Summary Of the Markets Today:

- The Dow closed up 527 points or 1.60%,

- Nasdaq closed up 1.54%,

- S&P 500 up 1.49%,

- WTI crude oil settled at $78 up $2.22,

- USD $104.03 down $0.69,

- Gold $1824 down $1.10,

- Bitcoin $16,780 down 0.54% – Session Low 16,744,

- 10-year U.S. Treasury 3.365% down 0.009%

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for December 2022

Today’s Economic Releases:

Existing-home sales fell for the tenth consecutive month to a seasonally adjusted annual rate of 4.09 million. Sales slipped 7.7% from October and 35.4% from the previous year. The median existing-home sales price rose to $370,700, an increase of 3.5% from one year ago. The inventory of unsold existing homes retreated for the fourth straight month to 1.14 million at the end of November or the equivalent of 3.3 months’ supply at the current monthly sales pace. Home sales continue to decline due to the increase in mortgage rates.

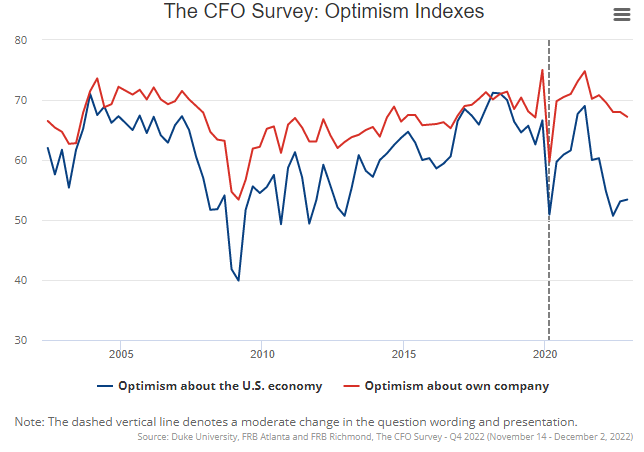

U.S. financial executives are generally pessimistic about next year’s economy, saying they expect price growth to subside some in 2023 but still remain high. They also report that wages at their firms have not kept pace with inflation.

A summary of headlines we are reading today:

- $100 Oil To Return In 2023

- Looming Deep Freeze Sends U.S. Natural Gas Prices Higher

- Home sales tumbled more than 7% in November, the 10th straight month of declines

- AMC says it’s no longer in talks to acquire theaters from bankrupt Cineworld

- Mortgage refinance demand surged 6%, as rates dropped to the lowest level since September

- Taliban Bans All Education For Afghan Girls, Ironically As Huge Pallets Of Cash ‘Humanitarian’ Aid Flown In

- Metals Stocks: Gold settles flat after a powerful advance as consumer confidence rises to its highest since April

These and other headlines and news summaries moving the markets today are included below.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

$100 Oil To Return In 2023Eric Nuttall, partner and senior portfolio manager at Ninepoint Partners LP, has told the Financial Post that oil prices will return to $100 per barrel in 2023. According to the analysts, many of the headwinds that have cut short the oil price rally this year including China’s zero-Covid policy and the coordinated SPR releases by several governments will no longer be there in 2023. Coupled with sanctions on Russias oil and gas, this should elevate oil prices. He has also predicted that the energy sector will continue to outperform Read more at: https://oilprice.com/Energy/Oil-Prices/100-Oil-To-Return-In-2023.html |

|

Octopus Energy Faces Legal Challenges After Rival TakeoverOctopus Energy has completed its takeover of fallen rival Bulb, absorbing its 1.5m customers and becoming the third-biggest supplier in the UK with over five million households on its books. The acquisition was finalized via a new process known as the Energy Transfer Scheme (ETS) which moves Bulb moves back into private ownership following a year-long stint in special administration. The ETS was approved by the Business and Energy Secretary on 7 November, and the High Court ruled that this month that the transfer can go ahead. It set a Read more at: https://oilprice.com/Latest-Energy-News/World-News/Octopus-Energy-Faces-Legal-Challenges-After-Rival-Takeover.html |

|

Kazakstan’s State-Owned Oil IPO Raises $330 MillionKazakhstan’s state-owned oil and gas company is ending the year with a $330 million cash infusion after finally making its stock exchange debut, over a decade after plans to go public were announced. The flotation of KazMunaiGaz (KMG) shares on the stock markets in Astana and Almaty breathes new life into a privatization drive that has been beset by delays. KMGs initial public offering (IPO) was the largest ever on Kazakhstan’s stock market in terms of the number of bids received and final sales volume. However, the results indicate Read more at: https://oilprice.com/Energy/Crude-Oil/Kazakstans-State-Owned-Oil-IPO-Raises-330-Million.html |

|

Canada Set To Mandate 20% EV Share Of New Car Sales By 2026Canada will propose on Wednesday that one-fifth of all passenger cars, SUVs, and trucks sold in the country in 2026 be electric vehicles (EVs), The Canadian Press reports. The target, part of new regulations by the Environment Ministry, is also expected to mandate that all passenger vehicles sold in Canada by 2035 need to be EVs. Another intermediate target is that by 2030, 60% of passenger car sales should be electric vehicles. Under the new regulations, vehicle manufacturers or importers could face fines under the Canadian Environmental Read more at: https://oilprice.com/Latest-Energy-News/World-News/Canada-Set-To-Mandate-20-EV-Share-Of-New-Car-Sales-By-2026.html |

|

New Research Could Pave The Way For Mass Market Perovskite Solar CellsHelmholtz-Zentrum Berlin fr Materialien und Energie (HZB) researchers reported a new world record for tandem solar cells consisting of a silicon bottom cell and a perovskite top cell. The new tandem solar cell converts 32.5 percent of the incident solar radiation into electrical energy. The certifying institute European Solar Test Installation (ESTI) in Italy measured the tandem cell and officially confirmed this value which is also included in the National Renewable Energy Lab, USA chart of solar cell technologies. Scientists from HZB could Read more at: https://oilprice.com/Alternative-Energy/Solar-Energy/New-Research-Could-Pave-The-Way-For-Mass-Market-Perovskite-Solar-Cells.html |

|

Looming Deep Freeze Sends U.S. Natural Gas Prices HigherU.S. natural gas prices rebounded on Wednesday as the market eyes the upcoming cold snap prepares to slap much of the nation with some of the coldest temperatures of the season. Natural gas prices shot up by more than 4% on Wednesday as an arctic blast looks to envelop the United States in freezing temperatures by Christmas. At 11:46 a.m. ET, natural gas prices were up 4.43% to $5.558, although prices were still down from a month ago. The Upper Plains states are already seeing sub-zero temperatures. As the week progresses, those freezing temperatures Read more at: https://oilprice.com/Latest-Energy-News/World-News/Looming-Deep-Freeze-Sends-US-Natural-Gas-Prices-Higher.html |

|

Home sales tumbled more than 7% in November, the 10th straight month of declinesHome sales dropped an unusually sharp 7.7% in November, as high mortgage rates and home prices keep buyers on the sidelines. Read more at: https://www.cnbc.com/2022/12/21/home-sales-tumbled-november.html |

|

H&M removes Justin Bieber merchandise following criticism from pop starH&M will no longer sell a line of Justin Bieber merchandise after the musician told fans he didn’t “approve” of the clothing bearing his name and likeness. Read more at: https://www.cnbc.com/2022/12/21/hm-justin-bieber-merchandise-removed-after-criticism-from-pop-star-.html |

|

NFL nearing rights deal with Google’s YouTube TV for Sunday Ticket game packageThe National Football League is working on a deal to partner with Google’s YouTube TV for Sunday Ticket rights. Read more at: https://www.cnbc.com/2022/12/20/nfl-nearing-rights-deal-with-googles-youtube-tv-for-sunday-ticket-.html |

|

I drove hundreds of miles ‘hands-free’ in GM, Ford, and Tesla cars – here’s how it wentCNBC’s Michael Wayland recently tested “hands-free” systems from Tesla, GM, and Ford. Theirs are among the most readily available and dynamic on the market. Read more at: https://www.cnbc.com/2022/12/21/test-driving-gm-ford-and-tesla-hands-free-systems.html |

|

AMC says it’s no longer in talks to acquire theaters from bankrupt CineworldAMC has ended talks to acquire Cineworld’s theaters following another quarterly loss. Read more at: https://www.cnbc.com/2022/12/21/amc-says-it-ended-talks-to-acquire-theaters-from-cineworld.html |

|

Mortgage refinance demand surged 6%, as rates dropped to the lowest level since SeptemberMortgage applications to refinance a home loan jumped 6% last week from the previous week. Read more at: https://www.cnbc.com/2022/12/21/mortgage-refinance-demand-surged-6percent-as-interest-rates-dropped.html |

|

Porsche begins production of ‘e-fuel’ that could provide gas alternative amid EV pushPorsche officials celebrated the beginning of e-fuel production with the filling of a Porsche 911 with the first synthetic fuel produced at the site. Read more at: https://www.cnbc.com/2022/12/20/porsche-starts-production-of-e-fuel-that-could-provide-gas-alternative.html |

|

Nike surges after results top expectations and retailer shows inventory progressNike reported fiscal second-quarter earnings after the bell Tuesday. Read more at: https://www.cnbc.com/2022/12/20/nike-nke-q2-earnings-2023.html |

|

The new top House Republican overseeing markets isn’t as ‘anti-ESG’ as some in GOP wantPatrick McHenry, the key Republican on the House Financial Services Committee, isn’t as big an opponent of ESG as you might think. Read more at: https://www.cnbc.com/2022/12/21/how-gop-controlled-house-will-attack-esg-and-corporate-climate-change.html |

|

5 things to know before the stock market opens WednesdayHere are the most important news items that investors need to start their trading day. Read more at: https://www.cnbc.com/2022/12/21/5-things-to-know-before-the-stock-market-opens-wednesday-december-21.html |

|

Stocks making the biggest moves premarket: Rite Aid, Nike, FedEx and othersThese are the stocks posting the largest moves before the bell. Read more at: https://www.cnbc.com/2022/12/21/stocks-making-the-biggest-moves-premarket-rite-aid-nike-fedex-and-others.html |

|

EV maker Lucid closes $1.5 billion raise from the Saudi public wealth fund and other investorsElectric vehicle maker Lucid Group said it has completed a planned $1.5 billion equity offering. Read more at: https://www.cnbc.com/2022/12/19/ev-maker-lucid-raises-from-the-saudi-public-wealth-fund-and-other-investors.html |

|

EV battery startup QuantumScape starts shipping prototypes to automakers, a key milestoneIt’s a key step for QuantumScape, but actual commercial production of its EV batteries is still at least a few years away. Read more at: https://www.cnbc.com/2022/12/20/quantumscape-starts-shipping-ev-battery-prototypes.html |

|

BOJ, Welcome To The PartyBy Russell Clark of Capital Flows and Asset Markets substack Finally, the BOJ decides to stop impoverishing Japanese workers.

The BOJ has not exactly raised interest rates, but is has allowed the yield curve to steepen somewhat. There was a time when a 4% strengthening of the Yen would be seen as the beginning of the end of the world. Broadly speaking, a rallying Yen, as we saw from 2007 to 2011 (falling here is Yen strengthening against US Dollar), would be associated with falling 10 year bond yields, or a generally deflationary outcome. Read more at: https://www.zerohedge.com/markets/boj-welcome-party |

|

“There Is No Left & Right” – Austin Fitts Warns Corruption Out Of Control In “Spending Machine Financed With Our Taxes”Via Greg Hunter’s USAWatchdog.com, Catherine Austin Fitts (CAF), Publisher of The Solari Report and former Assistant Secretary of Housing (Bush 41 Admin.), says the U.S. government is so fraudulent that it will self-destruct much sooner than later.

CAF predicts, “If you look at FTX, my question is how much of the money sent to Ukraine got laundered right back for the (2022 midterm) election?”

|

|

Taliban Bans All Education For Afghan Girls, Ironically As Huge Pallets Of Cash ‘Humanitarian’ Aid Flown InOn Tuesday the Taliban suspended university education for all women, and Afghan girls promptly began being turned away from any college campuses, sparking limited attempts at protest. But on Wednesday it emerged that the ban on education has extended to all levels and ages, even down to elementary schools, which has effectively been suspended for all girls. Teachers too, have been impacted, as The Wall Street Journal reports, “In a gathering in Kabul with private-school directors, clerics and community representatives, Taliban officials on Wednesday also barred female staff, including teachers, from working in schools, closing off one of the few professions that had remained open to Afghan women under the new government, according to school principals who attended the meeting.”

Read more at: https://www.zerohedge.com/geopolitical/taliban-bans-all-education-afghan-girls-ironically-huge-pallets-cash-humanitarian-aid |

|

SF Fed ‘Proxy Rate’ Signals Most-Inverted Yield Curve Since 1981Authored by Steve Vannelli via Knowledge Leaders Capital blog, In a recent San Francisco Federal Reserve Publication titled “Monetary Policy Stance is Tighter Than Fed Funds Rate,” the authors argue that the “all in” policy rate is actually higher than the Fed Funds rate would suggest. They open:

How is the rate constructed? Per the Fed’s explanation:

|

|

Who is striking? How Thursday 22 December’s walkouts will affect youWhat you need to know about Thursday’s walkout by highway workers, by the BBC’s Zoe Conway. Read more at: https://www.bbc.co.uk/news/uk-64001120?at_medium=RSS&at_campaign=KARANGA |

|

Trump business losses sharply reduced his tax billIn 2020, the then US president reported negative income and paid no income tax. Read more at: https://www.bbc.co.uk/news/business-64059437?at_medium=RSS&at_campaign=KARANGA |

|

Fresh warning of disruption on airport strike daysA senior Border Force official has said he hopes to keep all airports open as staff strike. Read more at: https://www.bbc.co.uk/news/business-64054606?at_medium=RSS&at_campaign=KARANGA |

|

Promoter Max Ventures sells 1.7% stake in Max Financial via open marketThe promoter sold 58,85,000 shares of the company at Rs 679.20 per share, bulk deals data on the National Stock Exchange showed Read more at: https://economictimes.indiatimes.com/markets/stocks/news/promoter-max-ventures-sells-1-7-stake-in-max-financial-via-open-market/articleshow/96405177.cms |

|

Promoter entities to sell 4.6% stake in Ajanta Pharma via block deal ThursdayThrough the sale the entities are looking at raising close to Rs 650 crore. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/promoter-entities-to-sell-4-6-stake-in-ajanta-pharma-via-block-deal-thursday/articleshow/96404879.cms |

|

Paytm CEO says there will be no more cash burnCLSA had also upgraded Paytm last month saying that cash burn could end in another four to six quarters Read more at: https://economictimes.indiatimes.com/markets/stocks/news/paytm-ceo-says-there-will-be-no-more-cash-burn/articleshow/96401616.cms |

|

The MarketWatch Q&A: Taking a holiday trip? Travel guru Samantha Brown says you should always do these 3 things to avoid delays.The host of ‘Samantha Brown’s Places to Love’ on PBS also shares packing tips — ‘shoes are your nemesis’ — and talks about where every American should visit Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7114-4626639CF942%7D&siteid=rss&rss=1 |

|

Metals Stocks: Gold settles flat after a powerful advance as consumer confidence rises to its highest since AprilGold settled flat on Wednesday as a rally in precious metals appeared to pause after recording solid gains in the prior session. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-716E-23E10312C75C%7D&siteid=rss&rss=1 |

|

Deep Dive: Tesla’s stock drop has been bad. But this company has wiped out more investor wealth in 2022.Despite all the pain from Elon Musk’s Twitter distractions, Tesla ranks fourth on a list of the worst S&P 500 stocks of 2022 by market-value decline. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-716E-8814F1964F08%7D&siteid=rss&rss=1 |