Summary Of the Markets Today:

- The Dow closed up 30 points or 0.10%,

- Nasdaq closed up 0.74%,

- S&P 500 up 0.34%,

- WTI crude oil settled at $89 up 2.03% for the week,

- USD $109.82 strengthened 0.14%,

- Gold $1705 down 0.73%,

- Bitcoin $19.958 down 1.07% – Session Low 19,691,

- 10-year U.S. Treasury 3.412 Unchanged,

Today’s Economic Releases:

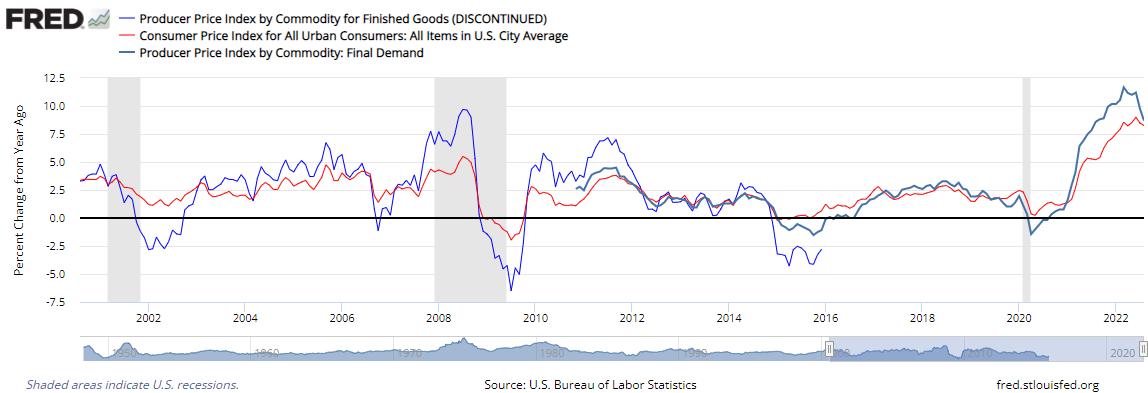

The Producer Price Index for final demand moved up 8.7% for the 12 months ended in August 2022 – down from last month’s 9.8%. The decrease in the index for final demand is attributable to a decline in final demand goods which was somewhat offset by a rise in final demand services. The CPI released yesterday for August 2022 showed an 8.2% YoY rise. In general, the CPI and PPI move in the same direction.

- U.S. Producer Prices Index Drops On Lower Gasoline Prices

- Japan Plans To Restart Seven Nuclear Reactors By Summer 2023

- Railroads say they won’t lock out workers as negotiators meet with Labor Secretary Walsh

- Taxpayers can avoid a ‘very nasty surprise’ by making quarterly payments by Sept. 15

- Mortgage demand from homebuyers falls 29% since last year, as interest rates surge past 6%

- Powell’s Pivot To “Pain” But No Gain: Triggering The Coming Recession

- Bond Report: Short-term Treasury yield holds at nearly 15-year high a day after August CPI shock

- Market Extra: Markets are waking up to the notion that inflation hasn’t peaked

These and other headlines and news summaries moving the markets today are included below.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Oil Gains On Crossed Economic WiresContinued volatility has seen oil prices gain 1% on Wednesday, as the market attempts to decipher the latest demand growth, US crude inventory data, inflation indications and the impact of China’s COVID lockdowns. As of 3:33 p.m. EST on Wednesday, Brent crude was trading up $0.53, at $93.73, for a 0.60% gain on the day. WTI was trading up $0.83, at $88.14, for a 0.95% gain on the day. Oil prices appear to be reacting, in part, to Wednesday’s release by the Bureau of Labor Statistics of the Producer Price Index (PPI), which Read more at: https://oilprice.com/Latest-Energy-News/World-News/Oil-Gains-On-Crossed-Economic-Wires.html |

|

Water And Energy Shortages Are Fueling A Global Food CrisisThe Colorado River drought is so bad you can see it from space. Lake Powell and Lake Mead, which supply drinking water to millions of people in Colorado, New Mexico, Utah, Wyoming, Nevada, Arizona, and California, are each currently down to just 27% of their capacity, a near-complete collapse from being 95% full in 2000. In China, record heatwaves and drought have dried up the Yangtze River. Yale Environment 360 is warning that the drying up of Europe’s great rivers, which function as the arteries of the continent’s economy, could be the Read more at: https://oilprice.com/Energy/Energy-General/Water-And-Energy-Shortages-Are-Fueling-A-Global-Food-Crisis.html |

|

U.S. Producer Prices Index Drops On Lower Gasoline PricesThe U.S. Bureau of Labor Statistics has released a report showing the second consecutive monthly drop in producer prices, prompted by steadily declining gasoline prices. The Producer Price Index (PPI) shows final demand dropping by 0.1% in August, compared with a 0.4% drop in July. Overall, the latest PPI shows a 1.2% drop in prices for goods. That drop in prices for goods is attributed to continually falling gasoline prices, which have dropped nearly 13%. The national average per gallon of gas on Monday dropped to $3.703, Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Producer-Prices-Index-Drops-On-Lower-Gasoline-Prices.html |

|

Europe Sees Wave Of Multi-Billion-Euro Renewable Energy InvestmentsIn European energy, Russia’s invasion of Ukraine has defined the market so far in 2022. Gas prices have soared, exacerbating inflation. How organizations, consumers, and governments respond could mark the beginning of an evolution in European energy. Is renewables the way forward for Europe? Renewed interest? Policymakers know they must move swiftly on renewables, but dealmakers are already aware of the benefits. Renewables deals came to the fore last year, such as when Engie and Crdit Agricole bought Spanish renewable power producer Read more at: https://oilprice.com/Energy/Energy-General/Europe-Sees-Wave-Of-Multi-Billion-Euro-Renewable-Energy-Investments.html |

|

Japan Plans To Restart Seven Nuclear Reactors By Summer 2023In Japan, a major reversal last month, the government now wants to restart more nuclear power plants that were idled after the 2011 Fukushima disaster and is interested in expanding investments in next-generation plants. Weeks after the announcement, Japanese broadcaster NHK commissioned a new survey that revealed half of the population supports the government’s initiative to expand nuclear power. NHK found that 48% of the respondents supported Japanese Prime Minister Fumio Kishida’s plan of developing next-generation nuclear reactors as Read more at: https://oilprice.com/Alternative-Energy/Nuclear-Power/Japan-Plans-To-Restart-Seven-Nuclear-Reactors-By-Summer-2023.html |

|

Offshore Drilling Rates Jump, Could Rise Further To $500,000 Per DayThe costs of renting offshore oil and gas rigs have more than doubled over the last two years, and could rise to $500,000 per day, oil company executives claimed on Wednesday, amid a tight hydrocarbon supply situation and as energy security continues to trump energy transition efforts. At the top end, some drilling companies have seen daily rental rates already near $400,000. And, with market conditions as they are, drillers are commanding higher rates for their equipment in what looks to be the end of a couple of rocky pandemic years that saw Read more at: https://oilprice.com/Latest-Energy-News/World-News/Offshore-Drilling-Rates-Jump-Could-Rise-Further-To-500000-Per-Day.html |

|

Railroads say they won’t lock out workers as negotiators meet with Labor Secretary WalshRailroads have already started diverting freight. A strike could cost the U.S. economy more than $2 billion a day. Read more at: https://www.cnbc.com/2022/09/14/railroad-strike-carriers-wont-lock-out-workers-negotiators-meet-with-labor-secretary.html |

|

Ford asks dealers to invest in EVs as it chases Tesla-like profitThe automaker is asking its nearly 3,000 dealers to invest upward of $1 million for upgrades to sell all-electric vehicles. Read more at: https://www.cnbc.com/2022/09/14/ford-outlines-ev-investment-structure-for-its-dealers-as-it-chases-tesla-like-profit.html |

|

Jim Beam ramps up bourbon production in $400 million renewable energy pushBeam Suntory said it is aiming to produce more Jim Beam bourbon while cutting back on its greenhouse-gas emissions. Read more at: https://www.cnbc.com/2022/09/14/jim-beam-ramps-up-bourbon-production-in-400-million-renewable-energy-push.html |

|

United Airlines partners with one-time foe Emirates, will launch Dubai flightsUnited Airlines and Emirates announced a codeshare partnership, which allows the carriers to sell seats on each other’s flights. Read more at: https://www.cnbc.com/2022/09/14/united-airlines-partners-with-one-time-foe-emirates-will-launch-dubai-flights.html |

|

GameStop adding NFT trading cards to loyalty program perks as it deepens push into digital worldGameStop is giving its loyalty program members NFT trading cards for the virtual game Gods Unchained as it works to deepen its reach into the digital world. Read more at: https://www.cnbc.com/2022/09/14/gamestop-gods-unchained-nft-trading-cards-to-loyalty-program-perks-in-digital-world-push.html |

|

Taxpayers can avoid a ‘very nasty surprise’ by making quarterly payments by Sept. 15The deadline for third-quarter estimated tax payments is Sept. 15. Here’s what filers need to know. Read more at: https://www.cnbc.com/2022/09/14/how-to-avoid-a-penalty-by-making-quarterly-tax-payments-by-sept-15.html |

|

Biden announces first round of funding for EV charging network across 35 statesPresident Joe Biden is in Michigan today at the Detroit Auto Show to promote the launch of electric vehicle manufacturing in the motor city. Read more at: https://www.cnbc.com/2022/09/14/watch-live-biden-touts-electric-vehicles-at-the-detroit-auto-show.html |

|

Northrop Grumman exec says SpaceX’s Starship rocket has ‘awesome’ potential but ‘not there yet’The leader of a Northrop Grumman subsidiary sees exciting potential in the massive Starship rockets that Elon Musk’s SpaceX is developing. Read more at: https://www.cnbc.com/2022/09/14/northrop-executive-spacex-starship-has-potential-but-not-ready-yet.html |

|

Mortgage demand from homebuyers falls 29% since last year, as interest rates surge past 6%Rates are surging due in large part to the Fed’s hawkish inflation policies, and that’s weighing on mortgage demand. Read more at: https://www.cnbc.com/2022/09/14/mortgage-demand-declines-29percent-from-last-year-as-rates-eclipse-6percent.html |

|

The tequila brand founded by Michael Jordan and other NBA owners makes a new play for the luxury marketFive NBA owners, including Chicago Bulls legend Michael Jordan, are launching the latest blend of their high-end tequila, Cincoro. Read more at: https://www.cnbc.com/2022/09/14/michael-jordan-tequila-brand-cincoro-new-350-dollar-blend.html |

|

Volvo starts series production of heavy-duty electric trucks, targets 50% of sales by 2030Company faces growing competition in the emerging sector. Read more at: https://www.cnbc.com/2022/09/14/volvo-starts-series-production-of-heavy-duty-electric-trucks.html |

|

Secondhand shopping is booming: Here’s how much you can saveWith the pandemic came a surge in ‘thrifting’ and secondhand shopping. Now the resale market is growing even faster than traditional retail. Read more at: https://www.cnbc.com/2022/09/14/secondhand-shopping-is-booming-heres-how-much-you-can-save.html |

|

Stocks making the biggest moves premarket: SoFi, Nucor, Starbucks, CSX & moreThese are the stocks posting the largest moves in premarket trading. Read more at: https://www.cnbc.com/2022/09/14/stocks-making-the-biggest-moves-premarket-sofi-nucor-starbucks-csx-more.html |

|

Amtrak Canceling All Long-Distance Trains Ahead Of “Potentially Disastrous” Rail StrikeSo it begins: on Wednesday afternoon, Amtrak said it will cancel all long-distance trains starting Thursday, September 15 “to avoid possible passenger disruptions while en route” as White House-led talks between freight-rail companies and unions continued in a race to avoid a rail-system shutdown Friday. “Such an interruption could significantly impact intercity passenger rail service, as Amtrak operates almost all of our 21,000 route miles outside the Northeast Corridor on track owned, maintained, and dispatched by freight railroads,” the company said in a statement Wednesday, adding that it has already started phased adjustments which “include canceling all Long Distance trains and could be followed by impacts to most State- Supported routes” “Adjustments are necessary to ensure trains can reach their terminals before freight railroad service interruption if a resolution in negotiations is not reached” The good news: most travel within the Amtrak-owned Northeast Corridor (Boston – New York – Washington) and related branch lines to Albany, N.Y., Harrisburg, Penn,, and Springfield, Mass., would not be affected. Additionally, the Acela service is not affected, and only a small number of Northeast Regional departures would be impacted. As reported earlier, about 125,000 freight-rail workers could walk off the job if a deal isn’t reached by Friday’s deadline, with a strike potentially costing the world’s biggest economy more than $2 billion a day. The stoppage would be the larg … Read more at: https://www.zerohedge.com/political/rail-shutdown-looms-large-even-congress-steps |

|

Powell’s Pivot To “Pain” But No Gain: Triggering The Coming RecessionAuthored by Jon Wolfenberger via The Mises Institute, Jay “The Inflation We Caused Is Transitory” Powell finally did it. On Friday August 26th, the Fed chair finally mustered the courage to say that he is going to do the job he has been hired to do: the Fed will not “pivot” to cut interest rates until inflation slows meaningfully and persistently—even if the stock, bond, and housing bear markets become much worse and the economy goes into recession.

Powell’s Speech TranslatedBelow we provide key quotes from Powell’s Jackson Hole speech, along with our honest translations:

|

|

Cathie Wood Goes Wild On ‘Dip Buying’ Amid Stock Market RoutTuesday’s stock market plunge was sparked by August’s hotter-than-expected consumer inflation print, which led to a massive unwind in bullish bets across all sectors that were placed on the back of expectations the Federal Reserve would quickly pivot and that peak inflation was locked in. But one investor went against the herd’s ‘pukefest’ and did the one thing she only knows how: ‘buy the dip’ in profitless tech. Of course, we’re talking about everyone’s favorite Ark Investment Management’s Cathie Wood.

Wood’s investing style is no different than the self-described apes and degenerates that use Reddit’s Wall Street Bet. Their strategy is to endlessly buy the dip of profitless tech companies and hope for the Fed to rescue them — and why not? It has worked over the last decade… But this time, the Fed has an inflation problem and can’t quickly pivot (well, maybe not yet) … Read more at: https://www.zerohedge.com/markets/cathie-wood-goes-wild-dip-buying-amid-stock-market-rout |

|

Watch: Dem Senator Slams Kamala Harris As “Dead Wrong” For Claiming Border Is SecureAuthored by Steve Watson via Summit News, Democratic Senator Joe Manchin described Vice President Kamala Harris as “dead wrong” following comments she made in an interview claiming that the southern border is secure.

Harris made the claim in an interview on Meet The Press:

|

|

Asda limits sales of Just Essentials budget rangeThe supermarket temporarily limits purchases in its Just Essentials range, blaming soaring demand. Read more at: https://www.bbc.co.uk/news/business-62905806?at_medium=RSS&at_campaign=KARANGA |

|

Queen Elizabeth II: First night trains for mourners set to departNight services will start on Wednesday after a busy day on London’s trains and tubes. Read more at: https://www.bbc.co.uk/news/business-62906851?at_medium=RSS&at_campaign=KARANGA |

|

McDonald’s to close for Queen’s funeral on MondayThe fast food chain will shut all its restaurants until 5pm on 19 September. Read more at: https://www.bbc.co.uk/news/business-62903404?at_medium=RSS&at_campaign=KARANGA |

|

Nifty50 recoups losses, forms bullish candle to reclaim 18K; what should investors do on Thursday?The Nifty50 formed a bullish candle for the third consecutive day. Supertrend indicator also triggered buy on September 13, and the Golden Cross was recorded on September 9 on the daily charts.The market closed with cuts despite the pullback from crucial support placed at 17,800. A bounce back from lows suggests that bulls are not ready to give up just yet. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty50-recoups-losses-forms-bullish-candle-to-reclaim-18k-what-should-investors-do-on-thursday/articleshow/94202486.cms |

|

These 7 stocks gained over 100% in second half of last 2 fiscal years; do you own any?As we are about to enter the second half of FY23, we analyzed the previous top-performing stocks of the second half of the last two fiscals. To examine, we kept only those stocks that have doubled wealth in the second half of the last two fiscal years (2HFY20 and 2HFY21). Further, we picked only stocks with a market cap of Rs 500 crore and exclude companies that made losses in any of the last 2 fiscal years. Interestingly, 7 stocks have made the cut. (Data Source: ACE Equity.) Read more at: https://economictimes.indiatimes.com/markets/stocks/news/these-7-stocks-gained-over-100-in-second-half-of-last-2-fiscal-years-do-you-own-any/on-radar/articleshow/94196192.cms |

|

Chart Check: Golden Cross on this home furnishing stock makes it an attractive buyThe stock might be trading at a discount when compared to January highs, but it has recouped the majority of its losses. The recent price action suggests that bulls are here to stay. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/chart-check-golden-cross-on-this-home-furnishing-stock-makes-it-an-attractive-buy/articleshow/94192291.cms |

|

Bond Report: Short-term Treasury yield holds at nearly 15-year high a day after August CPI shockThe 2-year Treasury yield remains at its highest level since November 2007 on Wednesday, a day after surprisingly strong CPI data. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7121-D27299C5963B%7D&siteid=rss&rss=1 |

|

Market Extra: Markets are waking up to the notion that inflation hasn’t peakedTuesday’s inflation data is forcing the market to confront a difficult reality: that inflation will likely be far more sticky than previously hoped. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7121-5A534BF43037%7D&siteid=rss&rss=1 |

|

Living With Climate Change: Biden to Detroit Auto Show: First $900 million to fill gaps in EV charging network is on its wayBiden announces approval of the first $900 million to build EV chargers across 53,000 miles of the national highway system and covering 35 states. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7122-01B0D30AA60A%7D&siteid=rss&rss=1 |