Summary Of the Markets Today:

- The Dow closed down 154 points or 0.35%,

- Nasdaq closed down 49 points or 0.25%, (New Historic high 19,887, Closed at 19,737)

- S&P 500 closed down 18 points or 0.30%,

- Gold $2,719 up $32.70 or 1.21%,

- WTI crude oil settled at $68 up $0.03 or 0.04%,

- 10-year U.S. Treasury 4.224 up 0.025 points or 0.595%,

- USD index $106.41 up $0.27 or 1.24%,

- Bitcoin $96,576 down $1,198 or 1.21%, (24 Hours),

*Stock data, cryptocurrency, and commodity prices at the market closing

Today’s Highlights

US stock markets experienced slight declines. Alphabet’s shares (Google’s parent company) jumped by over 4% following the announcement of breakthroughs in quantum computing with its new Willow quantum chip. This development initially boosted the tech sector but failed to sustain overall market gains. Oracle shares fell more than 7% after reporting quarterly revenue that fell short of expectations due to intense competition in the cloud computing space. Despite reporting a 34% year-on-year increase in November revenue, Taiwan Semiconductor Manufacturing Co.’s stock slipped nearly 3% as the figure represented a decline from the previous month. Anticipation of CPI Report Investors are keenly awaiting Wednesday’s Consumer Price Index (CPI) report, which is expected to show: Headline inflation of 2.7%, slightly up from October’s 2.6%. Core inflation (excluding food and gas) of 3.3% year-over-year. The CPI report is crucial for the Federal Reserve’s upcoming interest rate decision, with many anticipating a potential rate cut in December if inflation continues to show signs of cooling.

Click here to read our current Economic Forecast – December 2024 Economic Forecast: Insignificant Improvement And Still Indicating a Weak Economy

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

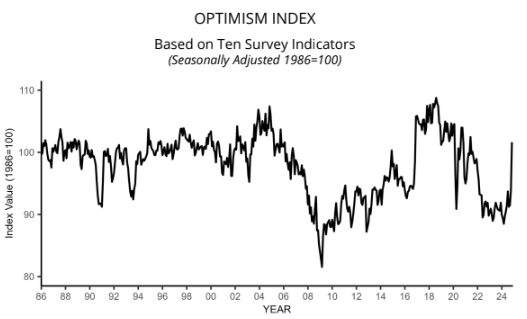

The NFIB Small Business Optimism Index rose by eight points in November to 101.7, after 34 months of remaining below the 50-year average of 98. This is the highest reading since June 2021. Of the 10 Optimism Index components, nine increased, none decreased, and one was unchanged. Not a fan of surveys – but business confidence indices above 100 suggest increased confidence in near-future business performance, which can be used to anticipate turning points in economic activity. NFIB Chief Economist Bill Dunkelberg added:

The election results signal a major shift in economic policy, leading to a surge in optimism among small business owners. Main Street also became more certain about future business conditions following the election, breaking a nearly three-year streak of record high uncertainty. Owners are particularly hopeful for tax and regulation policies that favor strong economic growth as well as relief from inflationary pressures. In addition, small business owners are eager to expand their operations.

Here is a summary of headlines we are reading today:

- Iran’s ‘Axis of Resistance’ Crumbles

- CME’s New 1-Ounce Gold Futures: A Game-Changer or a Paper Tiger?

- Trump Urges Putin to Seize Moment, Make Ukraine Deal

- EV Battery Pack Prices Drop the Most in Seven Years

- Saudi Arabia Accelerates $2.5 Trillion Mining Plans To Cut Oil Reliance

- Oil Prices Remain Under Pressure Despite Geopolitical Risk

- Alphabet shares jump 5% after Google touts ‘breakthrough’ quantum chip

- Dow falls more than 100 points to notch four losing days as year-end rally takes a breather: Live updates

- The CPI report Wednesday is expected to show progress on inflation has hit a wall

- Bitcoin continues pullback from all-time highs, trading near $96,000: CNBC Crypto World

- Treasury Yields Drop After 3Y Auction Tails But Is Otherwise Solid

- UnitedHealth shooting sparks security fears for execs but fixes are expensive and complicated

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Iran’s ‘Axis of Resistance’ CrumblesIran spent decades building the so-called axis of resistance, its network of regional armed proxies, Tehran-backed militant groups, and allied state actors. The network was the lynchpin of Tehran’s efforts to deter Israel and the United States and exert its influence across the Middle East. But the fall of the government of Syrian President Bashar al-Assad, an ally of Tehran, has done irreparable damage to the network, analysts say.For Iran, Syria provided a crucial land corridor to the Levant that was considered the logistical backbone of the… Read more at: https://oilprice.com/Geopolitics/International/Irans-Axis-of-Resistance-Crumbles.html |

|

ExxonMobil Ramps Up P’nyang Development, Eyes LNG DominationExxonMobil is shifting into high gear with its P’nyang gas field in Papua New Guinea (PNG), fast-tracking the project by “years sooner than previously envisaged”. This acceleration comes as the supermajor doubles down on its ambitious plans to expand its LNG portfolio to 40 million tons annually by 2030. The P’nyang field, holding a staggering 4.4 trillion cubic feet of gas, is key to keeping PNG’s LNG industry humming. With groundwork starting as early as April-June 2025, Exxon is advancing its concept select phase… Read more at: https://oilprice.com/Latest-Energy-News/World-News/ExxonMobil-Ramps-Up-Pnyang-Development-Eyes-LNG-Domination.html |

|

CME’s New 1-Ounce Gold Futures: A Game-Changer or a Paper Tiger?CME Group Inc., the parent company of COMEX, the leading U.S. exchange for gold and silver futures, will introduce a one-ounce gold futures contract in January. This move comes in response to soaring demand from retail investors, spurred by gold’s record-breaking rally this year from $2,000 to $2,630—a respectable 32% gain. Smaller-sized gold products have grown increasingly popular among retail investors seeking exposure to precious metals and greater diversification in their portfolios. Jin Hennig, CME’s Global Head of Metals, described… Read more at: https://oilprice.com/Metals/Commodities/CMEs-New-1-Ounce-Gold-Futures-A-Game-Changer-or-a-Paper-Tiger.html |

|

European Steel Market Faces Further ConsolidationVia Metal Miner ThyssenKrupp Steel (TKS) recently announced plans to cut up to 11,000 positions. In a blow to the struggling EU steel market, the German steelmaker stated it would also reduce rolled production by an average 23%. “This is the company’s response to the further consolidation of fundamental and structural changes in the European steel market and in key customer and target markets,” the steelmaker said in a November 25 announcement. “Increasingly, overcapacity and the resulting rise in cheap imports, particularly… Read more at: https://oilprice.com/Energy/Energy-General/European-Steel-Market-Faces-Further-Consolidation.html |

|

LNG Developers Caught in a Regulatory Waiting GameIf you think LNG is America’s energy darling, think again. Two major Gulf Coast projects—Venture Global’s CP2 and Commonwealth LNG—are stuck in limbo as the U.S. Department of Energy (DOE) says its hands are tied until the Federal Energy Regulatory Commission (FERC) finishes environmental reviews. This isn’t just bureaucratic red tape; it’s a tug-of-war between energy expansion and environmental scrutiny. FERC recently yanked Venture Global’s construction go-ahead for CP2, demanding another environmental review.… Read more at: https://oilprice.com/Latest-Energy-News/World-News/LNG-Developers-Caught-in-a-Regulatory-Waiting-Game.html |

|

Trump Urges Putin to Seize Moment, Make Ukraine DealPresident-elect Donald Trump said Russia and Iran are in a “weakened state” and called on Kremlin leader Vladimir Putin to end the nearly three-year war in Ukraine. Trump made the comments in a post on Truth Social on December 8 as Syrian rebels captured Damascus, ending the half-century rule of the Russia- and Iran-backed Assad family. The incoming U.S. president said Russia and Iran couldn’t come to the support of Syrian dictator Assad because they were in a “weakened state right now, one because of Ukraine and a bad economy, the other because… Read more at: https://oilprice.com/Geopolitics/International/Trump-Urges-Putin-to-Seize-Moment-Make-Ukraine-Deal.html |

|

EV Battery Pack Prices Drop the Most in Seven YearsThe price of battery packs for electric vehicles has dropped this year by the most since 2017 as oversupply from China and cheaper lithium prices have driven the decline, the annual battery price survey by BNEF showed on Tuesday. The average price of a lithium-ion EV battery pack has declined by 20% annually to $115 per kilowatt-hour (kWh) this year, BNEF’s survey found. A price of $100 per kWh is generally considered by industry observers as the inflection point at which electric vehicles (EVs) would reach price parity with conventional… Read more at: https://oilprice.com/Latest-Energy-News/World-News/EV-Battery-Pack-Prices-Drop-the-Most-in-Seven-Years.html |

|

Saudi Arabia and OPEC+ Brace for Impact as Trump Plans New Oil MovesIn is exceptionally difficult to imagine Saudi Arabia’s Crown Prince Mohammed bin Salman and his United Arab Emirates (UAE) counterpart Sheikh Mohammed bin Zayed al Nahyan disdaining to take an urgent telephone call from President Donald Trump, as they did from President Joe Biden at the height on the energy crisis just after Russia had invaded Ukraine in 2022. However, at its 5 December meeting, selected members of the OPEC+ oil cartel decided to delay the rollback of 2.2 million barrels per day (bpd) of oil production cuts (supposedly being… Read more at: https://oilprice.com/Energy/Crude-Oil/Saudi-Arabia-and-OPEC-Brace-for-Impact-as-Trump-Plans-New-Oil-Moves.html |

|

These Five States Produced 70% of U.S. Natural Gas Last YearJust five states produced more than 70% of the record U.S. natural gas marketed output last year, with Texas accounting for over one-fourth, the Energy Information Administration (EIA) said on Tuesday. The U.S. produced a record-breaking 113.1 billion cubic feet per day (Bcf/d) natural gas volumes in 2023. Texas accounted for 28% of all gas production last year, followed by Pennsylvania, Louisiana, West Virginia, and New Mexico, according to the EIA’s Natural Gas Monthly publications. Pennsylvania’s share of U.S. natural gas production… Read more at: https://oilprice.com/Latest-Energy-News/World-News/These-Five-States-Produced-70-of-US-Natural-Gas-Last-Year.html |

|

Saudi Arabia Accelerates $2.5 Trillion Mining Plans To Cut Oil RelianceAfter enjoying a rare budget surplus in 2022 amid high oil prices, most Gulf Cooperation Council (GCC) economies have seen their budget deficits widen with current oil prices still well below what they require to balance their budgets. According to the IMF, Saudi Arabia, the GCC’s biggest economy, needs an oil price of $96.20 per barrel to balance its books, more than $20 above current oil prices. The situation is not helped by the fact that over the past two years, the oil-rich nation has borne the lion’s share of OPEC+ production… Read more at: https://oilprice.com/Energy/Energy-General/Saudi-Arabia-Accelerates-25-Trillion-Mining-Plans-To-Cut-Oil-Reliance.html |

|

EU Members Advised Not to Grant UK Greater Access to Power MarketsAs the EU and the UK are looking to reset their post-Brexit relationship, the European Union’s executive arm, the European Commission, has told EU member states not to give the UK greater access to the EU electricity markets, the Financial Times reports, quoting a working paper it has seen. The advice aligns with the EU’s “no cherry-picking” stance regarding trade and market relations with the UK after Britain left the bloc. But it also goes contrary to what industry in both the EU and the UK want. In the document circulated… Read more at: https://oilprice.com/Latest-Energy-News/World-News/EU-Members-Advised-Not-to-Grant-UK-Greater-Access-to-Power-Markets.html |

|

Oil Prices Remain Under Pressure Despite Geopolitical RiskOil prices remain under pressure despite the recent developments in Syria, with oil market fundamentals countering geopolitical uncertainty.- Expectations for a weaker dollar in 2025-2026 are being gradually reconsidered as Donald Trump’s re-election and the prospect of stronger-than-expected US economic performance improved the outlook of the greenback.- Institutional investors have halved their net short dollar positions to just 2 billion in the week to December 3, the least in more than seven years, according to data aggregated by the… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Prices-Remain-Under-Pressure-Despite-Geopolitical-Risk.html |

|

CNPC: China’s Oil Demand Could Peak in 2025Oil demand in China, the world’s top crude importer, could peak as early as next year as the penetration of electric vehicles and LNG trucks is accelerating, state-owned China National Petroleum Corporation (CNPC) said on Tuesday. At this time last year, CNPC expected a peak in oil demand coming to China by 2030. Now, after a year of EVs and LNG-fueled trucks displacing some gasoline and diesel demand, respectively, the peak in China’s oil demand may occur five years earlier, in 2025, according to a report by CNPC economists carried… Read more at: https://oilprice.com/Latest-Energy-News/World-News/CNPC-Chinas-Oil-Demand-Could-Peak-in-2025.html |

|

World Coal Demand and Exports Set for New Record Highs in 2024The world’s consumption and exports of thermal coal are expected to rise this year from 2023 to hit fresh record-highs, according to export and power generation data cited by Reuters columnist Gavin Maguire. Coal-fired electricity generation has increased so far this year by 2% compared to 2023, to hit new highs as power demand in emerging markets grows. Coal power emissions are also set to rise to a record high in 2024, according to data from energy think tank Ember quoted by Maguire. Moreover, global exports of thermal coal – the… Read more at: https://oilprice.com/Latest-Energy-News/World-News/World-Coal-Demand-and-Exports-Set-for-New-Record-Highs-in-2024.html |

|

Bad Weather Delays Equinor’s Arctic Oilfield Startup to Early 2025The start-up of the Johan Castberg in the Barents Sea in the Arctic has been postponed to January or February 2025 from an initial launch date by the end of this year, due to bad weather conditions, Norwegian energy major Equinor said on Tuesday. Johan Castberg, a large field in the Barents Sea, has estimated recoverable volumes of between 450 and 650 million barrels of crude oil. The resource base for developing the Johan Castberg field consists of the three oil discoveries: Skrugard, Havis, and Drivis. The field will produce for 30 years, and… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Bad-Weather-Delays-Equinors-Arctic-Oilfield-Startup-to-Early-2025.html |

|

Alphabet shares jump 5% after Google touts ‘breakthrough’ quantum chipGoogle shares rose on Tuesday after the company’s unveiling of “Willow,” its latest quantum computing chip. Read more at: https://www.cnbc.com/2024/12/10/alphabet-shares-jump-5percent-after-google-touts-breakthrough-quantum-chip-.html |

|

Luigi Mangione rages about ‘insult’ to American people, challenges UnitedHealthcare murder extraditionLuigi Mangione is accused of killing UnitedHealthcare CEO Brian Thompson outside the Hilton hotel in New York City before fleeing to Pennsylvania last week. Read more at: https://www.cnbc.com/2024/12/10/luigi-mangione-extradition-brian-thompson.html |

|

Michael Saylor’s case for Microsoft buying bitcoin gets rejected by shareholdersMicrosoft investors voted against a proposal to consider diversifying the company’s balance sheet by purchasing bitcoin. Read more at: https://www.cnbc.com/2024/12/10/michael-saylor-case-for-microsoft-buying-bitcoin-gets-rejected-.html |

|

Dow falls more than 100 points to notch four losing days as year-end rally takes a breather: Live updatesStocks hovered near the flatline as traders digested a year-end rally to record levels while awaiting new U.S. inflation data set for release this week. Read more at: https://www.cnbc.com/2024/12/09/stock-market-today-live-updates.html |

|

The CPI report Wednesday is expected to show progress on inflation has hit a wallThe consumer price index is expected to show a 2.7% 12-month inflation rate for November. Read more at: https://www.cnbc.com/2024/12/10/the-cpi-report-wednesday-is-expected-to-show-progress-on-inflation-has-hit-a-wall.html |

|

Wall Street is eyeing this key inflation level to see if the Fed will keep cutting interest ratesTwo key inflation reports this week will impact next week’s Federal Reserve rate cut decision, including the consumer price index release on Wednesday. Read more at: https://www.cnbc.com/2024/12/10/investors-eye-this-key-inflation-level-to-see-if-fed-will-keep-cutting.html |

|

Oracle shares head for worst day of 2024 after earnings missOracle shares fell on Tuesday following disappointing quarterly results from the database software company. Read more at: https://www.cnbc.com/2024/12/10/oracle-shares-head-for-worst-day-of-2024-after-q2-earnings-miss.html |

|

Bitcoin continues pullback from all-time highs, trading near $96,000: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Alex Thorn of Galaxy Digital discusses the recent pullback in crypto prices. Read more at: https://www.cnbc.com/video/2024/12/10/bitcoin-pullback-from-all-time-highs-trading-near-96000-crypto-world.html |

|

Walgreens shares pop on report pharmacy chain could sell itself to PE firm SycamoreWalgreens and Sycamore have been discussing a deal that could be completed early next year, The Wall Street Journal reported. Read more at: https://www.cnbc.com/2024/12/10/walgreens-shares-pop-on-report-pharmacy-chain-could-sell-itself-to-pe-firm-sycamore.html |

|

Court blocks Kroger’s $25 billion acquisition of grocery rival AlbertsonsThe FTC argued the merger would eliminate head-to-head competition between the top two traditional grocery chains, leading to higher prices for shoppers. Read more at: https://www.cnbc.com/2024/12/10/court-blocks-krogers-25-billion-acquisition-of-grocery-rival-albertsons-.html |

|

How the Olympics helped transform Salt Lake City into a tech hubWith Salt Lake City set to host the Winter Olympics again in 2034, Utah will invest $31 million in upgrades and expects billions in economic benefit. Read more at: https://www.cnbc.com/2024/12/10/olympics-salt-lake-city-tech-hub.html |

|

Inside Salt Lake City’s booming banking industryCNBC takes viewers on a deep dive into Salt Lake City’s booming industrial banking sector. Read more at: https://www.cnbc.com/2024/12/10/inside-salt-lake-citys-booming-banking-industry.html |

|

If Trump adds tariffs, ‘either way, there is a cost to consumers,’ economist saysPresident-elect Donald Trump’s tariff plan is expected to raise costs, especially for low and middle earners, experts said. But the scope of tariffs is unclear. Read more at: https://www.cnbc.com/2024/12/10/trump-tariffs-would-add-costs-for-consumers-economist-says.html |

|

Dalio Predicts Global Debt Crisis, Backs Bitcoin & GoldAuthored by Helen Partz via CoinTelegraph.com, Billionaire investor Ray Dalio expressed concerns about a potential “pending debt money problem” in global finance and urged a shift toward hard assets like Bitcoin and gold.

Dalio, the founder of one the world’s largest hedge funds, Bridgewater Associates, said he would invest in “hard money” like gold and Bitcoin while avoiding debt assets, the South China Morning Post reported on Dec. 10. The veteran investor referred to “unprecedented levels” of indebtedness seen in all major countries, including the United States and China, stressing that its current levels will not be sustainable. “It is impossible for these countries to be able to not … Read more at: https://www.zerohedge.com/markets/dalio-predicts-global-debt-crisis-backs-bitcoin-gold |

|

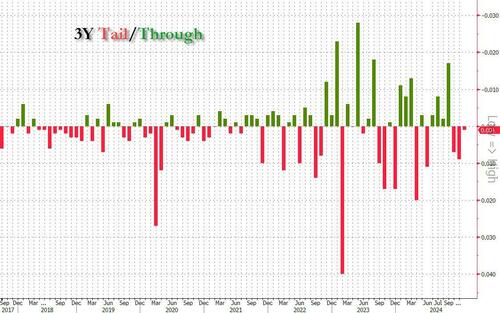

Treasury Yields Drop After 3Y Auction Tails But Is Otherwise SolidThe year may be drawing to a close but the US needs to feed the government debt monster – which just hit a record $36.17 trillion – with more and more debt come rain, shine, Chritmas, New Years, etc, etc, and this week happens to have three coupon auctions on deck, the first of which just concluded. At 1pm, the US Treasury sold $58BN in 3Y paper, at a yield of 4.117%, down from last month’s 4.152% but tailing the When Issued 4.116% by 10.1bps, and the third tail in a row.

The bid to cover dipped to 2.577 from 2.603 last month, but was just above the 2.56 six-auction average. As shown in the chart below, the BTC on the 3Y has been pretty much fixed for the past 6 years in the 2.4-2.8 range. The internals were ok. Indirects dropped to 64.2%, from 70.6% in November, and below the recent average of 66.4%. And with Directs surging to 20.7% from 9.6% in November, and above the 17.1% average, Dealers were left with just 15.1%, the lowest since September. Read more at: https://www.zerohedge.com/markets/treasury-yields-drop-after-3y-auction-tails-otherwise-solid |

|

Elon Musk Jokes Bill Gates Could Go “Bankrupt” On Backfiring Short Tesla BetThe rivalry between two of America’s top billionaires, Elon Musk and Bill Gates, continued on Tuesday morning when Musk jokingly suggested on X that Gates’ alleged short position on Tesla might lead to his financial demise. “If Tesla does become the world’s most valuable company by far, that short position will bankrupt even Bill Gates,” Musk wrote on X, referring to a multi-billion dollar equity short Gates put on Tesla a couple of years ago.

According to Walter Isaacson’s 2023 biography of Musk, Gates held an undisclosed short position in Tesla, allegedly worth billions. In late 2023, Musk wrote on X: “Gates placed a massive bet on Tesla dying when our company was at one of its weakest moments several years ago. Such a big short position also drives the stock down for everyday investors,” adding, “To the best of my knowledge, Gates *still* has that massive bet against Tesla on the table. Someone should ask him if he does.” Musk noted, “The lack of self-awareness and hypocrisy of Gates who had the nerve to ask me to donate to his mostly window-dressing environmental causes, while simultaneously … Read more at: https://www.zerohedge.com/markets/elon-musk-jokes-bill-gates-could-go-bankrupt-backfiring-tesla-bear-bet |

|

SCOTUS Asked To Block State From Investigating Doctors Who Question COVID-19 PoliciesAuthored by Matthew Vadum via The Epoch Times (emphasis ours), U.S. Supreme Court Justice Clarence Thomas this week revived an emergency application to block the Washington Medical Commission from investigating licensed physicians in the state over their criticism of COVID-19 policies.

A man receives a dose of the Pfizer COVID-19 vaccine in downtown Seattle on Jan. 24, 2021. Grant Hindsley/AFP via Getty Images The Washington state commission deems the doctors’ dissenting views on the disease as potentially dangerous misinformation that should be suppressed. The physicians counter that just because they have medical licenses they don’t forfeit their free speech rights under the F … Read more at: https://www.zerohedge.com/political/scotus-asked-block-state-investigating-doctors-who-question-covid-19-policies |

|

Avanti West Coast workers to strike over ChristmasTrain managers have voted for walkouts on 22, 23 and 29 December in a row over rest days. Read more at: https://www.bbc.com/news/articles/c1j0pn23ryjo |

|

Thames Water boss defends exec bonuses as sewage spills soarThe company saw a 40% increase in pollution incidents in the first half of the year as its debts continued to swell. Read more at: https://www.bbc.com/news/articles/cg4zklxgwwwo |

|

Car loan scandal victims told to complainAggrieved car buyers who feel they were mis-sold a loan should complain to their lender, MPs hear. Read more at: https://www.bbc.com/news/articles/c24n174qj35o |

|

MobiKwik raises Rs 257 crore from anchor investors ahead of IPOMobiKwik secured Rs 257 crore from anchor investors, including major funds, ahead of its Rs 572 crore IPO. The IPO, priced at Rs 265-279 per share, opens December 11-13. The company plans to use the proceeds for growth, expansion, and R&D. MobiKwik recently turned profitable after years of losses. Read more at: https://economictimes.indiatimes.com/markets/ipos/fpos/mobikwik-raises-rs-257-crore-from-anchor-investors-ahead-of-ipo/articleshow/116182126.cms |

|

Sebi revises guidelines for capacity planning, real-time performance monitoring of MIIsMarkets regulator Sebi on Tuesday came out with new guidelines for stock exchanges, clearing corporations and depositories to ensure robust capacity planning and real-time performance monitoring of their critical IT systems. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/sebi-revises-guidelines-for-capacity-planning-real-time-performance-monitoring-of-miis/articleshow/116181137.cms |

|

MobiKwik looks well placed to take advantage of growing digital payments trendMobiKwik is raising Rs 572 crore through an IPO to fund business expansion. The company offers online payment solutions and financial services. It has a large user base and strong growth in GMV. However, profitability remains a concern. Investors with a higher risk appetite and long-term horizon may consider the IPO. Read more at: https://economictimes.indiatimes.com/markets/ipos/fpos/mobikwik-looks-well-placed-to-take-advantage-of-growing-digital-payments-trend/articleshow/116178534.cms |

|

Federal judge blocks Kroger-Albertsons mergerA federal judge has blocked supermarket chain Kroger Co.’s merger deal with rival Albertsons Cos., saying it would stifle competition, Bloomberg reported on Tuesday. Read more at: https://www.marketwatch.com/story/federal-judge-blocks-kroger-albertsons-merger-4db1cb7a?mod=mw_rss_topstories |

|

Treasury yields finish higher for second day, ahead of CPI inflation dataYields on U.S. government debt ended at their highest levels in at least a week on Tuesday as investors awaited November’s consumer-price index ahead of the Federal Reserve’s final monetary-policy meeting of the year. Read more at: https://www.marketwatch.com/story/treasury-yields-nudge-higher-as-cpi-inflation-report-looms-95989f1c?mod=mw_rss_topstories |

|

UnitedHealth shooting sparks security fears for execs but fixes are expensive and complicatedSecurity company execs have seen a dramatic increase in inquiries for services after the murder of Brian Thompson. Read more at: https://www.marketwatch.com/story/unitedhealth-shooting-sparks-security-fears-but-fixes-are-expensive-and-complicated-for-execs-and-corporations-6d622a8f?mod=mw_rss_topstories |