Summary Of the Markets Today:

- The Dow closed down 293 points or 0.70%, (Closed at 41,915, New Historic high 42,300)

- Nasdaq closed up 0.04%,

- S&P 500 closed down 0.19%, (Closed at 5,722, New Historic high 5,741)

- Gold $2,684 up $6.90,

- WTI crude oil settled at $70 down $1.81,

- 10-year U.S. Treasury 3.789 up 0.053 points,

- USD index $100.98 up $0.51,

- Bitcoin $63,274 down $1,030 or 1.60%,

*Stock data, cryptocurrency, and commodity prices at the market closing

Today’s Highlights

The stock market rally lost steam, with major indexes closing mixed after retreating from all-time highs reached yesterday. Investors are debating the health of the economy and the chances of another large interest rate cut following the Fed’s surprise 0.5% cut. Economic data was mixed – new home sales declined in August, but mortgage applications jumped to the highest level since 2022 as rates dropped. The focus is now on upcoming GDP data and the PCE inflation index report later this week.

Click here to read our current Economic Forecast – September 2024 Economic Forecast: One Recession Flag Removed With Three Remaining

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

Human Resources Trends & Issues Survey conducted online among 182 HR executives and business leaders nationwide by global outplacement and business and executive coaching firm Challenger Gray & Christmas, Inc. found:

- Cost-Cutting Measures: Companies are actively pursuing cost reductions as they approach the end of the year, focusing on travel, bonuses, salaries, and technology solutions. A survey found that 9% of organizations are using return-to-office policies as part of their cost-cutting strategies, reflecting a shift from traditional methods like layoffs

- AI in the Workplace: There is a growing disconnect between employee usage of AI tools (37% of employees) and corporate policies, with only 12% of companies having formal AI training or strategies. This gap raises concerns about data security and ethical implications as employees navigate AI independently

- Quiet Quitting Concerns: The phenomenon of “quiet quitting,” where employees disengage without resigning, is a significant worry for 33% of companies. However, many lack concrete evidence or tracking mechanisms to assess its impact accurately

- Leadership Perception: Favorable views of leadership have slightly declined, with 54.55% of employees expressing positive opinions. There is an increase in mixed views and a notable rise in companies not tracking leadership perceptions

- Employee Priorities: Flexibility remains the top priority for employees, followed by meaningful work and career advancement. While salary and empathetic leadership are still valued, their importance has decreased compared to previous surveys

- Employer Offerings: Companies are adjusting their offerings in response to employee needs, with a focus on leadership development and DEI initiatives. However, financial incentives like signing bonuses have declined significantly

- Remote Work Trends: The trend towards hybrid and remote work continues, with 54% of companies offering such arrangements. The model of requiring three days in the office has become more common

- Hiring Challenges: Filling roles is becoming easier for some companies, though challenges remain, particularly in specialized fields like healthcare and technology. Despite improvements, 17% of companies are still in hiring freezes

Sales of new single-family houses in August 2024 were up 9.8% above the August 2023. The median sales price of new houses sold in August 2024 was $420,600. The average sales price was $492,700. The seasonally-adjusted estimate of new houses for sale at the end of August was 467,000. This represents a supply of 7.8 months at the current sales rate. New home sales remain a bright spot in the current economy.

Here is a summary of headlines we are reading today:

- Wells Fargo: Oil Prices To Stay Depressed Through 2025 on Global Oversupply

- Global Superpower Ranking Reveals Shifting Power Dynamics

- Oil Prices Decline As Investors Weigh China Stimulus

- Gold Prices Soar on Strong Demand From Hedge Funds and Central Banks

- BlackRock Sees AI Driving a 50% Jump in Asian Energy Demand

- Dow falls nearly 300 points to snap four-day win streak, S&P 500 retreats from record: Live updates

- Mortgage refinance boom takes hold, as weekly demand surges 20%

- Southwest Airlines to cut service and staffing in Atlanta to slash costs

- Surging AI demand could cause the world’s next chip shortage, research says

- Hidden Agendas: Beware Of The Government’s Push For A Digital Currency

- A port strike could be an economic ‘tsunami’ affecting these sectors

- The number of millionaire college athletes has tripled. Here are the top 10 earners this year.

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

| Here are the headlines moving the markets. | |

|

Will Iran Intervene Directly in the Israel-Hezbollah Conflict?Israel has conducted the deadliest bombardment of Lebanon since a devastating five-week conflict with Lebanese militant group Hezbollah in 2006. The September 23-24 attacks that killed hundreds of people mark the start of a new war between Israel and its longtime foe, Hezbollah, experts say. The sides have exchanged constant cross-border strikes since Israel launched its war in the Gaza Strip in October. Hezbollah has said it has fired rockets on Israel in solidarity with Palestinians. But Israel’s deadly air strikes, coming soon after a series… Read more at: https://oilprice.com/Geopolitics/International/Will-Iran-Intervene-Directly-in-the-Israel-Hezbollah-Conflict.html |

|

India Looks to Balance Short-Term Energy Needs with Long-Term VisionIndia’s growing energy needs are a complex puzzle, with pieces shaped by global politics, economic realities, and a pressing need for cleaner solutions. It’s a balancing act, with the country walking a tightrope between ensuring a reliable and affordable energy supply and pursuing a sustainable future. In a world where energy security is paramount, India isn’t shying away from securing the best deals, even if it means turning to discounted Russian crude amidst Western sanctions. Yet, India’s energy story is about more than just securing… Read more at: https://oilprice.com/Energy/Energy-General/India-Looks-to-Balance-Short-Term-Energy-Needs-with-Long-Term-Vision.html |

|

Wells Fargo: Oil Prices To Stay Depressed Through 2025 on Global OversupplyAnalysts at Wall Street bank Wells Fargo have predicted that oil prices will remain lower through 2025 due to the elevated risk of a global oversupply. According to the experts, a combination of persistent growth of U.S. shale production as well as slowing demand from key economies, especially China, are the key bearish drivers. Wells Fargo says the anticipated easing of OPEC+ production cuts by the end of 2024 further supports the likelihood of a supply surplus in 2025 despite current market tightness. Wells Fargo has predicted that global oil… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Wells-Fargo-Oil-Prices-To-Stay-Depressed-Through-2025-on-Global-Oversupply.html |

|

Global Superpower Ranking Reveals Shifting Power DynamicsThe global economic order is stitched together by trade and economic collaboration, but these show signs of fraying. With nationalism on the rise and cross-border trade flows stagnating, economies are growing more protectionist. At the same time, demographic shifts are driving economic growth and productivity in India and Asia, which could shift the global power balance. This graphic, via Visual Capitalist’s Dorothy Neufeld, ranks world superpowers in 2024, based on analysis from Ray Dalio’s Great Powers Index 2024. The Strength of Major… Read more at: https://oilprice.com/Geopolitics/International/Global-Superpower-Ranking-Reveals-Shifting-Power-Dynamics.html |

|

Equinor Shutters Gulf Oil Platform on Hurricane Watch as Oil Prices DipNorway’s Equinor has shut down operations at its Titan platform in the Gulf of Mexico, Reuters reports, a day after evacuating non-essential personnel as a Tropical Cyclone System moves towards Florida, where it is expected to turn into a massive hurricane by Thursday. Despite the precautionary oil and gas shut-ins in the Gulf of Mexico, oil prices were downwardly explosive on Wednesday, losing as much as 3% by 12:36 p.m. ET on China stimulus uncertainty and U.S. stockpiles. Earlier on Wednesday, reports suggested that the specific… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Equinor-Shutters-Gulf-Oil-Platform-on-Hurricane-Watch-as-Oil-Prices-Dip.html |

|

China Champions Multipolar World Order at UN SummitWorld leaders have gathered in New York for the 79th United Nations General Assembly (UNGA) under the shadow of global conflict as wars rage in the Middle East, Ukraine, Sudan, and elsewhere. Here’s what’s on China’s radar so far and what could play out as UNGA continues. Finding Perspective: While the gathering began with the adoption of an ambitious document called the Pact for the Future, which contains a series of pledges to improve development, fight climate change, and take more sustained action toward ending conflicts — among other measures… Read more at: https://oilprice.com/Geopolitics/International/China-Champions-Multipolar-World-Order-at-UN-Summit.html |

|

Low U.S. Natural Gas Prices Weigh on Oil Producers’ Cash FlowsThe slump in U.S. natural gas prices in early 2024 hit the cash flow generation of dozens of listed, mostly oil-producing companies. The financial reports of 36 publicly traded oil companies that produce most of their crude oil in the United States showed that combined cash from operations dropped to $23.3 billion in the first quarter of 2024, down by 12% compared to the first quarter of last year, the U.S. Energy Information Administration (EIA) said in an analysis this week. The benchmark U.S. crude prices, West Texas Intermediate… Read more at: https://oilprice.com/Energy/Natural-Gas/Low-US-Natural-Gas-Prices-Weigh-on-Oil-Producers-Cash-Flows.html |

|

Oil Prices Decline As Investors Weigh China StimulusOil markets have continued their rollercoaster ride, with oil prices declining during Wednesday’s morning session as traders continue weighing on China’s latest stimulus package. Brent crude for November delivery declined 1.3% to trade at $74.22 per barrel at 10.25 am ET while WTI crude for October delivery fell by a similar margin to change hands at $70.60 per barrel. China has unleashed a swath of stimulus measures including cuts to its benchmark interest rate as Beijing battles a slowdown in the world’s second-largest economy.… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Oil-Prices-Decline-As-Investors-Weigh-China-Stimulus.html |

|

Oil Moves Lower Despite Significant drop in Crude Oil InventoriesCrude oil prices fell today, after the Energy Information Administration reported an inventory decline of 4.5 million barrels for the week to September 20. The change compares with a draw of 1.6 million barrels for the previous week, which in turn followed a small inventory build of less than 1 million barrels that nevertheless weighed on prices. Last week’s crude oil inventory change was accompanied by more draws in fuel stocks. Gasoline inventories shed 1.5 million barrels in the reporting period, with production standing at an average… Read more at: https://oilprice.com/Energy/Crude-Oil/Oil-Moves-Lower-Despite-Significant-drop-in-Crude-Oil-Inventories.html |

|

Libya’s Rival Factions Resume Talks Amid Oil Production StandoffTalks between Libya’s feuding eastern and western administrations resumed on Wednesday in a bid to overcome the political impasse that has crushed Libyan oil production and exports, a Libyan MP told Bloomberg via a text message. The blockade of oil production and exports in OPEC’s North African producer is close to entering a second month. Oil production at several Libyan oilfields was halted on August 27 after the rival government in the east announced a stop to all oil production and exports from Libya. Libya, which pumped about 1.2… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Libyas-Rival-Factions-Resume-Talks-Amid-Oil-Production-Standoff.html |

|

Gold Prices Soar on Strong Demand From Hedge Funds and Central BanksSomething remarkable happened to the price of gold back in early 2022 around the time of the Ukraine war: having previously tracked gold ETF inflows to the tick, the price of gold suddenly disconnected and exploded higher even as “paper gold” as some call it, slumped. We showed this for the first time back in April with the following chart which showed the clear decoupling between paper and physical gold in 2022.A few months later, and two years after gold ETF holdings continued to drop even as the price of gold rose, it finally happened: attempts… Read more at: https://oilprice.com/Metals/Gold/Gold-Prices-Soar-on-Strong-Demand-From-Hedge-Funds-and-Central-Banks.html |

|

$9.5 Trillion Investor Alliance Says Its Emission Cuts Are 1.5C Pathway AlignedThe UN-convened Net-Zero Asset Owner Alliance, a group of institutional investors with a total of $9.5 trillion assets under management, said on Wednesday that its members have on average reduced their absolute financed greenhouse gas emissions by more than 6% annually, consistent with 1.5°C-aligned pathways. The alliance, launched in 2019 at the UN Secretary-General’s Climate Action Summit in New York, today issued a call to action to governments “to respond with urgency on systemic climate risk.” “Alliance members… Read more at: https://oilprice.com/Latest-Energy-News/World-News/95-Trillion-Investor-Alliance-Says-Its-Emission-Cuts-Are-15C-Pathway-Aligned.html |

|

Eni CEO Expects Brent Oil Price to Rebound to $80 in Q4Brent Crude prices are set to recover to $80 per barrel in the fourth quarter, Claudio Descalzi, chief executive at Italian energy major Eni, said on Wednesday. “Oil (is seen) at around $80 per barrel, while for natural gas in Italy we can (expect a price of) 30 euros per megawatt hour,” Descalzi said on the sidelines of the Energy Summit conference organized by Italian business daily Il Sole 24 Ore. There is extreme volatility in oil prices, Eni’s top executive said. The supply chain is not supporting the demand of around 104… Read more at: https://oilprice.com/Energy/Energy-General/Eni-CEO-Expects-Brent-Oil-Price-to-Rebound-to-80-in-Q4.html |

|

Insurers State Farm and Berkshire Boost Investments in Fossil FuelsWhile many insurers have reduced their investments in fossil fuel companies, State Farm, the largest U.S. home and auto insurer, and Berkshire Hathaway’s insurance companies have boosted their investments in oil and gas firms over the past decade, an analysis by The Wall Street Journal showed on Wednesday. Fossil fuel financing and insurance have come under scrutiny in recent years as ESG policies have become mainstream for many investors. The Journal has now analyzed annual filings of insurers’ investments in stocks and bonds obtained… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Insurers-State-Farm-and-Berkshire-Boost-Investments-in-Fossil-Fuels.html |

|

BlackRock Sees AI Driving a 50% Jump in Asian Energy DemandBlackRock expects the AI boom and data centers to drive a 50% jump in energy consumption in the Asia Pacific region over the next decade, a senior executive at the world’s largest asset manager said on Wednesday. “The need for data centers over the next five years is going to be double what is currently in the markets,” Brad Kim, BlackRock’s Asia Pacific managing director for global infrastructure funds, told a media briefing, as carried by Bloomberg. “[O]verall energy consumption will increase by about 50% in the… Read more at: https://oilprice.com/Latest-Energy-News/World-News/BlackRock-Sees-AI-Driving-a-50-Jump-in-Asian-Energy-Demand.html |

|

Meta unveils $299 Quest 3S VR headset, Orion AR glasses prototypeMeta announced the Quest 3S, the latest virtual-reality headset to come out of the company’s Reality Labs division and a cheaper offering than its predecessor. Read more at: https://www.cnbc.com/2024/09/25/meta-unveils-cheaper-299-quest-3s-vr-headset-.html |

|

Dow falls nearly 300 points to snap four-day win streak, S&P 500 retreats from record: Live updatesEconomic growth is in focus with the three major Wall Street stock averages on track for a winning September. Read more at: https://www.cnbc.com/2024/09/24/stock-market-today-live-updates.html |

|

Mortgage refinance boom takes hold, as weekly demand surges 20%Applications to refinance a home loan surged 20% last week compared with the previous week, according to the Mortgage Bankers Association’s seasonally adjusted index. Read more at: https://www.cnbc.com/2024/09/25/mortgage-refinance-boom-takes-hold-as-weekly-demand-surges-20percent.html |

|

OpenAI CTO Mira Murati announces she’s leaving the companyOpenAI chief technology officer Mira Murati said Wednesday she is leaving the company after more than six years. Read more at: https://www.cnbc.com/2024/09/25/openai-cto-mira-murati-announces-shes-leaving-the-company.html |

|

How your tech stock holdings will be impacted by the electionThe outcome of November’s presidential election could have some major implications for some popular technology stocks. Read more at: https://www.cnbc.com/2024/09/25/how-your-tech-stock-holdings-will-be-impacted-by-the-election.html |

|

Southwest Airlines to cut service and staffing in Atlanta to slash costsThe changes come a day before Southwest’s investor day, when executives will map out the company’s plan to cut costs and grow revenue. Read more at: https://www.cnbc.com/2024/09/25/southwest-airlines-cut-service-staffing-atlanta.html |

|

Secret Service agent under investigation for alleged sex assault on Harris aideThe alleged sexual assault of a Kamala Harris staffer comes as the Secret Service takes heat over the attempted assassination of Donald Trump. Read more at: https://www.cnbc.com/2024/09/25/secret-service-agent-investigated-for-sex-assault-harris-campaign-aide.html |

|

Investor Paul Viera doubles his San Antonio Spurs stake in a steep discount dealThe deal for a piece of the Spurs comes as NBA valuations rise on the back of an 11-year, $76 billion media rights deal. Read more at: https://www.cnbc.com/2024/09/25/investor-paul-viera-doubles-san-antonio-spurs-stake.html |

|

Surging AI demand could cause the world’s next chip shortage, research saysA surge in demand for AI semiconductors and AI-enabled smartphones and laptops could lead to the next global chip shortage, according to Bain & Company. Read more at: https://www.cnbc.com/2024/09/25/surging-ai-demand-could-cause-the-worlds-next-chip-shortage-report.html |

|

FTX fraudster Caroline Ellison sentenced to 2 years in prison, ordered to forfeit $11 billionCaroline Ellison, who headed a hedge fund affiliated with doomed crypto exchange FTX, testified against her former boyfriend Sam Bankman-Fried at trial. Read more at: https://www.cnbc.com/2024/09/24/sam-bankman-fried-caroline-ellison-sentenced-ftx-.html |

|

How birria took over restaurant menus across the countryBirria has become a popular protein option for tacos, quesadillas, grilled cheese and even ramen. Read more at: https://www.cnbc.com/2024/09/25/birria-restaurant-menus-across-the-country.html |

|

A huge Hurricane Helene is expected to strike Florida as a major storm and strike far inlandAs Big Bend residents battened down their homes, many saw the ghost of 2018’s Hurricane Michael. Read more at: https://www.cnbc.com/2024/09/25/helene-becomes-a-hurricane-and-is-expected-to-intensify-as-it-moves-toward-florida-.html |

|

Goldman recommends buying Tesla call options before two big catalysts in OctoberThis options trade could make a profit if Tesla’s robotaxi event next month gives the stock a boost. Read more at: https://www.cnbc.com/2024/09/25/goldman-recommends-buying-tesla-call-options-before-two-big-catalysts-in-october.html |

|

“High-End Cat. 3” Hurricane Helene Forecast To Hit Florida’s Big BendThe National Hurricane Center reports around 1100 ET that Helene has reached hurricane status and is expected to produce “life-threatening storm surge, damaging winds, and flooding rains to a large portion of Florida and the southeast US.”

Hurricane Helene is expected to rapidly strengthen over the eastern Gulf of Mexico on Wednesday and ahead of landfall on Thursday evening along the east part of the Florida Panhandle − possibly the Big Bend area.

|

|

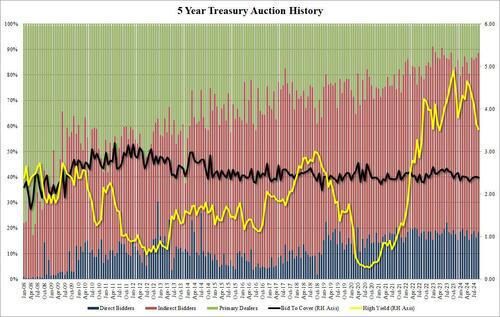

Mediocre 5Y Auction Prices On The Screws, Lowest Yield Since March 2023One day after a solid 2Y auction stopped “on the screws”, moments ago the $70 billion 5Y auction did it again, when it also closed on the screws, or right where the When Issued said it should, prompting questions whether we have ever had two consecutive “screw” auctions in a row. Today’s sale of $70 billion in 5 year paper priced at a high yield of 3.519%, right on top of the When Issued, and following 4 tails in the previous 5 auctions. This was also the lowest yield for the 5Y tenor since April 2023. The bid to cover dropped to 2.38 from 2.41, and was also right in line with the six-auction average or 2.38; in fact as shown in the chart below 2.40 is where the average Bid to Cover has stopped on pretty much all auctions in the past decade. The internals were also average, with Indirects awarded 70.31%, down from 70.54% in August but above the 68.0% recent average.

Overall, this was mediocre auction, one which helped push yields to session highs with the 10Y back up to 3.78% at last check. Read more at: https://www.zerohedge.com/markets/mediocre-5y-auction-prices-screws-lowest-yield-march-2023 |

|

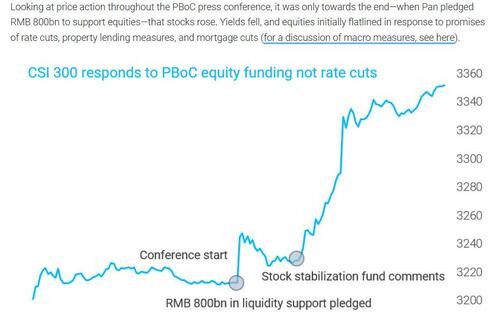

China Reloads Monetary Bazooka With Record Cut To One-Year Policy Rate, But Everyone Waiting For Fiscal FirehoseChina is not done stimulating. One day after the PBOC shocked markets with a monetary bazooka that included multiple rate cuts, house market supports and most notably, a remarkable RMB800 billion pledge to prop up the country’s flailing stock market (the Chinese Put has moved out of the “National Team” basement)…

… China was at it again, and on Tuesday, lowered the interest rate charged on its one-year policy loans by the most on record, expanding on its sweeping program to revive confidence in the world’s second-largest economy (which already appears to be fading). The PBOC cut the rate of the medium-term lending facility to 2% from 2.3%; the 30-basis-point cut was the biggest since the bank began using the monetary tool to guide market interest rates in 2016. Read more at: https://www.zerohedge.com/markets/china-reloads-monetary-bazooka-record-cut-one-year-policy-rate-everyone-waiting-fiscal |

|

Hidden Agendas: Beware Of The Government’s Push For A Digital CurrencyAuthored by John & Nisha Whitehead via The Rutherford Institute,

The government wants your money. It will beg, steal or borrow if necessary, but it wants your money any way it can get it. The government’s schemes to swindle, cheat, scam, and generally defraud taxpayers of their hard-earned dollars have run the gamut from wasteful pork barrel legislation, cronyism and graft to asset forfeiture, costly stimulus packages, and a national security complex that continues to undermine our freedoms while failing to making us any safer.

Americans have also been made to pay through the nose for the government’s endless wars, subsidization … Read more at: https://www.zerohedge.com/personal-finance/hidden-agendas-beware-governments-push-digital-currency |

|

Banks must refund fraud up to £85,000 in five daysVictims tricked into sending money to scammers must be refunded within five days under new rules. Read more at: https://www.bbc.com/news/articles/cy94vz4zd7zo |

|

Petrol prices fall to lowest for three yearsLower global oil prices and a stronger pound were the main reasons prices had fallen, the RAC says. Read more at: https://www.bbc.com/news/articles/cwyl79v1d1lo |

|

UK economic growth ‘robust’ in 2024, think tank saysA think tank says it expects UK economic growth grow by 1.1%, the same rate as Canada and France. Read more at: https://www.bbc.com/news/articles/c0lw07l7p70o |

|

Societe Generale sells shares worth Rs 47 crore in SpiceJet via block dealsSociete Generale sold 74.15 lakh shares in SpiceJet through block deals, netting Rs 47 crore. Vikasa India EIF I Fund also sold 1 crore shares.– Read more at: https://economictimes.indiatimes.com/markets/stocks/news/societe-generale-sells-shares-worth-rs-47-crore-in-spicejet-via-block-deals/articleshow/113672220.cms |

|

Sebi launches FPI outreach cell for seamless market accessSebi has launched a dedicated Foreign Portfolio Investor (FPI) outreach cell to enhance the experience of foreign investors in the Indian securities market. The cell will assist FPIs with documentation, compliance, and operational challenges, aiming to simplify the registration process and attract more foreign capital. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/sebi-launches-fpi-outreach-cell-for-seamless-mkt-access/articleshow/113673220.cms |

|

These 8 commodities stocks hit fresh 52-week highs; have rallied up to 30% in a monthHitting a 52-week high signifies a stock’s peak performance over the past year, providing crucial information for those navigating the market. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/these-8-commodities-stocks-hit-fresh-52-week-highs-have-rallied-up-to-30-in-a-month/slideshow/113673423.cms |

|

‘My wife dreams of owning a home’: We immigrated to the U.S. with our son, 25. We have $45,000. Do we buy a house in California — or save our money?“We are all naturalized citizens. We have a small savings of over $45,000 deposited in a high-yield savings account.” Read more at: https://www.marketwatch.com/story/my-wife-and-i-immigrated-to-the-u-s-with-our-son-25-we-have-45-000-do-we-buy-a-house-in-california-or-save-our-money-78b913c8?mod=mw_rss_topstories |

|

A port strike could be an economic ‘tsunami’ affecting these sectorsCertain sectors could bear the brunt of a looming strike at East Coast and Gulf of Mexico ports, experts say. Read more at: https://www.marketwatch.com/story/a-port-strike-could-be-an-economic-tsunami-affecting-these-sectors-ac87f4d9?mod=mw_rss_topstories |

|

The number of millionaire college athletes has tripled. Here are the top 10 earners this year.More college athletes are making over $1 million from NIL, and most of them play the same position Read more at: https://www.marketwatch.com/story/the-number-of-millionaire-college-athletes-has-tripled-here-are-the-top-10-earners-this-year-a1f406fb?mod=mw_rss_topstories |