Summary Of the Markets Today:

- The Dow closed down 155 points or 0.36%,

- Nasdaq closed up 146 points or 0.78%, (Closed at 18,713, New Historic high 18,753

- S&P 500 closed up 9 points or 0.16%,

- Gold $2,785 up $29.30 or 1.06%,

- WTI crude oil settled at $67 down $0.14 or 0.21%,

- 10-year U.S. Treasury 4.260 up 0.018 points or 0.148%,

- USD index $104.29 down $0.02 or 0.02%,

- Bitcoin $72,451 up $2,884 or 3.98%, (24 Hours)

*Stock data, cryptocurrency, and commodity prices at the market closing

Today’s Highlights

The tech-heavy Nasdaq Composite closed at a record high. The S&P 500 followed the NASDAQ’s lead but the Dow Jones Industrial Average was the only major index to close in the red, falling around 0.4%. Tech Stocks led the market gains, with Broadcom surging over 4% on news of a collaboration with Microsoft-aligned OpenAI. Investors absorbed a wave of earnings reports, with particular focus on upcoming results from tech giants. Alphabet’s highly anticipated results due after market close, are seen as a potential indicator of Big Tech’s AI investments paying off. Gold and silver prices rallied, with gold touching new highs near $2,770 per ounce. The U.S. presidential election is adding some uncertainty to markets in the final days of campaigning.

Click here to read our current Economic Forecast – October 2024 Economic Forecast: One More Recession Flag Removed Yet Little Headway On Inflation

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

The number of CEO changes at U.S. companies rose slightly to 202 in September from 200 one month prior. It is up 23% from 164 CEO exits recorded in the same month last year, according to a report released Tuesday by global outplacement and business and executive coaching firm Challenger, Gray & Christmas, Inc. So far this year, 1,652 CEOs have announced their departures, the highest year-to-date total on record, since Challenger began tracking CEO changes in 2002.

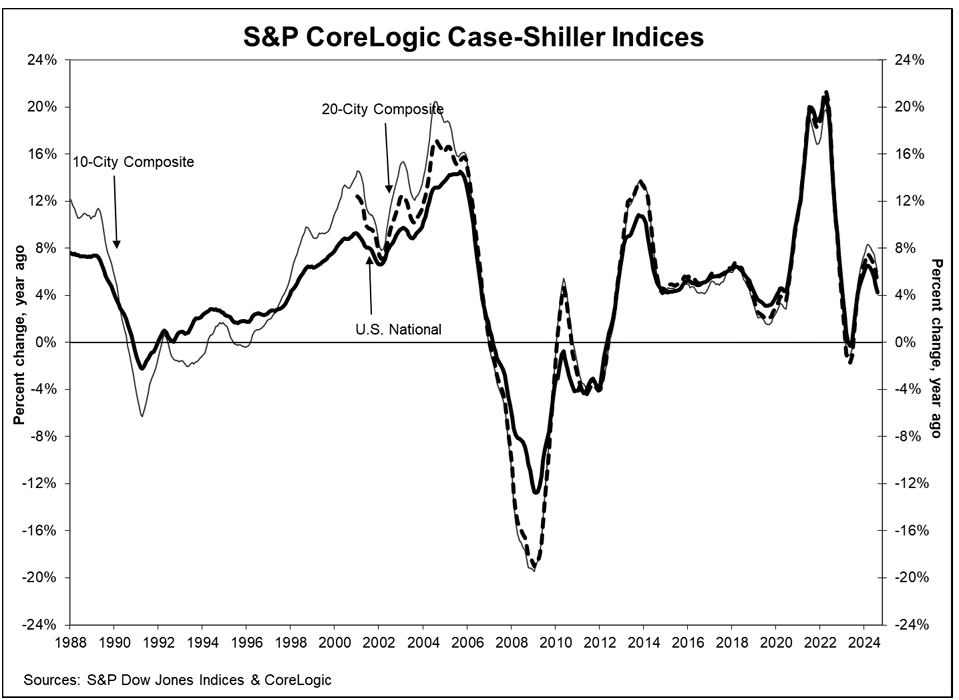

The S&P CoreLogic Case-Shiller 20-City Composite posted a year-over-year increase of 5.2% in August 2024, dropping from a 5.9% increase in the previous month. Generally, home price increases peak in March and decline for the rest of the year – so it comes as no surprise that inflation is moderating in August. Here is the perspective of CoreLogic Chief Economist Dr. Selma Hepp:

Despite much-needed optimism, brought by a sharp decline in mortgage rates in August, the boost was short lived and not enough to renew homebuyers’ interest. As a result, home prices continued to weaken relative to their seasonal trend and year-over- year gains took a step back. Nevertheless, bifurcation in housing demand and price growth remained with the West and South seeing stronger slowdown in home prices and Northeast and Midwest continuing to see home price gains remaining robust. The tale of two regions reflects significant affordability challenges in the West and South, where home price surge in recent years and high mortgage rates priced out many potential buyers, while the Northeast and Midwest continue to benefit from relative affordability and less collective increase in prices over the last few years, but also more limited for-sale inventory.

The number of job openings was little changed at 7.4 million on the last business day of September. Over the month, hires changed little at 5.6 million. The number of total separations was unchanged at 5.2 million. There is a general correlation between job openings and employment increases. The graph below shows that since March 2023, the year-over-year decline has been in a narrow range – but all the same it is a decline. One would expect that employment growth should continue to moderate IF the way job openings is counted does not include phantom job openings (and the phantom job openings are the ones being removed).

The Conference Board Consumer Confidence Index® increased in October to 108.7 (1985=100), up from 99.2 in September. Dana M. Peterson, Chief Economist at The Conference Board perspective:

Consumer confidence recorded the strongest monthly gain since March 2021, but still did not break free of the narrow range that has prevailed over the past two years. In October’s reading, all five components of the Index improved. Consumers’ assessments of current business conditions turned positive. Views on the current availability of jobs rebounded after several months of weakness, potentially reflecting better labor market data. Compared to last month, consumers were substantially more optimistic about future business conditions and remained positive about future income. Also, for the first time since July 2023, they showed some cautious optimism about future job availability. October’s increase in confidence was broad-based across all age groups and most income groups. In terms of age, confidence rose sharpest for consumers aged 35 to 54. On a six-month moving average basis, householders aged under 35 and those earning over $100K remained the most confident.

Here is a summary of headlines we are reading today:

- NATO Chief Confirms North Korean Troops in Russia’s Kursk Region

- U.S. To Buy 3 Million Barrels for The SPR, But There’s A Problem

- Small Nuclear Reactors to Power Czech Republic’s Green Energy Shift

- Ford’s Q3 Earnings: A Mixed Bag for Investors

- Gold’s Record High Suggests Inflation Isn’t Over Just Yet

- Alphabet beats on top and bottom lines, boosted by cloud revenue

- Consumer confidence surges as election nears, while job openings move lower

- Crypto company Consensys cuts 20% of workforce, citing regulatory uncertainty: CNBC Crypto World

- 10-year Treasury yield crosses ‘line in the sand’ that begins to spell trouble for stocks

- 10-year Treasury yield closes below 4.3% after Tuesday’s initial selloff fades

- Oil prices edge down to finish at lowest in seven weeks

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Armenia-Azerbaijan Peace Talks Gain Momentum After BRICS SummitFollowing months of stalled negotiations, the Armenian-Azerbaijani peace process is moving again. Despite the newfound optimism that a deal is close, both sides have given no indication of how they intend to settle major differences. Following a brief meeting on the sidelines of the BRICS summit in the Russian city of Kazan, Azerbaijani President Ilham Aliyev and Armenian Prime Minister Nikol Pashinyan instructed their respective foreign ministers to fast-track negotiations on an “Agreement on the Establishment of Peace and Interstate Relations.”… Read more at: https://oilprice.com/Geopolitics/International/Armenia-Azerbaijan-Peace-Talks-Gain-Momentum-After-BRICS-Summit.html |

|

NATO Chief Confirms North Korean Troops in Russia’s Kursk RegionThe NATO military alliance has confirmed that North Korean troops have moved to Russia’s Kursk region, which borders Ukraine. Speaking in Brussels on October 28, NATO chief Mark Rutte called the move a “significant escalation” in Russia’s full-scale invasion of Ukraine and said it shows Russian President Vladimir Putin’s “desperation” after “more than 600,000 Russian soldiers have been killed or wounded” in the war. Rutte’s comments follow weeks of reports suggesting that North Korea was sending troops to Russia in a further sign of increasingly… Read more at: https://oilprice.com/Geopolitics/International/NATO-Chief-Confirms-North-Korean-Troops-in-Russias-Kursk-Region.html |

|

U.S. To Buy 3 Million Barrels for The SPR, But There’s A ProblemThe U.S. Department of Energy (DoE) is seeking to purchase 3 million barrels of crude oil for the Strategic Petroleum Reserve (SPR), the latest in a string of contracts aimed at refilling emergency inventories following a record release of 180 million barrels in 2022. The DoE has since repurchased over 56 million barrels at an average price of around $76/barrel, considerably lower than its sale price of $95/barrel. The DoE has also worked with Congress to cancel a previously planned sale of 140 million barrels of oil from the reserve, also counting… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-To-Buy-3-Million-Barrels-for-The-SPR-But-Theres-A-Problem.html |

|

As Oil Job Losses Mount, Steelworkers Union Looks to Clean EnergyThe United Steelworkers union is counting on renewable energy projects to offset job losses at oil refining and petrochemical plants, a union official has told Reuters, adding that some 17,000 new union jobs could be replaced thanks to the 2022 Inflation Reduction Act (IRA). The USW–which represents some 30,000 workers from North American crude oil refinery and petrochemical plants–appears to remain optimistic even in the event of a victory for Donald Trump in next week’s elections. Trump has promised to reverse the IRA… Read more at: https://oilprice.com/Latest-Energy-News/World-News/As-Oil-Job-Losses-Mount-Steelworkers-Union-Looks-to-Clean-Energy.html |

|

Small Nuclear Reactors to Power Czech Republic’s Green Energy ShiftRolls-Royce has sold a minority stake in its small nuclear reactor division to Czech power company CEZ. The Derby-headquartered giant has handed a 20 per cent share in Rolls-Royce SMR in a deal worth hundreds of millions of pounds. CEZ plans to build the first small modular reactor at the existing Temelin nuclear plant in the first half of the 2030s. The deal is expected to result in up to three gigawatt-producing (GW) energy sources installed in the Czech Republic. CEZ will also participate in other projects by Rolls-Royce SMR in Europe and around… Read more at: https://oilprice.com/Alternative-Energy/Nuclear-Power/Small-Nuclear-Reactors-to-Power-Czech-Republics-Green-Energy-Shift.html |

|

Ford’s Q3 Earnings: A Mixed Bag for InvestorsFord shares jumped before tumbling after hours on Monday, as the legacy automaker reported guidance that was on the low end of expectations. Like many other automakers, Ford continues to grapple with balancing the costs of EV production, high interest rates and a tapped out American consumer. Ford announced third-quarter revenue of $46 billion, with net income totaling $0.9 billion. This figure includes a $1 billion charge related to its electric vehicle business, which the company had previously disclosed. Adjusted earnings before interest… Read more at: https://oilprice.com/Energy/Energy-General/Fords-Q3-Earnings-A-Mixed-Bag-for-Investors.html |

|

TotalEnergies to Produce More Gas Condensate Offshore DenmarkU.S. refining and chemicals giant Phillips 66 (NYSE: PSX) booked higher-than-expected earnings for the third quarter even if earnings plunged from a year earlier, as expected, due to weak refining margins and fuel demand. Phillips 66 reported on Tuesday adjusted earnings of $859 million, or $2.04 per share, for the third quarter, down from $2.1 billion, or $4.63 EPS, for the same period last year. Despite the profit slump, the company’s adjusted EPS topped the analyst consensus estimate of $1.65 compiled by The Wall Street Journal. During… Read more at: https://oilprice.com/Latest-Energy-News/World-News/TotalEnergies-to-Produce-More-Gas-Condensate-Offshore-Denmark.html |

|

Macroeconomic Concerns Cap Crude PricesOil prices failed to recover from the steep sell off on Monday and Brent is now hovering just above $71 per barrel. Surge in Geopolitical Risk Premium Gives Way to Great Disappointment – The sudden de-escalation of tensions between Israel and Iran led to a widespread cancellation of call options held by market participants who wanted to hedge their exposure against sudden upward price swings.- In the immediate aftermath of Iran’s attack on Israel in early October, trade in call options has soared to unprecedented levels, tripling compared… Read more at: https://oilprice.com/Energy/Energy-General/Macroeconomic-Concerns-Cap-Crude-Prices.html |

|

Phillips 66 Beats Analyst Estimates Despite Earnings Dip in Q3U.S. refining and chemicals giant Phillips 66 (NYSE: PSX) booked higher-than-expected earnings for the third quarter even if earnings plunged from a year earlier, as expected, due to weak refining margins and fuel demand. Phillips 66 reported on Tuesday adjusted earnings of $859 million, or $2.04 per share, for the third quarter, down from $2.1 billion, or $4.63 EPS, for the same period last year. Despite the profit slump, the company’s adjusted EPS topped the analyst consensus estimate of $1.65 compiled by The Wall Street Journal. During… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Phillips-66-Beats-Analyst-Estimates-Despite-Earnings-Dip-in-Q3.html |

|

Saudi Arabia Vows to Maintain Its Status as an Oil GiantAs Saudi Arabia prepares to tender 44 gigawatts (GW) of renewable energy projects, it will continue to maintain its oil-producing potential to ensure global energy security, officials from the Kingdom said at the annual investment forum in Riyadh on Tuesday. Saudi Arabia, the world’s biggest crude oil exporter, will keep its maximum sustainable capacity of 12.3 million barrels per day (bpd) going forward. By 2027, the Kingdom will have more than 1.1 million bpd of production of oilfields currently under development, which are expected to… Read more at: https://oilprice.com/Energy/Energy-General/Saudi-Arabia-Vows-to-Maintain-Its-Status-as-an-Oil-Giant.html |

|

UK Offshore Oil Platform Halted Due to Gas Compressor IssueProduction via the Triton Floating Production Storage & Offloading (FPSO) vessel in the UK North Sea has been halted due to a problem with the single gas compressor in operation, one of the project partners, Serica Energy, said on Tuesday. A potential dry gas seal failure was identified in the ‘A’ gas compressor during operations on October 26, 2024, Serica said today, adding that no oil and gas has been leaked from the platform. The FPSO operator, Dana Petroleum, is working to identify and execute the necessary repair, according… Read more at: https://oilprice.com/Latest-Energy-News/World-News/UK-Offshore-Oil-Platform-Halted-Due-to-Gas-Compressor-Issue.html |

|

Gold’s Record High Suggests Inflation Isn’t Over Just YetVia SchiffGold.com, On this week’s episode, Peter covered a record setting week for gold and a stellar week for silver. With the metals nearly cresting $2800 and $35, respectively, Peter sees this price action as confirmation that the Fed’s recent rate cuts are a mistake. Politicians may love inflation, and the media is oblivious, but the metals markets know that America’s economic trajectory is unsustainable. As Peter predicted, long-term interest rates are rising. Even though rate cuts are traditionally considered bearish for… Read more at: https://oilprice.com/Metals/Gold/Golds-Record-High-Suggests-Inflation-Isnt-Over-Just-Yet.html |

|

Nigeria Discusses Crude and Fuel Supply with Africa’s Top RefineryAliko Dangote, Africa’s richest person and the owner of the continent’s newest and biggest refinery, is discussing crude supply to the refinery and fuel supply to Nigeria with Nigeria’s President Bola Tinubu at an emergency meeting on Tuesday. Dangote and President Tinubu are meeting with representatives of the domestic oil industry regulators and oil industry officials as the new refinery of the Dangote Group has faced issues with crude supply since it started up operations earlier this year. The Dangote refinery began the production… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Nigeria-Discusses-Crude-and-Fuel-Supply-with-Africas-Top-Refinery.html |

|

Austria’s OMV Profit Slumps on Weak Oil Trading and RefiningAustrian energy company OMV reported a lower-than-expected net profit for the third quarter as stronger chemicals sales and margins could not fully offset weaker oil prices, refining margins, and trading. OMV on Tuesday said that its net profit on a current cost of supply (CCS) basis, its closest metric to net income, fell by 20% to $374 million (346 million euros) for the third quarter, lower than a company-provided consensus of $495 million (457 million euros). Operating profit adjusted for the current cost of supply fell by 21% year-over-year… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Austrias-OMV-Profit-Slumps-on-Weak-Oil-Trading-and-Refining.html |

|

BP Earnings Top Forecasts Despite Weaker Oil Prices and RefiningBP (NYSE: BP) booked third-quarter earnings above analyst expectations, although the profit was lower from a year earlier and the second quarter amid weaker oil prices and low refining margins. BP reported on Tuesday an underlying replacement cost (RC) profit – its key earnings metric closest to net profit – of $2.3 billion for the third quarter, down by 30% compared to the same period of 2023 and down from $2.8 billion for the previous quarter. While the third-quarter profit was BP’s weakest since the fourth quarter of 2020,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/BP-Earnings-Top-Forecasts-Despite-Weaker-Oil-Prices-and-Refining.html |

|

Alphabet beats on top and bottom lines, boosted by cloud revenueAlphabet reported earnings after the bell. Here are the results. Read more at: https://www.cnbc.com/2024/10/29/alphabet-to-report-q3-earnings-after-the-bell.html |

|

Chipotle misses revenue estimates as same-store sales growth disappointsChipotle’s same-store sales rose 6% in the third quarter, just missing Wall Street’s expectations. Read more at: https://www.cnbc.com/2024/10/29/chipotle-mexican-grill-cmg-q3-2024-earnings.html |

|

Consumer confidence surges as election nears, while job openings move lowerConsumers grew more optimistic heading into the contentious presidential election even as job openings hit multiyear lows. Read more at: https://www.cnbc.com/2024/10/29/consumer-confidence-surges-as-election-nears-job-openings-move-lower.html |

|

Harris vs. Trump: Auto insiders weigh in on both candidates, top issuesAuto executives and lobbyists told CNBC they’re ready for all election outcomes and EVs, trade, tariffs, China, emissions regulations and labor are top issues. Read more at: https://www.cnbc.com/2024/10/29/harris-trump-auto-industry-michigan.html |

|

How to keep your portfolio steady in volatile times as the election approachesMarket volatility is expected to pick up as Election Day approaches, but investors can take a few steps to help prepare their portfolios. Read more at: https://www.cnbc.com/2024/10/29/how-to-keep-your-portfolio-steady-in-volatile-times-as-the-election-approaches.html |

|

Morgan Stanley CEO says the era of zero interest rates and inflation ‘is over’Several of Wall Street’s chief executives don’t see more than one more interest rate cut by the Fed this year, citing expectations of continued inflation. Read more at: https://www.cnbc.com/2024/10/29/morgan-stanley-ceo-says-the-era-of-zero-interest-rates-and-inflation-is-over-.html |

|

Crypto company Consensys cuts 20% of workforce, citing regulatory uncertainty: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Coinbase chief legal officer Paul Grewal discusses the crypto industry’s final push to get out the vote for pro-crypto candidates across the country. Read more at: https://www.cnbc.com/video/2024/10/29/consensys-cuts-20percent-workforce-regulatory-uncertainty-crypto-world.html |

|

Apple announces new and smaller Mac Mini with first redesign since 2010Apple is framing the new Mac Minis, like all of its new products announced this year, as built for Apple Intelligence. Read more at: https://www.cnbc.com/2024/10/29/apple-mac-mini-2024-price-release-specs.html |

|

Trump Media shares halted repeatedly as DJT whipsaws in volatile tradingTrading of Trump Media shares was halted for volatility as the company majority owned by Donald Trump surged at the opening bell. Read more at: https://www.cnbc.com/2024/10/29/trump-media-shares-halted-for-volatility-as-djt-rally-accelerates.html |

|

23andMe appoints three new board members following abrupt resignations23andMe appointed three new independent directors to its board, the company said Tuesday. Read more at: https://www.cnbc.com/2024/10/29/23andme-appoints-three-new-board-members-after-abrupt-resignations-.html |

|

More than 46 million early voters already cast ballots as Harris, Trump enter final sprintVice President Kamala Harris and former President Donald Trump have encouraged voters to get to the ballot box as soon as they can. Read more at: https://www.cnbc.com/2024/10/29/harris-trump-early-voters-ballots-2024-election.html |

|

How the stock market is likely to react to the election outcomeEither way the results fall on Nov. 5 has the potential to roil markets — especially given the exceptionally tight race. Read more at: https://www.cnbc.com/2024/10/29/how-the-stock-market-is-likely-to-react-to-the-election-outcome.html |

|

Microsoft’s GitHub expands beyond OpenAI, lets developers use AI models from Anthropic, GoogleGitHub is giving software developers more choices for its popular coding assistant, meaning they won’t be limited to models from OpenAI. Read more at: https://www.cnbc.com/2024/10/29/microsoft-github-copilot-goes-past-openai-opens-to-anthropic-google.html |

|

“On One Level, The Entire US Election Echoes The Simpsons”By Michael Every of Rabobank As we enter the final week of the US election -we hope it’s the final week, not a 2020 or 2000 rerun, as the Nevada, Pennsylvania, and Virginia supreme courts already feature- things are splenetic. However, parsing the early-vote data, Trump continues to have a spring in his step; or a Springtime in his goosestep, say some US media in a manner that won’t help political stability if he wins a week from now. (Remember when New York loved this show?) USA Today just refused to endorse a presidential candidate, and the Washington Post’s refusal to do so either saw key staff threaten to quit and 200,000 subscribers cancel, prompting owner Jeff Bezos to pen an unapologetic op-ed that states: “In the annual public surveys about trust and reputation, journalists and the media have regularly fallen near the very bottom, often just above Congress. But in this year’s Gallup poll, we have managed to fall below Congress. Our profession is now the least trusted o … Read more at: https://www.zerohedge.com/markets/one-level-entire-us-election-echoes-simpsons |

|

Putin Oversees Sweeping Exercise Of Russia’s Nuclear Forces Days Before US ElectionOn Tuesday Russia launched a massive exercise of the country’s nuclear forces. The drills were ordered by President Vladimir Putin, notably just days before the US election. “Today we are conducting another exercise of strategic deterrence forces,” he announced. Putin in a video call with top defense officials detailed that the drills simulate using nuclear weapons, and featured practice launches of nuclear-capable ballistic and cruise missiles, as cited in The Associated Press via Russian media.

Illustrative file image: Roscosmos Space Agency Press Service/The Associated Press He further declared that the country’s strategic forces remain a “reliable guarantor of the country’s sovereignty and security.” “Taking into account growing geopolitical tensions and emerging new thre … Read more at: https://www.zerohedge.com/geopolitical/putin-oversees-sweeping-exercise-russias-nuclear-forces-days-us-election |

|

Coal Remains On Its Throne Despite Transition PushAuthored by Irina Slav via OilPrice.com,

Report upon report sings praises to energy transition efforts that are leading to record wind and solar electricity generation. Outside the spotlight, however, things look very different. There, coal remains king—and this is not about to change anytime soon.

Reuters recently reported that India’s coal power generation had fallen fo … Read more at: https://www.zerohedge.com/energy/coal-remains-its-throne-despite-transition-push |

|

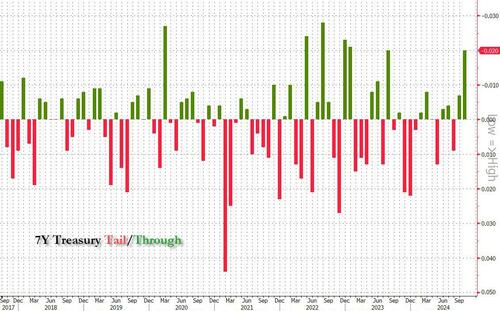

Yields Tumbles After Stellar 7Y Auction Stops Through Most Since Covid PanicAfter two ugly auctions yesterday to start the week, moments ago the Treasury concluded the truncated week’s coupon issuance when it sold $44 billion in 7Y paper in what was a stellar auction. The auction stopped at a high yield of 4.215%, 54bps higher than the 3.668% last month, and the highest since June, but more importantly, it was below the When Issued which traded at 4.235% at 1PM. As a result, the auction stopped through by 2bps, the biggest stop through Jan 2023 (and tied with the Stop in August 2023).

The bid to cover surged from 2.628 to 2.737, the highest since March 2020, the depths of the covid crisis when everyone was scrambling to get Treasury paper. The internals were also solid, with Indirects awarded 72.0, up from 70.8 and above the six auction average of 70.3. And with Directs awarded 20.6%, up from 20.3% in September and the highest since April, Dealers were left with just 7.5% of the allotment, the lowest since Jan 2023. Read more at: https://www.zerohedge.com/markets/yields-tumbles-after-stellar-7y-auction-stops-through-most-covid-panic |

|

Minimum wage to rise to £12.21 an hour next yearThe National Living Wage will rise by 77p from £11.44 per hour for workers over the age of 21. Read more at: https://www.bbc.com/news/articles/c5y37wqnvwxo |

|

Adidas ends ‘fight’ with Kanye West over antisemitismThe two collaborated on the Yeezy collection but cut ties due to the rapper’s controversial comments. Read more at: https://www.bbc.com/news/articles/cgej945wp9xo |

|

When is the Budget and what might be in it?Chancellor Rachel Reeves will set out the government’s financial plans for the next year. Read more at: https://www.bbc.com/news/articles/cdxl1zd07l1o |

|

Tech View: Nifty indicators give positive signals, likely to face resistance at 24,694. How to trade tomorrowNifty formed a bullish candle today, closing at a 5-session high after establishing a triple bottom in the 24,073-24,140 range. Indicators signal a bullish short-term trend, with support likely in this range and resistance expected around 24,567-24,694, according to Deepak Jasani of HDFC Securities. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-indicators-give-positive-signals-likely-to-face-resistance-at-24694-how-to-trade-tomorrow/articleshow/114732859.cms |

|

Tata Motors, other auto stocks fall up to 6%. Why the red signal?The Nifty Auto index was down over 2%, with Bajaj Auto and Hero Moto shares falling around 3% each, while Maruti Suzuki and Mahindra & Mahindra were about 2% lower. Analysts expect the auto index could decline by an additional 10-15% from current levels. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tata-motors-other-auto-stocks-fall-up-to-6-why-the-red-signal/articleshow/114724542.cms |

|

Afcons Infrastructure IPO subscribed 76% so far on last day of bidding. Check GMP, detailsAfcons Infrastructure’s IPO, a Shapoorji Pallonji company, was fully subscribed on the last day with the issue receiving bids 1.10 times the total size. The retail portion saw 52% subscription while non-institutional investors subscribed 2.42 times. The company plans to use the proceeds for construction equipment, working capital, and debt repayment. Read more at: https://economictimes.indiatimes.com/markets/ipos/fpos/afcons-infrastructure-ipo-subscribed-by-76-so-far-on-the-last-day-of-bidding-check-details/articleshow/114719714.cms |

|

10-year Treasury yield crosses ‘line in the sand’ that begins to spell trouble for stocksAn early bond-market selloff pushed the benchmark 10-year Treasury yield just over 4.3% for much of Tuesday’s session, a level which stocks have had a difficult time adjusting to over the past year. Read more at: https://www.marketwatch.com/story/10-year-treasury-yield-crosses-line-in-the-sand-thatbegins-tospell-trouble-for-stocks-00eb8521?mod=mw_rss_topstories |

|

10-year Treasury yield closes below 4.3% after Tuesday’s initial selloff fadesLong-dated Treasury yields finished lower on Tuesday after a selloff of U.S. government debt that began during European trading hours faded by the end of the New York session. Read more at: https://www.marketwatch.com/story/10-year-treasury-yields-rise-above-4-3-ahead-of-inflation-and-jobs-data-d71a4dcd?mod=mw_rss_topstories |

|

Oil prices edge down to finish at lowest in seven weeksOil futures declined on Tuesday, giving up earlier support a day after suffering their largest daily percentage decline in more than two years, with U.S. and global benchmark prices settling at their lowest in seven weeks. Read more at: https://www.marketwatch.com/story/oil-prices-find-support-after-biggest-one-day-rout-in-over-2-years-55e46e36?mod=mw_rss_topstories |