sHeadlines:

J.P. Morgan: ‘The Equity Market Selloff is Overdone.’

Gazprom’s Gas Exports Slump By 41% In January.

Tesla to recall FSD Beta software that let drivers slowly roll past stop signs .

U.S. Covid fatalities reach the highest level in a year as omicron cases subside.

Biden Flaunts The “Strongest Growth In Four Decades?”

Summary of Economic Releases Today:

- CoreLogic says home prices increased by 18.5% year over year in December 2021.

- According to the Bureau of Labor Statistics, December job openings were little changed whilst hires and total separations decreased to 6.3 million and 5.9 million, respectively. In short, this demonstrates the labor market continues to demonstrate that the skills mismatch is not growing and job-hopping is returning to historical levels.

- US Census data show construction spending continues its improvement trend with the value of construction spending in 2021 increasing 8.2% over 2020.

Tesla recalls full self-driving vehicles not stopping at stop signs. According to NHTSA, Tesla will recall 53,822 of its vehicles that contain its Full Self-Driving (Beta) software because of a defect that may not allow the car to come to a complete stop at some intersections.

Stocks gain for a third day as the market’s comeback from the depths of the January sell-off continues. Boeing and DOW share the gains that contributed to the DOW’s jump. But, after a huge year of growth, some analysts say the U.S. economy is about to slam into a wall.

As usual, we have included below the headlines and news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Goldman Sachs: OPEC+ Could Announce Larger Production HikeOPEC+ may decide on Wednesday to announce a larger production increase for March than the usual 400,000 barrels per day, considering the oil price rally to $90 and the potential for renewed discontent from major oil importers at these high price levels, Goldman Sachs said in a Tuesday note. We view growing potential for a faster ramp-up at this meeting, given the pace of the recent rally and the likely pressure from importing nations, Goldman Sachs analysts including Damien Courvalin, Jeffrey Currie, and Callum Bruce, wrote in the Read more at: https://oilprice.com/Energy/Crude-Oil/Goldman-Sachs-OPEC-Could-Announce-Larger-Production-Hike.html |

|

OPEC Underproduction Is Driving Bullish Sentiment In Oil MarketsBullish sentiment has taken over oil markets, with long positions outnumbering short positions by 13 to one as OPEC resists pressure to ramp up production.Chart of the Week- With ICE Brent spiking above $90 per barrel earlier this week, the focus of the oil industry is increasingly on stock changes across the globe as inventories in OECD nations plunged to a 7-year low.- Commercial crude stocks in the US have seen some optimism lately with another stock build expected this week, but combined crude and product stocks are still some 100 million Read more at: https://oilprice.com/Energy/Energy-General/OPEC-Underproduction-Is-Driving-Bullish-Sentiment-In-Oil-Markets.html |

|

Tesla Recalls Full Self-Driving Vehicles Not Stopping At Stop SignsTesla will recall 53,822 of its vehicles that contain its Full Self-Driving (Beta) software because of a defect that may not allow the car to come to a complete stop at some intersections. According to a safety recall report from the National Highway Traffic Safety Administration (NHTSA) dated last week, certain Model S, X, 3, and Y vehicles contain Teslas Full Self-Driving (Beta) feature that has a software functionality referred to as rolling stop. This rolling stop allows the vehicle to travel through all-way-stop Read more at: https://oilprice.com/Latest-Energy-News/World-News/Tesla-Recalls-Full-Self-Driving-Vehicles-Not-Stopping-At-Stop-Signs.html |

|

The Uncomfortable Truth About Green HydrogenLast year, BloombergNEF predicted that by 2030, green hydrogen would become cheaper than all other colors of hydrogen. The analytical firm did not supply specific reasons for its forecast, only saying that the current situation in which even blue hydrogenproduced from natural gaswith carbon capture is cheaper than green hydrogen should reverse over the next eight years. This was one of the forecasts that did not age well during the pandemic, what with all the supply chain problems and pent-up demand release that Read more at: https://oilprice.com/Energy/Energy-General/The-Uncomfortable-Truth-About-Green-Hydrogen.html |

|

Gazproms Gas Exports Slump By 41% In JanuaryGazproms natural gas exports to countries outside the former Soviet Union plunged by 41.3 percent year over year in January 2022, the Russian gas giant said on Tuesday, while it also reported a 1-percent annual increase in its gas production. The Companys gas deliveries are carried out as requested by consumers in full compliance with contractual obligations, said Gazprom, while Russia is being accused of deliberately withholding gas supplies to Europe, where inventory levels have sunk to historic lows. According to Read more at: https://oilprice.com/Energy/Natural-Gas/Gazproms-Gas-Exports-Slump-By-41-In-January.html |

|

Shell Forced to Reroute Oil Supplies After CyberattackA cyber attack on a German oil storage and logistics firm has impacted Shells oil supply chain in Germany, where it is rerouting supplies to alternative depots, the supermajor said on Tuesday. Shell was able to reroute to alternative supply depots for the time being, a spokesperson for Shells German unit, Shell Deutschland GmbH, said in a statement on Tuesday as carried by Reuters. A few days ago, oil supply and logistics firms Oiltanking Deutschland GmbH and oil trading firm Mabanaft, both of which are subsidiaries Read more at: https://oilprice.com/Latest-Energy-News/World-News/Shell-Forced-to-Reroute-Oil-Supplies-After-Cyberattack.html |

|

Starbucks posts mixed results as higher costs and Covid pay weigh on profitsStarbucks reported adjusted earnings per share of 72 cents and revenue of $8.1 billion. Read more at: https://www.cnbc.com/2022/02/01/starbucks-sbux-q1-2022-earnings.html |

|

GM forecasts 2022 operating profit of between $13 billion and $15 billionGM forecasts 2022 operating profit of between $13 billion and $15 billion Read more at: https://www.cnbc.com/2022/02/01/general-motors-gm-earnings-q4-2021.html |

|

Ford reportedly plans to increase EV spending by up to $20 billionFord could accelerate its deployment of EVs that could include increasing investments in the vehicles by up to $20 billion, according to Bloomberg News. Read more at: https://www.cnbc.com/2022/02/01/ford-reportedly-plans-to-increase-ev-spending-by-up-to-20-billion.html |

|

Tesla to recall FSD Beta software that let drivers slowly roll past stop signsNewer versions of FSD Beta (2020.40.4.10 or later) subject to the recall gave drivers an option to roll through stop signs slowly. Read more at: https://www.cnbc.com/2022/02/01/tesla-to-recall-fsd-beta-software-that-let-drivers-roll-past-stop-signs-.html |

|

Astra expects to receive new FAA license for first Florida launch this weekend, stock risesRocket builder Astra is preparing to launch from Florida for the first time as soon as this weekend. Read more at: https://www.cnbc.com/2022/02/01/astra-expects-to-receive-faa-license-for-florida-launch-by-friday.html |

|

WHO says the new omicron subvariant doesn’t appear to be more severe than the originalVaccines remain effective at preventing severe disease and death from omicron and all of its subvariants, the WHO said. Read more at: https://www.cnbc.com/2022/02/01/who-says-the-new-omicron-subvariant-doesnt-appear-to-be-more-severe-than-the-original.html |

|

Stocks making the biggest moves midday: Exxon Mobil, AMC Entertainment, UPS and moreThese are the stocks posting the largest moves in midday trading. Read more at: https://www.cnbc.com/2022/02/01/stocks-making-the-biggest-moves-midday-exxon-mobil-amc-entertainment-ups-and-more.html |

|

Cedar Fair says it’s reviewing a takeover offer from SeaWorld that’s reportedly worth $3.4 billionShares of Cedar Fair spiked nearly 10% after a report said SeaWorld Entertainment had offered to buy out the company for around $3.4 billion. Read more at: https://www.cnbc.com/2022/02/01/cedar-fair-stock-jumps-is-halted-after-report-of-seaworld-takeover-bid.html |

|

Microsoft and Shell are betting on a company making greener jet fuelChicago-based start-up LanzaJet, which builds on the decade of research at LanzaTech, is scaling a potential solution to clean up the airline industry. Read more at: https://www.cnbc.com/2022/02/01/microsoft-shell-invest-in-lanzajet-sustainable-jet-fuel-start-up.html |

|

Americans are ready to travel as their omicron fears fadeAmerican travelers seem to have largely brushed off the hesitation fueled by surging Covid-19 cases. Read more at: https://www.cnbc.com/2022/02/01/americans-are-ready-to-travel-as-their-omicron-fears-fade.html |

|

U.S. Covid fatalities reach highest level in a year as omicron cases subsideVaccines weren’t widely available the last time Covid deaths were this high in America. Read more at: https://www.cnbc.com/2022/02/01/us-covid-fatalities-reach-highest-level-in-a-year-as-omicron-cases-subside.html |

|

Bob Johnson says Biden’s Build Back Better bill needs to direct money to Black-owned businesses“Closing the Black wealth gap is not a job,” said the founder of The RLJ Cos. “It’s giving us more access to wealth sustainability.” Read more at: https://www.cnbc.com/2022/02/01/bob-johnson-says-bidens-build-back-better-bill-needs-to-direct-money-to-black-owned-businesses.html |

|

Bud Light Seltzer’s Super Bowl ad spotlights new hard soda line and stars Guy FieriBud Light Seltzer is hoping that a Super Bowl ad starring celebrity chef Guy Fieri will help jump-start sales of its new hard soda line. Read more at: https://www.cnbc.com/2022/02/01/bud-light-seltzers-super-bowl-ad-spotlights-new-line-stars-guy-fieri.html |

|

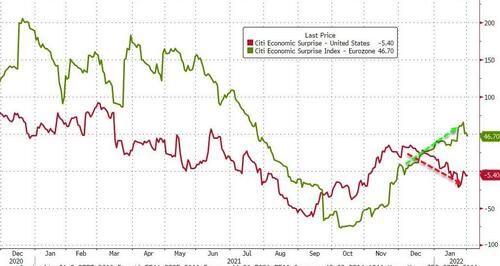

Stocks Shrug Off Bullard, Bad-Data, & ‘BBB’ Bust As Dollar DropsStocks Shrug Off Bullard, Bad-Data, & ‘BBB’ Bust As Dollar DropsAnother day, another disappointing macro data point with manufacturing growth slowing more than expected and inflation higher than expected in this morning’s PMI/ISM data (while EU unemployment fell to a record low – yea really)…

Source: Bloomberg Sen. Manchin’s comments that Build Back Better is dead spooked stocks after the usual post-opening-plunge dip-buying fest, and sentiment was also not helped by St.Louis Fed’s Jim Bullard reprising his role as ‘bad cop’ noting that QT could start in Q2 and 5 rate-hikes this year is ‘a good bet’… 1430ET BULLARD: I DON’T THINK A 50 BASIS POINT INCREASE REALLY HELPS US RIGHT NOW 1432ET BULLARD: I THINK MARKETS PRICING IN FIVE HIKES THIS YEAR “IS NOT TOO BAD A BET” 1438ET BULLARD FAVORS BEGINNING FED B/SHEET RUNOFF IN SECOND QUARTER 1443ET BULLARD: FED B/SHEET RUNOFF CAN BE FASTER THAN LAST TIME AROUND STIRs were unmoved by Bullard’s hawkishness… given that they … Read more at: https://www.zerohedge.com/markets/stocks-shrug-bullard-bad-data-bbb-bust-dollar-drops |

|

These Were The Best And Worst Performing Assets During January’s Rollercoaster MonthThese Were The Best And Worst Performing Assets During January’s Rollercoaster MonthWith the rollercoaster that was January market still fresh in everyone’s mind, Deutsche Bank’s Jim Reid published his monthly “best and worst” asset return analysis, and also shared some January performance bullets today after a fascinating month.

|

|

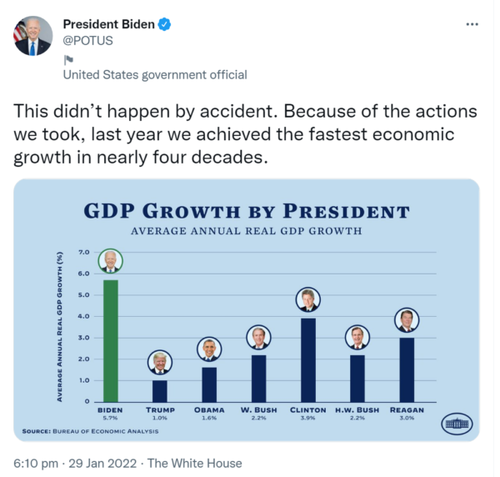

Can Biden Really Flaunt The “Strongest Growth In Four Decades”?Can Biden Really Flaunt The “Strongest Growth In Four Decades”?Authored by Daniel Lacalle, I was surprised to see a tweet from President Biden showing the GDP (Gross Domestic Product) of the United States for 2021 compared to the average GDP growth under other presidents. The Tweet stated “This didn’t happen by accident. Because of the actions we took, last year we achieved the fastest economic growth in nearly four decades.”

The first thing we must remind the president is that a recovery from a massive crisis is not “growth.” Unfortunately, this marketing tactic is not new. When Biden was vice-president under Obama, they always compared growth and jobs of the president’s tenure excluding the first year, 2009. Presidents tend to compare their figures favourably, but to talk about 2021 as the “fastest economic growth in nearly four decades” is misleading. First, reco … Read more at: https://www.zerohedge.com/political/can-biden-really-flaunt-strongest-growth-four-decades |

|

Melvin Capital Raises New “Long Only” Fund As Era Of Fed-Induced Easy Money EndsMelvin Capital Raises New “Long Only” Fund As Era Of Fed-Induced Easy Money EndsBefore making its infamous bet on Gamestop, Melvin Capital Management was a well-respected, multi-billion AUM hedge fund thanks to its founder, Gabe Plotkin, and his close ties with Wall Street legends like Steve Cohen. One year later, having been dragged in front of Congress and publicly humiliated by having the losses from his GameStop short held up in the business press as one of the worst bets of all time, Plotkin is in surprisingly good shape – reputationally speaking. After Melvin suffered a 17% drop in its main long-short (more longs than shorts now) fund during January’s market rout, Bloomberg reported that Melvin is stil somehow in the process of raising a new ‘long only’ fund (just as the Fed is supposedly about to start hiking interest rates to ‘aggressively tame’ inflation and send equities into another bear market). A Bloomberg reporter pointed out that Melvin and Plotkin had filed paperwork with the SEC to register a fund called “Melvin Capital Long Only LP”. Melvin Capital Long-Only Offshore. The paperwork shows that the new fund will be managed out of Melvin’s headquarters on Madison Avenue in Manhattan. As for the money under management, Melvin didn’t disclose … Read more at: https://www.zerohedge.com/markets/melvin-capital-raises-new-long-only-fund-era-fed-induced-easy-money-ends |

|

Michael Gove: Levelling up must not fail new Tory votersMichael Gove says tackling inequalities is a “moral mission”, but critics say his plan falls short. Read more at: https://www.bbc.co.uk/news/uk-politics-60216165?at_medium=RSS&at_campaign=KARANGA |

|

Colin the Caterpillar cake row crumblesMarks & Spencer and Aldi reach a settlement in a copyright row over caterpillar cakes. Read more at: https://www.bbc.co.uk/news/business-60223220?at_medium=RSS&at_campaign=KARANGA |

|

CO2 industry strikes deal to prevent shortagesTrade groups had warned there could food shortages without a fresh deal to ensure supplies to industry. Read more at: https://www.bbc.co.uk/news/business-60215991?at_medium=RSS&at_campaign=KARANGA |

|

What are ‘virtual digital assets’ that will be taxed at 30% now?The clarification on the taxation of cryptocurrency was a long pending demand from the industry. Read more at: https://economictimes.indiatimes.com/markets/cryptocurrency/what-are-virtual-digital-assets-that-will-be-taxed-at-30-now/articleshow/89270462.cms |

|

After 51% crash in stock, Tata Tele cancels plan to allocate equity to govt“The DoT in response has informed the company that the NPV of the interest which is eligible for conversion into equity is only Rs 195.22 crore as against the company‘s calculation of Rs 850 crore,” Tata Tele said in a regulatory filing. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/after-51-drop-from-highs-tata-tele-cancels-plan-to-allocate-equity-to-govt/articleshow/89278312.cms |

|

Market movers: Paytm surges 6% on fintech boost in Budget; HFCL, Sterlite Tech rally tooThe Union Budget announcements made way for digital rupee, which could be the next phase of growth in the digitisation of financial services and payments in India and will bring efficiency of transactions Read more at: https://economictimes.indiatimes.com/markets/stocks/news/market-movers-paytm-surges-6-on-fintech-boost-in-budget-hfcl-sterlite-tech-rally-too/articleshow/89277271.cms |

|

Earnings Results: Electronic Arts stock dives as forecast comes in short of expectationsElectronic Arts Inc. stock dropped more than 5% in late trading Tuesday after the videogame publisher suggested it will start off 2022 at a slower pace than expected. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-78E7-C7DFABCDB22B%7D&siteid=rss&rss=1 |

|

: WHO report points to tons of dangerous COVID-19 refuse — these waste-management stocks are poised to gain from itTens of thousands of metric tons of extra medical waste tied to COVID-19 put tremendous strain on health-care waste management around the world. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-78E4-0F8B43450ACC%7D&siteid=rss&rss=1 |

|

Market Pulse: Dow closes up 272 points and stock market rally in February’s first sessionU.S. stock benchmark end higher Tuesday in Wall Street’s first trading session in February, following a rough January. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-78E9-7B2F5DC36569%7D&siteid=rss&rss=1 |