Summary Of the Markets Today:

- The Dow closed down 173 points or 0.41%,

- Nasdaq closed down 1.53%,

- S&P 500 closed down 0.93%,

- Gold $2,680 up $20.60,

- WTI crude oil settled at $70 up $2.21,

- 10-year U.S. Treasury 3.739 down 0.063 points,

- USD index $101.20 up $0.42,

- Bitcoin $62,041 down $1,845 or 2.91%,

*Stock data, cryptocurrency, and commodity prices at the market closing

Today’s Highlights

US stocks closed lower on Tuesday after Iran fired over 100 ballistic missiles at Israel. Oil prices saw their biggest increases in nearly a year. West Texas Intermediate crude rose over 3% to above $70 per barrel, while Brent crude climbed about 3% to around $74 per barrel. New economic data showed job openings unexpectedly increased in August, while US manufacturing held steady in September, though still in contraction territory. Investors are looking ahead to Friday’s September jobs report for further clues on the economy and Federal Reserve policy. A dockworkers’ strike began on the East and Gulf coasts, threatening to disrupt shipping and potentially impact the economy.

Click here to read our current Economic Forecast – October 2024 Economic Forecast: One More Recession Flag Removed Yet Little Headway On Inflation

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

Construction spending during August 2024 was 4.1% above August 2023 (2.8% inflation-adjusted)- down from 5.3% the previous month. Spending on private construction was up 3.1% year-over-year (down from 4.2% the previous month). Public construction spending was up 7.8% year-over-year (down from 9.0% the previous month). The bottom line is that construction growth is moderating which is not good news for one of the bright spots in the economy.

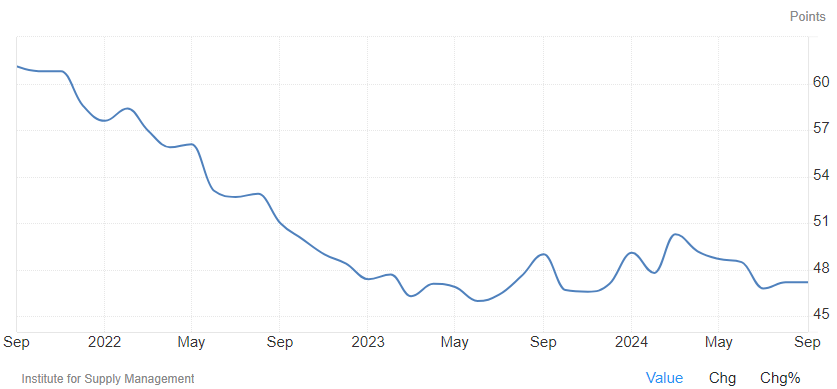

The ISM Manufacturing PMI® registered 47.2 percent in September 2024 – unchanged from August. A Manufacturing PMI® above 42.5 percent, over a period of time, generally indicates an expansion of the overall economy. The New Orders Index remained in contraction territory, registering 46.1 percent, 1.5 percentage points higher than the 44.6 percent recorded in August. The September reading of the Production Index (49.8 percent) is 5 percentage points higher than August’s figure of 44.8 percent. The Prices Index went into contraction (or ‘decreasing’) territory for the first time this year, registering 48.3 percent, down 5.7 percentage points compared to the reading of 54 percent in August. The Backlog of Orders Index registered 44.1 percent, up 0.5 percentage point compared to the 43.6 percent recorded in August. The Employment Index registered 43.9 percent, down 2.1 percentage points from August’s figure of 46 percent. The bottom line is that manufacturing continues to be in a recession.

The number of job openings was little changed at 8.0 million on the last business day of August but is down 14.5% year-over-year. What pundits watch is a correlation between job openings and total employment – and this correlation indicates a further slowing of job growth in the coming months. I see no forces at play which suggest a strengthening employment growth.

Here is a summary of headlines we are reading today:

- Falling Energy Prices Drive Eurozone Inflation Below 2% Goal

- Is a New Nuclear Arms Race Inevitable?

- Oil Prices Spike As Iran Sends Volley of 100+ Ballistic Missiles Into Israel

- U.S. Port Strike Could Trigger New Wave of Inflation

- Oil Trader Gunvor Doesn’t Expect Middle East Conflict to Restrict Supply

- U.S. Administration Buys 6 Million Barrels of Crude for SPR

- Iran launches missile attack on Israel for killing of Hezbollah leader, general

- S&P 500 falls, Nasdaq drops 1% to start October as Middle East tensions intensify: Live updates

- Where the charts indicate gold is headed next as it rallies on escalating geopolitical tensions

- Robinhood announces crypto transfers for European customers: CNBC Crypto World

- Tesla Prevails In Lawsuit Alleging Autopilot Fraud

- The “Everything Market” Could Last A While Longer

- Why was the stock market down today? It wasn’t just about Iran.

- 10-year Treasury yield ends at lowest in a week as Iran launches retaliatory strikes on Israel

Click on the “Read More”

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Falling Energy Prices Drive Eurozone Inflation Below 2% GoalEurozone inflation fell below the two per cent target for the first time since mid-2021, paving the way for the European Central Bank (ECB) to cut interest rates again this month. Annual inflation fell to 1.8 per cent in September, down from 2.2 per cent in August and below the 1.9 per cent expected by economists. Falling energy prices were the largest contribution to the lower headline rate, with energy prices falling six per cent in the year. But the release also showed signs of progress on measures of underlying inflation. Core inflation, which… Read more at: https://oilprice.com/Energy/Energy-General/Falling-Energy-Prices-Drive-Eurozone-Inflation-Below-2-Goal.html |

|

Is a New Nuclear Arms Race Inevitable?“For the first time since the Cuban missile crisis, we have a direct threat to the use of nuclear weapons…. We have not faced the prospect of Armageddon since Kennedy and the Cuban missile crisis,” U.S. President Joe Biden said in 2022. The stark warning came after Russia’s Vladimir Putin, suffering major setbacks in his full-scale invasion of Ukraine and forced to draft hundreds of thousands of civilians to bolster the military, said his government would “use all the means at our disposal” if Russia’s territorial integrity was threatened.… Read more at: https://oilprice.com/Geopolitics/International/Is-a-New-Nuclear-Arms-Race-Inevitable.html |

|

Supply Chain Disruptions Stall Progress on Major Offshore Wind FarmThere has been tons of controversy about wind farm projects on the Jersey shore, with residents in beaches like Brigantine against the initiatives, while others argue for implementing the clean energy. Turns it out may be a moot point: one project is having “a hard time finding someone to manufacture blades for its turbines”, local radio station NJ 101.5 reported this week. We guess when you focus too much on green virtue signaling and ignore the fact that the country doesn’t produce or manufacture anything anymore, there’s eventually consequences. … Read more at: https://oilprice.com/Alternative-Energy/Wind-Power/Supply-Chain-Disruptions-Stall-Progress-on-Major-Offshore-Wind-Farm.html |

|

Oil Prices Spike As Iran Sends Volley of 100+ Ballistic Missiles Into IsraelIran has fired more than 100 ballistic missiles into Israel, according to the latest reports, after the United States warned Israel this morning that an attack was imminent. Israel had time to move its cabinet members and Mossad to safety prior to the attack, and Israel is expected to issue a report shortly detailing what damage—if any—was done. Another wave of missiles from Iran is expected. Today’s missiles are different from what Iran sent into Israel in April. Today’s missiles are ballistic missiles that travel far more… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Oil-Prices-Spike-As-Iran-Sends-Volley-of-100-Ballistic-Missiles-Into-Israel.html |

|

Climate Change and Geopolitics Collide at COP29Azerbaijani leader Ilham Aliyev is stoking a geopolitical grudge with France, issuing a pledge to fund the participation of small island developing states, some of which have French connections, in the upcoming COP29 environmental conclave. Azerbaijan’s financial assistance would cover airfare, accommodation and per diems for up to four delegates for each island state participating in COP29, which will be held in Baku in November. The assistance offer comes several months after Aliyev proposed establishing a special fund to help small island… Read more at: https://oilprice.com/Geopolitics/International/Climate-Change-and-Geopolitics-Collide-at-COP29.html |

|

U.S. Port Strike Could Trigger New Wave of InflationMore than 45,000 International Longshoremen’s Association (ILA) members from over three dozen facilities across 14 Gulf and East Coast ports went on strike early Tuesday, marking the largest labor action at US ports in nearly 50 years. The labor action, driven by disputes over automation and wages in a new multi-year labor contract, threatens to disrupt supply chains nationwide. If the strike persists for more than a week, retailers could face shortages of certain goods (read: here), potentially sparking another wave of inflation. ILA’s strike… Read more at: https://oilprice.com/Finance/the-Economy/US-Port-Strike-Could-Trigger-New-Wave-of-Inflation.html |

|

Houthi Attacks Damage Oil Tanker and Bulk Carrier in the Red SeaThe Iran-aligned Houthis attacked and damaged two commercial vessels in the Red Sea near Yemen early on Tuesday, as the conflict in the Middle East escalated in recent days with Israeli attacks on Yemen and Israel’s killing of the top Hezbollah leaders in Lebanon. The oil tanker Cordelia Moon, flying a Panama flag, and the Liberia-flagged bulk carrier Minoan Courage came under attack from missiles and a drone boat while transiting the Red Sea near Yemen, various reports say. One vessel was hit by an unmanned boat, and the master reported… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Houthi-Attacks-Damage-Oil-Tanker-and-Bulk-Carrier-in-the-Red-Sea.html |

|

Iran Missile Launch Rumors Fire Up Oil PricesOil prices are surging in the wake of rumors that Iran is preparing to launch a missile attack on Israel. Reports from U.S. officials suggest that an Iranian missile strike is imminent—the specter of which is driving uncertainty across global markets. As of today, West Texas Intermediate (WTI) crude is trading at $70.16 per barrel, up 2.92% (+$1.99), while Brent crude is also seeing significant gains, trading at $73.61 per barrel, up 2.66% (+$1.91). The potential for an armed conflict between Iran and Israel has triggered concerns about the… Read more at: https://oilprice.com/Energy/Oil-Prices/Missile-Rumors-Fire-Up-Oil-Prices.html |

|

Oil Trader Gunvor Doesn’t Expect Middle East Conflict to Restrict SupplyOil supply from the Middle East will not be impacted by the conflict in the Middle East, according to Torbjorn Tornqvist, co-founder and chairman of one of the world’s biggest independent oil traders, Gunvor. “I’m very confident that this will not have any impact at all on oil supply,” Tornqvist said at the Energy Markets Forum in the UAE on Tuesday, commenting on the conflict in the Middle East. Instead, it “seems the market is more focused on concerns about the lack of growth in oil demand,” Tornqvist said,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Oil-Trader-Gunvor-Doesnt-Expect-Middle-East-Conflict-to-Restrict-Supply.html |

|

Oil Prices Under Pressure Ahead of OPEC+ MeetingOil prices were once again under pressure early on Tuesday morning, with Brent falling below $71 and WTI trading at $67.57. Oil markets will now look toward the OPEC+ meeting tomorrow for some support, as well as any developments in the Middle East following Israel’s ground invasion of Lebanon. – Europe is preparing for a colder winter this year as meteorologists see an 80-85% probability of the La Niña phenomenon developing, bringing cooler weather to the Atlantic Coast as soon as October.- According to forecasters, France, the… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Prices-Under-Pressure-Ahead-of-OPEC-Meeting.html |

|

Brent Traders Reroute WTI Oil Cargoes From EuropeBig traders of the U.S. WTI Midland crude, which is now part of the dated Brent benchmark, have used a ‘bookout’ option in the Platts window to reroute Europe-bound cargoes elsewhere, in a move that could influence the price of dated Brent, Reuters reported exclusively on Tuesday, citing trading sources and analysts. The so-called bookout clause is allowed under the Platts methodology for commodities. WTI Midland, produced in Texas, was included last year in the Dated Brent part of the Brent benchmark as one of several grades underpinning… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Brent-Traders-Reroute-WTI-Oil-Cargoes-From-Europe.html |

|

Germany Undecided on Whether to Support EU Tariffs on Chinese EVsGermany hasn’t decided yet if it would support the EU’s plans to officially introduce tariffs on electric vehicles imported from China, the chief economic adviser of German Chancellor Olaf Scholz told Bloomberg TV on Tuesday. The EU earlier this year imposed provisional tariffs of up to 36% on EVs imported from China, on top of the regular import duty of 10%. The EU member states are expected to vote on Friday on whether to officially impose these tariffs, after finding that China has been heavily subsiding EV manufacturers. But Germany,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Germany-Undecided-on-Whether-to-Support-EU-Tariffs-on-Chinese-EVs.html |

|

Nigeria Set to Approve Exxon’s $1.3-Billion Shallow Water Asset SaleNigeria’s government is set to approve within days the proposed $1.3-billion sale of ExxonMobil’s shallow water assets to local firm Seplat, Nigerian President Bola Tinubu said on Tuesday. The U.S. supermajor announced two years ago its intention to sell its shallow water business in Nigeria to Seplat, the biggest Nigerian energy company by market value, in a $1.3 billion deal. The transaction has been stuck at the regulatory approval level for months and Exxon has yet to receive full clearance for the asset sale. Earlier this year,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Nigeria-Set-to-Approve-Exxons-13-Billion-Shallow-Water-Asset-Sale.html |

|

U.S. Administration Buys 6 Million Barrels of Crude for SPRThe U.S. Administration has awarded contracts to buy 6 million barrels of crude oil for the Strategic Petroleum Reserve (SPR) for deliveries through May 2025, the Department of Energy said this week. The contracts were awarded last week and are for deliveries of 1.5 million barrels per month between February and May 2025 to the Bayou Choctaw site in Louisiana, following the Request for Proposal (RFP) that was announced on September 18. In August, the Administration said that the United States would continue to buy crude when prices are in the $70s… Read more at: https://oilprice.com/Energy/Energy-General/US-Administration-Buys-6-Million-Barrels-of-Crude-for-SPR.html |

|

UAE’s Oil Giant ADNOC to Buy Chemicals Firm Covestro in $16-Billion DealFollowing a year of negotiations, Abu Dhabi’s oil company ADNOC has agreed to buy Germany’s chemicals giant Covestro in a deal worth $16.3 billion (14.7 billion euros) including debt, the German group said on Tuesday. ADNOC will make a takeover offer at $68.86 (62.00 euros) per Covestro share, which is set to be accepted by the chemicals company. “Subject to the review of the offer document, the Board of Management and the Supervisory Board assume that they will recommend the acceptance of the offer to the Company’s… Read more at: https://oilprice.com/Latest-Energy-News/World-News/UAEs-Oil-Giant-ADNOC-to-Buy-Chemicals-Firm-Covestro-in-16-Billion-Deal.html |

|

Port strike could reignite inflation, with larger economic impact dependent on how long it lastsManufacturers of everything from trucks to toys to artificial Christmas trees face obstacles now that the ILA has called a stoppage. Read more at: https://www.cnbc.com/2024/10/01/port-strike-could-reignite-inflation-with-larger-economic-impact-dependent-on-how-long-it-lasts.html |

|

Iran launches missile attack on Israel for killing of Hezbollah leader, generalIsrael launched a ground incursion into Lebanon as part of an attack on Hezbollah, the militant group backed by Iran. Read more at: https://www.cnbc.com/2024/10/01/iran-readying-imminent-ballistic-missile-attack-against-israel-us-official-tells-nbc-news.html |

|

S&P 500 falls, Nasdaq drops 1% to start October as Middle East tensions intensify: Live updatesStocks slipped Tuesday, the first trading day of October and the fourth quarter, after a surprisingly strong September performance. Read more at: https://www.cnbc.com/2024/09/30/stock-market-today-live-updates.html |

|

Where the charts indicate gold is headed next as it rallies on escalating geopolitical tensionsTodd Gordon sees an opportunity in miner Harmony Gold. Read more at: https://www.cnbc.com/2024/10/01/where-the-charts-indicate-gold-is-headed-next-as-it-rallies-on-escalating-geopolitical-tensions.html |

|

Nike reports earnings after the bell. Here’s what Wall Street expectsNike is in a reset after critics say it lost sight of innovation and ceded share to competitors. Its CEO, John Donahoe, is scheduled to step down this month. Read more at: https://www.cnbc.com/2024/10/01/nike-nke-earnings-q1-2025.html |

|

VP debate live updates: Vance and Walz to face off tonight in New YorkSen. JD Vance, the Republican vice presidential nominee, and Democratic pick Gov. Tim Walz of Minnesota are debating Tuesday night in New York City. Read more at: https://www.cnbc.com/2024/10/01/vice-presidential-debate-jd-vance-tim-walz.html |

|

500 Starbucks locations have voted to unionize as labor talks continueBaristas at a Starbucks in Bellingham, Washington, voted to unionize on Monday, becoming the 500th location to join Starbucks Workers United. Read more at: https://www.cnbc.com/2024/10/01/500-starbucks-locations-have-voted-to-unionize.html |

|

Investors hope October paves way for records as cryptocurrency enters historically strong monthA September surprise has given bitcoin a head start on a potential run to record highs in the fourth quarter. Read more at: https://www.cnbc.com/2024/10/01/october-bitcoin-outlook.html |

|

Robinhood announces crypto transfers for European customers: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Cleve Mesidor of the National Policy Network of Women of Color in Blockchain discusses the letter the group sent to the Kamala Harris campaign, advocating for crypto policy. Read more at: https://www.cnbc.com/video/2024/10/01/robinhood-announces-crypto-transfers-for-european-customers-cnbc-crypto-world.html |

|

Crude oil rises more 2% after Iran fires missiles at IsraelA direct conflict between Israel and Iran would raise the risk of oil supply disruptions, analysts say. Read more at: https://www.cnbc.com/2024/10/01/crude-oil-prices-today.html |

|

Facebook parent Meta rehired worker after he stalked a coworker for over a year, lawsuit saysAn employee with Facebook parent Meta is suing the company after the tech giant rehired a former colleague who had been accused of stalking and harassment. Read more at: https://www.cnbc.com/2024/10/01/meta-sued-for-hiring-employee-accused-of-stalking.html |

|

Harris campaign launches small business battleground tour in a play for Latino, Black votersThe Harris campaign will announce the new campaign tour hours before her VP pick, Gov. Tim Walz, debates Trump’s running mate, Sen. JD Vance. Read more at: https://www.cnbc.com/2024/10/01/harris-small-business-tour-latino-black-voters-trump-election.html |

|

The Latest Chemical Weapons False Flag Scare In Syria Is Suspiciously TimedAuthored by Andrew Korybko via Substack, Russia’s Foreign Intelligence Service (SVR) warned on Tuesday that some NATO countries and Ukraine are preparing a chemical weapons false flag provocation in Syria so as to discredit Russia in the Global South. They specified that “The plan of the operation envisages the militants dropping a mined container with chlorine from a UAV during strikes by the Syrian Armed Forces and the Russian Aerospace Forces on terrorist groups’ positions in the Idlib de-escalation zone”, which the White Helmets will then film.

The timing is suspicious since it coincides with the start of Israel’s ground operation in Lebanon. Syria isn’t … Read more at: https://www.zerohedge.com/geopolitical/latest-chemical-weapons-false-flag-scare-syria-suspiciously-timed |

|

Tesla Prevails In Lawsuit Alleging Autopilot FraudAuthored by Zachary Stieber via The Epoch Times, Tesla has beaten a lawsuit alleging the company and its top officials misled the public and investors over the state of its autopilot systems.

Plaintiffs in the case failed to show Tesla CEO Elon Musk and other officials committed fraud with statements such as the autopilot on average being safer than normal drivers, U.S. District Judge Araceli Martínez-Olguín said in a Sept. 30 ruling. Musk said during a 2019 investor event that “we publish accidents per mile every quarter, and what we see right now is that autopilot is about twice as safe as a normal driver on average.” That same year, he wrote on Twitter (now X) that “buying a car in 2019 that can’t upgrade to full self-driving is like buying a horse instead of a car in 1919.” Those and other statements were … Read more at: https://www.zerohedge.com/technology/tesla-prevails-lawsuit-alleging-autopilot-fraud |

|

The Mad Dash In India To Buy GoldWith a decade-low tariff in place and both the festive and wedding seasons approaching, there is expected to be a mad dash for gold in India this year, according to a new report from Nikkei. The country is the world’s second-largest gold consumer after China. India’s festival and wedding season begins Thursday, leading up to Diwali on Nov. 1. During this auspicious period, gold purchases surge as it symbolizes luck and financial security. Gold is also a popular gift for brides and families during weddings. India saw gold imports surge to a record $10.1 billion in August—more than double compared to a year ago and triple July’s $3.1 billion—according to the Indian Commerce Ministry. The Nikkei report says that the spike followed the government’s late-July decision to cut import taxes on gold and gold dore, a semi-pure alloy, by 9%. The duties now stand at 6% for gold and 5.35% for gold dore, the lowest rates since June 2013, after remaining above 10% for over a decade. Read more at: https://www.zerohedge.com/markets/mad-dash-india-buy-gold |

|

The “Everything Market” Could Last A While LongerAuthored by Lance Roberts via RealInvestmentAdvice.com, We are currently in the “everything market.” It doesn’t matter what you have probably invested in; it is currently increasing in value. However, it isn’t likely for the reasons you think. A recent Marketwatch interview with the always bullish Jim Paulson got his reasoning for the rally.

Read more at: https://www.zerohedge.com/markets/everything-market-could-last-while-longer |

|

People told to read meter as energy bills riseA 10% energy price rise has taken effect, meaning annual bills will be £1,717 on average. Read more at: https://www.bbc.com/news/articles/c7v6l26v585o |

|

Workers must keep all customer tips under new lawBosses must pass on all tips and service charges to staff under new employment rules. Read more at: https://www.bbc.com/news/articles/czj9mxnyezdo |

|

‘I’m not playing games’ on port strikes, union boss saysHarold Daggett says his dockworkers will are “going to win” in their battle to secure higher wages. Read more at: https://www.bbc.com/news/articles/c78d442v3e6o |

|

Sebi favours tax breaks for municipal bond subscribers: OfficialSebi has asked the government to approve tax breaks for municipal bonds to fund grass-root infrastructure. Currently, India’s municipal bond market is 0.6% of the nation’s bond market, contrasting with the US’s $4 trillion market. Sebi is also planning steps to enhance investor protection in the futures and options (F&O) segment. Read more at: https://economictimes.indiatimes.com/markets/bonds/sebi-favours-tax-breaks-for-municipal-bond-subscribers-official/articleshow/113859976.cms |

|

FPIs increase net flows in the secondary market in SeptemberA strong net inflow by foreign portfolio investors (FPIs) in September has turned their total secondary market investment in Indian equities positive for the calendar year so far to $4,140.3 million (Rs 34,554 crore) compared with a net outflow of $1,417 million (negative Rs 11,998 crore) at the end of August. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/fpis-increase-net-flows-in-the-secondary-market-in-september/articleshow/113855374.cms |

|

GIFT Nifty records all-time high monthly turnover of $100.7 billion in SeptemberGIFT Nifty achieved a new milestone with a monthly turnover of $100.7 billion in September 2024. This surpasses its previous record of $100.13 billion set in August 2024. This reflects the growing global interest and trust in GIFT Nifty as a benchmark for India’s growth story. NSE IX, the exchange hosting GIFT Nifty, has seen a total cumulative volume of over 27.11 million contracts with total cumulative turnover of US $1.18 trillion till September 2024. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/gift-nifty-records-all-time-high-monthly-turnover-of-100-7-billion-in-september/articleshow/113857784.cms |

|

As port strike begins, these air-delivery stocks could be poised to benefitThe dockworkers strike began at midnight, leading to shutdowns of U.S. East Coast and Gulf ports. Read more at: https://www.marketwatch.com/story/as-port-strike-begins-these-air-delivery-stocks-could-be-poised-to-benefit-b28678a5?mod=mw_rss_topstories |

|

Why was the stock market down today? It wasn’t just about Iran.Stocks felt pressure as Iran launched a missile attack on Israel, but geopolitical worries weren’t the only thing rattling Wall Street on Tuesday. Read more at: https://www.marketwatch.com/story/why-is-the-stock-market-down-today-it-isnt-just-about-iran-6bb33118?mod=mw_rss_topstories |

|

10-year Treasury yield ends at lowest in a week as Iran launches retaliatory strikes on IsraelFlight-to-safety flows into U.S. government debt left the 10-year yield lower for the second time in the past three sessions on Tuesday, as Iran launched a wave of retaliatory missile strikes on Israel. Read more at: https://www.marketwatch.com/story/treasury-yields-slip-as-traders-eye-raft-of-jobs-data-this-week-01d9c41b?mod=mw_rss_topstories |