Summary Of the Markets Today:

- The Dow closed down 27 points or 0.08%,

- Nasdaq closed down 0.58%,

- S&P 500 down 0.07%,

- WTI crude oil settled at $94 up 2.25%,

- USD $104.82 down 1.39%,

- Gold $1801 down 0.68%,

- Bitcoin $24,211 up 2.34% – Session Low 23,656,

- 10-year U.S. Treasury 2.893% up 1.12%

Today’s Economic Releases:

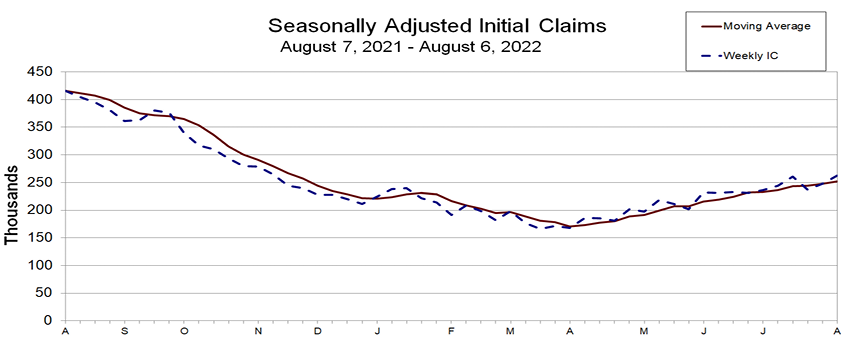

In the week ending August 6, the advance figure for seasonally adjusted initial claims grew 14,000 from the previous week’s revised level, and the 4 week moving average increased 4,500 from the previous week’s revised average.

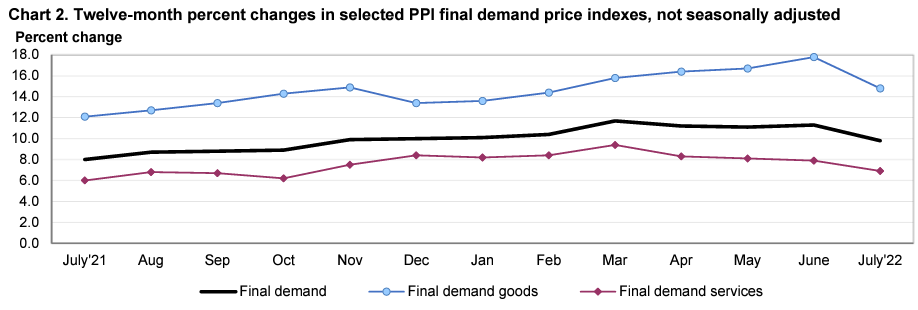

The Producer Price Index final demand prices moved up 9.8 percent for the 12 months ended in July 2022. Producer prices are a measure of inflation from the perspective of producers whilst the Consumer Price Index measures inflation from the standpoint of consumers. The bottom line is both the CPI and PPI moderated in July – and going forward, the year-over-year growth will be measured against a period where inflation was growing. Therefore, it is easy to speculate that inflation will continue to moderate.

A summary of headlines we are reading today:

- Shell Halts Oil Output At Three Gulf Of Mexico Platforms

- Disney is raising prices, but this time, don’t blame inflation

- U.S. Postal Service to temporarily hike prices for the holiday season

- Justice Department seeks to unseal Trump raid search warrant, Attorney General Garland says

- Ethereum Soars To 2-Month High As Critical Test Passed, Merge Set For Sept 15

- The US Labor Market Is A House Of Cards – Here Are The Reasons Why

- Semiconductor companies have split into two groups — the resilient and the risky

- Bond Report: Ten-year Treasury yield rises to the highest level in three weeks despite signs of cooler inflation

These and other headlines and news summaries moving the markets today are included below.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Shell Halts Oil Output At Three Gulf Of Mexico PlatformsShell has halted production at three of its deepwater platforms in the Gulf of Mexico, Shell said in a statement to Reuters on Thursday. Shell has halted production at its Mars, Ursa, and Olympus platforms, which combined can produce 410,000 barrels of Mars sour crude oil per day, after a leak shut in the Mars and Amberjack Pipelines that connect to the platforms. Shell has not provided a timetable for restart, although the company said it was evaluating “alternative flow paths” to bring the oil to shore through other pipeline routes. “Shell is Read more at: https://oilprice.com/Latest-Energy-News/World-News/Shell-Halts-Oil-Output-At-Three-Gulf-Of-Mexico-Platforms.html |

|

IEA: Russian Oil Output Resilient, But Could Drop With EU EmbargoRussian oil production and exports have been holding resilient in recent months, with much smaller declines than initially expected, the International Energy Agency (IEA) said on Thursday. But the agency’s report warned of a 20% drop in Russia’s production if its oil doesn’t find a home with Asian buyers when the EU embargo takes full effect in February 2023. In its Oil Market Report published today, the IEA revised its outlook for global oil supply for 2022 upward due to more limited declines in Russian supply than previously Read more at: https://oilprice.com/Latest-Energy-News/World-News/IEA-Russian-Oil-Output-Resilient-But-Could-Drop-With-EU-Embargo.html |

|

France Announces Emergency Renewable Energy PackageRare earths and renewable energy are two sectors that almost every country races to dominate. One of these nations, France, takes serious strides toward this goal. Recently, the French government announced an emergency measures package to hasten renewable energy development. Rising infrastructure costs recently pushed the French government towards this decision. Along with the rest of the world, these are riding on the back of record inflation. Only about 20% of France’s current electricity comes from renewable sources. This includes just Read more at: https://oilprice.com/Alternative-Energy/Renewable-Energy/France-Announces-Emergency-Renewable-Energy-Package.html |

|

An Unjustified Fear Of Nuclear Energy Is Holding The Industry BackGovernments are backing nuclear power in a big way but fears of disasters still linger, with any mishap having the potential to derail the big nuclear resurgence. As governments get behind nuclear projects for the first time in several decades, in order to boost their energy security, many continue to be fearful of nuclear developments for both safety and environmental reasons. But will leaders be able to convince the public of the need for nuclear energy as part of a green transition? Nuclear energy was hailed years ago as the cleaner alternative Read more at: https://oilprice.com/Energy/Energy-General/An-Unjustified-Fear-Of-Nuclear-Energy-Is-Holding-The-Industry-Back.html |

|

China Heralds Another Major Oil DiscoveryChinas state-run China Petrochemical Group, Sinopec, says it has discovered a massive oilfield in the Tarim Basin, containing 1.7 billion tons of oil reserves. The discovery is the result of exploration in the Shunbei oil and gas field, said to be one of the deepest commercial fields in the world, in the country’s Xinjiang region. According to the Global Times, Sinopec’s exploration program at Shunbei includes 117 wells, one of which strikes 9,300 meters in depth. Citing the director of China’s Center for Energy Economics Read more at: https://oilprice.com/Latest-Energy-News/World-News/China-Heralds-Another-Major-Oil-Discovery.html |

|

U.S. Sanctions Russian Steel Giant MMKOn August 2, the United States officially added integrated steelmaker Magnitogorsk Iron & Steel (MMK) and its chairman Viktor Rashnikov to its list of sanctioned entities. The move is yet another punitive measure in response to Russia’s February invasion of Ukraine, in hopes that the steel manufacturing sanction will place more economic pain on Russia. The announcement came from The Office of Foreign Assets Control (OFAC), part of the US Department of the Treasury. It was part of a new round of sanctions targeting individuals and entities Read more at: https://oilprice.com/Geopolitics/International/US-Sanctions-Russian-Steel-Giant-MMK.html |

|

New York Times stock jumps after activist investor ValueAct reveals 6.7% stakeActivist investor ValueAct has built a 6.7% stake in the New York Times. Read more at: https://www.cnbc.com/2022/08/11/new-york-times-stock-jumps-on-valueact-6point7percent-stake.html |

|

Disney is raising prices, but this time, don’t blame inflationDisney is raising prices on the strength of its brand and products rather than because of inflation. Read more at: https://www.cnbc.com/2022/08/11/disney-is-raising-prices-but-this-time-dont-blame-inflation.html |

|

GM reveals new GMC Canyon premium midsize pickup, starting at $40,000GM expects to begin producing the 2023 Canyon early next year, with new AT4X off-road models beginning in spring. Read more at: https://www.cnbc.com/2022/08/11/gm-reveals-new-gmc-canyon-premium-midsize-pickup-starting-at-40000.html |

|

McDonald’s says it’s planning to reopen some restaurants in UkraineThe fast-food giant said it will begin a phased re-opening of restaurants, beginning in Kyiv and western Ukraine. Read more at: https://www.cnbc.com/2022/08/11/mcdonalds-says-its-planning-to-reopen-some-restaurants-in-ukraine.html |

|

U.S. Postal Service to temporarily hike prices for the holiday seasonThe United States Postal Service filed a notice Wednesday of a temporary price hike for the 2022 peak holiday season. Read more at: https://www.cnbc.com/2022/08/11/us-postal-service-to-temporarily-hike-prices-for-holiday-season.html |

|

Warby Parker slashes sales outlook for the year as loss widensWarby Parker on Thursday joined the slew of retailers that have cut their financial forecasts for the year. Read more at: https://www.cnbc.com/2022/08/11/warby-parker-wrby-reports-q2-2022-losses.html |

|

The CEOs of Disney and Devon Energy deliver upbeat outlooks to CNBCCNBC checked in with the top bosses at Disney (DIS) and Devon Energy (DVN) on Thursday. They had lots of positive things to say. Read more at: https://www.cnbc.com/2022/08/11/top-brass-at-disney-and-devon-energy-deliver-upbeat-outlooks-to-cnbc-.html |

|

Justice Department seeks to unseal Trump raid search warrant, Attorney General Garland saysThe Justice Department had been under pressure to explain why the FBI raid the Florida home of former President Donald Trump. Read more at: https://www.cnbc.com/2022/08/11/watch-live-attorney-general-merrick-garland-makes-statement-.html |

|

4 takeaways from the Investing Club’s ‘Morning Meeting’ on ThursdayThe Club talks Disney’s great quarter, improving inflation reports and more Club stocks. Read more at: https://www.cnbc.com/2022/08/11/4-takeaways-from-the-investing-clubs-morning-meeting-on-thursday.html |

|

Disney raises streaming prices after services post a big operating lossDisney is unveiling a brand new pricing structure to incorporate its ad-supported Disney+ service. Read more at: https://www.cnbc.com/2022/08/10/disney-raises-price-on-ad-free-disney-38percent-as-part-of-new-pricing-structure.html |

|

Ford CEO doesn’t expect electric vehicle battery costs to drop anytime soonFord CEO Jim Farley said the prices of key battery minerals will likely stay elevated for a while, but the company is looking into alternatives. Read more at: https://www.cnbc.com/2022/08/10/ford-ceo-doesnt-expect-electric-vehicle-battery-costs-to-drop-soon.html |

|

Jim Beam maker says some customers trading down, but others still paying more for high-end liquorSome price-sensitive whiskey and tequila drinkers are swapping out their high-end bottles for cheaper options, according to Beam Suntory. Read more at: https://www.cnbc.com/2022/08/10/some-spirits-drinkers-are-starting-to-trade-down-beam-suntory-says.html |

|

AG Merrick Garland Makes Statement Following Trump RaidUS Attorney General Merrick Garland will make a statement to the media at 2:30 pm ET on Thursday, following the FBI’s Monday raid on Mar-a-Lago. Garland has found himself in the crosshairs of conservatives, who claim that the establishment has once again ‘weaponized’ the DOJ against Donald Trump.

Watch live:

Sen. Rand Paul and other conservatives have called for an investigation. “And if it warrants it, there’s going to have to be a look at whether or not the attorney general has misused his office for political purposes. Have they gone after a political opponent? I mean, this is beyond the pale,” he told Fox News on Wednesday. “No one would have ever imagined before that we would be using or one political party would be using the FBI to attack their … Read more at: https://www.zerohedge.com/political/watch-live-ag-merrick-garland-makes-statement-following-trump-raid |

|

Counselor For Sex Offenders Defends “Minor-Attracted Persons”Authored by Paul Joseph Watson via Summit News, A counselor for sex offenders who works with the Pennsylvania Department of Corrections has stoked controversy after defending “minor-attracted persons” and comparing pedophilia to a normal sexual preference.

In a video posted to YouTube that has since been clipped and posted to Twitter, Miranda Galbreath describes adults who are sexually attracted to children as “probably the most vilified population of folks in our culture.” “The term pedophile has moved from being a diagnostic label to being a judgmental, hurtful insult that we hurl at people in order to harm them or slander them,” Galbreath insisted. “I also like to use person-first language that recognizes that any label we apply to a person is only part of who they are and doesn’t represent everything that they are,” she added. Asserting that “many m … Read more at: https://www.zerohedge.com/medical/counselor-sex-offenders-defends-minor-attracted-persons |

|

Ethereum Soars To 2-Month High As Critical Test Passed, Merge Set For Sept 15Ether hit a two-month high as the planned software upgrade to the Ethereum blockchain underwent a major successful test, paving the way for one of the most significant changes in the cryptocurrency sector as Ethereum transitions to Ethereum 2.0, and from Proof of Work to Proof of Stake. As Bloomberg reports, “the Goerli test conducted late Wednesday New York time was a kind of dress-rehearsal for switching the Ethereum network from proof-of-work to a more energy-efficient proof-of-stake system. The full shift is expected next month.” Ethereum co-founder Vitalik Buterin retweeted a post saying the test had activated proof-of-stake.

In another tweet, Tim Beiko, a computer scientist who coordinates Ethereum developers, posted a screenshot suggesting the test of the planned merge had been successful. Kunal Goel, a research analyst at crypto intelligence firm Messari, also said the Goerli test had been passed.

|

|

The US Labor Market Is A House Of Cards – Here Are The Reasons WhyIn typical Orwellian fashion, the Biden Administration and the corporate media have attempted to rewrite history and even the definitions of words in recent weeks by changing the standards of what constitutes a “Recession.” A recession is two consecutive negative GDP prints signaling an overall decline of a nation’s economy. This IS what a recession is, and no president or puppet media economist is going to change that fact. The US is, by definition, in the middle of a recession. At no point ever in the history of economics has a recession required an explosion in unemployment. This is not a factor that matters because unemployment is not a leading indicator, it is a lagging indicator. Job losses usually happen at the END of an economic breakdown, not at the beginning, because governments and corporations will do everything in their power to artificially prop up the jobs market and hide instability until the system becomes so broken that they can no longer pull the wool over the public’s eyes. Jobs and stock market tickers tell us nothing ahead of time. If you really want to know where the economy is headed, you look at inflation vs. deflation, rising prices vs. stagnant wages, rising or falling interest rates, national and consumer debt levels, bankruptcy and small business health, supply chain stability, currency devaluation, bond market stability, and yes, even GDP. There are a hundred indicators a person could look at to gauge a financial downturn – Stocks and jobs are at the bottom of the list. GDP is also questionable, but for different reasons. GDP numbers are essent … Read more at: https://www.zerohedge.com/economics/us-labor-market-house-cards-here-are-reasons-why |

|

People can’t wait for energy help – Citizens AdviceThe charity voices concerns of delaying support for households bracing themselves for energy bill hikes. Read more at: https://www.bbc.co.uk/news/business-62509970?at_medium=RSS&at_campaign=KARANGA |

|

Superdry boss warns shoppers will choose Europe over BritainTax-free shopping is no longer available to international visitors to Britain. Read more at: https://www.bbc.co.uk/news/business-62509760?at_medium=RSS&at_campaign=KARANGA |

|

Sainsbury’s to stop sale of disposable barbecuesThe supermarket is joining other chains in removing the barbecues from its shelves for safety reasons. Read more at: https://www.bbc.co.uk/news/business-62510098?at_medium=RSS&at_campaign=KARANGA |

|

Tech View: Nifty50 forms small bearish candle; major hurdles ahead“If we draw a trendline connecting the October 2021 high and subsequent highs, the Nifty50 is now steadily approaching the resistance zone of 17,900-18,000. This is a make-or-a-break range for the Nifty50. If the index fails to move beyond 18,000, we could see a serious decline coming in,” said independent analyst Manish Shah. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty50-forms-small-bearish-candle-major-hurdles-ahead/articleshow/93503396.cms |

|

PMS funds that managed to outperform Nifty by a wide margin in JulySunil Singhania’s Abakkus Emerging Opportunities fund on small and midcaps delivered 10.30 percent while Prashant Khemka-led White Oak Capital also managed a 10 percent return along with Samir Arora’s Helios Capital. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/pms-funds-that-managed-to-outperform-nifty-by-a-wide-margin-in-july/articleshow/93498121.cms |

|

Chart Check: Over 100% in a year! Should you stay put in this capital goods stock?“The stock on the daily chart had given a breakout from a cup and handle pattern formation. The stock retested the support zone and bounced back sharply with volumes confirming the strength,” Kunal Shah-Senior Technical & Derivative Analyst at LKP Securities, said. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/chart-check-over-100-in-a-year-should-you-stay-put-in-this-capital-goods-stock/articleshow/93496738.cms |

|

Distributed Ledger: Will ether price fall after the ‘Merge’ in September?A weekly look at the most important moves and news in crypto and what’s on the horizon in digital assets. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-710C-DAE93F074EDA%7D&siteid=rss&rss=1 |

|

: Semiconductor companies have split into two groups — the resilient and the riskyEven outperformers including AMD and Nvidia face a slowdown in some segments after years of surging demand. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-710C-EB350D689C7D%7D&siteid=rss&rss=1 |

|

Bond Report: Ten-year Treasury yield rises to highest level in three weeks despite signs of cooler inflationTen- and 30-year Treasury yields rose on Thursday with investors expressing concern that the market may be too optimistic in betting the Federal Reserve will ease the pace of interest rate rises despite signs of easing U.S. inflation. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-710C-BDB6D786DCBD%7D&siteid=rss&rss=1 |