Summary Of the Markets Today:

- The Dow closed down 178 points or 0.43%, (Closed at 40,713, New Historic high 41.027)

- Nasdaq closed down 1.67%,

- S&P 500 closed down 0.89%, (Closed at 5,571, New Historic high 5,643)

- Gold $2,518 down $29.40,

- WTI crude oil settled at $73 up $0.95,

- 10-year U.S. Treasury 3.862 up 0.086 points,

- USD index $101.53 up $0.49,

- Bitcoin $60,314 down $657 or 1.07%,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Highlights:

U.S. stocks declined on Thursday, with technology stocks leading the losses as investors turned their attention to Federal Reserve Chair Jerome Powell’s upcoming speech at the Jackson Hole symposium on Friday. Market Dynamics: The market’s focus has shifted to the Fed’s Jackson Hole symposium, which began on Thursday. Investors are particularly interested in any potential changes in tone from policymakers during Powell’s speech on Friday. This comes after minutes from the Fed’s last meeting revealed that several officials were open to a July rate cut, suggesting a possible pivot in next month’s policy decision. Economic Data: New data from the Department of Labor showed 232,000 initial jobless claims for the week ending August 17, slightly up from the previous week and in line with economists’ expectations. This data has gained increased attention following an official revision to payrolls that indicated the labor market may have been cooling earlier than initially thought. Rate Cut Expectations: Market expectations for interest rate cuts have been fluctuating. While there were earlier hopes for a 0.5% reduction, recent developments have tempered these expectations. Currently, markets are pricing in just a 25% chance of a 50 basis point cut at the Fed’s September meeting, down from 38% the previous day.The upcoming speech by Powell at Jackson Hole is highly anticipated, as investors look for any signals that might contradict or confirm the market’s current optimistic outlook on rate cuts.

Click here to read our current Economic Forecast – August 2024 Economic Forecast: New Recession Flag

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

The Chicago Fed National Activity Index (CFNAI) three-month moving average, CFNAI-MA3, was unchanged at –0.06 in July 2024 which implies the economy is not recessionary but is in the neighborhood of weak expansion. Twenty-eight of the 85 individual indicators made positive contributions to the CFNAI in July, while 57 made negative contributions. Thirty-one indicators improved from June to July, while 53 indicators deteriorated and one was unchanged. Of the indicators that improved, 12 made negative contributions.

Existing-home sales improved in July 2024 but year-over-year sales fell 2.5%. Total housing inventory was up 19.8% from one year ago with unsold inventory sits at a 4.0-month supply at the current sales pace, down from 4.1 months in June but up from 3.3 months in July 2023. The median existing-home price for all housing types in July was $422,600, up 4.2% from one year ago ($405,600). Note that existing home sales are not a component of GDP. NAR Chief Economist Lawrence Yun added:

Despite the modest gain, home sales are still sluggish. But consumers are definitely seeing more choices, and affordability is improving due to lower interest rates.

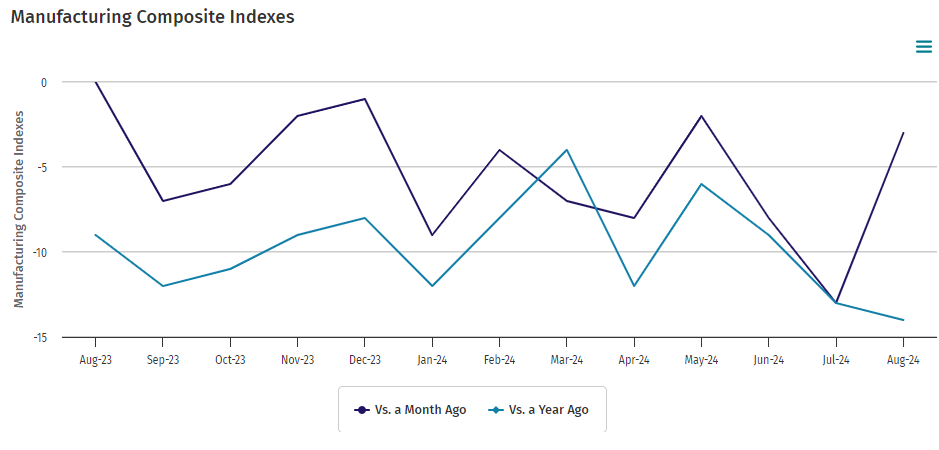

The Kansas City Fed’s manufacturing activity declined less in August 2024 than in July. The month-over-month composite index was -3 in August, up from -13 in July and -8 in June . Manufacturing remains the soft spot in the current economy.

In the week ending August 17, the advance figure for seasonally adjusted initial unemployment claims 4-week moving average was 236,000, a decrease of 750 from the previous week’s revised average. The previous week’s average was revised up by 250 from 236,500 to 236,750. There is no indication in unemployment numbers that a recession is in view.

Here is a summary of headlines we are reading today:

- Oil Buying Opportunity May Have Arrived: Citi

- Is China’s Steel Industry on the Brink of a Major Crisis?

- Experts Skeptical of Lasting Cease-Fire Between Israel and Hamas

- Global Offshore Wind Installations to Surpass 520 GW by 2040

- Ford’s $5 Billion EV Loss Sparks Strategic Shift Towards Hybrids

- Fed Minutes Signal September Rate Cut

- Stocks close lower, Nasdaq slides 1% as Treasury yields rise and Powell speech looms: Live updates

- Peloton shares soar 35% as turnaround plan takes hold, losses shrink

- FDA approves updated Pfizer, Moderna Covid vaccines as virus surges; shots to be available within days

- Philadelphia Fed President Harker advocates for interest rate cut in September

- Stocks making the biggest moves midday: Urban Outfitters, Peloton, Advance Auto Parts and more

- ‘No Israeli Withdrawal, No Ceasefire Deal’: Hamas

- Treasury yields jump by most in at least a week after fresh data ease near-term recession concerns

- Is the August stock-market volatility behind us? This key indicator says not yet.

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Oil Buying Opportunity May Have Arrived: CitiOil prices have dipped, with Brent crude hovering around $77 per barrel, leading some market analysts to spot potential short-term buying opportunities. Citi Research, in a note dated August 21, and seen by Investing.com, sees this price pressure as a likely precursor to a rebound despite recent easing in geopolitical tensions. The recent price decline is primarily driven by two key factors: easing geopolitical risks, particularly in Gaza with a potential ceasefire on the horizon, and China’s economic slowdown. China’s weakened industrial production… Read more at: https://oilprice.com/Energy/Oil-Prices/Oil-Buying-Opportunity-May-Have-Arrived-Citi.html |

|

Geopolitical Shifts Cast Shadow on Russia-China Gas PipelineMongolia’s government voted not to to include the Power of Siberia-2 natural gas pipeline that connects Russia to China through its territory in its spending plans for the next four years, a sign that the megaproject may be on hold. Finding Perspective: Mongolia’s new coalition government voted on August 16 for its action program for its four-year term and notably did not include the 2,594-kilometer pipeline, meaning they don’t expect the ambitious project to begin construction during that span. While the bulk of the energy project rests between… Read more at: https://oilprice.com/Energy/Natural-Gas/Geopolitical-Shifts-Cast-Shadow-on-Russia-China-Gas-Pipeline.html |

|

US Shale Oil Set for Production Boost in 2025: BNEF ForecastU.S. shale oil production is poised for a significant boost, with BloombergNEF (BNEF) forecasting a 4.5% increase in output to 13.9 million barrels per day by 2025. This represents an additional 600,000 barrels per day compared to this year, thanks to improved well productivity and more efficient drilling and fracking techniques. It should be noted that BNEF’s projection is more optimistic than the U.S. Energy Information Administration’s (EIA) estimate of 13.7 million barrels per day, and decidedly more optimistic than OPEC’s estimate for U.S.… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Shale-Oil-Set-for-Production-Boost-in-2025-BNEF-Forecast.html |

|

Is China’s Steel Industry on the Brink of a Major Crisis?Via Metal Miner China’s direct dumping of steel in foreign markets and indirect dumping via proxy countries are finally under the global lens. According to the Malaysian Trade Ministry, the country recently launched an investigation into whether or not to impose anti-dumping duties on flat-rolled iron or non-alloy steel products imported from China as well as India, Japan and South Korea. Meanwhile, India has also initiated an anti-dumping investigation into imports of hot-rolled flat products from Vietnam. The move comes after complaints… Read more at: https://oilprice.com/Metals/Commodities/Is-Chinas-Steel-Industry-on-the-Brink-of-a-Major-Crisis.html |

|

Fuel Supply Chief Suspended as Libya’s Fuel Crisis WorsensA severe fuel shortage in oil-rich Libya has led to the suspension of the country’s top fuel supply official as tit-for-tat moves between rival governments escalate and sound alarm bells over the fragility of the political status quo. Rival governments that control different parts of Libya’s oil wealth chain are jockeying for position ahead of another showdown that could once again lead to a halt of Libyan oil exports. On Wednesday, the PM of Libya’s Tripoli-based Government of National Unity (GNU), Abdul Hamid Dbeibah,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Fuel-Supply-Chief-Suspended-as-Libyas-Fuel-Crisis-Worsens.html |

|

Experts Skeptical of Lasting Cease-Fire Between Israel and HamasU.S. Secretary of State Antony Blinken arrived in the Middle East hoping to broker an elusive cease-fire deal aimed at ending Israel’s devastating war in the Gaza Strip. But the top U.S. diplomat left the region on August 21 — his ninth visit during the 10-month-old war — without securing any major breakthroughs. Experts say key differences remain between Israel and EU- and U.S.-designated Palestinian terrorist group Hamas, the two sides in the conflict. “This is still very much a work in progress, and I’m personally not optimistic,”… Read more at: https://oilprice.com/Geopolitics/International/Experts-Skeptical-of-Lasting-Cease-Fire-Between-Israel-and-Hamas.html |

|

Leading Wall Street Banks Help Pemex to Pay Outstanding Bills to SLBLegendary Wall Street firms Citigroup Inc. and Deutsche Bank AG have provided financing to Mexico’s state oil company, Pemex, to help pay outstanding bills to the world’s biggest oilfield services provider, Schlumberger Limited (NYSE:SLB). In effect, SLB has effectively guaranteed against a Pemex default on the loan by issuing more than $1 billion of credit-default swaps to the two banks. U.S.-based SLB disclosed the swaps in US federal filings–$550 million in July and $560 million in January–but did not disclose the names of the… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Leading-Wall-Street-Banks-Help-Pemex-to-Pay-Outstanding-Bills-to-SLB.html |

|

Global Offshore Wind Installations to Surpass 520 GW by 2040Global offshore wind projects have faced significant headwinds due to recent inflationary pressures and supply chain disruptions, exemplified by postponed permitting processes, delayed auctions and slow supply chain build-ups. Despite these challenges, the sector staved off challenges in 2023, seeing a 7% increase in new capacity additions compared to the previous year. This momentum is expected to accelerate this year, with new capacity additions expected to grow by 9% to over 11 gigawatts (GW) by the end of the year. Rystad Energy expects this… Read more at: https://oilprice.com/Alternative-Energy/Wind-Power/Global-Offshore-Wind-Installations-to-Surpass-520-GW-by-2040.html |

|

Arctic LNG 2 Expansion Delayed to 2028 Amid Sanctions PressureRussia’s Novatek has once again hit a snag with its Arctic LNG 2 project, postponing the start of its third line from 2026 to 2028, according to RBC Media. This delay is a direct consequence of the Western sanctions imposed due to Russia’s ongoing conflict with Ukraine. These sanctions have significantly restricted Novatek’s access to vital equipment and ice-class tankers, which are critical for the project’s operation in the frigid Arctic conditions. Arctic LNG 2 was poised to be a game-changer for Russia’s LNG ambitions, with plans to produce… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Arctic-LNG-2-Expansion-Delayed-to-2028-Amid-Sanctions-Pressure.html |

|

Ford’s $5 Billion EV Loss Sparks Strategic Shift Towards HybridsThe trend of legacy automakers ditching their plans and investments in EVs continues, with Ford reportedly the latest to cancel plans for a large three-row electric sport-utility vehicle, according to a new report from the Wall Street Journal. The company will take $1.9 billion in related special charges and write-downs as a result, the report said. Ford is canceling due to pricing pressures and increased competition, instead opting to focus on hybrid versions of its popular Explorer and Expedition models. This decision reflects a broader… Read more at: https://oilprice.com/Energy/Energy-General/Fords-5-Billion-EV-Loss-Sparks-Strategic-Shift-Towards-Hybrids.html |

|

Brazil’s Grid Limits Threaten Renewable InvestmentsBrazil’s grid operator is capping the amount of electricity wind and solar producers can supply to the national grid, seriously threatening future renewable energy investments in the country. Industry executives and representatives have lamented that renewable energy investments are less viable under the National Electric System Operator’s (ONS) current “curtailments” policy that temporarily caps how much power the operator accepts from wind and solar plants. The problem has been most acute in northeast Brazil, one of Brazil’s top producers of… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Brazils-Grid-Limits-Threaten-Renewable-Investments.html |

|

Can Azerbaijan Meet Its Pledge to Double Gas Exports to Europe?Azerbaijan is on pace to meet its natural gas export target this year. But Baku still has a long way to go before the country can meet its ambitious export commitments for 2027. Touting Azerbaijan as a “reliable supplier,” President Ilham Aliyev announced at a political conference in the UK in July that the country’s annual export volume for this year was projected to increase by over 10 percent of 2022’s total, reaching almost 13 billion cubic meters (bcm) of gas. Provided Azerbaijan hits that number, it will mark the first… Read more at: https://oilprice.com/Energy/Natural-Gas/Can-Azerbaijan-Meet-Its-Pledge-to-Double-Gas-Exports-to-Europe.html |

|

India Surpasses China as Largest Importer of Russian OilIndia has become the world’s biggest importer of Russian oil, surpassing China, Reuters has reported. Data on Indian shipments from trade and industry showed that the country imported 2.07 million barrels per day (bpd) of Russian crude in July, good for a 4.2% M/M and 12% Y/Y increase. According to Chinese customs data, India’s July crude oil imports exceeded China’s 1.76 million bpd via pipelines and shipments. Indian refiners have been buying Russian crude at a discount to Brent ever since Western nations curtailed imports of Russian energy commodities… Read more at: https://oilprice.com/Latest-Energy-News/World-News/India-Surpasses-China-as-Largest-Importer-of-Russian-Oil.html |

|

Fed Minutes Signal September Rate CutA September rate cut looks nailed on after minutes from the US Federal Reserve’s last meeting, released last night, showed many rate-setters had considered a cut in July. Several members at the Fed’s last meeting thought there was a “plausible case” for cutting rates by 25 basis points given the progress on inflation and increases in unemployment. “The vast majority observed that, if the data continued to come in about as expected, it would likely be appropriate to ease policy at the next meeting,” the minutes… Read more at: https://oilprice.com/Finance/the-Economy/Fed-Minutes-Signal-September-Rate-Cut.html |

|

Europe’s Gas Supply Tightens as Norway Begins Field MaintenanceEurope is facing a tighter gas market as Norwegian field operators enter scheduled maintenance season. Any unplanned extension of the maintenance period would cause an imbalance on gas markets on the continent and leas to price rises, Bloomberg reported. “Europe is already struggling,” Florence Schmit, a European energy strategist at Rabobank, told the publication. “Any deviation to the planned maintenance season can cause significant fluctuations in gas availability and in turn market prices, especially this year.” Norway… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Europes-Gas-Supply-Tightens-as-Norway-Begins-Field-Maintenance.html |

|

Stocks close lower, Nasdaq slides 1% as Treasury yields rise and Powell speech looms: Live updatesTraders are looking ahead to commentary from Fed Chair Jerome Powell on Friday for further clues about a potential rate cut. Read more at: https://www.cnbc.com/2024/08/21/stock-market-today-live-updates.html |

|

Perplexity AI plans to start running ads in fourth quarter as AI-assisted search gains popularityFollowing months of controversy surrounding plagiarism allegations, Perplexity AI is about to start selling ads alongside AI-assisted search results. Read more at: https://www.cnbc.com/2024/08/22/perplexity-ai-plans-to-start-running-search-ads-in-fourth-quarter.html |

|

Peloton shares soar 35% as turnaround plan takes hold, losses shrinkPeloton has been working to generate free cash flow and return to profitability, and has made cuts to sales and marketing budgets to improve its balance sheet. Read more at: https://www.cnbc.com/2024/08/22/peloton-pton-earnings-q4-2024.html |

|

Crypto asset managers look past the next big coin to diversify portfoliosYou can forget about a Solana ETF alone. The next step in crypto asset management goes beyond identifying the next big coin. Read more at: https://www.cnbc.com/2024/08/22/crypto-asset-managers-seek-next-big-coin-for-portfolio-diversification.html |

|

FDA approves updated Pfizer, Moderna Covid vaccines as virus surges; shots to be available within daysThe Covid jabs target a strain called KP.2, a descendant of the highly contagious omicron subvariant JN.1 that began circulating widely in the U.S. this year. Read more at: https://www.cnbc.com/2024/08/22/covid-vaccines-fda-approves-pfizer-moderna-updated-kppoint2-shots.html |

|

Former FTX exec Ryan Salame’s romantic partner indicted on campaign finance crimesMichelle Bond was charged two months before her romantic partner, former FTX exec Ryan Salame, is due to surrender to being a prison sentence. Read more at: https://www.cnbc.com/2024/08/22/michelle-bond-romantic-partner-of-former-ftx-exec-salame-indicted.html |

|

Snowflake shares sink 13% on decelerating product revenue growthShares of Snowflake fell after it released fiscal second-quarter 2025 earnings that showed decelerating product revenue growth compared to past quarters. Read more at: https://www.cnbc.com/2024/08/22/snowflake-stock-down-on-decelerating-product-revenue-growth.html |

|

Philadelphia Fed President Harker advocates for interest rate cut in SeptemberHarker gave the strongest statement yet from a central bank official that easing is almost a certainty next month. Read more at: https://www.cnbc.com/2024/08/22/philadelphia-fed-president-harker-advocates-for-interest-rate-cut-in-september.html |

|

Stocks making the biggest moves midday: Urban Outfitters, Peloton, Advance Auto Parts and moreThese are the stocks posting the largest moves in midday trading. Read more at: https://www.cnbc.com/2024/08/22/stocks-making-the-biggest-moves-midday-urbn-pton-aap-zm.html |

|

Where this BlackRock global CIO sees opportunity for income in ‘new era’ for stocksBlackRock’s Tony DeSpirito, who manages the BlackRock Equity Dividend fund, looks for income, value and quality when picking stocks. Read more at: https://www.cnbc.com/2024/08/22/where-this-blackrock-global-cio-sees-opportunity-for-income-in-new-era-for-stocks.html |

|

Kamala Harris to accept Democratic nomination on Day 4 of DNC. Here’s who else is speakingVice President Kamala Harris became the Democratic nominee in the race against Republican Donald Trump after President Joe Biden dropped his reelection bid. Read more at: https://www.cnbc.com/2024/08/22/dnc-kamala-harris-nomination-president-trump.html |

|

Walz’s family relied on Social Security when his father died. Many don’t know kids are eligible for benefitsWhen a parent dies, children may be eligible for Social Security benefits. But some eligible kids may not be receiving that money. Read more at: https://www.cnbc.com/2024/08/22/children-may-qualify-for-social-security-benefits-what-to-know.html |

|

Josh Shapiro blasts Trump for calling him ‘overrated Jewish Governor’Donald Trump had slammed Gov. Josh Shapiro for supporting Kamala Harris even though, Trump claims, she “hates Israel.” Read more at: https://www.cnbc.com/2024/08/22/trump-shapiro-jewish-governor-antisemitism.html |

|

Suezmax Tanker Crew Forced To Abandon Ship After Missile Attack In Red SeaSuezmax Tanker Crew Forced To Abandon Ship After Missile Attack In Red SeaThe X account for EUNAVFOR ASPIDES, the European Union’s military operation committed to ensuring freedom of navigation and maritime security in the Red Sea, reported that the crew of a Suezmax tanker—the largest type of oil tanker capable of transiting the Suez Canal—was forced to abandon ship after “coming under attack.” Greek-flagged oil tanker MV Sounion was bombarded in what earlier reports stated was a missile attack about 77 nautical miles west of the Yemeni port of Hodeidah, an area controlled by Iran-backed Houthis. EUNAVFOR ASPIDES dispatched a naval vessel to Sounion after the attack. While rescuing the crew, gunners on the warship destroyed a kamikaze boat drone.

The Read more at: https://www.zerohedge.com/commodities/suezmax-tanker-crew-forced-abandon-ship-after-missile-attack-red-sea |

|

Trump Shooter Had Encrypted Accounts In Multiple Countries: CongressmanAuthored by Zachary Stieber via The Epoch Times, The man who fired shots at former President Donald Trump during a rally in Pennsylvania had encrypted accounts in multiple countries, according to a member of the U.S. House of Representatives task force investigating the attempted assassination.

Waltz is on the “Task Force on the Attempted Assassination of Donald J. Trump.”

FBI officials Read more at: https://www.zerohedge.com/political/trump-shooter-had-encrypted-accounts-multiple-countries-congressman |

|

With Merit Back At The Fore, MIT’s Black Enrollment Plummets, Asian Share LeapsThe composition of the Massachusetts Institute of Technology’s incoming freshman class is vividly reflecting the effect of the Supreme Court’s 2023 decision banning affirmative action — with the share of spots given to black people down sharply, while Asian enrollment has jumped. “Every student admitted to the class of 2028 at MIT will know that they were accepted only based upon their outstanding academic and extracurricular achievements, not the color of their skin,” Edward Blum, who founded the Students for Fair Admissions group that was victorious in the Supreme Court case, told the New York Times.

Read more at: https://www.zerohedge.com/political/merit-back-fore-mits-black-enrollment-plummets-asian-enrollment-leaps |

|

‘No Israeli Withdrawal, No Ceasefire Deal’: HamasVia The Cradle Hamas and the Palestinian Islamic Jihad (PIJ) movement released a joint statement on Thursday, confirming they will reject any agreement that does not include an Israeli withdrawal from the Gaza Strip. The joint statement was issued following a meeting between PIJ Secretary-General Ziad Nakhala and Hamas Shura Council head Mohammad Darwish in Qatar’s capital, Doha. The statement stressed the “necessity of stopping the aggression and war to which the Palestinian people are being subjected and punishing the leaders of the occupation for the crimes they are committing against humanity.” “The position of the resistance and the Palestinian people on achieving any agreement is a comprehensive cessation of aggression, a complete withdrawal from the Strip, the start of reconstruction, and the end of the siege with a serious exchange deal,” the joint statement added. Read more at: https://www.zerohedge.com/geopolitical/no-israeli-withdrawal-no-ceasefire-deal-hamas |

|

Mike Lynch: Tributes paid to ‘UK’s greatest tech entrepreneur’A leading figure in the UK tech scene, Mike Lynch died shortly after winning a legal battle in the US. Read more at: https://www.bbc.com/news/articles/cdxl5kpvrg9o |

|

Child benefit claims rise after income rule changeThe number of new claims rose in April, after a rule change on how much parents can earn and still be eligible. Read more at: https://www.bbc.com/news/articles/c23lkd25g5no |

|

Starbucks new boss under fire for 1,000-mile commuteJob offer which allows new boss to commute to and from work on corporate jet sparked criticism. Read more at: https://www.bbc.com/news/articles/c5y3e0ljnllo |

|

Rupee’s record lows mask currency’s trade-weighted overvaluationThe index tracking the rupee’s value against a weighted basket of 40 trading partners, adjusted for inflation, climbed to 107.33, its highest level since December 2017, according to Reserve Bank of India data. Read more at: https://economictimes.indiatimes.com/markets/forex/rupees-record-lows-mask-currencys-trade-weighted-overvaluation/articleshow/112714906.cms |

|

Harindarpal Singh Banga to sell 1.4% stake in Nykaa for Rs 809 croreAs outlined in the bankers’ term sheet, the Bangas intend to sell 4.09 crore shares at a floor price of Rs 198 per share, representing a 5.9% discount to Thursday’s closing price of Rs 210. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/harindarpal-singh-banga-to-sell-1-4-in-nykaa-for-rs-809-crore/articleshow/112717024.cms |

|

Blackstone-owned International Gemological Institute files papers for Rs 4,000 crore IPOUS fund Blackstone backed diamond certification company International Gemological Institute (IGI) has filed draft papers with the capital markets regulator SEBI to raise Rs 4,000 crore ($480 mn) through an initial public offering (IPO). Read more at: https://economictimes.indiatimes.com/markets/ipos/fpos/blackstone-owned-international-gemological-institute-files-papers-for-rs-4000-crore-ipo/articleshow/112714584.cms |

|

Treasury yields jump by most in at least a week after fresh data ease near-term recession concernsU.S. government debt sold off on Thursday, sending yields up by the most in up to two weeks, after a batch of new data showed the economy and labor market continuing to hold up as the Federal Reserve’s annual Jackson Hole Economic Symposium got under way. Read more at: https://www.marketwatch.com/story/treasury-yields-hold-near-2024-lows-ahead-of-jobless-claims-powell-speech-e8746578?mod=mw_rss_topstories |

|

As theft increases, store closures and ‘retail deserts’ could be the new consumer realityTarget has seen its financial standing improve after shuttering nine crime-prone locations Read more at: https://www.marketwatch.com/story/as-theft-increases-store-closures-and-retail-deserts-could-be-the-new-consumer-reality-99a4a74e?mod=mw_rss_topstories |

|

Is the August stock-market volatility behind us? This key indicator says not yet.Calm appears to have returned to Wall Street after the recent mayhem, but one volatility indicator suggests some investors are betting on another round of mammoth swings in the stock market. Read more at: https://www.marketwatch.com/story/is-the-august-stock-market-volatility-behind-us-this-key-indicator-says-not-yet-f25d4d45?mod=mw_rss_topstories |

Massachusetts Institute of Technology, alma mater of Kentucky Rep. Thomas Massie, overlooks the Charles River in Boston …

Massachusetts Institute of Technology, alma mater of Kentucky Rep. Thomas Massie, overlooks the Charles River in Boston …