News/World-News/Why-Canadian-Crude-Producers-Arent-Sending-More-Oil-To-The-US.html |

|

Astra stock drops 25% after NASA mission fails mid-launchShares of rocket builder Astra fell sharply in trading on Thursday after the company’s latest mission failed to reach orbit. Read more at: https://www.cnbc.com/2022/02/10/astra-stock-drops-after-nasa-mission-fails-mid-launch.html |

|

Kellogg may raise prices again in 2022 as it sees ‘double-digit cost inflation,’ says CEO“Our goal is to cover all of those input costs with pricing and productivity, and we think we’re in very good shape to do that,” the Kellogg CEO said Thursday. Read more at: https://www.cnbc.com/2022/02/10/kellogg-may-raise-prices-again-in-2022-amid-double-digit-cost-inflation-says-ceo.html |

|

Brooklyn Nets will send James Harden to Philadelphia 76ers for deal centered around Ben SimmonsHarden will give the 76ers more firepower next to Joel Embiid, while Philadelphia will resolve a long impasse with Simmons. Read more at: https://www.cnbc.com/2022/02/10/nba-trade-deadline-nets-send-james-harden-to-sixers-for-ben-simmons.html |

|

Stocks making the biggest moves midday: Disney, Uber, Coca-Cola and moreThese are the stocks posting the largest moves in midday trading. Read more at: https://www.cnbc.com/2022/02/10/stocks-making-the-biggest-moves-midday-disney-uber-coca-cola-and-more.html |

|

Inflation eroded pay by 1.7% over the past yearWorkers have seen their hourly pay jump at about the fastest clip in 15 years. But high annual inflation has eaten into those raises. Read more at: https://www.cnbc.com/2022/02/10/inflation-eroded-pay-by-1point7percent-over-the-past-year.html |

|

Mattel CEO says ‘Barbie’ movie production begins next month, reflects on doll turning 63“Barbie, at 63, is still the most diverse doll in the market, it continues to evolve, be more relevant than ever,” Mattel’s Ynon Kreiz told CNBC on Thursday. Read more at: https://www.cnbc.com/2022/02/10/mattel-ceo-ynon-kreiz-says-barbie-movie-production-begins-next-month.html |

|

Investing Club Stock Profile: American Eagle is making smart supply chain investments to improve profitsAmerican Eagle has improved its profitability with a more efficient supply chain and less promotional activity to drive sales. Read more at: https://www.cnbc.com/2022/02/10/investing-club-american-eagle-is-making-smart-supply-chain-investments-to-improve-profits.html |

|

Connecticut governor says Covid mask mandate can be lifted because ‘hospitals aren’t overwhelmed’“The most important metric for me is hospitalizations. We want to make sure our hospitals aren’t overwhelmed,” Gov. Ned Lamont told CNBC on Thursday. Read more at: https://www.cnbc.com/2022/02/10/democratic-governor-covid-mask-mandate-was-able-to-be-lifted-because-hospitals-arent-overwhelmed.html |

|

‘Austin Powers’ villains fight climate change to promote GM’s new EVs in Super Bowl adThe Super Bowl ad stars actors Mike Myers, Rob Lowe and others reclaiming roles from the spy comedy trilogy. Read more at: https://www.cnbc.com/2022/02/10/super-bowl-ads-austin-powers-villains-fight-climate-change-.html |

|

Automakers cut production as Canadian truckers block deliveries across key border bridge to protest vaccine mandateGeneral Motors, Ford Motor and Toyota Motor have been forced to cut production at several plants in the U.S. and Canada this week due to a lack of parts. Read more at: https://www.cnbc.com/2022/02/10/automakers-cut-production-due-to-anti-vaccine-canadian-trucker-protest.html |

|

More Covid relief for small businesses? Struggling industries hope that’s the caseThe omicron surge hit industries that had already struggled through the pandemic. Now some, including gyms, hotels and restaurants, are pushing for more relief. Read more at: https://www.cnbc.com/2022/02/10/small-businesses-hope-for-more-covid-relief.html |

|

European nuclear fusion experiment announces ‘record-breaking’ resultsFusion is described as “the process that takes place in the heart of stars and provides the power that drives the universe.” Read more at: https://www.cnbc.com/2022/02/10/european-nuclear-fusion-experiment-announces-record-breaking-results.html |

|

5 things to know before the stock market opens ThursdayU.S. stock futures turned lower Thursday after government data showed a stronger-than-expected increase in consumer inflation. Read more at: https://www.cnbc.com/2022/02/10/5-things-to-know-before-the-stock-market-opens-thursday-february-10.html |

|

Bullard Bombshell & Soaring CPI Spark VaR Shock-nado, Rate-Hike Odds ExplodeBullard Bombshell & Soaring CPI Spark VaR Shock-nado, Rate-Hike Odds ExplodeA 40-year-high print for US CPI stole the jam out of most investors donuts today as the hawkish implications of the far hotter than expected inflation print sparked a total VaR Shock across every asset class

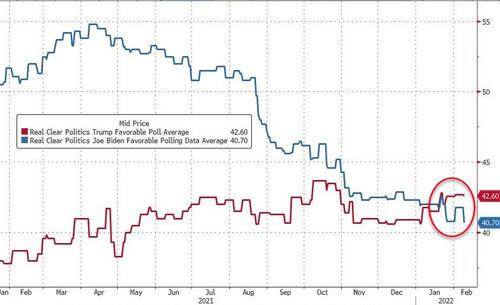

Notably, The White House commented that it would be appropriate for The Fed to recalibrate support for the economy (after blaming the soaring inflation on the pandemic). This sounds a lot like “meddling” with the independence of The Fed (cough Trump cough) but seems like a clear message to Powell that it’s ok to crash the economy (to slow inflation)… perhaps in the mistaken belief that it will somehow help his approval ratings?

Since even Goldman admitted that the Fed has never successfully hiked its way into a soft la … Read more at: https://www.zerohedge.com/markets/soaring-cpi-sparks-market-wide-var-shock-nado-rate-hike-odds-explode |

|

Elon Musk Says Tesla Has “Dropped The Ball Badly” On Ramping Production Of The New Model XElon Musk Says Tesla Has “Dropped The Ball Badly” On Ramping Production Of The New Model XIf there’s one thing we can’t help but notice every time Tesla reports deliveries, it’s that the company looks as though it has simply given up on its Model S and Model X vehicles, with its Model 3 and Model Y cars making up a majority of the company’s sales. Now, even Elon Musk is copping to the fact that the company has botched the rollout of its red-headed stepchild, the Model X revamp. On Twitter this week, Musk admitted that Tesla “dropped the ball badly regarding new Model X production ramp & still haven’t fully recovered”. He also said it was “idiotic to stop production of old X in Dec 2020 when there was still plenty of demand!”

The statement was responding to a customer who said they had been waiting on the vehicle for over a year. “Here’s a criticism, the refreshed Model X rollout has been horrible & the lack of communication to customers who have been waiting for a year or more for their car & keep receiving delays is disappointing,” the customer wrote. As a reminder, in January, Tesla announced that for 2021, it had delivered “over 936,000” vehicles, p … Read more at: https://www.zerohedge.com/markets/elon-musk-says-tesla-has-dropped-ball-badly-ramping-production-new-model-x |

|

The Lone Bear Calling For $65 OilThe Lone Bear Calling For $65 OilBy Irina Slav of OilPrice.com, Bullishness across commodity markets is overwhelming. Goldman’s Jeffrey Currie summed it up earlier this week by saying “This is a molecule crisis. We’re out of everything, I don’t care if it’s oil, gas, coal, copper, aluminum, you name it we’re out of it.” Yet there is the occasional bear – and in oil, one bear is arguing that oil will fall in just a few months.

Citi’s head of commodity analysis Ed Morse is a rare contrarian voice in a sea of commodity analysts predicting oil at $100. For a while now, Morse has argued that instead of rising … Read more at: https://www.zerohedge.com/markets/lone-bear-calling-65-oil |

|

Whispers Of An Emergency Fed Rate Hike As Soon As TomorrowWhispers Of An Emergency Fed Rate Hike As Soon As TomorrowWith the punditry obsessing over the March FOMC meeting, where odds earlier today hit 100% of a 50bps rate hike before easing modestly (and more than 6 hikes for all of 2022)…

… the real action is in the February Fed funds contract which has spiked to 13bps, suggesting 5bps of tightening relative to the effective Fed funds rate of 0.08%.

Why is this notable? Because the February contra … Read more at: https://www.zerohedge.com/markets/whispers-emergency-fed-rate-hike-soon-tomorrow |

|

Four Gupta steel firms face winding up orders, say reportsWinding up petitions have been issued against four companies owned by metals tycoon Sanjeev Gupta, reports say. Read more at: https://www.bbc.co.uk/news/business-60335647?at_medium=RSS&at_campaign=KARANGA |

|

Marmite maker Unilever to raise prices as costs soarConsumer goods giant Unilever is set to raise prices again as the cost of raw materials climbs. Read more at: https://www.bbc.co.uk/news/business-60324332?at_medium=RSS&at_campaign=KARANGA |

|

US consumer prices rise at fastest rate since 1982Inflation hit 7.5% in the 12 months to January – the highest rate in 40 years. Read more at: https://www.bbc.co.uk/news/business-60336676?at_medium=RSS&at_campaign=KARANGA |

|

RBI policy-driven euphoria to be short-lived, D-St to take cues from Q3 results, state pollsThough the intent of the RBI to support the recovery in the economy in the face of disruption due to Covid is commendable, economists will now fear whether the RBI will fall behind the curve, having maintained the easy monetary stance longer than most other central banks had Read more at: https://economictimes.indiatimes.com/markets/stocks/news/rbi-policy-driven-euphoria-to-be-short-lived-d-st-to-take-cues-from-q3-results-state-polls/articleshow/89482599.cms |

|

Trade setup: PSBs, select lenders to see traction; avoid creating shortsGiven the next week’s options data, the levels of 17,600 will act as an inflection point as it holds the highest Put and Call OI accumulation Read more at: https://economictimes.indiatimes.com/markets/stocks/news/trade-setup-psbs-select-lenders-to-see-traction-avoid-creating-shorts/articleshow/89483089.cms |

|

Day Trading Guide: 2 stock recommendations for FridayThe Bank Nifty reclaimed levels of the 39,000 mark. However, it remains beneath the prior week’s high. The positive internal breadth of the Bank Nifty indicates that stocks specific rallies are likely to continue. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/day-trading-guide-2-stock-recommendations-for-friday/articleshow/89485427.cms |

|

Bond Report: Aggressive Treasury selloff gives 2-year rate its biggest daily gain since 2009 and lifts 10-year yield above 2%The 2-year Treasury yield has its biggest one-day gain in more than a decade after the U.S. inflation rate for January came in at a 40-year high of 7.5%. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7923-A029F67802A2%7D&siteid=rss&rss=1 |

|

Mark Hulbert: This market-timing model has made stock investors more money than the ‘Super Bowl Predictor’Rams or Bengals? For the stock market, it makes no difference which team wins the big game. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-78FA-C51FC3E7F66E%7D&siteid=rss&rss=1 |

|

Sustainable Investing: A dirty secret: Here’s why your ESG ETF likely owns stock in fossil-fuel companiesSome ESG ETFs funds also may own tobacco and gambling stocks. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-791F-BA7B68D963B8%7D&siteid=rss&rss=1 |