Summary Of the Markets Today:

- The Dow closed up 517 points 1.61%,

- Nasdaq closed up 2.68%,

- S&P 500 closed up 1.99%,

- WTI crude oil settled at 115, down 1.76%,

- USD $101.87 up 0.018%,

- Gold 1837 up 0.94%,

- Bitcoin up 0.11% to $31666,

- 10-year U.S. Treasury up 0.108% / 2.857%

Today’s Economic Releases:

CoreLogic Deputy Chief Economist Selma Hepp commented on the S&P CoreLogic Case-Shiller National Home Price Index for March that was released this morning:

The S&P CoreLogic Case-Shiller Index posted a 20.6% increase in March – the strongest March annual gain in the history of the data series. At 2.6%, the monthly acceleration also peaked prior to the mortgage rate jump and is likely to return to historical averages in the coming months. After 32 months of logging the strongest home price gains, Phoenix’s price growth slowed considerably more than the other metro regions and is now outpaced by Tampa, Florida. Nevertheless, the first quarter of 2022 was marked by some of the most competitive housing market conditions since the onset of the pandemic. Home-buyer frenzy reached another new high as eager buyers pursued last-ditch efforts to secure a home purchase before the mortgage rate surge.

Chicago Business Barometer lifted to 60.3 in May, following last month’s 56.4. Inventories saw a fresh near 50-year high. All main indicators increased except for supplier deliveries, which hit the lowest since November 2020.

The Dallas Fed May 2022 manufacturing index improved from 10.8 to 18.8.

A summary of headlines we are reading today:

- Oil Prices Continue To Climb As Supply Uncertainties Mount

- The Hamptons summer rental market is facing an unexpected chill as inventory piles up and prices come down

- Rising gas prices and inflation top travel concerns, overtaking Covid, survey finds

- Stocks Go Nowhere In May, USD Sinks Amid Worst Macro-Meltdown Since Lehman

- Trade Setup: Strong chances of markets consolidating at current levels

- The Tell: Retailers hit with ‘double-whammy’ as inventories rise, consumer sector stocks punished in May

These and other headlines and news summaries moving the markets today are included below.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Rising Energy Prices Could Tip World Into 1980s-Style RecessionRising energy prices and boxing Russian crude oil out of the global market risks a global recession, Bank of America’s head of global commodities and derivatives research Francisco Blanch warned in a recent research note. “Can the global economy continue to expand with tightening oil supplies? Our estimates suggest that the world can handle a total disruption of just about 2mn b/d of Russian oil without risking a global recession,” the note cautioned. In 2023, BoA sees oil demand approaching pre-Covid levels but only if Russia’s crude oil Read more at: https://oilprice.com/Latest-Energy-News/World-News/Rising-Energy-Prices-Could-Tip-World-Into-1980s-Style-Recession.html |

|

Oil Prices Continue To Climb As Supply Uncertainties MountReader Update: Whether you are new to the oil and gas industry or an energy market veteran, you will regret not signing up for Global Energy Alert. Oilprice.com’s premium newsletter provides everything from geopolitical analysis to trading analysis, all for less than a cup of coffee per week. Chart of the Week- According to Bloomberg, the ESG industry is facing an increasing amount of criticism despite its incredible growth. While the industry is worth as much as $40 trillion, a large portion of that value is reportedly due to greenwashing.- Read more at: https://oilprice.com/Energy/Energy-General/Oil-Prices-Continue-To-Climb-As-Supply-Uncertainties-Mount.html |

|

OPEC Considers Suspending Russia From Oil DealSome OPEC members are mulling over the possibility of suspending Russia from the OPEC+ deal that limits the amount of crude oil that each member can produce, the Wall Street Journal reported on Tuesday, citing OPEC delegates. Suspending Russia’s role in the group could allow other members to increase oil production at a quicker pace although there are only a few OPEC members believed to have the capacity to ramp up production as quickly as the current deal allows. Removing Russia from the group could be more of a long-term move, or Read more at: https://oilprice.com/Latest-Energy-News/World-News/OPEC-Considers-Suspending-Russia-From-Oil-Deal.html |

|

EU Commission Studies Price Cap On Imported Russian GasThe European Commission will look into setting a price cap on imported Russian natural gas, Italy’s Prime Minister Mario Draghi said on Tuesday. The Commission received a mandate to study the feasibility of a gas price cap, Draghi told reporters after today’s summit in Brussels. The European Union leaders agreed to cut Russian crude oil imports by as much as 90 percent by the end of this year, setting out first to target crude oil shipments via tankers. Hungary, Slovakia, and the Czech Republic are exempt from the embargo. Read more at: https://oilprice.com/Energy/Energy-General/EU-Commission-Studies-Price-Cap-On-Imported-Russian-Gas.html |

|

Double-digit Inflation Prompts Russia To Raise Wages, PensionsThe federal Russian government will increase minimum wages and pensions from June 1 as it seeks to counter the effects of double-digit inflation closely linked to Western sanctions. Inflation in Russia stood at an annual 17.83 percent in April, according to official statistics, and 1.14 percent on a monthly basis. The United States, the UK, and the European Union have all imposed sanctions on Russia and Russian citizens and entities, and while some of these are largely symbolic, such as banning high-ranking officials from traveling to certain countries, Read more at: https://oilprice.com/Latest-Energy-News/World-News/Double-digit-Inflation-Prompts-Russia-To-Raise-Wages-Pensions.html |

|

Permian Leaves Rivals Behind As Production Continues To GrowPermian oil production growth is set to outpace OPEC heavyweight Iraq this year and next as demand for oil surges on historically tight supply, Rystad Energy research shows. Total oil output from the Permian, including both conventional and unconventional, is forecast to grow by almost 1 million barrels per day (BPD) this year, jumping from 4.7 million to 5.6 million bpd, before climbing further to around 6.5 million BPD in 2023. By contrast, Iraq’s output will grow by some 600,000 BPD in 2022 and 400,000 in 2023. In 2010, the Permian only Read more at: https://oilprice.com/Energy/Crude-Oil/Permian-Leaves-Rivals-Behind-As-Production-Continues-To-Grow.html |

|

Help (mostly) wanted: A diverging job market boosts some workers’ prospects and puts others on noticeThe divergence could mean a slowdown in wage growth, or hiring itself, and could curtail spending, which has been robust despite low consumer confidence. Read more at: https://www.cnbc.com/2022/05/29/us-job-market-divide-boosts-some-workers-prospects-puts-others-on-notice.html |

|

The first act of the streaming wars saga is over — Netflix’s fall from grace has ushered in the pivotal second actNetflix’s fall from grace has ended the first act of the streaming wars. Act two will determine whether the industry can right itself. Read more at: https://www.cnbc.com/2022/05/29/netflix-and-rivals-enter-pivotal-second-act-of-streaming-wars-saga.html |

|

The Hamptons summer rental market is facing an unexpected chill as inventory piles up and prices come downAfter two years of strong demand and soaring prices, the supply of rentals in the Hamptons is surging, leading to a wave of last-minute price cuts. Read more at: https://www.cnbc.com/2022/05/30/hamptons-summer-rental-market-beach-house-inventory-is-up-prices-are-down.html |

|

Ex-Disney CEO Bob Iger takes stake in Australian design company Canva, which has been valued at $40 billionBob Iger, the former Disney chief, has already invested his own money in GoPuff and Funko. Read more at: https://www.cnbc.com/2022/05/29/former-disney-ceo-bob-iger-takes-stake-in-australian-design-company-canva.html |

|

Taco Bell locations are running out of Mexican Pizza less than two weeks after its returnDemand for Mexican Pizza was seven times higher than the last time it was on Taco Bell’s menu. Read more at: https://www.cnbc.com/2022/05/31/taco-bell-is-running-out-of-mexican-pizza-less-than-two-weeks-after-its-return.html |

|

Stocks making the biggest moves midday: American Eagle Outfitters, Unilever, Nio and moreThese are the stocks posting the largest moves in midday trading. Read more at: https://www.cnbc.com/2022/05/31/stocks-making-the-biggest-moves-midday-american-eagle-outfitters-unilever-nio-and-more.html |

|

Rising gas prices and inflation top travel concerns, overtaking Covid, survey findsMost Americans plan to travel this summer, but rising gas prices and inflation now top their list of concerns, overtaking Covid. Read more at: https://www.cnbc.com/2022/05/31/gas-prices-and-inflation-overtake-covid-as-top-travel-worry-.html |

|

As employers call workers back to the office, some AAPI women are on edgeOne of the many things lost since the coronavirus pandemic began more than two years ago is a sense of safety in public spaces. Read more at: https://www.cnbc.com/2022/05/31/as-employers-call-workers-back-to-the-office-some-aapi-women-worry-.html |

|

Home prices surged over 20% in March as interest rates also rose, according to S&P Case-ShillerHome prices continued to increase their gains, despite slower sales and higher mortgage rates. Read more at: https://www.cnbc.com/2022/05/31/home-prices-surged-in-march-as-interest-rates-also-rose-sp-case-shiller.html |

|

‘Top Gun: Maverick’ grosses $124 million, making it Tom Cruise’s best domestic opening weekend“Top Gun: Maverick” soared to $124 million during its opening weekend, earning Tom Cruise his highest domestic debut. Read more at: https://www.cnbc.com/2022/05/29/top-gun-maverick-box-office-results-tom-cruise.html |

|

Britain urges people with monkeypox to abstain from sex as cases riseU.K. health authorities have issued new guidance, including sexual abstinence, for anyone who tests positive for monkeypox. Read more at: https://www.cnbc.com/2022/05/31/britain-urges-people-with-monkeypox-to-abstain-from-sex-as-cases-rise.html |

|

“Our Legal System Is Corrupt” – Trump Responds After Sussman ‘FBI-Russia-Hoax-Lie’ Acquittal“Our Legal System Is Corrupt” – Trump Responds After Sussman ‘FBI-Russia-Hoax-Lie’ AcquittalUpdate (1600ET): Following the Sussman acquittal, Former President Donald Trump was quick to respond, raging that the legal system isn’t working properly…

Jason Miller, a former Trump campaign aide, also reacted to the verdict, writing on Gettr that Sussmann admitted to giving opposition research to the FBI and not telling the bureau that the research was conducted for Clinton.

The jury unanimously found Sussmann not guilty.

We are unsure what that has to do with the legal principles involved in judging Sussman’s guilt? But then again… Read more at: https://www.zerohedge.com/markets/hillary-lawyer-sussman-acquitted-lying-fbi-russia-hoax-farce |

|

Stocks Go Nowhere In May, USD Sinks Amid Worst Macro-Meltdown Since LehmanStocks Go Nowhere In May, USD Sinks Amid Worst Macro-Meltdown Since LehmanTl;dr: May… 30Y Bond unch-ish, S&P unch-ish, Gold unch-ish, Oil way-up, Crypto way-down, USD down, US Macro data total collapse…

Source: Bloomberg To put that in context, outside of the April 2020 crash (where the government basically shut down the entire economy), May 2020’s collapse in US Macro Surprise data was the worst since Oct 2008 (the immediate aftermath of the Lehman crisis and freezing of all capital markets). The S&P, Dow, and Russell 2000 were basically unchanged on the month, thanks to the ramp of the last few days) but Nasdaq ended the month red (4th red month of the last 5 for Nasdaq)… Read more at: https://www.zerohedge.com/markets/stocks-go-nowhere-may-usd-sinks-amid-worst-macro-meltdown-lehman |

|

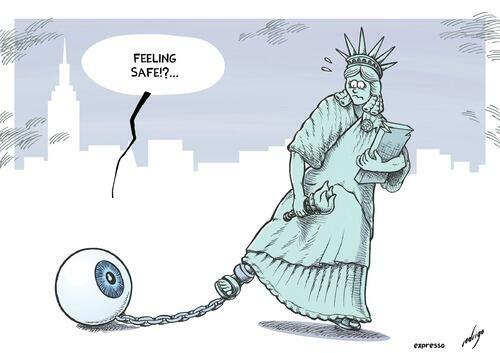

Ron Paul: Don’t Trade Real Liberty For Phony SecurityRon Paul: Don’t Trade Real Liberty For Phony SecurityAuthored by Ron Paul via The Ron Paul Institute for Peace & Prosperity, Authoritarian politicians wasted no time using the recent shootings in Buffalo, New York, and Uvalde, Texas, to justify new infringements on liberty. Just days after the Buffalo shooting, the US House of Representatives passed a law creating new domestic terrorism offices in the FBI, the Justice Department, and the Department of Homeland Security.

This is a step toward achieving the longstanding goal of many progressives of focusing the national security state on “domestic terrorists” and “right-wing extremists.” Supporters of these efforts have used the Buffalo shooter’s mention of “replacement theory” in his “manifesto” to attack prominent conservative commentators, most notably Tucker Carlson. Carlson and others are accused of sp … Read more at: https://www.zerohedge.com/political/ron-paul-dont-trade-real-liberty-phony-security |

|

“Just Another Bear Market Rally”: Mike Wilson Spoils The Bulls Party, Sees Just 5% More Upside“Just Another Bear Market Rally”: Mike Wilson Spoils The Bulls Party, Sees Just 5% More UpsideWith the S&P tumbling as low as 3,800 just over a week ago, briefly triggering a bear market, before exploding higher in yet another furious bear market rally, one may think that Wall Street’s (second) most bearish strategist (after BofA’s Michael Hartnett), Michael Wilson, is content with the market collapsing in line with his weekly prophecies of doom and gloom, and is finally calling for a bounce. No such luck: in fact, in his latest weekly note (available to pro subs in the usual place), Wilson first takes yet another victory lap writing that “consensus is now more in line with our bearish outlook”, and using that as his basis, asks rhetorically “what’s the bull case?” His answer: “outside of a peace agreement in Ukraine, it’s difficult to construct a case for more than a bear market rally” which according to Wilson could at best push stocks another 5% higher, and the main reason for his downbeat view – his gloomy view on the state of the US consumer who “remains a focal point for whether a recession is coming” (and as we discussed last week, it is). Let’s go over his arguments, starting at the top, namely Wilson’s contention that “over the past few months, many clients, competitors, and commentators have moved into our more bearish camp” i.e., that Wilson he was ahead of everyone, claiming that his “competitors” have even adopted a ‘Fire’ and ‘Ice’ narrative—i.e., Fed tightening into a growth slowdown … Read more at: https://www.zerohedge.com/markets/just-another-bear-market-rally-mike-wilson-spoils-bulls-party-sees-just-5-more-upside |

|

More flights canceled ahead of Jubilee breakTui has cut six flights a day as around two million passengers prepare to fly over the bank holiday. Read more at: https://www.bbc.co.uk/news/business-61638567?at_medium=RSS&at_campaign=KARANGA |

|

What are my rights if my flight is canceled?Airlines including Tui and EasyJet have canceled dozens of flights over the half-term holiday. Read more at: https://www.bbc.co.uk/news/business-61646214?at_medium=RSS&at_campaign=KARANGA |

|

Russian gas firm Gazprom to cut some supply to ShellShell says it will work to keep Europe supplied after Gazprom says it will cut flows to it and Orsted. Read more at: https://www.bbc.co.uk/news/business-61652931?at_medium=RSS&at_campaign=KARANGA |

|

Trade Setup: Strong chances of markets consolidating at current levelsThis has converted the level of 16,700 into an immediate resistance point for the index. For any sustainable extension of the up move to happen, moving past 16,700 will be crucial and moving past this level comprehensively will open up some more upside for the markets. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/trade-setup-strong-chances-of-markets-consolidating-at-current-levels-immediate-technical-structure-remains-strong-and-buoyant/articleshow/91922731.cms |

|

Market movers: Bharat Dynamics rockets 5% on deal with MoD; NCC spikes 5%NXT Digital and Thaicom Public Company made a joint announcement of having signed a binding Memorandum of Understanding (MOU) to form a strategic partnership to enter the Broadband-over-satellite (BoS) market and related services in India. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/market-movers-bharat-dynamics-rockets-5-on-deal-with-mod-ncc-spikes-5/articleshow/91921678.cms |

|

Tech View: Nifty50 forms indecisive Doji but uptrend intact, say analystsThe price action for the last couple of sessions is developing as a Flag pattern on the hourly chart, said Gaurav Ratnaparkhi of Sharekhan, who believes the sideways action can continue in the range of 16,500-16,700 before the index prepares for the next leg up. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty50-forms-indecisive-doji-but-uptrend-intact-say-analysts/articleshow/91919172.cms |

|

: 5 large companies that will emerge from the tech wreck as even more fearsomeTechnology companies that provide a real value for the economy will stand apart from those that benefited from pandemic-era hype. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7DEB-E8AEA7B45D1E%7D&siteid=rss&rss=1 |

|

The Tell: Retailers hit with ‘double-whammy’ as inventories rise, consumer sector stocks punished in MayThe economy’s “normalization process” after the COVID-19 crisis was never going to be “orderly,” according to Morgan Stanley Wealth Management. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7DF2-40EB881E96AC%7D&siteid=rss&rss=1 |

|

Deep Dive: Dividend stocks have trounced the market this year. Here are 15 high-yield stocks expected to raise payouts the most through 2024Investors have favored companies with healthy cash flows as the central bank dials back stimulus. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7DBE-A91680331DFB%7D&siteid=rss&rss=1 |