Wall Street opened higher then fluctuated between gains and losses until late afternoon. Then, stocks slid in a sea-saw fashion to close sharply down in choppy trading after quarterly earnings results rolled in. The DOW closed down 340 points, NASDAQ down 1.2%, and the S&P 500 down 1.0%. All below the 100 MDA.

Drops through moving averages are concerning because they may signal a change in momentum — but in this case, buying the next day has been an almost sure-fire winner for the past 19 months.

Tech-heavy NASDAQ falls 10% from November high before a slight move higher, and Bank Of America Predicts Tesla Market Share Will Collapse In Next Few Years, wherein the bank suggests that Tesla’s U.S. EV market share could drop to just 19% by 2024.

The S&P 500 closed below its 100-day average — having already slipped below that measure intraday Tuesday for the first time in more than three months.

As usual, we have included below the headlines and news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

UAE Says Climate Talks Should Include Input From Oil & Gas SectorThe COP28 climate summit slated to be held in Abu Dhabi in 2023 should include input from experts and professionals from the oil and gas industry because the world cannot simply unplug from the energy system as it is today, Sultan bin Ahmed Al Jaber, the UAE’s Minister of Industry and Advanced Technology, said on Wednesday. “We can’t simply unplug from the energy system of today and we can’t do this with a flip of a switch. We need to include the energy experts in the consultations and in the discussions and we need to make economic systems work Read more at: https://oilprice.com/Latest-Energy-News/World-News/UAE-Says-Climate-Talks-Should-Include-Input-From-Oil-Gas-Sector.html |

|

Eastern Europe Has A Bitcoin ProblemAs Europe remains in the grips of an energy crisis caused by sky-high demand for liquefied natural gas, a tight global energy supply, and Putin keeping the pipelines at low capacity as gas-rich Russia gains political ground, another sleeping giant has emerged to become a huge and surprising hindrance to the continents energy security: crypto-mining. As miners producing cryptocurrencies like Bitcoin and Etherium suck up massive amounts of energy to perform the complex proof-of-work computing necessary to create new crypto-assets, some European Read more at: https://oilprice.com/Energy/Energy-General/Eastern-Europe-Has-A-Bitcoin-Problem.html |

|

Gas Prices Dip As Europe Sees An Influx Of LNG DeliveriesGas prices have slumped despite seemingly favorable geopolitical trends such as increased tensions between Russia and Ukraine, delays in the Nord Stream 2 pipeline, and eastward flows on the key Yamal-Europe pipeline for the 30th consecutive day with no further exports to Europe planned from Gazprom in February. Nevertheless, UK natural gas prices are down nearly five percent, with futures trading for March and April reporting near six percent drops. Meanwhile, Dutch futures on the TTF benchmark are also down nearly five per cent, with similar Read more at: https://oilprice.com/Latest-Energy-News/World-News/Gas-Prices-Dip-As-Europe-Sees-An-Influx-Of-LNG-Deliveries.html |

|

Iraq-Turkey Pipeline Resumes Oil Flows After ExplosionThe 450,000-barrels-per-day Kirkuk-Ceyhan pipeline that carries crude from northern Iraq to Turkeys Ceyhan port for export resumed oil flows on Wednesday after an explosion and a fire interrupted operations on Tuesday, Turkeys state-controlled operator Botas said. The explosion and the fire that broke out as a result of the explosion were extinguished, Botas said on Wednesday, adding that All necessary precautions have been taken by BOTA? teams and the oil flow has been resumed. The pipeline is a crucial export route Read more at: https://oilprice.com/Latest-Energy-News/World-News/Iraq-Turkey-Pipeline-Resumes-Oil-Flows-After-Explosion.html |

|

Bank Of America Predicts Tesla Market Share Will Collapse In Next Few YearsOne of the big investment banks is offering a “reality check” about Tesla’s market share that one might not expect from a firm likely trying to win investment banking business from the company. That’s why this morning’s Bank of America note – wherein the bank suggests that Tesla’s U.S. EV market share could drop to just 19% by 2024 – caught our eye. The bank says that a “slew” of new EV models hitting the market could force Tesla’s U.S. market share to plunge from its current 69%, Bloomberg wrote in a Wednesday morning note. We Read more at: https://oilprice.com/Energy/Energy-General/Bank-Of-America-Predicts-Tesla-Market-Share-To-Collapse-In-Next-Few-Years.html |

|

White House Ready To Deploy “Tools” For Oil Price ControlThe Biden administration stands ready to deploy its tools to address the latest increase in oil prices, a spokeswoman for the National Security Council said this week. “We continue to work with producer and consumer countries and these steps have had real effects on prices and ultimately tools continue to remain on the table for us to address prices,” Emily Horne said, as quoted by Reuters. “We will continue to monitor prices in the context of global economic growth and engage our OPEC+ partners, as appropriate.”Horne also said. Last year, Read more at: https://oilprice.com/Energy/Oil-Prices/White-House-Ready-To-Deploy-Tools-For-Oil-Price-Control.html |

|

Biden administration announces plan to confront worsening wildfiresThe plan quadruples the government’s fuels and forest health treatments as wildfires grow more frequent and intense with climate change. Read more at: https://www.cnbc.com/2022/01/19/biden-administration-announces-plan-to-confront-worsening-wildfires.html |

|

Disney taps Rebecca Campbell to head new content group as it gears up for international streaming pushDisney has formed a new international content group to expand its pipeline in local and regional markets and bolster its global subscriber numbers. Read more at: https://www.cnbc.com/2022/01/19/disney-forms-international-content-group-gears-up-for-streaming-push.html |

|

Stocks making the biggest moves midday: SoFi, Procter & Gamble, U.S. Bancorp and moreThese are the stocks posting the largest moves in midday trading. Read more at: https://www.cnbc.com/2022/01/19/stocks-making-the-biggest-moves-midday-sofi-procter-gamble-us-bancorp-and-more.html |

|

Higher prices ahead for Tide detergent and other Procter & Gamble products as costs climb higherProcter & Gamble is raising prices across more of its portfolio to protect its profit margins as commodity and freight costs climb higher. Read more at: https://www.cnbc.com/2022/01/19/procter-gamble-plans-more-price-hikes-for-tide-and-other-products-.html |

|

Peloton insiders sold nearly $500 million in stock before its big drop, SEC filings showThe wave of insider selling started when the stock surged past $80 in the fall of 2020, and gained momentum in 2021 as it held above $100, SEC filings show. Read more at: https://www.cnbc.com/2022/01/19/peloton-insiders-sold-nearly-500-million-in-stock-before-its-big-drop-.html |

|

Biden will make 400 million N95 masks available to Americans for freeThe masks will start to become available late next week, and the program will be fully up and running by early February, according to an official. Read more at: https://www.cnbc.com/2022/01/19/biden-will-make-400-million-n95-masks-available-to-americans-for-free.html |

|

Scientists warn it’s too soon to relax despite omicron Covid variant proving to be less severeInfectious disease experts have warned against complacency with Covid-19, despite health officials claiming infection is practically inevitable for most people. Read more at: https://www.cnbc.com/2022/01/19/omicron-is-milder-but-scientists-say-its-still-too-soon-to-relax.html |

|

P&G earnings top estimates as price hikes offset rising costs, company raises 2022 sales forecastShares of P&G have climbed 18% in the last 12 months, giving the company a market value of $387 billion. Read more at: https://www.cnbc.com/2022/01/19/procter-gamble-pg-q2-2022-earnings.html |

|

England looks to ease Covid rules while Europe is engulfed by omicronU.K. Prime Minister Boris Johnson is expected to announce that Covid rules in England will be eased when he makes a statement later Wednesday. Read more at: https://www.cnbc.com/2022/01/19/england-looks-to-ease-covid-rules-while-europe-is-engulfed-by-omicron.html |

|

The world is hungry for lithium. Geothermal energy could transform how it’s sourcedConcerns around sustainability and the security of global supply chains could boost opportunities related to direct lithium extraction. Read more at: https://www.cnbc.com/2022/01/19/geothermal-energy-could-transform-the-way-lithium-is-sourced.html |

|

Obamacare enrollment hits record high after Biden makes post-Trump tweaks to health insurance programExperts noted that while former President Donald Trump tried to gut Obamacare, President Joe Biden has been a cheerleader for the health insurance law. Read more at: https://www.cnbc.com/2022/01/18/obamacare-enrollment-hits-record-high-after-biden-makes-changes.html |

|

5 things to know before the stock market opens WednesdayU.S. stock futures rose as investors got better-than-expected earnings while digesting the 10-year Treasury yield topping 1.9% early Wednesday Read more at: https://www.cnbc.com/2022/01/19/5-things-to-know-before-the-stock-market-opens-wednesday-jan-19.html |

|

Stocks making the biggest moves premarket: Bank of America, UnitedHealth, P&G and moreThese are the stocks posting the largest moves before the bell. Read more at: https://www.cnbc.com/2022/01/19/stocks-making-the-biggest-moves-premarket-bank-of-america-unitedhealth-pg-and-more.html |

|

JPMorgan Trading Desk Commentary: “The Reality Is No One Is Really Buying Anything Right Now”JPMorgan Trading Desk Commentary: “The Reality Is No One Is Really Buying Anything Right Now”With markets in flux and traders uncertain what to do now that it has been almost three weeks without a new all time high ahead of a FOMC meeting where the hawkish screws will tighten that much more, here is some perspective from the beating heart of one of the largest trading desks in the world, that of JPMorgan (whose traders, judging by the recent comp disclosures are among the best paid in the world, so they should know) WHAT ARE WE SEEING? An unnerving start to the week with the S&P down -1.5%, 10yr up +3.5% (to 1.84%) and VIX creeping higher. Every sector in the red (except energy…Crude closing in on $89/bbl) with financials worst performing… a bit of a head scratcher but our trader, Taylor Barry, suggests:“Largely, the disappointment in expenses is driving performance… Usually with rates up like this the group would be trading well. But lot of “newer” $$ has come into the sector so potentially weak hands kicking some out….we aren’t seeing much supply”. As value outperforms growth once again (outperformed by an impressive +14% YTD), we’re seeing a “relatively” predictable playbook at a sector level with Tech, Comm Srvc, Discretionary dragging markets lower. Flow wise, overall JPM vols +7% across HT and LT skewed slightly better to SELL. On the HT desk, vols are +9% although generally speaking, feels orderly (vs. sea of red on the screen). TMT is ~3:2 better for sale (demand mostly covering, unsurprisingly), financials flows are better for sale but we’re not exactly ‘busy’, consumer too remains better for sale with LOs … Read more at: https://www.zerohedge.com/markets/jpmorgan-trading-desk-commentary-reality-no-one-really-buying-anything-right-now |

|

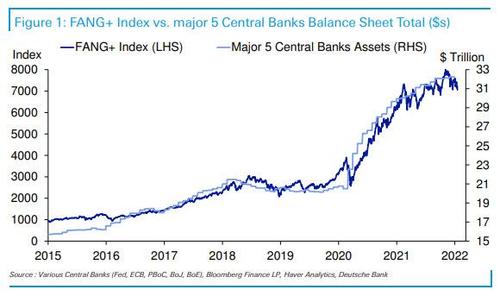

Correlation Doesn’t Imply Causation, But…Correlation Doesn’t Imply Causation, But…In his “chart of the day”, DB’s Jim Reid writes this morning that “correlation does not imply causation but unless you are an incredibly strong advocate of a completely new earnings paradigm for the largest technology companies, that coincidently have tracked unconventional monetary policy, then it is hard to argue against the notion that central bank policies have been a big contributor to an incredible run for the sector over the last 6-7 years.” Indeed, as the chart below shows, the only notable setback for the gigatech space was when global QT arrived in 2018, however briefly. Just don’t show this to the handful of remaining macrotourists who are still so clueless they actually argue the Fed doesn’t dominate every aspect of the market, while bizarrely still claiming to be “finance experts.”

2022 has been a perfect negative storm for tech with higher nominal and more importantly real yields, as markets price in a Fed that seems strongly committed to starting QT later this year. Meanwhile, as we Read more at: https://www.zerohedge.com/markets/correlation-doesnt-imply-causation |

|

A Technical Sell-Signal With A 100% Hit-Rate For Dip-Buyers Just TriggeredA Technical Sell-Signal With A 100% Hit-Rate For Dip-Buyers Just TriggeredBy Mark Cudmore, Bloomberg Markets Live commentator and analyst It’s crunch time for the buy-the-dip crowd. The S&P 500 is threatening to close below its 100-day average — having already slipped below that measure intraday Tuesday for the first time in more than three months. Drops through moving averages can be seen as concerning because they may signal a change in momentum — but in this case, buying the next day has been an almost sure-fire winner for the past 19 months. Since June 2020, the benchmark has closed below its 100-day average eight times, data compiled by Bloomberg show. Three of those instances, it never traded lower after that, even intraday, and three times there was never a lower close after. One of the occurrences there was one lower close — by 0.03% — before it headed higher, and the worst time was one close 0.16% lower before it recovered, the data show.

Dip-buyers in U.S … Read more at: https://www.zerohedge.com/markets/technical-sell-signal-100-hit-rate-dip-buyers-triggered |

|

Supreme Court Issues Rare Statement Refuting CNN/NPR ‘Fake News’ About Tension Over MasksSupreme Court Issues Rare Statement Refuting CNN/NPR ‘Fake News’ About Tension Over MasksAuthored by Zachary Stieber via The Epoch Times, The Supreme Court on Wednesday weighed in after a report alleged the reason Justice Sonia Sotomayor is participating in arguments from her chambers as opposed to sitting with colleagues is due to Justice Neil Gorsuch’s refusal to wear a mask.

One report from Read more at: https://www.zerohedge.com/political/supreme-court-issues-rare-statement-refuting-cnnnpr-fake-news-about-tension-over-masks |

|

Working-from-home guidance shift ‘may not save my shop’End of work-from-home guidance a boost for hospitality, while nightclubs welcome scrapping of Covid passes. Read more at: https://www.bbc.co.uk/news/business-60057276?at_medium=RSS&at_campaign=KARANGA |

|

Unilever says it will not increase £50bn bid for rivalConsumer goods giant Unilever says it will not sweeten its bid for the healthcare arm of GlaxoSmithKline. Read more at: https://www.bbc.co.uk/news/business-60053927?at_medium=RSS&at_campaign=KARANGA |

|

US and UK finally sit down on steel tariffsThe US and UK have opened formal discussions on border taxes on UK steel and aluminium. Read more at: https://www.bbc.co.uk/news/business-60061265?at_medium=RSS&at_campaign=KARANGA |

|

Make use of the mutual fund route to silver for a more diversified portfolioWhile silver as an asset class has always been there, the regulator has now allowed mutual funds to offer this as an underlying. This makes the process of investment and redemption seamless. Read more at: https://economictimes.indiatimes.com/markets/commodities/news/make-use-of-the-mutual-fund-route-to-silver-for-a-more-diversified-portfolio/articleshow/88994386.cms |

|

Crypto bets: Six tokens to pick for good returns in coming daysCrypto cart is getting its mojo back, following the sharp run up in equity markets and improved risk appetite of the investors. Positive news flow is also supporting the sentiments. However, selection of tokens is still a very tough task for investors, who miss the bus in the 24×7 markets. Here are some suggestions from industry experts that investors may choose for decent returns in coming days: Read more at: https://economictimes.indiatimes.com/markets/cryptocurrency/crypto-bets-six-tokens-to-pick-for-good-returns-in-coming-days/crypto-token-ideas/articleshow/88995445.cms |

|

Gold demand seen resilient as Indians ‘learn to live with virus’There was a “huge spurt” in demand in the last quarter of 2021, as millions of weddings took place, prices softened and higher savings flowed into the precious metal as people couldn’t travel much, he said. Read more at: https://economictimes.indiatimes.com/markets/commodities/news/gold-demand-seen-resilient-as-indians-learn-to-live-with-virus/articleshow/88992606.cms |

|

Market Extra: The 60/40 portfolio ‘is in danger’ as Federal Reserve gears up for a rate-hike cycle in coming months“Multiasset portfolios might face some headwinds as policy gets tighter,” JPMorgan Chase & Co. strategists said in a note released Wednesday. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7889-1F55804E4282%7D&siteid=rss&rss=1 |

|

: Biden is giving away 400 million N95 masks — here’s how to extend their use, and recycle themEven when disposable feels safer, it can be challenging for Americans who typically recycle to accept so much mask waste. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-788B-3581D9A7312B%7D&siteid=rss&rss=1 |

|

TaxWatch: ‘Not all the money belongs to you’: Self-employed? Avoid these mistakes when filing your 2021 taxesThe deadline for self-employed workers to submit estimated tax payments for the fourth quarter of 2021 is Jan. 18. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7865-6CC743C7FF01%7D&siteid=rss&rss=1 |