Summary Of the Markets Today:

- The Dow closed up 309 points or 0.69%,

- Nasdaq closed up 254 points or 1.30%,

- S&P 500 closed up 37 points or 0.61%,

- Gold $2,675 up $6.60 or 0.24%,

- WTI crude oil settled at $69 down $1.13 or 1.62%,

- 10-year U.S. Treasury 4.186 down 0.035 points or 0.83%,

- USD index $106.33 down $0.03 or 0.02%,

- Bitcoin $98,882 up $2,891 or 3.01%, (24 Hours)

*Stock data, cryptocurrency, and commodity prices at the market closing

Today’s Highlights

On Wednesday, all three major US stock indexes reached record closing highs, driven by a tech rally. The Dow Jones Industrial Average surpassing 45,000 for the first time. Investors reacted positively to Federal Reserve Chair Jerome Powell’s comments at the New York Times DealBook Summit, where he described the US economy as being in “remarkably good shape.” This bolstered confidence that the Fed may cut interest rates at its upcoming December meeting, with traders estimating a 77% chance of a 25 basis point reduction. Significant gains were seen in major tech stocks: Amazon (AMZN) and Apple (AAPL) both reached intraday all-time highs. Nvidia (NVDA) surged over 3%, nearing its record. Salesforce (CRM) stock jumped by 11% following strong quarterly revenue results that raised expectations for its AI products. Bitcoin approached $100,000 per coin amid positive investor sentiment following President-elect Donald Trump’s nomination of Paul Atkins as SEC Chairman, who is viewed favorably by the cryptocurrency community.

Click here to read our current Economic Forecast – December 2024 Economic Forecast: Insignificant Improvement And Still Indicating a Weak Economy

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

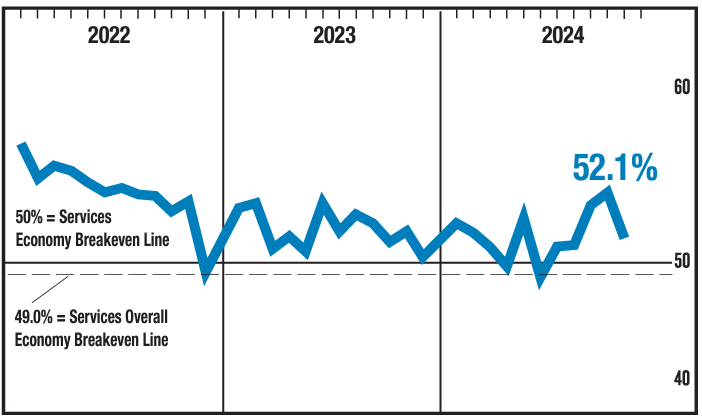

In November 2024, the ISM Services PMI® registered 52.1 percent, 3.9 percentage points lower than October’s figure of 56 percent. A reading close to but above 50 indicates a weak economy.

The November 2024 Beige Book showed a slight economic increase in most Districts with no increase or decline in two Districts (San Francisco and Boston). Consumer Spending was generally stable with decreased spending on home furnishings. There was low mortgage demand with mixed recent trends with subdued commercial real estate lending Flat or declining capital spending with weak farm equipment sales, flat oil and gas activity, but growing electricity demand. Labor Markets were flat or slightly increasing with subdued hiring activity and softening wage growth except in entry-level and skilled trades positions. There were modest price increases with difficulty in passing costs to customers. Rising input prices outpacing selling prices. Significant cost pressures from rising insurance prices. Remember this Fed release is simply anecdotal – it is the gut feel for each of the Fed Districts.

Here is a summary of headlines we are reading today:

- Oil Prices Predicted to Plummet Below $60 Under Trump

- Rare Earth Prices Surge as Myanmar Mines Fall Under Rebel Control

- Shell Splits Power Division and Scales Back Offshore Wind

- NATO Pledges Urgent Support for Ukraine’s Battered Infrastructure

- China’s Export Ban Sends Antimony Prices Soaring 40% in One Day

- Oil Prices Tick Higher on Crude Inventory Draw

- Russia’s Oil Revenues Slump by 21% as Prices Drop

- Aramco, SLB, and Linde to Build One of the World’s Top Carbon Capture Hubs

- French government toppled in no-confidence vote brought by opposition

- Trump picks Peter Navarro as top trade advisor

- Trump considers replacing Pete Hegseth, his embattled secretary of defense pick, with Ron DeSantis

- Trump Selects An Actual Astronaut To Lead NASA

- Why More Middle Income Americans Are Struggling to Save Money

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Oil Prices Predicted to Plummet Below $60 Under TrumpA new survey from law firm Haynes Boone LLC has revealed that banks are gearing up for oil prices to fall below $60 a barrel by the middle of President-elect Donald Trump’s new term, Bloomberg reported on Monday. The survey of 26 bankers showed that they expect WTI prices to drop to $58.62 a barrel by 2027, more than $10 lower than the intraday price of $69.87 at 11.00 am ET on Wednesday. Trump says he’ll push shale producers to ramp up output, even if it means operators “drill themselves out of business.” However,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Oil-Prices-Predicted-to-Plummet-Below-60-Under-Trump.html |

|

Rare Earth Prices Surge as Myanmar Mines Fall Under Rebel ControlVia Metal Miner The Rare Earths MMI (Monthly Metals Index) trended sideways with a slightly downward movement of 2.59%. Numerous factors remain at play within the global rare earths market. One of the most significant factors rare earths buyers need to remain aware of is the ongoing conflict within Myanmar, one of the world’s key rare earth suppliers, regarding rebel mine takeovers. The Kachin Independence Army (KIA) caused numerous problems throughout November, including seizing control of Kanpaiti, a pinnacle rare earths trading point within… Read more at: https://oilprice.com/Metals/Commodities/Rare-Earth-Prices-Surge-as-Myanmar-Mines-Fall-Under-Rebel-Control.html |

|

UK’s £1 Billion Wind Power Waste Sparks Net-Zero ConcernsThe clean Green energy fiasco has reached a new level of incompetence and waste… Totally Wasted Wind Power Bloomberg reports UK Is Paying £1 Billion to Waste a Record Amount of Wind Power Burgeoning capacity and blustery weather should have driven huge growth in output in 2024. But the grid can’t cope, forcing the operator to pay wind farms to turn off, a cost ultimately borne by consumers. It’s a situation that puts at risk plans to decarbonize the network by 2030 and makes it harder to cut bills. Crucial to the net zero grid… Read more at: https://oilprice.com/Alternative-Energy/Wind-Power/UKs-1-Billion-Wind-Power-Waste-Sparks-Net-Zero-Concerns.html |

|

Shell Splits Power Division and Scales Back Offshore WindShell Plc (NYSE:SHEL) has announced plans to cease new offshore wind investments and is splitting its power division as CEO Wael Sawan looks to boost the company’s profitability. “While we will not lead new offshore wind developments, we remain interested in offtakes where commercial terms are acceptable and are cautiously open to equity positions, if there is a compelling investment case,” a company spokesperson said in a statement carried by Reuters. Shell appears to be systematically scaling back its clean… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Shell-Splits-Power-Division-and-Scales-Back-Offshore-Wind.html |

|

The Global Energy Transition Is at Risk After COP29 Pledges Fall ShortThe 29th Conference of the Parties (COP29) in Baku, Azerbaijan concluded last week, with lengthy and challenging negotiations yielding an eleventh-hour deal on tackling climate change. At its core was a groundbreaking pledge by wealthy nations to provide $300 billion annually in climate finance by 2035—a tripling of the current target, but significantly lower than what is needed to support emerging and developing economies. Last year, energy end-users spent a staggering $10.5 trillion, with $6.3 trillion borne by non-OECD countries.… Read more at: https://oilprice.com/Energy/Energy-General/The-Global-Energy-Transition-Is-at-Risk-After-COP29-Pledges-Fall-Short.html |

|

NATO Pledges Urgent Support for Ukraine’s Battered InfrastructureNATO members have agreed to make protecting Ukraine’s infrastructure a top priority, alliance chief Mark Rutte said on December 4, as Russia continues to pound Ukrainian cities and towns with drone and missile strikes. Speaking to reporters ahead of the second day of a meeting of foreign ministers from the 32-member military alliance, Rutte said the gathering discussed providing Ukraine with enough air defense systems to protect its infrastructure against Russian attacks. “There was a clear agreement around the table last night that to help Ukraine,… Read more at: https://oilprice.com/Energy/Energy-General/NATO-Pledges-Urgent-Support-for-Ukraines-Battered-Infrastructure.html |

|

China’s Export Ban Sends Antimony Prices Soaring 40% in One DayAntimony prices soared 40% on Wednesday after China on Tuesday banned exports to the United States of several critical minerals. China enforced the existing limits on antimony, gallium, and germanium – critical minerals that have widespread military applications ahead of President-elect Donald Trump taking office next month. “In principle, the export of gallium, germanium, antimony, and superhard materials to the United States shall not be permitted,” Chinese Commerce Ministry said. China is the world’s largest producer of antimony, accounting… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Chinas-Export-Ban-Sends-Antimony-Prices-Soaring-40-in-One-Day.html |

|

One Stock to Watch as Antimony Prices Soar 40% in a DayThe Pentagon just got a painful wake-up call.Its stockpiles of crucial armaments are depleting at a record pace as the war in Ukraine drags on, and its poorly armed allies are even worse off. Intelligence officers in Germany said that the country has only two days’ worth of ammunition in case of a military threat. In March 2024, the European Union allocated 500,000,000 Euros under the Act in Support of Ammunition Production (ASAP) to boost output capacity to 2 million shells annually by the end of 2025.But the Western militaries have… Read more at: https://oilprice.com/Energy/Energy-General/One-Stock-to-Watch-as-Antimony-Prices-Soar-40-in-a-Day.html |

|

Oil Prices Tick Higher on Crude Inventory DrawCrude oil prices moved higher today after the U.S. Energy Information Administration reported an inventory decline of 5.1 million barrels for the week to November 29. The change compared with a build of 1.23 million barrels for the week, as estimated by the American Petroleum Institute a day earlier. It also compared with an EIA-estimated draw of 1.8 million barrels for the prior week. The authority also reported builds in fuel inventories for the period. In gasoline, the EIA estimated an inventory build of 2.4 million barrels for the final week… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Prices-Tick-Higher-on-Crude-Inventory-Draw.html |

|

Russia’s Oil Revenues Slump by 21% as Prices DropRussia’s revenues from oil plunged by 21% in November compared to a year earlier as the international benchmark prices and the price of Russia’s flagship crude, Urals, fell last month amid concerns about global oil demand. In November, for a second month in a row, Russia’s oil revenues slumped from the comparable month in 2023, according to Bloomberg’s estimates based on official government data released on Wednesday. Russia has based its tax levies and calculations for November on an average price of the Urals grade of… Read more at: https://oilprice.com/Energy/Energy-General/Russias-Oil-Revenues-Slump-by-21-as-Prices-Drop.html |

|

Hungary Seeks US Sanctions Waiver for Gazprombank Gas PaymentsHungary, which continues to receive Russian natural gas via pipeline, has asked U.S. authorities to exempt Russia’s Gazprombank from the sanctions when payments for natural gas are processed, Hungarian Foreign Minister Peter Szijjarto said on Wednesday. “Yesterday we filed our request with the relevant American authorities that calls for Gazprombank being granted an exception from sanctions when it comes to payments for natural gas,” Szijjarto said at a briefing, as quoted by Reuters. Last month, the U.S. Department of the Treasury’s… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Hungary-Seeks-US-Sanctions-Waiver-for-Gazprombank-Gas-Payments.html |

|

Spain’s Crude Oil Imports From Venezuela Hit the Highest Level Since 2006Thanks to a U.S. license for Spanish energy major Repsol to import Venezuelan crude, Spain’s crude oil imports from the South American country have hit this year the highest level since 2006, according to Spanish government data. So far this year, Spain has imported about 2.6 million metric tons of crude oil from Venezuela, per data from Spanish government agency Cores cited by Reuters. Back in 2006, Spain’s crude imports from Venezuela at this time of the year were roughly 2.7 million tons. Venezuela has boosted its crude oil exports… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Spains-Crude-Oil-Imports-from-Venezuela-At-Highest-Level-Since-2006.html |

|

South African Court Rules Plans for New Coal Capacity Are UnlawfulThe High Court of South Africa has ruled that government plans for new coal-fired power capacity are unlawful as they violate the constitutional right to health. South Africa’s government has planned to seek 1.5 gigawatts (GW) of new coal-fired electricity capacity. But the plans have been challenged in court by activists who argued that new coal plants could lead to damages to public health. Upholding the challenge brought up by three environmental groups, the High Court says that the government plans and decisions to seek the procurement… Read more at: https://oilprice.com/Latest-Energy-News/World-News/South-African-Court-Rules-Plans-for-New-Coal-Capacity-Are-Unlawful.html |

|

Aramco, SLB, and Linde to Build One of the World’s Top Carbon Capture HubsSaudi state oil giant Aramco is teaming up with the world’s largest oilfield services provider, SLB, and the world’s largest industrial gases company, Linde, to build a carbon capture and storage (CCS) hub in Saudi Arabia, which will be one of the largest such sites in the world. The companies on Wednesday said they had signed a shareholders’ agreement to advance the project in Jubail, in Saudi Arabia’s Eastern Province. Under the terms of the deal, Aramco will hold a 60% equity interest in the CCS hub, with Linde and SLB… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Aramco-SLB-and-Linde-to-Build-One-of-the-Worlds-Top-Carbon-Capture-Hubs.html |

|

China Could Approve 100 New Nuclear Reactors by 2035China could keep the pace of approving at least 10 new nuclear reactors over the next 10 years, a domestic industry group says, as the country has been accelerating the approval and construction of nuclear power plants over the past few years. China could commit to a “realistic target” of 10 new approvals each year through 2035, Tian Jiashu, deputy secretary-general of the Chinese Nuclear Society, said at the BloombergNEF Summit in Shanghai this week. Air pollution from coal-fired power plants is a major impetus for China to expand… Read more at: https://oilprice.com/Latest-Energy-News/World-News/China-Could-Approve-100-New-Nuclear-Reactors-by-2035.html |

|

Powell says he’s not worried about the Fed losing its independence under TrumpFederal Reserve Chair Jerome Powell spoke Wednesday at the New York Times DealBook conference. Read more at: https://www.cnbc.com/2024/12/04/powell-says-hes-not-worried-about-the-fed-losing-its-independence-under-trump.html |

|

UnitedHealthcare CEO Brian Thompson fatally shot in New York in targeted attackThompson, who led the largest private insurer in the U.S., was set to attend UnitedHealth Group’s investor day, which the company canceled. Read more at: https://www.cnbc.com/2024/12/04/unitedhealth-cancels-investor-day-after-reports-of-executive-shot-in-manhattan.html |

|

S&P 500 and Nasdaq rise to fresh record highs as tech shares jump: Live updatesStocks rose Wednesday as Salesforce and Marvell Technology led tech shares higher on the back of strong quarterly earnings. Read more at: https://www.cnbc.com/2024/12/03/stock-market-today-live-updates.html |

|

French government toppled in no-confidence vote brought by oppositionThe French government has been ousted in a vote of no-confidence, plunging the euro zone’s second-largest country into deep political and economic uncertainty. Read more at: https://www.cnbc.com/2024/12/04/french-government-toppled-in-no-confidence-vote-brought-by-opposition.html |

|

This income strategy could deliver a total yield of up to 7% a year, according to UBSInvestors can turn to dividend-paying equities and options to nab some attractive income. Read more at: https://www.cnbc.com/2024/12/04/ubs-says-this-income-strategy-could-deliver-a-total-yield-of-up-to-7percent-a-year-.html |

|

Trump picks former SEC Commissioner Paul Atkins to lead agency: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s episode, Asymmetric CEO and CIO Joe McCann reacts to President-elect Trump’s pick of Paul Atkins as next SEC chair. Read more at: https://www.cnbc.com/video/2024/12/04/trump-picks-former-sec-commissioner-paul-atkins-to-lead-agency-cnbc-crypto-world.html |

|

Trump picks Peter Navarro as top trade advisorPresident-elect Donald Trump announced that Peter Navarro will serve as “Senior Counselor for Trade and Manufacturing” in his next White House term. Read more at: https://www.cnbc.com/2024/12/04/trump-picks-peter-navarro-as-top-trade-advisor.html |

|

ESPN hopes to reach more casual sports fans with Disney+ integrationDisney debuted an ESPN tab on Disney+ on Wednesday for ESPN+ subscribers and will make about 100 live games available on Disney+ to nonsubscribers. Read more at: https://www.cnbc.com/2024/12/04/espn-to-add-more-sports-content-to-disney.html |

|

Trump plans to nominate Paul Atkins as SEC chair in crypto-friendly movePresident-elect Donald Trump plans to nominate financier Paul Atkins to head the Securities and Exchange Commission. Read more at: https://www.cnbc.com/2024/12/04/trump-plans-to-nominate-paul-atkins-as-sec-chair.html |

|

Robinhood considering move into sports betting, CEO Vlad Tenev saysThe comments came at Robinhood’s inaugural investor day event. Read more at: https://www.cnbc.com/2024/12/04/robinhood-considering-move-into-sports-betting-ceo-vlad-tenev-says.html |

|

Trump nominates Jared Isaacman, private astronaut and Shift4 CEO, for NASA chiefPresident-elect Donald Trump on Wednesday nominated Jared Isaacman to be NASA Administrator. Read more at: https://www.cnbc.com/2024/12/04/trump-nominates-jared-isaacman-for-nasa-administrator.html |

|

Trump considers replacing Pete Hegseth, his embattled secretary of defense pick, with Ron DeSantisTrump’s choice of Hegseth is now in jeopardy because of allegations of drinking and reports about his treatment of women. Read more at: https://www.cnbc.com/2024/12/04/trump-considers-replacing-pete-hegseth-his-embattled-secretary-of-defense-pick-with-ron-desantis.html |

|

This chip stock could be ready for a catch-up trade with Nvidia, according to the chartsFrank Cappelleri breaks down the charts on AMD. Read more at: https://www.cnbc.com/2024/12/04/this-chip-stock-could-be-ready-for-a-catch-up-trade-with-nvidia-according-to-the-charts.html |

|

Trump Selects An Actual Astronaut To Lead NASAPresident-elect Donald Trump announced Wednesday afternoon that he has selected billionaire entrepreneur and veteran SpaceX astronaut Jared Isaacman to lead the National Aeronautics and Space Administration (NASA). If confirmed, Isaacman would replace Bill Nelson, a former US senator from Florida who oversaw the space agency under the outgoing Biden administration.

Here’s Trump’s statement on Isaacman’s nomination:

|

|

Why More Middle Income Americans Are Struggling to Save MoneyAuthored by Autumn Spredemann via The Epoch Times, Reduced inflation and wage increases haven’t stemmed the economic struggles of middle-class Americans. In fact, some middle-income earners say it’s harder than ever to put money away in savings.

Many ascribe this to stagnant wages and higher prices for things like gas, groceries, and utilities that began in 2021 and persist to this day. The United States hit a 41-year inflation high in 2022, which is when residents saw historic price hikes. In 2022, the consumer price index soared by more than 9 percent, according to the Bureau of Labor Statistics.

|

|

Unexpectedly Hawkish Beige Book Finds Economic Activity “Rose” In Most Districts As “Slowness” TumblesBack in September, the otherwise sleepy and mostly boring report that is the Fed’s Beige Book report (which nobody otherwise reads due to its sheer size and dismal signal-to-noise ratio) got a sudden boost of notoriety and popularity when none other than Jerome Powell explained after the Fed’s 50bps rate cut, that he had been closely following the Beige Book which had emerged as a driving force behind the Fed’s unexpected “jumbo” 50bps rate cut. And unlike others, we actually do read the Beige Book, which is why two weeks before the FOMC rate cut we titled our analysis of the latest report as follows: “Ugly Beige Book Reveals Economic Activity “Flat Or Declining”, Consumer Spending Slowing In Most Districts.” So one can see why Powell panicked and why two rate cuts followed in September and November, just days after the election. Fast forward to today when moments ago the Fed published its latest, December, Beige Book which suggested that a reversal of the sluggish, “flat or declining” conditions observed in September and November is underway, and which together with a strong jobs report on Friday may be sufficient to enable the Fed to pause rate cuts for the foreseeable future, especially … Read more at: https://www.zerohedge.com/economics/unexpectedly-hawkish-beige-book-finds-economic-activity-rose-most-districts-slowness |

|

French Government Falls As PM Barnier Loses Confidence VoteWhat seemed like a foregone conclusion is now confirmed – French PM Barnier just lost a no-confidence vote (with 331 votes – 288 was needed) forcing his government’s resignation and Macron to appoint a new premier

The debate before the vote was lively with RN’s Le Pen blasting Barnier’s budget and making it clear he was dead in the water.

Much of her comments are focused on taxes in Barnier’s budget, saying it was “all about taxes, taxes and more taxes.”

Read more at: https://www.zerohedge.com/political/le-pen-declares-end-ephemeral-government-french-pm-barnier-loses-confidence-vote |

|

Five key takeaways from the Scottish BudgetScrapping the two-child cap and changes to tax thresholds are among plans for the next financial year. Read more at: https://www.bbc.com/news/articles/ce8ndr578e8o |

|

Guinness supplies being limited after demand soarsGuinness-maker Diageo has placed limits on wholesale distribution of the stout to pubs in Great Britain after “exceptional demand” Read more at: https://www.bbc.com/news/articles/cx2v5z0wvwzo |

|

Rail fares to rise despite renationalisation plansThree rail operators will be renationalised next year but fares are due to go up as outlined in the Budget. Read more at: https://www.bbc.com/news/articles/ceqlnrgjr79o |

|

Gland Pharma and Go Digit GI among 12 midcap stocks that may lose midcap status soonNuvama Alternative Research estimates that the large-cap cut-off will rise to around Rs 99,200 crore, up from Rs 84,000 crore in June 2024, while the mid-cap threshold is projected to reach approximately Rs 32,400 crore, compared to Rs 27,500 crore in June 2024. Read more at: https://economictimes.indiatimes.com/mf/analysis/gland-pharma-and-go-digit-gi-among-12-midcap-stocks-that-may-lose-midcap-status-soon/slideshow/115973657.cms |

|

SBI MF, Tata MF buy Ratnamani Metals Tubes shares worth Rs 262 croreSBI Mutual Fund and Tata MF acquired a 1.12% stake in Ratnamani Metals & Tubes for Rs 262 crore through open market transactions. They purchased shares at an average price of Rs 3,335 each. Nalanda Capital offloaded its shares. Ratnamani Metals & Tubes’ stock price dipped slightly following the transaction. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/sbi-mf-tata-mf-buy-ratnamani-metals-tubes-shares-worth-rs-262-crore/articleshow/115979904.cms |

|

RateGain Travel bets on improving order pipeline for a recoveryRateGain Travel Technologies’ stock has declined 13% post Q2 results despite strong revenue and profit growth. Concerns include lower growth in contract wins, pricing pressure, and the loss of a key account. However, the company expects strong growth in the second half of the fiscal year. RateGain is a SaaS provider focused on the travel and hospitality sector. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/rategain-travel-bets-on-improving-order-pipeline-for-a-recovery/articleshow/115977869.cms |

|

Treasury yields end at lowest since October after French government fallsU.S. government debt rallied on Wednesday, sending yields to their lowest closing levels in more than a month, after France’s parliament voted to oust the government of Prime Minister Michel Barnier and a U.S.-based survey of service companies missed expectations. Read more at: https://www.marketwatch.com/story/treasury-yields-rise-ahead-of-economic-updates-and-powell-comments-d1e88526?mod=mw_rss_topstories |

|

Oil prices end lower as investors look to OPEC+ decisionU.S. oil futures finished lower Wednesday, as pressure from uncertainty a day ahead of a decision by major oil producers on output levels outweighed support from weekly U.S. data showing a crude inventory drop of more than 5 million barrels. Read more at: https://www.marketwatch.com/story/oil-prices-tick-higher-as-investors-await-opec-decision-9512ecf1?mod=mw_rss_topstories |

|

French government topples after losing no-confidence vote. What happens next.France could be set for months of potentially market-roiling political uncertainty after a no-confidence vote ousted the minority coalition government led by Prime Minister Michel Barnier. Read more at: https://www.marketwatch.com/story/what-happens-next-if-french-government-loses-no-confidence-vote-999abb25?mod=mw_rss_topstories |