Summary Of the Markets Today:

- The Dow closed down 313 points or 1.01%,

- Nasdaq closed down 0.95%,

- S&P 500 down 1.13%,

- Gold $1674 down $4.50,

- WTI crude oil settled at $84 down $1.54,

- 10-year U.S. Treasury 3.559% little changed,

- USD index $110.16 weakening 0.37%,

- Bitcoin $19,048 down 2.74%,

Today’s Economic Releases:

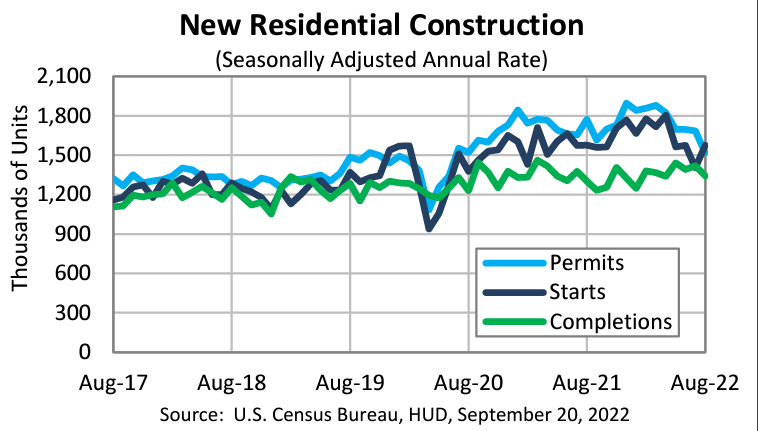

Privately‐owned housing units authorized by building permits in August 2022 were 10.0% below July and 14.4% below August 2021. Privately-owned housing starts in August were up 12.2% month-over-month and down 0.1% year-over-year. Privately‐owned housing completions in August were down 5.4% month-over-month but are up 3.1% year-over-year. The new home construction sector remains near or above the pre-pandemic levels.

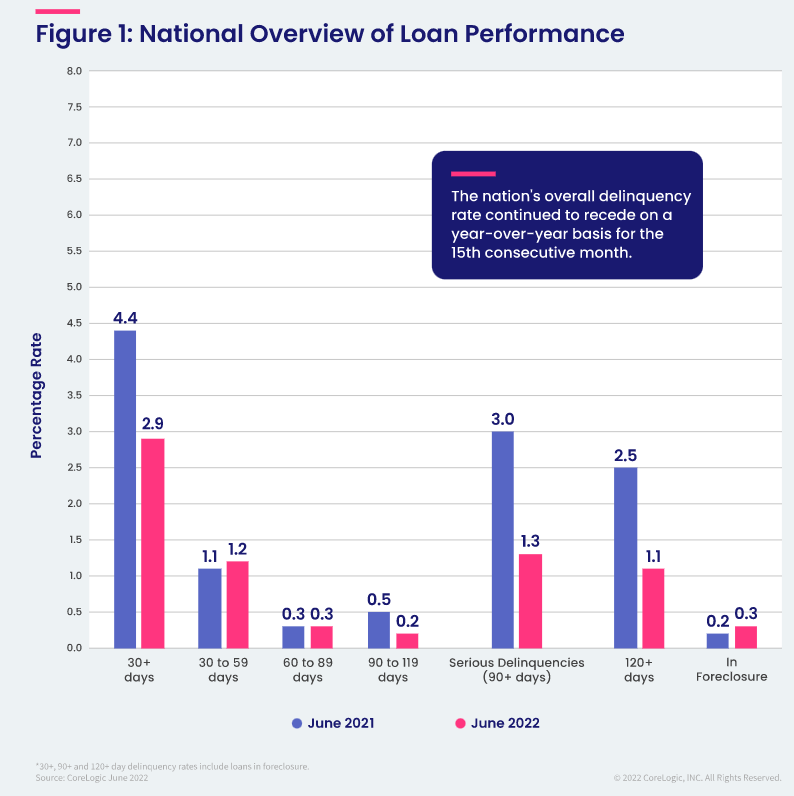

Mortgage Delinquencies Inch Up From May but Remain Near Record Low in June. For the month of June 2022, 2.9% of all mortgages in the U.S. were in some stage of delinquency (30 days or more past due, including those in foreclosure), representing a 1.5 percentage point decrease compared to 4.4% in June 2021.

- U.S. Senators Propose Secondary Sanctions On Russian Oil

- U.S. Refiners May Soon Purchase More Canadian Crude

- Single-family rent increases cool for the third straight month

- Ford stock suffers worst day since 2011 after cost warning, shedding $7 billion in market value

- Ford warns investors of an extra $1 billion in supply chain costs during the third quarter

- Emerging Markets Start Sending Out Warning Signals Against The Soaring Dollar

- Market Extra: Why investors fear a full-percentage-point Fed rate hike would ‘unnerve’ Wall Street

These and other headlines and news summaries moving the markets today are included below.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Biden’s Buy Clean Initiative Is A Boon For Steel ManufacturersVia AG Metal Miner The Biden-Harris Administration today announced that they would prioritize the purchase of key low-carbon construction materials, covering 98% of materials purchased by the Federal government. As steel plants shutter around the world, this is a boon to U.S. manufacturers concerned about dropping steel prices. The announcement highlights the latest section of the Buy Clean initiative, which is backed by multiple domestic steel producers. Among the most notable supporters are Cleveland-Cliffs out Read more at: https://oilprice.com/Metals/Commodities/Bidens-Buy-Clean-Initiative-Is-A-Boon-For-Steel-Manufacturers.html |

|

EU Willing To Pay Up For Russian Diesel Ahead Of BanThe EU may have a plan to ban all Russian diesel purchases in February, but in the meantime, European buyers are happy to pay more for Russian diesel now than they did back in May, industry sources told Reuters. The ban on Russian seaborne diesel imports, set to go into effect as part of a larger strategy to cut off Russia’s revenue stream, follows the EU’s crude oil ban set to go into effect in December. Two months later, the ban on Russian diesel imports and all its refined products will go into effect. The discount on Read more at: https://oilprice.com/Latest-Energy-News/World-News/EU-Willing-To-Pay-Up-For-Russian-Diesel-Ahead-Of-Ban.html |

|

U.S. Senators Propose Secondary Sanctions On Russian OilU.S. senators have put forward legislation that would impose secondary sanctions on Russian crude oil, Reuters said on Tuesday, in a move that could provoke two of Russia’s largest oil importers, China and India. Democratic Senator Chris Van Hollen and Republican Senator Pat Toomeytwo members of the Senate Banking, Housing, and Urban Affairs Committee have implored the Biden Administration to enact secondary sanctions on Russia’s crude oil and crude oil products. If passed, the legislation would target banks and other financial institutions, Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Senators-Propose-Secondary-Sanctions-On-Russian-Oil.html |

|

Organic Solar Cell Breakthrough Improves Performance And StabilityGwangju Institute of Science and Technology (GIST) scientists use water treatment for morphology control in the fabrication of active layer thin films, improving the performance and stability of large-area organic solar cells. Morphology control is essentially about making and placing very small particles in their working position. Albeit somewhat a simplified description, as miniaturization becomes micro miniaturization and now molecule, crystal, and sometimes even atom placement, the process engineering efforts are getting very challenging indeed. Read more at: https://oilprice.com/Alternative-Energy/Solar-Energy/Organic-Solar-Cell-Breakthrough-Improves-Performance-And-Stability.html |

|

U.S. Refiners May Soon Purchase More Canadian CrudeCanada’s benchmark heavy oil price could soon see a boost as U.S. refiners are expected to return to buying large volumes of Canadian crude once the massive releases from the Strategic Petroleum Reserve (SPR) by the Biden Administration end in October, traders, and analysts told Reuters. The U.S. Administration authorized in March the release of 1 million barrels per day (BPD) from the SPR over a period of six months in a bid to lower oil prices and potentially boost domestic production through contracts with companies to purchase future oil Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Refiners-May-Soon-Purchase-More-Canadian-Crude.html |

|

Macro Data Dominates Oil MarketsCrude prices have been weighed down by a strong dollar and the anticipation of a large interest rate hike, largely ignoring OPECs underproduction and the reopening of Chinese megacities Reader Update: Whether you are new to the oil and gas industry or an energy market veteran, you will regret not signing up for Global Energy Alert. Oilprice.com’s premium newsletter provides everything from geopolitical analysis to trading analysis, all for less than a cup of coffee per week. Chart of the Week Freight Is the Oil Markets New Achilles Read more at: https://oilprice.com/Energy/Energy-General/Macro-Data-Dominates-Oil-Markets.html |

|

Beyond Meat operating chief suspended after arrest for allegedly biting man’s noseBeyond Meat says operating chief Doug Ramsey is suspended after he was arrested for allegedly punching another man and biting his nose. Read more at: https://www.cnbc.com/2022/09/20/beyond-meat-suspends-operating-chief-doug-ramsey-arrest-for-alleged-nose-biting.html |

|

Trump-linked SPAC faces new pressure from investors as merger hangs in the balanceInvestors in the Trump-linked SPAC Digital World are seeking protections against risk as the company faces another fate-deciding vote. Read more at: https://www.cnbc.com/2022/09/20/trump-media-investor-pressure-dwac-merger-at-risk.html |

|

Single-family rent increases cool for the third straight monthRents for single-family homes are still higher than they were a year ago, but increases are slowing down. Read more at: https://www.cnbc.com/2022/09/20/single-family-rent-increases-cool-for-the-third-straight-month.html |

|

Ford stock suffers worst day since 2011 after cost warning, shedding $7 billion in market valueFord’s stock suffered its worst day in more than 11 years after the company pre-released part of its third-quarter earnings report. Read more at: https://www.cnbc.com/2022/09/20/ford-stock-on-pace-for-worst-day-in-more-than-11-years.html |

|

Gap eliminating about 500 corporate jobs as sales fallGap Inc. is cutting about 500 corporate positions amid declining sales and a push to cut spending. Read more at: https://www.cnbc.com/2022/09/20/gap-eliminating-about-500-corporate-jobs-as-sales-fall.html |

|

GM to sell up to 175,000 electric vehicles to Hertz through 2027GM is the latest automaker to strike such an agreement with Hertz following Tesla and Polestar, a Volvo-backed electric vehicle startup. Read more at: https://www.cnbc.com/2022/09/20/gm-to-sell-up-to-175000-electric-vehicles-to-hertz-through-2027.html |

|

Peloton adds $3,195 rowing machine to fitness equipment lineupThe fitness company known for its bikes introduced Peloton Row on Tuesday. Read more at: https://www.cnbc.com/2022/09/20/peloton-adds-3195-rowing-machine-to-fitness-machine-lineup-.html |

|

Ford warns investors of an extra $1 billion in supply chain costs during the third quarterFord warned investors the company expects to incur an extra $1 billion in costs during the third quarter due to inflation and supply chain issues. Read more at: https://www.cnbc.com/2022/09/19/ford-warns-investors-of-1-billion-in-supply-chain-costs-during-the-third-quarter.html |

|

Beyond Meat COO Doug Ramsey arrested for allegedly biting man’s nose after Arkansas college football gameBeyond Meat Chief Operating Officer Doug Ramsey was arrested Saturday after allegedly biting a man’s nose in an Arkansas parking garage. Read more at: https://www.cnbc.com/2022/09/19/beyond-meat-coo-doug-ramsey-arrested-for-allegedly-biting-mans-nose.html |

|

Amazon memo says ‘Thursday Night Football’ drew record number of Prime signups for a 3-hour periodAmazon is paying about $1 billion a year for exclusive Thursday night rights from the NFL. Read more at: https://www.cnbc.com/2022/09/20/amazon-thursday-night-football-nfl-stream-draws-record-prime-signups.html |

|

Two veteran sports execs launch firm aiming to invest up to $50M in early-stage companiesDavid Abrams and Arne Rees have started Velocity Capital Management, an investment firm that will seek opportunities in sports and media companies. Read more at: https://www.cnbc.com/2022/09/20/2-sports-execs-launch-firm-to-invest-up-to-50m-in-early-stage-firms.html |

|

‘The Woman King’ poised for big box-office run after surprisingly strong opening weekendDuring a lull in the movie calendar, “The Woman King” is generating the kind of buzz, and ticket sales, that the box office desperately needs. Read more at: https://www.cnbc.com/2022/09/19/the-woman-king-poised-for-big-box-office-strong-opening-weekend.html |

|

FAA rejects proposal to halve flight-time requirement for pilots as shortage prompts route cutsThe FAA’s decision comes as airlines grapple with a severe shortfall of pilots, which executives have blamed on service cuts, particularly to small cities. Read more at: https://www.cnbc.com/2022/09/19/faa-rejects-republic-airways-proposal-to-halve-pilot-training-hours.html |

|

Watch: Visualizing US Interest Rates Since 2020In March 2020, the U.S. Federal Reserve cut already depressed interest rates to historic lows amid an unraveling COVID-19 pandemic. Fast-forward to 2022, and the central bank is grappling with a very different economic situation that includes high inflation, low unemployment, and increasing wage growth. Given these conditions, it raised interest rates to 2.25% up from 0% in just five months. As Visual Capitalist shows in the animation by Jan Varsava shows U.S. interest rates over the last two years along with its impact on Treasury yields, often considered a key indicator for the economy. Timeline of Interest RatesBelow, we show how U.S. interest rates have changed over the course of the pandemic: Read more at: https://www.zerohedge.com/markets/watch-visualizing-us-interest-rates-2020 |

|

New England’s Power Crisis Set To Return, Regulator WarnsNew England’s power grid could be several cold snaps away from the start of an energy crisis that reappears whenever temperatures dip because of the state’s heavy reliance on natural gas generation, delayed/blocked expansion/upgrades to energy infrastructure, and lack of grid diversification. Bloomberg spoke with Allison Clements, commissioner for the Federal Energy Regulatory Commission, who warned New England (for our international readers, New England consists of six states in the US Northeast, Connecticut, Maine, Massachusetts, New Hampshire, Rhode Island, and Vermont) faces another energy crisis this winter.

Clements outlined precisely what we pointed out during last winter’s peak in a note titled “New England Is An Energy Crisis Waiting To Happen.” We said soaring NatGas prices in the region are due primarily to NatGas pipeline infrastructure having been delayed, blocked, or abandoned over the years. She said that the region would need to increase stockpiles of Na … Read more at: https://www.zerohedge.com/commodities/new-englands-power-crisis-set-return-regulator-warns |

|

Watch: Biden Proclaims “There’s A Through Line Of Hate” In American HistoryAuthored by Steve Watson via Summit News, During comments at the ironically titled “United We Stand” summit last week, Joe Biden declared that “hate” runs throughout American history, and once again singled out those who don’t agree with his politics as ‘violent extremists’.

“There’s a through line of hate from massacres of indigenous people to the original sin of slavery,” Biden declared. He continued, “The terror of the clan, to anti-immigration violence against the Irish, Italians, Chinese, Mexicans. So many of those laced through our history.” “There’s a through line of violence against religious groups anti semitic, anti Catholic, anti Mormon, anti Muslim, anti Hindu, anti Sikh,” Biden further asserted. Biden vowed to expose “hate-fueled violence”, … Read more at: https://www.zerohedge.com/political/watch-biden-proclaims-theres-through-line-hate-american-history |

|

Emerging Markets Start Sending Out Warning Signals Against The Soaring DollarA few weeks ago we said that the real Fed pivot will not take place because of some arbitrary (actually not arbitrary at all but entirely political) BLS determination of what inflation or employment is, but when the US dollar soars so high it trips trillions in dollar margin calls and finally breaks something, a something which we speculated would be in the form of “devastation across the rest of the world”, something which China – whose pegged yuan is suffering from crippling pain as a result of the soaring dollar – has realized penning a scathing anti-Fed editorial titled “The strong dollar should not become a sharp blade to cut the world.”

And with the dollar ascent relentless amid growing rumors of an imminent Plaza Accord 2.0, Bloomberg’s Simon White today looks at Turkey and Chile, which “are sending an ominous signal for broader EM equity returns” and may be the first EMs to break as a result of the soaring dollar. Pointing to EMs with inadequ … Read more at: https://www.zerohedge.com/markets/emerging-markets-start-sending-out-warning-signals-against-soaring-dollar |

|

Treasury refuses to publish UK economic forecastThe UK’s independent forecaster has provided an updated outlook for the economy, the BBC understands. Read more at: https://www.bbc.co.uk/news/business-62970803?at_medium=RSS&at_campaign=KARANGA |

|

Butlin’s sold back to family firm for £300mThe Harris family has bought back Hertfordshire-based Butlin’s from Blackstone and Bourne Leisure. Read more at: https://www.bbc.co.uk/news/uk-england-beds-bucks-herts-62974028?at_medium=RSS&at_campaign=KARANGA |

|

Gap to cut 500 office jobs in US and Asia as sales sinkThe move marks the latest shake-up at the company which has been looking for a turnaround. Read more at: https://www.bbc.co.uk/news/business-62973377?at_medium=RSS&at_campaign=KARANGA |

|

Tech View: Nifty forms small-bodied bullish candle; what should traders do on Wednesday?The Nifty reclaimed 17,900 in intraday trade on Tuesday but failed to hold on to the momentum and closed just above 17,800, which resulted in a small-bodied candle on the daily charts. Experts advise caution ahead of the Fed’s 2-day meeting starting today. The Street is expecting a rate hike of about 75 bps, but a jumbo 100 bps hike or a hawkish stance could lead to a knee-jerk reaction, they say. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-forms-small-bodied-bullish-candle-what-should-traders-do-on-wednesday/articleshow/94330068.cms |

|

The number of millionaires in India to double by 2026: Credit SuisseThe report said wealth per adult in India has risen at an impressive average annual rate of 8.8 percent since the year 2000 and stood at $15,535 at the end of 2021, which is far below the global mean.By year-end 2021, median wealth in India had fallen to 41% of the world value, but median wealth in China had risen to 338 percent. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/number-of-millionaires-in-india-to-double-by-2026-credit-suisse/articleshow/94324040.cms |

|

Multibagger! This RK Damani stock rallies over 100% in 3 months, hits 15-year highCement stocks have been on the radar considering the government’s infra push and acquisition of Ambuja Cements and ACC by Adani Group. Analysts said the twin acquisitions by Adani have raised hopes of more such deals in the sector as a few players are finding it difficult to pare their leverage and may be willing to exit the cement business at good valuations. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/multibagger-the-rk-damani-rallies-over-100-in-3-months-hits-15-year-high/articleshow/94320165.cms |

|

Market Extra: Why investors fear a full-percentage-point Fed rate hike would ‘unnerve’ Wall StreetSome on Wall Street believe investors are underestimating the possibility that the Fed might deliver a surprise-100 basis-point interest-rate hike at the close of its two-day policy meeting on Wednesday. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7125-FA97EDFC69B4%7D&siteid=rss&rss=1 |

|

Market Snapshot: Dow down 300 points as stocks pare losses; Fed decision loomsU.S. stocks pare losses in the final hour of trading Tuesday, but remain sharply lower as Treasury yields climb and traders are skittish about opening new long positions ahead of the Federal Reserve’s next interest-rate hike. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7125-D6FDF0E9005C%7D&siteid=rss&rss=1 |

|

Market Extra: Bond ETFs fall ahead of expected Fed rate hikeExchange-traded funds that focus on bonds were falling Tuesday as Federal Reserve officials gather for a two-day meeting that will conclude Wednesday with a widely anticipated announcement on its interest rate policy. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7126-2E7B24536F73%7D&siteid=rss&rss=1 |