Summary Of the Markets Today:

- The Dow closed down 185 points or 0.44%,

- Nasdaq closed down 7 points or 0.04%,

- S&P 500 closed down 10 points or 0.17%,

- Gold $2,678 up $8.50 or 0.28%,

- WTI crude oil settled at $74 up $3.83 or 5.31%,

- 10-year U.S. Treasury 3.850 up 0.067 points or 0.54%,

- USD index $101.97 up $0.30 or 0.3%,

- Bitcoin $60,987 up $314 or 0.52%,

*Stock data, cryptocurrency, and commodity prices at the market closing

Today’s Highlights

U.S. stocks slipped on Thursday as investors turned their focus back to the economy and the upcoming monthly jobs report, while concerns over the Middle East conflict pushed oil prices higher. Here are the key points: Investors are bracing for the September jobs report to be released on Friday. This comes after a surprise uptick in private payrolls and signs of loosening in the labor market. Weekly jobless claims increased slightly from the previous week, indicating a general cooling trend in the labor market. A report from Challenger, Gray and Christmas showed planned layoffs in the U.S. decreased from a five-month high. The ongoing Israel-Iran crisis has contributed to rising oil prices for the third consecutive day. Brent crude and West Texas Intermediate futures both gained over 5% following comments from President Biden about a potential Israeli retaliatory attack on Iran’s oil facilities. Signs of labor market deterioration could prompt the Federal Reserve to consider another significant interest rate cut, following last month’s 0.5% reduction. Tesla stock continued to decline, falling more than 3% on Thursday, following disappointing delivery figures and reports of halting U.S. online orders for its cheapest Model 35.

Click here to read our current Economic Forecast – October 2024 Economic Forecast: One More Recession Flag Removed Yet Little Headway On Inflation

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

New orders for manufactured goods in August 2024 were down 0.6% year-over-year – down from +3.8% the previous month. I believe that manufacturing remains in a recession and no action to re-shore manufacturing is evident.

U.S.-based employers announced 72,821 job cuts in September 2024, a 4% decrease from the 75,891 cuts announced one month prior. It is up 53% from the 47,457 cuts announced in the same month in 2023. The current layoffs are a sign of a mature market where employers are trying to optimize profits. Andrew Challenger, Senior Vice President of Challenger, Gray & Christmas, Inc. added:

We’re at an inflection point now, where the labor market could stall or tighten. It will take a few months for the drop in interest rates to impact employer costs, as well as consumer savings accounts. Consumer spending is projected to increase, which may lead to more demand for workers in consumer-facing sectors. Layoff announcements have risen over last year, and job openings are flat. Seasonal employers seem optimistic about the holiday shopping season. That said, many of those who found themselves laid off this year from high-wage, high-skill roles, will not likely fill seasonal positions.

In the week ending September 28, the advance figure for seasonally adjusted initial unemployment claims 4-week moving average was 224,250, a decrease of 750 from the previous week’s revised average. The previous week’s average was revised up by 250 from 224,750 to 225,000. There is no sign of a recession in this data.

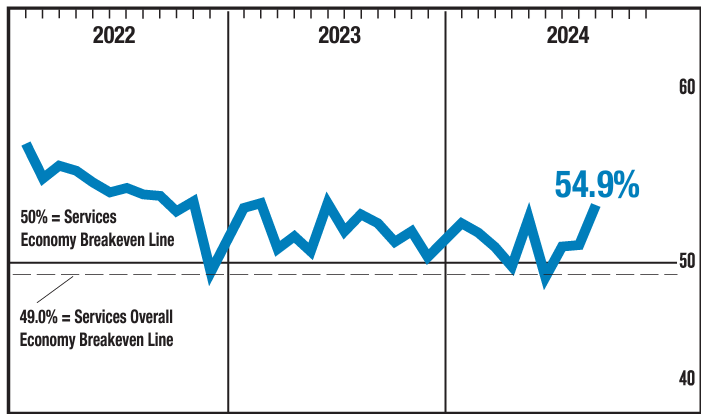

In September 2024 , the ISM Services PMI® registered 54.9%, 3.4 percentage points higher than August’s figure of 51.5 percent. The Business Activity Index registered 59.9 percent in September, 6.6 percentage points higher than the 53.3 percent recorded in August, indicating a third month of expansion after a contraction in June. The New Orders Index expanded to 59.4 percent in September, 6.4 percentage points higher than August’s figure of 53 percent. The Employment Index contracted for the first time in three months; the reading of 48.1 percent is a 2.1-percentage point decrease compared to the 50.2 percent recorded in August. These are not great numbers as the US is a services driven economy – but at least they are moving in the right direction.

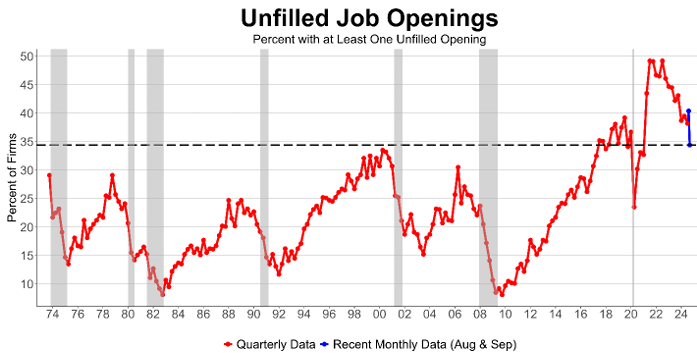

NFIB’s September jobs report found that 34% (seasonally adjusted) of small business owners reported job openings they could not fill in September, down 6 points from August and the lowest reading since January 2021. It appears that the abnormally high unfilled positions in small business is moderating. NFIB Chief Economist Bill Dunkelberg added:

Overall, the job market appears to be softening. Fewer small firms have openings they can’t fill as we head into fall. But many still report trouble finding qualified applicants and plans to increase compensation is once again on the rise.

Here is a summary of headlines we are reading today:

- AI-Powered Disinformation Campaigns Target U.S. Voters

- Nuclear Power Gains Momentum as Multiple Plants Seek Revival

- Reuters Poll Shows OPEC September Output At Yearly Low

- Oil Explodes 4% Amid Talk of Israel Attacking Iranian Oil & Gas

- Bank of England Warns Middle East Conflict Could Lead to a Major Oil Price Shock

- Here’s everything to expect when the September jobs report is released Friday

- Panic buying amid U.S. ports strike is creating supermarket supply concerns

- U.S. crude oil jumps as Biden comments on possible Israel retaliation against Iran

- OpenAI gets $4 billion revolving credit line, giving it more than $10 billion in liquidity

- States affected by Hurricane Helene warn of price gouging and other scams. Here’s how to avoid being a victim of post-storm schemes

- Why Open AI’s $100 billion 2029 revenue target seems like a tech-fever dream

- 10-year Treasury yield ends at highest level since August after better-than-expected ISM data

Click on the “Read More”

The Market in Perspective

| Here are the headlines moving the markets. | |

|

South Caucasus Faces Urgent Environmental ChallengesEnvironmental degradation is hindering socio-economic development across the South Caucasus, according to published research conducted by regional experts. While the three South Caucasus states — Armenia, Azerbaijan and Georgia — have adequate legislative frameworks to address environmental challenges, they lack comprehensive planning mechanisms to promote sustainable growth. The findings, contained in an academic work titled Biodiversity, Conservation and Sustainability in Asia, have broad implications for public health and food security… Read more at: https://oilprice.com/The-Environment/Global-Warming/South-Caucasus-Faces-Urgent-Environmental-Challenges.html |

|

Nigeria Looks To Jumpstart Natural Gas Sector with Tax CutsNigeria is moving forward with a new policy framework aimed at jumpstarting its natural gas sector, hoping to draw in up to $10 billion in investments. The proposed measures include a series of tax incentives to attract both local and international investors to explore the country’s deep-water gas resources. The framework, which has already been approved by the Federal Executive Council, now awaits approval from the National Assembly. Once passed into law, this policy is expected to fast-track the development of Nigeria’s natural gas infrastructure.… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Nigeria-Looks-To-Jumpstart-Natural-Gas-Sector-with-Tax-Cuts.html |

|

AI-Powered Disinformation Campaigns Target U.S. VotersThe United States expects Russia, Iran, and China to continue their attempts to influence the November 5 elections by using artificial intelligence to disseminate fake information, according to a report released on October 2 by the Department of Homeland Security (DHS). The department considers the three countries the most pressing foreign threats to U.S. critical infrastructure and expects them to remain so. The Justice Department last week provided examples of how Russia was behind a fake San Francisco television channel that spread lies about… Read more at: https://oilprice.com/Geopolitics/International/AI-Powered-Disinformation-Campaigns-Target-US-Voters.html |

|

Nuclear Power Gains Momentum as Multiple Plants Seek RevivalFollowing the news of the Three Mile Island restart plans, it looks like our assertion that ‘nuclear is back’ is correct. That’s because this week the U.S. closed on a deal to resurrect another nuclear plant, Holtec’s Palisades nuclear plant in Michigan, thanks to a $1.52 billion loan from the Biden administration, according to Reuters. A senior Biden administration official stated that reopening the plant could take up to two years—longer than the company’s estimate. The Reuters report said that the administration aims to triple U.S. nuclear… Read more at: https://oilprice.com/Energy/Energy-General/Nuclear-Power-Gains-Momentum-as-Multiple-Plants-Seek-Revival.html |

|

Reuters Poll Shows OPEC September Output At Yearly LowA Reuters survey on Thursday shows September oil production from OPEC dropping to its lowest point this year, at 26.14 million barrels per day, down nearly 400,000 bpd from the previous month, primarily due to disruptions in Libya. In August, OPEC produced 390,000 bpd more than in September, according to the Reuters survey, with Libya accounting for around 300,000 bpd of that and Nigeria responsible for 40,000 bpd, while Iraq continued to produce at 90,000 bpd above quota. “OPEC pumped about 130,000 bpd more than the implied… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Reuters-Poll-Shows-OPEC-September-Output-At-Yearly-Low.html |

|

Beyond Coal: The Future of UK’s Electricity SupplyA quiet revolution occurred in the very earliest moments of this morning, probably while you were asleep. You went to bed in one sort of country, and woke up in another sort entirely. The difference is largely invisible but undeniably huge: yesterday, the UK’s last coal power station was still operational and by this morning it wasn’t. As of today, and for the first time in 142 years, the UK no longer generates electricity from burning coal. The Ratcliffe-on-Soar power station, near Nottingham, began producing power from coal in 1967.… Read more at: https://oilprice.com/Energy/Coal/Beyond-Coal-The-Future-of-UKs-Electricity-Supply.html |

|

Africa’s Oil Nations Make Progress in Creating $5-Billion Energy BankThe oil-producing nations in Africa have raised 45% of the initial $5-billion seed capital for the planned Africa Energy Bank (AEB), which is set to fund oil projects on the continent amid a crunch in financing on the international markets. The early financial supporters of the Africa Energy Bank include major oil producers Nigeria, Angola, and Ghana, according to Omar Farouk Ibrahim, Secretary General of the African Petroleum Producers Organization (APPO). “I believe we are the first development bank to progress from conceptualization to… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Africas-Oil-Nations-Make-Progress-in-Creating-5-Billion-Energy-Bank.html |

|

Oil Explodes 4% Amid Talk of Israel Attacking Iranian Oil & GasBenchmark crude oil prices surged well over 4% on Thursday on fears of an Israeli strike that could target Iran’s oil and gas infrastructure, with Washington attempting to put the brakes on exploding oil prices with assurances that there will be no Israeli strike today. At 10:47 a.m. ET on Thursday, Brent crude was trading up 3.83%, slightly tapering its upward trajectory of well over 4% just half an hour prior, sitting at $76.73. The U.S. benchmark crude, West Texas Intermediate (WTI), was trading up 4.25% at $73.08 per barrel. Earlier… Read more at: https://oilprice.com/Energy/Oil-Prices/Oil-Explodes-4-Amid-Talk-of-Israel-Attacking-Iranian-Oil-Gas.html |

|

$100 Oil? Traders Bet on Middle East DisruptionFor months, oil traders shrugged off any threat of a supply shock in the Middle East, betting on softening demand from China and the West, along with hopes of increased production from OPEC+. Bearish sentiment dominated the global market in late summer and early fall. But this week, the oil market faced a rude awakening after Iran launched several waves of ballistic and hypersonic missiles against Israel, sending bears scrambling and prices jumping above $75/bbl. The broadening war in the Middle East comes as Israel has vowed a “painful”… Read more at: https://oilprice.com/Energy/Oil-Prices/Is-100-Oil-on-the-Horizon-Traders-Bet-on-Middle-East-Disruption.html |

|

Enbridge to Build Pipelines for BP’s Latest Gulf of Mexico Oil ProjectCanada’s pipeline giant Enbridge Inc has decided it would build and operate oil and gas pipelines in the U.S. Gulf of Mexico which will service BP’s latest oil project in the area. Enbridge will build the pipelines, expected to cost about US$700 million, for the recently sanctioned Kaskida development announced by BP earlier this year, the Canadian firm said on Thursday. In late July, BP took the final investment decision on the Kaskida project as part of its long-term commitment to deliver secure, affordable, and reliable energy. Kaskida,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Enbridge-to-Build-Pipelines-for-BPs-Latest-Gulf-of-Mexico-Oil-Project.html |

|

Libya’s Oil Production Restarts as Political Standoff EndsLibya’s oil production is resuming on Thursday, the country’s Oil Minister Khalifa Abdul Sadiq told Bloomberg in an interview today, after more than a month of suspended output due to a political standoff between the eastern and western administrations in the North African OPEC producer. The end of this Libyan crisis will lead to the return of a few hundred thousand barrels of crude per day to the market, which is currently fearing a supply shock from the Middle East on the brink of an all-out war. Crude production at most Libyan oilfields has… Read more at: https://oilprice.com/Energy/Energy-General/Libyas-Oil-Production-Restarts-as-Political-Standoff-Ends.html |

|

Russia’s Oil and Gas Revenues Fell in SeptemberRussia’s budget proceeds from oil and gas sales declined by 0.9% in September from the previous month, according to official Russian government data published on Thursday. The Russian budget received $8.13 billion (771.9 billion Russian rubles) from oil and gas sales last month, per the data, which confirmed earlier Reuters estimates that proceeds would be roughly stable month-on-month. The revenues for September were 4.3% higher compared to September last year. For the first nine months of the year, Russia’s oil and gas revenues surged… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russias-Oil-and-Gas-Revenues-Fell-in-September.html |

|

Bank of England Warns Middle East Conflict Could Lead to a Major Oil Price ShockThe escalating conflict in the Middle East, if it goes out of hand, risks dealing a severe blow to monetary policy as it would lead to a surge in oil prices, Bank of England Governor Andrew Bailey told the Guardian in an interview published on Thursday. “Geopolitical concerns are very serious,” Bailey told the newspaper. International crude oil prices have been on the rise this week after Iran’s missile attack on Israel earlier in the week, as markets are awaiting the Israeli response. Oil prices were rising by 2% early on Thursday,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Bank-of-England-Warns-Middle-East-Conflict-Could-Lead-to-a-Major-Oil-Price-Shock.html |

|

IEA: Global Natural Gas Demand Set for New Record HighsAmid a normalization of natural gas prices, global gas demand is picking up this year at a stronger pace than in the past two years and is set for a record high in 2024 and 2025, the International Energy Agency (IEA) said in a new report on Thursday. After the supply and price shock of 2022 and 2023, which weighed on natural gas demand, consumption is picking up pace this year and is set to rise by over 2.5% in 2024, or by just over 100 billion cubic meters (bcm). As a result, natural gas demand is set to reach a new record-high of 4,200 bcm in… Read more at: https://oilprice.com/Latest-Energy-News/World-News/IEA-Global-Natural-Gas-Demand-Set-for-New-Record-Highs.html |

|

China Should Target 30% Emissions Cut by 2035 to Meet Paris GoalsAs the largest carbon emitter globally, China needs to aim for at least a 30% CO2 emissions reduction by 2035 in its new climate targets if the world has a chance to meet the Paris Agreement goals, Finland-based think tank Centre for Research on Energy and Clean Air (CREA) said in a report on Thursday. China, and other nations, must submit to the UN by February 2025 their new national climate plans, the so-called nationally determined contributions (NDCs), as required by the Paris Agreement. The trajectory of China’s emissions and emissions… Read more at: https://oilprice.com/Latest-Energy-News/World-News/China-Should-Target-30-Emissions-Cut-by-2035-to-Meet-Paris-Goals.html |

|

Here’s everything to expect when the September jobs report is released FridayNonfarm payrolls are projected to show growth of 150,000, form 142,000 the month before, with a steady unemployment rate of 4.2%. Read more at: https://www.cnbc.com/2024/10/03/heres-everything-to-expect-when-the-september-jobs-report-is-released-friday.html |

|

Biden administration can move forward with student loan forgiveness, federal judge rulesA federal judge will let expire a temporary restraining order against the Biden administration’s sweeping new student loan forgiveness plan. Read more at: https://www.cnbc.com/2024/10/03/student-loan-forgiveness-plan-goes-ahead-biden.html |

|

Chaos is building for shippers as U.S. port strike continues and costs riseAs the strike at ports enters its third day, cargo containers are stranded at the wrong terminals or at sea, and ocean carrier charges are starting to mount. Read more at: https://www.cnbc.com/2024/10/03/ports-strike-chaos-costs-starting-to-rise.html |

|

Panic buying amid U.S. ports strike is creating supermarket supply concernsGrocery stores and retailers say consumers are panic buying products over shortage concerns due to East and Gulf Coast ports strike, but fears are unfounded. Read more at: https://www.cnbc.com/2024/10/03/panic-buying-us-ports-strike-food-supply-concerns.html |

|

Active bond funds put up a strong performance — and they may be poised to stand out as rates fallActive bond funds had a strong showing in the 12-month period ending June 2024, according to recent data from Morningstar. Read more at: https://www.cnbc.com/2024/10/03/active-bond-funds-may-be-poised-to-stand-out-as-rates-fall.html |

|

U.S. crude oil jumps as Biden comments on possible Israel retaliation against IranSupply disruption risks are increasing as fighting in the Middle East intensifies, according to analysts. Read more at: https://www.cnbc.com/2024/10/03/crude-oil-prices-today.html |

|

Trump election conspiracist Tina Peters sentenced to 9 years in prison by Colorado judgeTina Peters, the former Mesa County, Colorado, clerk, falsely claimed Donald Trump lost the 2020 election to President Joe Biden due to ballot fraud. Read more at: https://www.cnbc.com/2024/10/03/trump-election-conspiracist-tina-peters-sentenced.html |

|

Nvidia CEO Jensen Huang says demand for next-generation Blackwell AI chip is ‘insane’Nvidia CEO Jensen Huang said in an interview with CNBC that demand for the company’s next-generation artificial intelligence chip Blackwell is “insane.” Read more at: https://www.cnbc.com/2024/10/03/nvidia-ceo-demand-for-blackwell-ai-chip-is-insane.html |

|

OpenAI gets $4 billion revolving credit line, giving it more than $10 billion in liquidityOn top of its latest funding round, OpenAI has put a $4 billion revolving credit line in place — bringing its total liquidity to more than $10 billion. Read more at: https://www.cnbc.com/2024/10/03/openai-gets-4-billion-revolving-credit-line-on-top-of-latest-funding.html |

|

XRP sinks after SEC files notice of appeal in Ripple case: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Cuy Sheffield of Visa explains the payment processor’s new tokenization platform for banks. Read more at: https://www.cnbc.com/video/2024/10/03/xrp-sinks-after-sec-files-notice-of-appeal-in-ripple-case-cnbc-crypto-world.html |

|

Sydney Sweeney doesn’t think she’ll ‘ever feel comfortable’ financially: ‘I saw my parents lose everything’The 27-year-old star told Glamour that her family’s past financial struggles have influenced how she thinks about her wealth. Read more at: https://www.cnbc.com/2024/10/03/sydney-sweeney-says-she-might-not-ever-feel-comfortable-about-money.html |

|

Miami Dolphins are in advanced talks to sell minority stake in team to Ares Management, billionaire Joe TsaiThe deal, which would also include Hard Rock Stadium, values the team at $8.1 billion, according to a person familiar with the negotiations. Read more at: https://www.cnbc.com/2024/10/03/miami-dolphins-talks-sell-minority-stake-ares-management-joe-tsai.html |

|

States affected by Hurricane Helene warn of price gouging and other scams. Here’s how to avoid being a victim of post-storm schemesIn the aftermath of Hurricane Helene, affected states are working to clamp down on price gouging and other schemes. Read more at: https://www.cnbc.com/2024/10/03/states-affected-by-hurricane-helene-warn-of-price-gouging-other-scams.html |

|

Seeking To Cut Food Waste (& Save The Planet), California Bans ‘Sell By’ Labeling On ProductsAuthored by Jill McLaughlin via The Epoch Times, Food products sold in California will no longer have a “sell by” stamp after July 1, 2026, after Gov. Gavin Newsom approved the nation’s first law governing food labeling.

When it goes into effect, Assembly Bill 660 will require the use of two standard terms for food products that choose to use a date label—“best if used by” to indicate the quality date of food, or “use by” to indicate the safety of food. Newsom said in a Read more at: https://www.zerohedge.com/political/seeking-cut-food-waste-california-bans-sell-labeling-products |

|

Why Political “Solutions” Don’t Fix Crises, They Make Them WorseAuthored by Charles Hugh Smith via OfTwoMinds blog, The system has reached the limits of its adaptability. Everything else is entertainment. A great many people have immense faith in political solutions to looming crises: if only we elect new leaders, if only we replace current policies with new policies, everything would be fixed and the crises will all dissipate. There are powerful reasons for this faith and equally powerful reasons why political solutions fail in crisis. Our faith in politics is nurtured by recency bias in eras of relatively low-level volatility: when the system is humming along, decade after decade, the incremental adaptations of politics are enough to resolve whatever spots of bother arise. There are three key points here. One is that politics is by its nature incremental, and there are profound reasons for this aversion to radical reforms. All organisms are well-served by the innate conservatism of natural selection: if it isn’t broken, don’t fix it. If the current set of instructions–genetic, epigenetic, social, cultural, economic, political–is working, then it makes sense to conserve what works and be cautious about adapting new instructions. Natural selection tinkers with experiments when selective pressure is applied to a species, and this is an incremental process: if random mutations in an individual offer some meaningful advantage in changing conditions, over time that impro … Read more at: https://www.zerohedge.com/political/why-political-solutions-dont-fix-crises-they-make-them-worse |

|

Hims & Hers Plunges After FDA Ends ‘Shortage’ Status Of Eli Lilly’s Weight-Loss DrugOn Wednesday, the Food and Drug Administration announced that the supply shortages of Eli Lilly’s popular weight-loss and diabetes drugs have been resolved. These drugs have been in short supply since the anti-obesity drug craze erupted several years ago. Now, an ample supply of GLP-1 drugs could signal that the ‘fat bubble’ in equity markets has popped. FDA said that Lilly’s Zepbound and Mounjaro multi-year shortage is over, adding that there are “legal restrictions on making copies of FDA-approved drugs” when there isn’t a shortage.

Shares of telehealth firm Hims & Hers Health plunged nearly 12% in premarket trading in New York. The company sells copycat weight-loss drugs. As noted above on X, “The Fat bubble has officially popped.” Read more at: https://www.zerohedge.com/markets/hims-hers-plunges-after-fda-ends-shortage-status-eli-lillys-weight-loss-drug |

|

Loan For Once-Iconic Detroit Tower Goes DelinquentBy Leslie Shaver of Multifamily Dive, The more-than-$80 million Freddie Mac commercial mortgage-backed securities loan for the rental portion of the once-iconic Detroit property Riverfront Towers has gone 30 days delinquent, according to a report Morningstar Credit shared with Multifamily Dive.

Image Capital is listed as the owner of the property, according to Yardi Matrix. Indianapolis-based AMP Residential manages the property. Neither firm replied to Multifamily Dive’s request for comment as of press time. The complex was once home to civil rights activist Rosa Parks and singer Aretha Franklin, accordin … Read more at: https://www.zerohedge.com/markets/loan-once-iconic-detroit-tower-goes-delinquent |

|

Faisal Islam: Oil price rise comes at a critical pointAny extended rise raises the possibility of higher petrol prices and gas and electricity bills. Read more at: https://www.bbc.com/news/articles/cx250ygn9ddo |

|

Interest rates could fall more quickly, Bank chief hintsGovernor Andrew Bailey hints that borrowing costs could come down faster if inflation stays in line. Read more at: https://www.bbc.com/news/articles/cx2lp5l9dpro |

|

Banks to put four-day hold on suspicious paymentsRules allowing banks to delay payments to investigate fraud will come into force at the end of October. Read more at: https://www.bbc.com/news/articles/cn7yel28rx6o |

|

Tech view: ‘Sell on rise’ strategy advised in Nifty with 25,000 as key support. How to trade tomorrowA bearish candle suggests further market weakness. Traders should “sell on rise” and only buy above 26,000. Key levels to watch are support at 25,000 and 24,750, and resistance at 25,500. Breaking below support could trigger more declines, while hitting resistance may limit any upward movement, according to Hardik Matalia of Choice Broking. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-sell-on-rise-strategy-advised-in-nifty-with-25000-as-key-support-how-to-trade-tomorrow/articleshow/113909084.cms |

|

Zaggle stock shows resilience amid volatile market backed by acquisitions and partnershipsZaggle Prepaid Ocean Services stock has gained 28% in the past month and 51% in the past three months. The company’s acquisitions and partnerships are expected to boost future growth. Analysts have raised EPS targets. Zaggle offers SaaS-based employee spend management services to corporates and has a diverse client base. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/zaggle-stock-shows-resilience-amid-volatile-market-backed-by-acquisitions-and-partnerships/articleshow/113911848.cms |

|

Warren Buffett sells $338 million of BofA stock as spree slowsWarren Buffett’s Berkshire Hathaway has been gradually reducing its stake in Bank of America, with recent sales at lower prices compared to earlier disposals. The latest transactions fetched $338 million, marking a decrease from prior rounds, though Berkshire remains the bank’s top shareholder with a 10.2% stake valued at over $31 billion. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/warren-buffett-sells-338-million-of-bofa-stock-as-spree-slows/articleshow/113905543.cms |

|

Why Open AI’s $100 billion 2029 revenue target seems like a tech-fever dreamBeing at the cutting edge doesn’t necessarily bring financial success. Read more at: https://www.marketwatch.com/story/openai-making-money-from-the-ai-revolution-is-far-from-certain-32249d5a?mod=mw_rss_topstories |

|

Oil prices turn higher for the year on risks to crude flow in the Middle EastOil futures finished higher for a third straight session on Thursday, prompting prices to turn higher for the year, as traders awaited Israel’s response to a missile barrage earlier this week by Iran amid concerns of a wider Middle East conflict that could disrupt flows of crude from the region. Read more at: https://www.marketwatch.com/story/oil-prices-rise-as-traders-await-israel-response-to-iran-attack-17829cc3?mod=mw_rss_topstories |

|

10-year Treasury yield ends at highest level since August after better-than-expected ISM dataU.S. government debt sold off on Thursday, pushing 10- and 30-year yields to almost five-week closing highs, after data showed the economy’s services side grew last month and businesses remained reluctant to lay off many workers. Read more at: https://www.marketwatch.com/story/treasury-yields-inch-higher-as-traders-eye-u-s-data-dump-c2cb132e?mod=mw_rss_topstories |