Summary Of the Markets Today:

- The Dow closed up 409 points or 1.04%,

- Nasdaq closed up 2.43%,

- S&P 500 closed up 1.68%,

- Gold $2,506 up $1.80,

- WTI crude oil settled at $78 down $1.59,

- 10-year U.S. Treasury 3.850 down 0.059 points,

- USD index $102.60 down $0.54,

- Bitcoin $60,848 up $1,490 or 2.51%,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Highlights:

U.S. stocks closed with significant gains as Wall Street responded to cooler-than-expected inflation data and anticipated the upcoming Consumer Price Index (CPI) report. This marked the best three-day stretch for the Nasdaq Composite, Nasdaq 100, and S&P 500, with each index achieving four consecutive wins. The U.S. Producer Price Index (PPI) for July rose just 0.1% month-over-month, lower than economists’ forecasts, and increased 2.2% year-over-year, aligning closely with the Federal Reserve’s 2% inflation target.In the corporate sector, Home Depot’s shares fell after the company lowered its outlook on same-store sales for the rest of the year. Conversely, Starbucks saw a 24% increase in its stock following the announcement of a new CEO, Brian Niccol from Chipotle, whose shares dropped more than 7%. Nvidia continued its upward trend, gaining about 7% after being named a top “rebound” stock by Bank of America.

Click here to read our current Economic Forecast – August 2024 Economic Forecast: New Recession Flag

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

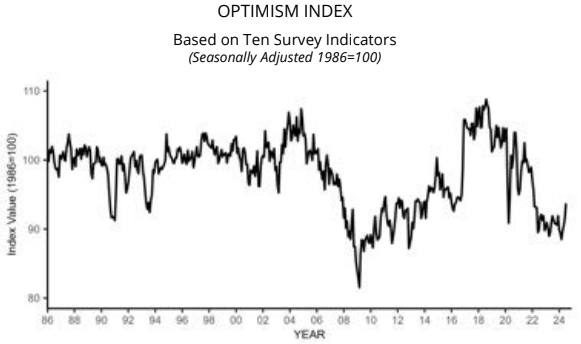

The NFIB Small Business Optimism Index rose 2.2 points in July to 93.7, the highest reading since February 2022. However, this is the 31st consecutive month below the 50-year average of 98. Inflation remains the top issue among small business owners, with 25% reporting it as their single most important problem in operating their business, up four points from June. NFIB Chief Economist Bill Dunkelberg added:

Despite this increase in optimism, the road ahead remains tough for the nation’s small business owners. Cost pressures, especially labor costs, continue to plague small business operations, impacting their bottom line. Owners are heading towards unpredictable months ahead, not knowing how future economic conditions or government policies will impact them.

The Producer Price Index for final demand increased 2.3% for the 12 months ended in July 2024 – down from 2.7% last month. The index for final demand services fell 0.2 percent. The index for final demand less foods, energy, and trade services moved up 3.3%. What a mixed bag of inflation indicators at the producer level! It is saying overall inflation subsided this month – but when you strip away food, energy and trade services (core inflation), it actually worsened this month. In fact, core inflation is nearly as high as any reading in the past 12 months. The good news in this data is that inflation in the services portion of this index declined (but the goods portion worsened).

Here is a summary of headlines we are reading today:

- The Future of U.S. Manufacturing: Key Trends and Challenges

- Billions in Taxpayer Dollars Tied Up in Stalled Green Power Projects

- Biden Administration Doubles Tariff-Free Solar Cell Import Quota

- U.S. Seeks Iran De-escalation With Turkey’s Help

- Refiners Are Reeling From Low Margins and Weak Demand

- Starbucks replaces CEO Laxman Narasimhan with Chipotle CEO Brian Niccol

- Wholesale inflation measure rose 0.1% in July, less than expected

- Stocks rise as first of the two major inflation reports this week comes in light: Live updates

- Investors are banking on the Fed to save stocks and the economy, according to Wall Street survey

- Rabobank: Questions Swirl What The Economic Program Of A Harris Administration Might Look Like

- PMS Tracker: HNI investors make up to 24%

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

The Future of U.S. Manufacturing: Key Trends and ChallengesVia Metal Miner The Construction MMI (Monthly Metals Index) finally broke free of its year-long sideways trend, but only slightly. All in all, price action moved down by 3.52%, adding to questions about the state of US manufacturing. Iron ore, h-beam, and steel rebar prices dropping were the main components driving the index down. In general, numerous factors continue to pull at the construction index. Most anticipate that the construction index will experience more bearish action for the remainder of 2024 due to fewer construction projects, high… Read more at: https://oilprice.com/Finance/the-Economy/The-Future-of-US-Manufacturing-Key-Trends-and-Challenges.html |

|

Billions in Taxpayer Dollars Tied Up in Stalled Green Power ProjectsPresident Joe Biden and Vice President Kamala Harris signed the Democrats’ Inflation Reduction Act and Chips and Science Act in 2022, promising to lower inflation and make life more affordable for Americans. However, the reality has been quite the opposite, as the federal government embarked on a spending spree of taxpayers’ dollars. Even VP Harris recently admitted on the camping trail that a cost of living crisis persists. Two years after Biden-Harris’ Inflation Reduction Act and Chips and Science began offering some of the $400 billion… Read more at: https://oilprice.com/Energy/Energy-General/Billions-in-Taxpayer-Dollars-Tied-Up-in-Stalled-Green-Power-Projects.html |

|

Oil Prices Under Pressure Despite Continued Geopolitical UncertaintyOil prices are under pressure from continued demand concerns but geopolitical risks and the recent rally from last week’s crash means Brent is still sitting comfortably above the psychologically-important $80 mark.- Ukraine’s incursion into Russian territory, occupying parts of the Kursk region in and around the key pipeline station in Sudzha, have sent European natural gas prices soaring to their highest this year to date.- Whilst pipeline flows to Europe via Ukraine continue largely uninterrupted, fears of a potential cut-off lifted TTF… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Prices-Under-Pressure-Despite-Continued-Geopolitical-Uncertainty.html |

|

Crude Flow to Libyan Oil Export Terminal Disrupted by Pipeline FireEs Sider oil export terminal in eastern Libya has seen crude flows disrupted due to a fire along a pipeline from the oilfields in the Sirte basin, Argus reported on Tuesday, citing shipping agents and traders. The latest disruptions to Libya’s oil output and exports come a week after production at the largest oilfield in the country, Sharara, was halted by protests. A fire at the pipeline to Es Sider has been extinguished, operator Waha Oil said on Tuesday, but sources and operational reports cited by Argus pointed to reduced flows via the… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Crude-Flow-to-Libyan-Oil-Export-Terminal-Disrupted-by-Pipeline-Fire.html |

|

Elon Musk Warns Against Vilifying the Oil and Gas IndustryThe world should stop vilifying the oil and gas industry, Elon Musk told Donald Trump in an interview on X, reiterating previous similar calls. “My views on climate change and oil gas […] are pretty moderate,” Musk told Trump during the conversation. “I don’t think we should vilify the oil and gas industry and the people that have worked very hard in those industries to provide the necessary energy to support the economy,” added the Tesla CEO billionaire, who has endorsed Trump for president. Musk also said… Read more at: https://oilprice.com/Energy/Energy-General/Elon-Musk-Warns-Against-Vilifying-the-Oil-and-Gas-Industry.html |

|

Biden Administration Doubles Tariff-Free Solar Cell Import QuotaThe Biden Administration has more than doubled the volumes of solar cell imports that would be allowed to enter the United States tariff-free to help solar module producers relying on imported materials. Tariffs on solar cell imports were introduced by former President Donald Trump to protect small American solar-product makers from competition from cheaper materials imported from Asia. The Biden Administration is now boosting the so-called tariff-rate quota (TRQ) on imports of certain crystalline silicon photovoltaic (CSPV) cells, not partially… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Biden-Administration-Doubles-Tariff-Free-Solar-Cell-Import-Quota.html |

|

European Natural Gas Prices Ease From 2024 HighsEuropean benchmark natural gas prices have dropped from their highest level this year as concerns about a possible halt to Russian pipeline supplies via Ukraine have eased. The Dutch TTF Natural Gas Futures, the benchmark for Europe’s gas trading, were up by 0.3% as of 11 a.m. local time in Amsterdam on Tuesday, recovering from a 2% drop earlier in the trading session. However, the front-month price has dropped below $43.70 (40 euros) per megawatt-hour (MWh) this week, after soaring at the end of last week above this threshold – and… Read more at: https://oilprice.com/Latest-Energy-News/World-News/European-Natural-Gas-Prices-Ease-From-2024-Highs.html |

|

IEA Maintains Muted Oil Demand Growth OutlookGlobal oil demand is set to rise by less than 1 million barrels per day (bpd) in both 2024 and 2025, as a contraction in Chinese consumption has limited growth so far this year, the International Energy Agency (IEA) said on Tuesday, keeping its near-term growth forecasts unchanged. World oil demand rose by 870,000 bpd in the second quarter of the year, amid China’s oil demand contracting for a third consecutive month in June, the agency said in its closely-watched Oil Market Report. While China’s oil demand weakened, gasoline consumption… Read more at: https://oilprice.com/Energy/Energy-General/IEA-Maintains-Muted-Oil-Demand-Growth-Outlook.html |

|

UK Regulator Approves $4.35 Billion Electricity SuperhighwayThe UK’s energy regulator Ofgem has approved a $4.35 billion (£3.4 billion) funding to fast-track an electricity superhighway—a major subsea and underground cable project between Scotland and Yorkshire in England that could power up to 2 million British homes. The funding package that Ofgem announced on Tuesday is part of the regulator’s Accelerated Strategic Transmission Investment (ASTI) framework, which is fast-tracking 26 major connection projects aimed at boosting the UK’s grid capacity. The expanded capacity… Read more at: https://oilprice.com/Latest-Energy-News/World-News/UK-Regulator-Approves-435-Billion-Electricity-Superhighway.html |

|

U.S. Seeks Iran De-escalation With Turkey’s HelpThe United States is calling on its allies that also maintain relations with Iran to persuade them not to escalate further the tensions in the Middle East, the U.S. Ambassador to Turkey, Jeff Flake, said. “We ask all of our allies that have any relations with Iran to prevail on them to de-escalate, and that includes Turkey,” Flake told reporters in Istanbul, as carried by Reuters. Turkey officials with whom the U.S. is talking “seem more confident than we are that it won’t escalate,” the ambassador said of the current situation… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Seeks-Iran-De-escalation-With-Turkeys-Help.html |

|

Marathon Oil Shareholder Seeks to Block Conoco TakeoverA shareholder in Marathon Oil has filed a lawsuit seeking to stop an acquisition of the company by ConocoPhillips, claiming that the price Conoco agreed to pay undervalued the company. Per a Bloomberg report on the news, investor Martin Siegel alleged in his filing that the acquisition could deprive Marathon Oil shareholders of some $6 billion in company value. Siegel also accused the company’s management and its adviser Morgan Stanley of misrepresenting the deal with Conoco to shareholders when it sought their backing for the move. Conoco… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Marathon-Oil-Shareholder-Seeks-to-Block-Conoco-Takeover.html |

|

CrownRock Hopes to Generate $1.7 Billion by Selling Occidental Petroleum SharesShale driller CrownRock is selling a stake in Occidental Petroleum it hopes to generate some $1.7 billion, Bloomberg has reported, citing unnamed sources. Per the report, the Permian oil producer is putting 29.6 million Oxy shares on sale, pricing the stock at a discount to Occidental’s closing price on Monday, which stood at $58.98 per share. Occidental announced it had struck a deal to buy CrownRock in December last year. The value of the deal stood at $12 billion, including debt. The acquisition boosted Occidental’s premier Permian… Read more at: https://oilprice.com/Latest-Energy-News/World-News/CrownRock-Hopes-to-Generate-17-Billion-by-Selling-Occidental-Petroleum-Shares.html |

|

Canada’s Top Natural Gas Producer Acquires Rival to Capitalize on Higher PricesCanada’s Tourmaline Oil Corp. has announced the acquisition of Crew Energy for some C$1.3 billion, or $950 million, as part of expansion plans ahead of an expected uptick in natural gas prices. Like Tourmaline itself, Crew Energy operates in the Montney Formation and the Alberta Deep Basin, which, the acquiring company noted in its release, are the biggest natural gas reservoirs in Canada. “Generally, the right time (for deals) is at the bottom of cycles, and we think we are near, or at, or past the bottom in the natural gas pricing… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Canadas-Top-Natural-Gas-Producer-Acquires-Rival-to-Capitalize-on-Higher-Prices.html |

|

Refiners Are Reeling From Low Margins and Weak DemandDuring the latest profit season, U.S. oil refiners signaled they would be curbing output this quarter, pressured by lower margins and the seasonal decline in demand. Petrochemical makers are also having difficulties, mostly due to overcapacity in China. And they are changing in order to overcome them. A forecast by Wood Mackenzie cited in a recent Reuters article on the petrochemical industry and its long-term outlook said that almost a quarter of global petrochemical capacity was at risk of permanent closure because of depressed—and depressing—margins… Read more at: https://oilprice.com/Energy/Energy-General/Refiners-Are-Reeling-From-Low-Margins-and-Weak-Demand.html |

|

BP’s New Iraq Adventure Could be a Turning Point for the West in the Middle EastOil companies occupy a unique position at the intersection of global economics, politics, and security. Part of the reason for this is that energy is a crucial determinant of every country’s financial future and therefore its political manoeuvrings at home and abroad. Another part is that oil firms’ enterprises in foreign lands are enormous and multilayered operations involving the cultivation of relationships at the highest levels of a host nation’s government, industry, and society. The final part is that oil companies are legally… Read more at: https://oilprice.com/Energy/Energy-General/BPs-New-Iraq-Adventure-Could-be-a-Turning-Point-for-the-West-in-the-Middle-East.html |

|

Starbucks replaces CEO Laxman Narasimhan with Chipotle CEO Brian NiccolAfter several quarters of weak sales, Starbucks has tapped Chipotle CEO Brian Niccol as Laxman Narasimhan’s replacement. Read more at: https://www.cnbc.com/2024/08/13/starbucks-replaces-ceo-laxman-narasimhan-with-chipotle-ceo-brian-niccol.html |

|

Wholesale inflation measure rose 0.1% in July, less than expectedThe producer price index for July was expected to increase 0.2%, according to the Dow Jones consensus estimate. Read more at: https://www.cnbc.com/2024/08/13/producer-price-index-july-2024.html |

|

Digital health company Ro launches GLP-1 insurance-coverage checker to help patients navigate costsRo said it hopes its new tool will be able to help patients understand their GLP-1 coverage options so they can decide how to pursue weight loss. Read more at: https://www.cnbc.com/2024/08/13/ro-launches-glp-1-insurance-coverage-checker.html |

|

Stocks rise as first of the two major inflation reports this week comes in light: Live updatesU.S. stocks were higher Tuesday as investors parse this week’s first batch of key inflation data and weighed fresh earnings. Read more at: https://www.cnbc.com/2024/08/12/stock-market-today-live-updates.html |

|

UAW hits Musk, Trump with federal labor charges over union busting commentsDuring Donald Trump and Elon Musk’s two-hour long conversation on X, the former president complimented the Tesla CEO on firing workers who wanted to strike. Read more at: https://www.cnbc.com/2024/08/13/musk-trump-uaw-labor-union-x-interview.html |

|

Investors are banking on the Fed to save stocks and the economy, according to Wall Street surveyMore than 90% of fund managers are expecting lower short-term rates in the next 12 months, marking the highest percentage in the past 24 years, BofA said. Read more at: https://www.cnbc.com/2024/08/13/investors-are-banking-on-the-fed-to-save-stocks-and-the-economy-according-to-wall-street-survey.html |

|

Crypto magnate buys SpaceX mission for private polar spaceflight expeditionCryptocurrency speculator Chun Wang bought a SpaceX multi-day flight for an undisclosed amount, the company announced on Monday. Read more at: https://www.cnbc.com/2024/08/13/crypto-magnate-chun-wang-buys-spacex-polar-spaceflight-fram2.html |

|

This startup will sell methane-eating microbes to Whole FoodsWindfall uses “mems” — methane-eating microbes. These naturally occurring microscopic organisms live in the soil and eat methane as food for survival. Read more at: https://www.cnbc.com/2024/08/13/this-startup-will-sell-methane-eating-microbes-to-whole-foods.html |

|

Home Depot expects sales to weaken as consumers grow more cautiousHome Depot’s CFO said homeowners are now deferring projects due to a “sense of greater uncertainty in the economy.” Read more at: https://www.cnbc.com/2024/08/13/home-depot-hd-q2-2024-earnings.html |

|

We drove Chinese EVs to see why rival automakers are worriedCNBC tested four EVs built by Chinese automakers to see how they stack up against the Tesla Model Y and why they inspire fear in rivals. Read more at: https://www.cnbc.com/2024/08/13/we-drove-chinese-evs-to-see-why-rival-automakers-are-worried.html |

|

Murdoch family battle highlights Nevada’s secret trust boomNevada is at the forefront of a massive wealth surge pouring into the asset-protection trusts. Read more at: https://www.cnbc.com/2024/08/13/murdoch-battle-nevada-trust-boom.html |

|

Is Netflix recession resistant? JPMorgan thinks soNetflix provides “compelling value” even in an economic slowdown scenario, says Netflix. Read more at: https://www.cnbc.com/2024/08/13/is-netflix-recession-resistant-jpmorgan-thinks-so.html |

|

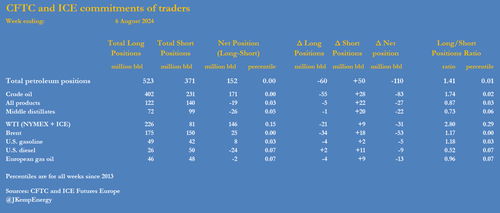

Bullish Positioning In Oil Just Hit An All-Time Low, Signaling Price ReboundWith investors increasingly unwilling to express a bearish bias ahead of the coming recession via the stock market (at least until a six-sigma deleveraging event like last Monday’s carry trade unwind forces them to do so), they are instead pilling into bearish bets in the commodity sector, and nowhere more so than energy, where bullish bets just hit a record low! As John Kemp writes, investors cut their petroleum positions to the lowest level on record, part of a broad-based retreat from risk amid rising concerns over a global economic slowdown. Hedge funds and other money managers sold the equivalent of 110 million barrels in the six most important petroleum futures and options contracts over the seven days ending on August 6, The most recent week saw sales across the board in Brent (-53 million barrels), NYMEX and ICE WTI (-31 million), European gas oil (-13 million), U.S. diesel (-9 million) and U.S. gasoline (-5 million).

As the next chart from John Kemp Energy show … Read more at: https://www.zerohedge.com/commodities/bullish-positioning-oil-just-hit-all-time-low-signaling-price-rebound-imminent |

|

Green Party Survives Dems’ Ballot Challenge In Battleground State – Kamala ShuddersFor a party that’s constantly crowing about the need to save Our Democracy, the Democrats have been working awfully hard to limit Americans’ choices in November. Happily, Democrats’ drive to exclude the Green Party from the ballot in the battleground state of Nevada was defeated on Monday — sending shudders through Democrats who blame Green presidential candidate Jill Stein for enabling Donald Trump’s 2016 victory. Stein, who’s back at it in 2024, wasn’t even on the Nevada ballot when Trump upset Hillary Clinton that year. However, Democrats point to Stein’s share in Pennsylvania, Wisconsin and Michigan — which was larger than the margin by which Clinton lost those pivotal Rust Belt states. The Democrats’ challenge to the Green Party’s ballot-access petition questioned the validity of the signatures the Greens had collected. Carson County District Court Judge Kristin Luis shot the challenge down, saying “The Democratic Party has not met its burden of demonstrating that the petition is clearly invalid because it has not produced sufficient evidence to show that the petition has less than the required number of valid signatures in any petition district.” Stein took to social media to celebrate, saying, “We are excited to say that the ruling has been made in our … Read more at: https://www.zerohedge.com/political/green-party-survives-dems-ballot-challenge-battleground-state-kamala-shudders |

|

“America’s Worst Mayor” Tiffany Henyard Disappears After Investigation Reveals Millions In Debt, $40,000 In Amazon PurchasesDolton Mayor Tiffany Aiesha Henyard, who has been dubbed “America’s Worst Mayor”, has disappeared after an investigation into the village’s spending revealed more than $3.5 million in debt, “out of control” credit card spending and $40,000 spend on Amazon purchases in one day. Believe it or not, former Chicago Mayor Lori Lightfoot was hired to lead the investigation into the Dolton, Il mayor. Village trustees hired Lightfoot to address concerns about excessive spending, including taxpayer-funded billboards, ads, lavish dinners, and trips, according to CBS. Earlier this year it was reported Henyard spent $7,650 on hair and makeup after taking office and billed the city for it.

Dolton Trustee Brittney Norwood tol … Read more at: https://www.zerohedge.com/markets/dolton-mayor-tiffany-henyard-disappears-after-investigation-reveals-35-million-hidden-debt |

|

Rabobank: Questions Swirl What The Economic Program Of A Harris Administration Might Look LikeBy Benjamin Picton, Senior strategist at Rabobank Post Hoc Ergo Propter HocStocks struggled for direction yesterday as markets looked ahead to a packed data calendar for the rest of the week. The S&P500 closed flat, the NASDAQ rose 0.21% and the EuroStoxx 50 closed marginally lower. Active Brent crude futures defied lower demand estimates from OPEC+ to rise 3.31% (the most since October last year) as markets continue to brace for escalation in the Middle East, and the Treasuries curve barely moved at all. Energy markets are particularly interesting at the moment. Dutch TTF natural gas futures took a bit of a breather yesterday after rallying for four-straight sessions last week. Active TTF futures closed down 1.79% following signs that Ukraine’s military incursion into Russian territory has not materially interrupted natural gas flows through the Sudzha metering point. Meanwhile, UK National Balance Point gas prices hit their highest levels since December last year before selling off into the close. Read more at: https://www.zerohedge.com/political/rabobank-questions-swirl-what-economic-program-harris-administration-might-look |

|

Rising grocery prices fail to dampen wine salesGrocery price inflation has risen for the first time since March last year, analysis by Kantar suggests. Read more at: https://www.bbc.com/news/articles/cm2n35483gmo |

|

Starbucks replaces boss after sales slumpShares in the chain soared after the appointment of a new chief executive to try to boost sales. Read more at: https://www.bbc.com/news/articles/cy0npj1n6rko |

|

UK unemployment falls slightly as pay growth slowsThe UK’s unemployment rate fell to 4.2% in the three months to the end of June, figures suggest. Read more at: https://www.bbc.com/news/articles/c2l1000q4ywo |

|

Hero MotoCorp Q1 Results: PAT jumps 36% YoY to Rs 1,123 crore, revenue up 16%Hero MotoCorp Q1 Results: Hero MotoCorp on Tuesday reported a standalone net profit of Rs 1,123 crore for the quarter ended June 30, 2024 which was up by 36% from Rs 825 crore posted by the two-wheeler maker in the year ago period. Read more at: https://economictimes.indiatimes.com/markets/stocks/earnings/hero-motocorp-q1-results-pat-jumps-36-yoy-to-rs-1123-crore-revenue-up-16/articleshow/112499906.cms |

|

Apollo Hospitals Q1 Results: Profit zooms 83% YoY to Rs 305 crore, revenue up 15%Apollo Hospitals Q1 Results: Leading hospital chain Apollo Hospitals reported 83% growth in its consolidated net profit at Rs 305 crore for the first quarter ended June 2024. It was Rs 167 crore in the year-ago period. Read more at: https://economictimes.indiatimes.com/markets/stocks/earnings/apollo-hospitals-q1-results-profit-zooms-83-yoy-to-rs-305-crore-revenue-up-15/articleshow/112500305.cms |

|

PMS Tracker: HNI investors make up to 24% return in JulyIn July, only a small group of 8 PMS schemes reported negative returns, notably including Capitalmind’s Adaptive Momentum fund led by Deepak Shenoy. On the brighter side, star fund manager Shyam Shekhar’s ithought smallcap fund Vrddhi saw impressive gains of over 10%, while his multicap fund Solitaire also performed well with a 6.7% increase. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/pms-tracker-hni-investors-make-up-to-24-return-in-july/articleshow/112491298.cms |