Summary Of the Markets Today:

- The Dow closed up 535 points or 1.63%,

- Nasdaq closed up 2.89%,

- S&P 500 up 2.13%,

- WTI crude oil settled at $91 up 0.998%,

- USD $104.82 down 1.39%,

- Gold $1806 down 0.34%,

- Bitcoin $23,674 up 2.49% – Session Low 22,750,

- 10-year U.S. Treasury 2.786% down 0.11%

Today’s Economic Releases:

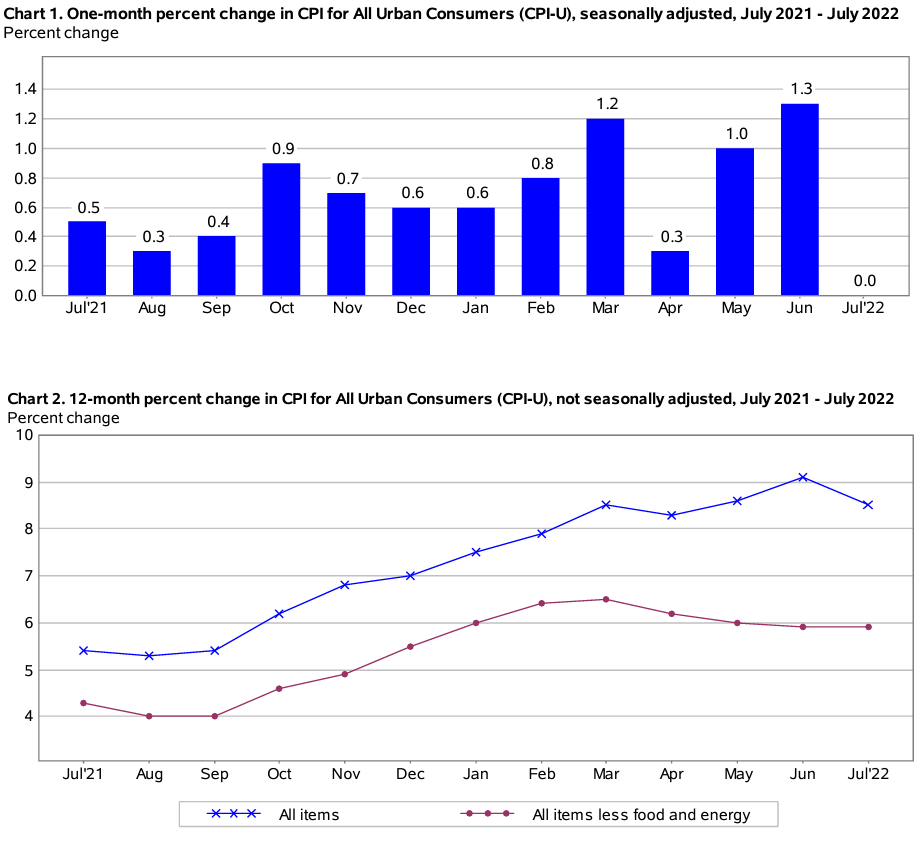

The Consumer Price Index for All Urban Consumers (CPI-U) increased 8.5 percent year-over-year before seasonal adjustment – in June 2022 the index had increased 9.0 percent year-over-year. Over the gasoline component of the index moderated whilst food and shelter increased. Depending on how one spends their money, this 8.5 percent increase may be significantly higher. Although inflation did modestly moderate in July, it is still significant and likely puts on the table another 75 basis point increase in the federal funds rate during the September 20/21 Fed meeting.

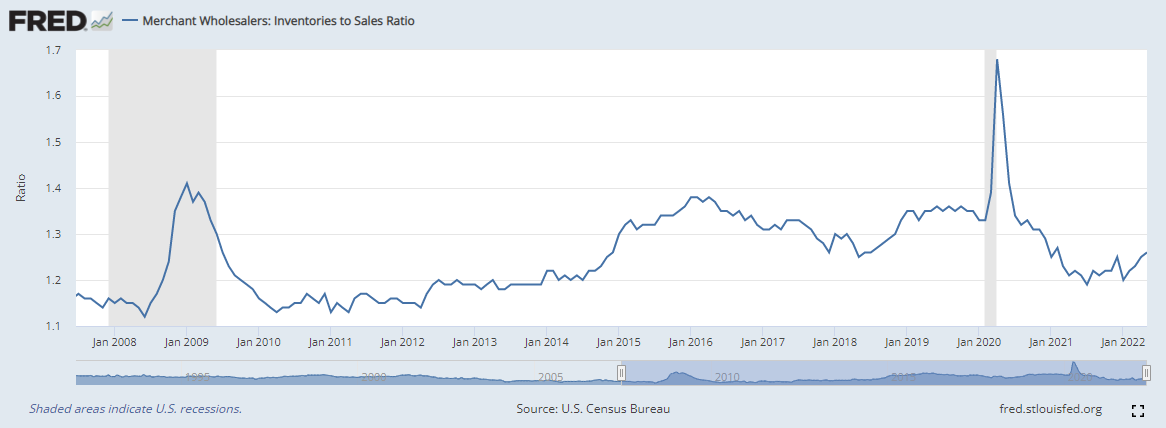

June 2022 sales of merchant wholesalers, up 1.8 percent month-over-month and 20.4 percent year-over-year. Inventories of merchant wholesalers were up 1.8 percent month-over-month and up 25.5 percent year-over-year. The June inventories/sales ratio for merchant wholesalers, except manufacturers’ sales branches and offices, based on seasonally adjusted data, was 1.26. The June 2021 ratio was 1.21. Generally, the sales-to-inventory ratios spike during a recession.

The number of CEO changes at U.S. companies plunged to 58 in July, down 45% from the 106 CEO exits recorded in June. It is the lowest monthly total since April 2020, when the uncertainty and economic turmoil caused by the pandemic led to 48 CEO exits in that month. Andrew Challenger, Senior Vice President of Challenger, Gray & Christmas, Inc. stated:

The economy is facing uncertainty right now, but it’s much more positive than in early 2020. Inflation fell in July, gas prices are falling steadily, the job market remains tight, and supply chain issues have mostly cleared up. Consumers lack confidence at the moment and interest rates are rising to battle inflation, which might slow business borrowing and some growth plans.

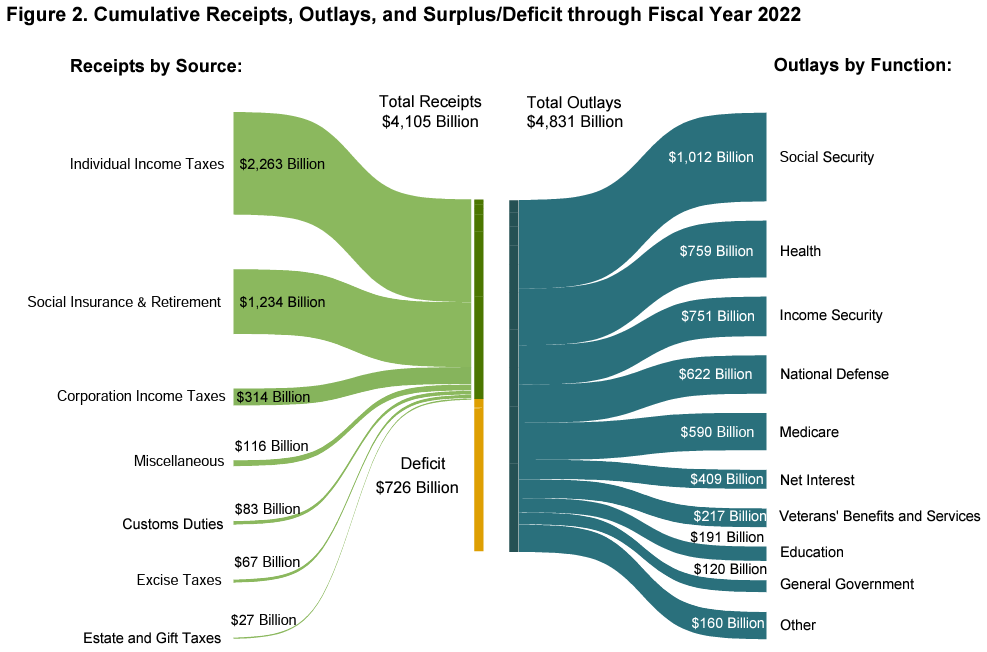

The U.S. Treasury’s Monthly Treasury Statement shows the fiscal-year-to-date deficit is $726 billion, a record year-over-year decrease of $1.814 trillion (71%), for the first ten months of the fiscal year. Fiscal-year-to-date Receipts were $787 billion (24%) higher, while Outlays were lower by $1.027 trillion (18%). July has been a deficit month 66 times out of 68 fiscal years since there are usually no major corporate or individual tax due dates in this month.

A summary of headlines we are reading today:

- Is U.S. Inflation Actually Cooling Quicker Than Expected?

- Chip Shortages And Inflation Are Plaguing The Auto Industry

- How the EV tax credits in Democrats’ climate bill could hurt electric vehicle sales

- Business travel costs are expected to rise through 2023, industry report says

- Russian Spy Planes Enter Alaska Air Defense Zone In 1st Since Ukraine War: NORAD

- Key Words: No shrinkflation at Kellogg, CEO says. ‘If we make it smaller, we also make it cheaper’

- Bond Report: 2-year Treasury yield slides by most in almost a week after U.S. inflation data bring downside surprises

These and other headlines and news summaries moving the markets today are included below.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

The EU Ban On Russian Coal Goes Into Effect At MidnightAn EU embargo on the import of Russian coal goes into effect on August 11 after a midnight deadline for the transition period agreed by bloc members four months ago. The ban is part of the fifth package of EU sanctions to punish the Russian economy since President Vladimir Putin ordered tens of thousands of Russian troops into Ukraine in late February. The coal embargo is the first measure among the seven rounds of EU sanctions so far to hit energy supplies, which have been particularly hard-hit along with grain exports by the Ukraine conflict. Read more at: https://oilprice.com/Energy/Coal/The-EU-Ban-On-Russian-Coal-Goes-Into-Effect-At-Midnight.html |

|

U.S. Refiners See Demand Holding Strong Through Year-EndAmerican refiners and oil and gas operators expect strong demand for fuels and energy through the remainder of the year, despite analyst concerns in recent weeks that demand could take a hit with a possible recession or demand destruction. The firms’ short-term views on the market are generally brighter than most analysts’, according to a Reuters review of earnings calls. “It’s still a strong environment for gasoline compared to historical levels,” Kian Hidari, an analyst at Tudor, Pickering, Holt and Co, told Reuters. “Permian Basin volumes Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Refiners-See-Demand-Holding-Strong-Through-Year-End.html |

|

U.S.-Europe Oil Tankers Hit Blowout Day RatesRates for mid-sized oil tankers sailing from the U.S. Gulf of Mexico to Europe hit the $57,000-per-day level this week, a figure representing a 12X increase since January and a two-year high, according to Bloomberg citing Aframax vessel data. The dramatic increase in shipping rates from the U.S. to Europe reflects a shortage of vessels and a diversion of product to different markets due to sanctions and Russia’s war on Ukraine. On Tuesday, Bloomberg’s initial review of new shipping data showed that overall, fuel tankers Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Europe-Oil-Tankers-Hit-Blowout-Day-Rates.html |

|

Is U.S. Inflation Actually Cooling Quicker Than Expected?US inflation is cooling much quicker than experts are betting in a sign the Federal Reserve’s series of steep rate hikes are quashing price pressures. Prices climbed 8.5 percent in the world’s biggest economy last month, down from a 40-year high 9.1 percent, according to the Labor Department. Wall Street had forecast headline consumer price index inflation to have dipped to 8.7 percent in July. Fed chair Jerome Powell and the rest of the federal open market committee have embarked on the quickest rate hike cycle since the early 1980s Read more at: https://oilprice.com/Finance/the-Economy/Is-US-Inflation-Actually-Cooling-Quicker-Than-Expected.html |

|

Chip Shortages And Inflation Are Plaguing The Auto IndustryThe Automotive MMI (Monthly Metals Index) dropped by 6.32% this past month, a downward trend it has been maintaining since May. The drop comes despite valiant efforts to put out some of the fires plaguing the car manufacturing industry. But with the microchip shortage, surging inflation, and issues with both supply and demand, the automotive market cannot seem to catch a break. J.D. Power Quality Study Puts Premium Vehicles on Blast In an automotive market this tight, the industry does not need bad press. Read more at: https://oilprice.com/Energy/Energy-General/Chip-Shortages-And-Inflation-Are-Plaguing-The-Auto-Industry.html |

|

Freeport LNG Retracts Force Majeure, Leaving Buyers On The Hook For $8 BillionThe largest gas exporter in the United States, Freeport LNG, has retracted its force majeure, according to anonymous sources who shared the information with Reuters, leaving traders to source product on the spot market at significant losses. Freeport LNG had declared a force majeure back in June after it suffered an explosion on June 8, triggering a shutdown of the facility to assess the repairs. Freeport originally said it would return to full operations in late 2022, but partial operations could resume within 90 days. Freeport’s force majeure Read more at: https://oilprice.com/Latest-Energy-News/World-News/Freeport-LNG-Retracts-Force-Majeure-Leaving-Buyers-On-The-Hook-For-8-Billion-I.html |

|

Disney subscriber growth blows past estimates, as company beats on top and bottom lineDisney posted better-than-expected earnings on both the top and bottom line, bolstered by increased spending at its domestic theme parks. Read more at: https://www.cnbc.com/2022/08/10/disney-dis-fiscal-q3-2022-earnings.html |

|

Disney raises the price on ad-free Disney+ 38% to $10.99 as part of a new pricing structure for streaming servicesDisney is unveiling a brand new pricing structure to incorporate its ad-supported Disney+ service. Read more at: https://www.cnbc.com/2022/08/10/disney-raises-price-on-ad-free-disney-38percent-as-part-of-new-pricing-structure.html |

|

WWE discloses another $5 million in McMahon payments, delays earnings reportWorld Wrestling Entertainment disclosed another $5 million in payments from former CEO Vince McMahon, who is being probed for alleged misconduct. Read more at: https://www.cnbc.com/2022/08/10/wwe-discloses-5-million-in-mcmahon-payments-delays-earnings-report.html |

|

Jim Beam maker says some customers trading down, others still paying more for high-end liquorSome price-sensitive whiskey and tequila drinkers are swapping out their high-end bottles for cheaper options, according to Beam Suntory. Read more at: https://www.cnbc.com/2022/08/10/some-spirits-drinkers-are-starting-to-trade-down-beam-suntory-says.html |

|

How the EV tax credits in Democrats’ climate bill could hurt electric vehicle salesProposed tax credits of up to $7,500 for EVs under the Inflation Reduction Act could be counterintuitive for sales of EVs, according to several companies. Read more at: https://www.cnbc.com/2022/08/10/inflation-reduction-act-ev-tax-credits-could-hurt-sales.html |

|

Ford CEO doesn’t expect electric vehicle battery costs to drop anytime soonFord CEO Jim Farley said the prices of key battery minerals will likely stay elevated for a while, but the company is looking into alternatives. Read more at: https://www.cnbc.com/2022/08/10/ford-ceo-doesnt-expect-electric-vehicle-battery-costs-to-drop-soon.html |

|

Airfares, hotel rates, and rental car prices fell in July. Here’s how you can score a good dealThe price for major components of vacation travel have declined for two consecutive months, according to the U.S. Department of Labor’s Consumer Price Index. Read more at: https://www.cnbc.com/2022/08/10/travel-costs-fell-in-july-heres-how-you-can-score-a-good-deal.html |

|

Business travel costs are expected to rise through 2023, an industry report saysBusiness travel has rebounded but challenges include economic weakness and labor shortages. Read more at: https://www.cnbc.com/2022/08/10/business-travel-costs-are-expected-to-rise-through-2023-report-says.html |

|

Disney’s earnings could define how the media industry views streaming’s futureA big quarter for Disney+ will give investors hope there’s still growth in streaming, while disappointing numbers will ring alarm bells. Read more at: https://www.cnbc.com/2022/08/10/disneys-earnings-results-could-define-how-industry-views-streaming.html |

|

Nikola CEO Mark Russell to retire at the end of the yearCEO Mark Russell will retire at the end of 2022. His successor is former Opel CEO Michael Lohscheller, who joined Nikola in February. Read more at: https://www.cnbc.com/2022/08/10/nikola-ceo-mark-russell-to-retire-at-the-end-of-the-year.html |

|

Wild swings in mortgage rates last week caused a rare surge in refinancingMortgage rates made unusually wide swings last week, and that may have caused some borrowers to try to take advantage and save money on a refinance. Read more at: https://www.cnbc.com/2022/08/10/wild-swings-in-mortgage-rates-last-week-caused-a-rare-surge-in-refinancing.html |

|

FCC denies SpaceX bid for nearly $1 billion in rural broadband subsidies for StarlinkThe FCC said Starlink “failed to demonstrate that the providers could deliver the promised service” needed to receive the subsidies. Read more at: https://www.cnbc.com/2022/08/10/fcc-denies-spacex-bid-for-nearly-1-billion-in-broadband-subsidies-for-starlink.html |

|

Stocks making the biggest moves midday: Coinbase, Roblox, Wendy’s and moreThese are the stocks posting the largest moves in midday trading. Read more at: https://www.cnbc.com/2022/08/10/stocks-making-biggest-midday-moves-coinbase-roblox-wendys-and-more.html |

|

Trump Critics Say FBI Mar-a-Lago Raid May Have Handed Him GOP Nomination, “Potentially The Presidency”Authored by Dorothy Li via The Epoch Times, The FBI’s raid of former president Donald Trump’s Mar-a-Lago estate “handed” the 2024 Republican presidential nomination to Trump and prompted moderate Republicans to vote for him, according to Joe Walsh, a former Republican congressman and a critic of Trump.

Trump announced that his Florida property was “under siege” and “occupied by a group of FBI agents” in a statement late on Aug. 8, calling it evidence of “prosecutorial misconduct” and a “weaponization of the Justice System.” The raid was not announced and was motivated because Democrats do not want Trump to run again for president in 2 … Read more at: https://www.zerohedge.com/political/trump-critics-say-fbi-mar-lago-raid-may-have-handed-him-gop-nomination-potentially |

|

Russian Spy Planes Enter Alaska Air Defense Zone In 1st Since Ukraine War: NORADThe North American Aerospace Defense Command (NORAD) has revealed that Russian aircraft breached the Alaskan Air Defense Identification Zone (ADIZ) twice in the past two days, according to a fresh statement. The Alaskan NORAD “detected, tracked and identified Russian surveillance aircraft entering and operating within” the zone off the Alaskan coast, according to an offical statement posted to Twitter.

Read more at: https://www.zerohedge.com/geopolitical/russian-spy-planes-enter-alaska-air-defense-zone-1st-ukraine-war-norad |

|

The J6 Hearings Had Virtually No Impact On Changing Public Views, New Poll FindsAuthored by Jonathan Turley, For months, we have been discussing the heavy-handed, one-sided approach of the J6 Committee in the presentation of evidence and witnesses. Both sides blame each other for the absence of a single Republican-selected member. Yet, the Committee treated the lack of balance as a license to present a rigid and scripted account of events and actions, including editing out countervailing views or evidence. For those of us who welcomed the greater transparency on the events of that terrible day, it was a lost opportunity to have a truly historic investigation akin to Watergate or the Kennedy assassination. The result is now evident and unsurprising. A Monmouth University poll shows that almost 90 percent of respondents report that the hearings have made no change in how they view the J6 riot. Moreover, despite the overwhelming cooperation and support of the media with the Committee, the vast majority believe that the J6 Committee was a political rather than investigative exercise, focused on opposing Trump rather than disclosing the facts of January 6th. Read more at: https://www.zerohedge.com/political/j6-hearings-had-virtually-no-impact-changing-public-views-new-poll-finds |

|

Did Amazon Buy iRobot To Map Inside Your Home?Amazon.com Inc.’s $1.7 billion acquisition of robot vacuum cleaner company iRobot Corp. is a move by the megacorporation to use Roombas to map the interior of homes. This data type is a digital gold mine for Amazon because if marketers know more about what’s inside, they can easily create tailormade ads. From a market perspective, Amazon’s acquisition of iRobot is to gain deeper insight into customers’ homes via the autonomous robotic vacuum cleaner called “Roomba.”

The latest model of the Roomba, called J7, has a front-facing, AI-powered camera that maps out each room and will identify nearly everything in its path, such as floor plans, where the kitchen is, which space is the master bedroom, and where the kids sleep, as well as items on the floor.

|

|

Energy bills could go up before October price cap riseThe energy regulator says it’s “possible” customers’ direct debit payments will rise before October. Read more at: https://www.bbc.co.uk/news/business-62494406?at_medium=RSS&at_campaign=KARANGA |

|

Supermarkets not passing on lower fuel price – RACThe margin between the price of fuel at the pump and what retailers buy it for is at its widest since 2013. Read more at: https://www.bbc.co.uk/news/business-62494404?at_medium=RSS&at_campaign=KARANGA |

|

Martin Lewis: Energy bill crisis is on scale of pandemicGovernment support needs to double to make up for the huge expected rise in bills, the consumer expert says. Read more at: https://www.bbc.co.uk/news/business-62483770?at_medium=RSS&at_campaign=KARANGA |

|

Tech View: Nifty ends flat but uptrend stays intact“Despite overbought readings on the daily as well as some weekly oscillators, the price chart is not displaying meaningful weakness which may not materialize unless the index slips below the 17,359 level. If the index sustains above 17,442, eventually the index can head towards the 17,800 level. Short-side traders are advised to remain neutral whereas longside players should maintain a stop below 17,440 level,” he said. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-ends-flat-but-uptrend-stays-intact/articleshow/93480389.cms |

|

Vedant Fashions faces rating cuts after Q1 nos on punchy valuationsPunchy valuations drive our downgrade to sell, said Kotak Institutional Equities, which has a target of Rs 1,075 for the stock from Rs 1,000 earlier. This is even as the brokerage has raised its FY2023-25E EPS estimates by 5-10 percent on account of strong momentum in wedding demand and higher margin forecasts.Edelweiss has downgraded Vedant Fashions Read more at: https://economictimes.indiatimes.com/markets/stocks/news/vedant-fashions-faces-rating-cuts-after-q1-nos-on-punchy-valuations/articleshow/93480741.cms |

|

How Titan Company’s expansion plans may impact its marginsTitan Company Limited is primarily engaged in the manufacturing and selling of jewelry and has also penetrated into segments such as watches, eyewear, sarees, Indian wear and accessories & products. As of the end of Q1 FY23, it had 2,303 stores with a total retail area of more than 2.9 million sqft under operations, with a presence in 366 towns, 10 manufacturing and assembly facilities, and around 9,500 employees. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/how-titan-companys-expansion-plans-may-impact-its-margins/articleshow/93472972.cms |

|

Outside the Box: I was CEO of one of the largest U.S. mortgage lenders: This move would lower the cost of buying a home.Digitizing consumer data would reduce closing costs and make housing more affordable, writes Sanjiv Das. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7105-D6146B8E8B31%7D&siteid=rss&rss=1 |

|

Key Words: No shrinkflation at Kellogg, CEO says. ‘If we make it smaller, we also make it cheaper’Some companies respond to inflation by shrinking package sizes, but keeping prices the same. Kellogg CEO says they’re ‘not necessarily working a margin play.’ Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7109-6F0C3B50BFC4%7D&siteid=rss&rss=1 |

|

Bond Report: 2-year Treasury yield slides by most in almost a week after U.S. inflation data brings downside surprisesMost Treasury yields fall sharply after a better-than-expected U.S. inflation report for July. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-710B-D5837E114DDA%7D&siteid=rss&rss=1 |

Prior 2020 intercept involving F-22s and CF-18s and two Russian Tu-142 maritime reconnaissance aircraft entering the Alaskan Air Defense Identification Zone on March 9th, 2020. Image: NORADWhile the ADIZ is not considered technically part of US airspace, it is airspace over which the US requires identification and tracking of aircraft in the interest of national security, which acts as a buffer before planes enter nati …

Prior 2020 intercept involving F-22s and CF-18s and two Russian Tu-142 maritime reconnaissance aircraft entering the Alaskan Air Defense Identification Zone on March 9th, 2020. Image: NORADWhile the ADIZ is not considered technically part of US airspace, it is airspace over which the US requires identification and tracking of aircraft in the interest of national security, which acts as a buffer before planes enter nati …