Summary Of the Markets Today:

- The Dow closed down 192 points or 0.62%,

- Nasdaq closed down 0.95%,

- S&P 500 down 0.92%,

- WTI crude oil settled at $95.80 down 8.0%,

- USD $108.17 up 0.15%,

- Gold $1723 down 0.46%,

- Bitcoin $19,463 down 2.4%,

- 10-year U.S. Treasury 2.967% flat 0.0%

Today’s Economic Releases:

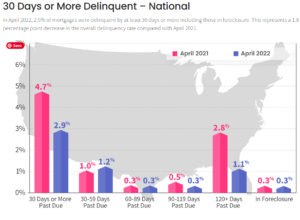

CoreLogic’s Loan Performance Insights Report for April 2022 shows 2.9% of all mortgages in the U.S. were in some stage of delinquency (30 days or more past due, including those in foreclosure), representing a 1.8 percentage point decrease compared to 4.7% in April 2021.

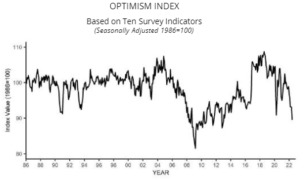

The NFIB Small Business Optimism Index dropped 3.6 points in June to 89.5, marking the sixth consecutive month below the 48-year average of 98. Small business owners expecting better business conditions over the next six months decreased seven points to a net negative 61%, the lowest level recorded in the 48-year survey. Expectations for better conditions have worsened every month this year.

The Conference Board Consumer Confidence Index decreased in June and now stands at its lowest level since February 2021.

A summary of headlines we are reading today:

- BlackRock Is Bracing For Persistent Inflation

- Copper Prices Plummet To Lowest Levels Since 2020

- Hedge Funds Are Unloading Oil Futures In A Hurry

- OPEC Remains 1 Million Bpd Below Target

- Long Beach Container Backlog Crosses Red Line As Delays Mount

- Stocks Sink, Yield Curve Inverts, Crude Crashes As Global Stagflation Accelerates

These and other headlines and news summaries moving the markets today are included below.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

BlackRock Is Bracing For Persistent InflationThe worlds biggest asset manager BlackRock said the era of steady growth and inflation was over as it revealed it had slashed its exposure to developed market equities and was bracing for extended period of volatility. In its mid-year outlook statement yesterday, the investor said it was now bracing for a persistent inflation amid sharp and short swings in economic activity after a fundamental reshaping of the global macroeconomic environment. The Great Moderation, a period of steady growth and inflation, is over, in Read more at: https://oilprice.com/Energy/Energy-General/BlackRock-Is-Bracing-For-Persistent-Inflation.html |

|

IEA Director: Price Cap On Russian Oil Should Extend To FuelsThe G7 idea to place a price cap on Russian oil should include a cap on the prices of gasoline and diesel, too, Fatih Birol, Executive Director of the International Energy Agency (IEA), told Reuters in an interview published on Tuesday. My hope is that the proposal, which is important to minimize the effect on the economies around the world, gets buy-in from several countries, Birol told Reuters on the sidelines of an energy forum in Australia. And if it is pursued, it is not only focused on crude oil, as refined products are Read more at: https://oilprice.com/Latest-Energy-News/World-News/IEA-Director-Price-Cap-On-Russian-Oil-Should-Extend-To-Fuels.html |

|

Copper Prices Plummet To Lowest Levels Since 2020Copper price action continues to show massive bear trends and signals further declines. The continuous breakdown of short-term trading ranges fosters a volatile market. This leaves industrial buyers at risk of inventory value fluctuations. Spike in COVID Cases Puts Chinas Recovery in Limbo and Affects Copper Prices The highly infectious BA.5.2 sub-variant of the coronavirus arrived in China as Beijing issued its first vaccine mandate. Meanwhile, Shanghai’s covid cases rose to their highest level since late May. The city continues Read more at: https://oilprice.com/Metals/Commodities/Copper-Prices-Plummet-To-Lowest-Levels-Since-2020.html |

|

Libyan Oil Crisis Intensifies With Attempt to Remove NOC BoardLibya’s government in Tripoli has reportedly appointed a new board to govern the National Oil Company (NOC), with interim Government of National Unity prime minister dismissing long-time chairman Mustafa Sanalla in a leaked government decree reported by LibyaUpdate. According to the leaked decree, Sanalla will be replaced with Farhat Omar Bengdara, a former Central Bank Governor from 2007 to 2011. The move comes as Libyan oil remains shut-in and protests over blackouts and a political stalemate intensify. Interim prime minister Read more at: https://oilprice.com/Latest-Energy-News/World-News/Libyan-Oil-Crisis-Intensifies-With-Attempt-to-Remove-NOC-Board.html |

|

Hedge Funds Are Unloading Oil Futures In A HurryInvestors dumped petroleum-related derivatives last week at one of the fastest rates of the pandemic era as recession fears intensified. Hedge funds and other money managers sold the equivalent of 110 million barrels in the six most important petroleum-related futures and options contracts in the week to July 5. Fund managers have now sold a total of 201 million barrels in the past four weeks, according to position records published by ICE Futures Europe and the U.S. Commodity Futures Trading Commission. The combined position has fallen to only Read more at: https://oilprice.com/Energy/Crude-Oil/Hedge-Funds-Are-Unloading-Oil-Futures-In-A-Hurry.html |

|

OPEC Remains 1 Million Bpd Below TargetThe ten OPEC producers in the OPEC+ pact pumped 24.8 million barrels per day (bpd) of crude oil in June, OPEC data showed on Tuesday, with production falling 1 million bpd short of the target levels. All 13 OPEC members produced 28.716 million bpd in June, up by 234,000 bpd from May, according to secondary sources used by OPEC to track production in its Monthly Oil Market Report (MOMR). The 10 producers in the OPEC+ pact, however, produced 24.8 million bpd, which was 1 million bpd below OPECs own target of 25.864 million bpd for the ten Read more at: https://oilprice.com/Latest-Energy-News/World-News/OPEC-Remains-1-Million-Bpd-Below-Target.html |

|

Here are the nominees for the major Emmy categories — ‘Succession’ and ‘Ted Lasso’ lead the field“Succession” tops the 2022 Emmy Award nominations followed by “Ted Lasso” and “The White Lotus.” Read more at: https://www.cnbc.com/2022/07/12/emmys-2022-nominations-led-by-succession-ted-lasso.html |

|

Here are four past cases Twitter and Elon Musk’s lawyers will be examining as they head to courtA look at past specific performance cases may help assess Twitter’s chances of forcing Elon Musk into buying the company. Read more at: https://www.cnbc.com/2022/07/12/here-are-four-past-cases-twitter-and-elon-musks-lawyers-will-be-examining-as-they-head-to-court.html |

|

PepsiCo raises revenue forecast as it deploys price hikes, smaller sizes to fight rising costsPepsiCo raised its revenue outlook for the year as consumers snacked on more Doritos chips and drank more Gatorade, even as prices increased. Read more at: https://www.cnbc.com/2022/07/12/pepsico-pep-q2-2022-earnings.html |

|

Peloton to outsource all manufacturing as part of its turnaround effortsInstead, Peloton said it will expand its current relationship with Taiwanese manufacturer Rexon Industrial, in a bid to turn the money-losing business around. Read more at: https://www.cnbc.com/2022/07/12/peloton-to-outsource-all-manufacturing-as-part-of-its-turnaround-efforts.html |

|

Electric vehicle startup Lordstown Motors names new CEO following Foxconn dealVeteran engineer Edward Hightower will lead Lordstown as it transitions to product development. Read more at: https://www.cnbc.com/2022/07/12/electric-vehicle-startup-lordstown-motors-names-new-ceo-following-foxconn-deal-.html |

|

Shares of EV maker Canoo surge after Walmart agrees to buy 4,500 electric delivery vansWalmart will buy at least 4,500, and up to 10,000, of Canoo’s electric delivery vans. Read more at: https://www.cnbc.com/2022/07/12/canoo-walmart-deal-for-4500-vans-sends-ev-stock-jumping.html |

|

U.S. greenhouse gas emissions have caused over $1.8 trillion in global economic losses, study saysResearchers said the findings, published in the journal Climatic Change, could provide opportunities for climate liability claims between individual countries. Read more at: https://www.cnbc.com/2022/07/12/us-emissions-caused-1point8-trillion-in-global-economic-losses-study.html |

|

These 10 U.S. real estate markets are cooling the fastest: Here’s what to know if you’re a prospective buyerAfter staggering growth during the pandemic, the U.S. housing market is starting to cool fastest in cities along the West Coast, according to a Redfin analysis. Read more at: https://www.cnbc.com/2022/07/12/us-real-estate-markets-that-are-cooling-the-fastest.html |

|

Covid hospitalizations have doubled since May as omicron BA.5 sweeps U.S., but deaths remain lowBA.5 does not appear to be more severe than past omicron subvariants, U.S. health officials said. Read more at: https://www.cnbc.com/2022/07/12/covid-hospitalizations-have-doubled-since-may-as-omicron-bapoint5-sweeps-us-but-deaths-remain-low.html |

|

Gap CEO Sonia Syngal is stepping down, effective immediatelySyngal will stay on in a transition period, while Bob Martin, the company’s current executive chairman of the board, will serve as interim president and CEO. Read more at: https://www.cnbc.com/2022/07/11/gap-ceo-sonia-syngal-is-stepping-down-effective-immediately.html |

|

Moviegoers are leaving their couches for theaters, bringing summer box office sales close to pre-pandemic levelsMoviegoers aren’t just returning to cinemas, they are spending more on premium tickets and concessions. Read more at: https://www.cnbc.com/2022/07/11/moviegoers-are-leaving-their-couches-for-theaters-bringing-summer-box-office-sales-close-to-pre-pandemic-levels.html |

|

Stocks making the biggest moves midday: Gap, Peloton, Boeing, American Airlines, Twitter and moreThese are the stocks posting the largest moves in midday trading. Read more at: https://www.cnbc.com/2022/07/12/stocks-making-the-biggest-moves-midday-gap-peloton-boeing-american-airlines-twitter-and-more.html |

|

Op-ed: The toughest challenges for cryptocurrency lie ahead, not in the rear-view mirrorInvestors contemplating a long-term allocation to cryptocurrencies should remain wary, writes Taimur Hyat, chief operating officer of PGIM. Read more at: https://www.cnbc.com/2022/07/12/op-ed-the-toughest-challenges-for-cryptocurrency-lie-ahead.html |

|

Stocks Sink, Yield Curve Inverts, Crude Crashes As Global Stagflation AcceleratesIt was not a pretty day for global sentiment as German investor confidence crashed to its weakest since 2011’s EU debt crisis and then the US NFIB Small Business Outlook hit a record low. Heading into tomorrow’s CPI print, global stagflation appears to be accelerating (inflation is consistently hotter than expected and economic growth weaker than expected)…

Source: Bloomberg Rate-hike expectations have fallen for the last two days… Read more at: https://www.zerohedge.com/markets/us-yield-curve-inverts-crude-crashes-global-stagflation-accelerates |

|

Long Beach Container Backlog Crosses Red Line As Delays MountBy Greg Miller of FreightWaves The number of container ships waiting off Los Angeles and Long Beach is well off its highs, but the pileup of import containers waiting on Southern California terminal yards is rapidly reapproaching its peak. Long Beach just crossed a red line. The number of import containers sitting on Long Beach terminals for nine days or more is now higher than it was on Oct. 28, 2021, the date the port first began counting these boxes as part of a plan to reduce them.

Gains from ‘key’ fee plan largely goneBack in October, the ports of Long Beach and Los Angeles announced a controversial strategy to charge a fee on long-dwelling containers. Or at least, they threatened to charge a fee (it has been delayed ever since). The Biden administration coor … Read more at: https://www.zerohedge.com/economics/long-beach-container-backlog-crosses-red-line-delays-mount |

|

US Is Paying $1.7 Billion To Health Care Workers… In UkraineAs the war in Ukraine heads into its sixth month, military aid from the West has become routine, with the US leading the way after so far sending $7 billion in aid to Kiev since February. But the Biden administration isn’t just propping up Ukraine’s military and aspects of its war-time economy alongside the huge sums of humanitarian aid being regularly sent for the internally displaced refugee problem – the US is now going to pay Ukrainian health care workers.

The healthcare funds come as Ukraine’s minister of health Viktor Liashko is sounding the alarm over collapsing medical and hospital infrastructure and availability, describing that < … Read more at: https://www.zerohedge.com/geopolitical/us-paying-17-billion-health-care-workers-ukraine |

|

Bill Gross Blasts “Ignorant” Fed For Enabling “Global Supernova”, Says Hike Rates ASAP, But…Authored by Bill Gross, (emphasis ours) 3.5% ASAPBack in 2013 I wrote a rather prescient Investment Outlook entitled “Credit Supernova”. It characterized the U.S. and developed global economies economy as “credit based”, especially since 1971 when Nixon broke the gold standard and central banks and private lending institutions were free to expand credit without a firm foundation of gold. Economist Hyman Minsky around the same time created a model which nearly 40 years later led to what became famously known, thanks to Paul McCulley, as a “Minsky moment”. That “moment” was the cause of the 2007-2009 Great Recession and was unique in that it involved the internal implosion of the financial system itself without outside triggers such as war, OPEC, or stringent fiscal policies which had formed the basis of prior Keynesian models. Minsky’s system categorized three stages of monetary evolution from what he called “hedge finance” to “speculative finance” and finally to “Ponzi Finance”, with each stage requiring more and more credit growth to keep nominal GDP at acceptable levels but with accelerating inflation and the possible “implosion” (supernova) of a fragile debt-ladened economy as the end result. My 2013 Investment Outlook noted (thankfully) that this supernova metaphor was more instructive than literal at that time. The end of the global monetary system was not nigh but it was losing energy and was entropic, because more and more cred … Read more at: https://www.zerohedge.com/markets/bill-gross-blasts-ignorant-fed-enabling-global-supernova-says-hike-rates-asap |

|

Network Rail puts fresh pay offer to unionsThe rail track firm says the offer is worth more than 5%, but unions say it is a real terms pay cut. Read more at: https://www.bbc.co.uk/news/business-62141374?at_medium=RSS&at_campaign=KARANGA |

|

Heathrow tells airlines to stop selling summer ticketsThe airport limits the number of passengers who can depart each day as it struggles to cope with demand. Read more at: https://www.bbc.co.uk/news/business-62136022?at_medium=RSS&at_campaign=KARANGA |

|

Lego pulls out of Russia ‘indefinitely’The Danish toymaker says it will end its partnership with a company which runs its 81 shops. Read more at: https://www.bbc.co.uk/news/business-62139668?at_medium=RSS&at_campaign=KARANGA |

|

Tech View: Nifty forms bearish candle; a fall below 16,000 may attract selling“The 16,000-16,275 range is a tight consolidation range. The index is now approaching the lower end of the consolidation range i.e. 16,000 that needs to be monitored closely on a closing basis. A breach of 16,000 on a closing basis will drag the index into a short-term correction mode,” Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-forms-bearish-candle-a-fall-below-16000-may-attract-selling/articleshow/92830918.cms |

|

2 stocks that may contribute 65% of incremental Nifty earnings in Q1“These two companies contribute 65 per cent to Nifty’s incremental earnings,” said Motilal Oswal. The brokerage is expecting sales for Nifty50 to grow at 35 per cent, Ebitda at 19 per cent and profit before tax at 29 per cent. Kotak said it sees Nifty50 profit growing 27 per cent YoY but down 11 per cent sequentially. Read more at: https://economictimes.indiatimes.com/markets/stocks/earnings/2-stocks-that-may-contribute-65-of-incremental-nifty-earnings-in-q1/articleshow/92824905.cms |

|

What should investors do with Gujarat Fluorochemicals, ITC and Eicher Motors?Indian market snapped a 3-day winning streak on Monday to close marginally in the red following muted global cues. The S&P BSE Sensex was down by nearly 100 points while the Nifty50 managed to hold on to 16,200 levels. Sectorally, buying was seen in power, utilities, oil & gas, energy, and metals while some selling was visible in IT, capital goods, and telecom stocks. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/big-movers-on-d-st-what-should-investors-do-with-gujarat-fluorochemicals-itc-and-eicher-motors/articleshow/92817407.cms |

|

Living With Climate Change: Amazon Prime Day: 7 ‘greener’ ways to shop the deals, including plastic-free packagingClimate-conscious shoppers can limit their guilt for jumping on Amazon Prime Day deals if they’re smart about packaging and delivery options. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7F8A-458631267160%7D&siteid=rss&rss=1 |

|

Elon Musk is losing more than $150 million on his Twitter stockShares of Twitter Inc. bounced Tuesday, but stayed below where Elon Musk purchased his 73.1 million share stake earlier this year. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7F8F-9B8579565306%7D&siteid=rss&rss=1 |

|

The Tell: Stock market faces inflation test Wednesday: Here are ‘good, bad and ugly’ scenariosThe June consumer-price index won’t reflect the latest drop in commodity prices, but that doesn’t mean it won’t have a serious impact on markets. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7F8C-08530EC7B0DD%7D&siteid=rss&rss=1 |

Administrator of USAID Samantha Power. Source: USAID”Ukraine is getting an additional $1.7 billion in assistance from the U.S. government and the World Bank to pay the salaries of its beleaguered health care workers and provide other essential services,” Politico reports Tuesday.

Administrator of USAID Samantha Power. Source: USAID”Ukraine is getting an additional $1.7 billion in assistance from the U.S. government and the World Bank to pay the salaries of its beleaguered health care workers and provide other essential services,” Politico reports Tuesday.