Summary Of the Markets Today:

- The Dow closed down 39 points or 0.12%,

- Nasdaq closed down 1.54%,

- S&P 500 down 0.83%,

- WTI crude oil settled at $85 down $1.47,

- USD $106.52 down $0.15,

- Gold $1778 up $0.70,

- Bitcoin $16,575 down 1.36% – Session Low 16,407,

- 10-year U.S. Treasury 3.684% down 0.115%

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Economic Releases:

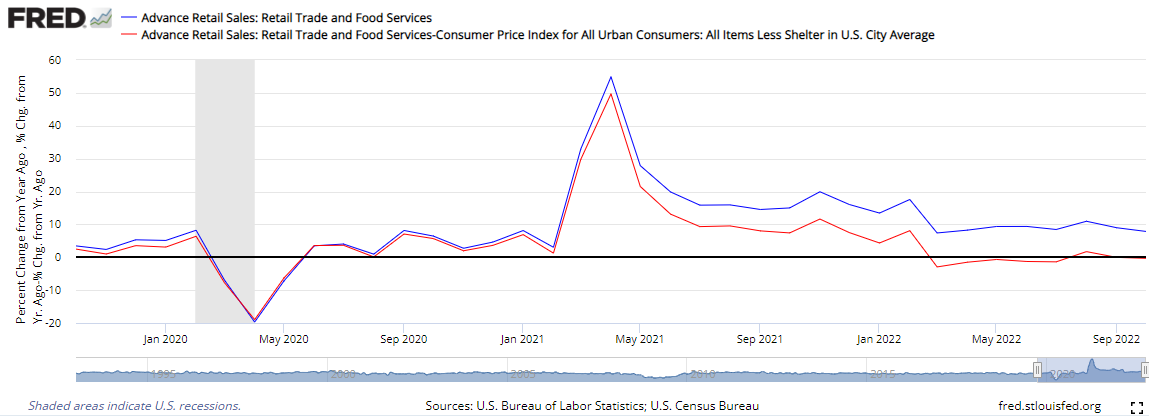

Advance estimates of U.S. retail and food services sales for October 2022 is up 8.3% above October 2021. Once one adjusts for inflation – there is little growth in retail sales (see graph below).

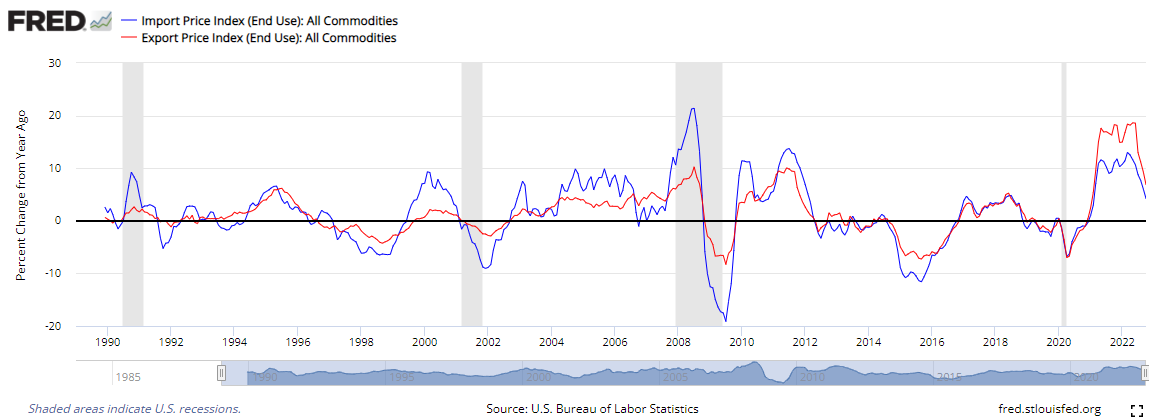

Both import and export prices continued their moderation in October 2022 with imports falling to 4.2% growth year-over-year and exports falling to 6.9% growth year-over-year. Import and export prices do not correlate to economic activity.

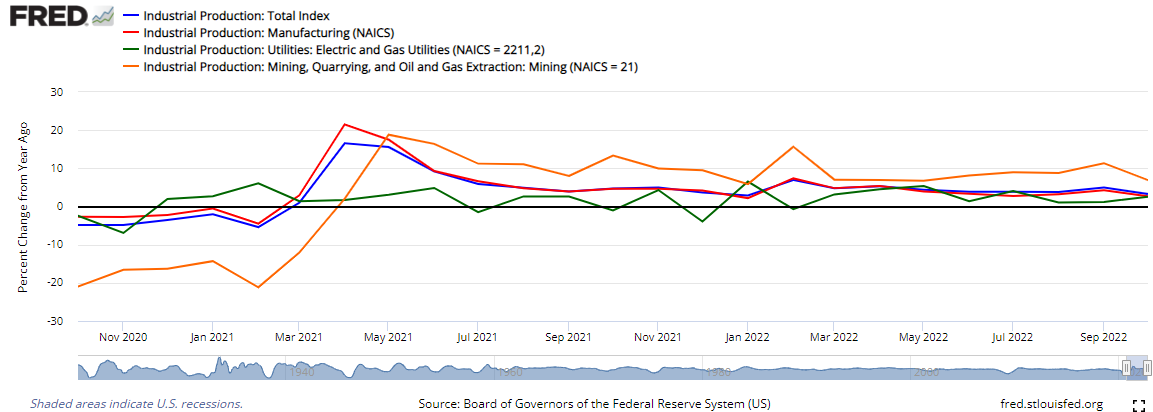

Industrial production in October 2022 was up 3.3% year-over-year. The graph below shows industrial production’s year-over-year growth as well as its three components (manufacturing, mining, and utilities):

Here is a summary of headlines we are reading today:

- OPEC Ready To Intervene For The Benefit Of Oil Markets

- Target shares plunge after retailer reports profit decline, warns of soft holiday quarter

- Lowe’s says it’s not seeing negative impact of inflation as sales, profit top expectations

- Sharp drop in mortgage rates does little to boost demand

- Apple Will Source US-Made Chips From Arizona As Supply Chain Rejiggering Accelerates

- US Retail Sector’s Problems Are Poised To Worsen

- US stocks open lower on grim sales outlook from Target

- Futures Movers: U.S. oil prices settle at a 3-week low after missile strike in Poland, as global supply risks ease

These and other headlines and news summaries moving the markets today are included below.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Shareholders Rejoice As Energy Companies Dish Out Record DividendsOil firms have been dishing out bumper sums to shareholders as a crisis in the energy sector drives profits to record levels, according to research released today. Dividends from oil firms rose by 75.1 percent to a record $46.4bn in the three months through September and pushed up the total figure paid out globally, according to the Global Dividend Index from Janus Henderson. The total dished out to investors rose by seven percent on a headline basis to $415.9bn. More than 85 percent of UK firms hiked their payout in the third quarter Read more at: https://oilprice.com/Energy/Energy-General/Shareholders-Rejoice-As-Energy-Companies-Dish-Out-Record-Dividends.html |

|

OPEC Ready To Intervene For The Benefit Of Oil MarketsOPEC Secretary General Haitham al-Ghais said on Wednesday that the organization is ready to intervene for the benefit of oil markets, Saudi-owned Al-Arabiya TV reports, citing Ghais as saying that OPEC is aware, cautious, and monitoring economic developments worldwide. In early October, OPEC+ announced plans to reduce oil production by 2 mb/d in November 2022 from the August 2022 required production level, a move that angered President Joe Biden who lambasted the organization for colluding with Russia to keep oil prices high. Read more at: https://oilprice.com/Latest-Energy-News/World-News/OPEC-Ready-To-Intervene-For-The-Benefit-Of-Oil-Markets.html |

|

Are Nickel Prices Poised For A Breakout?Via AG Metal Miner The Stainless Monthly Metals Index (MMI) moved sideways with a modest 1.41% decline from October to November. All in all, the stainless steel price movement primarily reacted to volatility in nickel trading. Nickel held historically low volume levels over recent months, while nickel prices remained within their short-term range. By November, however, prices began to see upside price action with a sharp rally. The question is whether this is a true reversal or mere volatility. To qualify as the former, prices would need to sustain Read more at: https://oilprice.com/Metals/Commodities/Are-Nickel-Prices-Poised-For-A-Breakout.html |

|

Suspected Drone Strike Blows Up Fuel Depot Deep In Russian TerritoryThough all eyes have been on the Polish border blast and the resulting back-and-forth on who was responsible, a separate major attack unfolded in southern Russia near the Ukraine border on Wednesday. Russian authorities described a suspected drone attack after a fuel depot exploded. It took place in Oryol oblast about 125 miles from the Ukrainian border.”Today [Wednesday] at 04:00 [01:00 GMT]a suspected drone blew up a fuel depot in the village of Stalnoi Kon. There were no casualties,” the Oryol regional governor said in a statement. Read more at: https://oilprice.com/Latest-Energy-News/World-News/Suspected-Drone-Strike-Blows-Up-Fuel-Depot-Deep-In-Russian-Territory.html |

|

Romania And Azerbaijan Aim To Build New LNG Project In Black SeaOn October 19, Romania’s Romgaz and Azerbaijan’s Socar inked a memorandum of understanding expressing an intention to explore the opportunity of jointly developing a liquefied natural gas project [LNG] in the Black Sea (Romgaz.ro, October 19). Both parties committed to preparing a comprehensive feasibility study; however, this concept is not new, as the Black Sea LNG Project (as coined by Romgaz) has been discussed for over a decade already. According to the official Romgaz press release, the Black Sea LNG Project will Read more at: https://oilprice.com/Energy/Natural-Gas/Romania-And-Azerbaijan-Aim-To-Build-New-LNG-Project-In-Black-Sea.html |

|

Chinese Automakers To Begin Production At Kazakhstan Factory In 2024Kazakhstan’s president this week oversaw the start to work on the construction of a plant that is scheduled to start manufacturing Chinese cars under license from late 2024. The factory in Almaty, the business capital, will produce models designed by Chinese automobile makers Changan, Chery and Haval, according to a press release from the office of President Kassym-Jomart Tokayev. This Read more at: https://oilprice.com/Latest-Energy-News/World-News/Chinese-Automakers-To-Begin-Production-At-Kazakhstan-Factory-In-2024.html |

|

Target shares plunge after retailer reports profit decline, warns of soft holiday quarterTarget saw sales decline as families contended with higher prices, a potential warning sign for the holiday shopping season. Read more at: https://www.cnbc.com/2022/11/16/target-will-report-earnings-before-the-bell-heres-what-to-expect.html |

|

Here’s why Home Depot and Lowe’s are booming in a housing market bustLowe’s and Home Depot are faring well even as the housing market is going through a rough patch. Read more at: https://www.cnbc.com/2022/11/16/home-depot-lowes-booming-housing-market-bust.html |

|

See which states have suffered the most major climate disasters since 2011The financial losses resulting from recent climate disasters are greater than the amount of federal funds provided for recovery efforts, the report said. Read more at: https://www.cnbc.com/2022/11/16/which-states-have-had-the-most-major-climate-disasters-since-2011.html |

|

Lowe’s says it’s not seeing the negative impact of inflation as sales, profit top expectationsLowe’s earnings report comes a day after Home Depot’s third-quarter earnings beat analysts’ estimates. Read more at: https://www.cnbc.com/2022/11/16/lowes-low-earnings-3q-2022.html |

|

Sharp drop in mortgage rates does little to boost demandMortgage application volume rose 2.7% last week compared with the previous week, according to the Mortgage Bankers Association. Read more at: https://www.cnbc.com/2022/11/16/sharp-drop-in-mortgage-rates-does-little-to-boost-demand.html |

|

Homebuilder sentiment drops to a decade low, as builders add more incentivesHigher costs and lower demand caused homebuilder sentiment to drop to a decade low. Read more at: https://www.cnbc.com/2022/11/16/homebuilder-sentiment-drops-to-a-decade-low.html |

|

TJX hits an all-time high as reason we own off-price retailer played out in the quarterThe inventory glut at full-price chains proved to be a boon to TJX, whose brands include T.J. Maxx, Marshalls and HomeGoods. Read more at: https://www.cnbc.com/2022/11/16/tjx-hits-an-all-time-high-as-reason-we-own-off-price-retailer-played-out-in-the-quarter.html |

|

Stocks making the biggest moves midday: Target, Carnival, Advance Auto Parts, Lowe’s, and moreThese are the stocks posting the largest moves in midday trading Thursday. Read more at: https://www.cnbc.com/2022/11/16/stocks-making-the-biggest-moves-midday-target-carnival-advance-auto-parts-lowes-and-more.html |

|

3 takeaways from our daily meeting: Mixed economic picture, sticking with energy, EL deal officialThe Investing Club holds its “Morning Meeting” every weekday at 10:20 a.m. ET. Read more at: https://www.cnbc.com/2022/11/16/takeaways-from-meeting-mixed-economic-picture-energy-el-deal.html |

|

Toyota unveils new Prius hybrids amid skepticism of its EV strategyMoving forward with the Prius as other automakers vow to go all-electric in the years ahead is part of Toyota CEO Akio Toyoda’s electrification strategy. Read more at: https://www.cnbc.com/2022/11/16/toyota-unveils-new-prius-hybrids-amid-skepticism-of-its-ev-strategy.html |

|

JetBlue plans Paris flights next summer in trans-Atlantic expansionJetBlue Airways plans to launch flights from New York to Paris next summer. Read more at: https://www.cnbc.com/2022/11/16/jetblue-plans-paris-flights-next-summer-in-trans-atlantic-expansion.html |

|

Burger King owner Restaurant Brands hires former Domino’s CEO Patrick Doyle as chairRestaurant Brands International announced that it hired former Domino’s Pizza CEO Patrick Doyle as executive chair. Read more at: https://www.cnbc.com/2022/11/16/restaurant-brands-taps-former-dominos-ceo-patrick-doyle-as-chair.html |

|

The four-day workweek is new standard for 40% of companies, EY survey findsAmerican companies are increasingly adopting a four-day workweek, an EY report found, as they move to expand real estate holdings and improve employee morale. Read more at: https://www.cnbc.com/2022/11/16/four-day-workweek-is-new-standard-for-40percent-of-companies-ey-study-finds.html |

|

Apple Will Source US-Made Chips From Arizona As Supply Chain Rejiggering AcceleratesApple could be sourcing US semiconductors for its devices in the next few years, signaling the company’s move to rejigger complex and now unreliable supply chains across Asia. CEO Tim Cook spoke with engineers in Germany during an internal meeting about sourcing chips from a plant in Arizona in 2024, according to Bloomberg.

Cook explained Apple could broaden its sourcing in the Western world to purchase chips from Europe:

The meeting included Apple services chief Eddy Cue and Deirdre O’Brien, the head of retail and human resources. Bloomberg pointed out that the Arizona factory Cook was referencing is likely the one being built by Taiwan Semiconductor Manufacturing Co, the world’s largest contract chipmaker. Last week, there was news that TSMC was expanding its US footprint by constructing another advanced semiconductor plant. Read more at: https://www.zerohedge.com/markets/apple-will-source-us-made-chips-arizona-supply-chain-rejiggering-accelerates |

|

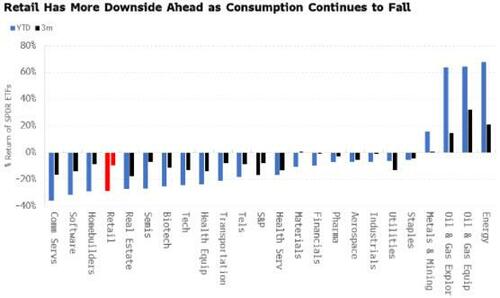

US Retail Sector’s Problems Are Poised To WorsenAuthored by Simon White, Bloomberg macro strategist, Retail stocks face becoming the poorest-performing sector as the cumulative impact from higher rates causes consumption to weaken further. Tuesday was a reminder that markets remain vulnerable to geopolitical risks. Still, the inflation backdrop remains the market’s primary driver, and the interplay between real growth and rates will continue to be paramount. The S&P is down almost 17% on the year, but this masks some big underlying sectoral differences. Energy and Oil and Gas are up on the year, yet almost every other sector is down. The worst-affected are some of the most interest-rate sensitive — tech, real-estate and homebuilders, and retail.

We get October retail sales data today, with expectations for a robust 1% m/m rise after a flat move last month. But retail sales and consumption face two strong headwinds. First, credit is tightening as rates rise. Consumption is heavily reliant on … Read more at: https://www.zerohedge.com/markets/us-retail-sectors-problems-are-poised-worsen |

|

Musk To Employees: Commit To “Hardcore” Twitter Vision Or Take 3 Months Severance And LeaveThe changing of the guard at Twitter is officially complete. For snowflake employees at the company that wasn’t ready to grasp that fact, Elon Musk likely made it abundantly clear this week when he released an ultimatum to employees, demanding they commit to a new “hardcore” version of Twitter or leave the company with severance pay, WaPo reported. “If you are sure that you want to be part of the new Twitter, please click yes on the link below,” an email to employees said. Employees were also made to “sign a pledge” to stay on and work for the company, the report says. The pledge was to be signed by 5PM eastern on Thursday, or else employees would be terminated and receive 3 months of severance pay.

Twitter “will need to be extremely hardcore,” Musk said in his email, adding: “This will mean working long hours at high intensity. Only exceptional performance will consti … Read more at: https://www.zerohedge.com/markets/musk-employees-commit-hardcore-twitter-vision-or-take-3-months-severance-and-leave |

|

NASA Releases Breathtaking Views Of Earth From Moon-Bound SpacecraftUpdate (1417ET): NASA’s Artemis I uncrewed Orion capsule is headed to the moon. The first view of Earth from the spacecraft was posted on Twitter.

Here’s another breathtaking view from the spacecraft.

NASA placed a manikin named “Commander Moonikin Campos” in the Orion capsule for the 26-day mission a … Read more at: https://www.zerohedge.com/technology/nasas-massive-moon-rocket-go-launch |

|

Retailer Joules collapses risking 1,600 jobsThe clothing group appoints administrators as the retail sector struggles. Read more at: https://www.bbc.co.uk/news/business-63651838?at_medium=RSS&at_campaign=KARANGA |

|

Milk and cheese drive food price inflation to 45-year highHigh prices are hitting poorer people hardest, as they spend more of their income on food and energy. Read more at: https://www.bbc.co.uk/news/business-63641414?at_medium=RSS&at_campaign=KARANGA |

|

What is behind the big tech companies’ job cuts?Thousands of redundancies have been announced by some of the largest firms in the industry. Read more at: https://www.bbc.co.uk/news/technology-63635821?at_medium=RSS&at_campaign=KARANGA |

|

Opec countries responsible for 35% of the world’s crude oil productionFor more such web stories click on the ET icon below Read more at: https://economictimes.indiatimes.com/markets/web-stories/opec-countries-responsible-for-35-of-the-worlds-crude-oil-production/articleshow/95552043.cms |

|

Hindustan Zinc announces Rs 15.5 second interim dividend for FY23Prior to this, the company had declared Rs 21 per share as the first interim dividend for FY23 Read more at: https://economictimes.indiatimes.com/markets/stocks/news/hindustan-zinc-announces-rs-15-5-second-interim-dividend-for-fy23/articleshow/95561370.cms |

|

US stocks open lower on grim sales outlook from TargetTarget Corp tumbled as much as 16.9% as a pullback in consumer spending despite heavy discounting also hurt its third-quarter profit, which missed market expectations Read more at: https://economictimes.indiatimes.com/markets/stocks/news/us-stocks-open-lower-on-grim-sales-outlook-from-target/articleshow/95562816.cms |

|

Market Snapshot: S&P 500 trades lower, Dow wobbles as investors rethink rally, Target results disappointU.S. stocks are slipping Wednesday afternoon following a poorly-received Target earnings report and as strong retail sales put focus back on the Federal Reserve’s likely pace of rate hikes. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7155-95F2312AF083%7D&siteid=rss&rss=1 |

|

The Tell: ‘We’ve only just begun to see the layoffs and squeezes on profit margins,’ warns Wells Fargo strategistThe rally in stocks tied to signs of cooling inflation isn’t likely sustainable, says a senior global market strategist at the Wells Fargo Investment Institute Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7156-0BB0A6A30CA7%7D&siteid=rss&rss=1 |

|

Futures Movers: U.S. oil prices settle at a 3-week low after missile strike in Poland, as global supply risks easeOil futures settled lower on Wednesday after Poland and NATO reportedly said there was no indication that Russia was behind a missile strike in Poland, easing worries about risks to crude supplies. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7155-C353C07FE8A6%7D&siteid=rss&rss=1 |