Summary Of the Markets Today:

- The Dow closed up 332 points or 1.03%,

- Nasdaq closed up 1.08%,

- S&P 500 up 1.21%,

- WTI crude oil settled at $97 down 0.98%,

- USD $106.26 down 0.19%,

- Gold $1755 uo 0.05%,

- Bitcoin $23,864 up 5.02% – Session Low 22,644,

- 10-year U.S. Treasury 2.669% down 0.65%

Today’s Economic Releases:

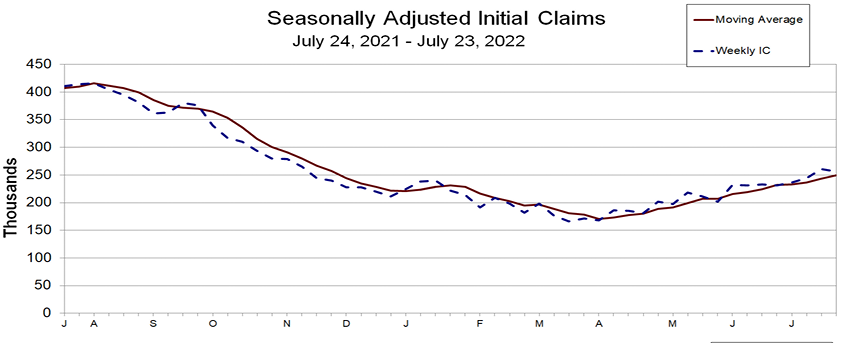

The 4-week-moving average of initial unemployment insurance claims continues growth – and is at its highest level for 2022.

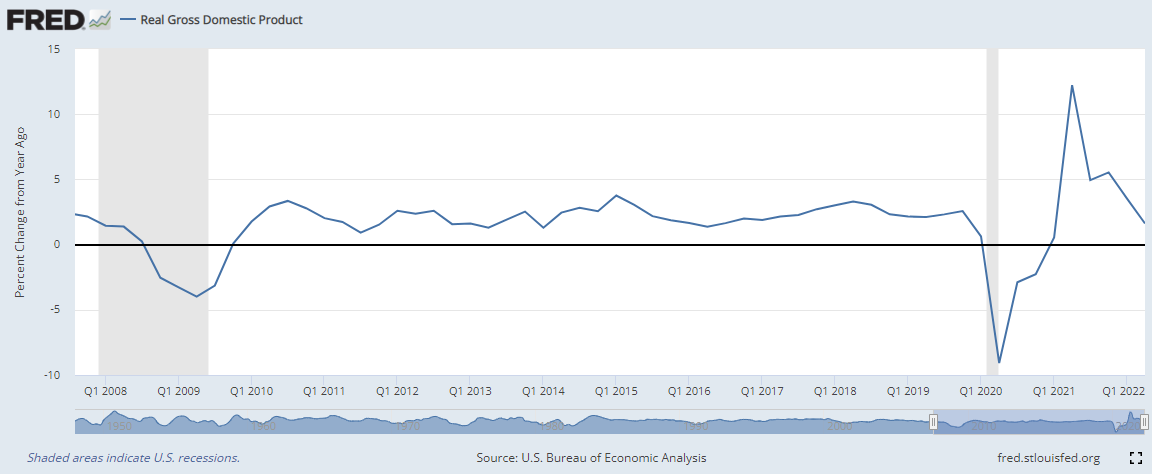

As expected, real gross domestic product (GDP) declined for the second consecutive quarter in 2Q2022. In the past, two consecutive declines were an automatic recession call – but this criteria has been discarded recently. However, it is safe to say the economy is in a strange place with decreases in private inventory investment, residential fixed investment, federal government spending, state and local government spending, and nonresidential fixed investment. Still, year-over-year GDP growth is 1.6% which is about average for GDP growth seen since the Great Recession (see graph below). My view is that the 3Q2022 will be stronger as it is no longer being compared to the 12%+ GDP growth seen one year ago.

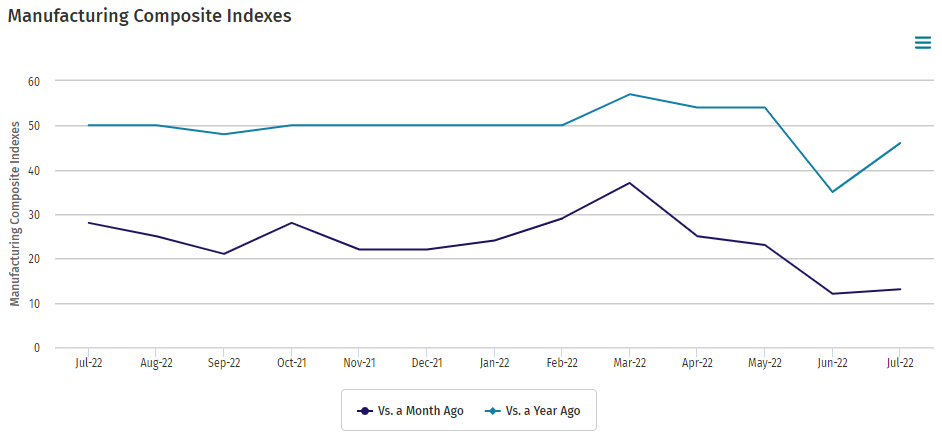

The Kansas City Fed’s manufacturing index remains positive and was little changed in July 2022 – but remains near the lowest levels seen in years.

A summary of headlines we are reading today:

- Gas Levy Could Triple Household Heating Bills In Germany

- Flash Floods Disrupt Operations At Middle Easts Largest Oil Bunkering Hub

- JetBlue won the battle for Spirit. Now it has to win over Biden’s Justice Department

- Comcast shares slide after the cable giant fails to add broadband subscribers for first time ever

- Best Buy cuts its outlook, joining other retailers as inflation pressures shoppers

- Ford beats expectations and raises dividends as the company sells more of its top models

- US economy shrinks again sparking recession fears

- Bond Report: 2-year Treasury leads drop in yields after GDP contraction fuels expectations Fed will slow rate hikes

These and other headlines and news summaries moving the markets today are included below.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

How Renewable Forests Could Solve A Major Electric Vehicle ProblemAutomakers and energy companies are racing to find innovative options to boost electric vehicle (EV) battery technology as governments around the world attempt to curb the sale of diesel and petrol cars, increasing EV uptake. The latest experiment in this space is the use of wooden components in lithium-ion batteries, as companies invest in making their EVs greener. Finish-Swedish firm Stora Enso and Volkswagen-backed Northvolt have partnered in the development of a sustainable battery that uses an anode manufactured from lignin-based hard Read more at: https://oilprice.com/Energy/Energy-General/How-Renewable-Forests-Could-Solve-A-Major-Electric-Vehicle-Problem.html |

|

Gas Levy Could Triple Household Heating Bills In GermanyGermany plans to introduce a levy for all its gas consumers beginning in October as the government looks to avoid a wave of collapsing gas-importing and gas-trading companies amid record-high natural gas prices, a new bill seen by Reuters showed on Thursday. Russia is further reducing flows via Nord Stream this week,to just 20% of the pipeline’s capacity, days after restarting the link at 40% capacity after regular maintenance. The German government has already intervened to rescue energy group Uniper, Russia’s single largest Read more at: https://oilprice.com/Latest-Energy-News/World-News/Gas-Levy-Could-Triple-Household-Heating-Bills-In-Germany.html |

|

The Chinese Entity That Could Change The Iron Market ForeverIt’s no secret that China believes in the concentration of power. However, that philosophy extends far beyond governance. It also dramatically affects the way the country does business. For instance, earlier this week, we saw the inauguration of the state-owned and centrally administered China Mineral Resources Group. Many mining companies perceive the move as China attempting to exert more influence of iron ore prices. In fact, some have called it one of the biggest shake-ups of the global iron ore market in more than a decade. Read more at: https://oilprice.com/Metals/Commodities/The-Chinese-Entity-That-Could-Change-The-Iron-Market-Forever.html |

|

Flash Floods Disrupt Operations At Middle Easts Largest Oil Bunkering HubUnusually heavy rains and flash floods in the UAE forced the closure overnight of one of the biggest oil bunkering ports in the world, with operations slowly resuming on Thursday but disruptions still hindering bunkering. At the time of writing, Bloomberg reports that while the port has started to reopen, some berths remained out of commission. The military was called in to lead rescue operations overnight across the province of Fujairah, as all operations at the port of Fujairah came to a standstill amid the emergency weather incident. Read more at: https://oilprice.com/Latest-Energy-News/World-News/Flash-Floods-Disrupt-Operations-At-Middle-Easts-Largest-Oil-Bunkering-Hub.html |

|

UK-GCC Trade Deal Could Be A Boon For RenewablesAs part of plans to expand and diversify its global trade partners, the GCC has launched negotiations with the UK on a free trade agreement that is expected to bolster the blocs economy, help attract investment and provide greater opportunities for local businesses. On June 22 the two parties officially launched talks on a comprehensive trade deal, with Anne-Marie Trevelyan, the UK trade secretary, meeting with Nayef Falah Al Hajraf, the GCC secretary-general, in Riyadh. Trevelyan then traveled to Dubai to meet with representatives from Read more at: https://oilprice.com/Energy/Energy-General/UK-GCC-Trade-Deal-Could-Be-A-Boon-For-Renewables.html |

|

OPEC+ May Keep Production Quota Unchanged At Next Weeks MeetingThe OPEC+ group will decide at the meeting next week whether they should keep production targets steady, or a small output hike, eight anonymous OPEC+ sources told Reuters on Thursday. OPEC+s current production cuts that have been in place for years will be fully wound back as of August 2022. After that, OPEC+ members would be free to raise production. But the group is still meeting next week to discuss their course of action even after the production curtailments have been fully rolled back. Two of the OPEC+ sources said that a modest increase Read more at: https://oilprice.com/Latest-Energy-News/World-News/OPEC-May-Keep-Production-Quota-Unchanged-At-Next-Weeks-Meeting.html |

|

JetBlue won the battle for Spirit. Now it has to win over Biden’s Justice DepartmentJetBlue’s takeover of Spirit Airlines requires the blessing of the Justice Department. Read more at: https://www.cnbc.com/2022/07/28/jetblue-won-the-battle-for-spirit-now-it-has-to-win-over-bidens-justice-department.html |

|

Comcast shares slide after the cable giant fails to add broadband subscribers for first time everComcast beat revenue and profit estimates but failed to deliver broadband subscriber growth. Peacock subscriber numbers were also flat. Read more at: https://www.cnbc.com/2022/07/28/comcast-earnings-2q-2022.html |

|

Beyond Meat stock falls after the conclusion of McDonald’s McPlant testAnalyst research reported lackluster demand in the U.S. for McDonald’s McPlant burger, which is made using Beyond Meat patties. Read more at: https://www.cnbc.com/2022/07/28/beyond-meat-stock-falls-after-conclusion-of-mcdonalds-mcplant-test.html |

|

UPS workers rally in New York to protest hot working conditionsUnion leaders at the rally described UPS distribution centers “infernos” with limited air conditioning. Read more at: https://www.cnbc.com/2022/07/28/ups-workers-rally-in-new-york-to-protest-hot-working-conditions.html |

|

Best Buy cuts its outlook, joining other retailers as inflation pressures shoppersBest Buy said sales have slowed amid a tougher economic backdrop, as customers contend with inflation. Read more at: https://www.cnbc.com/2022/07/27/best-buys-shares-fall-10percent-as-it-cuts-its-forecast-for-second-quarter-cites-weaker-demand.html |

|

Health secretary calls on Congress and states to do more to help contain monkeypox outbreakHealth and Human Services Secretary Xavier Becerra said Congress and local authorities need to do more to help end the growing monkeypox outbreak. Read more at: https://www.cnbc.com/2022/07/28/health-secretary-calls-on-congress-and-states-to-do-more-to-help-contain-monkeypox-outbreak.html |

|

There is deflation in some items as Wingstop notes dropping chicken wing pricesAt a time when many consumers may have forgotten what deflation is, Wingstop said it’s reaping the benefits of lower chicken wing prices. Read more at: https://www.cnbc.com/2022/07/28/there-is-deflation-in-some-items-as-wingstop-notes-dropping-chicken-wing-prices.html |

|

House passes bill to boost U.S. chip production and China competition, sending it to BidenThe Chips and Science Act includes more than $52 billion in funding for U.S. companies producing computer chips, among other provisions. Read more at: https://www.cnbc.com/2022/07/28/china-competitiveness-and-chip-bill-passes-house-goes-to-biden.html |

|

JetBlue to buy Spirit for $3.8 billion, Frontier shares jump after its deal falls apartJetBlue Airways reached a deal to buy Spirit Airlines after the discounter broke off its merger agreement with Frontier Airlines. Read more at: https://www.cnbc.com/2022/07/28/jetblue-airways-reaches-deal-to-buy-spirit-airlines.html |

|

Ford beats expectations and raises dividends as the company sells more of its top modelsFord reported second-quarter results that beat Wall Street’s estimates for revenue and profit. Read more at: https://www.cnbc.com/2022/07/27/ford-f-earnings-q2-2022.html |

|

McDonald’s and Chipotle say customers are trading down, visiting less often as inflation hits budgetsMcDonald’s and Chipotle Mexican Grill are seeing customers trade down and visit less often as inflation pressures their budgets. Read more at: https://www.cnbc.com/2022/07/27/mcdonalds-and-chipotle-say-customers-are-trading-down-visiting-less-often-as-inflation-hits-budgets.html |

|

‘Jeopardy!’ locks in hosting deals for Mayim Bialik and Ken Jennings“Jeopardy!” has signed on Mayim Bialik and Ken Jennings to be hosts of the show moving forward. Read more at: https://www.cnbc.com/2022/07/27/jeopardy-locks-in-hosting-deals-for-mayim-bialik-and-ken-jennings.html |

|

Gun CEOs call shootings ‘local problems’ and defend ‘inanimate’ weaponsMajor gun manufacturers have made over $1 billion in the the last decade selling assault-style weapons, according to the House Oversight panel. Read more at: https://www.cnbc.com/2022/07/27/gun-companies-made-1-billion-off-assault-weapons-over-10-years-house-panel-says.html |

|

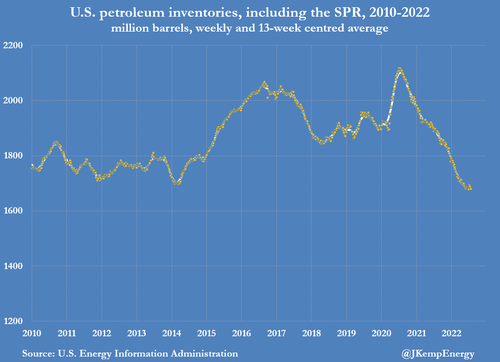

Plunging US Oil Inventories Imply Deeper Slowdown Will Be NeededBy John Kemp, senior market analyst at Reuters U.S. petroleum inventories are not rebuilding – despite record releases from the government’s strategic reserve and a slowdown in the economy which is weighing on fuel consumption by manufacturers and freight firms.

In the short term, pressure on inventories is bullish for oil prices. In the medium term, however, it implies a deeper and longer cyclical downturn will be needed later in 2022 and early 2023 to rebalance the market. Total stocks, including the strategic petroleum reserve, have fallen in 80 of the last 108 weeks by a total of 438 million barrels since the start of July 2020, according to data from the U.S. Energy Information Administration (EIA). Read more at: https://www.zerohedge.com/markets/plunging-us-oil-inventories-imply-deeper-slowdown-will-be-needed |

|

Manchin’s ‘Inflation Reduction Act’ One Giant, Misnamed Nothingburger, Goldman Finds: “It Will Change Fiscal Impulse By Less Than 0.1% Of GDP”While few have had a chance to read the details of the Manchin-Schumer so-called “Inflation Reduction Act” (where the only inflation reduction is in the title and nowhere else) especially those who have been championing it all day across various media outlets, Goldman’s chief political economist Alec Phillips spent the night digging into the nuances of the proposed bill and found … well… nothing. As Phillips writes, the fiscal deal that already looked likely to pass now looks likely to be a bit broader than expected: the potential Senate deal now includes a version of the corporate minimum tax the House passed late last year, as well as a package of energy provisions similar in size to the House-passed bill. However, and this is the punchline, the Goldman strategist finds that “the fiscal impact remains limited” and warns that “over the next few years, it looks unlikely that this bill would change the fiscal impulse by more than 0.1% of GDP, as new spending and new taxes roughly offset and, in any case, both are fairly small in absolute terms.” Goldman concludes that while the details are still apt to change – the tax increase might shrink even more – this version of the bill looks fairly likely to become law, although “the omission of any changes to state and local tax deductibility raises some questions about House passage.” Below we excerpt from the Goldman note (the full pdf available to pro subscribers) The fiscal deal that looked increasingly likely … Read more at: https://www.zerohedge.com/economics/manchins-inflation-reduction-act-one-giant-misnamed-nothingburger-goldman-finds-it-will |

|

Watch Live: President Biden Explain (Again) That The US Economy Is Not In Recession, ‘No Way Man!’President Biden, having already explained that the US economy is not in recession, will reiterate that the US economy is not in recession during a roundtable with a number of the nation’s CEOs.

He will likely once again lean on how strong the jobs market is (don’t show him this chart)… Read more at: https://www.zerohedge.com/markets/watch-live-president-biden-explain-again-us-economy-not-recession-no-way-man |

|

Microsoft Joins With Rivals To Try And Unseat Amazon’s Dominance In Government Cloud Computing ContractsAs the old saying goes: “The enemy of my enemy is my friend.” Putting this into action, Microsoft has been making nice with its competitors like Google and Oracle in order to try and get the U.S. government to stop exclusively using Amazon for many of its cloud computing contracts. Microsoft “has issued talking points to other cloud companies aimed at jointly lobbying Washington to require major government projects to use more than one cloud service”, the Wall Street Journal reported this week. It has also sought help from names like VMWare, Dell and HP, so far not asking Amazon to join the group. As of now, Amazon has about 39% of the global cloud market, the report notes. Microsoft comes in at 21%.

But when it comes to government work, Amazon truly dominates, with a 47% share of the 2021 U.S. and Canada public-sector market order, the report says. For example, the NSA selected Amazon last year for a contract worth as much as $10 billion, the report say … Read more at: https://www.zerohedge.com/markets/microsoft-joins-rivals-try-and-unseat-amazons-dominance-government-cloud-computing |

|

British Gas owner Centrica and Shell see profits soar as bills riseBritish Gas owner Centrica and Shell report huge profits, as UK households face even higher energy bills. Read more at: https://www.bbc.co.uk/news/business-62330190?at_medium=RSS&at_campaign=KARANGA |

|

US economy shrinks again sparking recession fearsThe US economy contracted at an annual rate of 0.9% in the three months to July. Read more at: https://www.bbc.co.uk/news/business-62310355?at_medium=RSS&at_campaign=KARANGA |

|

Martin Lewis says energy bills are at a ‘desperate’ pointThe personal finance expert says people will be “panicking” and will have to “make awful choices”. Read more at: https://www.bbc.co.uk/news/business-62334566?at_medium=RSS&at_campaign=KARANGA |

|

This multi-bagger zoomed over 10,000% in 10 years! Why brokerages see up to 100% further upsideThe stock crashed 20 per cent for straight two sessions after the company posted a massive 81 per cent year-on-year (YoY) fall in consolidated net profit to Rs 100.4 crore in the June 2022 quarter. It had registered a net profit of Rs 539.2 crore in the corresponding period last fiscal. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/this-multibagger-zoomed-over-10000-in-10-years-why-brokerages-see-up-to-100-further-upside/articleshow/93189518.cms |

|

FANGMAN isn’t haunting Indian investors as optimism for growth continuesFANGMAN includes seven of the biggest tech companies or tech mega-caps of the world — Meta (Facebook), Amazon, Netflix, Alphabet (Google), Microsoft, Apple and Nvidia. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/fangman-isnt-haunting-indian-investors-as-optimism-for-growth-continues/articleshow/93194343.cms |

|

Can Divi’s maintain its premium valuation amid headwinds?Indian pharma companies have been struggling to maintain margins because of strong headwinds. Due to increased competition, pharma companies are experiencing price erosion in the market, resulting in sluggish growth. While price erosion is not the only issue at hand, China’s lockdown that caused supply chain disruption, the rise in raw material prices, and the Russia-Ukraine war have raised packaging costs. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/can-divis-maintain-its-premium-valuation-amid-headwinds/articleshow/93178939.cms |

|

Bond Report: 2-year Treasury leads drop in yields after GDP contraction fuels expectations Fed will slow rate hikesTreasury yields drop after a fall in second-quarter gross domestic product stokes recession fears. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7103-F1374F346F0C%7D&siteid=rss&rss=1 |

|

ETF Wrap: These clean-energy ETFs are surging after ‘handily’ beating the S&P 500 over the past three monthsClean-energy funds are outshining the S&P 500 recently, getting another boost Thursday after an unexpected agreement in Washington on a bill that includes climate-related spending. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7104-04D0017FB40C%7D&siteid=rss&rss=1 |

|

The New York Post: Family of slain elderly Texas woman awarded $7.3 billion in damages against Charter CommunicationsThe family of a slain 83-year-old Texas woman was awarded $7.3 billion in damages against Charter Communications – after an off-duty cable guy stabbed her to death during a robbery gone awry, according to a report. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7104-70F8F0686C2A%7D&siteid=rss&rss=1 |