Summary Of the Markets Today:

- The Dow closed up 77 points or 0.23%,

- Nasdaq closed down 0.50%,

- S&P 500 down 0.16%,

- WTI crude oil settled at $88 dup 0.65%,

- USD $106.55 up 0.75%,

- Gold $1774 down 0.87%,

- Bitcoin $22,961 up 1.96% – Session Low 22,485,

- 10-year U.S. Treasury 2.827% up 0.151%

- Baker Hughes Rig Count: U.S. -3 to 764 Canada -1 to 203

Today’s Economic Releases:

The NBER considers indicators including nonfarm payrolls, industrial production, and retail sales, among others, in designating the start and end of U.S. recessions. Today’s July 2022 BLS employment report is showing nonfarm payrolls are far from recession territory with a significant gain in employment.

- The household survey showed an increase of 179,000 whilst the establishment survey says 528,000.

- The employment/population ratio remains on an improvement trend.

- The unemployment rate modestly reduced to 3.5% – but the larger reason for this slight reduction is that the civilian labor force was reduced by 63,000. In all cases, the establishment survey is volatile – and there can be significant changes month-over-month.

- A strong jobs report will allow the Fed to raise the federal funds rate another 75 basis points.

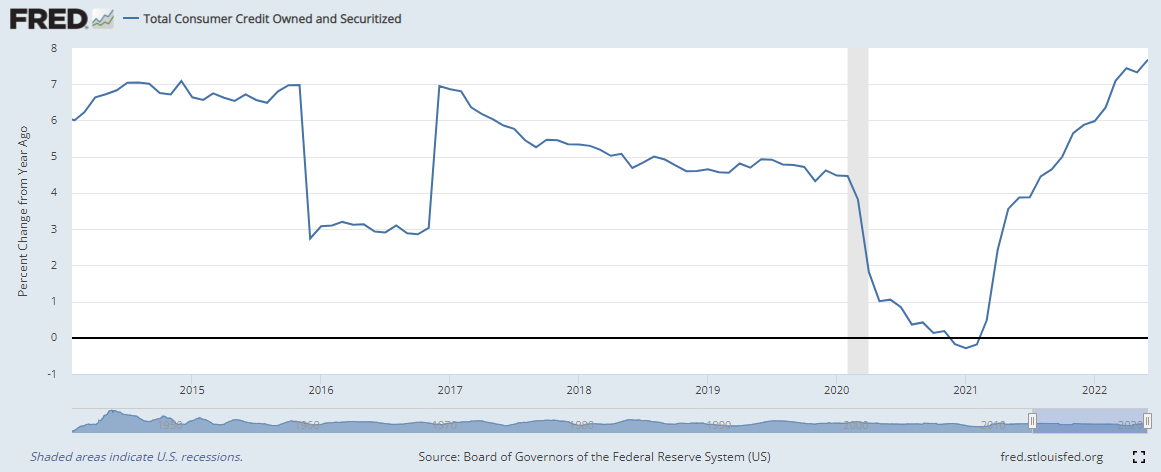

According to the Federal Reserve: “Consumer credit [in June 2022] increased at a seasonally adjusted annual rate of 8.7 percent during the second quarter. Revolving credit increased at an annual rate of 14.6 percent, while nonrevolving credit increased at an annual rate of 6.9 percent. In June, consumer credit increased at an annual rate of 10.5 percent.” Looking at year-over-year growth, credit was up 7.7%.

A summary of headlines we are reading today:

- Russian Refinery Returns To Operations After Drone Strike

- U.S. Drilling Activity Slows As Prices Ease

- AMC plans to issue 517 million shares of preferred stock, under the ticker symbol ‘APE’

- Job Gains & Powell’s Pains Demolish Dovish-Dreams, Spark Market Turmoil This Week

- Firearm Companies Say Packages Shipped With UPS Being Damaged, Disappearing: Reports

- Consumer Credit Surged In June, 2nd Largest Monthly Increase Ever

- Bond Report: Treasury yields surge after blockbuster U.S. July jobs data

- Market Extra: A red-hot July jobs number has traders penciling in another jumbo Fed rate hike

These and other headlines and news summaries moving the markets today are included below.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Russian Refinery Returns To Operations After Drone StrikeRussia’s oil refinery that was struck by drones in June has resumed full operations, Interfax said on Friday, citing authorities. Russias Novoshakhtinsk oil refinery, located in the Rostov region, was struck by two drones in June, after which production at both primary crude oil distillation units was suspended. The attack created an explosion that erupted in fire, Russian news agency TASS said at the time, damaging the refinery’s crude oil tank. Russian police had said the drones were Ukrainian. Novoshakhtinsk has a capacity Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russian-Refinery-Returns-To-Operations-After-Drone-Strike.html |

|

Recession Fears Take Hold Of Oil MarketsOil prices are back around the levels they were at before Russia invaded Ukraine, highlighting that a global recession and demand destruction are now the central focus of traders. Oilprice Alert:This month’s Intelligent Investor column, now available for Global Energy Alertmembers, compares two of the most promising Canadian oil stocks on the market. If you’re an investor in the energy space then now is the time to sign up for Global Energy Alert. Friday, August 5th, 2022It is hard to escape from the fact that nearly Read more at: https://oilprice.com/Energy/Energy-General/Recession-Fears-Take-Hold-Of-Oil-Markets.html |

|

Tullow Comes Up Empty In Guyana Offshore Oil WellUK-listed Tullow Oil failed to find oil at yet another well offshore Guyana in what could be its final well drilled in the region where Exxon has found billions of barrels of oil in place. Tullow Oil plc said on Friday that drilling operations at the Beebei-Potaro exploration well, drilled in the Kanuku license, offshore Guyana, had been completed. The well encountered good quality reservoir in the primary and secondary targets, but both targets were water-bearing, the company said. Tullow Oil, originally focused on Africa, has seen several failures Read more at: https://oilprice.com/Latest-Energy-News/World-News/Tullow-Comes-Up-Empty-In-Guyana-Offshore-Oil-Well.html |

|

Putin Signs Decree That Bans Unfriendly Investors From Selling Energy StakesRussia banned companies from what it considers unfriendly countries from selling stakes in key energy projects and oil and gas production sharing agreements by the end of the year under a new decree signed by Vladimir Putin on Friday. Russia is thus upping the ante in the standoff with the West, which has imposed massive sanctions on Russia. The U.S. has already banned imports of Russian energy, including oil, natural gas, and coal, while the EU plans to enact an embargo on seaborne imports of Russian crude oil and refined products Read more at: https://oilprice.com/Latest-Energy-News/World-News/Putin-Signs-Decree-That-Bans-Unfriendly-Investors-From-Selling-Energy-Stakes.html |

|

U.S. Drilling Activity Slows As Prices EaseThe number of total active drilling rigs in the United States fell by 3 this week, according to new data from Baker Hughes published on Friday. The total rig count fell to 764 this week273 rigs higher than the rig count this time in 2021. Oil rigs in the United States fell by 7 this week to 598. Gas rigs rose by 4, to 161. Miscellaneous rigs held steady at 5. The rig count in the Permian Basin fell by 4 to 347 this week. Rigs in the Eagle Ford stayed the same at 72. Oil and gas rigs in the Permian are 104 above where they were this time Read more at: https://oilprice.com/Energy/Energy-General/US-Drilling-Activity-Slows-As-Prices-Ease.html |

|

Europe’s Insatiable Thirst For Natural Gas1. OPEC+ Agrees on Lowest Monthly Increase in Years- In a move widely perceived as the undoing of the widely publicized Biden-MBS fist bump, OPEC+ has agreed to a 100,000 b/d production quota increase for September 2022. – The likelihood that the oil group will fulfill the output target seems somewhat slim, considering that members’ compliance rate stands at 320% as of June, equivalent to an underproduction rate of 2.85 million b/d. – Even though the likes of Saudi Arabia and UAE have acknowledged having issues with readily available spare Read more at: https://oilprice.com/Energy/Energy-General/Europes-Insatiable-Thirst-For-Natural-Gas.html |

|

SpaceX raises another $250 million in equity, lifts total to $2 billion in 2022Elon Musk’s SpaceX raised $250 million in a July equity round, the company disclosed in a securities filing on Friday. Read more at: https://www.cnbc.com/2022/08/05/elon-musks-spacex-raises-250-million-in-equity.html |

|

Bed Bath & Beyond is discontinuing a private brand as it tries to reverse declining salesThe retailer had made an aggressive push into exclusive brands and touted them as a linchpin of its turnaround strategy. Read more at: https://www.cnbc.com/2022/08/05/bed-bath-beyond-discontinues-wild-sage-private-brand-as-it-tries-to-improve-sales.html |

|

Warner Bros. Discovery CEO David Zaslav embraces the past as he plans his company’s futureUnlike WarnerMedia’s last CEO, new chief David Zaslav is embracing movie theaters and traditional cable TV instead of taking a streaming-first attitude. Read more at: https://www.cnbc.com/2022/08/04/warner-bros-discovery-ceo-zaslav-embraces-linear-tv-as-he-plans-a-streaming-future.html |

|

Space factory startup Varda secures NASA partnerships ahead of demo flight next yearThe agreements secure Varda access to key technologies the company will need for the first demonstration of its space factory system. Read more at: https://www.cnbc.com/2022/08/05/varda-signs-nasa-partnerships-for-space-factory-demo-flight-next-year.html |

|

Beyond Meat cuts revenue outlook, says it’s trimming workforceBeyond Meat on Thursday lowered its revenue forecast for 2022 and announced it will trim its workforce by 4%, citing broader economic uncertainty. Read more at: https://www.cnbc.com/2022/08/04/beyond-meat-bynd-q2-2022-earnings.html |

|

AMC plans to issue 517 million shares of preferred stock, under the ticker symbol ‘APE’The company has applied to list these preferred equity units on the New York Stock Exchange under the symbol “APE.” Read more at: https://www.cnbc.com/2022/08/04/amc-to-issue-preferred-stock-under-the-ticker-symbol-ape.html |

|

Here are 5 stocks in our portfolio that can benefit from rising interest ratesA strong labor market with robust wage gains might mean the Fed still has more work to do. Read more at: https://www.cnbc.com/2022/08/05/investing-club-here-are-5-stocks-in-our-portfolio-that-can-benefit-from-rising-interest-rates.html |

|

Burger King parent says more customers are redeeming coupons and loyalty rewardsMore customers at Burger King and its sister brands are redeeming coupons and loyalty program rewards as inflation pushes menu prices higher. Read more at: https://www.cnbc.com/2022/08/04/burger-king-parent-says-more-customers-are-redeeming-coupons-and-loyalty-rewards.html |

|

Stocks making the biggest moves midday: Lyft, Carvana, Warner Bros. Discovery, DraftKingsThese are the stocks posting the largest moves in midday trading. Read more at: https://www.cnbc.com/2022/08/05/stocks-making-the-biggest-moves-midday-lyft-carvana-warner-bros-discovery-draftkings.html |

|

New York polio case is the ‘tip of the iceberg,’ hundreds of others could be infected, health official saysNew York’s top health official warned the polio case in an unvaccinated adult and the detection of the virus in sewage could indicate there’s a larger outbreak. Read more at: https://www.cnbc.com/2022/08/05/new-york-polio-case-tip-of-iceberg-hundreds-of-others-could-be-infected.html |

|

Warner Bros Discovery’s DC universe, and its direct-to-streaming strategy, are getting a resetThe decision to shelve “Batgirl” surprised fans and offered a glimpse into the streaming strategy and new no-nonsense era under recently installed Zaslav. Read more at: https://www.cnbc.com/2022/08/04/warner-bros-discovery-streaming-strategy-in-focus-for-q2-earnings.html |

|

Virgin Galactic again delays space tourism flights, to second quarter 2023Virgin Galactic postponed the beginning of commercial flights by another three months, with the company citing delays in work refurbishing its carrier aircraft. Read more at: https://www.cnbc.com/2022/08/04/virgin-galactic-again-delays-space-tourism-flights-to-second-quarter-2023.html |

|

Higher housing costs force more pet owners to surrender their dogsShelters across the country are hearing from more pet owners that they’ve been forced to surrender their animals due to housing or financial constraints. Read more at: https://www.cnbc.com/2022/08/05/higher-housing-costs-force-more-pet-owners-to-surrender-their-dogs.html |

|

Job Gains & Powell’s Pains Demolish Dovish-Dreams, Spark Market Turmoil This WeekWith a ‘malarkey’ of Fed Speakers all singing from the same hymn sheet – no pivot, we’re battling inflation, don’t expect rate-cuts next year – this morning’s 6-standard-deviation beat in payrolls really stole the jam out of the exuberant donut the market had been hoping for as ‘good news’ was definitely ‘bad news’ from hoping for a dovish Fed to return imminently. The Hawkmen (and women and cisgender types) were back this week…

Rate-hike expectations soared this week (interesting subsequent rate-cut expectations also rose)…

Source: Bloomberg With the odds of a 75bps hike in September spiking to 80% (from 25% earlier in the week), and the market is also pricing in positive odds of a hike for Dec … Read more at: https://www.zerohedge.com/markets/job-gains-jays-pals-demolish-dovish-hopes-spark-market-turmoil-week |

|

Israel Launches “Pre-emptive” Airstrikes On Gaza, Vowing To Wipe Out Islamic JihadOvernight, Israel declared an “emergency” on its southern border with the Gaza Strip, citing fresh tensions and unrest facilitated by the Palestinian Islamic Jihad. Israeli settlements and agricultural towns near the border have reportedly suffered disruptions and states of alerts over a series of cross-border security incidents following the Israeli Defense Forces (IDF) arresting Bassem Saadi Monday night – the leader of Islamic Jihad. The elderly commander “was seen being dragged by forces and was slightly bitten by a military dog during his arrest,” regional reports detailed. “Despite his old age, he was not brought to the hospital,” Saadi’s family said, after receiving a blow to the head. Following this, tensions soared along the border amid days of protests.

Read more at: https://www.zerohedge.com/geopolitical/israel-launches-pre-emptive-airstrikes-gaza-vowing-wipe-out-islamic-jihad |

|

Firearm Companies Say Packages Shipped With UPS Being Damaged, Disappearing: ReportsAuthored by Katabella Roberts via The Epoch Times, A number of firearm companies have seen their shipments with UPS become damaged or go missing while on route to customers, while others have allegedly had their corporate accounts canceled by the parcel service, according to a report by Bearing Arms, a pro-Second Amendment news site.

Patrick Collins, CEO of The Gun Food, an ammunition supply company, told the news outlet that many packages his business had shipped via UPS had mysteriously vanished in transit. Specifically, Collins alleged that out of 18,000 rounds … Read more at: https://www.zerohedge.com/political/firearm-companies-say-packages-shipped-ups-being-damaged-disappearing-reports |

|

Consumer Credit Surged In June, 2nd Largest Monthly Increase EverLast month we began to see the first signs of the consumer cracking as credit numbers slowed drastically after months of spend-heavy consumption amid tumbling real wages. One month late and June data, released today by The Fed, show that consumer credit rebounded dramatically with an additional $40.154 billion piled on (well above the expectation of a $27 billion rise). That is the second largest monthly spike in consumer credit in history.

Non-revolving debt – funds less discretionary items such as cars and college education – surged by a record $25.35 billion in June… Read more at: https://www.zerohedge.com/personal-finance/consumer-credit-surged-june-2nd-largest-monthly-increase-ever |

|

Bank’s recession warning matters to everyoneTimes are already hard but the Bank of England says they’ll get worse and stay that way until late 2023 Read more at: https://www.bbc.co.uk/news/business-62433139?at_medium=RSS&at_campaign=KARANGA |

|

How will a recession hit the UK housing market?The UK economy is forecast to shrink this year but what will it mean for first-time home buyers? Read more at: https://www.bbc.co.uk/news/business-62430395?at_medium=RSS&at_campaign=KARANGA |

|

Cost of living: Over a third cut back on essentialsMore than a third of Britons are cutting back on food to cope with higher costs, a new report has shown. Read more at: https://www.bbc.co.uk/news/business-62408121?at_medium=RSS&at_campaign=KARANGA |

|

Tech View: Nifty50 loses momentum, may enter a consolidation phaseA weakness in the next session below 17,348 can drag it towards 17,160. Strength can be expected only at a close above 17,500, which should expand the rally towards 17,800,” said Mazhar Mohammad of Chartviewindia.in. The analyst advised traders to avoid long positions in the index unless it closes above 17,500. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty50-loses-momentum-may-enter-consolidation-phase/articleshow/93373623.cms |

|

This banking stock showing signs of rebound after 15% fall; should you buy?“The stock had made a double top around Rs 815 in the month of April this year and fell sharply by about 25 percent to reach towards Rs 615 by mid-June,” Rupak De, Senior Research Analyst at LKP Securities, said. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/chart-check-this-banking-stock-showing-signs-of-rebound-after-15-fall-should-you-buy/articleshow/93361355.cms |

|

Zomato says preferential issue price for Blinkit buyout in compliance with lawThe company had on July 26 announced a preferential issue of 62.85 crore shares, being the discharge of total purchase consideration of Rs 4,447 crore for the acquisition of up to 33,018 shares of Blink Commerce Private. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/zomato-says-preferential-issue-price-for-blinkit-buyout-in-compliance-with-law/articleshow/93370486.cms |

|

Bond Report: Treasury yields surge after blockbuster U.S. July jobs dataTreasury yields jump Friday after a much stronger than expected U.S. July jobs report. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7109-0297A855D344%7D&siteid=rss&rss=1 |

|

Market Snapshot: U.S. stocks trade mostly lower as robust July jobs report stokes worries over aggressive Fed rate hikesDow struggles for direction Friday afternoon after a much stronger-than-expected July jobs report that reinforced expectations for the Fed to continue aggressively hiking interest rates. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7109-13BD3CB407ED%7D&siteid=rss&rss=1 |

|

Market Extra: A red-hot July jobs number has traders penciling in another jumbo Fed rate hikeA red-hot July jobs report has traders penciling in another 75 basis-point rate rise by the Federal Reserve at their next meeting in September. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7109-B41E53237B1E%7D&siteid=rss&rss=1 |

Images circulating on social media of some of the initial Israeli strikes on Gaza Friday afternoon.Isr …

Images circulating on social media of some of the initial Israeli strikes on Gaza Friday afternoon.Isr …