Summary Of the Markets Today:

- The Dow closed up 341 points or 0.81%,

- Nasdaq closed up 219 points or 1.22%,

- S&P 500 closed up 51 points or 0.90%,

- Gold $2,671 down $7.70 or 0.29%,

- WTI crude oil settled at $74.43 up $0.77 or 1.02%,

- 10-year U.S. Treasury 3.971 up 0.123 points or 1.0%,

- USD index $102.48 up $0.49 or 0.48%,

- Bitcoin $62,365 up $1,591 or 2.62%,

- Baker Hughes rig count 585 down 2

*Stock data, cryptocurrency, and commodity prices at the market closing

Today’s Highlights

The stock market rallied strongly on Friday following a better-than-expected September jobs report: The strong jobs data suggests the labor market remains robust, boosting hopes for a “soft landing” for the economy. Financial and Consumer Discretionary stocks led the gains. The positive jobs report shifted expectations toward a smaller 25 basis point interest rate cut from the Federal Reserve next month, rather than a larger 50 basis point cut. Oil prices saw their biggest weekly gain in over a year due to the Israel-Iran conflict, though gains were pared on Friday after President Biden discouraged Israel from targeting Iranian oil fields. The US dockworkers’ strike ended after a tentative wage deal was reached. Concerns remain about the potential escalation of the Middle East conflict. Overall, stocks showed resilience in the face of various economic and geopolitical challenges, with major indexes closing out the week with gains and nearing record highs.

Click here to read our current Economic Forecast – October 2024 Economic Forecast: One More Recession Flag Removed Yet Little Headway On Inflation

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

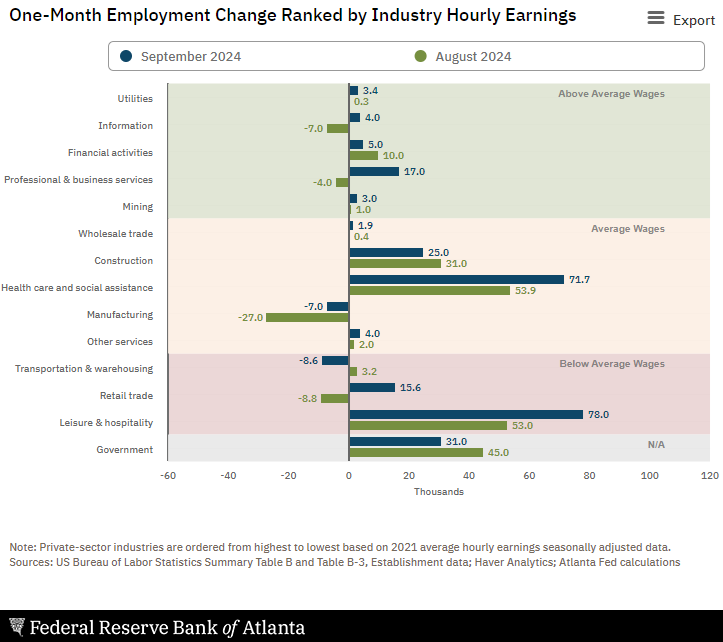

Total BLS nonfarm payroll employment increased by 254,000 (establishment survey) in September 2025, and the unemployment rate changed little at 4.1% (household survey). In comparing the two surveys that comprise this report – the household survey estimates 430,000 jobs were added whilst the headline establishment survey shows only 254,000. The headline unemployment rate declined because of the significant increase in the number of jobs added combined with a 281,000 DECLINE in the number of unemployed. Well over 2/3rds of the employment gains were in three sectors – health care, leisure/hospitality, and government employment. Manufacturing lost 7,000 jobs. Weekly work hours declined from 34.3 to 34.2. I see little recessionary data in this report.

Here is a summary of headlines we are reading today:

- Will EU’s EV Tariffs Ignite a Global Trade War?

- Brazil Eyes Fresh Oil Boom as it Revitalizes Tupi Field

- Iran Aims at Israel’s Gas Assets if Conflict Ignites

- Natural Gas Demand From European Industry Is Set to Drop Again

- OPEC+ Spare Capacity Could Cushion Oil Markets

- Fears of World War III Are Greatly Exaggerated

- Fed close to pulling off the elusive economic soft landing in 2024 after great September jobs report

- East and Gulf Coast ports strike deal is not close to done: Automation still a big hurdle in ILA/USMX negotiations

- Stellantis files federal lawsuit against UAW union over strike threats

- Selena Gomez couldn’t afford to go to her first Disney casting—now she’s a billionaire startup founder

- “Doghouse Is Back!”: Stellantis CFO Instructs Staff To Take “Drastic Measures” To Conserve Cash

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Will EU’s EV Tariffs Ignite a Global Trade War?Bloomberg reports that EU member states have voted to slap tariffs of up to 45% on Chinese-made electric vehicles, ignoring warnings from some members that this dangerous move risks sparking an “economic cold war” with Beijing. The European Commission, the bloc’s executive arm, recently concluded its anti-subsidy investigation into Chinese imports of battery electric vehicles. The findings supported the Commission’s move to implement the duties, which would last for five years. Sources familiar with the voting told Bloomberg that ten member… Read more at: https://oilprice.com/Energy/Energy-General/Will-EUs-EV-Tariffs-Ignite-a-Global-Trade-War.html |

|

Oil Rig Count Drops as Oil Prices See Strongest Weekly Gain Since 2022The total number of active drilling rigs for oil and gas in the United States fell this week, according to new data that Baker Hughes published on Friday. The total rig count fell by 2 this week to 585, compared to 619 rigs this same time last year. The number of oil rigs fell by 5 this week to 479—down by 18 compared to this time last year. The number of gas rigs rose by 3 this week to 102, a loss of 16 active gas rigs from this time last year. Miscellaneous rigs stayed the same at 4. Meanwhile, U.S. crude oil production rose in the week… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Rig-Count-Drops-as-Oil-Prices-See-Strongest-Weekly-Gain-Since-2022.html |

|

Brazil Eyes Fresh Oil Boom as it Revitalizes Tupi FieldPetrobras, Brazil’s state-owned oil giant, is nearing a major step toward redeveloping the Tupi oil field, one of the largest deep-water reserves globally. The company is close to resolving a long-standing tax dispute with Brazil’s National Agency of Petroleum (ANP), which would allow it to extend Tupi’s operating contract for another 27 years. This move is critical for Petrobras to justify the billions of dollars needed to boost production at Tupi. Discovered in 2006, Tupi played a key role in elevating Brazil to one of the world’s… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Brazil-Eyes-Fresh-Oil-Boom-as-it-Revitalizes-Tupi-Field.html |

|

Iran Aims at Israel’s Gas Assets if Conflict IgnitesTensions in the Middle East are escalating as Iran has issued a stern warning against Israel, threatening to target its energy and gas infrastructure if Israel initiates an attack. This development follows Iran’s recent missile strikes on Israeli targets, which came in retaliation for the killing of Hezbollah leader Hassan Nasrallah. Iran’s Revolutionary Guards’ deputy commander, Ali Fadavi, emphasized that any misstep by Israel would prompt a strong military response, specifically targeting its energy assets. Iran’s bold statement comes amidst… Read more at: https://oilprice.com/Geopolitics/Middle-East/Iran-Aims-at-Israels-Gas-Assets-if-Conflict-Ignites.html |

|

Natural Gas Demand From European Industry Is Set to Drop AgainDespite a slight uptick in industrial consumption of natural gas this year, Europe’s heavy industry is likely to return to curtailing gas use next year amid a tighter gas market and higher prices, analysts and industry officials have told Bloomberg. Since the 2022 energy crisis, European industry has been squeezed amid sky-high energy costs and weak industrial demand in weakening economies. European companies have been losing competitive advantage to firms outside the EU, especially in Asia, with its low labor costs, and the U.S., where gas… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Natural-Gas-Demand-From-European-Industry-Is-Set-to-Drop-Again.html |

|

U.S. Averts Supply Chain Crisis with Port Strike DealAs we detailed overnight, the union behind the 45,000 striking dockworkers agreed to end a three-day strike that paralyzed major US East and Gulf Coast ports. This was a major risk of becoming yet another shitstorm for the Biden-Harris team, already dealing with a president totally out of it… And good lord, if Biden’s mental health has imploded – much like Bidenomics – then who the hell is in charge of the nation with mounting WW3 risks in the Middle East? Iranian hypersonic missiles rained down on Israel just days ago. Meanwhile, the International… Read more at: https://oilprice.com/Finance/the-Economy/US-Averts-Supply-Chain-Crisis-with-Port-Strike-Deal.html |

|

EU Commission Gets Support to Slap Up to 45% Tariffs on Chinese EVsThe European Commission has received enough support from EU member states to impose hefty tariffs of up to 45% on imports of electric vehicles from China, the EU’s executive arm said on Friday, as fears of an EU-China trade war intensify. On Friday, the Commission’s proposal to impose definitive duties on imports of battery electric vehicles (BEVs) from China “has obtained the necessary support from EU Member States for the adoption of tariffs,” the European Commission said. “In parallel, the EU and China continue… Read more at: https://oilprice.com/Latest-Energy-News/World-News/EU-Commission-Gets-Support-to-Slap-Up-to-45-Tariffs-on-Chinese-EVs.html |

|

Oil Markets Are Fully Focused on Geopolitical RiskGeopolitical risk has dominated oil markets this week, with both WTI and Brent up by roughly 8% since the start of the week when Iran fired at least 180 missiles at Iran in retaliation for Israeli strikes in Lebanon.Friday, October 4th, 2024Oil prices are set to post a solid $6 per barrel week-on-week increase as ICE Brent futures entrenched themselves around $78 per barrel. Iran’s missile barrage on Israel and a potential retaliatory action from the Netanyahu government boosted the geopolitical risk premium, in fact so much that the oil… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Markets-Are-Fully-Focused-on-Geopolitical-Risk.html |

|

Russia Sues Shell UnitsRussia is suing eight of Shell’s units, according to court documents revealed by Reuters on Friday. Shell has withdrawn from its operations in Russia following the Russian invasion of Ukraine in February 2022. Now Russian officials and authorities are suing a number of units of the UK-based supermajor in a lawsuit filed with an Arbitration Court in Moscow and dated October 2, Reuters reports. The court documents seen by the newswire did not give further details beyond who is filing the lawsuit. The documents indicated that eight Shell units… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russia-Sues-Shell-Units.html |

|

Oil Majors Are Facing a Major DilemmaBig Oil Braces for Impact as Pace of Buybacks Becomes Untenable- Oil majors are confronted with a difficult dilemma as the investor community is anticipating Q3 2024 results, as most would find it very hard to replicate last year’s performance when they’ve paid more than $272 billion in dividends and share repurchases. – Share buybacks would need to be downscaled as Chevron, ExxonMobil, and TotalEnergies would need to borrow $5-8 billion each to maintain the current pace of buybacks, with ENI most probably offsetting some… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Majors-Are-Facing-a-Major-Dilemma.html |

|

OPEC+ Spare Capacity Could Cushion Oil MarketsThe crude oil market faces a critical juncture, driven by escalating geopolitical tensions in the Middle East and questions over global spare production capacity. Traders are caught between the potential for significant supply disruptions and the possibility that OPEC+ and other producers could step in to mitigate shortages. As conflict threatens key oil-producing regions, market participants are watching closely for signals of both price surges and stability. Middle East Conflict: A Looming Supply Disruption In recent days, crude oil prices have… Read more at: https://oilprice.com/Energy/Energy-General/OPEC-Spare-Capacity-Could-Cushion-Oil-Markets.html |

|

Libya Restarts Oil Production and Exports… For NowPolitics, Geopolitics & Conflict On Thursday, Libya’s parallel eastern government (Haftar clan) lifted the force majeure on output and exports just hours after a deal was reached for two compromise candidates to head the Central Bank, which controls the country’s oil revenues. Now it’s about who can control those candidates, and how can those candidates simply insert themselves into the corrupt circles that swarm around both governments, east and west. As we have mentioned before, both the Haftar (east) and Dbeibah (west)… Read more at: https://oilprice.com/Energy/Energy-General/Libya-Restarts-Oil-Production-and-Exports-For-Now.html |

|

Is It Time to Turn Bullish on Oil?The last time I wrote here about crude, it was to explain why oil had dropped that week on what looked, on the surface, like bullish news. In that piece, I warned that the “logical” trade following news is not always the correct one. Depending on market conditions going into the release of news or data, and the nature of the news or numbers, fading an initial reaction in the obvious direction is very often a better play. But not always. Sometimes, the news is potentially so impactful that a move in the obvious direction is sustainable,… Read more at: https://oilprice.com/Energy/Energy-General/Is-It-Time-to-Turn-Bullish-on-Oil.html |

|

Fears of World War III Are Greatly ExaggeratedImminent war makes for great headlines, but they roil oil markets that are already operating at the height of disconnect, contradiction, and confusion. The whipsaw nature of oil market sentiment continues, with analysts generally reacting to a moment rather than a longer narrative, but overall, despite a momentary flirtation with 5% gains earlier on Thursday, oil markets aren’t really buying the WWIII scenario should Israel attack Iran. Even the markets recognize that we’ve been here before, so many times. The world is already… Read more at: https://oilprice.com/Energy/Energy-General/Fears-of-World-War-III-Are-Greatly-Exaggerated.html |

|

UK Auto Industry Warns Lack of Incentives Slows EV UptakeThe UK’s auto manufacturing industry will likely miss its 2024 target of electric vehicle sales as drivers lack the “fiscal incentive” to switch to EVs, the main industry body and several manufacturers wrote in a letter to the Chancellor of the Exchequer, Rachel Reeves. The Society of Motor Manufacturers and Traders (SMMT) called on the Labour government to introduce new incentives for EV buyers as the car manufacturing industry by itself cannot sustain the costs amid flailing demand for EVs. “Unfortunately, the private… Read more at: https://oilprice.com/Latest-Energy-News/World-News/UK-Auto-Industry-Warns-Lack-of-Incentives-Slows-EV-Uptake.html |

|

Fed close to pulling off the elusive economic soft landing in 2024 after great September jobs reportIf this sounds like a Goldilocks scenario, it’s probably not far from it, even with the lingering inflation concerns. Read more at: https://www.cnbc.com/2024/10/04/fed-close-to-pulling-off-the-elusive-economic-soft-landing-in-2024-after-great-september-jobs-report.html |

|

Jamie Dimon denies Trump’s claim that JPMorgan CEO has endorsed himJPMorgan Chase CEO Jamie Dimon previously urged corporate leaders to back Nikki Haley over Donald Trump. Trump faces Vice President Kamala Harris in November. Read more at: https://www.cnbc.com/2024/10/04/trump-jamie-dimon-endorsement-jpmorgan.html |

|

Dow jumps 300 points for record close as September’s big jobs report spurs rally: Live updatesU.S. stocks advanced on Friday as traders parsed the all-important jobs data. Read more at: https://www.cnbc.com/2024/10/03/stock-market-today-live-updates.html |

|

East and Gulf Coast ports strike deal is not close to done: Automation still a big hurdle in ILA/USMX negotiationsThe East and Gulf Coast ports strike deal isn’t close to done, with a fight over automation between ILA union and USMX ownership group facing Jan. 15 deadline. Read more at: https://www.cnbc.com/2024/10/04/port-strike-deal-not-done-automation-big-hurdle-for-ila-union-usmx.html |

|

Stock market next week: Investors wonder what’s to come after tumultuous October startInvestors are looking ahead to the first major earnings reports and some economic releases. Read more at: https://www.cnbc.com/2024/10/04/stock-market-next-week-outlook-for-october-7-11-2024.html |

|

Stellantis files federal lawsuit against UAW union over strike threatsStellantis is suing the United Auto Workers, escalating a monthslong battle between the trans-Atlantic automaker and American union, CNBC has learned. Read more at: https://www.cnbc.com/2024/10/04/stellantis-sues-uaw-union-strike.html |

|

Mortgage rates spike after stronger-than-expected jobs reportThe average rate on the 30-year fixed mortgage is now 6.53% according to Mortgage News Daily. Read more at: https://www.cnbc.com/2024/10/04/mortgage-rates-jobs-report.html |

|

Here’s where the jobs are for September 2024 — in one chartHospitality and health care were two bright spots for the U.S. labor market in September, according to Friday’s jobs report. Read more at: https://www.cnbc.com/2024/10/04/heres-where-the-jobs-are-for-september-2024-in-one-chart.html |

|

Biden discourages Israel from striking Iran’s oil industry, crude posts best week in more than yearThough oil prices have surged this week on geopolitical tensions, they have risen from a low baseline. Read more at: https://www.cnbc.com/2024/10/04/crude-oil-prices-today.html |

|

Bitcoin pares weekly losses after better-than-expected September jobs data: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Sam Kessler of CoinDesk discusses his reporting that North Korean IT workers have infiltrated global crypto companies. Read more at: https://www.cnbc.com/video/2024/10/04/bitcoin-pares-weekly-losses-better-than-expected-jobs-data-crypto-world.html |

|

Selena Gomez couldn’t afford to go to her first Disney casting—now she’s a billionaire startup founderSinger and actor Selena Gomez is a newly minted billionaire due to the success of her makeup brand Rare Beauty, according to a Bloomberg estimate. Read more at: https://www.cnbc.com/2024/10/04/selena-gomez-couldnt-afford-childhood-auditions-now-billionaire-startup-founder.html |

|

Tiger Woods’ logo dispute with Tigeraire escalates with federal court filingA logo dispute between Tiger Woods’ apparel company Sun Day Red and Tigeraire is now in the hands of the federal court system. Read more at: https://www.cnbc.com/2024/10/04/tiger-woods-tigeraire-logo-dispute-escalates.html |

|

10-year Treasury yield soars after jobs report blows past expectationsIn Friday’s report, nonfarm payrolls grew by 254,000 in September, significantly exceeding economists’ expectations. Read more at: https://www.cnbc.com/2024/10/04/treasury-yields-september-jobs-report.html |

|

Man Turns $88K Into $415M With Tesla, Then Sues After Losing It All…Authored by Brayden Lindrea via CoinTelegraph.com, A man who reportedly turned $88,000 into $415 million before losing it all has sued his investment firm and advisers for failing to provide adequate advice as he carried out risky trades.

Christopher DeVocht claimed RBC Dominion Securities set him up with a margin account and substantial loans that ultimately backfired, wiping out his entire investment portfolio, Stockwatch reported on Oct. 3. DeVocht made most of the wealth by trading shares and using Tesla options. The Canada-based man then hired RBC, who assigned advisers that Devotch claims were supposed to help him preserve his wealth by recommending risk mitigation strategies. It included a Grant Thornton LLP tax adviser and an RBC employe … Read more at: https://www.zerohedge.com/markets/man-turns-88k-415m-tesla-then-sues-after-losing-it-all |

|

Schiff: The Phony Economy Must DieVia SchiffGold.com, Peter recently joined Francis Hunt on his Youtube channel, The Market Sniper, for an interview. Throughout the course of their conversation, they cover the future of gold, destructive campaign promises made by Kamala Harris, soaring deficit figures, and why the public is mistaken about gold ETFs.

Francis begins by asking Peter about the similarities between today’s economy and the economy in 2006 and 2007. Many of the Great Recession era problems linger, but we have even more debt:

|

|

“Doghouse Is Back!”: Stellantis CFO Instructs Staff To Take “Drastic Measures” To Conserve CashVolkswagen, Mercedes, Aston Martin, and BMW have all recently slashed their forecasts. The broader economic landscape for Western automobile companies is dire as high interest rates crush demand, EV programs hemorrhage cash, and demand in China wanes. Many Western firms are plagued with de-growth climate change policies that muzzle economic output or make the manufacturing process way too expensive, ultimately giving Chinese firms an unfair advantage in global markets. Expanding our coverage on automaker Stellantis, a new report from Wall Street Journal journos on Friday reveals a leaked email from Stellantis Chief Financial Officer Natalie Knight, who informed her team of white collar workers about the need to take “drastic measures” to shore up the Jeep and Ram parent’s finances. Read more at: https://www.zerohedge.com/markets/doghouse-back-stellantis-cfo-instructs-staff-take-drastic-measures-conserve-cash |

|

The Dockworkers Were Just The Start: Other Unions Will Now Strike, Expecting 62% Wage IncreasesBy Philip Marey, senior US strategist at Rabobank Markets remain concerned by developments in the Middle East. This morning oil prices were subdued, but still heading for a weekly gain of about 8%. Meanwhile, markets are waiting for Israel’s pending retaliation against Iran and today’s US Employment Report. Yesterday, the union of East Coast and Gulf Coast dockworkers reached an agreement with port operators, ending three day strike at ports from Maine to Texas. Port operators offered a 62% wage increase over six years, after the White House pressed the shipping lines and cargo terminal operators who employ the longshore workers to raise their earlier offer of 50%. The agreed wage increase is lower than the 77% demanded by the union (International Longshoremen’s Association, ILA), but it is a better deal than the union of the West Coast dockworkers reached last year. The base hourly rate for ILA port workers will be raised from $39 to $63 over six years. Note that many dockworkers currently earn more than $100,000 per year. The agreement lasts until January 15, 2025, while the two sides negotiate on other issues, such as automation on the docks. Obviously, the strike and wage increase have raised the incentives for cargo terminal operators to invest in automation: robots don’t strike! Or will they? Perhaps it depends on how much artificial intelligence you put in them. While this deal averts shortages and price spikes in the short run, as many forward-looking importers brought in products earlier or diverted cargo to West Coast ports, it will lead to higher costs for s … Read more at: https://www.zerohedge.com/markets/dockworkers-were-just-start-other-unions-will-now-strike-expecting-62-wage-increases |

|

How worried should I be about rising oil prices?As the conflict across the Middle East widens, rising oil prices are being closely watched. Read more at: https://www.bbc.com/news/articles/cgry10924jqo |

|

Ex-Harrods exec: I lost my job due to Al FayedNigel Blow claims that Fenwick withdrew offer to become chief executive due to his time at Harrods Read more at: https://www.bbc.com/news/articles/ced068nl600o |

|

Builders’ £2.5bn merger backed after monopoly probeThe housebuilding giants’ plan gets the go-ahead after a competition probe into two homes projects. Read more at: https://www.bbc.com/news/articles/ce8vnxenjl3o |

|

Tech View: Nifty breaks below 50 DEMA, forms bear candle. How to trade on MondayA bear candle appeared on both the daily and weekly charts, indicating a sharp reversal in Nifty’s near-term uptrend. Currently positioned near the support level around 25,000, there is potential for a minor upside bounce early in the week, likely presenting a sell-on-rise opportunity. A decisive break below the 25,000-24,950 range could lead to a further decline toward 24,500. Immediate resistance is expected around 25,300, according to Nagaraj Shetti of HDFC Securities. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-breaks-below-50-dema-forms-bear-candle-how-to-trade-on-monday/articleshow/113941853.cms |

|

NSE, former chief Vikram Limaye, others settled TAP system case with Sebi; pay Rs 643 crThe National Stock Exchange (NSE), its former chief Vikram Limaye and eight others on Friday settled with markets regulator Sebi a case pertaining to alleged bypass of trading access point (TAP) system by certain brokers after paying Rs 643 crore. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/nse-former-chief-vikram-limaye-others-settled-tap-system-case-with-sebi-pay-rs-643-cr/articleshow/113943527.cms |

|

Citi initiates ‘Buy’ rating on Varun Beverages, sees 36% upsideCiti has given Varun Beverages a ‘Buy’ rating with a target price of Rs 800, citing strong market position and growth prospects. Despite this, shares fell 3% to Rs 570. HSBC also rated it ‘Buy’ at Rs 780, highlighting potential for market share gains through innovative marketing. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/citi-initiates-buy-rating-on-varun-beverages-sees-36-upside/articleshow/113927721.cms |

|

Investors question Fed’s rate cut amid signs of faster economic growthSomething unexpected is happening on the road to the much-hoped-for soft landing in the U.S.: The growing possibility of an economic reacceleration, which handed Treasury yields their biggest weekly advances in up to two years. Read more at: https://www.marketwatch.com/story/investors-question-feds-rate-cut-amid-signs-of-faster-economic-growth-8b00b5a6?mod=mw_rss_topstories |

|

2-, 10-year Treasury yields see biggest weekly gains in up to 2 years after ‘supernova’ jobs reportTreasury yields recorded their biggest weekly advances in up to two years on Friday after September’s nonfarm-payrolls report produced far more new jobs than expected, erasing the likelihood of another big Federal Reserve interest-rate cut next month. Read more at: https://www.marketwatch.com/story/treasury-yields-inch-higher-ahead-of-pivotal-jobs-data-943eafd5?mod=mw_rss_topstories |

|

Why Cisco is looking at investing in CoreWeave, a hot AI startupCisco Systems Inc. is reportedly looking at making a big investment in CoreWeave, one of the hotter artificial-intelligence startup companies, as the networking giant seeks to get a stronger foothold in the AI data center. Read more at: https://www.marketwatch.com/story/why-cisco-is-looking-at-investing-in-coreweave-a-hot-ai-startup-0e2eae2c?mod=mw_rss_topstories |