Summary Of the Markets Today:

- The Dow closed up 316 points or 0.97%,

- Nasdaq closed up 1.88%,

- S&P 500 up 1.42%,

- WTI crude oil settled at $98 up 0.84%,

- USD $105.96 down 0.23%,

- Gold $1763 up 1.33%,

- Bitcoin $23,827 up 0.12% – Session Low 23,485,

- 10-year U.S. Treasury 2.66% down 0.25%

- Baker Hughes Rig Count: U.S. +9 to 767 Canada +9 to 204

Today’s Economic Releases:

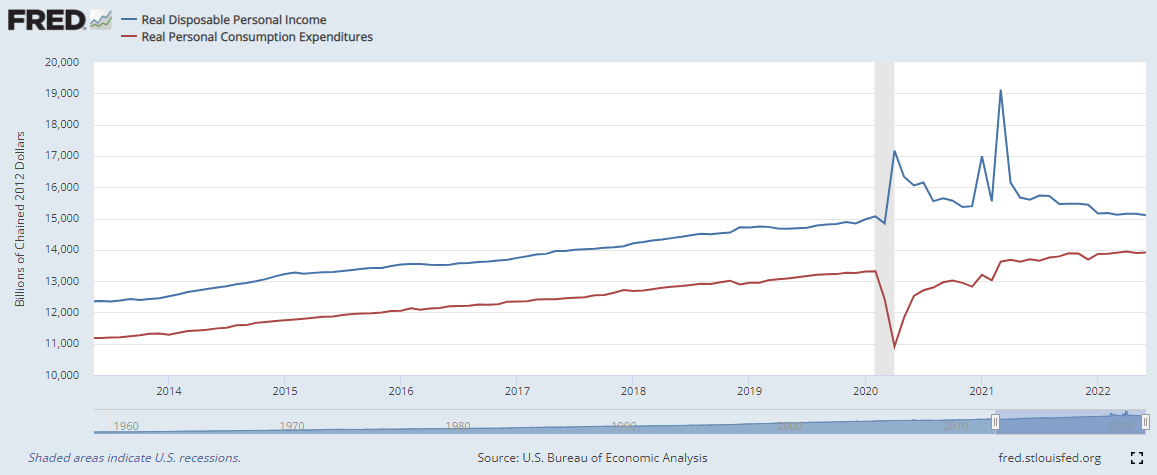

Real personal income decreased whilst real personal expenditures grew in June 2022. In overview, there has been little growth in income or expenditures in 2022.

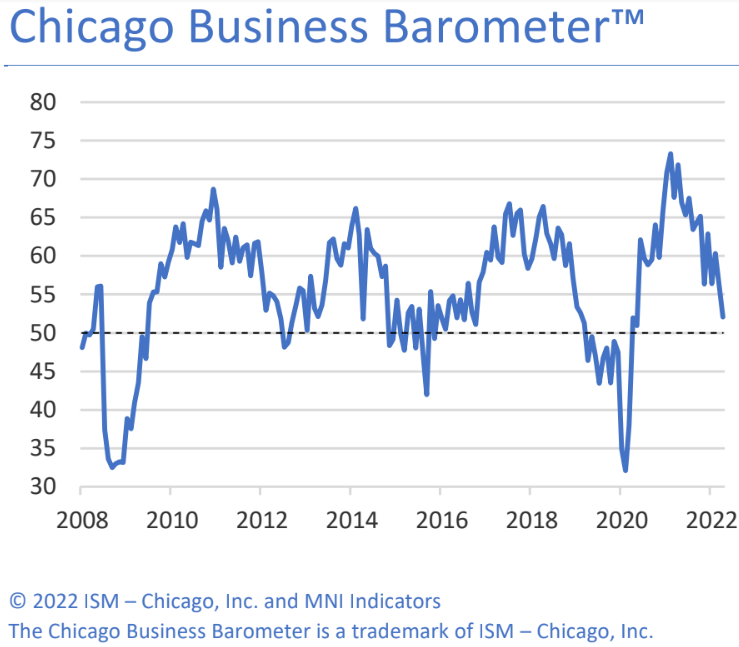

The Chicago Business Barometer slid further in July 2022, extending June’s decline. The indicator fell 3.9-points to 52.1, the lowest level since August 2020.

Job seekers’ relocating for new jobs fell to the lowest level on record in the second quarter, as employers continue to offer remote and hybrid positions to attract talent, and the economy falls into a possible recession. According to Andrew Challenger, Senior Vice President of Challenger, Gray & Christmas, Inc.:

When lockdowns took effect in 2020, many workers lost jobs and needed to relocate for new positions, while many others wanted to move or buy property, and sought jobs in their new locations. Others purchased homes or relocated and found remote work. Now, workers want the flexibility of remote work and are seeking jobs that allow them to do it.

The final July 2022 of Michigan Consumer sentiment reading showed little change in consumer sentiment from its historic low in June. The one-year economic outlook fell to its lowest reading since 2009. At the same time, concerns over global factors have eased somewhat.

A summary of headlines we are reading today:

- U.S. Crude Production Sinks In May

- U.S. Drillers Continue To Add Rigs As Crude Prices Rally

- Trucking CEOs expect higher prices, potential disruptions in the second half of the year

- Here are 4 key things to consider if you actually hit the $1.28 billion Mega Millions jackpot

- Dems Set To Push Bill To Ban Congress From Trading Stock

- The US enters ‘technical recession’. But why is Dalal Street rallying?

- Market Snapshot: U.S. stocks pick up steam heading toward the closing bell, S&P 500 on track for best month since November 2020

These and other headlines and news summaries moving the markets today are included below.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

U.S. Crude Production Sinks In MayU.S. field production of crude oil fell in May to an average of 11.595 million barrels per day (bpd), new data from the Energy Information Administration showed on Friday. That figure is down from 11.652 million bpd in April – a 57,000 bpd decline. Mays production figures are just 239,000 bpd above where they were at the same time last year and 1.247 million bpd below pre-Covid levels. U.S. crude oil production fell in May in PADDs 1 and 3 and rose in PADDs 2, 4, and 5. The largest state gain by far was in North Dakota, which saw its Read more at: https://oilprice.com/Energy/Crude-Oil/US-Crude-Production-Sinks-In-May.html |

|

Gas Demand Declines As Prices Soar, Utility Giant Engie SaysGas demand from all customers of French utility giant Engie has dropped in recent weeks amid surging natural gas prices in Europe as Russia slashed deliveries, the French company said on Friday. “Gas demand has declined among our customers, whether its households, small businesses, or large manufacturers,” Engie’s chief executive Catherine MacGregor said on an earnings call today, as carried by Bloomberg. The drop in demand is partly due to gas and energy conservation, utilities and industries switching to other fuels, and the “price signal,” MacGregor Read more at: https://oilprice.com/Latest-Energy-News/World-News/Gas-Demand-Declines-As-Prices-Soar-Utility-Giant-Engie-Says.html |

|

U.S. Drillers Continue To Add Rigs As Crude Prices RallyThe number of total active drilling rigs in the United States rose by 9 this week, according to new data from Baker Hughes published on Friday. The total rig count rose to 767 this week279 rigs higher than the rig count this time in 2021. Oil rigs in the United States rose by 6 this week to 605. Gas rigs rose by 2, to 157. Miscellaneous rigs rose by 1 to 5. The rig count in the Permian Basin rose by 2 to 351 this week. Rigs in the Eagle Ford increased by 2 to 72. Oil and gas rigs in the Permian are 108 above where they were this time last Read more at: https://oilprice.com/Energy/Energy-General/US-Drillers-Continue-To-Add-Rigs-As-Crude-Prices-Rally.html |

|

Energy Aspects: Crude Oil Demand Not Declining In Recession PatternGlobal oil demand is not declining in a pattern that would be consistent with a recession, and demand will still grow next year from this year despite expected slowdowns in Europe and the United States, Amrita Sen, director of research at Energy Aspects, told Bloomberg on Friday. There is still a lot of pent-up demand following the reopening after COVID lockdowns, and people generally still have a lot of savings, Sen said. Energy Aspects research director was discussing fears of a recession and the oil market a day after the advance estimate Read more at: https://oilprice.com/Latest-Energy-News/World-News/Energy-Aspects-Crude-Oil-Demand-Not-Declining-In-Recession-Pattern.html |

|

Trading An Illogical Oil MarketInterpreting economic data, the figures as those of us in the interbank forex market used to call them used to be simple. If a number relevant to the dollar beat expectations say better than expected GDP growth, or lower than expected inflation, you bought. If it was worse than expected, you sold. Simple. Now, though, it seems that we are in a kind of post-ironic world, where everyone is so determined to prove that they are thinking outside the box that markets frequently move in a completely illogical way after releases. Read more at: https://oilprice.com/Energy/Energy-General/Trading-An-Illogical-Oil-Market.html |

|

Why Oil Prices Could Spike Next WeekU.S. West Texas Intermediate crude oil futures are trading higher on Friday on reports that OPEC and its allies will ignore President Biden’s request to boost supply at next week’s production meeting. A weaker U.S. Dollar and stronger risk sentiment are also lending support at the close of the week. Crude oil traders have been reacting positively to the hope that U.S. monetary tightening would not be as hawkish as initially expected after disappointing economic growth figures were released on Thursday. Another big event driving the price Read more at: https://oilprice.com/Energy/Energy-General/Why-Oil-Prices-Could-Spike-Next-Week.html |

|

Mortgage rates fall sharply after negative GDP report and Fed’s latest hikeThe average rate on the popular 30-year fixed mortgage fell to 5.22% on Thursday from 5.54% on Wednesday, according to Mortgage News Daily. Read more at: https://www.cnbc.com/2022/07/29/mortgage-rates-fall-sharply-after-negative-gdp-report-and-feds-latest-hike.html |

|

Higher prices help Procter & Gamble offset commodity costs, but Tide maker warns of more challengesProcter & Gamble reported mixed quarterly results and warned it expects challenges such as rising commodity costs to persist in its fiscal 2023. Read more at: https://www.cnbc.com/2022/07/29/procter-gamble-pg-q4-2022-earnings.html |

|

JetBlue won the battle for Spirit. Now it has to win over Biden’s Justice DepartmentJetBlue’s takeover of Spirit Airlines requires the blessing of the Justice Department. Read more at: https://www.cnbc.com/2022/07/28/jetblue-won-the-battle-for-spirit-now-it-has-to-win-over-bidens-justice-department.html |

|

Trucking CEOs expect higher prices, potential disruptions in the second half of the yearU.S. trucking CEOs expect to maintain pricing power even with volumes softening as retailers, manufacturers, and consumers adjust to disruptions. Read more at: https://www.cnbc.com/2022/07/28/trucking-ceos-expect-high-prices-demand-in-second-half-of-2022.html |

|

Saudi-backed LIV Golf envisions franchises in its future, executive saysLIV Golf, the Saudi-backed league that has the blessing of former President Trump and Phil Mickelson, aims to build franchises. Read more at: https://www.cnbc.com/2022/07/29/liv-golf-backed-by-saudis-and-trump-sees-franchises-in-its-future-exec-says.html |

|

AbbVie’s mixed quarter doesn’t warrant a 5% stock drop. Here’s whyIt wasn’t a clean quarter from AbbVie but Friday’s selloff is a bit confusing. Read more at: https://www.cnbc.com/2022/07/29/investing-club-abbvies-mixed-quarter-doesnt-warrant-a-5percent-stock-drop-heres-why.html |

|

Space company Masten files for bankruptcy after struggle with NASA moon contractMasten had won a $75 million NASA contract to deliver payloads to the moon’s south pole, but the project ran far over budget. Read more at: https://www.cnbc.com/2022/07/29/masten-files-for-bankruptcy-after-nasa-moon-contract-struggle.html |

|

‘Stranger Things’ cinematographer went from ‘struggling’ in LA to shooting the biggest show on TV: ‘I was thrilled beyond belief’Caleb Heymann’s foray into the Upside Down and the world of ‘Stranger Things’ came almost completely by accident, and “was not a strategic move.” Read more at: https://www.cnbc.com/2022/07/29/how-stranger-things-cinematographer-made-it-to-tvs-biggest-show.html |

|

House Democrats push for Biden’s billionaire minimum income taxHouse Democrats have introduced the Billionaire Minimum Income Tax Act, calling for a 20% levy on total income for households worth more than $100 million. Read more at: https://www.cnbc.com/2022/07/29/house-democrats-push-for-bidens-billionaire-minimum-income-tax.html |

|

Stocks making the biggest moves midday: Roku, Amazon, First Solar, Intel, Apple & moreThese are the stocks posting the largest moves in midday trading. Read more at: https://www.cnbc.com/2022/07/29/stocks-making-the-biggest-moves-midday-roku-amazon-first-solar-intel-apple-more.html |

|

How US-made mobile-rocket artillery could change the battlefield in UkraineThe effectiveness of HIMARS, a U.S.-made rocket-artillery system, has been a boon to Ukrainian efforts to fend off Russia. But could it lead to more escalation? Read more at: https://www.cnbc.com/2022/07/29/how-himars-could-change-the-ukraine-russia-war.html |

|

We’re trimming 3 stocks that we still like after they all rallied in recent weeksFriday afternoon’s three sales allow us to raise cash because the stock market is getting into overbought territory. Read more at: https://www.cnbc.com/2022/07/29/investing-club-were-trimming-3-stocks-that-we-still-like-after-they-all-rallied-in-recent-weeks.html |

|

Here are 4 key things to consider if you actually hit the $1.28 billion Mega Millions jackpotWhile the odds are stacked against you snaring the top prize, it’s worth giving thought to what you actually would do if you were to win. Read more at: https://www.cnbc.com/2022/07/29/4-key-considerations-if-you-hit-the-mega-millions-jackpot.html |

|

Will The Fed Bring Back That 70’s Show? Stay TunedAuthored by Nicholas Baum via The Mises Institute, Those who don’t learn from the past, as the old adage goes, are doomed to repeat it. Even in the realm of something as seemingly abstract and technical as economic policy, this saying holds true. Prices are soaring in all areas of consumption, from the grocery store aisle to the pump, with the United States experiencing its highest rate of inflation since 1981. Yet this, in turn, brings up the question of what caused inflation to be even higher over forty years ago. The reason why inflation was so high back then is the same reason behind why we’re experiencing similar levels of it today. That is an incredibly loose monetary policy employed by the Fed, often as the result of political pressures from the White House. As we’ll see, however, history also provides a solution to the problem of inflation, but it will require a sense of bravery and resilience, particularly in Fed Chairman Jay Powell in a manner that has not been seen in forty years, under then-Fed Chairman Paul Volcker. Read more at: https://www.zerohedge.com/economics/will-fed-bring-back-70s-show-stay-tuned |

|

Bill Clinton Sets The Record Straight On Definition Of RecessionWhile this week’s Q2 GDP data confirmed that the United States is now in a recession (as traditionally defined – for decades – as two consecutive quarters of negative GDP growth), the Biden administration, in cooperation with its media lapdogs – and even the ‘unbiased’ lads at Wikipedia, has been furiously peddling a Sith mind trick that “this is not the recession you’re looking for.”

It’s not a recession, Read more at: https://www.zerohedge.com/political/bill-clinton-sets-record-straight-definition-recession |

|

China’s Army Posts “Get Ready For War!” Message On Social Media, State Mouthpiece Says PLA Has “Right” To Intercept Pelosi’s PlaneUpdate(1408ET): The Chinese government’s English language mouthpiece Global Times has grown particularly loud and bellicose in response to Nancy Pelosi’s potential trip to the self-ruled island of Taiwan:

Below: reportedly the message in question appearing on a PLA channel Friday on the popular Chinese social media app Weibo:

|

|

Dems Set To Push Bill To Ban Congress From Trading StockFinally, house Democrats are going to be addressing the ugly black eye of their leadership Nancy Pelosi making ungodly sums from day-trading millions of dollars worth of stock and options ahead of legislative initiatives – while, at the same time, railing on capitalism with every opportunity they get publicly. Apparently, the optics aren’t that great. Go figure. And so House Democrats are now set to announce a proposal “to ban lawmakers, their spouses and senior staff from trading stocks”, Punchbowl news wrote this week.

And in a blow to Paul Pelosi, who has taken much of the “blame” for Nancy’s stock purchase disclosures, family members and spouses would only be able to hold mutual funds. Democrats are looking to introduce the legislation in September and push it through the chamber that month, the report says. Read more at: https://www.zerohedge.com/markets/dems-set-push-bill-ban-congress-trading-stock |

|

Details of £400 energy payment to households revealedThe money will be spread over six months but how it is received depends on how you pay your bills. Read more at: https://www.bbc.co.uk/news/business-62338543?at_medium=RSS&at_campaign=KARANGA |

|

Train strikes: When are they and which rail lines are running?Thousands of train drivers and rail workers are striking in July and August. Read more at: https://www.bbc.co.uk/news/business-61634959?at_medium=RSS&at_campaign=KARANGA |

|

Asos, Boohoo and Asda investigated over green claimsConcerns include the use of vague language which may suggest clothes are more eco-friendly than they are. Read more at: https://www.bbc.co.uk/news/business-62344564?at_medium=RSS&at_campaign=KARANGA |

|

Tech View: Bullish engulfing candle on monthly chart reflects the improved sentimentThe index formed a bullish candle on the daily scale. On the weekly scale, it formed a solid bullish candle, with a long lower wick, suggesting buying at low. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-bullish-engulfing-on-monthly-chart-reflects-improved-sentiment/articleshow/93216600.cms |

|

US enters ‘technical recession’. But why is Dalal Street rallying?The US economy entering a ‘technical recession’ is not good news for India and the world. But analysts said one should not see too much into the GDP print, as other data points in the world’s largest consumer economy still suggest resilience. If anything, the GDP print could persuade the Fed to go slow on the pace of rate hike. The data could also weaken the dollar, offering some respite to the rupee, and halt foreign equity outflows in the short term. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/us-enters-technical-recession-but-why-is-dalal-street-rallying/articleshow/93202204.cms |

|

Dr Reddy’s Labs net profit doubles in Q1: What should investors do?Share of the pharma major fell about 4 percent in the first hour of the trade on Friday. Experts see concerns over the US business, as well as, pressure on operating performance as key drags. Despite near-term headwinds, most brokerage firms maintained their rating and target prices but slashed earnings per share (EPS) estimates for FY23-24. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/dr-reddys-labs-net-profit-doubles-in-q1-what-should-investors-do/articleshow/93203117.cms |

|

Bond Report: Treasury yields slip with 10-year ending at lowest since April despite inflation dataTreasury yields mostly fell on Friday as traders digested June inflation data that may impact Federal Reserve thinking on the pace of interest rate rises. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7105-00C252A70FB2%7D&siteid=rss&rss=1 |

|

MarketWatch: Mega Millions is now over $1.2 billion because Americans need hope, says lottery expertThe lottery is capturing Americans’ imagination as inflation hits a 40-year high. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7105-9F0A07D32359%7D&siteid=rss&rss=1 |

|

Market Snapshot: U.S. stocks pick up steam heading toward closing bell, S&P 500 on track for best month since November 2020Wall Street is on track for a third day of gains as stocks rise after big-tech earnings reports. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7104-FF93ABDBE71B%7D&siteid=rss&rss=1 |