Summary Of the Markets Today:

- The Dow closed up 97 points or 0.3%,

- Nasdaq closed up 0.99%,

- S&P 500 up 0.59%,

- Gold $1752 up $11.90,

- WTI crude oil settled at $77 down $3.48,

- 10-year U.S. Treasury 3.696% down 0.062%,

- USD index $106.11 down $1.11,

- Bitcoin $16,542 up $342.90

Today’s Economic Releases:

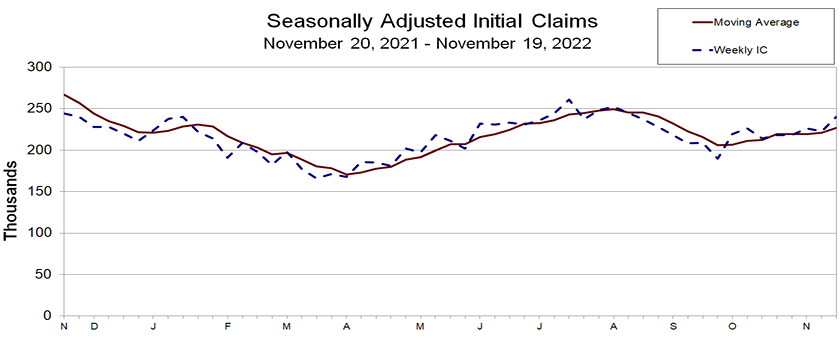

In the week ending November 19, the advance figure for Unemployment Insurance Weekly Claims 4-week moving average was 226,750, an increase of 5,500 from the previous week’s revised average. The previous week’s average was revised up by 250 from 221,000 to 221,250. The current increases are likely a result of layoffs in the tech industry.

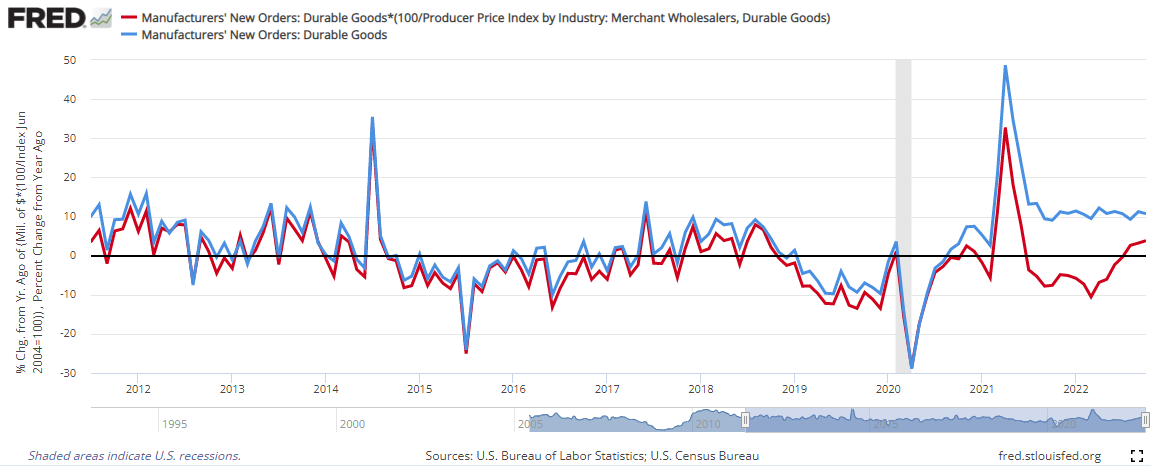

New orders for manufactured durable goods in October 2022 slowed somewhat to 10.7% year-over-year (blue line on graph below). However, inflation adjusted durable goods improved to 3.8% year-over-year as inflation is moderating in the durable goods sector (red line on graph below). The durable goods sector has been improving since March 2022.

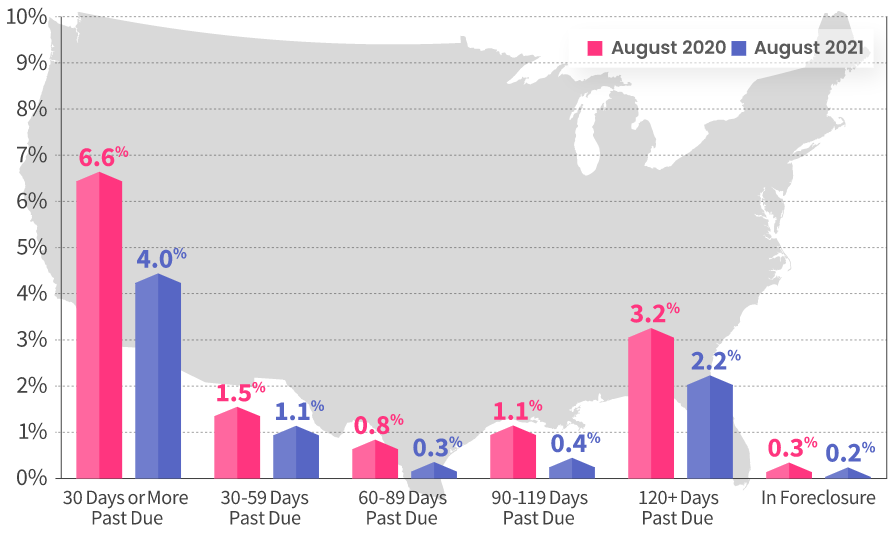

The CoreLogic Loan Performance Insights report shows that in August 2021, 4% of mortgages were delinquent by at least 30 days or more including those in foreclosure. This represents a 2.6-percentage point decrease in the overall delinquency rate compared with August 2020.

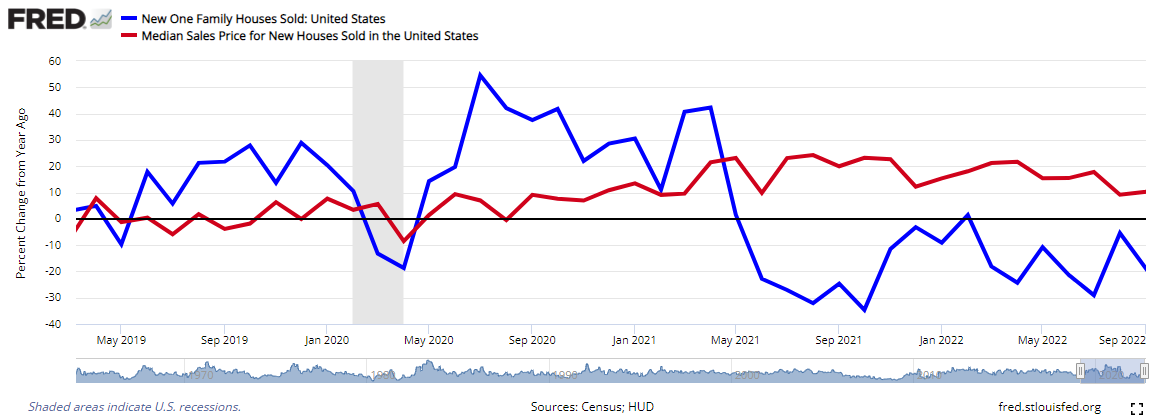

Sales of new single‐family houses in October 2022 is 5.8% below October 2021. Sales Price The median sales price of new houses sold in October 2022 was $493,000. The average sales price was $544,000.

The Federal Reserve’s FOMC released the minutes for their meeting which ended on November 2, 2022. Highlights:

… participants observed that although real GDP rebounded in the third quarter, recent data suggested that economic activity in the near term appeared likely to expand at a pace below its trend growth rate. Participants noted a softening in consumer and business spending growth, and some participants remarked that there had been a notable slowing in interest rate-sensitive sectors, particularly housing, in response to the tightening of financial conditions associated with the Committee’s policy actions. With inflation remaining far too high and showing few signs of moderating, participants observed that a period of below-trend real GDP growth would be helpful in bringing aggregate supply and aggregate demand into better balance, reducing inflationary pressures, and setting the stage for the sustained achievement of the Committee’s objectives of maximum employment and price stability.

… Participants agreed that inflation was unacceptably high and was well above the Committee’s longer-run goal of 2 percent. Some participants noted that the burden of high inflation was falling disproportionally on low-income households, for whom necessities like food, energy, and shelter make up a larger share of expenditures. Many participants observed that price pressures had increased in the services sector and that, historically, price pressures in this sector had been more persistent than those in the goods sector. Some participants noted that the recent high pace of nominal wage growth, taken together with the recent low pace of productivity growth, would, if sustained, be inconsistent with achievement of the 2 percent inflation objective. Several participants, however, commented on signs of a moderation in nominal wage growth. Participants agreed that near-term inflation pressures were high, but some noted that lower commodity prices or the expected reduced pressure on goods prices due to an easing of supply constraints should contribute to lower inflation in the medium term.

… Participants discussed the length of the lags in the response of the economy to monetary policy actions, taking into account historical experience and the various estimates of timing relationships provided in economic research, as well as the high degree of uncertainty involved in applying the evidence on lags to the current situation. They noted that monetary policy tightening typically produced rapid effects on financial conditions but that the full effects of changes in financial conditions on aggregate spending and the labor market, and then on inflation, likely took longer to materialize. With regard to current circumstances, many participants remarked that, even though the tightening of monetary policy had clearly influenced financial conditions and had had notable effects in some interest rate-sensitive sectors, the timing of the effects on overall economic activity, the labor market, and inflation was still quite uncertain, with the full extent of the effects yet to be realized. Several participants observed that, because of the difficulties in isolating the effects of monetary policy, changes in economic structure, or increasing transparency over time regarding monetary policy decisions, the historical record did not provide definitive evidence on the length of these lags. In addition, some participants noted that the post-pandemic dynamics of the economy may differ from those prevailing prior to the pandemic.

… various participants noted that, with inflation showing little sign thus far of abating, and with supply and demand imbalances in the economy persisting, their assessment of the ultimate level of the federal funds rate that would be necessary to achieve the Committee’s goals was somewhat higher than they had previously expected.

… a substantial majority of participants judged that a slowing in the pace of increase would likely soon be appropriate. A slower pace in these circumstances would better allow the Committee to assess progress toward its goals of maximum employment and price stability.

A summary of headlines we are reading today:

- Is Climate Change Really Fueling A Rise In Dangerous Hurricanes?

- Controversial Russia-Azerbaijan Gas Deal Raises Questions For EU

- MIT Reports Breakthrough In Solid-State Lithium Battery Development

- Mortgage demand rises 2.2% as interest rates decline slightly

- Abortion pill is the most common method to end a pregnancy in the U.S., CDC says

- “The Statement Comes Across As Dovish” – Wall Street Reacts To FOMC Minutes

- Washington Watch: Cannabis banking bill and retirement package both could actually pass Congress by year’s end, analysts say

These and other headlines and news summaries moving the markets today are included below.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Is Climate Change Really Fueling A Rise In Dangerous Hurricanes?The effects of climate change are being increasingly felt across the United States. The National Oceanic and Atmospheric Administration (NOAA) recently predicted a seventh consecutive above average hurricane season for 2022. This comes after suggestions by scientists that anthropogenic (human-caused) climatic factors had exacerbated previous above-average seasons. In line with this evidence, US political actors frequently depict climate-exacerbated hurricanes as a threat to national security. However, this rhetoric is not culminating Read more at: https://oilprice.com/The-Environment/Global-Warming/Is-Climate-Change-Really-Fueling-A-Rise-In-Dangerous-Hurricanes.html |

|

Moldova Dismisses Gazprom Allegations That Ukraine Is Withholding Gas DeliveriesMoldova has accused Moscow of energy “blackmail” and dismissed allegations by Russian energy giant Gazprom that Ukraine is withholding deliveries intended for its neighbor as “manipulation” meant to justify cutting supplies for Chisinau. Moldovan Deputy Prime Minister Andrei Spinu said in a Facebook post on November 23 that some gas supplies — over 200 million cubic meters — from Russia remain in storage in Ukraine for future use and that Gazprom is falsely using that fact to threaten to cut supplies “in an unfriendly manner we have already been Read more at: https://oilprice.com/Latest-Energy-News/World-News/Moldova-Dismisses-Gazprom-Allegations-That-Ukraine-Is-Withholding-Gas-Deliveries.html |

|

Controversial Russia-Azerbaijan Gas Deal Raises Questions For EUAzerbaijan has begun importing gas from Russia under a deal which should enable Baku to meet its own domestic demand but which raises serious questions over its recent agreement to boost exports to Europe. Russia’s state gas producer and exporter Gazprom announced on November 18 that it had begun supplying gas to Azerbaijan’s state gas company SOCAR on November 15 and would supply a total of up to a billion cubic meters through March 2023. Neither Azerbaijan’s Energy Ministry nor SOCAR replied to questions from Eurasianet seeking confirmation of Read more at: https://oilprice.com/Energy/Energy-General/Controversial-Russia-Azerbaijan-Gas-Deal-Raises-Questions-For-EU.html |

|

Unipers Bailout Costs Jump To $53 Billion After Russian Gas Supply CutsGermanys largest energy company Uniper is facing some $53 billion (51B euros) in extra costs for nationalization after Russia cut gas supplies to the struggling company. This comes after the cancellation of a gas levy designed to help German gas importers bear additional costs, with Berlin now needing to pump as much as 25 billion euros ($25.8 billion) of additional equity into Uniper to cover losses. Back in September, the German government announced that it would ditch earlier plans for a gas levy on consumers and instead would introduce Read more at: https://oilprice.com/Latest-Energy-News/World-News/Unipers-Bailout-Costs-Jump-To-53-Billion-After-Russian-Gas-Supply-Cuts.html |

|

MIT Reports Breakthrough In Solid-State Lithium Battery DevelopmentMassachusetts Institute of Technologys new discovery could finally usher the development of solid-state lithium batteries, which would be more lightweight, compact, and safe than current lithium batteries. The growth of metallic filaments called dendrites within the solid electrolyte has been a longstanding obstacle, but the new study explains how dendrites form and how to divert them. This is a goal thats been pursued by labs around the world for years. The key to this potential leap in battery technology is replacing the liquid Read more at: https://oilprice.com/Energy/Energy-General/MIT-Reports-Breakthrough-In-Solid-State-Lithium-Battery-Development.html |

|

U.S. Authorizes Firms To Provide Services To Russian Oil TradeU.S. persons are allowed to provide certain services relating to the maritime transportation of Russian oil as long as said crude oil is purchased at or below the price cap expected to be announced shortly, according to new guidance from the U.S. Treasury. The new price cap policy guidance, issued late on Tuesday, sheds more light on the so-called price cap mechanism, how it will apply, and who will be affected. The guidance, as well as several general licenses for certain exemptions, were issued by the Office of Foreign Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Authorizes-Firms-To-Provide-Services-To-Russian-Oil-Trade.html |

|

Walmart supervisor Andre Bing identified as gunman in deadly Chesapeake, Virginia, mass shootingAt least seven people, including the suspect, were killed at the Walmart Supercenter in Chesapeake, Virginia. Read more at: https://www.cnbc.com/2022/11/23/walmart-shooting-suspect-chesapeake-virginia-disgruntled-employee-source.html |

|

Disney CEO Bob Iger to hold town hall with employees on MondayDisney CEO Bob Iger to speak with Disney employees at town hall on Monday, a week after he was rehired. Read more at: https://www.cnbc.com/2022/11/23/disney-ceo-bob-iger-to-hold-town-hall-with-employees-on-monday.html |

|

Potential News Corp, Fox reunion faces opposition from large shareholderOne of the largest shareholders in both News Corp and Fox is opposing a recombination of the companies. Read more at: https://www.cnbc.com/2022/11/23/news-corp-fox-reunion-faces-opposition-from-large-shareholder.html |

|

Hyundai is on a hot streak in the U.S., but Biden’s Inflation Reduction Act could spoil itWith new EVs and SUVs, the company’s Hyundai, Kia and Genesis brands are expected to capture nearly 11% of the U.S. new vehicle market this year. Read more at: https://www.cnbc.com/2022/11/23/hyundais-best-years-in-the-us-face-an-inflation-reduction-act-test.html |

|

Movie theater stocks pop after report says Amazon plans to spend $1 billion on releasesCinemas stocks got a boost after a report surfaced that Amazon plans to spend $1 billion a year on theatrical film releases. Read more at: https://www.cnbc.com/2022/11/23/amazon-to-spend-1-billion-on-theatrical-releases-boosting-cinema-stocks.html |

|

Mortgage demand rises 2.2% as interest rates decline slightlyMortgage applications rose for the week, but were still far below last year’s levels. Read more at: https://www.cnbc.com/2022/11/23/mortgage-demand-rises-as-interest-rates-decline-slightly.html |

|

The future of parking is in New York — and it costs at least $300,000 per spaceHidden deep below some of New York City’s most luxurious apartment buildings is an exclusive world of futuristic parking spaces. Read more at: https://www.cnbc.com/2022/11/23/nyc-robotic-parking-systems-luxury-residents.html |

|

Abortion pill is the most common method to end a pregnancy in the U.S., CDC saysThe CDC, in a report published Wednesday, found that about 51% of abortions in 2020 were performed with the pill at or before the ninth week of pregnancy. Read more at: https://www.cnbc.com/2022/11/23/abortion-pill-most-common-way-to-end-pregnancy-cdc-says.html |

|

Here’s why you may want to say ‘no’ to a store credit card offer this holiday shopping seasonIn the holiday shopping rush, you may be tempted to say yes when asked if you want to apply for a store credit card. Here’s why you may want to think twice. Read more at: https://www.cnbc.com/2022/11/23/reasons-to-say-no-to-a-store-credit-card-offer-this-black-friday.html |

|

Black Friday car deals are hard to come by even as prices ease. Here’s what to expectWhile discounts on new cars remain minimal by historical standards, buyers are paying less above sticker price than they have been as inventory improves a bit. Read more at: https://www.cnbc.com/2022/11/23/black-friday-car-deals-are-hard-to-come-by-even-as-prices-soften.html |

|

Disney’s ‘Avatar: The Way of Water’ gets coveted China releaseDisney’s “Avatar: The Way of Water” will be released in China on Dec. 16. Read more at: https://www.cnbc.com/2022/11/23/disneys-avatar-the-way-of-water-gets-coveted-china-release.html |

|

TSA sees ‘concerning’ rise in number of firearms at security checkpoints – and most are loadedOf the 5,832 firearms stopped so far this year, as of Monday, nearly 88% were loaded, according to the TSA. That’s about 17 guns a day. Read more at: https://www.cnbc.com/2022/11/23/tsa-sees-rise-in-number-of-firearms-at-security-checkpoints.html |

|

Disney is counting on Bob Iger to make hard decisions about its streaming and TV assets — or find someone who willBob Iger may have to make major strategic decisions in his new tenure as Disney CEO that he avoided making in the past. Read more at: https://www.cnbc.com/2022/11/22/iger-hard-decisions-disney-streaming-tv.html |

|

“The Statement Comes Across As Dovish” – Wall Street Reacts To FOMC MinutesWhile prevailing consensus was that the Fed didn’t really say anything unexpected, or anything that wasn’t already telegraphed both in the Nov 2 statement and subsequent Fed speak, Wall Street commentators agreed that “the statement overall comes across as dovish” as BBG Economics chief Anna Wong put it, With Integrity Asset Management’s Joe Gilbert adding that “it is constructive that Fed participants were becoming increasingly aware of the lagged impact of all the rate hikes this year. Generally, this is bullish for equities and fixed income because there is now a slight change in consensus at the Fed which means that significantly more rate hikes are now less likely.” Wong added that “there’s widespread agreement within the committee to slow the pace of rate hikes soon, with only ‘a few’ preferring to wait until the policy stance is more clearly in restrictive territory. We think Powell belongs to this latter group.” The market agrees with the dovish take and stocks have jumped to session highs while the market implied Fed Funds curve has dipped on the outer end, Read more at: https://www.zerohedge.com/markets/statement-comes-across-dovish-wall-street-reacts-fomc-minutes |

|

“US Flips Into Withdrawal Season” As NatGas Prices SurgeUS natural gas prices jumped Wednesday on a combination of thin holiday trading ahead of Thanksgiving, colder weather forecasts, and a bigger-than-expected draw in inventories. Futures in New York for December jumped as high as $7.60/mmbtu, or about 82 cents, on cooler forecasts, peaking around 0900 ET. Prices slid from the high but gained slightly after EIA reported a bigger-than-expected draw in inventories at 1030 ET. As of 1400 ET, prices were up 59 cents to $7.37. “The United States has officially flipped over to withdrawal season as the cold set across the East and Midwest in the last week, driving gas burns higher and ramping industrial and residential plus commercial (ResComm) demand. The cold was coupled with weak production in Appalachia, but strong production in South Central and Canada helped meet that rising demand,” Houston-based energy firm Criterion Research said. They added: “The current w … Read more at: https://www.zerohedge.com/commodities/us-flips-withdrawal-season-natgas-prices-surge |

|

Why Is The US Losing Oil Refining Capacity?Authored by Robert Rapier via OilPrice.com, The U.S. energy policy is clear about its intention to phase out fossil fuels. This has forced refiners to exercise caution in order to stay afloat. It has also resulted in a loss of U.S. refining capacity. One of the under-reported factors behind the ongoing diesel shortage is the loss of U.S. refining capacity since the start of the Covid-19 pandemic. Today I will discuss the factors that led to this loss.

According to the Energy Information Administration (EIA), at the beginning of the pandemic U.S. refiners had 19.0 million barrels per day (BPD) of operable refining capacity (Source). This was the highest number ever reported by the EIA. By December 2021, that number had fallen to 17.9 million BPD — a loss … Read more at: https://www.zerohedge.com/energy/why-us-losing-oil-refining-capacity |

|

EU Parliament Hit By Pro-Kremlin Cyberattack After Russian Terror DesignationThe European Parliament on Wednesday voted to formally recognize Russia as a “state sponsor of terrorism” for what it called “deliberate attacks and atrocities carried out by the Russian Federation against the civilian population of Ukraine.” European legislators also cited “serious violations of human rights and international humanitarian law amount to acts of terror” in the overwhelming vote in favor of the terror label. The move is more symbolic than anything, however, carry no specific legal consequences for Moscow. The EP is now urging the European Union to enact the same, which would mark a major escalation in already spiraling relations, as it would also likely require more sanctions.

The parliament statement said it “recognizes Russia as a state sponsor of terrorism and as a state which uses means of terrorism.” Ukrain … Read more at: https://www.zerohedge.com/geopolitical/eu-parliament-hit-suspected-russian-cyberattack-after-terror-designation |

|

Royal Mail: Strikes over Christmas and Black Friday to go aheadRoyal Mail said it had made its “best and final offer” and accused the union of “holding Christmas to ransom”. Read more at: https://www.bbc.co.uk/news/business-63732421?at_medium=RSS&at_campaign=KARANGA |

|

Pound hits post-Truss high as dollar weakensSterling has reached its highest level against the US dollar since mid-August. Read more at: https://www.bbc.co.uk/news/business-63732425?at_medium=RSS&at_campaign=KARANGA |

|

Manchester United: Who might buy the football club?One of the world’s biggest football clubs is up for sale, but who are the runners and riders to buy it? Read more at: https://www.bbc.co.uk/news/business-63732120?at_medium=RSS&at_campaign=KARANGA |

|

Should you exit Inox Green Energy after its muted debut?Pravesh Gour, Senior Technical Analyst, Swastika Investmart said the company has been incurring losses for the last two years, and according to the IPO objective, the funds raised will be used to pay off liabilities. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/inox-green-energy-along-expected-lines-made-a-muted-debut-on-the-bourses-on-wednesday-even-after-the-listing-the-stock-continued-to-trade-on-a-lacklustre-note-/articleshow/95708259.cms |

|

Gautam Adani weighs $5 bn fundraise as banks urge deleveragingThe network of companies owned by Asia’s richest person has reportedly reached out to top officials at firms, including Mubadala Investment Co. and Abu Dhabi Investment Authority about investments Read more at: https://economictimes.indiatimes.com/markets/stocks/news/gautam-adani-weighs-5-bn-fundraise-as-banks-urge-deleveraging/articleshow/95718903.cms |

|

US stocks open lower ahead of Fed minutes, Apple fallsHeavyweight stocks including Apple Inc Microsoft Corp, Amazon.com Inc and Meta Platforms Inc rose between 0.4% and 0.7% Read more at: https://economictimes.indiatimes.com/markets/stocks/news/us-stocks-open-lower-ahead-of-fed-minutes-apple-falls/articleshow/95720783.cms |

|

The Fed: Fed’s Bullard set to talk inflation, interest rates in MarketWatch Q&A MondaySign up to watch St. Louis Federal Reserve President James Bullard’s exclusive interview with MarketWatch on Monday. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-715B-7C0DB6701F43%7D&siteid=rss&rss=1 |

|

Washington Watch: Bipartisan push on R&D tax break looks likely to flop, analysts sayWhile companies are lobbying Congress to bring back immediate tax deductions for research-and-development costs, analysts are not optimistic on that front. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-715A-C32AECD8E9E2%7D&siteid=rss&rss=1 |

|

Washington Watch: Cannabis banking bill and retirement package both could actually pass Congress by year’s end, analysts sayIt has been a long road for Washington’s cannabis banking bill and an unrelated measure targeting the U.S retirement system. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-715B-8F10336B962D%7D&siteid=rss&rss=1 |