Summary Of the Markets Today:

- The Dow closed up 658 points or 2.15%,

- Nasdaq closed up 1.79%,

- S&P 500 up 1.92%,

- WTI crude oil settled at 98 up 1.06%,

- USD $108.03 down 0.56%,

- Gold $1705 down 0.03%,

- Bitcoin $21,075 up 2.07% – Session Low 20,385,

- 10-year U.S. Treasury 2.926% down 0.033%

- Baker Hughes Rig Count: U.S. +4 to 756 Canada +16 to 191

Today’s Economic Releases:

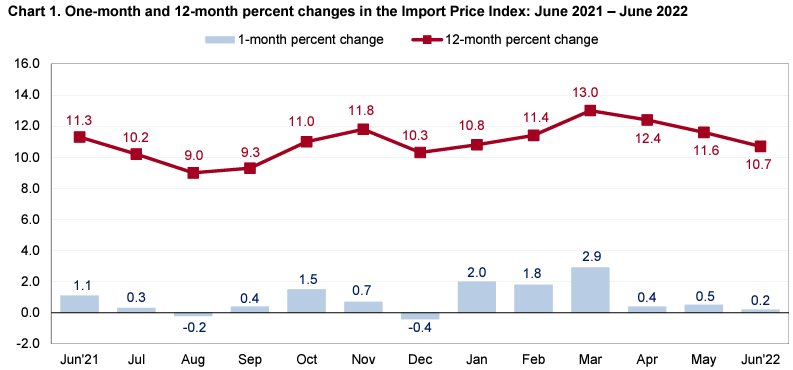

June 2022 Import prices rose 10.7% from a month one year ago.

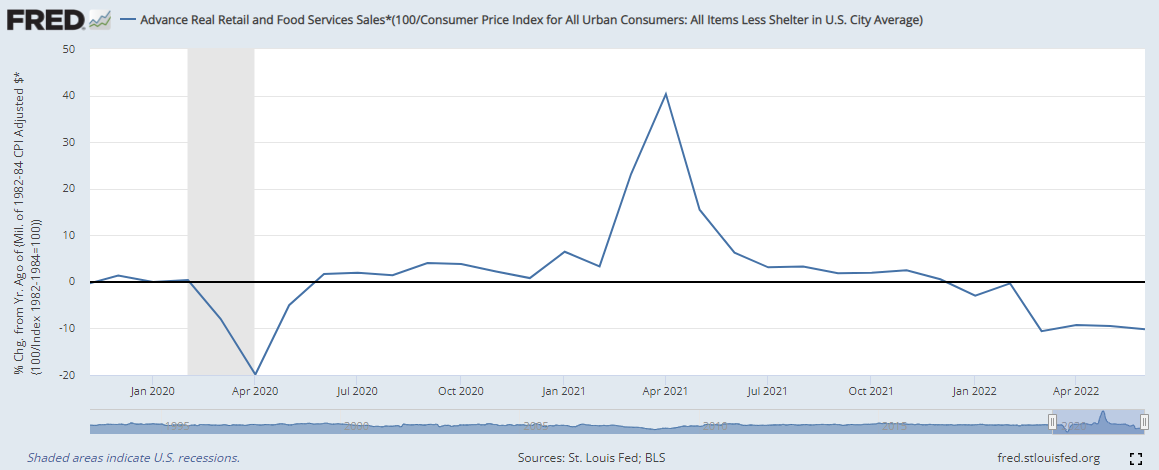

On the surface, retail sales for June 2022 look great rising 8.1% year-over-year. But headline retail sales are not adjusted for inflation – and consider overall inflation has been growing by 9.1% over the last 12 months. The bottom line is that retail sales when adjusted for inflation contracted a little over 10% year-over-year.

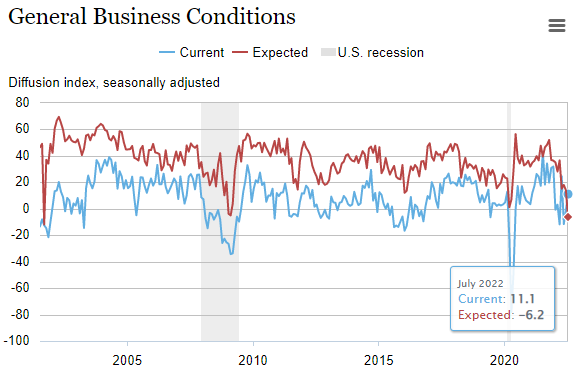

The New York Fed’s July 2022 Empire State Manufacturing Survey improved to 11.1 after being in contraction the previous month.

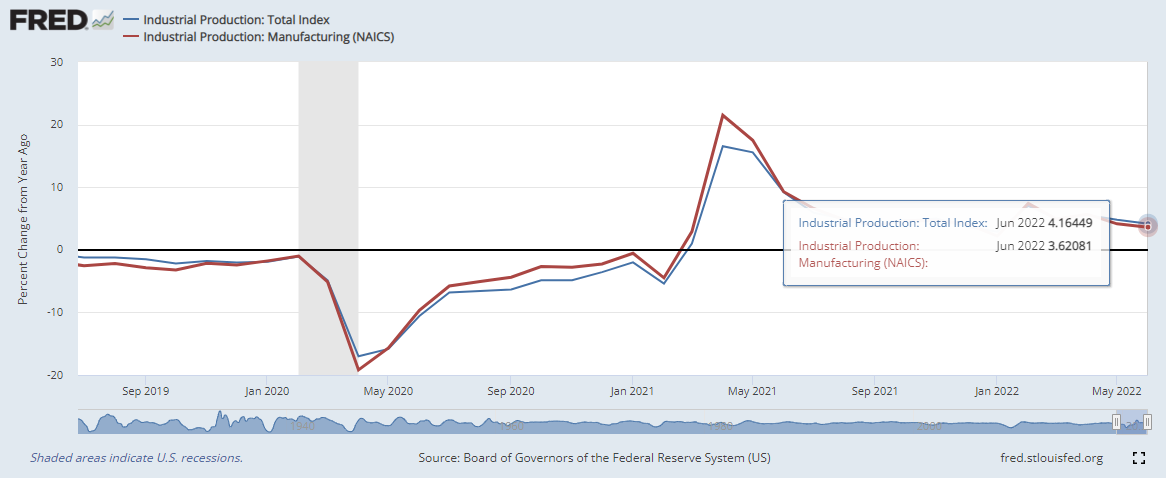

Industrial Production slowed in June 2022 but still posted a 4.2% gain year-over-year (no need for inflation adjustment). The manufacturing portion of Industrial Production also declined month-over-month but posted a 3.6% gain year-over-year.

The Atlanta Fed’s GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2022 is -1.5 percent on July 15, down from -1.2 percent on July 8. If the 2Q2022 is in contraction, it would be the second quarter of negative GDP growth.

Michigan Consumer Sentiment was relatively unchanged, remaining near all-time lows. Current assessments of personal finances continued to deteriorate, reaching its lowest point since 2011. Buying conditions for durables adjusted upwards, owing both to consumers who cited easing supply constraints and those who believed that one should buy now to avoid future price increases, which would exacerbate inflation going forward. Even with the adjustment, buying conditions remained 26% lower than a year ago.

A summary of headlines we are reading today:

- Oil Markets Torn Between Recession Fears And Physical Tightness

- Russian Fuel Oil Is Too Cheap For Saudi Arabia To Resist

- Musk says Tesla can lower car prices if inflation ‘calms down’

- Nickel Prices Plummet To 6-Month Low

- Former White House Physician Says “Biden Won’t Finish His Term”

- Bond Report: 10- and 30-year Treasury yields post third weekly drop in four weeks as inflation expectations slip

These and other headlines and news summaries moving the markets today are included below.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Libya’s New NOC Chair Vows Oil Will Flow Within A WeekAfter an armed takeover of Libya’s National Oil Company (NOC) on Thursday, newly appointed chairman Farhat Bengdara has told media that he is in full control and that force majeure could be lifted on Libya’s oil exports within a week. In an interview with Bloomberg, Bengdara said he would double Libya’s crude oil production to 1.2 million bpd. He also reiterated assurances to foreign partners that all existing contracts would be honored. Serious doubts remain as to Bengdaras control, however, as long-time NOC Read more at: https://oilprice.com/Latest-Energy-News/World-News/Libyas-New-NOC-Chair-Vows-Oil-Will-Flow-Within-A-Week.html |

|

Oil Markets Torn Between Recession Fears And Physical TightnessUncertainty is dominating the oil market this week, with recession fears being countered by physical tightness and growing supply risks. Oilprice Alert:This month’s Intelligent Investor column, now available forGlobal Energy Alertmembers, outlines the bullish case for oil, gas, and coal. If you’re an investor in the energy space then now is the time to sign up for Global Energy Alert. Friday, July 15th, 2022 Oil market watchers have become senior macroeconomists lately, with price swings increasingly dependent on Read more at: https://oilprice.com/Energy/Energy-General/Oil-Markets-Torn-Between-Recession-Fears-And-Physical-Tightness.html |

|

Russian Fuel Oil Is Too Cheap For Saudi Arabia To ResistRussian fuel oil exports to Saudi Arabia rose almost twofold during the second quarter as the Saudis sought to free up more local crude for export while using the discount imports for power generation. According to Reuters data, Saudi Arabia imported some 647,000 tons of Russian fuel oil between April and June, compared with 320,000 tons a year earlier. Saudi Arabia is one of the relatively few countries that use crude oil for power generation, although it has taken steps to reduce this amount by boosting its natural gas output and switching power Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russian-Fuel-Oil-Is-Too-Cheap-For-Saudi-Arabia-To-Resist.html |

|

Nickel Prices Plummet To 6-Month LowAccording to a recent Bloomberg report, the man behind the historic March nickel squeeze walked away from the crisis with an estimated loss of $1 billion. To most, that figure sounds almost unimaginable. However, its a far cry from the more than $10 billion loss he faced when nickel prices surged past $100,000/mt. Instead, Xiang Guangda, owner of mining and steelmaking company Tsingshan Holding Group, managed to close out nearly all of his short positions almost four months later. Guangdas ability to withdraw with nearly all his assets Read more at: https://oilprice.com/Energy/Energy-General/Nickel-Prices-Plummet-To-6-Month-Low.html |

|

Russia Looks To Expand Its Domestic Natural Gas NetworkRussia is capable of manufacturing by itself all the equipment necessary for expanding its domestic gasification network, Russian Trade and Industry Minister Denis Manturov said on Friday. We will be able to provide ourselves all the technological equipment and piping for the gasification of the whole country, the minister said during a speech at the Russian Parliament, as carried by Russian news agency TASS. It is important to upgrade our capacities by replacing foreign exploration, drilling, and offshore equipment, as well Read more at: https://oilprice.com/Energy/Energy-General/Russia-Looks-To-Expand-Its-Domestic-Natural-Gas-Network.html |

|

Big Oil Poised For Exceptional Earnings Thanks To High Refining MarginsHigh refining margins and fuel demand in the second quarter are set to lead to exceptional earnings at Big Oils refining businesses. Some of the largest international oil majors have already announced expectations of blockbuster earnings from their refining divisions when they report Q2 profits later this month. The latest company to preview blockbuster earnings in refining was Frances supermajor TotalEnergies, which said on Friday that Refining & Chemicals results are expected to be exceptional given the very Read more at: https://oilprice.com/Latest-Energy-News/World-News/Big-Oil-Poised-For-Exceptional-Earnings-Thanks-To-High-Refining-Margins.html |

|

Disney highlights value of its streaming bundle by increasing price of ESPN+ 43% to $9.99 per monthDisney is raising the price of ESPN+ 43% to $9.99 per month while keeping the price of its Disney bundle unchanged at $13.99 per month. Read more at: https://www.cnbc.com/2022/07/15/disney-raises-price-of-espn-43percent-to-9point99-per-month-beginning-aug-23.html |

|

ISS urges Spirit shareholders to vote against Frontier merger, calls JetBlue bid superiorProxy advisory firm ISS has changed its opinion on the Spirit-Frontier deal again. Read more at: https://www.cnbc.com/2022/07/15/iss-urges-spirit-shareholders-to-vote-against-frontier-merger-calls-jetblue-bid-superior.html |

|

General Motors is handling production issues on a ‘weekly basis,’ CEO Mary Barra says“This will go into ’23. … It’s going to take additional capacity,” Barra said in an interview on “Mad Money.” Read more at: https://www.cnbc.com/2022/07/14/general-motors-is-handling-production-issues-on-a-weekly-basis-ceo-mary-barra-says.html |

|

Tiger Woods misses the cut at what could be his last British Open at St. Andrews“I don’t know if I’ll be physically able to play another British Open here at St. Andrews,” Tiger Woods said. Read more at: https://www.cnbc.com/2022/07/15/tiger-woods-misses-the-cut-at-what-could-be-his-last-british-open-at-st-andrews.html |

|

These are the 10 cities seeing the most price cuts for homesMore home sellers are dropping their asking prices as rising mortgage interest rates and inflation have eased competition in the market. Read more at: https://www.cnbc.com/2022/07/14/these-are-the-10-cities-seeing-the-most-price-cuts-for-homes.html |

|

Musk says Tesla can lower car prices if inflation ‘calms down’Tesla hiked prices across its models as recently as June, increasing the cost of its Model Y long-range from $62,990 to $65,990. Read more at: https://www.cnbc.com/2022/07/15/elon-musk-tesla-can-lower-car-prices-if-inflation-calms-down.html |

|

CDC expects monkeypox outbreak to grow as total cases surpass 1,400 and vaccine demand outstrips supplyThe federal government has made more than 300,000 doses of the Jynneos vaccine available to states since May, but demand is outstripping current supply. Read more at: https://www.cnbc.com/2022/07/15/monkeypox-cdc-expects-outbreak-to-grow-as-vaccine-demand-outstrips-supply.html |

|

Amazon had a record Prime Day. What Wall Street and the Club think about the numbersThe CNBC Investing Club takes a look at Wall Street’s reactions to Amazon’s record Prime Day earlier this week. Read more at: https://www.cnbc.com/2022/07/15/amazon-had-a-record-prime-day-what-wall-street-and-the-club-think-about-the-numbers.html |

|

These are the 5 markets where home sales are cooling fastest: Sellers need to be ‘realistic’ about price, says brokerAfter the frenzy of bidding wars, the U.S. housing market is cooling amid rising mortgage interest rates, forcing some sellers to adjust. Read more at: https://www.cnbc.com/2022/07/15/markets-where-home-sales-are-cooling-fastest.html |

|

Maryland gubernatorial candidate Wes Moore sets fundraiser plan with Spike Lee in Martha’s VineyardMaryland gubernatorial candidate Wes Moore has set a private fundraiser at the Martha’s Vineyard home of Oscar-winning filmmaker Spike Lee. Read more at: https://www.cnbc.com/2022/07/15/wes-moore-plans-fundraiser-at-spike-lees-marthas-vineyard-home.html |

|

People are paying more for clothes even as retailers like Walmart and Gap mark down prices to cut inventoryShoppers are paying more to refresh their wardrobes, even as retailers such as Walmart and Target, mark down prices to eat away at excess inventory. Read more at: https://www.cnbc.com/2022/07/13/inflation-apparel-prices-remain-high-even-as-retailers-try-to-clear-inventory.html |

|

These are the 16 U.S. stores that Starbucks is set to close because of safety concernsThe closures come after a series of “challenging incidents” at these locations brought employees’ and customers’ safety into question. Read more at: https://www.cnbc.com/2022/07/14/starbucks-is-set-to-close-these-16-us-stores-over-safety-concerns.html |

|

Chinese fast-fashion company Shein seeks U.S. IPO as soon as 2024, report saysShein, the Chinese fast-fashion giant, has faced criticism over how workers are treated at plants that manufacture apparel for the company. Read more at: https://www.cnbc.com/2022/07/14/chinese-fast-fashion-company-shein-seeks-us-ipo-as-soon-as-2024-report.html |

|

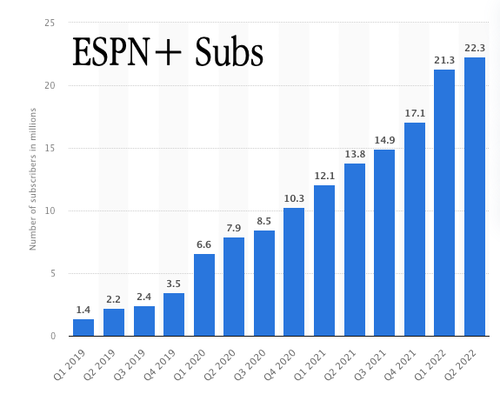

ESPN+ Subscription Cost Will Jump 43% Next MonthWalt Disney co.’s ESPN+ will jack up the monthly price for the live sports streaming service, hoping customers won’t mind shelling out 43% more next month. Bloomberg reports the cost of an ESPN+ subscription will jump from $6.99 per month to $9.99, effective on August 23. For those who pay yearly, the price will increase by $30 to $99.99.

The imminent price hike comes as ESPN+ subscribers have nearly doubled since last year, from 13.8 million in April 2021 to 22.3 million in the most recent earnings report. Subscriber growth noticeably increased during the pandemic and after it ended as sporting events returned — before the increase, the platform had years of horrendous subscriber growth.

One reason for the price increase is … Read more at: https://www.zerohedge.com/markets/espn-subscriptions-will-jump-43-next-month |

|

Former White House Physician Says “Biden Won’t Finish His Term”Authored by Paul Joseph Watson via Summit News, Former White House physician Ronny Jackson says that Joe Biden “won’t finish his term” because “his mind is too far gone.”

Jackson, who served on the White House medical team in the mid-2000s and served as personal physician to both Barack Obama and Donald Trump, made the remarks on Twitter. “Biden won’t finish his term. EVERYONE knows he’s unfit for the job. His mind is too far gone. This can’t go on any longer. He needs to RESIGN!” tweeted Jackson.

|

|

Saudis Double Russia Crude Imports As It Prepares For BRICS InclusionSaudi Arabia has a thirst for heavily discounted Russian diesel and other fuel products banned by many countries in the West. The world’s largest oil exporter more than doubled the amount of Russian fuel oil in the second quarter to supply power generation stations to meet surging cooling demand this summer and allow the kingdom’s crude exports to increase. Western sanctions forced Russia to discount fuel oils on spot markets, which has increased demand in the East, not just from the Saudis but also from China and India. Energy trade data provided by Reuters shows Saudis imported 647,000 tons (48,000 barrels per day) of fuel oils from Russia in the second quarter — up from 320,000 tons in the same quarter last year. The surge in the Russia-Saudi energy trade (also detailed in “Middle East Ramps Up Imports Of Shunned Russian Fuels”) comes as BRICS International Forum President Purnima Anand told Russian newspaper Izvestia that Saudis are planning to join. That would boost multilateral cooperation between BRICS, including Saudis, meaning they wouldn’t cave to the US demands to restrict Russian energy imports. Read more at: https://www.zerohedge.com/geopolitical/saudi-arabia-doubles-russia-crude-imports-it-prepares-brics-inclusion |

|

5 Candidates For UK Prime Minister Face Off In 1st TV Debate TonightAuthored by Lily Zhou via The Epoch Times, All five remaining contenders vying to be the UK’s next prime minister will take part in the first televised debate tonight at 7pm GMT on Channel 4, the network has confirmed.

The candidates still in the race (clockwise from top left): Liz Truss, Kemi Badenoch, Tom Tugendhat, Rishi Sunak and Penny Mordaunt. Rishi Sunak, Penny Mordaunt, Liz Truss, Kemi Badenoch, and Tom Tugendhat are expected to stand toe to toe in three debates over the weekend, ahead of the third ballot scheduled on Monday to further narrow the field. Sunak, the former Chancellor whose resignation helped trigger the collapse of Prime Minister Boris Johnson’s government, remains the frontrunner after two … Read more at: https://www.zerohedge.com/political/5-candidates-uk-prime-minister-face-1st-tv-debate-tonight |

|

BT strike: Thousands of workers to take action for two daysThe union behind the strike says it could cause significant issues for those working at home. Read more at: https://www.bbc.co.uk/news/business-62184802?at_medium=RSS&at_campaign=KARANGA |

|

Heathrow delays: Emirates agrees to cap summer flightsThe airline agrees to limit summer flight ticket sales after criticising the airport for travel delays. Read more at: https://www.bbc.co.uk/news/business-62182881?at_medium=RSS&at_campaign=KARANGA |

|

Rail passengers told to avoid travel in heatwaveNetwork Rail says people should only travel if necessary, and services could be delayed or canceled Read more at: https://www.bbc.co.uk/news/business-62182880?at_medium=RSS&at_campaign=KARANGA |

|

Tech View: Nifty50 weekly chart suggests loss of momentum; 15,850 to offer supportThat said, the index formed an Inside Bar candle on the weekly chart that signals a loss of momentum. Analysts said the index has support around 15,850 levels while they see resistance for the index above 16,200 levels. It’s a sell-on-rise market, they said. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty50-weekly-chart-suggests-loss-of-momentum-15850-to-offer-support/articleshow/92903347.cms |

|

Chart Check: This heavy electrical equipment maker has given Double Bottom breakoutThe heavy electrical equipment stock hit a 52-week high of Rs 550 recorded on 26 October 2021, but it failed to hold on to the momentum. The stock closed at Rs 447 on 13 July 2022. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/chart-check-down-nearly-20-from-highs-this-heavy-electrical-equipment-maker-has-given-double-bottom-breakout-time-to-buy/articleshow/92896201.cms |

|

What Motilal Oswal is saying on LIC stock post FY22 business updateEmbedded value stood at Rs 5.41 lakh crore in FY22, which was broadly similar to the last disclosed EV in September 2021 and was 4.7 per cent lower than Motilal’s estimate. EV for FY22 was significantly higher as compared to FY21 levels due to the bifurcation of a single fund into a separate PAR and non-PAR fund, pursuant to changes in the LIC Act in FY22, it noted. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/what-motilal-oswal-is-saying-on-lic-stock-post-fy22-business-update/articleshow/92894705.cms |

|

Washington Watch: Republicans still favored in midterm elections, but their chances for taking back Senate are droppingRepublicans are widely expected to score wins in this November’s midterm elections, but the GOP’s odds for taking back control of the Senate have fallen significantly this month. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7FAB-D40708C1A485%7D&siteid=rss&rss=1 |

|

The Wall Street Journal: House passes bills to protect abortion access at federal level after Roe v. Wade is overturnedThe House passed two bills Friday aimed at ensuring abortion access and protecting the ability of women seeking abortions to cross state lines, marking the first moves since the Supreme Court ended the federal right to the procedure. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7FBB-FE1C54F356EB%7D&siteid=rss&rss=1 |

|

Bond Report: 10- and 30-year Treasury yields post third weekly drop in four weeks as inflation expectations slipLong-dated Treasury yields finish the week lower on Friday after a heavy barrage of U.S. data. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7FB2-52953EBF8BB3%7D&siteid=rss&rss=1 |