Summary Of the Markets Today:

- The Dow closed down 306 points or 0.70%,

- Nasdaq closed down 428 points or 2.24%,

- S&P 500 closed down 79 points or 1.32%,

- Gold $2,568 down $4.70 or 0.19%,

- WTI crude oil settled at $67 down $1.71 or 2.49%,

- 10-year U.S. Treasury 4.441 up 0.021 points or 0.475%,

- USD index $106.90 up $0.42 or 0.39%,

- Bitcoin $91,327 up $1,624 or 4.58%, (24 Hours), (New Bitcoin Historic high 93,383)

- Baker Hughes Rig Count: U.S. -1 584 Canada -7 to 200

U.S. Rig Count is down 1 from last week to 584 with oil rigs down 1 to 478, gas rigs down 1 to 101 and miscellaneous rigs up 1 to 5.

*Stock data, cryptocurrency, and commodity prices at the market closing

Today’s Highlights

US stocks experienced significant declines on Friday, leading to steep weekly losses as investors processed Federal Reserve Chair Jerome Powell’s indication that the central bank is not rushing to implement interest rate cuts. The major indexes all fell sharply. Powell’s hawkish comments dampened market sentiment, erasing much of the initial optimism surrounding President-elect Donald Trump’s policy agenda. The S&P 500 has already retraced about one-third of its post-election gains. For the week the S&P 500 lost over 2%, the Dow shed 1.2%, and the Nasdaq logged a 3.2% decline. Traders are now reassessing expectations for rate cuts. The probability of a December rate cut has fallen to 62%, down from 72% the previous day. The January rate cut odds decreased to 74% from 81%. Adding to the hawkish tone, retail sales data released Friday showed continued strength in consumer spending. Investors are also closely watching Trump’s transition plans, including potential cabinet appointments that could impact certain sectors.

Click here to read our current Economic Forecast – November 2024 Economic Forecast: Our Index Marginally Declines – We Are Stuck With The Crappy Economy We Have Seen So Far This Year

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

The latest Survey of Professional Forecasters conducted by the Federal Reserve Bank of Philadelphia indicates an improved near-term outlook for the U.S. economy compared to three months ago. The economy is predicted to expand at an annual rate of 2.2% in Q4 2024 and 1.9% in Q1 2025, up from previous estimates of 1.7% for both quarters. Real GDP growth is expected to be 2.7% in 2024 and 2.2% in 2025 on an annual-average basis. The unemployment rate forecast remains largely unchanged from the previous survey. Projections show the unemployment rate increasing from 4.0% in 2024 to 4.3% in 2025, then decreasing to 4.1% in 2027. Job gains are expected to continue at a steady pace. Forecasters project monthly job gains of 208,400 in 2024 and 134,100 in 2025. These projections suggest a more optimistic view of economic growth in the near term, with stable labor market conditions expected to persist.

Median Forecasts for Selected Variables in the Current and Previous Surveys

| Real GDP (%) | Unemployment Rate (%) | Payrolls (000s/month) | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Previous | New | Previous | New | Previous | New | ||||

| Quarterly data: | |||||||||

| 2024:Q4 | 1.7 | 2.2 | 4.3 | 4.2 | 125.4 | 138.8 | |||

| 2025:Q1 | 1.7 | 1.9 | 4.3 | 4.2 | 128.7 | 123.7 | |||

| 2025:Q2 | 1.8 | 1.8 | 4.3 | 4.3 | 116.2 | 117.2 | |||

| 2025:Q3 | 2.2 | 2.2 | 4.3 | 4.2 | 145.8 | 114.2 | |||

| 2025:Q4 | N.A. | 2.0 | N.A. | 4.3 | N.A. | 128.2 | |||

| Annual data (projections are based on annual-average levels): | |||||||||

| 2024 | 2.6 | 2.7 | 4.1 | 4.0 | 210.1 | 208.4 | |||

| 2025 | 1.9 | 2.2 | 4.3 | 4.3 | 130.0 | 134.1 | |||

| 2026 | 2.3 | 2.1 | 4.2 | 4.2 | N.A. | N.A. | |||

| 2027 | 2.0 | 2.1 | 4.2 | 4.1 | N.A. | N.A. | |||

Advance estimates of unadjusted U.S. retail and food services sales for October 2024 were up 4.6% from October 2023 (3.3% inflation adjusted). This was a broad based increase across all sectors of retail sales.

Industrial production (IP) decreased 0.3% year-over-year in October 2024. According to the Federal Reserve, the Boeing strike slowed IP growth by an estimated 0.3 percentage point in September and 0.2 percentage point in October – whilst Hurricane Milton and the lingering effects of Hurricane Helene together reduced October IP growth 0.1 percentage point. For the components of IP, note that growth in manufacturing was down 0.3% year-over-year, mining was down 1.5% year-over-year, and utility growth was up 1.5% year-over-year. Capacity utilization moved down to 77.1 percent in October, a rate that is 2.6 percentage points below its long-run (1972–2023) average. My position remains that manufacturing is in a recession.

Imported prices rose to 0.8% in October 2024 (2.3% excluding fuels). Export prices contracted 0.1%. Notice that the import prices less fuel rate of increase has been steadily growing (black line on the graph below) – and that is now growing into a major source of inflation into the economy. Almost 30% of consumer goods are imported.

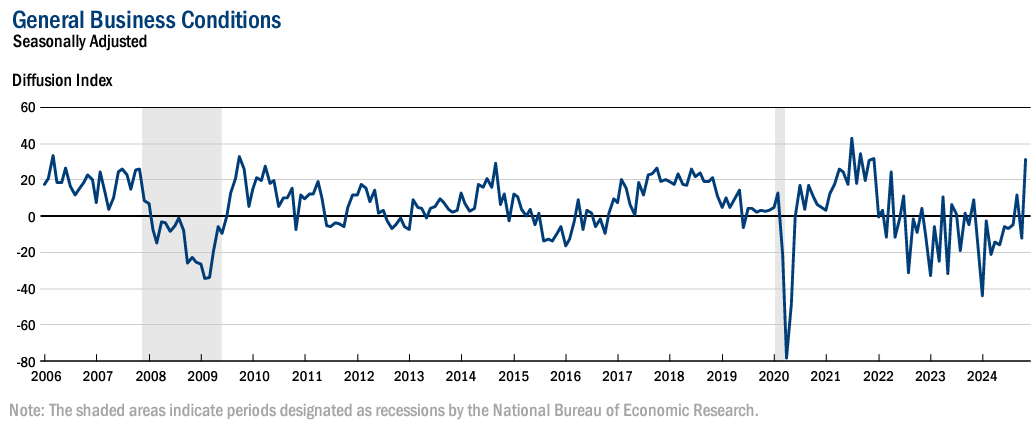

The New York Fed’s Empire State Manufacturing Survey‘s headline general business conditions index shot up forty-three points to 31.2, its highest reading in nearly three years. New orders and shipments rose substantially. Delivery times were slightly longer, while supply availability was somewhat lower. Remember this is a survey, and I will not conceded that manufacturing has magically jumped to the highest level in three years from a negative number one month ago. Really do not like surveys.

Here is a summary of headlines we are reading today:

- Why Musk Supports Trump’s Plan to Axe EV Tax Credits

- U.S. Rig Count Sees Small Drop

- Space Junk: The Unseen Crisis Threatening Earth’s Ecosystems

- Bearish Sentiment Is Dominating Oil Markets

- Carbon Credit Dispute Overshadows Early Progress at COP29

- Libya’s Fragile Peace Is Under Threat Again

- The Strong Dollar Is Back and Weighing on Oil Prices

- Dow closes 300 points lower Friday as rate worries hinder postelection rally: Live updates

- Palantir jumps 9% to a record after announcing move to Nasdaq

- Super Micro faces deadline to keep Nasdaq listing after 85% plunge in stock

- Processed food stocks fall as investors brace for increased scrutiny under Trump, RFK Jr.

- Bitcoin rises over 16% in a week on hopes of crypto-friendly U.S. policy: CNBC Crypto World

- Consumers Are Drowning In Debt As Hordes Of Businesses Fail All Over The US

- Investors are bracing for higher-for-even-longer interest rates

- Treasury yields finish mixed as spike in rates sparks buying demand

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Why Musk Supports Trump’s Plan to Axe EV Tax CreditsThe final chapter of the electric vehicle price war, sparked by Tesla’s Elon Musk, hinges on President-elect Donald Trump’s plan to eliminate the $7,500 consumer tax credit. Sources with direct knowledge told Reuters that the Trump team has discussed ending the EV tax credit as part of broader tax reform legislation. Sources indicated that Tesla – the largest EV automaker in the US and the only one not reliant on EV credits for survival – told the Trump transition committee that it fully supports the federal government ending the subsidy. Here’s… Read more at: https://oilprice.com/Energy/Energy-General/Why-Musk-Supports-Trumps-Plan-to-Axe-EV-Tax-Credits.html |

|

U.S. Rig Count Sees Small DropThe total number of active drilling rigs for oil and gas in the United States saw fell this week, according to new data that Baker Hughes published on Friday, after holding steady in the week prior. The total rig count fell by a single rig to 584, according to Baker Hughes, down more than 5% from this same time last year. The number of oil rigs fell by one this week to 478—down by 22 compared to this time last year. The number of gas rigs also fell by a single rig, landing at 101, a loss of 13 active gas rigs from this time last year. Miscellaneous… Read more at: https://oilprice.com/Energy/Energy-General/US-Rig-Count-Sees-Small-Drop.html |

|

Space Junk: The Unseen Crisis Threatening Earth’s EcosystemsAs more equipment is sent into space, experts are concerned about the quantity of debris being left behind. To this end, companies are attempting to create more sustainable satellites and better regulate the sector. A 2024 UNDP report entitled ‘Hope for responsible technological progress – CONGESTED SPACE’ explains, “Competition is intensifying to explore and understand space – and mine its resources. The global space economy grew to $546 billion in 2023. Like the oceans, space has been exploited with little care for its… Read more at: https://oilprice.com/Energy/Energy-General/Space-Junk-The-Unseen-Crisis-Threatening-Earths-Ecosystems.html |

|

Russia Eyes New Gas Route to China, Betting Big on Growing DemandRussia is eyeing yet another pipeline to China, this time via Kazakhstan, capable of delivering up to 35 bcm of natural gas annually. Announced by Deputy Prime Minister Alexander Novak, the plan comes as Moscow pivots hard toward Beijing, already shipping 40 bcm of gas to the Asian giant this year. With Europe now firmly out of the picture, China is the Kremlin’s star energy customer, even if gas accounts for just 2.8% of Beijing’s energy mix. The logic is simple: China likes gas, and its appetite is growing. Domestic consumption surged… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russia-Eyes-New-Gas-Route-to-China-Betting-Big-on-Growing-Demand.html |

|

Shale Industry Wants Liberty CEO Wright as U.S. Energy SecretaryChris Wright, founder and CEO of fracking services company Liberty Energy, is a top pick among shale industry executives to lead the U.S. Department of Energy in the coming Trump Administration. Wright, who advocates for “better human lives by expanding access to abundant, affordable, and reliable energy,” does not have political experience, but is being endorsed by his peer executives to be the next U.S. Secretary of Energy. “Chris is an excellent choice for Secretary of Energy,” Thomas Pyle, president of the American Energy… Read more at: https://oilprice.com/Energy/Energy-General/Shale-Industry-Wants-Liberty-CEO-Wright-as-US-Energy-Secretary.html |

|

Gazprom Cuts Gas To Austria Off, Just in Time for WinterRussia’s Gazprom PJSC has decided to play its favorite game: pipeline politics. Starting November 16, Austria is off the guest list for Russian natural gas, following a €230 million ($242 million) arbitration spat between Gazprom and Austria’s OMV AG. OMV, refusing to let that cash slip away, decided to withhold payments to Gazprom. As one might have guessed, that ended poorly. Unsurprisingly, European gas prices didn’t take the news well. Futures climbed 2.7% to €47.49 per megawatt-hour, as traders braced for yet another… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Gazprom-Cuts-Gas-To-Austria-Off-Just-in-Time-for-Winter.html |

|

Bearish Sentiment Is Dominating Oil MarketsBearish sentiment continued to dominate oil markets this week despite steep gasoline and diesel draws in the U.S.Friday, November 15th, 2024Steep gasoline and diesel inventory draws in the United States have helped offset the overwhelmingly bearish sentiment in the oil market, although it wasn’t enough to halt the decline in oil prices. With China posting its seventh successive month of refinery run declines and Jerome Powell cooling down expectations on U.S. interest rate cuts, Brent below $72 per barrel feels justified. Chinese… Read more at: https://oilprice.com/Energy/Energy-General/Bearish-Sentiment-Is-Dominating-Oil-Markets.html |

|

Russian Refiners Cut Crude Processing as Hefty Losses MountRussia’s refineries have started to reduce run rates and some consider shutting in operations, as the facilities are struggling with hefty losses amid export restrictions, rising oil prices, sanctions, and Ukrainian drone attacks, industry sources have told Reuters. At least three refineries in Russia have recently suspended crude processing, on the back of mounting losses, which are also exacerbated by high borrowing costs amid high interest rates, five sources in the industry told Reuters. The Tuapse, Ilsky, and Novoshakhtinsky refineries… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russian-Refiners-Cut-Crude-Processing-as-Hefty-Losses-Mount.html |

|

Carbon Credit Dispute Overshadows Early Progress at COP29Some participants at the COP29 climate conference in Baku are giving it high marks for organization and appearance. The proceedings themselves, however, have been tumultuous. Several attendees have noted the presence of a legion of omnipresent young volunteers who are “polite, smiling, and always ready to help.” The “pristine cleanliness” of the venue, another adds, “feels a bit excessive.” The biggest hassle, some say, is connected to getting to and from the venue, which is sealed behind a vast security cordon.… Read more at: https://oilprice.com/Energy/Energy-General/Carbon-Credit-Dispute-Overshadows-Early-Progress-at-COP29.html |

|

China Could Lead Climate Fight if U.S. Drops OutChina could become the leader of the global fight to slow down climate change if the United States backs down under President Donald Trump, South Africa’s Minister of Environment, Dion George, told Bloomberg Television in an interview on Friday. “That’s the big debate that is going on,” George said, referring to China’s reluctance so far to finance climate change mitigation measures in poorer countries. China has said that as a developing country itself it shouldn’t be held accountable for climate finance. However,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/China-Could-Lead-Climate-Fight-if-US-Drops-Out.html |

|

Which Oil Companies Stand to Benefit Most From a Trump Presidency?With the US Presidential election more than a week behind us and, with Republicans controlling the Senate and House as well as the White House, the so-called “Trump trade” is well underway. One might expect that a large part of that would be a bullish move in US oil stocks but, while that has happened to some extent, the exuberance of the market has been tempered by the fact that crude has been mired below $70, close to its 52-week lows. The main reason for that seems to be the perception of relative weakness in the Chinese economy,… Read more at: https://oilprice.com/Energy/Energy-General/Which-Oil-Companies-Stand-to-Benefit-Most-From-a-Trump-Presidency.html |

|

Uncertainty Is Rife in the European Natural Gas MarketWith the current transit contract for Russian gas through Ukraine expiring at the end of this year, it’s now a desperate scramble for Slovakia, Hungary, and (to a lesser extent) Austria to secure new deals for alternative gas, while the rest of the European Union watches from the sidelines, simply hoping that new deals don’t disrupt the market. The only silver lining is that EU gas storage is pretty much full for the winter, and meteorologists are predicting a mild one. Last week, we saw Hungary’s MOL sign a unilateral deal with… Read more at: https://oilprice.com/Energy/Energy-General/Uncertainty-Is-Rife-in-the-European-Natural-Gas-Market.html |

|

Libya’s Fragile Peace Is Under Threat AgainPolitics, Geopolitics & Conflict While foreign operators are returning to Libya with a renewed zeal and oil is again flowing, another protest this week highlights how fragile the situation is. Protesters on Tuesday shut down oil distribution valves in Zintan over the abduction of a general attached to the Central Security Department. Protesters accuse the Tripoli government of Dbeibah and the Presidential Council of being behind the abduction. That would suggest the general abducted is an ally of the Haftar clan and the rival eastern government… Read more at: https://oilprice.com/Energy/Energy-General/Libyas-Fragile-Peace-Is-Under-Threat-Again.html |

|

The Strong Dollar Is Back and Weighing on Oil PricesCrude oil prices fell 2.5% this week due to softening demand projections, a strong U.S. dollar, and rising supply expectations. Amid global economic uncertainty, reports from the U.S. Energy Information Administration (EIA), the International Energy Agency (IEA), and OPEC are collectively highlighting a bearish outlook, particularly as non-OPEC supply growth appears likely to outpace sluggish demand. Key factors remain China’s economic slowdown, dollar strength, and record-high U.S. output. China’s Economic Challenges Weigh on Oil Demand… Read more at: https://oilprice.com/Energy/Energy-General/The-Strong-Dollar-Is-Back-and-Weighing-on-Oil-Prices.html |

|

Supply Risk and Soaring Demand Keep European Natural Gas Prices at 1-Year HighEuropean benchmark natural gas prices continued to hover on Friday around their highest level in a year amid soaring demand in colder weather and an imminent risk to Russian gas supply to Austria. Dutch TTF Natural Gas Futures, the benchmark for Europe’s gas trading, were trading on Friday around the highest level so far this year. This level was reached on Thursday, when prices soared by nearly 6%. At 11:02 a.m. in Amsterdam on Friday, the front-month futures were at $48.32 (45.70 euros) per megawatt-hour (MWh) amid concerns about supply… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Supply-Risk-and-Soaring-Demand-Keep-European-Natural-Gas-Prices-at-1-Year-High.html |

|

Dow closes 300 points lower Friday as rate worries hinder postelection rally: Live updatesThe three major indexes were headed for weekly losses on Friday as the postelection rally evaporated. Read more at: https://www.cnbc.com/2024/11/14/stock-market-today-live-updates.html |

|

Palantir jumps 9% to a record after announcing move to NasdaqPalantir’s stock has been on a tear since the company’s better-than-expected earnings report last week, which was a day before the election. Read more at: https://www.cnbc.com/2024/11/15/palantir-jumps-9percent-to-a-record-after-announcing-move-to-nasdaq.html |

|

Super Micro faces deadline to keep Nasdaq listing after 85% plunge in stockSuper Micro could also get a reprieve and an extension from the Nasdaq, giving it months to come into compliance. Read more at: https://www.cnbc.com/2024/11/15/super-micro-faces-deadline-to-keep-nasdaq-listing-after-85percent-plunge-.html |

|

Jake Paul, Mike Tyson fight breaks record for biggest boxing gate outside of Las VegasThe fight’s promoter, Most Valuable Promotions, told CNBC it has sold more than 65,000 tickets to the Friday night bout at AT&T Stadium in Arlington, Texas. Read more at: https://www.cnbc.com/2024/11/15/jake-paul-mike-tyson-fight-record-boxing-gate.html |

|

Markets are grappling with the impact of Trump’s win and how the Fed will reactInvestors thought they had the whole ‘Trump Trade’ figured out, until, unfortunately, they didn’t. Read more at: https://www.cnbc.com/2024/11/15/markets-are-grappling-with-the-impact-of-trumps-win-and-how-the-fed-will-react.html |

|

Processed food stocks fall as investors brace for increased scrutiny under Trump, RFK Jr.Shares of several companies behind popular soda and snack brands pulled back sharply Friday. Read more at: https://www.cnbc.com/2024/11/15/food-stocks-fall-as-investors-brace-for-increased-scrutiny-from-rfk-jr.html |

|

Major Trump Media shareholder ARC Global unloads nearly all DJT stockPresident-elect Donald Trump is the majority owner of Trump Media, which trades on the Nasdaq as DJT. Read more at: https://www.cnbc.com/2024/11/15/djt-trump-media-stock-arc-global-patrick-orlando.html |

|

U.S. companies could be caught in the crosshairs if China retaliates to fight TrumpChina’s retaliation tactics could range from economic changes to matters of diplomacy and security. Read more at: https://www.cnbc.com/2024/11/15/us-companies-in-the-crosshairs-if-china-retaliates-to-fight-trump.html |

|

Trump Defense pick Hegseth investigated in 2017 for alleged sex assault; no charges filedPresident-elect Donald Trump surprised some Republican senators by picking former Fox News host Pete Hegseth to lead the Pentagon. Read more at: https://www.cnbc.com/2024/11/15/trump-defense-pete-hegseth-sex-assault-investigation-.html |

|

Democratic senators call for probe into Musk’s Russia calls: ReutersTesla and SpaceX CEO Musk, who has been given a government role by President-elect Donald Trump, oversees billions in Pentagon and intelligence contracts. Read more at: https://www.cnbc.com/2024/11/15/democratic-senators-call-for-probe-into-musks-russia-calls-reuters.html |

|

Disney is turning record parks profits — even before its big expansionsDisney is breaking ground on new additions and updates to its theme parks, but it will be several years before they become available to the public. Read more at: https://www.cnbc.com/2024/11/15/disney-parks-profit-expansions.html |

|

President Joe Biden has forgiven over $166 billion in student debt—see how much in each stateFixes to existing forgiveness programs and a brief window under the new SAVE program allowed President Biden to forgiven $166 billion in student debt. Read more at: https://www.cnbc.com/2024/11/15/map-where-bidens-student-loan-forgiveness-went.html |

|

Bitcoin rises over 16% in a week on hopes of crypto-friendly U.S. policy: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Will Peck, head of digital assets at WisdomTree, discusses what a national bitcoin stockpile could mean for prices and the future of crypto-focused ETFs. Read more at: https://www.cnbc.com/video/2024/11/15/bitcoin-rises-over-16percent-in-week-crypto-friendly-policy-crypto-world.html |

|

Big-Tech & Bullion Battered, Bitcoin Bid As ‘Goldilocks’ Narrative CollapsesBig-Tech & Bullion Battered, Bitcoin Bid As ‘Goldilocks’ Narrative Collapses’Good news’ was definitely ‘bad news’ this week as US macro data generally surprised positively…

Source: Bloomberg …with both growth and inflation surprises soaring…

Source: Bloomberg Not exactly the kind of data that supports a dovish Fed and the market has notably reduced its expectations for rate-cuts… Read more at: https://www.zerohedge.com/market-recaps/big-tech-bullion-battered-bitcoin-bid-goldilocks-narrative-collapses |

|

Pentagon ‘Shocked’ By Houthi Arsenal, Sophistication Is ‘Getting Scary’A top Pentagon official responsible for purchasing arms for America’s defense stockpile has expressed ‘shock’ at the increasingly sophisticated arsenal possessed by Yemen’s Houthis. Under Secretary of Defense for Acquisition and Sustainment Bill LaPlante spoke at an event hosted by Axios on Wednesday, where he said that Houthis are displaying and deploying advanced weaponry, especially missiles that “can do things that are just amazing.” He described that Houthis “are getting scary” in terms of their capability on display for more than a year in the Red Sea, where they’ve gone to war against Israeli and international shipping.

Read more at: https://www.zerohedge.com/military/pentagon-shocked-houthi-arsenal-sophistication-getting-scary |

|

Consumers Are Drowning In Debt As Hordes Of Businesses Fail All Over The USAuthored by Michael Snyder via TheMostImportantNews.com, U.S. consumers have piled up the largest mountain of household debt in the history of the world. If the federal government was not almost 36 trillion dollars in debt, the fact that U.S. households are nearly 18 trillion dollars in debt would be making a lot more headlines. Sadly, our entire society is absolutely saturated with debt at this point. Government debt on all levels is spiraling out of control, corporate debt has ballooned to absurd levels, and consumers have been gorging on debt as if there will never be any consequences. Unfortunately, a time of reckoning has arrived, and it is going to be incredibly painful.

On Wednesday, we learned that Read more at: https://www.zerohedge.com/personal-finance/consumers-are-drowning-debt-hordes-businesses-fail-all-over-us |

|

Russia Eyes New Gas Route To China, Betting Big On Growing DemandAuthored by Julianne Geiger via OilPrice.com, Russia is eyeing yet another pipeline to China, this time via Kazakhstan, capable of delivering up to 35 bcm of natural gas annually.

Announced by Deputy Prime Minister Alexander Novak, the plan comes as Moscow pivots hard toward Beijing, already shipping 40 bcm of gas to the Asian giant this year. With Europe now firmly out of the picture, China is the Kremlin’s star energy customer, even if gas accounts for just 2.8% of Beijing’s energy mix. The logic is simple:

Domestic consumption surged 8.8% in the first eight months of the year, hitting 28 … Read more at: https://www.zerohedge.com/energy/russia-eyes-new-gas-route-china-betting-big-growing-demand |

|

X users jump to Bluesky – but what is it and who owns it?Bluesky is picking up one million new users every day at its current rate. Read more at: https://www.bbc.com/news/articles/c8dm0ljg4y6o |

|

UK economy barely grows with Budget fears blamedThe chancellor says she is “not satisfied” by the latest growth figures, which were weaker than expected. Read more at: https://www.bbc.com/news/articles/cwygw982e3xo |

|

Typhoo Tea teeters on the brink of administrationThe loss-making firm is attempting a turnaround amid a break-in and fire at its former factory. Read more at: https://www.bbc.com/news/articles/c5yr22qq5q8o |

|

The gamification of India’s investment landscape decodedIndia’s retail investment boom is driven by tech and gamification but raises risks. Regulatory reforms on transparency, investor education, and gamification practices are essential to ensure long-term financial stability. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/the-gamification-of-indias-investment-landscape-why-investor-protection-must-come-first/articleshow/115323761.cms |

|

D-Street falls for 6th day in a row, FPIs sell and sell moreIndian equity indices witnessed their sixth consecutive day of decline, marking the longest losing streak since October 7, as investor sentiment remained subdued. Despite signs of markets being oversold, the NSE Nifty fell by 0.11% while the BSE Sensex declined by 0.14%. Market analysts suggest a further slide is possible if Bank Nifty drops below its current level. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/d-street-falls-for-6th-day-in-a-row-fpis-sell-and-sell-more/articleshow/115319463.cms |

|

October logs lowest demat account additions in FY25India witnessed its lowest monthly increase in demat accounts this financial year, adding 3.5 million in October, as market volatility, fueled by overseas fund withdrawals and a dip in benchmark indices, seemingly impacted investor sentiment. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/october-logs-lowest-demat-account-additions-in-fy25/articleshow/115319554.cms |

|

Investors are bracing for higher-for-even-longer interest ratesFriday’s stronger-than-expected economic data, combined with fresh remarks from Federal Reserve Chairman Jerome Powell on Thursday, were adding up to a shift in market participants’ thinking about how much lower interest rates can go starting next year. Read more at: https://www.marketwatch.com/story/investors-are-bracing-for-higher-for-even-longer-interest-rates-a0ec4c8f?mod=mw_rss_topstories |

|

I’m a 73-year-old retiree with a 50/50 portfolio whose bonds are doing terribly! Should I sell?Diversification can be frustrating, but it’s still necessary. Read more at: https://www.marketwatch.com/story/im-a-73-year-old-retiree-with-a-50-50-portfolio-whose-bonds-are-doing-terribly-should-i-sell-06d85dd6?mod=mw_rss_topstories |

|

Treasury yields finish mixed as spike in rates sparks buying demandYields on U.S. government debt closed little changed on Friday after a post-data spike in rates triggered buying demand for most Treasurys. Read more at: https://www.marketwatch.com/story/treasury-yields-slip-ahead-of-retail-sales-report-2e8f591f?mod=mw_rss_topstories |

Houthi anti-ship missiles, via The War Zone”I’m an engineer and a physicist, and I’ve been around missiles my whole career,” LaPlante said before the summit, called the “Future …

Houthi anti-ship missiles, via The War Zone”I’m an engineer and a physicist, and I’ve been around missiles my whole career,” LaPlante said before the summit, called the “Future …