Summary Of the Markets Today:

- The Dow closed down 42 points or 0.14%,

- Nasdaq closed down 0.25%,

- S&P 500 down 0.20%,

- WTI crude oil settled at $88 up $1.45

- USD $111.06 up $0.86,

- Gold $1717 up $0.75

- Bitcoin $20,209 down 0.7% – Session Low 19,788,

- 10-year U.S. Treasury 3.753% up 0.14%

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Economic Releases:

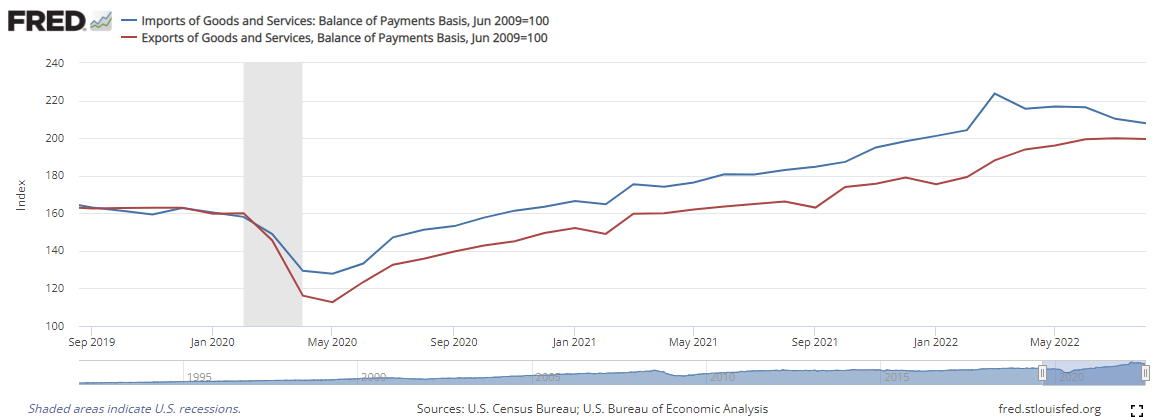

The goods and services deficit was $67.4 billion in August 2022, down $3.1 billion from $70.5 billion in July. Yes, the trade deficit has been shrinking because imports have been shrinking whilst exports have remained relatively level (see graph below). Generally a decline in imports is a sign the economy is slowing.

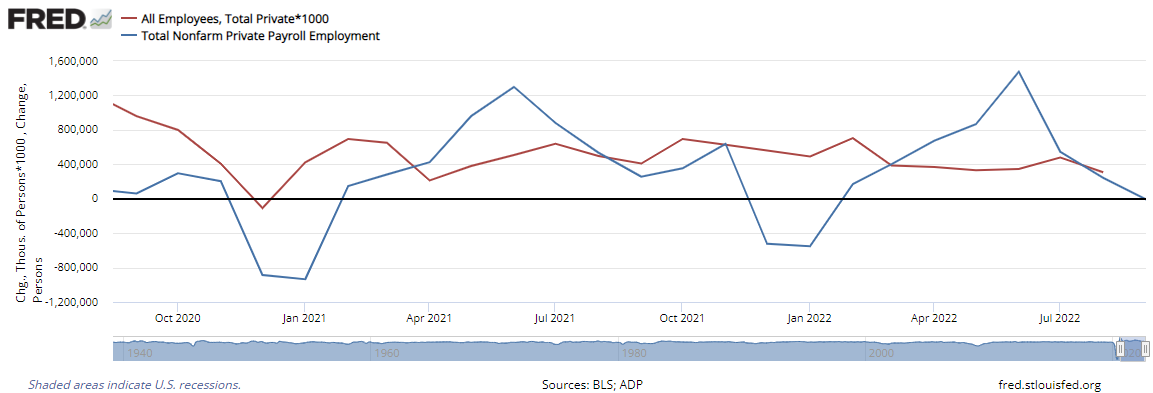

Private sector employment increased by 208,000 jobs in September 2022 according to the September ADP National Employment Report. The biggest gains were in the trade / transportation / utilities sector. The ADP numbers were good this month showing employment remains strong – but historically ADP has not been a good indicator (blue line on graph below) for this Friday’s BLS non-farm private employment (red line on graph below).

Elliott Wave International just released a NEW report that shows you the dangers — and opportunities — unfolding now in key property markets around the world. If you own a home — or are thinking about buying one — you need to read this report. Get it FREE for a limited time at elliottwave.com now ($29 value).

A summary of headlines we are reading today:

- Russia Signs Fuel Deal With Taliban

- Tokyo Scientists Announce Breakthrough In CO2 Conversion Tech

- SpaceX launches Crew-5 mission for NASA, carrying astronauts to space station

- Mortgage applications plummet 14% as higher interest rates and Hurricane Ian crush demand

- Stocks making the biggest moves midday: Tesla, Enphase Energy, Exxon Mobil, and more

- High mortgage rates, tight supply, and economic uncertainty: Here’s what’s happening with home prices

- Average two-year mortgage rate highest for 14 years

- Is the stock market rally a case of dead cat bounce or festive cheer?

These and other headlines and news summaries moving the markets today are included below.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

China’s Balancing Act In AfghanistanIn late June, a severe earthquake struck southeastern Afghanistan. In the immediate aftermath of the disaster, the Peoples Republic of China (PRC) announced it would provide 50 million RMB ($7.2 million) in emergency aid, including tents, blankets, cots, and other sorely needed supplies to the impacted areas (Peoples Republic of China Ministry of Foreign Affairs (FMPRC), June 25). Beijing invests in Afghanistan to further its long-term economic, strategic and political interests. Since the U.S. withdrawal last year, China has had an Read more at: https://oilprice.com/Geopolitics/International/Chinas-Balancing-Act-In-Afghanistan.html |

|

Russia Officially Claims Ownership Of Ukraine Nuclear PlantRussian President Vladimir Putin has decreed Ukraine’s Zaporozhye Nuclear Power Plant is a Russian federal asset, absorbing all facilities and employees as the Kremlins push in the east loses momentum against Ukrainian forces. The nuclear facility, the largest in Europe, was captured by Russian forces in March, with Ukrainian employees running day-to-day operations under siege conditions that have the world’s nuclear watchdog, the IAEA, concerned about the facility’s vulnerability to disaster. In a decree published Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russia-Officially-Claims-Ownership-Of-Ukraine-Nuclear-Plant.html |

|

Russia Signs Fuel Deal With TalibanThe Taliban, struggling to navigate Afghanistan through an economic and humanitarian crisis as its rule over the country remains unrecognized by the world, has found willing partners in two countries whose trade is severely restricted by international sanctions — Russia and Iran. Moscow joined Tehran on the short list of capitals willing to deal with the Taliban under a preliminary agreement signed last week. Afghanistan will get 1 million tons of gasoline, 1 million tons of diesel fuel, 500,000 tons of liquefied petroleum gas, and 2 million tons Read more at: https://oilprice.com/Geopolitics/International/Russia-Signs-Fuel-Deal-With-Taliban.html |

|

Georgia Grapples With Russias Mobilization ExodusA new piece of street art in a Tbilisi underpass is a play on the classic Soviet The Motherland Calls poster from World War II. But instead of holding the military oath as in the original, the woman is clutching a Georgian khinkali dumpling. And instead of the patriotic slogan, the caption now reads, Hurry, or it will get cold. As thousands more Russians again pour into Georgia this time, escaping their countrys mass military mobilization for the war in Ukraine Georgians are greeting them with Read more at: https://oilprice.com/Latest-Energy-News/World-News/Georgia-Grapples-With-Russias-Mobilization-Exodus.html |

|

Tokyo Scientists Announce Breakthrough In CO2 Conversion TechTokyo Institute of Technology scientists developed a polymer-based photocatalyst for CO2 reduction that exhibits unprecedented performance. Made from abundant elements and requiring no complex post-synthesis treatment or modifications, it could pave the way for a new class of photocatalysts for efficiently converting CO2 into useful chemicals. The idea is to convert CO2 into useful chemicals, such as carbon monoxide (CO) and formic acid (HCOOH). In particular, photocatalytic CO2 reduction systems use visible or ultraviolet light to drive CO2 reduction, Read more at: https://oilprice.com/Alternative-Energy/Nuclear-Power/Tokyo-Scientists-Announce-Breakthrough-In-CO2-Conversion-Tech.html |

|

ArcelorMittal Makes $5 Billion Bet On Indian Steel ManufacturingArcelorMittal appears quite bullish on India. In fact, the company recently announced its intention to double steel manufacturing at one of its primary plants. ArcelorMittal-Nippon Steel India Ltd. (AM/NS India) plans to spend US $5.1 billion at its Gujarat plant in western India. Betting on strong growth in domestic consumption, the company hopes to boost its crude steel capacity to 15 million tons by 2026. The plant, a deal between ArcelorMittal SA & Nippon Steel Corporation, currently has a capacity of 7.6 million tons. During a recent presentation Read more at: https://oilprice.com/Latest-Energy-News/World-News/ArcelorMittal-Makes-5-Billion-Bet-On-Indian-Steel-Manufacturing.html |

|

SpaceX launches Crew-5 mission for NASA, carrying astronauts to space stationThe mission is SpaceX’s fifth operational crew launch for NASA to date, and the company’s eighth human spaceflight in just over two years. Read more at: https://www.cnbc.com/2022/10/05/spacex-crew-5-nasa-launch-live-stream.html |

|

New York Comic Con tries to get back to normal in a world changed by CovidNew York Comic Con, which will feature events from DC and Marvel Comics, among others, begins Thursday and is set to run through Sunday. Read more at: https://www.cnbc.com/2022/10/05/new-york-comic-con-2022-marvel-dc-jacob-javits-center.html |

|

Ukraine joins Spain and Portugal’s joint bid to host 2030 World CupUkraine has joined Spain and Portugal in their joint bid to host the 2030 World Cup. Read more at: https://www.cnbc.com/2022/10/05/ukraine-joins-spain-and-portugals-joint-bid-to-host-2030-world-cup.html |

|

Ford to end production of $500,000 GT supercar with special editionThe 2022 Ford GT LM (Le Mans) will be the last model of the third-generation car, which was resurrected in 2016 after being a decade out of the market. Read more at: https://www.cnbc.com/2022/10/05/ford-to-end-production-of-500000-gt-supercar-with-special-edition.html |

|

Mortgage applications plummet 14% as higher interest rates and Hurricane Ian crush demandThe highest mortgage rates in more than 20 years coincided with one of the deadliest hurricanes on record, both contributing to a steep drop in mortgage demand. Read more at: https://www.cnbc.com/2022/10/05/weekly-mortgage-applications-plummet-14percent-as-higher-interest-rates-and-hurricane-ian-crush-demand.html |

|

President Joe Biden addresses Hurricane Ian victims in Fort Myers, FloridaPresident Joe Biden traveled to Fort Myers, Florida on Wednesday to address the aftermath of Hurricane Ian. Read more at: https://www.cnbc.com/2022/10/05/watch-live-president-joe-biden-addresses-hurricane-ian-victims-in-fort-myers-florida.html |

|

Key Democrat outlines 5 priorities for $80 billion in IRS fundingSenate Finance Committee Chairman Ron Wyden, D-Ore., has outlined five priorities for nearly $80 billion in new IRS funding. Here’s a breakdown of each one. Read more at: https://www.cnbc.com/2022/10/05/key-democrat-outlines-5-priorities-for-80-billion-in-irs-funding.html |

|

Stocks making the biggest moves midday: Tesla, Enphase Energy, Exxon Mobil, and moreThese are the stocks posting the largest moves in midday trading. Read more at: https://www.cnbc.com/2022/10/05/stocks-making-the-biggest-moves-midday-tesla-enphase-energy-exxon-mobil-and-more.html |

|

Streaming bundles are forming, but don’t expect a cable TV-like package any time soonIt’s easy to say streaming will morph into cable-like bundles, but business realities are working against the concept. Read more at: https://www.cnbc.com/2022/10/04/dont-expect-cable-tv-like-package-for-streaming-bundles.html |

|

Spacecraft builder York sells stake to private equity firm AEI at over $1 billion valuationYork Space Systems is selling a majority stake in the company to private equity firm AE Industrial Partners at an enterprise valuation of $1.125 billion. Read more at: https://www.cnbc.com/2022/10/04/york-space-hits-1-billion-valuation-after-aei-investment-deal.html |

|

Defendant in case of $100 million NJ deli hires lawyer who repped ‘pharma bro’ Martin ShkreliPeter Coker Sr., one of the defendants in the case of the $100 million New Jersey deli, hired a lawyer who previously represented “pharma bro” Martin Shkreli. Read more at: https://www.cnbc.com/2022/10/04/defendant-in-100-million-nj-deli-case-hires-lawyer-who-repped-martin-shkreli.html |

|

High mortgage rates, tight supply, and economic uncertainty: Here’s what’s happening with home pricesRecent reports are using monthly comparisons because of the sharp turnaround in the once-hot, pandemic-driven housing boom. So the changes can appear dramatic. Read more at: https://www.cnbc.com/2022/10/04/whats-happening-with-home-prices.html |

|

JPMorgan Sees Oil Rising Back Over $100 If These Five Conditions Are Met…The OPEC+ meeting has come and gone, with “Fist-bump bro” Biden humiliated…

… and the White House scrambling to save at least a little face…

… and failing. And so, with oil surging – even as the dollar spikes sharply higher – traders are asking two questions: i) is the drop in oil over, and ii) how much higher can it get. Here are the answers: i) with just a few more weeks left on Biden’s SPR drain mandate, which has soaked up a record 30% of all the “emergency” oil inventory this year… Read more at: https://www.zerohedge.com/markets/jpmorgan-sees-oil-rising-back-over-100-if-these-five-conditions-are-met |

|

Biden Blasts “Short-Sighted” OPEC+ Cut, Blames US Energy Firms For Surging Pump PricesThe Biden administration is absolutely furious with the Joint Ministerial Monitoring Committee (JMMC) of the Organization of the Petroleum Exporting Countries (OPEC) and allies, including Russia, for agreeing to slash oil production by 2 million barrels per day. CNN’s Chief Congressional Correspondent Manu Raju tweeted that Biden responded to the OPEC+ cut announcement by saying he’s “concerned” and called it “unnecessary.”

Biden’s top national security and economic advisors expressed their disappointment in the OPEC+ production cuts via a statement:

|

|

“The Whites Of Their Eyes”By Peter Tchir of Academy Securities The Whites of Their Eyes“Don’t Fire Until You See the Whites of Their Eyes” was allegedly the command given to soldiers at the Battle of Bunker Hill. The original intent of the order was to ensure that ammunition wasn’t wasted when the shots were unlikely to be effective. That has changed over time to mean “don’t act too early.”

But maybe we need to go back to the original order and think about the soldiers (nervous, even scared, facing an enemy likely already firing at them) and imagine how difficult it was to stand their ground and hold their fire until the right moment. At Academy, many of my colleagues have faced enemy fire. I think that universally they will tell you how difficult it is. Even with intense training, team building, leadership, and so many other things designed to prepare them for that moment, it is still a difficult test. Which brings me to the Fed. The Fed has had a consist … Read more at: https://www.zerohedge.com/markets/whites-their-eyes |

|

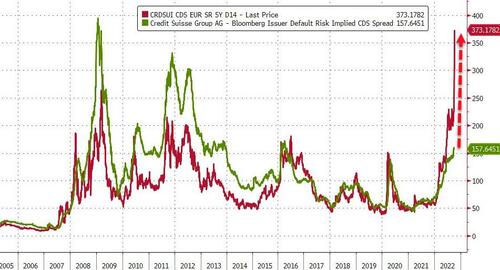

Meanwhile Over At Lehman-Suisse…What do credit traders know that equity traders are ignoring? While equity prices had risen for the last two days, dragged higher by the market’s melt-up, Credit Suisse credit risk continued to wide dramatically…

For context, with CDS trading at around 373bps, the equity market (price and volatility) is implying a spread around 157bps…

So either CDS is drastically too high, and/or CS stock price is too hi … Read more at: https://www.zerohedge.com/markets/meanwhile-over-lehman-suisse |

|

Average two-year mortgage rate highest for 14 yearsA typical two-year fixed rate deal has breached the 6% mark for the first time since November 2008. Read more at: https://www.bbc.co.uk/news/business-63144506?at_medium=RSS&at_campaign=KARANGA |

|

Faisal Islam: Is Truss’s growth plan running out of time?The prime minister wants to be judged on boosting economic growth, but how easy will that be to deliver? Read more at: https://www.bbc.co.uk/news/business-63144645?at_medium=RSS&at_campaign=KARANGA |

|

Petrol price rise warning after Opec oil output cutMajor oil producers including Saudi Arabia will pump less, raising fears of higher petrol prices. Read more at: https://www.bbc.co.uk/news/business-63149044?at_medium=RSS&at_campaign=KARANGA |

|

Is the stock market rally a case of dead cat bounce or festive cheer?The rally in the global markets was triggered by an unexpected slowdown in the US Manufacturing PMI, which gave hope that the US Fed would slow the pace of policy tightening. Following suit, US bond yields fell in tandem with the US dollar. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/is-the-stock-market-rally-a-case-of-dead-cat-bounce-or-festive-cheer/articleshow/94661826.cms |

|

Mindblowing multibaggers that delivered up to 1500% return since last DussehraIT stocks were the worst hit as the BSE IT index slumped over 22% during the period amid worries around the impact of the recession on margins as well as demand. The realty index was hit equally badly as interest rates began to rise. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/mindblowing-multibaggers-that-delivered-up-to-1500-return-since-last-dussehra/articleshow/94656662.cms |

|

Will Q3 be better than Q2 for D-St? Top stocks to buy in the Oct-Dec quarterNifty gained over 9% in September quarter even as Fed’s ultra-hawkish move led to heavy sell-off. Domestic brokerage ICICI Direct amid global headwinds, expects anxiety around the global volatility to settle down in coming weeks. Further, it sees the index reclaiming September 2022 high of 18,100 in coming months. It suggests that investors should not view the ongoing correction as negative and instead should use it as an incremental buying opportunity as key support exists around 16,500.In this backdrop, the brokerage suggested top stocks to buy this quarter across eight sector Read more at: https://economictimes.indiatimes.com/markets/stocks/news/will-q3-be-better-than-q2-for-d-st-top-stocks-to-buy-in-the-oct-dec-quarter/betting-on-rebound/articleshow/94658278.cms |

|

Jonathan Burton’s Life Savings: This stock-market strategist says the coming recession could be the biggest ever: ‘I recommend prayer’‘I’m about as bearish as I’ve been since 2008,’ says Hedgeye’s Keith McCullough. He’s steering investors to cash, gold and other defensive plays. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-712D-DE918562A102%7D&siteid=rss&rss=1 |

|

Outside the Box: Investors have been pouring money into companies promising climate-change solutions. Here’s how to spot the winners.An estimated $100-$150 trillion will be needed by 2050 to decarbonize the global economy and cut greenhouse gas emissions to near-zero. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7129-3B605E295B94%7D&siteid=rss&rss=1 |

|

The Margin: Aaron Judge could earn $300 million after home run record, MLB executives say. Will the Yankees reward him?Judge hit his 62nd home run of the season on Tuesday, breaking the American League total from Roger Maris in 1961. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7127-35240C75AA45%7D&siteid=rss&rss=1 |