Summary Of the Markets Today:

- The Dow closed down 141 points or 0.33%,

- Nasdaq closed up 139 points or 0.76%,

- S&P 500 closed up 12 points or 0.21%,

- Gold $2,749 up $19.10 or 0.07%,

- WTI crude oil settled at $71 down $0.26 or 0.35%,

- 10-year U.S. Treasury 4.210 up 0.032 points or 0.258%,

- USD index $104.02 down $0.41 or 0.39%,

- Bitcoin $68,144 up $1,894 or 2.78%, (24 Hours)

*Stock data, cryptocurrency, and commodity prices at the market closing

Today’s Highlights

The Nasdaq Composite gained, led by Tesla’s strong performance. The S&P 500 closed up while the Dow Jones Industrial Average fell extending losses from the previous day. Tesla reported its biggest quarterly profit in over a year. Tesla shares surged more than 20%, its best day in over a decade. CEO Elon Musk forecasted 20% to 30% EV sales growth next year. The company grew adjusted EBITDA margins for the first time in over a year. IBM shares fell over 6% following a third-quarter revenue miss. Boeing shares sagged around 1% after striking workers rejected a pay deal.

Click here to read our current Economic Forecast – October 2024 Economic Forecast: One More Recession Flag Removed Yet Little Headway On Inflation

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

Sales of new single-family houses in September 2024 were up 6.3% above September 2023. The median sales price of new houses sold in September 2024 was $426,300. The average sales price was $501,000. The seasonally-adjusted estimate of new houses for sale at the end of September was 470,000. This represents a supply of 7.6 months at the current sales rate. New home construction is one of the bright spots in the economy.

The Chicago Fed National Activity Index (CFNAI ) three-month moving average, CFNAI-MA3, decreased to –0.19 in September from –0.14 in August. A zero value for the CFNAI has been associated with the national economy expanding at its historical trend (average) rate of growth; negative values with below-average growth (in standard deviation units); and positive values with above-average growth. The CFNAI is my favorite coincident indicator, and shows a continuing weak economy.

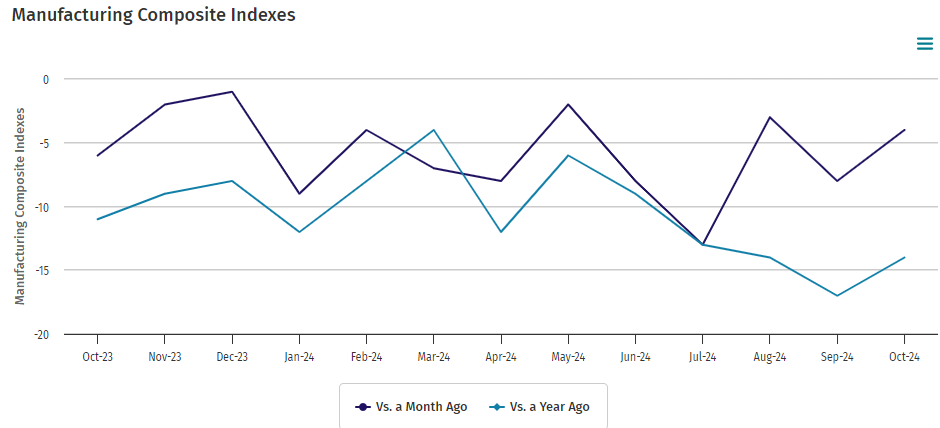

Kansas Fed manufacturing activity declined modestly in October 2024. The month-over-month composite index was -4, up from -8 in September. Manufacturing remains in a recession in the US.

In the week ending October 19, the advance figure for seasonally adjusted initial unemployment claims 4-week moving average was 238,500, an increase of 2,000 from the previous week’s revised average. The previous week’s average was revised up by 250 from 236,250 to 236,500. There is no sign of a recession in this data.

Here is a summary of headlines we are reading today:

- Valero Could Be Next To Shutter California Oil Refineries

- Mckinsey: Europe’s Data Center Power Demand To Triple By 2030

- Russia’s Advance Threatens to Cripple Ukraine’s Steel Industry

- Saudi Oil Export Revenues Hit Three-Year Low as Prices Decline

- Tesla Stock Soars After Q3 Earnings Beat

- China’s Coal Imports Could Decline in 2025

- Tesla stock soars 20%, heads for best day in over a decade on Musk’s 2025 growth projection

- S&P 500 rises to end three-day losing run, lifted by surge in Tesla: Live updates

- U.S. will be ‘more pro-crypto’ after this election, no matter who wins, says Ripple CEO Garlinghouse

- Bitcoin eyes $68,000 as it reclaims some weekly losses: CNBC Crypto World

- Hezbollah Targets Tel Aviv With Large Iranian Missiles Launched From Underground Silos

- Why stock investors have been on edge over the prospects of a total sweep for Republicans

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Putin’s Middle East Balancing ActOn October 16, Russian air strikes hit a furniture workshop, a sawmill, and an olive press in Syria’s Idlib Province, killing 10 civilians, including a child, according to the U.K.-based Syrian Observatory for Human Rights and the White Helmets civil defense force. Two days later, Russian President Vladimir Putin was playing the Middle East peacemaker at a meeting with journalists from countries in the BRICS grouping of nations ahead of a summit this week, saying Moscow is ready to do whatever it can to end what he called the “terrible strikes… Read more at: https://oilprice.com/Geopolitics/International/Putins-Middle-East-Balancing-Act.html |

|

Valero Could Be Next To Shutter California Oil RefineriesLast week, Phillips 66 said it would shut down its Los Angeles oil refinery by the end of next year. Now, refining peer Valero Energy Corp is suggesting it could be next. Valero, the United States’ second-largest refiner by capacity, is keeping all options “on the table” for its two California refineries. According to the company’s Chief Executive Lane Riggs, this is due to the increasing regulatory pressure that has pervaded California. Oil refiners in California saw lower-than-average margins in late spring/early summer… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Valero-Could-Be-Next-To-Shutter-California-Oil-Refineries.html |

|

The Hidden Dangers of Puerto Rico’s LNG Import BoomPuerto Rico’s green energy transition has been full of hurdles and shocks thanks to economic volatility, natural disasters, ambitious frontier clean energy models, and poor oversight and governance mechanisms on the part of local and federal United States institutions. Now, a liquefied natural gas (LNG) terminal could be the site of the U.S. territory’s next energy disaster. For years, Puerto Rico’s energy security has been under extreme duress. Puerto Rico’s electrical grid has been critically under-invested in and… Read more at: https://oilprice.com/Energy/Energy-General/The-Hidden-Dangers-of-Puerto-Ricos-LNG-Import-Boom.html |

|

Mckinsey: Europe’s Data Center Power Demand To Triple By 2030Europe’s data center power consumption is expected to almost triple by 2030 and will require a surge in electricity—supply mostly from low-carbon sources coupled with grid infrastructure upgrades, McKinsey has reported. According to the global business management consultant, total IT load demand for data centers in the European Union, Norway, Switzerland and Britain will hit 35 gigawatts (GW) by 2030, up from 10 GW today. Europe’s data centers are expected to account for ~5% of the continent’s total consumption over the next six years compared… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Mckinsey-Europes-Data-Center-Power-Demand-To-Triple-By-2030.html |

|

Russia’s Advance Threatens to Cripple Ukraine’s Steel IndustryIn what promises to be a major milestone in more than two-and-a-half years of war, Russia is closing in on the capture of a vital industrial asset: a Ukrainian coal mine that’s a cornerstone of the country’s steel industry. Owned by Ukrainian firm Metinvest, the modern facility — opened in 1990 — is Ukraine’s largest mine for producing coking-coal, a specific grade used to fuel blast furnaces. It’s near the village of Udachne, about 10 kilometers west of the city of Pokvrosk, which is itself a key supply hub in Ukraine’s Donetsk oblast.… Read more at: https://oilprice.com/Metals/Commodities/Russias-Advance-Threatens-to-Cripple-Ukraines-Steel-Industry.html |

|

Can BRICS Deliver on its Promises?As Russian President Vladimir Putin hosts leaders for the 16th annual BRICS summit, he’s determined to show the West that he still has important allies by his side after nearly three years of attempts to isolate Russia for its full-scale invasion of Ukraine. But while Putin is getting the optics he wants, what kind of an organization is BRICS actually growing into? Finding Perspective: The summit in Kazan, which began on October 22 and will run until October 24, is the first meeting for the group since Egypt, Ethiopia, Iran, and the United Arab… Read more at: https://oilprice.com/Geopolitics/International/Can-BRICS-Deliver-on-its-Promises.html |

|

Norway’s Oil Giant Sverdrup Set to Peak in 2025Norway’s largest oilfield, Johan Sverdrup, is expected to come off its production peak by early 2025, according to operator Equinor. The field, a cornerstone of Norway’s oil output since it started production in 2019, hit a record daily production of over 756,000 barrels in September. This represents about 6-7% of Europe’s daily oil consumption, making Johan Sverdrup a critical player in the region’s energy supply. Since its inception, the field has produced a billion barrels of oil, and Equinor expects it to remain an essential resource for years.… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Norways-Oil-Giant-Sverdrup-Set-to-Peak-in-2025.html |

|

Saudi Oil Export Revenues Hit Three-Year Low as Prices DeclineLower crude oil prices dragged Saudi Arabia’s oil export revenues to the lowest level in more than three years in August, amid underwhelming oil demand and continued supply constraints from the world’s top crude exporter. The value of Saudi Arabia’s oil exports in August 2024 stood at $17.4 billion (65.3 billion Saudi riyals), down by 15.5% from $20.6 billion (77.3 billion riyals) in August 2023, data from the Kingdom’s General Authority for Statistics showed on Thursday. The August 2024 oil export revenues also fell by… Read more at: https://oilprice.com/Energy/Oil-Prices/Saudi-Oil-Export-Revenues-Hit-Three-Year-Low-as-Prices-Decline.html |

|

Tesla Stock Soars After Q3 Earnings BeatTesla (NASDAQ: TSLA) saw its shares jump by 20% after hours on Wednesday and another 14% in pre-market trade on Thursday after reporting earnings for the third quarter beating analyst estimates. Tesla booked earnings per share of $0.72, higher than the $0.58 EPS expected by Wall Street analysts. Total revenues rose to $25.182 billion, up by 8% year-over-year, with total automotive revenues at $20 billion, a 2% annual increase. “We delivered strong results in Q3 with growth in vehicle deliveries both sequentially and year-on-year, resulting… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Tesla-Stock-Soars-After-Q3-Earnings-Beat.html |

|

Strict Oil Sanctions Enforcement Could Cripple IRGC’s PowerThe ongoing Israeli war with Hamas, Hezbollah, and Iran is currently ruling geopolitics and media headlines. At the same time, US presidential elections in the coming weeks could refocus the discussion on the need to increase Western sanctions on Iran. Without any question, current sanctions regimes are flawed, not only due to a growing division of global powers but also to a lack of hardline implementation of existing or future sanction regimes. The need is clear, especially when looking at the latest news coming from Iran. Tehran has proposed… Read more at: https://oilprice.com/Energy/Crude-Oil/Strict-Oil-Sanctions-Enforcement-Could-Cripple-IRGCs-Power.html |

|

Oil Refining Giant Valero Tops Estimates Despite Q3 Profit PlungeOne of the biggest U.S. refiners, Valero Energy (NYSE: VLO), beat Wall Street estimates even as it reported a widely expected plunge in its third-quarter earnings due to slumping refining margins. Valero reported on Thursday earnings per share (EPS) of $1.14 for the third quarter, down by a massive 86% compared to the EPS of $7.49 for the same period last year. Yet, the earnings per share for July-September 2024 beat the analyst consensus estimate of $0.98. All U.S. refiners are expected to report much lower profits for the third quarter compared… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Oil-Refining-Giant-Valero-Tops-Estimates-Despite-Q3-Profit-Plunge.html |

|

Tesla’s Profit Surge Signals End of Price WarAhead of yesterday’s Tesla earnings report, UBS analyst Joe Spak asked whether Tesla numbers even matter this quarter after the Robotaxi reveal, which disappointed markets. His response is that while they should matter more, Tesla is really about the future/multiple, not the current EV biz (which drives numbers). Of the number that will be report, auto gross margins ex credits remains “the” metric investors follow, and feedback indicates buyside expectations are for flat-to-slightly-higher quarter over quarter (consensus +30bp q/q to 14.9%).… Read more at: https://oilprice.com/Energy/Energy-General/Teslas-Profit-Surge-Signals-End-of-Price-War.html |

|

India’s Adani Total Gas Books Higher Profit as Natural Gas-Vehicle Use GrowsIndian firm Adani Total Gas reported on Thursday a 7.5% increase in its consolidated profit for the quarter ended September 30, as sales of compressed natural gas (CNG) for vehicles continue to grow. Adani Total Gas, part of the Adani conglomerate in India, thus reported higher profits for the seventh consecutive quarter amid a wider government-led push for cleaner vehicle fuel use. Diesel is still the most widely used road transport fuel in India, with sales outstripping the consumption of gasoline. Adani Total Gas said on Thursday that its consolidated… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Indias-Adani-Total-Gas-Books-Higher-Profit-as-Natural-Gas-Vehicle-Use-Grows.html |

|

Lower Oil Prices Drag Equinor’s Q3 Earnings Below EstimatesLower oil prices and production volumes failed to offset rising natural gas prices and output at Equinor (NYSE: EQNR), which reported on Thursday lower-than-expected adjusted operating income, its key earnings metric, for the third quarter. The Norwegian energy giant booked an adjusted operating income of $6.89 billion for Q3, down by 13% compared to the same period of 2023, and lower than the company-compiled analyst consensus expecting $7.01 billion. Revenues fell by 2%, amid lower liquids prices which couldn’t be offset by rising natural… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Lower-Oil-Prices-Drag-Equinors-Q3-Earnings-Below-Estimates.html |

|

China’s Coal Imports Could Decline in 2025China’s recent surge in coal production and imports has combined with a weaker economy to create a coal glut, which has prompted Chinese importers to discuss lowering volumes under long-term contracts next year, Bloomberg reports, quoting the main coal trade body. This year, Chinese coal importers have seen losses on their purchases of thermal coal, the type of coal used in power plants, amid persistently low domestic prices, the China Coal Transportation and Distribution Association says. Chinese coal imports could fall next year by 4% from… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Chinas-Coal-Imports-Could-Decline-in-2025.html |

|

Tesla stock soars 20%, heads for best day in over a decade on Musk’s 2025 growth projectionTesla shares soared 20% Thursday, putting the stock on pace for its best day in 11 years, following its better-than-expected third-quarter earnings. Read more at: https://www.cnbc.com/2024/10/24/tesla-shares-surge-as-analysts-react-to-q3-earnings-musk-predictions.html |

|

French trader bet over $28 million on Trump election win using 4 Polymarket accountsSupporters of Donald Trump, including Elon Musk, have touted shifting election odds on Polymarket even as polls largely show a tight race with Kamala Harris. Read more at: https://www.cnbc.com/2024/10/24/polymarket-trump-french-election-bet.html |

|

Yum Brands and Burger King pull onions from select restaurants after McDonald’s E. coli outbreakYum Brands said it has been monitoring the recently reported E. coli outbreak, which has been linked to Quarter Pounder burgers served at McDonald’s. Read more at: https://www.cnbc.com/2024/10/24/yum-brands-pulls-onions-from-select-locations-after-mcdonalds-e-coli-outbreak.html |

|

S&P 500 rises to end three-day losing run, lifted by surge in Tesla: Live updatesThe broad market index broke a three-day losing streak on Thursday. Read more at: https://www.cnbc.com/2024/10/23/stock-market-today-live-updates.html |

|

Where Vanguard sees opportunity to earn income right nowWith the Federal Reserve rate-cutting cycle underway, income investors may want to take a closer look at their portfolios. Read more at: https://www.cnbc.com/2024/10/24/where-vanguard-sees-opportunity-to-earn-income-right-now.html |

|

Spirit AeroSystems weighs hundreds more furloughs or layoffs if Boeing strike goes beyond Nov. 25More than 32,000 Boeing machinists walked off the job on Sept. 13 after turning down an earlier tentative agreement. Read more at: https://www.cnbc.com/2024/10/24/spirit-aerosystems-weighs-more-furloughs-layoffs.html |

|

U.S. will be ‘more pro-crypto’ after this election, no matter who wins, says Ripple CEO GarlinghouseRipple CEO Brad Garlinghouse is a big cynic on U.S. crypto regulation, but highly optimistic about the post-election environment around the corner. Read more at: https://www.cnbc.com/2024/10/24/us-will-be-more-pro-crypto-after-election-no-matter-who-wins-ripple-ceo.html |

|

Mattel, Hasbro lower guidance ahead of holiday seasonToy giants Mattel and Hasbro decreased 2024 guidance prior to the holiday season as toy sales continue to fall during the third quarter. Read more at: https://www.cnbc.com/2024/10/24/mattel-hasbro-lower-guidance-ahead-of-holiday-season.html |

|

Bitcoin eyes $68,000 as it reclaims some weekly losses: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Crypto World visits Pubkey, the bitcoin-branded Manhattan bar, to learn about former President Donald Trump’s recent campaign visit and how the pub serves as a gathering space for bitcoin enthusiasts. Read more at: https://www.cnbc.com/video/2024/10/24/bitcoin-eyes-68000-reclaims-some-weekly-losses-crypto-world.html |

|

Southwest and activist investor Elliott strike deal to keep CEO Bob Jordan, add six new directorsSouthwest Airlines stuck a deal with activist Elliott which staves off a potential proxy fight in exchange for sizable board representation. Read more at: https://www.cnbc.com/2024/10/24/southwest-elliott-near-settlement-which-would-end-proxy-fight-source-says.html |

|

Jeff Vinik sells stake in NHL’s Tampa Bay Lightning to investor groupJeff Vinik sold a portion of the NHL’s Tampa Bay Lightning to a group of investors led by Doug Ostrover and Marc Lipschultz, both of Blue Owl Capital. Read more at: https://www.cnbc.com/2024/10/24/nhl-tampa-bay-lightning-stake-sold-to-investor-group.html |

|

NBA Commissioner Adam Silver laments the TNT breakup — and says officiating changes could be comingNBA Commissioner Adam Silver spoke to CNBC’s Alex Sherman in an exclusive interview, discussing TNT, officiating, politics and the WNBA. Read more at: https://www.cnbc.com/2024/10/24/sport-videocast-episode-1-adam-silver.html |

|

TKO Group to acquire IMG, Professional Bull Riders and On Location from Endeavor for $3.25 billionTKO Group, the company that owns UFC and WWE, is expanding its reach in the sports world by acquiring three businesses from Endeavor Group for $3.25 billion. Read more at: https://www.cnbc.com/2024/10/24/tko-group-to-acquire-img-pbr-and-on-location-from-endeavor.html |

|

Hezbollah Targets Tel Aviv With Large Iranian Missiles Launched From Underground SilosThe Israeli army says that over 120 rockets have been fired from Hezbollah in Lebanon on Thursday, resulting in at least five injuries. Some intercepts of the inbound projectiles have been made, but clearly a number of rockets have hit the ground, as the Shia paramilitary group backed by Iran continues targeting Haifa and other sites across northern Israel. Some of the launches of the past 24 hours appear to have included large Iranian-made surface to surface missiles. Hezbollah channels have publicized the recent launch of this beast below…

“According to a video published on X (formerly Twitter) on October 23, 2024, Hezbollah combatants launched Iranian-made Qader-2 surface-to-surface cruise missiles from underground silos, targeting Israeli territory,” one regional war monitor Read more at: https://www.zerohedge.com/geopolitical/hezbollah-targets-tel-aviv-large-iranian-missiles-launched-underground-silos |

|

Silver, The A-Bomb, & RussiaAuthored by Adam Sharp via DailyReckoning.com, During a critical stage of the Manhattan Project in 1942, its organizers ran into a problem while attempting to build those first atomic bombs. They had figured out a way to enrich uranium using electromagnets, but it was a highly resource-intensive process. Thousands of tons of copper were needed to create electromagnetic coils, but the metal was in short supply due to its use in weapons production. Copper was needed for shell casings, coatings, wiring and other applications. Thus the leaders of the Manhattan Project decided to secretly borrow 300 million ounces of 0.999% silver from the Treasury Department. As the most conductive metal in the world, silver was the ideal material for the job. It made highly efficient wire coils, which created the powerful magnetic fields needed to separate and enrich uranium. In all, 14,700 tons of US silver was melted down and forged into the massive electromagnetic coils used to build the nation’s initial nuclear arsenal. Nearly 1% of the entire nation’s electric capacity was directed toward these efforts, and the silver coils ensured an efficient use of it. Read more at: https://www.zerohedge.com/precious-metals/silver-bomb-russia |

|

“Maybe They’re Not Data-Dependent…” – Former Governor Questions Fed’s ‘Independence’Kevin Warsh, Hoover Institution distinguished visiting fellow and former Federal Reserve Governor, said the quiet part out loud this morning during an interview with CNBC’s ‘Squawk Box’ when he dared to offer a logical rebuttal of the over-arching narrative that a) The Fed is apolitical/independent, b) The Fed is data dependent, and c) The Fed knows what it is doing…

Warsh began by explaining why he thinks The Fed’s decision to cut 50bps goes against what The Fed had been saying regarding their policy. “They’ve had different theories about the cause of inflation and the measures they use, and people in the financial markets have tried to follow them,” Warsh begins, then clarifying several of those measures still being significantly far away from The Fed’s mandated 2% goals. “…a few years ago they were for flexible average inflation targeting. When inflation was at 1.7%, they said ‘we’ll get it a little higher and try to balance around 2%’ … Read more at: https://www.zerohedge.com/markets/maybe-theyre-not-data-dependent-former-governor-questions-feds-independence |

|

Trump Claims Kamala Isn’t Campaigning Because She Knows Something The American Public Doesn’tAuthored by Paul Joseph Watson via Modernity.news, Donald Trump claimed that Kamala Harris is taking days off and not properly campaigning because she knows something about the election that the American public doesn’t.

Trump made the cryptic comments during his campaign rally in Georgia. “This is a woman who took yesterday off, how do you take yesterday off?” asked Trump. “You’ve got 13 days, you’re running for the presidency, she takes time off,” he added. “I’ve got 52 days in a row and I’m not taking any days off, that I can tell you,” said Trump.

|

|

Chancellor to change debt rules to release billionsReeves has said the government will change these rules to free up billions for spending on big projects. Read more at: https://www.bbc.com/news/articles/cvg745ggn3no |

|

Pub closure warning: Many landlords only make 12p a pintThe boss of Britain’s biggest pubs group urges the chancellor to extend business rates relief. Read more at: https://www.bbc.com/news/articles/cpvzypy8ndyo |

|

What we know about the McDonald’s E. coli outbreakHealth officials are hunting for the source of 49 cases of e-coli poisoning, which includes one death. Read more at: https://www.bbc.com/news/articles/ce9gzlpyx7mo |

|

NTPC Q2 Results: Net profit grows 14% to Rs 5,380 croreThe Board of Directors also approved the first interim dividend of Rs 2.50 on the face value of paid-up equity shares of Rs 10 each for the financial year 2024-25. The date of payment/dispatch of the dividend will be 18 November 2024. Read more at: https://economictimes.indiatimes.com/markets/stocks/earnings/ntpc-net-profit-grows-14-pc-to-rs-5380-crore-in-jul-sep-qtr/articleshow/114554561.cms |

|

JSW Steel Q2 results preview: PAT may decline by 71-80% YoY, revenue fall likely by up to 8.5%JSW Steel’s net sales and profit after tax (PAT) for Q2FY25 are expected to decline significantly. Various brokerages predict revenue to decrease by up to 8.5% and PAT to drop by 71-80% year-on-year. The company will report its earnings on October 25, 2023. Estimates show a challenging quarter ahead for the steel giant. Read more at: https://economictimes.indiatimes.com/markets/stocks/earnings/jsw-steel-q2-results-preview-pat-may-decline-by-71-80-yoy-revenue-fall-likely-by-up-to-8-5/articleshow/114535383.cms |

|

Tech view: Move above 24,700 likely to signal upside in Nifty. How to trade tomorrowA small negative candle was formed on the daily chart at the new swing lows of 24,341 with minor upper and lower shadows. Technically, this pattern indicates the formation of a Doji-type candle pattern (not a classical one). The short-term trend of the Nifty remains negative. But the present pattern formation is signaling a possibility of an upside bounce from here or from slightly lower levels. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-move-above-24700-likely-to-signal-upside-in-nifty-how-to-trade-tomorrow/articleshow/114548118.cms |

|

Why stock investors have been on edge over the prospects of a total sweep for RepublicansA so-called “red wave” sweep of the White House and Congress would most likely make it easier to pass the Republican Party’s agenda, according to market participants. Read more at: https://www.marketwatch.com/story/why-stock-investors-have-been-on-edge-over-the-prospects-of-a-total-sweep-for-republicans-98fcd3f2?mod=mw_rss_topstories |

|

If you became rich, what luxuries would you want? For some, it’s all about new socks (seriously).When asked what they would do with ‘FU money,’ people often choose relatively inexpensive things. Read more at: https://www.marketwatch.com/story/what-would-you-do-if-you-were-rich-surprisingly-many-people-choose-pretty-inexpensive-things-4ee0e67f?mod=mw_rss_topstories |

|

These 3 struggles sent this retired couple back to the U.S. after a move overseasMoving to Portugal in retirement was a dream — but they weren’t ready for the reality. Read more at: https://www.marketwatch.com/story/these-3-struggles-sent-this-retired-couple-back-to-the-u-s-after-a-move-overseas-e3a7edf4?mod=mw_rss_topstories |