Summary Of the Markets Today:

- The Dow closed down 103 points or 0.25%, (Closed at 41,503, New Historic high 41.982)

- Nasdaq closed down 0.31%,

- S&P 500 closed down 0.29%, (Closed at 5,618, New Historic high 5,690)

- Gold $2,575 down $17.00,

- WTI crude oil settled at $70 down $1.21,

- 10-year U.S. Treasury 3.713 up 0.071 points,

- USD index $100.99 up $0.09,

- Bitcoin $60,218 down $421 or 0.70%,

*Stock data, cryptocurrency, and commodity prices at the market closing

Today’s Highlights

The Federal Reserve cut interest rates by 0.5% on Wednesday, marking its first rate reduction since 2020. This decision was largely anticipated but exceeded some analysts’ expectations of a smaller 0.25% cut. Stocks initially rallied on the news but ended the session lower: The Fed cited increased confidence that inflation is moving toward its 2% target. The decision signals a shift in the Fed’s aggressive stance to combat inflation, which had previously led to rates reaching two-decade highs. This rate cut comes as the Fed aims to balance economic growth concerns with ongoing efforts to control inflation. The market’s mixed reaction reflects uncertainty about the implications of this policy shift for the broader economy. [see more below on the rate cut]

Click here to read our current Economic Forecast – September 2024 Economic Forecast: One Recession Flag Removed With Three Remaining

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

Privately-owned housing units authorized by building permits in August 2024 were 6.5% below August 2023. Privately-owned housing starts 3.9% above August 2023. Privately-owned housing completions 30.2% above August 2023. To put this sector in perspective, housing completions are the highest seen since March 2007. Even permits are the highest seen since May 2007. In other words, this sector is one of the bright spots in today’s economy.

The Federal Reserve’s Federal Open Market Committee (FOMC) statement for the meeting ending today indicates a significant shift in the Federal Reserve’s monetary policy, with the first rate cut in several years, reflecting growing confidence in the progress of inflation control while maintaining a cautious stance on future economic developments. Key points of this statement:

- The economy continues to expand at a solid pace, although job gains have slowed. The unemployment rate has increased slightly but remains low overall

- Inflation has made further progress towards the Committee’s 2% objective but is still somewhat elevated

- The FOMC has decided to lower the target range for the federal funds rate by 0.5 percentage points, setting it at 4-3/4 to 5 percent. The Committee cites increased confidence in inflation moving sustainably toward 2% and judges that risks to achieving its employment and inflation goals are roughly balanced

- As always, the FOMC will continue to carefully assess incoming data, the evolving economic outlook, and the balance of risks when considering further adjustments to the federal funds rate

- The Committee will continue reducing its holdings of Treasury securities, agency debt, and agency mortgage-backed securities

- The decision was not unanimous. Michelle W. Bowman voted against the action, preferring a smaller rate cut of 0.25 percentage points

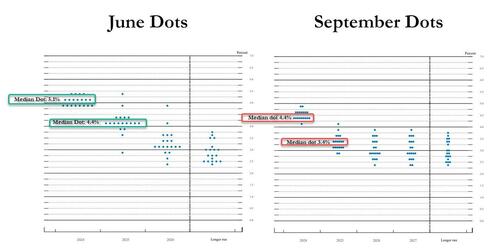

The Federal Open Market Committee (FOMC) has released its latest economic projections for the United States economy. These projections suggest that the FOMC expects a gradual improvement in economic conditions, with inflation moving towards the 2% target over the next few years and a slight decrease in unemployment rates. The federal funds rate is projected to decrease gradually, indicating a potential easing of monetary policy in the coming years. Here’s a summary of the key points:

Economic Growth (GDP)

The median projection for real GDP growth:

2024: 1.5%

2025: 1.8%

2026: 1.9%

Longer run: 1.8%

Unemployment Rate

The median projection for the unemployment rate:

2024: 4.1%

2025: 4.1%

2026: 4.0%

Longer run: 4.0%

Inflation

The median projection for PCE inflation:

2024: 2.5%

2025: 2.2%

2026: 2.0%

Longer run: 2.0%

For core PCE inflation (excluding food and energy):

2024: 2.6%

2025: 2.3%

2026: 2.1%

Federal Funds Rate

The median projection for the federal funds rate:

2024: 5.1%

2025: 3.9%

2026: 3.4%

Longer run: 2.5%

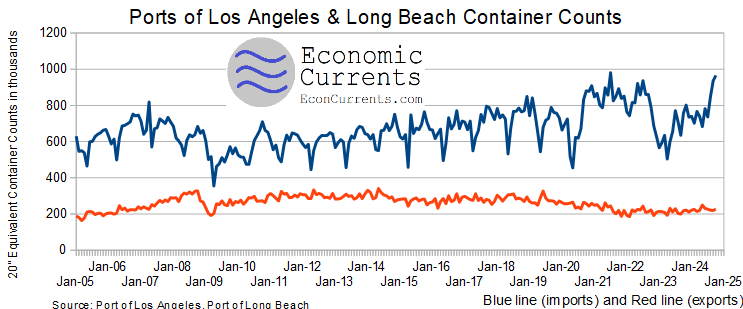

The Port of Los Angeles and the Port of Long Beach is a crucial gateway for international trade in the United States. It handles approximately 29% of all containerized international waterborne trade in the U.S. The container traffic data from these ports is often used as a leading indicator for economic trends as it can signal changes in consumer demand and retail activity and fluctuations in container counts can reflect broader economic cycles and global trade patterns. Well in August 2024. Import container counts are up 27% year-over-year – and stands as the third highest import level in history. Export container counts are up 4% year-over-year but remains in a long term decline. The bottom line is that import growth means that the economy is improving and as the industrial production is NOT growing – Americans desire for foreign goods is increasing.

Here is a summary of headlines we are reading today:

- Oil Prices Rise on Jumbo Fed Rate Cut

- Why the EU is Falling Behind in the Global AI Race

- China’s Gasoline Exports Plunge 44% on Loss-Making Margins

- Goldman Sachs: Iron Ore Prices to Fall to $85

- Europe’s Natural Gas Demand and Inventories Rose in July

- Russia’s Oil Revenues Have Dropped by 30% Since June

- Fed meeting recap: Chair Jerome Powell defends central bank’s decision to go big with first cut

- Fed slashes interest rates by a half point, an aggressive start to its first easing campaign in four years

- Dow closes lower, giving up 375-point pop after big Fed rate cut: Live updates

- Traders got their big-rate-cut wish and markets still couldn’t rally

- Bitcoin whipsaws after Fed cuts interest rates for the first time in four years: CNBC Crypto World

- New Wave Of Blasts Rock Beirut For 2nd Day: Hand-Held Radios Explode, Over 300 Wounded

- Treasury-bill rates tumble after Fed delivers biggest interest-rate cut in 16 years

- Moody’s lifts outlook on four big regional banks to stable from negative

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Putin’s Meme Machine: How Russia Weaponized Social MediaA trove of leaked records from a Russian disinformation campaign reveals how Moscow sought to discredit Ukraine and Western governments that support it while also trying to boost support for far-right political parties in the European Union. The documents obtained by a consortium of European media outlets and shared with Schemes, the investigative unit of RFE/RL’s Ukrainian Service, highlight the internal operations of the Social Design Agency, a Moscow-based company that the United States says has led the propaganda campaign at the Kremlin’s behest.The… Read more at: https://oilprice.com/Geopolitics/International/Putins-Meme-Machine-How-Russia-Weaponized-Social-Media.html |

|

Germany and Central Asia Explore Energy and Technology CooperationCentral Asian leaders sent German Chancellor Olaf Scholz a clear and consistent message during his three-day visit to the region: ‘to get, you’ve got to give.’ The five Central Asian heads of state gathered in the Kazakh capital Astana on September 17 for a meeting with Scholz, with discussions focusing on expanding trade between the West and Central Asia. Germany is particularly interested in boosting natural gas imports from the region as part of a continuing pan-European Union effort to pivot away from Russian energy. No specific… Read more at: https://oilprice.com/Energy/Energy-General/Germany-and-Central-Asia-Explore-Energy-and-Technology-Cooperation.html |

|

Oil Prices Rise on Jumbo Fed Rate CutAs widely anticipated, the Federal Reserve announced a rate cut on Wednesday at the close of its meeting in a move that represents the first time the Fed has cut interest rates since the COVID-19 pandemic, going for an extra large 50-basis-point cut. The Fed has lowered its key rate to ~4.8% from the two-decade high of 5.3%, while inflation has dipped to 2.5% as of August, down from 9.1% in 2022. More rate cuts are now likely on the books, with the Fed indicating that they may make two additional 25-basis-point rate cuts before the… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Oil-Prices-Rise-on-Jumbo-Fed-Rate-Cut.html |

|

Renewable Energy’s Rise Creates Challenges for Traditional Power UtilitiesRenewable energy generation in Europe has surged over 280% since 2000 and now accounts for more than 50% of the continent’s total power generation. Solar power has seen particularly strong growth in recent years due to significant cost declines. However, the rise of renewables has also led to challenges for the power industry, as the sector’s underlying profitability declines and an increasingly competitive energy landscape emerges. Apart from hydropower, the operational performance of most renewable power assets is determined… Read more at: https://oilprice.com/Energy/Energy-General/Renewable-Energys-Rise-Creates-Challenges-for-Traditional-Power-Utilities.html |

|

Russia Boosts Insurance Coverage For India’s Oil ImportsRussian firms increased insurance cover for India’s oil imports to 60% of all cargoes in July, significantly higher than 40% in December 2023 as the two nations continue cementing their energy ties, Reuters reported on Wednesday. India has become the top buyer of Russian oil, with more than 60% of Russia’s seaborne oil exports going to India. By using Russian insurers, Moscow is able to sell its oil above the $60 per barrel price cap the West imposed on Russian crude in a bid to limit Russia’s oil revenue following its invasion of Ukraine.… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russia-Boosts-Insurance-Coverage-For-Indias-Oil-Imports.html |

|

Turkey Signs 10-Year LNG Supply Deal With TotalEnergiesTurkey’s ambitions to become a regional gas hub just received a fresh boost after the country signed a 10-year agreement with French energy giant TotalEnergies (NYSE:TTE), Turkey’s Daily Sabah reported on Wednesday. Under the terms of the deal, the oil and gas supermajor will supply Turkish state energy firm BOTAS with 1.1 million metric tons annually (mtpa) of liquefied natural gas (LNG) for 10 years starting in 2027. This marks the fourth long-term import deal BOTAS has signed with non-state-owned firms this year, having… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Turkey-Signs-10-Year-LNG-Supply-Deal-With-TotalEnergies.html |

|

Why the EU is Falling Behind in the Global AI RaceEU regulatory overreach has gone from a Brexiteer conspiracy theory and source of ridicule to something that EU leaders themselves acknowledge and are trying to address. But when it comes to AI, they’re already behind, says James Price If you’ve bought a plastic drinks bottle in recent months, you may have noticed a maddening change – the lid can no longer be detached from the rest of the bottle. You may find this rather annoying; you may even pretend to yourself that you like the increase in spills and mess in order… Read more at: https://oilprice.com/Energy/Energy-General/Why-the-EU-is-Falling-Behind-in-the-Global-AI-Race.html |

|

Oil Is Not Out of the Woods YetOil prices started the week with a gain after slumping to the lowest in nearly three years, with analysts of a mostly unanimous opinion that bearish factors are stronger than bullish ones, regardless of their actual weight. Some even believe prices will fall further before a correction begins. Morgan Stanley, for instance, revised down its Brent crude forecast for the fourth quarter to $75 per barrel from $80 per barrel. Swedish financial major SEB concurs, with its chief commodities analyst also putting Brent’s average at $75 per barrel—in… Read more at: https://oilprice.com/Energy/Oil-Prices/Oil-Is-Not-Out-of-the-Woods-Yet.html |

|

China’s Gasoline Exports Plunge 44% on Loss-Making MarginsChinese gasoline exports slumped by 44% in August from a year earlier as export margins turned negative and refiners started using up their government-mandated export quotas. China exported 770,000 tons of gasoline last month, down by 44% compared to August 2023, according to Chinese customs data quoted by Bloomberg. Refiners have been struggling with weak refining margins and low and sub-zero export margins on fuels amid weaker-than-expected demand in the region. Moreover, refiners and fuel sellers are estimated to have already used around 80%… Read more at: https://oilprice.com/Energy/Energy-General/Chinas-Gasoline-Exports-Plunge-44-on-Loss-Making-Margins.html |

|

China’s Coal Power Generation Returns to GrowthChina saw in August the first increase in coal-fired power generation in four months as coal remains a vital part of the system despite soaring output from clean energy sources and a growing share of renewables in the electricity mix. China’s electricity output from thermal sources – which are predominantly coal-fired – increased by 3.7% in August compared to the same month last year, according to official Chinese data cited by Reuters columnist Clyde Russell. The rise in coal power generation lagged the growth in electricity… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Chinas-Coal-Power-Generation-Returns-to-Growth.html |

|

Oil Moves Higher on Surprise Crude DrawCrude oil prices ticked higher today after the U.S. Energy Information Administration reported an estimated inventory draw of 1.6 million barrels for the week to September 13. This compared with a modest build of 800,000 barrels for the previous week that weighed on prices already depressed by demand concerns. This week, however, the biggest news on the oil market is the upcoming rate announcement by the Federal Reserve, scheduled for 2 pm Eastern Time. Market participants and analysts alike expect the central bank to announce its first interest… Read more at: https://oilprice.com/Energy/Crude-Oil/Oil-Moves-Higher-on-Surprise-Crude-Draw.html |

|

Rosneft Unlikely to Stop Shell’s Sale of German Refinery StakeRosneft is likely to fail in its legal challenge against a planned sale of a minority stake in a German refinery that it used to control before Germany took over the Russian oil giant’s assets in the country. Rosneft has a 54% stake in the Schwedt refinery, the fourth-largest refinery in Germany, which gets its oil from the Druzhba oil pipeline from Russia. The Schwedt refinery supplies 90% of the fuel needs of Germany’s capital city Berlin. Shell, which holds a 37.5% interest in the refinery, announced at the end of last… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Rosneft-Unlikely-to-Stop-Shells-Sale-of-German-Refinery-Stake.html |

|

Goldman Sachs: Iron Ore Prices to Fall to $85The short-cover rally Goldman analysts forecasted early last week in Chinese iron ore prices has completely reversed. After all, analysts from the bank said the rally should be sold. Now, analysts have revised their Q4 2024 iron ore price forecast to $85/t, down from $100, based on strong global supply and soft demand in the world’s second largest economy. They add that the buildup in Chinese port stocks suggests prices will be pressured lower unless lower-cost producers cut production. Last week, ahead of Goldman’s iron ore note telling… Read more at: https://oilprice.com/Metals/Commodities/Goldman-Sachs-Predicts-Iron-Ore-Prices-Will-Drop-to-85.html |

|

Europe’s Natural Gas Demand and Inventories Rose in JulyNatural gas demand in the EU and UK rose in July compared to June, but inventories increased at a faster clip as Europe is moving to stockpile gas ahead of the winter, the latest data by the Joint Organizations Data Initiative (JODI) showed on Wednesday. EU and UK natural gas demand rose by 1.3 bcm from June to 200.1 bcm in July, according to the JODI data shared by the Riyadh-based International Energy Forum (IEF). Globally, natural gas demand rose by 12.9 bcm in July from June, settling at higher than the 5-year seasonal average. Natural… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Europes-Natural-Gas-Demand-and-Inventories-Rose-in-July.html |

|

Russia’s Oil Revenues Have Dropped by 30% Since JuneThe value of Russia’s crude oil exports has plummeted by nearly 30% since the end of June as falling international benchmark prices are depressing the value of the cheaper Russian crude grades, Bloomberg has estimated. Higher export volumes were unable to offset the slump in oil prices in recent weeks and Russia’s flagship Urals crude is now trading below the $60 per barrel cap imposed by the EU and the U.S. if Russia is to use Western shippers, insurers, and financiers for moving the crude. The decline in oil prices, with Brent Crude… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russias-Oil-Revenues-Have-Dropped-by-30-Since-June.html |

|

Fed meeting recap: Chair Jerome Powell defends central bank’s decision to go big with first cutThe Federal Reserve slashed interest rates by 50 basis points at the conclusion of its September policy meeting. Read more at: https://www.cnbc.com/2024/09/18/fed-meeting-live-updates-traders-await-september-interest-rate-cut.html |

|

Fed slashes interest rates by a half point, an aggressive start to its first easing campaign in four yearsThe Federal Reserve on Wednesday lowered the federal funds rate to a range between 4.75%-5%. Read more at: https://www.cnbc.com/2024/09/18/fed-cuts-rates-september-2024-.html |

|

Dow closes lower, giving up 375-point pop after big Fed rate cut: Live updatesStocks were volatile Wednesday after the Federal Reserve lowered interest rates in a half-point percentage move. Read more at: https://www.cnbc.com/2024/09/17/stock-market-today-live-updates.html |

|

Traders got their big-rate-cut wish and markets still couldn’t rallyStocks struggled to advance after the decision, after initially popping. Some investors believe the central bank may have jumped the gun. Read more at: https://www.cnbc.com/2024/09/18/traders-got-their-big-rate-cut-wish-and-markets-still-couldnt-rally.html |

|

Boeing starts furloughing tens of thousands of employees amid machinist strikeCEO Kelly Ortberg said affected employees would take one week of furlough every four weeks for the strike’s duration and he and his team would take pay cuts. Read more at: https://www.cnbc.com/2024/09/18/boeing-furlough-strike.html |

|

The iPhone 16 Pro Max has better battery life and great cameras, but Apple Intelligence hasn’t arrivedCNBC’s iPhone 16 Pro Max review. There are a lot of good upgrades but Apple Intelligence isn’t ready yet. Read more at: https://www.cnbc.com/2024/09/18/apple-iphone-16-pro-max-review.html |

|

Teamsters will not endorse Harris or Trump in 2024 presidential electionThe major labor union did not endorse any candidate in the race between Republican nominee Donald Trump and Democratic nominee Kamala Harris. Read more at: https://www.cnbc.com/2024/09/18/teamsters-no-endorsement-harris-trump-presidential-election.html |

|

111 Republican former officials endorse Harris, say Trump is ‘unfit to serve’Kamala Harris’ campaign has netted Republican endorsements from numerous Trump administration officials as well as from figures such as Dick Cheney. Read more at: https://www.cnbc.com/2024/09/18/republicans-endorse-harris-over-trump.html |

|

YouTube announces AI features from Google DeepMind for Shorts creatorsYouTube on Wednesday announced artificial-intelligence features for creators on its Shorts platform that tap into Google’s DeepMind video generation model. Read more at: https://www.cnbc.com/2024/09/18/youtube-announces-ai-features-from-google-deepmind-for-shorts-creators.html |

|

Bitcoin whipsaws after Fed cuts interest rates for the first time in four years: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Tyrone Ross of 401 Financial discusses adoption of crypto ETFs and what Wall Street still needs to learn about the asset class. Read more at: https://www.cnbc.com/video/2024/09/18/bitcoin-slips-fed-cuts-rates-first-time-in-four-years-crypto-world.html |

|

The Federal Reserve just cut interest rates by a half point. Here’s what that means for your walletThe first rate cut in years will affect many types of consumer products. Here’s what it means for credit cards, mortgage rates, auto loans and savings accounts. Read more at: https://www.cnbc.com/2024/09/18/federal-reserve-cuts-interest-rates-what-that-means-for-your-wallet.html |

|

Powell downplays impact of rate cut on Trump-Harris presidential raceVice President Kamala Harris and Donald Trump are each fighting to convince voters they are best candidate for the U.S. economy. Read more at: https://www.cnbc.com/2024/09/18/fed-chair-powell-downplays-rate-cut-trump-harris-election-impact.html |

|

These are the stocks that do best immediately after the first Fed rate cut of a cycleThe top 10 stocks that perform the best three months after an initial cut include a megacap name and some big retailers. Read more at: https://www.cnbc.com/2024/09/18/stocks-that-do-best-right-after-the-first-fed-rate-cut-of-a-cycle.html |

|

New Wave Of Blasts Rock Beirut For 2nd Day: Hand-Held Radios Explode, Over 300 WoundedAxios and regional media are reporting a new wave of blasts in the Lebanese capital of Beirut, including explosions in the south of the country. Israel has reportedly detonated hand-held personal radios used by Hezbollah members, the emerging reports say. The prominent regional news source War Monitor writes “Communications devices that exploded across Lebanon moments ago are hand-held radios, different to pagers that exploded on Tuesday, Security sources informed me.”

Hezbollah’s Al-Manar TV is also confirming wireless devices exploded in the hands of those carrying them in several Lebanese areas. There are reports of at least nine new fatalities and over 300 injured in this second day of explosions. Several ambulances have been witnessed rushing to the scenes of multiple new blasts. It appe … Read more at: https://www.zerohedge.com/geopolitical/new-wave-blasts-rock-beirut-2nd-day-hand-held-radios-personal-devices-explode |

|

After Overwhelming Pro-Trump Polling, Teamsters Will Not Endorse Any Candidate For First Time Since 1996The Teamsters announced on Wednesday that they will not endorse any candidate for president after a shocking internal poll found that more than half of Teamsters members back former President Donald Trump in the upcoming election.

Sean O’Brien, the president of the International Brotherhood of Teamsters, speaking at the Republican National Convention in Milwaukee in July. Vice President Kamala Harris met with Mr. O’Brien and other Teamsters leaders on Monday.Credit…Kenny Holston/The New York Times One of the largest unions in the country which endorsed Joe Biden in the 2020 election, the Teamsters found that 58% of members polled back Trump vs. 31% for Harris. This marks the first time since 1996 that the union hasn’t endorsed … Read more at: https://www.zerohedge.com/political/after-overwhelming-pro-trump-polling-teamsters-will-not-endorse-any-candidate |

|

Wall Street Reacts To Today’s 50bps “But No Crisis” Rate CutWell, once again the majority – make that the vast majority – of “economisseds” were dead wrong, and as we noted earlier, 105 of 114 economists predicted a 25bps cut… and were wrong. But don’t blame them: it really is the Fed’s fault – again – because while odds of a 50bps rate cut were only 10% as the Fed entered its “blackout period”, these surged after an unprecedented media leak campaign in the past week pushed 50bps odds to 70% (and yes, we can now confirm that Powell used Nick “Nikileaks” Timiraos not once but twice in the past few days to ease the blow of the 50bps cut), which brought us to today, when the Fed shocked with a 50bps rate cut, and slashed its expectations for the 2025 rate cut…

… even though the conditions from June until September were barely changed:

And somehow that justified the FOMC predictin … Read more at: https://www.zerohedge.com/markets/wall-street-reacts-todays-50bps-no-crisis-rate-cut |

|

Army Sends 130 Troops, Missile Systems To Remote Alaskan Island For ‘Russia Threat’The Pentagon has taken the rare step of deploying US Army ground forces to an Alaskan island on fears that Russian and Chinese warships are coming closer and closer to America’s shores. Some 130 soldiers have been sent to an uninhabited, remote island in the Aleutian chain of western Alaska following a series of Russian and Chinese military assets being spotted of the coast, including warplanes.

US Army/Task & Purpose: Soldiers with Alpha Battery, 5th Battalion, 3rd Field Artillery Regiment (Long Range Fires Battalion), 1st Multi-Domain Task Force set up a M142 High Mobility Artillery Rocket System on Shemya Island on Sept. 12, 2024. For example, just the past week saw a grouping consisting of 8 Russian planes and four navy vessels come close to Alaska. Moscow and Beijing recently ordered stepped-up joint patrols and naval drills in the Pacific region. “It’s not the first time that we’ve … Read more at: https://www.zerohedge.com/geopolitical/army-sends-130-troops-missile-systems-remote-alaskan-island-russia-threat |

|

US goes big with first interest rate cut in four yearsThe Federal Reserve has cut its key lending rate by 0.5 percentage points – a larger cut than expected. Read more at: https://www.bbc.com/news/articles/cz04md0zdrno |

|

What will a US interest rate cut mean for me?It will influence mortgages, credit card and saving rates for millions of people in the US – and even around the world. Read more at: https://www.bbc.com/news/articles/cvgl474nrygo |

|

Boeing suspends jobs for thousands after strikeBoeing says it is suspending jobs for thousands of staff in the US due to a worker strike. Read more at: https://www.bbc.com/news/articles/cpdqvwexqv4o |

|

Rs 1 lakh mutual fund SIP can be the new status symbol: Radhika Gupta of Edelweiss Mutual FundRadhika Gupta, CEO of Edelweiss Mutual Fund, suggests that with India’s financialization, the new measure of wealth should be the size of one’s monthly SIP book. She envisions young people proudly discussing their SIP investments rather than properties. Read more at: https://economictimes.indiatimes.com/mf/analysis/rs-1-lakh-mutual-fund-sip-can-be-the-new-status-symbol-radhika-gupta-of-edelweiss-mutual-fund/articleshow/113447939.cms |

|

11 stocks boast over 20% gains in every Q3 for 4 yrsIt is interesting to be watchful of the consistently performing stocks. ETMarkets analysis found that there are 11 stocks on BSE universe which have gained over 20% in each of the October to December quarters for the last 4 years. We considered only stocks with a market cap of over Rs 1,000 crore. It is interesting to know that 7 out of these 11 stocks have given even multibaggers return in last one-year period. (Data : ACE Equity) Read more at: https://economictimes.indiatimes.com/markets/stocks/news/multibaggers-11-stocks-gain-over-20-in-each-of-the-oct-dec-quarters-for-the-last-4-years/stellar-show/slideshow/113454776.cms |

|

How to trade BSE, ICICI Bank and Hero MotoCorpIndian market pared gains after hitting record high in intraday trade on Wednesday.The S&P BSE Sensex fell more than 100 points after hitting a high of 83,326 while Nifty50 was down by 41 points after scaling a record peak of 25,482. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/technical-breakout-stocks-bse-icici-bank-and-hero-motocorp-hit-fresh-record-highs-on-wednesday-buy-sell-or-hold/market-roundup/slideshow/113461834.cms |

|

Treasury-bill rates tumble after Fed delivers biggest interest-rate cut in 16 yearsYields on Treasury bills maturing in up to three months tumbled on Wednesday, after the Federal Reserve delivered a half-percentage-point interest-rate cut and signaled the likelihood of additional adjustments in borrowing costs. Read more at: https://www.marketwatch.com/story/treasury-yields-hold-just-above-recent-lows-ahead-of-fed-rate-cut-86263dbc?mod=mw_rss_topstories |

|

Moody’s lifts outlook on four big regional banks to stable from negativeThe debt outlook for Fifth Third Bancorp, First Citizens Bancshares Inc., Regions Financial Corp. and Huntington Bancshares Inc. has been raised to stable from negative by Moody’s on healthier balance sheets from the four big regional banks. Read more at: https://www.marketwatch.com/story/moodys-lifts-outlook-on-four-big-regional-banks-to-stable-from-negative-3dd598e4?mod=mw_rss_topstories |

|

Here’s when falling interest rates will hit your mortgage, car loan, credit-card bills and savings accountsThe Fed’s interest-rate cuts will soften the prices consumers pay for debt — but people may not see an impact on their payments for a while. Read more at: https://www.marketwatch.com/story/heres-when-falling-interest-rates-will-hit-your-mortgage-car-loan-credit-card-bills-and-savings-accounts-cabac8c1?mod=mw_rss_topstories |