Headlines:

JPMorgan: Not enough capitulation to call a bottom.

US economy has grown at the fastest pace in decades.

The two-year Treasury yield posts its biggest one-day gain

CEO Elon Musk talked up Tesla’s longer-term ambitions to develop a robotaxi and a humanoid robot that could work in factories.

Angry stocks come to terms with hawkish Fed as yield curve screams ‘policy error.’ DOW ends the session flat, down 7 points, NASDAQ down 1.4%, and the S&P 500 down 0.5%.

Algos lifted everything overnight, sellers appeared at the cash open, and it was a one-way trip to yesterday’s lows (or worse) for the rest of the day. Small Caps are down 5% from pre-Fed, Nasdaq is down over 3%, and The Dow is down around 1%.

In other news, Economic activity jumped by 5.7% in 2021, but analysts expect growth to slow this year. Treasury yield curve shrinks to narrowest levels in years as two-year rate has biggest daily gain since March 2020in almost two years on Thursday, a day after the Federal Reserve pointed to the possibility of a series of interest-rate hikes.

As usual, we have included below the headlines and news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Low-Carbon Energy Investment Must Triple To Reach Net-Zero TargetThe world invested a record $755 billion in the energy transition in 2021, up by 27 percent compared to 2020, but total annual investment in low-carbon energy needs to triple from todays levels to put the world on track for net-zero emissions by 2050, research firm BloombergNEF (BNEF) said in a new report on Thursday. Last year, global investments in all low-carbon energy sectors rose, with the exception of carbon capture and storage (CCS), BNEFs Energy Transition Investment Trends 2022 report showed. Renewable energy continued to Read more at: https://oilprice.com/Alternative-Energy/Renewable-Energy/Low-Carbon-Energy-Investment-Must-Triple-To-Reach-Net-Zero-Target.html |

|

Norways Oil Fund Booked Second-Best Return Ever In 2021The worlds largest sovereign wealth fund, Norways $1.3-trillion wealth fund, enjoyed last year its second-best return in history, earning the equivalent of $176 billion, driven by technology and financials, while energy stocks globally made the strongest return last year. The Government Pension Fund Global, as the so-called oil fund is officially known, said on Thursday that it returned 14.5 percent, equivalent to $176 billion (1.58 trillion Norwegian crowns) last year. This was the second-best return ever for the worlds Read more at: https://oilprice.com/Latest-Energy-News/World-News/Norways-Oil-Fund-Booked-Second-Best-Return-Ever-In-2021.html |

|

Restocking Efforts Lift Steel PricesHealthy construction demand and increased activity from the auto sector are likely to push up northern European prices for hot rolled coil in January and into February, following decreases from the previous month, sources stated. Mills are now transacting material at around 900-920 ($1,020-1,045) per metric ton exw, down from previous transactions 980-1,000 ($1,110-1,135) heard in late December. Cold rolled coil normally carries a premium of 80-120 ($90-135) per metric tons. Turkish imports An onslaught of imports from Turkey, Read more at: https://oilprice.com/Metals/Commodities/Restocking-Efforts-Lift-Steel-Prices.html |

|

UK Car Production Has Fallen To Lowest Levels Since 19562021 was a dismal year for the UK automotive industry, as output fell 6.7 percent to less than 860,000 units the lowest since 1956. Figures released today by the Society of Motor Manufacturers and Traders (SMMT) reported that production went down 34 percent on pre-pandemic levels, especially as a result of the pandemic and supply chain issues such as the semiconductor shortage. The biggest single cause of this is semiconductors, as the average car takes between 1,500 and 3,000 chips. That was the most impactful issue Read more at: https://oilprice.com/Latest-Energy-News/World-News/UK-Car-Production-Has-Fallen-To-Lowest-Levels-Since-1956.html |

|

A Flying Car Could Be Commercially Available Within 12 MonthsA hybrid car-airplane known as AirCar has been issued a certificate of airworthiness by the Slovakian civil aviation authority, potentially paving the way for the future of flying vehicles. The dual-mode car-aircraft vehicle, which looks like a sports car, was created by a team of eight highly-skilled specialists at the Slovakian company Klein Vision, which was founded by Professor Stefan Klein. Klein has devoted the last 20 years to making the flying car a reality. It was awarded the certificate by the Slovak Transport Authority Read more at: https://oilprice.com/Energy/Energy-General/A-Flying-Car-Could-Be-Commercially-Available-Within-12-Months.html |

|

UK And U.S. To Sit Down To Resolve Trump-Era Trade DisputeAs an example of how trade disputes often have little to do with trade, the announcement this week that the US and UK would sit down for talks to resolve the Trump era trade dispute over steel and aluminum tariffs serves as a case in point. Back in March 2018, when the former US president first imposed section 232 import tariffs of 25% on steel and 10% on aluminum imported from nearly everywhere, the UK belonged to the EU. While the application appeared heavy-handed, strong arguments for action existed. Capacity utilization among Read more at: https://oilprice.com/Latest-Energy-News/World-News/UK-And-US-To-Sit-Down-To-Resolve-Trump-Era-Trade-Dispute.html |

|

LVMH CEO Bernard Arnault says ‘we have to be wary of bubbles’ with the metaverseLVMH CEO Bernard Arnault expressed a note of caution regarding the hype around the metaverse, during the luxury goods company’s latest earnings call. Read more at: https://www.cnbc.com/2022/01/27/lvmh-ceo-arnault-says-we-have-to-be-wary-of-bubbles-with-the-metaverse.html |

|

Southwest weighs bringing onboard booze back this springSouthwest extended a pause on sales of alcohol in May after a spate of unruly passenger incidents including one that turned violent. Read more at: https://www.cnbc.com/2022/01/27/southwest-weighs-bringing-onboard-booze-back-this-spring.html |

|

GM CEO Mary Barra takes first autonomous car ride with Cruise: ‘It’s just surreal’“It’s just surreal,” GM CEO Mary Barra says while testing one of the company’s driverless cars in San Francisco, calling it a highlight of her career. Read more at: https://www.cnbc.com/2022/01/27/watch-gm-ceo-mary-barra-takes-her-first-autonomous-car-ride-with-cruise.html |

|

Supreme Court Justice Ruth Bader Ginsburg’s library sells for nearly $2.4 million in auctionThe auction of Supreme Court Justice Ruth Bader Ginsburg’s library ended the same day that Justice Stephen Breyer confirmed he will retire this year. Read more at: https://www.cnbc.com/2022/01/27/supreme-court-justice-ruth-bader-ginsburg-book-nets-100000-at-auction.html |

|

Cramer’s Investing Club: Mastercard’s earnings, outlook for travel recovery justify stock priceWhile the full-year 2022 outlook was more or less in line, we think it was better than feared. Read more at: https://www.cnbc.com/2022/01/27/cramers-investing-club-mastercards-earnings-outlook-for-travel-recovery-justify-stock-price.html |

|

Cramer’s Investing Club: Danaher once again delivers reliable earnings, and that’s why we own the stockAll in, this was a solid quarter from Danaher and exemplary of the type of company we believe investors must focus on in this volatile market. Read more at: https://www.cnbc.com/2022/01/27/cramers-investing-club-danaher-once-again-delivers-reliable-earnings-and-thats-why-we-own-the-stock.html |

|

Kansas City Chiefs fans donate over $300,000 to Buffalo children’s hospital following playoff win over BillsOishei Children’s Hospital in Buffalo is receiving donations in increments of $13 from Chiefs fans, which represents the 13 seconds it took to tie the game. Read more at: https://www.cnbc.com/2022/01/27/kansas-city-chiefs-fans-donate-to-buffalo-childrens-hospital-after-win-over-bills.html |

|

Cramer’s Investing Club: We’re trimming our Walmart holding to boost cash in volatile marketAt the same time, we also want to be careful about how much cash we raise because the market is heavily oversold right now. Read more at: https://www.cnbc.com/2022/01/27/cramers-investing-club-were-trimming-our-walmart-holding-to-boost-cash-in-volatile-market.html |

|

Tesla drops 10% as investors digest new vehicle delaysInstead, CEO Elon Musk talked up Tesla’s longer-term ambitions to develop a robotaxi and a humanoid robot that could be put to work in factories. Read more at: https://www.cnbc.com/2022/01/27/tesla-stock-investors-digest-new-vehicle-delays.html |

|

Italian space company D-Orbit to go public via SPAC at a $1.4 billion valuationItalian space transportation and services company D-Orbit announced plans to go public via a SPAC, in a deal valued at $1.4 billion. Read more at: https://www.cnbc.com/2022/01/27/italian-space-company-d-orbit-going-public-via-nasdaq-spac.html |

|

Populist nations fared much worse during Covid outbreak, new research saysA new study has compared the response of populist and non-populist governments during the Covid-19 pandemic in 2020. Read more at: https://www.cnbc.com/2022/01/27/populist-nations-fared-much-worse-during-covid-outbreak-research-says.html |

|

EV car manufacturing jumps in the UK but overall production sinks to 65-year lowThe U.K. wants to stop the sale of new diesel and gasoline cars and vans by 2030. Read more at: https://www.cnbc.com/2022/01/27/ev-manufacturing-jumps-in-uk-overall-production-sinks-to-65-year-low.html |

|

Back to reality at last? Covid rules are being dropped in Europe despite high omicron spreadFrom the re-opening of bars and restaurants to the dropping of legal requirements for masks, many of Europe’s biggest economies are now relaxing Covid rules. Read more at: https://www.cnbc.com/2022/01/27/covid-rules-are-being-dropped-in-europe-despite-high-omicron-spread.html |

|

Angry Stocks Come To Terms With Hawkish Fed As Yield Curve Screams ‘Policy Error’Angry Stocks Come To Terms With Hawkish Fed As Yield Curve Screams ‘Policy Error’GDP “good news” appears to have been greeted as “bad news”, providing more cover for Powell to do what he said he would do with rates and QT… and while the algos lifted everything overnight, sellers appeared at the cash open and it was a one-way trip to yesterday’s lows (or worse) for the rest of the day. Small Caps are down 5% from pre-Fed, Nasdaq is down over 3%, and The Dow is down around 1% only

On the day, Small Caps are down over 2% in a massive whipsaw and The Dow is clinging to unchanged after swinging up and down 1000s of points… Read more at: https://www.zerohedge.com/markets/angry-stocks-come-terms-hawkish-fed-yield-curve-screams-policy-error |

|

‘Rogue Wave’ 2.0: US NatGas Futures Explode Higher Into Chaotic Expiration‘Rogue Wave’ 2.0: US NatGas Futures Explode Higher Into Chaotic ExpirationFebruary U.S. natural gas futures violently surged Thursday in what appears to be a delivery squeeze into expiration. Bloomberg’s Javier Blas had some early insight that something was amiss…

Around 1400 ET, natgas contracts for February jumped as much as 72% in minutes, the most significant increase ever since the contract launched in 1990, according to Bloomberg, citing a spokesperson for CME Group.

The spread between February and March contracts erupted. Read more at: https://www.zerohedge.com/commodities/us-natgas-contracts-february-spike-72-after-chaotic-squeeze |

|

Goldman President Complains Overly “Political” Fed “Does Not Have The Will” To Stop InflationGoldman President Complains Overly “Political” Fed “Does Not Have The Will” To Stop InflationShortly before the start of yesterday’s Fed announcement, Goldman Sachs No. 2 John Waldron, the investment bank’s president and a Wall Street insider if there ever was one, apparently decided to vent his frustrations with the Powell Fed in front of a live (if virtual) audience at a meeting of the New Jersey State Investment Council, and (apparently) one Bloomberg journalist. During what the reporter later characterized as a rant encompassing many of the Fed’s failures in responding to the COVID pandemic, the senior Goldman banker complained that the Fed’s political “independence” has been hurt, which in turn has weakened its credibility with markets. For a preview of how this could play out in the long term, just take a look at how successful Turkey’s central bank has been at enforcing price stability. The problem is that, thanks to its newfound political bearings, the Fed is more reluctant to take dramatic but ultimately necessary action for fear of damaging its public image (and also giving lawmakers reason to start another round of Fed bashing). What’s gone on in the past couple of years has brought “into question the independence of the Fed,” Waldron said hours before the Fed’s meeting Wednesday. He questioned the Fed’s strength to act as an “independent, monetary policy engine th … Read more at: https://www.zerohedge.com/economics/goldmans-no-2-complains-overly-political-fed-does-not-have-will-stop-inflation |

|

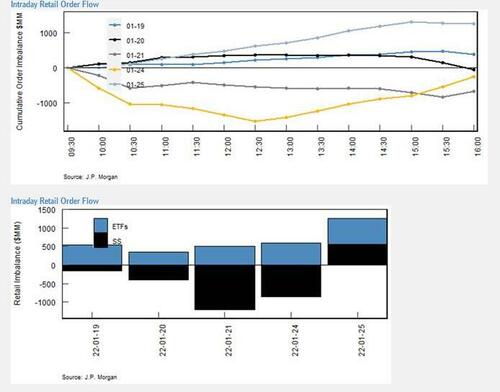

JPMorgan: Not Enough Capitulation To Call A BottomJPMorgan: Not Enough Capitulation To Call A BottomOne day (and one week and one month) after JPM called again to buy the dip, at least one group inside the largest US bank – arguably the most important one – is getting cold feet on a quick bounce. As the bank’s trading desk writes this morning, while stocks reacted poorly to Powell’s unexpectedly hawkish comments, interestingly retail investors bought $1.69bn on the day: “this is the second most on record.”

Read more at: https://www.zerohedge.com/markets/jpmorgan-not-enough-capitulation-call-bottom |

|

Kwarteng: No U-turn on National Insurance tax riseBusiness Secretary Kwasi Kwarteng says a National Insurance rise to fund the NHS will go ahead. Read more at: https://www.bbc.co.uk/news/business-60149993?at_medium=RSS&at_campaign=KARANGA |

|

US economy grows at fastest pace in decadesEconomic activity jumped by 5.7% in 2021, but analysts expect growth to slow this year. Read more at: https://www.bbc.co.uk/news/business-60158934?at_medium=RSS&at_campaign=KARANGA |

|

Tesco encourages shoppers and staff to keep wearing masksUK’s largest retailer will encourage people in England to wear masks after rules are relaxed. Read more at: https://www.bbc.co.uk/news/business-60152763?at_medium=RSS&at_campaign=KARANGA |

|

Disinvestment-bound companies in spotlight, more names likely to be addedAnalysts expect that the divestment targets for the new financial year are likely to be elevated, though a lot will depend upon the proposed initial public offering (IPO) of Life Insurance Company of India (LIC). Read more at: https://economictimes.indiatimes.com/markets/stocks/news/disinvestment-bound-companies-in-spotlight-more-names-likely-to-be-added/articleshow/89149568.cms |

|

Britannia Q3 Results Preview: Analysts see drop in profit on high agri input prices, packaging costsAccording to Phillip Capital, the fast-moving consumer goods major is likely to report a profit after tax of Rs 363.2 crore in October-December, down 0.3 per cent sequentially and 33.5 per cent on-year. Read more at: https://economictimes.indiatimes.com/markets/stocks/earnings/britannia-q3-results-preview-analysts-see-drop-in-profits-on-high-agri-input-prices-packaging-costs/articleshow/89158178.cms |

|

Are the golden days of ‘Dogecoin Killer’ Shiba Inu over?The total market cap of Shiba Inu has dropped to $11.35 billion. It was as much as thrice the current value during its golden days. However, the trading volumes of the token have remained healthy, thanks to its dirt-cheap price. Read more at: https://economictimes.indiatimes.com/markets/cryptocurrency/is-shiba-inu-losing-its-sheen-golden-days-of-this-dogecoin-killer-are-over/articleshow/89154167.cms |

|

Retail Stocks: Walmart, Costco and other big-box stores in Canada begin enforcing vaccine mandates, and some shoppers aren’t buying itSome Canadian retailers are now requiring proof of vaccination due to local regulations, resulting in some critics calling to boycott Walmart in response Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-78B3-19A516F2F33D%7D&siteid=rss&rss=1 |

|

Bond Report: Treasury yield curve shrinks to narrowest levels in years as two-year rate has biggest daily gain since March 2020The two-year Treasury yield posts its biggest one-day gain in almost two years on Thursday, a day after the Federal Reserve pointed to the possibility of a series of interest-rate hikes. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-78C5-FB7D22634735%7D&siteid=rss&rss=1 |

|

The Wall Street Journal: Maximalist approach to classifying information poses threat to national security and undermines trust, says Biden director of national intelligencePrice is paid in constrained capacity to share information with allies, policy makers and the public, Avril Haines says. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-78CC-57DECFB68810%7D&siteid=rss&rss=1 |

…

…