Summary Of the Markets Today:

- The Dow closed up 38 points or 0.09%,

- Nasdaq closed down 0.36%,

- S&P 500 closed down 0.16%,

- Gold $2,647 up $31.90,

- WTI crude oil settled at $72 down $0.18,

- 10-year U.S. Treasury 3.739 down 0.001 points,

- USD index $100.79 up $0.18,

- Bitcoin $62,928 down $16 or 0.03%,

- Baker Hughes Rig Count down 2 to 588

*Stock data, cryptocurrency, and commodity prices at the market closing

Today’s Highlights

US stocks closed mixed on Friday as the initial enthusiasm for potential rate cuts faded. Investors had initially embraced Fed Chair Jerome Powell’s message about interest rate cuts, but concerns about economic risks and potential market bubbles tempered enthusiasm. Despite the muted action, the major averages still ended the week in positive territory. Dow Jones Industrial Average: Managed to stay above 42,000, eking out another record close. The market’s rally slowed as investors reassessed the Federal Reserve’s stance on interest rate cuts. Traders are pricing in deeper cuts this year than policymakers’ projections, according to Fed Funds futures. Concerns about potential risks to economic growth persisted. Shares spiked nearly 8% following reports that Qualcomm had approached the company about a potential takeover – stock fell about 4% after the takeover approach news. FedEx shares slumped after reporting a sharp drop in profit, missing Wall Street estimates. Nike stock jumped after naming a new CEO amid pressure on sales.

Click here to read our current Economic Forecast – September 2024 Economic Forecast: One Recession Flag Removed With Three Remaining

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

no releases today

Here is a summary of headlines we are reading today:

- The State of Joe Sixpack in 2Q2024: Most Households Are Worse Off Than They Were One Year Ago

- Canada’s Role in Global Energy Supply Critical for U.S., Says RBC Chief

- Oil, Gas Drilling Stalls in U.S.

- Gazprom Accelerates Pipeline Gas Transports to China

- 3-Mile-Long Freight Trains Cause Traffic Nightmares in Texas

- Three Mile Island Nuclear Power Plant to Restart Following Microsoft Agreement

- Russia Boosts Use of Sanctioned Tankers to Export Its Oil

- Tensions Between Israel and Hezbollah Reach Fever Pitch

- Intel shares pop on report Qualcomm has approached it about takeover

- The big post-Fed rally could get tested in week ahead: ‘A lot holds in the balance’ of the next few days

- China-Mexico freight traffic surges in Trump, Biden tariff era, as companies find ways to evade U.S. trade war

- Georgia Election Board Approves Rule Requiring Hand Count Of Ballots

- The Fed rate cut scared me. Where should I invest my $127,000 in savings now?

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Armenia Accuses Russia of Undermining SovereigntyRussian Foreign Minister Sergei Lavrov recently announced that Russia was fine with letting Armenia and Azerbaijan work out their own peace deal without Kremlin mediation. But it appears Russia can’t help itself from meddling, as Moscow seeks to preserve a controlling level of influence in the Caucasus. Armenian law enforcement officials announced September 18 that they had broken up a Russian-sponsored effort to foment an uprising aimed at overthrowing Prime Minister Nikol Pashinyan’s government and installing a more Kremlin-friendly… Read more at: https://oilprice.com/Geopolitics/International/Armenia-Accuses-Russia-of-Undermining-Sovereignty.html |

|

Human Rights Concerns Loom Over Germany-Central Asia SummitGerman Chancellor Olaf Scholz on September 17 told the leaders of the five Central Asian states that the development of cooperation with their countries was “a strategic goal” for Germany. “Never before has the exchange between our societies been so close — and it is constantly increasing: politically, economically, and culturally,” Scholz said, adding that Berlin wants “to continue and further intensify this.” Speaking in Astana at the second summit of the Central Asian states and Germany, Scholz said that “especially in times of global uncertainty,… Read more at: https://oilprice.com/Geopolitics/International/Human-Rights-Concerns-Loom-Over-Germany-Central-Asia-Summit.html |

|

Canada’s Role in Global Energy Supply Critical for U.S., Says RBC ChiefRBC CEO Dave McKay believes Canada plays a critical role in the energy security of the United States, especially when it comes to supplying oil and gas to Asia. Speaking in Toronto, McKay highlighted that while the U.S. focuses on “Buy American,” they rely on Canadian energy to meet global demands. The United States needs Canada’s energy resources—particularly oil and LNG—to support Asia, which allows the U.S. to divert its energy supplies to Europe, according to McKay. Canada’s Trans Mountain pipeline expansion and upcoming… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Canadas-Role-in-Global-Energy-Supply-Critical-for-US-Says-RBC-Chief.html |

|

Oil, Gas Drilling Stalls in U.S.The total number of active drilling rigs for oil and gas in the United States fell slightly this week, according to new data that Baker Hughes published on Friday. The total rig count fell by 2 this week, compared to 630 rigs this same time last year. The number of oil rigs stayed the same this week at 488—down by 19 compared to this time last year. The number of gas rigs fell by 1 this week to 96, a loss of 22 active gas rigs from this time last year. Miscellaneous rigs fell by 1 rig, to 4. Meanwhile, U.S. crude oil production fell for the… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Gas-Drilling-Stalls-in-US.html |

|

Germany Calls On EU To Extend Transition Period for Green Hydrogen RulesGermany is seeking an EU delay to some of the rules on green hydrogen production to allow the industry to take off and produce clean hydrogen at lower costs, Germany’s Economy Minister Robert Habeck wrote this week in a letter to EU Energy Commissioner Kadri Simson seen by Bloomberg. The EU and Germany are betting on green hydrogen as a fuel for industry. The EU has set a priority to develop… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Germany-Calls-On-EU-To-Extend-Transition-Period-for-Green-Hydrogen-Rules.html |

|

Gazprom Accelerates Pipeline Gas Transports to ChinaRussia is accelerating its natural gas exports to China through the Power of Siberia pipeline, aiming to hit maximum capacity by the end of 2024—a full year ahead of schedule. Gazprom, Russia’s state-run energy giant, has agreed with China National Petroleum Corporation (CNPC) to boost December supplies, reaching the pipeline’s designed capacity of 38 billion cubic meters (bcm) annually. This increase in gas flows reflects Russia’s pivot towards China, as Moscow seeks to replace lost European buyers following its invasion of Ukraine. Gazprom… Read more at: https://oilprice.com/Energy/Natural-Gas/Gazprom-Accelerates-Pipeline-Gas-Transports-to-China.html |

|

TotalEnergies Set to Develop $9 Billion Suriname Oil ResourcesFrench supermajor TotalEnergies has started to scour the market for deepwater rigs and support vessels to begin development of massive resources discovered offshore Suriname, anonymous sources with knowledge of the tenders told Bloomberg on Friday. Exploration and resource development in the Atlantic Basin is now alive more than ever, following the huge developments offshore Guyana led by ExxonMobil and the plans of TotalEnergies to tap the discovered resources in Guyana’s neighbor, Suriname. TotalEnergies, which partners with APA Corp offshore… Read more at: https://oilprice.com/Latest-Energy-News/World-News/TotalEnergies-Set-to-Develop-9-Billion-Suriname-Oil-Resources.html |

|

3-Mile-Long Freight Trains Cause Traffic Nightmares in TexasTexas freight trains have become a problem when they cross busy roadways. With some trains now 3 miles or longer in length, places like Pleasantville, Texas often see traffic waiting for up to 7 minutes for them to pass. The town is near rail yards run by Union Pacific, Wall Street Journal highlighted in a new article. It says the ‘monster trains’ are a way to make higher profits because they can haul more goods with less locomotives and less crew. There are no federal limits on train length, though regulators are reviewing the issue, the… Read more at: https://oilprice.com/Finance/the-Economy/3-Mile-Long-Freight-Trains-Cause-Traffic-Nightmares-in-Texas.html |

|

Three Mile Island Nuclear Power Plant to Restart Following Microsoft AgreementConstellation Energy has signed its largest-ever power purchase agreement with Microsoft, which paves the way for the restart of the Three Mile Island Unit 1 nuclear plant, the biggest owner of U.S. nuclear power plants said on Friday. Microsoft and other major technology firms have been looking to purchase zero-carbon electricity to power up their data centers, which are consuming growing amounts of electricity. For their part, power-generating companies and utilities are raising power supply and planning for a surge in U.S. electricity demand,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Three-Mile-Island-Nuclear-Power-Plant-to-Restart-Following-Microsoft-Agreement.html |

|

Has Sentiment Finally Shifted in Oil Markets?Oil prices are on track to post a second weekly gain as bullish sentiment builds and the prospect of a prolonged price rally becomes increasingly likely. Friday, September 20th, 2024Oil prices are set to record their second straight week-on-week gain with WTI rebounding above $70 per barrel and now trading closer to $72 per barrel, but the fact that the US Federal Reserve has at last initiated a new cycle of monetary easing should have prompted a stronger market response. With a weaker dollar and an improved macro risk outlook, next week could… Read more at: https://oilprice.com/Energy/Energy-General/Has-Sentiment-Finally-Shifted-in-Oil-Markets.html |

|

Russia Boosts Use of Sanctioned Tankers to Export Its OilOver the past weeks, Russia has been using a growing number of oil tankers sanctioned by the West to export its oil, in a move suggesting that Moscow has become more successful in defying U.S. and EU restrictions. A total of six oil tankers sanctioned by the U.S., the EU, or the UK loaded oil cargoes from Russia in August, and at least another six have done the same so far in September, according to tanker-tracking data compiled by Bloomberg. The data showed that at least 17 sanctioned tankers have left Russian ports loaded with oil since the end… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russia-Boosts-Use-of-Sanctioned-Tankers-to-Export-Its-Oil.html |

|

The Market May Be Misinterpreting Libya’s Oil BlockadeClaims that the rival governments in Libya will soon resolve their differences and entirely lift the blockade on oil exports put in place by the Haftar clan in the country’s east seem hard to believe. Two weeks ago, we saw Libya’s oil exports plummet by over 80% (week on week), with the NOC canceling cargoes. For the past week, exports have reportedly ticked up to an estimated 550,000 bpd, from the 1-1.2 million bpd Libya was exporting prior to the August 26 blockade. Kpler data from Thursday put Libya’s crude exports so far for… Read more at: https://oilprice.com/Energy/Energy-General/The-Market-May-Be-Misinterpreting-Libyas-Oil-Blockade.html |

|

A Relatively Safe Dividend Stock to Avoid Political RiskLong-term investing in anything in the run up to a US election is a risky proposition, but stocks in the energy sector are particularly prone to post election volatility. The widely differing energy policies of the two parties, or at least the perception that that is true, mean that oil and gas stocks represent an exaggerated risk every four years as the seemingly endless American Presidential campaigns finally end. History suggests that who is in the White House actually has very little influence on stock prices in general, including those in… Read more at: https://oilprice.com/Energy/Energy-General/A-Relatively-Safe-Dividend-Stock-to-Avoid-Political-Risk.html |

|

Tensions Between Israel and Hezbollah Reach Fever PitchPolitics, Geopolitics & Conflict South Sudan said this week that it had cut a deal with the SAF (Sudanese Armed Forces) in neighboring Sudan to resume crude oil exports, which have been halted as a casualty of Sudan’s ongoing civil war. Officials now say the pipeline has been repaired. Landlocked South Sudan gets its oil to market via the Petrodar pipeline, which leads to Port Sudan. Petrodar was damaged in February in the armed conflict between the SAF and the paramilitary Rapid Support Forces. There could still be some delays in restarting… Read more at: https://oilprice.com/Energy/Energy-General/Tensions-Between-Israel-and-Hezbollah-Reach-Fever-Pitch.html |

|

Crude Oil Futures Surge as Bullish Sentiment BuildsLight crude oil futures have rallied sharply this week, supported by multiple key factors. The U.S. Federal Reserve’s aggressive rate cut, escalating geopolitical tensions between Israel and Hezbollah, and a significant drawdown in U.S. crude stockpiles have all contributed to higher prices. However, concerns over weak demand from China remain a limiting factor, creating mixed sentiment in the market. Fed Rate Cut Fuels Economic Optimism The Federal Reserve’s decision to cut interest rates by 50 basis points has injected fresh momentum into… Read more at: https://oilprice.com/Energy/Energy-General/Crude-Oil-Futures-Surge-as-Bullish-Sentiment-Builds.html |

|

Dow rises to close at fresh record, posts winning week after big Fed rate cut: Live updatesThe 30-stock Dow eked out a gain on Friday, posting a fresh record close. Read more at: https://www.cnbc.com/2024/09/19/stock-market-today-live-updates.html |

|

Intel shares pop on report Qualcomm has approached it about takeoverThe deal, if it were to happen, would be one of the largest technology mergers in years. Read more at: https://www.cnbc.com/2024/09/20/qualcomm-reportedly-approached-intel-about-takeover.html |

|

Apple iPhone 16, Apple Watch Series 10 and AirPods 4 debut around the worldApple greeted customers at its stores around the world on Friday, for the debuts of the iPhone 16, Apple Watch Series 10 and AirPods 4. Read more at: https://www.cnbc.com/2024/09/20/apple-iphone-16-apple-watch-series-10-and-airpods-4-released.html |

|

Constellation Energy to restart Three Mile Island nuclear plant, sell the power to Microsoft for AIConstellation described the agreement with Microsoft as the largest power purchase agreement that the nuclear plant operator has ever signed. Read more at: https://www.cnbc.com/2024/09/20/constellation-energy-to-restart-three-mile-island-and-sell-the-power-to-microsoft.html |

|

The big post-Fed rally could get tested in week ahead: ‘A lot holds in the balance’ of the next few daysThe next several trading sessions could determine whether the big post-Fed rally can continue, especially as investors brace for a seasonally weak October. Read more at: https://www.cnbc.com/2024/09/20/big-post-fed-rally-could-get-tested-in-week-ahead-a-lot-holds-in-the-balance.html |

|

Fed Governor Waller says inflation softening faster than he expected put him in half-point-cut campWaller told CNBC that the data is showing core inflation in the Fed’s preferred measure is running below 1.8% Read more at: https://www.cnbc.com/2024/09/20/fed-governor-waller-says-inflation-softening-faster-than-he-expected-put-him-in-half-point-cut-camp.html |

|

FTC sues drug middlemen for allegedly inflating insulin pricesThe FTC suit targets the three biggest so-called pharmacy benefit managers, UnitedHealth Group’s Optum Rx, CVS Health’s Caremark and Cigna’s Express Scripts. Read more at: https://www.cnbc.com/2024/09/20/ftc-sues-drug-middlemen-for-allegedly-inflating-insulin-prices.html |

|

China-Mexico freight traffic surges in Trump, Biden tariff era, as companies find ways to evade U.S. trade warA CNBC analysis of trade data reveals a multi-year surge in trade between China and Mexico helping manufacturers and the supply chain avoid Trump/Biden tariffs. Read more at: https://www.cnbc.com/2024/09/20/china-mexico-backdoor-trade-booms-in-trump-biden-tariff-era.html |

|

Bitcoin posts 5.5% weekly gain after rate cut, MicroStrategy increases holdings: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Greg Benhaim of 3iQ discusses the sentiment for digital assets among investment advisors. Read more at: https://www.cnbc.com/video/2024/09/20/bitcoin-posts-weekly-gain-rate-cut-microstrategy-holdings-crypto-world.html |

|

Trump Media hits new 52-week low after DJT lockup restrictions expireFormer President Donald Trump’s majority stake in the Truth Social owner was worth almost $1.6 billion mid-day Friday. Read more at: https://www.cnbc.com/2024/09/20/djt-trump-media-stock-selloff-lockup-.html |

|

Panthers-Raiders game marks a first for the NFL with two women presidents at the helmCarolina Panthers President Kristi Coleman and Las Vegas Raiders President Sandra Douglass Morgan are the only two female presidents out of the NFL’s 32 teams. Read more at: https://www.cnbc.com/2024/09/20/panthers-raiders-game-nfl-first-with-two-women-presidents.html |

|

Buffalo Bills fans can buy bonds to finance the team’s new stadiumBuffalo Bills fans will have the opportunity to help finance their favorite NFL team’s new stadium. Read more at: https://www.cnbc.com/2024/09/20/buffalo-bills-fans-can-buy-bonds-to-finance-the-teams-new-stadium.html |

|

American Airlines in talks to pick Citigroup over rival bank Barclays for crucial credit card deal, sources sayAmerican has been working with banks and card networks on a new deal with the aim of consolidating its business with a single issuer, sources tell CNBC. Read more at: https://www.cnbc.com/2024/09/20/american-airlines-credit-card-talks-to-pick-citigroup-over-barclays.html |

|

Georgia Election Board Approves Rule Requiring Hand Count Of BallotsAuthored by Tom Ozimek via The Epoch Times (emphasis ours), The Georgia Election Board has approved a new rule requiring election workers to hand count ballots in the November election and confirm that the numbers match machine counts before the vote can be certified.

The new hand-count regulation was, at the time of reporting, the … Read more at: https://www.zerohedge.com/political/georgia-election-board-approves-rule-requiring-hand-count-ballots |

|

Sugar Futures Erupt In Largest Weekly Gain In Years Amid “Unusual & Persistent Weather Events” In BrazilBrazil’s Center for Natural Disaster Monitoring and Alerts has reported that drought conditions plague roughly 59% of the country, including vast areas of agricultural land. The severe drought has damaged several key commodity crops in the South American country, which is known as the world’s top exporter of soybeans, sugarcane, beef, coffee, corn, orange juice, and poultry. Focusing on sugar markets, Bloomberg cited data from trader Wilmar International showing that droughts are expected to severely impact sugar production in the Center-South, Brazil’s central growing region. So far, the dismal crop forecasts have catapulted raw sugar futures in New York to the largest weekly gain in six years, nearly eclipsing those levels and hitting levels not seen since 2008. Wilmar wrote on X that a series of unusual weather events have significantly impacted the sugarcane crop in the Center-South region. This has led to a downward revision of the crop estimate to 38.8-40.8 million tons, down from the initial 42 million tons.

|

|

The Kamala Harris Non-Sequitur On Energy IndependenceAuthored by Michael O’Sullivan via RealClearEnergy, We don’t want to be dependent on foreign oil and we should invest in diverse forms of energy. That’s what we heard from sitting Vice President Kamala Harris in the most recent debate spectacle. Her exact words: “My position is that we have got to invest in diverse sources of energy so we reduce our reliance on foreign oil.”

Now let’s be fair. If she wants to convince people to spend more money on “diverse” energy sources, then this is a clever angle. If you’re one of those stubborn contrarians opposed to scaring people about the climate, then perhaps you’ll join up in the spirit of American independence. Renewables are not just about being green—they’re about freedom from the stranglehold of forei … Read more at: https://www.zerohedge.com/energy/kamala-harris-non-sequitur-energy-independence |

|

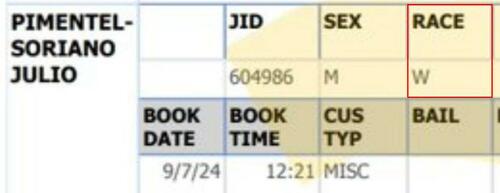

Black Illegal Immigrant Who Stabbed Family Of Four To Death Labeled As “White” In Monroe County Jail RosterEver wonder why those crime statistics don’t necessarily seem to line up with what you’re bearing witness to in real life and on social media? Try this one on for size… A black illegal immigrant, already wanted for murder in his home country of the Dominican Republic, wound up stabbing a family of four, including two toddlers in upstate New York. Then, in the in the Monroe County Jail roster, he was recorded as “white”.

Police in Irondequoit, a Rochester suburb, arrested Julio Cesar Pimentel-Soriano earlier this month after responding to an August 31 house fire where a family was found murdered and the home set ablaze, the Daily Wire Read more at: https://www.zerohedge.com/markets/black-illegal-immigrant-who-stabbed-family-four-death-labeled-white-monroe-county-jail |

|

Construction giant collapse sees 2,200 jobs cutThe UK operations of the construction group ISG collapsed into administration on Friday. Read more at: https://www.bbc.com/news/articles/c07nke2e9ego |

|

‘Painful’ Budget warning spooks people’s confidenceSome economists have linked a drop in consumer confidence to officials’ warnings of a painful Budget. Read more at: https://www.bbc.com/news/articles/cje39kw1281o |

|

Microsoft chooses infamous nuclear site for AI powerThe 1979 accident at Three Mile Island had cast a shadow on nuclear power in the US for decades. Read more at: https://www.bbc.com/news/articles/cx25v2d7zexo |

|

Leela hotels owner Schloss Bangalore files for $599 million India IPOThe company would issue fresh shares worth 30 billion rupees, while existing shareholder Project Ballet Bangalore Holdings (DIFC) will sell shares worth 20 billion rupees. Read more at: https://economictimes.indiatimes.com/markets/ipos/fpos/leela-hotels-owner-schloss-bangalore-files-for-599-million-india-ipo/articleshow/113531558.cms |

|

Sebi relaxes financial disincentives norms for technical glitches, restricts it to Market Infrastructure InstitutionsSecurities and Exchange Board of India (Sebi) on Friday relaxed rules governing financial disincentives imposed by the regulator on Market Infrastructure Institutions (MIIs) and individuals for omissions and commissions leading to technical glitches. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/sebi-relaxes-financial-disincentives-norms-for-technical-glitches-restricts-it-to-market-infrastructure-institutions/articleshow/113527854.cms |

|

UBS sells shares worth Rs 480 crore in Concord Biotech, IIFL Securities, 2 more stocks via block dealsUBS sold holdings in Concord Biotech, Five Star Business Finance, IIFL Securities, and Marksans Pharma through block deals, totaling Rs 480 crore. The largest sale was in Concord Biotech, worth Rs 192 crore at a 15% premium. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/ubs-sells-shares-worth-rs-480-crore-in-concord-biotech-iifl-securities-2-more-stocks-via-block-deals/articleshow/113531832.cms |

|

Oil prices log weekly gains after Fed rate cut, rising Middle East tensionsOil futures booked solid weekly gains, boosted by the Federal Reserve’s large interest-rate cut and a renewed rise in tensions in the Middle East. Read more at: https://www.marketwatch.com/story/oil-on-track-for-weekly-gains-after-fed-rate-cut-rising-middle-east-tensions-bdf3b843?mod=mw_rss_topstories |

|

The Fed rate cut scared me. Where should I invest my $127,000 in savings now?This reader wonders whether CD rates, high-yield savings accounts and bond ladders are still smart moves, even if interest rates keep dropping. Read more at: https://www.marketwatch.com/story/the-fed-rate-cut-scared-me-where-should-i-invest-my-127-000-in-savings-now-9cfd3ae2?mod=mw_rss_topstories |

|

Uranium ETFs rally amid plans to revive nuclear reactor in Microsoft agreementConstellation Energy said Friday it plans to restart a nuclear reactor at Three Mile Island. Read more at: https://www.marketwatch.com/story/uranium-etfs-rally-amid-plans-to-revive-nuclear-reactor-in-microsoft-agreement-52af4e19?mod=mw_rss_topstories |

A person waits in line to vote in Georgia’s primary election in Atlanta on May 24, 2022. Brynn Anderson/AP PhotoThe rule, which was first proposed in August, passed in a 3–2 vote on the morning of Sept. 20, making Georgia the only state in the union to adopt such a requirement as part of its standard vote-counting.

A person waits in line to vote in Georgia’s primary election in Atlanta on May 24, 2022. Brynn Anderson/AP PhotoThe rule, which was first proposed in August, passed in a 3–2 vote on the morning of Sept. 20, making Georgia the only state in the union to adopt such a requirement as part of its standard vote-counting.