Summary Of the Markets Today:

- The Dow closed down 154 points or 0.47%,

- Nasdaq closed down 0.00% (flat),

- S&P 500 down 0.22%,

- WTI crude oil settled at 94 up 6.60% for the week,

- USD $108.61 down 0.32%,

- Gold $1760 up 0.7%,

- Bitcoin $21,569 up 0.71% – Session Low 20,920,

- 10-year U.S. Treasury 3.05% unchanged

Today’s Economic Releases:

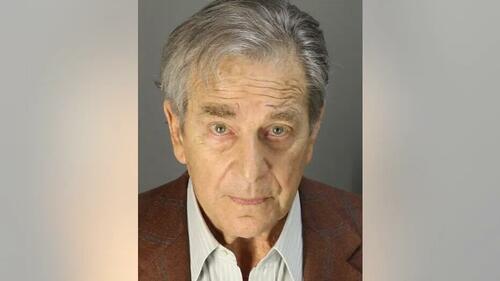

The Richmond Fed manufacturing firms reported slowdowns in August 2022 with their composite manufacturing index falling from 0 in July to −8 in August. Two of its three component indexes tumbled: the indexes for shipments and volume of new orders slid from 7 and −10 in July to −8 and −20 in August, respectively.

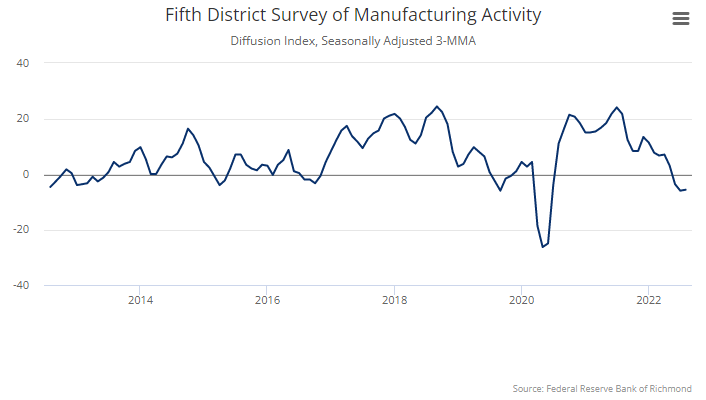

Sales of new single‐family houses in July 2022 were 12.6% below the revised June rate and is 29.6% below the July 2021 estimate. The median sales price of new houses sold in July 2022 was $439,400. The average sales price was $546,800.

A summary of headlines we are reading today:

- Bullish OPEC+ Rhetoric Sends Oil Prices Soaring

- European Crop Yields Collapse Amid Worst Drought In 500 Years

- Macy’s cuts full-year forecast despite strong quarter, fearing shoppers will pull back on spending

- Dick’s Sporting Goods boosts 2022 outlook after second-quarter earnings top estimates

- Intel Inks $30 Billion Financing Partnership With Brookfield To Fund Manufacturing Expansion

- Futures Movers: Oil prices rebound; natural gas pulls back from 14-year highs

- Crypto: What is the Ethereum Merge? Here are 5 things you should know

These and other headlines and news summaries moving the markets today are included below.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Is Zinc On The Brink Of A Breakout?If you look at zinc price trends from this past year, it’s hard to identify what you might call a clear trend. After building from a pandemic-driven low of just $1,960 a ton, the metal skyrocketed to over $4,500 just four months ago. Unfortunately, pride cometh before a fall. And fall zinc did. In fact, by mid-July, it had sunk below $2,700 only to bounce back to the mid $3,000s in August. So, what exactly is the story behind the zinc price fluctuations? Moreover, is it possible to predict which direction zinc will take for Read more at: https://oilprice.com/Metals/Commodities/Is-Zinc-On-The-Brink-Of-A-Breakout.html |

|

Bullish OPEC+ Rhetoric Sends Oil Prices SoaringCrude prices soared on Tuesday morning after OPEC+ leaked that it may decide to cut output once again if, and when Iran makes a full comeback to oil markets. Reader Update: Whether you are new to the oil and gas industry or an energy market veteran, you will regret not signing up for Global Energy Alert. Oilprice.com’s premium newsletter provides everything from geopolitical analysis to trading analysis, all for less than a cup of coffee per week. Chart of the WeekDiesel Spikes Just Around the Corner- Diesel prices have demonstrated exceptional Read more at: https://oilprice.com/Energy/Energy-General/Bullish-OPEC-Rhetoric-Sends-Oil-Prices-Soaring.html |

|

Freeport LNG Pushes Back RestartFreeport LNG has pushed back the date of its expected restart that it provided earlier in the month. Freeport LNG has been shut since June and shared earlier this month that it expected to complete the repairs in time to resume partial operations in early October. But now, Freeport LNG isn’t expecting to resume partial operations until early to mid-November, reaching 2 billion cubic feet of gas production per day by the end of November, the company said in a Tuesday press release. The 2 Bcf per day mark represents 85% of the facility’s export Read more at: https://oilprice.com/Latest-Energy-News/World-News/Freeport-LNG-Pushes-Back-Restart.html |

|

Norway To Maintain High Gas Production Through End Of DecadeNorway will continue to produce natural gas at the current high levels for the remainder of the decade, Norway’s energy minister said on Tuesday. To maintain that high level of natural gas production, the country has approved applications from operators to increase production from several gas fields, energy minister Terje Aasland told Reuters in an interview. Norway is planning on producing 122 billion cubic meters of gas this year, according to May forecasts, up 8% from last year, with nat gas exports likely setting a new record this year. Norway’s Read more at: https://oilprice.com/Latest-Energy-News/World-News/Norway-To-Maintain-High-Gas-Production-Through-End-Of-Decade.html |

|

European Crop Yields Collapse Amid Worst Drought In 500 YearsBesides the news of record high electricity prices, a troubling new crop failure report about Europe’s upcoming harvest was published Monday. The bloc’s Monitoring Agricultural Resources forecasted corn yields could drop by nearly a fifth due to a devastating drought, according to Bloomberg. Before we dive into the crop report, Europe’s centuries-old ‘hunger stones’ were recently revealed in the Elbe River, which runs from the mountains of Czechia through Germany to the North Sea. The stones date back to a drought in 1616 and read: “Wenn Read more at: https://oilprice.com/Energy/Energy-General/European-Crop-Yields-Collapse-Amid-Worst-Drought-In-500-Years.html |

|

Germany Could Adjust New Gas Levy As Soon As This WinterThe new gas levy on consumers in Germany, designed to help German energy firms cover the costs of natural gas imports and expected to enter into force on October 1, may have to be adjusted as soon as winter comes, with the adjustment up or down depending on market conditions, according to market operator Trading Hub Europe (THE). “Because of dynamic development, I assume that the levy will have to be adjusted as early as this winter,” Torsten Frank, Managing Director of the operator, told German newspaper Rheinische Post as carried by Reuters. Read more at: https://oilprice.com/Latest-Energy-News/World-News/Germany-Could-Adjust-New-Gas-Levy-As-Soon-As-This-Winter.html |

|

Apartment rents are finally easing after an incredible run. Here’s how to play itRent growth for apartments looks to have peaked after a tremendous run in 2021, and that could boost some real estate stocks. Read more at: https://www.cnbc.com/2022/08/23/apartment-rents-are-finally-easing-after-an-incredible-run-heres-how-to-play-it.html |

|

Los Angeles Angels owner Arte Moreno exploring sale of the teamArte Moreno, who bought the Los Angeles Angels in 2003, is exploring a sale of the team. Read more at: https://www.cnbc.com/2022/08/23/los-angeles-angels-owner-arte-moreno-exploring-sale-of-the-team.html |

|

Amazon Prime signs deal with DirecTV to air ‘Thursday Night Football’ games in bars, restaurantsAmazon Prime holds the exclusive rights to “Thursday Night Football” games for the next 11 seasons. Read more at: https://www.cnbc.com/2022/08/23/amazon-signs-deal-with-directv-to-air-thursday-night-football-games-in-bars.html |

|

Nets say Kevin Durant is going to stay in Brooklyn, after allThe Nets said the team would continue its partnership with two-time NBA champion Kevin Durant. Read more at: https://www.cnbc.com/2022/08/23/kevin-durant-to-stay-with-brooklyn-nets-team-says-after-trade-talks.html |

|

Starbucks informs workers at two stores of closures, union claims retaliationStarbucks has informed workers at two stores with union activity that the locations will be closed, but the coffee chain said the organizing efforts aren’t the reason. Read more at: https://www.cnbc.com/2022/08/23/starbucks-informs-workers-at-two-stores-of-closures-union-claims-retaliation.html |

|

MoviePass is coming back—Here’s what we know about the subscription service’s relaunchThe revived service will reportedly include three price tiers depending on where in the country a user lives. Read more at: https://www.cnbc.com/2022/08/23/moviepass-is-backheres-what-we-know-about-the-services-relaunch.html |

|

88% of investors worry about inflation, rate hikes. Here’s how to prepare your portfolio as interest rates continue to riseAfter nearly eight months of market volatility, many investors still worry about rising interest rates and how they affect their portfolio. Here’s what to know. Read more at: https://www.cnbc.com/2022/08/23/how-to-prepare-your-portfolio-as-interest-rates-continue-to-rise.html |

|

Comcast agrees to sell its majority stake in regional network NBC Sports WashingtonComcast will offload its majority stake in NBC Sports Washington to Monumental Sports & Entertainment, making it the sole owner of the regional sports network. Read more at: https://www.cnbc.com/2022/08/23/comcast-agrees-to-sell-majority-stake-in-nbc-sports-washington.html |

|

Macy’s cuts full-year forecast despite strong quarter, fearing shoppers will pull back on spendingMacy’s on Tuesday cut its full-year forecast, saying it anticipates deteriorating consumer spending on discretionary items like apparel. Read more at: https://www.cnbc.com/2022/08/23/macys-m-reports-fiscal-q2-2022-earnings.html |

|

Dick’s Sporting Goods boosts 2022 outlook after second-quarter earnings top estimatesDick’s Sporting Goods reported quarterly earnings and revenue that topped analysts’ expectations and boosted its financial outlook for the year. Read more at: https://www.cnbc.com/2022/08/23/dicks-sporting-goods-dks-q2-earnings-report.html |

|

‘House of the Dragon’ draws nearly 10 million viewers, making it the largest premiere in HBO historyThe first episode of “House of the Dragon” was seen by 9.986 million viewers across linear and HBO Max platform Sunday night. Read more at: https://www.cnbc.com/2022/08/22/house-of-the-dragon-is-largest-hbo-series-premiere-in-history.html |

|

Ford to eliminate 3,000 jobs in an effort to cut costsFord Motor is cutting about 3,000 jobs from its global workforce, a majority of which are in North America. Read more at: https://www.cnbc.com/2022/08/22/ford-to-cut-3000-jobs-primarily-in-north-america.html |

|

Trump-linked SPAC warns decline in ex-president’s popularity could hurt his social media companyDigital World Acquisition Corp. set a meeting to vote on delaying the deadline for completing a merger with Trump Media and Technology Group. Read more at: https://www.cnbc.com/2022/08/22/trump-popularity-decline-could-hurt-his-social-media-company-dwac-warns.html |

|

Intel Inks $30 Billion Financing Partnership With Brookfield To Fund Manufacturing ExpansionIntel is taking a large step in expanding its manufacturing at a time when many in the market are counting the semiconductor company out. The former chip leader signed a $30 billion funding partnership with Brookfield Asset Management that will help finance its “massive factory expansion ambitions,” a Tuesday morning report by the Wall Street Journal said. The deal could be the “first of many”, according to the report, as Chief Executive Pat Gelsinger looks to make a manufacturing push over competitors based in Taiwan and South Korea. Intel will fund 51% of the cost of building new chip-making facilities in Arizona and will have a controlling stake in the financing entities that will own the factories. “Brookfield will own the remainder of the equity and the companies will split the revenue that comes out of the factories,” Intel Chief Financial Officer David Zinsner told WSJ. Read more at: https://www.zerohedge.com/markets/intel-inks-30-billion-financing-partnership-brookfield-fund-its-aggressive-expansion |

|

US NatGas Slides From 2008 Highs After Restart Delay At FreeportUS natural gas prices plunged from the highest level since the 2008 commodity boom after news that a key LNG export terminal in Texas would delay restarting for another month. The Freeport plant, which closed in June due to an explosion, was initially slated to begin exports in October. The company released a statement Tuesday afternoon specifying the restart date will now be pushed to mid-November. The restart delay means more NatGas supplies for the US and less for Europe. The facility accounted for 20% of all US LNG exports. Following the news, US Natgas tumbled more than 5% to $9.18/mmbtu after topping $10/mmbtu earlier in the session (the highest level since 2008).

Inversely, EU Natgas should move higher as this would mean fewer LNG carriers for the energy-stricken continent. … Read more at: https://www.zerohedge.com/commodities/us-natgas-slides-2008-levels-after-restart-delay-freeport |

|

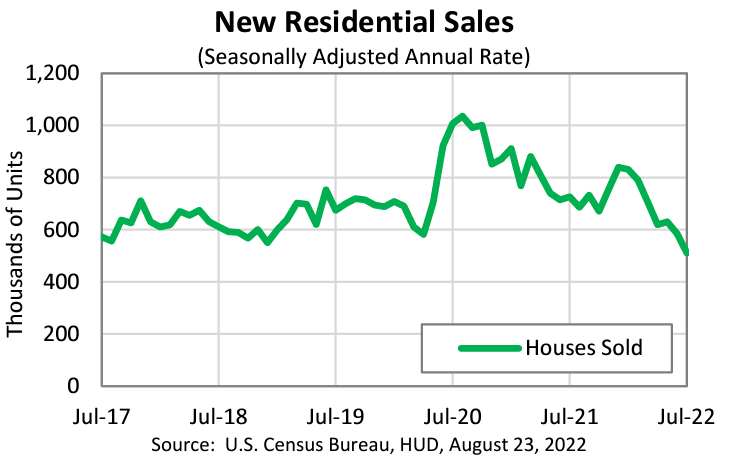

Investment Guru Paul Pelosi Avoids Jail In DUI CaseHouse Speaker Nancy Pelosi’s husband, Paul Pelosi, dodged jail time in a plea agreement following his May DUI arrest.

Pelosi pleaded guilty to driving under the influence and causing injury on Tuesday, for which he technically received five days in jail – except that Judge Joseph Solga, a Gavin Newsom appointee, gave Pelosi credit for two days of actual time served and two days for ‘conduct’ credits. The remaining day will be covered by an 8-hour work program. Pelosi – who allegedly had a drug in his system and addressed officers with a slurred speech before trying to slide them a ‘police courtesy card’ – will also have to participate in a 90-day drunk driving program, install an ignition interlock device on his vehicle(s), pay restitution of $1,700, and will be on probation for three years. Read more at: https://www.zerohedge.com/political/investment-guru-paul-pelosi-avoids-jail-dui-case |

|

Head Of JPM Cash Trading: I Currently Have Zero Sell-Short Orders, I Have 5 Chunky HF Orders, All BuyersSpoos have slumped since hitting the 200DMA resistance last week, sliding almost 200 points from the closely watched 4,328 level, but despite the widespread selling – sparked in part by the latest popping of the meme stonk bubble courtesy of Ryan Cohen’s masterful pump and dump – the mood is anything but panicky, with some actually expecting that the bigger the selloff now, the less hawkish Powell’s remarks will be on Friday morning at Jackson Hole, and the faster the bounce. In any case, and as is abundantly clear by now, JPM trader Andrew Tyler writes this morning that the market’s primary focus is Friday’s Jackson Hole event featuring Powell’s speech, and several media outlets are reporting that HFs are positioning for a more hawkish speech, with Powell pushing back on the concept of a pivot. While this is aligned with JPM’s thinking, given that the Fed is waiting on the Sept 2 NFP and the Sept 13 CPI prints, which should dictate 50bps or 75bps, it is unclear why this is “new news” as this was the Fed’s stance since the July meeting. That said, any talk of a pivot will be reserved until the Sept 21 Fed meeting, and as a result rate vol is likely to remain elevated around these near-term macro events, with September a seasonally weak month for stocks. Read more at: https://www.zerohedge.com/markets/head-jpm-cash-trading-i-currently-have-zero-sell-short-orders-i-have-5-chunky-hf-orders-all |

|

Energy bills: Half of UK households face fuel poverty, EDF warnsPeople are in for a “catastrophic winter” unless the government does more to help, says EDF. Read more at: https://www.bbc.co.uk/news/business-62643934?at_medium=RSS&at_campaign=KARANGA |

|

House sales peak in July but buyers are cautiousMore homes were sold in the UK in July than in any other month this year, despite pressure on budgets. Read more at: https://www.bbc.co.uk/news/business-62646676?at_medium=RSS&at_campaign=KARANGA |

|

Gatwick flights canceled at short notice due to staff sicknessAround 26 EasyJet flights have been canceled in and out of the London airport. Read more at: https://www.bbc.co.uk/news/business-62643664?at_medium=RSS&at_campaign=KARANGA |

|

Tech View: Nifty50 forms Bullish Piercing Line pattern, signals reversalIn that scenario, the index can attempt to bridge the bearish gap present between 17,690 and 17,710 level registered on August 22 and a close above 17,710 can strengthen the optimism of the bulls further. Contrary to this, a fall below 17,345, on a closing basis, may resume weakness till 17,000 and 16,950 levels,” he said Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty50-forms-bullish-piercing-line-pattern-signals-reversal/articleshow/93733999.cms |

|

Cryptos will lead to financial instability, dollarization of the economy, says RBI GovernorThe RBI chief said, “cryptos may lead to dollarization of the developing countries like India as the prices of crypto tokens are mostly denominated in dollars.”He said that this will create serious financial instability in the country. The RBI governor also added that cryptos pose a serious risk for small investors who are prone to lose their money. Read more at: https://economictimes.indiatimes.com/markets/cryptocurrency/cryptos-will-lead-to-financial-instability-dollarization-of-the-economy-says-rbi-governor/articleshow/93736661.cms |

|

Foreigners return to Indian equities on hopes over earningsDomestic investors bought over $30 billion worth of stocks in the first half, helping to prop up the market. But this month, overseas investors have taken the baton, pouring in over $5 billion on hopes that Indian companies will deliver stronger earnings and that a fall in crude oil prices will help narrow the country’s current account deficit. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/foreigners-return-to-indian-equities-on-hopes-over-earnings/articleshow/93731147.cms |

|

Futures Movers: Oil prices rebound; natural gas pulls back from 14-year highsEurope’s looming energy crisis remains a major factor impacting commodity markets. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7114-1F8C2ABDBD43%7D&siteid=rss&rss=1 |

|

Earnings Results: We’re done with pajamas. What we need is luggage. Macy’s sales show how consumer behavior is changing.Macy’s executives on Tuesday outlined the ways that inflation is changing customer behavior across all income brackets, as higher prices for food and gas and rising interest rates weigh on sentiment. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7114-4D4B47F190AC%7D&siteid=rss&rss=1 |

|

Crypto: What is the Ethereum Merge? Here are 5 things you should knowEthereum’s ‘Merge,’ expected in September, could lower the blockchain’s carbon footprint, reduce ether supply and have a profound impact on the whole crypto ecosystem. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7114-4BA10F9AEC09%7D&siteid=rss&rss=1 |