Summary Of the Markets Today:

- The Dow closed down 47 points or 0.14%,

- Nasdaq closed down 0.18%,

- S&P 500 down 0.28%,

- WTI crude oil settled at 94 down 4.50%,

- USD $105.43 down 0.47%,

- Gold $1771 down 0.07%,

- Bitcoin $22,988 down 3.78% – Session Low 22,891,

- 10-year U.S. Treasury 2.595% down 0.47%

Today’s Economic Releases:

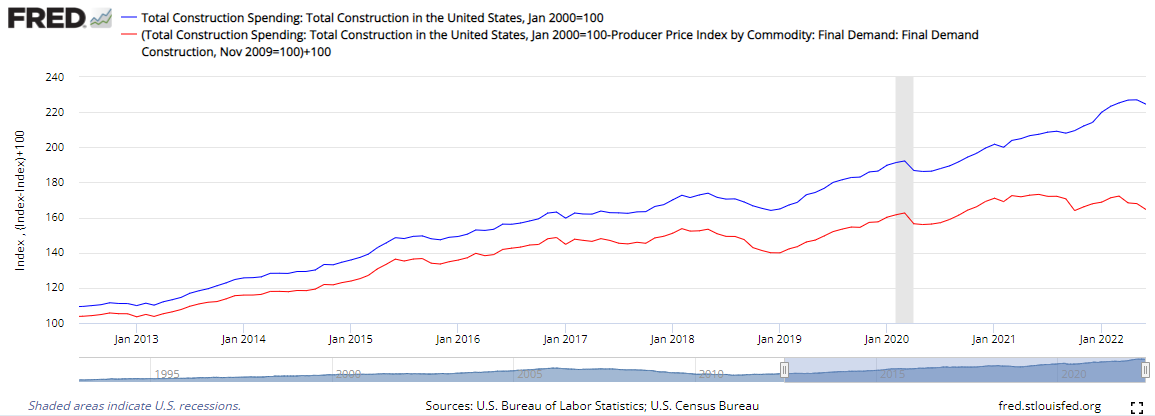

Construction spending during June 2022 was down 1.1% month-over-month and up 8.3% year-over-year. During the first six months of this year, construction spending is up 10.7% over the same period in 2021. But folks, since there is inflation, construction spending is contracting in 2022 and is down year-over-year – see the red line in the graph below:

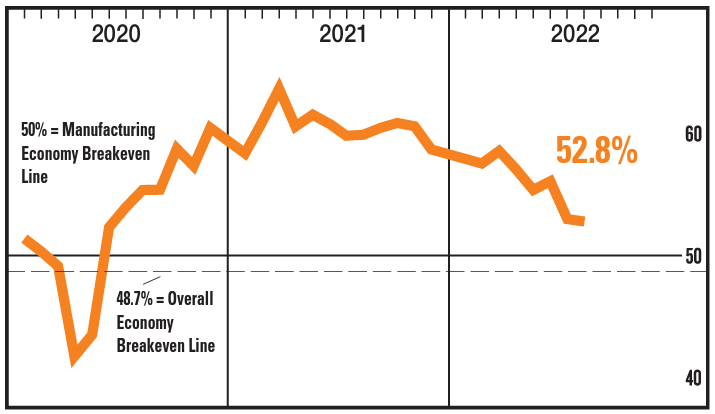

According to the Institute of Supply Management, manufacturing activity was little changed in July 2022 – and remains at a level modestly in expansion and remains on an 18-month decline.

A summary of headlines we are reading today:

- Today’s Energy Crisis Spells Disaster For The Global Economy

- Home prices cooled at a record pace in June, according to housing data firm

- Mortgage rates fall sharply after negative GDP report and Fed’s latest hike

- Ford CEO offers more clues about the automaker’s ambitious electric vehicle plans

- “No One Is Positioned For Any Good News:” Record Shorting In Tech Ensures ‘Most Hated Rally’ Will Continue

- Bond Report: Treasury yields fall in choppy trade to start August

- Living With Climate Change: Americans want EV tax incentives. But are they ready to lose gas cars forever?

These and other headlines and news summaries moving the markets today are included below.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Is Silver A Better Investment Than Gold Right Now?Precious metals like gold, silver, and palladium are fighting back hard against the global trend of dropping metal prices. Last month, MetalMiner reported that the global precious metals index fell 3.77% between June and July. On July 20th, however, gold bullion prices began to rise steadily. Shortly after that, silver bullion prices also started an upward trend. Last month, the Fed’s interest rate hikes managed to slightly impact rising inflation, though inflation continues to pose significant challenges. This week, the Fed hiked those rates Read more at: https://oilprice.com/Metals/Commodities/Is-Silver-A-Better-Investment-Than-Gold-Right-Now.html |

|

Russia Says It Can’t Help With Nord Stream Gas Turbine RepairsThere is little Russia can do to help with repairs of equipment at Nord Stream compressor stations, according to Kremlin spokesman Dmitry Peskov. The situation with the necessary repairs needs to be resolved, but Russia can do little in this regard, Peskov told Russian reporters on Monday. The Kremlin doesn’t have anything to add to what Gazprom has already said: there are equipment failures necessitating urgent repairs, and there are additional “artificial difficulties” caused by the “illegal sanctions and restrictions,” Peskov added. The Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russia-Says-It-Cant-Help-With-Nord-Stream-Gas-Turbine-Repairs.html |

|

Today’s Energy Crisis Spells Disaster For The Global EconomyIt is my view that when the energy supply falls, it falls not because reserves run out. It falls because economies around the world cannot afford to purchase goods and services made with energy products and use energy products in their operation. It is really a price problem. Prices cannot be simultaneously high enough for oil producers (such as Russia and Saudi Arabia) to ramp up production and remain low enough for consumers around the world to buy the goods and services that they are accustomed to buying. Figure 1. Chart showing Read more at: https://oilprice.com/Energy/Energy-General/Todays-Energy-Crisis-Spells-Disaster-For-The-Global-Economy.html |

|

Saudi Arabia’s Economy Grows 12% In Q2 On High Oil PricesSaudi Arabia recorded a GDP growth rate of 11.8 percent for the second quarter, driven by a 23.1-percent rise in oil income, according to preliminary data cited by Reuters. The value of Saudi Arabia’s oil exports has been growing this year, especially after the Russian invasion of Ukraine in February. The latest monthly data, for May, revealed a 106-percent increase on the year to SR116.2 billion, with oil exports making up 80.6 percent of all exports out of Saudi Arabia in that month. Saudi Arabia, OPEC’s biggest oil producer, was Read more at: https://oilprice.com/Latest-Energy-News/World-News/Saudi-Arabias-Economy-Grows-12-In-Q2-On-High-Oil-Prices.html |

|

Ukrainian Grain Shipment Hailed As A Relief For The WorldThe first ship carrying Ukrainian grain was on its way to Istanbul after it set off from the Black Sea port of Odesa on August 1 under an UN-brokered deal, raising moderate hope that a looming global food crisis could be averted. Ukraine and Russia signed agreements with Turkey and the United Nations on July 22 in Istanbul to free up three of Ukraine’s ports — Odesa, Chornomorsk, and Pivdenniy — which had been blockaded since Russia launched the invasion of Ukraine in late February. Ukrainian Infrastructure Minister Oleksandr Kubrakov said the Read more at: https://oilprice.com/Geopolitics/International/Ukrainian-Grain-Shipment-Hailed-As-A-Relief-For-The-World.html |

|

Australia May Limit LNG Exports Amid Domestic Gas ShortageAustralia is again facing a domestic gas shortage because of excessive exports, and the Australian Competition and Consumer Commission is warning that the government must impose limits on LNG exports to secure local supply. This warning follows a decision by the Australian Energy Market Operator to activate a supply guarantee mechanism that was set up in the wake of another looming shortage a few years ago when the Australian government realized it needed a way to ensure that the local market would be well supplied with gas despite rising LNG exports. Read more at: https://oilprice.com/Latest-Energy-News/World-News/Australia-May-Limit-LNG-Exports-Amid-Domestic-Gas-Shortage.html |

|

PepsiCo takes $550 million stake in energy drink maker CelsiusPepsiCo announced Monday a $550 million investment in energy drink maker Celsius Holdings as part of a long-term distribution deal with the smaller company. Read more at: https://www.cnbc.com/2022/08/01/pepsico-takes-550-million-stake-in-energy-drink-maker-celsius-.html |

|

Starbucks union asks coffee giant to extend pay hikes, benefits to unionized storesWith pay hikes set to kick in at Starbucks cafes around the U.S., labor organizers are asking the coffee giant to extend the benefits to unionized stores as well without going through the bargaining process. Read more at: https://www.cnbc.com/2022/08/01/starbucks-union-asks-coffee-giant-to-extend-pay-hikes-benefits-to-unionized-stores.html |

|

Home prices cooled at a record pace in June, according to housing data firmHome price gains are cooling fast, as demand wanes and still-tight supply builds. Read more at: https://www.cnbc.com/2022/08/01/home-prices-cooled-at-record-pace-in-june-according-to-housing-data-firm.html |

|

Ford is adding an off-road package to its hot-selling Maverick compact pickupBuyers of Ford’s smallest pickup will be able to opt for a $3,000 Tremor off-road package starting this fall. Read more at: https://www.cnbc.com/2022/08/01/ford-maverick-tremor-off-road-package-2022.html |

|

Nikola to acquire battery pack supplier Romeo Power in $144 million dealNikola will acquire Romeo Power, a key supplier of battery packs for its trucks, in a $144 million all-stock transaction. Read more at: https://www.cnbc.com/2022/08/01/nikola-nkla-to-acquire-romeo-power-rmo-.html |

|

Space company Masten files for bankruptcy after struggle with NASA moon contractMasten had won a $75 million NASA contract to deliver payloads to the moon’s south pole, but the project ran far over budget. Read more at: https://www.cnbc.com/2022/07/29/masten-files-for-bankruptcy-after-nasa-moon-contract-struggle.html |

|

From legroom to airfare: How JetBlue’s takeover of Spirit could change air travelJetBlue is setting its sights on getting rid of Spirit’s tight seating and basic cabins. Read more at: https://www.cnbc.com/2022/07/30/spirit-airlines-jetblue-deal-air-travel.html |

|

Ford CEO offers more clues about the automaker’s ambitious electric vehicle plansFord has big plans to build millions of EVs. Analysts have been skeptical, but this past week, CEO Jim Farley hinted at how Ford will hit its ambitious goals. Read more at: https://www.cnbc.com/2022/07/31/ford-ceo-farley-outlined-plans-for-automakers-electric-vehicle-shift.html |

|

Mortgage rates fall sharply after negative GDP report and Fed’s latest hikeThe average rate on the popular 30-year fixed mortgage fell to 5.22% on Thursday from 5.54% on Wednesday, according to Mortgage News Daily. Read more at: https://www.cnbc.com/2022/07/29/mortgage-rates-fall-sharply-after-negative-gdp-report-and-feds-latest-hike.html |

|

Trucking CEOs expect higher prices, potential disruptions in second half of the yearU.S. trucking CEOs expect to maintain pricing power even with volumes softening as retailers, manufacturers, and consumers adjust to disruptions. Read more at: https://www.cnbc.com/2022/07/28/trucking-ceos-expect-high-prices-demand-in-second-half-of-2022.html |

|

Higher prices help Procter & Gamble offset commodity costs, but Tide maker warns of more challengesProcter & Gamble reported mixed quarterly results and warned it expects challenges such as rising commodity costs to persist in its fiscal 2023. Read more at: https://www.cnbc.com/2022/07/29/procter-gamble-pg-q4-2022-earnings.html |

|

JetBlue won the battle for Spirit. Now it has to win over Biden’s Justice DepartmentJetBlue’s takeover of Spirit Airlines requires the blessing of the Justice Department. Read more at: https://www.cnbc.com/2022/07/28/jetblue-won-the-battle-for-spirit-now-it-has-to-win-over-bidens-justice-department.html |

|

Saudi-backed LIV Golf envisions franchises in its future, executive saysLIV Golf, the Saudi-backed league that has the blessing of former President Trump and Phil Mickelson, aims to build franchises. Read more at: https://www.cnbc.com/2022/07/29/liv-golf-backed-by-saudis-and-trump-sees-franchises-in-its-future-exec-says.html |

|

“No One Is Positioned For Any Good News:” Record Shorting In Tech Ensures ‘Most Hated Rally’ Will ContinueJuly was a tremendous month for stocks, it was also a mediocre (at best) month for hedge funds which not only underperform the S&P when stocks slide (as they did during the crashes of 2020 and early this year), but also underperform the broader market during sharp squeezes like the one that took place in July, prompting some to ask just what is the point of paying someone 2 and 20 to some overweight billionaire always to underperform. The question of hedge fund utility becomes that much more pressing when one reads in the latest Goldman Sachs Prime Services hedge fund weekly report that while the GS Equity Fundamental L/S Performance Estimate rose +0.57% between 7/22 and 7/28 (roughly a third of the performance of broader – and free – MSCI World TR +1.74%), this return was driven almost entirely by beta of +0.56% (i.e., market exposure), with an alpha of just +0.01%. In other words, not only can’t hedge funds generate alpha, they can’t even keep up with the market’s own beta! That will cost 2 and 20, please. Read more at: https://www.zerohedge.com/markets/no-one-positioned-any-good-news-record-shorting-tech-ensures-most-hated-rally-will-continue |

|

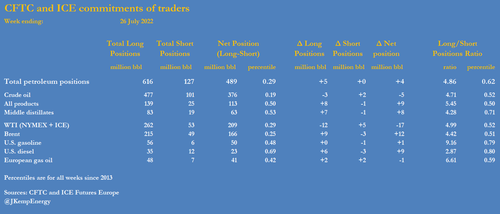

Hedge Funds Bullish On U.S. Diesel As Inventories DwindleBy John Kemp, senior market analyst at Reuters Portfolio managers were heavy buyers of U.S. distillates last week, reflecting the continued shortage of diesel and heating oil despite signs of an economic slowdown. Hedge funds and other money managers purchased the equivalent of 4 million barrels in the six most important petroleum futures and options contracts in the week to July 26. Purchases of Brent (+12 million barrels) and U.S. gasoline (+1 million) were offset by sales of NYMEX and ICE WTI (-17 million) and European gas oil (-1 million).

But the most significant change was buying of U.S. diesel (+9 million barrels), which funds purchased at the fastest rate since November 2020. Read more at: https://www.zerohedge.com/markets/hedge-funds-bullish-us-diesel-inventories-dwindle |

|

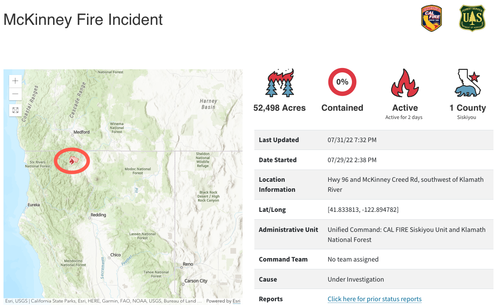

McKinney Fire In Northern California Becomes Largest Of SeasonFirefighters battle an out-of-control Northern California wildfire near the Oregon state line, growing into the state’s largest wildfire this season in just a few days. The McKinney fire exploded in size late Sunday to more than 52,498. The fire remained at 0% contained, consuming dry vegetation in Klamath National Forest, near the city of Yreka.

Gavin Newsom, the governor of California, declared a state of emergency on Saturday. He said the wildfire “threatened critical infrastructure” and “destroyed homes” after breaking out on Friday. The fire was “intensified and spread by dry fuels, extreme drought conditions, high temperatures, winds, and lightning storms,” Newsom added. “These conditions can be extremely dangerous for firefighters, as winds can be erratic and extremely strong, causing fire to spread in any direction,” forest service officials said.

|

|

EU, UK Fold? Delay Cutting Off Russia From Oil Insurance MarketAuthored by Tsvetana Paraskova via OilPrice.com, The EU and UK insurance ban was to be a much bigger deal than the actual EU embargo on Russian oil imports. The EU and the UK have slowed efforts to have Russia shut off from the most important maritime insurance market. Full insurance ban could push oil prices even higher. The EU and the UK have slowed efforts to have Russia shut off from the most important maritime insurance market amid concerns that a full insurance ban would limit global oil supply and push oil prices even higher, the Financial Times reports, citing UK and EU officials.

The UK was set to join an EU insurance ban after the UK and the European Union agreed in May to jointly shut off Russia’s access to … Read more at: https://www.zerohedge.com/energy/eu-uk-fold-delay-cutting-russia-oil-insurance-market |

|

How much do women footballers get paid?BBC analysis shows a wide gap between leading male and female players’ wages, but could that be about to change? Read more at: https://www.bbc.co.uk/news/business-62378095?at_medium=RSS&at_campaign=KARANGA |

|

JD Sports loses millions in forced Footasylum saleThe sportswear chain has sold the retailer after just three years following competition concerns. Read more at: https://www.bbc.co.uk/news/business-62375570?at_medium=RSS&at_campaign=KARANGA |

|

Mortgage affordability test scrapped by Bank of EnglandSome potential homebuyers may find it easier to get a loan as the central bank eases borrowing rules. Read more at: https://www.bbc.co.uk/news/business-62353114?at_medium=RSS&at_campaign=KARANGA |

|

Is trading that easy? 5 key learnings from option tradersAt the 3-day-long Traders Carnival 2022 held in Bengaluru last week, the newbies got to learn some of the tricks of the trade from the masters of the game like Sivakumar Jayachandran, Super Trader Lakshya, Rajesh Sriwastava, Santosh Pasi, Jegathesan Durairaj, Nayan Pokharkar, Harshubh Shah and others. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/is-trading-that-easy-5-key-learnings-from-option-traders-at-traders-carnival/articleshow/93268695.cms |

|

RIL at Rs 2,725? Risk-reward looks favorable on tech chartsBuying demand has emerged from the 52-week EMA, which has historically acted as an incremental buying opportunity on multiple occasions (currently at Rs 2,430), which also confluences with the rising demand line joining lows since January 2021, it added. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/ril-at-rs-2725-risk-reward-looks-favourable-on-tech-charts/articleshow/93265184.cms |

|

How to analyze a business: A case study of Intellect Design Arena“Intellect Design is a software products company that operates in the banking, financial services, and insurance domain. I do not have an exact number for the addressable market but it probably runs into billions of dollars globally.” Read more at: https://economictimes.indiatimes.com/markets/stocks/news/how-to-analyse-a-business-a-case-study-of-intellect-design-arena/articleshow/93266305.cms |

|

Bond Report: Treasury yields fall in choppy trade to start AugustLong-dated Treasury yields fall Monday as investors weigh prospects for recession and the pace and scope of future Fed rate increases. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7105-F662BB4468CF%7D&siteid=rss&rss=1 |

|

Living With Climate Change: Americans want EV tax incentives. But are they ready to lose gas cars forever?Pew finds a broad majority of Americans support providing incentives for electric vehicles, but are more divided when it comes to an actual EV purchase. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7106-6B3D6619E04F%7D&siteid=rss&rss=1 |

|

The Margin: Netflix sues ‘Unofficial Bridgerton Musical’ after the parody put on a Kennedy Center show with $149 seatsProducer Shonda Rhimes called out the Grammy-winning parody for its ‘blatant taking of intellectual property’ following a recent Kennedy Center performance. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7106-67FAD07635DE%7D&siteid=rss&rss=1 |