Summary Of the Markets Today:

- The Dow closed down 495 points or 1.21%,

- Nasdaq closed down 2.30%,

- S&P 500 closed down 1.37%,

- Gold $2,487 up $14.10,

- WTI crude oil settled at $77 down $0.94,

- 10-year U.S. Treasury 3.981 down 0.123 points,

- USD index $104.39 down $0.300,

- Bitcoin $63,346 down $1,268 or 1.96%,

Today’s Highlights:

US stocks experienced significant selling pressure on Thursday, with all three major indexes falling sharply. Here’s a summary of the key points:

- The tech-heavy Nasdaq Composite led the decline, falling 2.3%, while the S&P 500 dropped 1.4% and the Dow Jones Industrial Average lost 494 points (1.2%).

- Chip stocks were hit particularly hard, with the Philadelphia Semiconductor Index falling more than 7%. Arm Holdings plummeted 15% after disappointing results, dragging down other market leaders like Nvidia and AMD, which fell over 6% and 8% respectively.

- The 10-year Treasury yield dropped below 4% for the first time since February, settling around 3.98%.

- Weak economic data contributed to the sell-off. The US manufacturing sector contracted further in July, jobless claims rose to an 11-month high, and construction spending unexpectedly declined in June.

- Despite the Federal Reserve signaling a likely rate cut in September, investors reacted negatively to the economic data, viewing it as “bad news” rather than a potential catalyst for steeper rate cuts.

- Traders increased bets on more aggressive Fed moves, with the probability of a 50 basis point rate cut in September rising from 11% to 25%.

- Meta was a notable exception, rising 4.4% after reporting better-than-expected quarterly results.

- The July jobs report, due on Friday, is the next key data release that investors will be watching closely.

This sell-off highlights the market’s sensitivity to economic data and suggests that investors are becoming more concerned about economic growth rather than just focusing on potential rate cuts.

Click here to read our current Economic Forecast – August 2024 Economic Forecast: New Recession Flag

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

U.S.-based employers announced 25,885 job cuts in July 2024, a 47% decrease from the 48,786 cuts announced one month prior – but up 9% from the 23,697 cuts announced in the same month in 2023. Andrew Challenger, Senior Vice President of Challenger, Gray & Christmas, Inc. perspective:

The job market is indeed cooling, with hiring at the lowest point in over a decade. While we are seeing increased cuts in manufacturing sectors, both consumer and industrial, most industries are cutting below last year’s levels.

Construction spending during June 2024 is 6.2% above June 2023 estimate – but this is down from the 7.1% year-over-year in the previous month. Spending on private construction was up 5.9% year-over-year but down from the 6.5% growth in the previous month. Public construction was up 7.3% year-over-year but down from the 9.3% seen the previous month. Unfortunately, construction continues to slow even though it remains one of the bright spots in the U.S. economy.

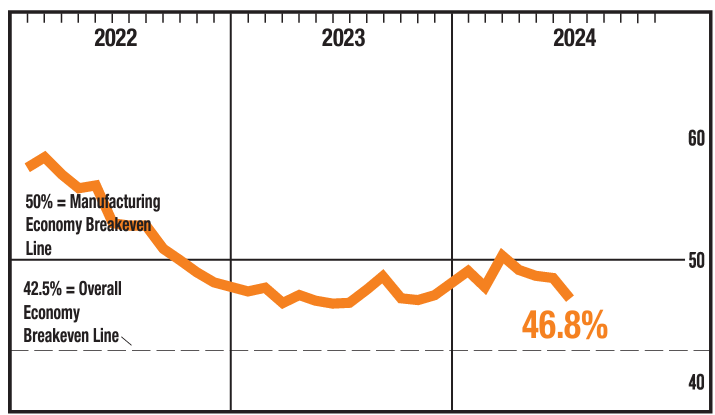

The Manufacturing PMI® registered 46.8% in July 2024,down 1.7 percentage points from the 48.5% recorded in June. A Manufacturing PMI® above 42.5 percent, over a period of time, generally indicates an expansion of the overall economy. The New Orders Index remained in contraction territory, registering 47.4%, 1.9 percentage points lower than the 49.3 percent recorded in June. The July reading of the Production Index (45.9 percent) is 2.6 percentage points lower than June’s figure of 48.5 percent. Just one more nail in the manufacturing coffin indicating it has slid into a recession.

In the week ending July 27, the advance figure for seasonally adjusted initial unemployment claims 4-week moving average was 238,000, an increase of 2,500 from the previous week’s unrevised average of 235,500. Initial unemployment claims remain in territory associated with an expanding economy.

Nonfarm business sector labor productivity increased 2.7% year-over-year in the second quarter of 2024 with unit labor costs increasing 0.5% year-over-year. Note that the trends are that both productivity and unit labor costs are moderating – however with productivity growth being significantly higher than labor cost growth, it helps the U.S. competitive position.

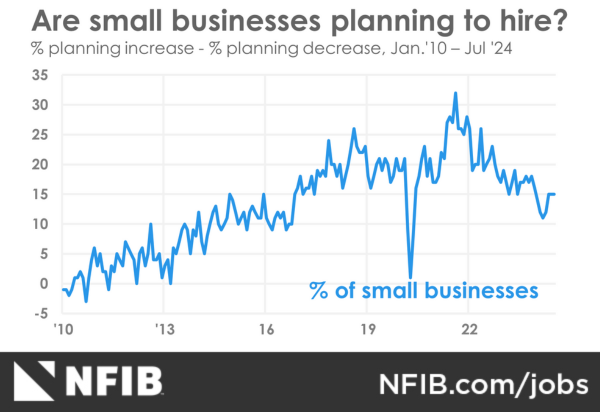

NFIB’s July jobs report found a seasonally adjusted net 33% of small business owners reported raising compensation in July, down five points from last month and the lowest reading since April 2021. A net 18% (seasonally adjusted) plan to raise compensation in the next three months, down four points from June. NFIB Chief Economist Bill Dunkelberg stated:

Fewer small business owners are planning to raise compensation in the coming months, and plans to hire remain stable,. July marks the second month of net gains in employment on Main Street, and the number of firms with open positions remains exceptionally high.

Here is a summary of headlines we are reading today:

- Bullish and Bearish Signals Clash in a Tug-of-War Across Global Markets

- The 10 Most Exciting Technologies of 2024

- China’s Energy Revolution: Wind and Solar Surpass Coal in Historic Milestone

- Record Production Helps ConocoPhillips Beat Q2 Profit Estimate

- High Energy Costs Prompt German Firms to Consider Relocating

- Traders Bet on $130 Oil as Middle East Tensions Spike

- Dow closes nearly 500 points lower Thursday as investors’ recession fears awaken: Live updates

- Markets are clamoring for the Fed to start cutting soon: ‘What is it they’re looking for?’

- Stocks making the biggest moves midday: Shake Shack, C.H. Robinson, Mobileye Global and more

- Stocks & Bond Yields Puke Amid ‘Most Volatile Earnings Season’ Since GFC

- New Video Emerges Of Shooter Running Across Roof As Trump Is Speaking

- ‘Important moment’ as interest rates cut to 5%

- 10-year Treasury yield ends below 4% for first time since February after weak ISM manufacturing data

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Bullish and Bearish Signals Clash in a Tug-of-War Across Global MarketsVia Metal Miner Financial market performance came in in mixed and uncertain for July, with markets across the globe exhibiting both bullish and bearish sentiment. Meanwhile, a number of factors continued to pull markets in different directions, including economic indicators, central bank monetary policies, geopolitical tensions, and the upcoming U.S. presidential election. In the Middle East, geopolitical risks continued to affect oil prices, commodities, indices and currency markets, adding another layer of complexity to the global market… Read more at: https://oilprice.com/Finance/the-Markets/Bullish-and-Bearish-Signals-Clash-in-a-Tug-of-War-Across-Global-Markets.html |

|

OPEC+ Members Achieve High Conformity with Oil Production CutsOPEC members achieved “high overall conformity” to production quotas in May and June, OPEC’s Joint Ministerial Monitoring Committee (JMMC) said in a press release following Thursday’s uneventful meeting. On August 1, 2024, OPEC’s JMMC reviewed crude oil production data from its members for May and June 2024, noting high overall conformity among OPEC and non-OPEC countries participating in the Declaration of Cooperation (DoC). The committee highlighted the commitment of Iraq, Kazakhstan, and Russia—chronic laggards in the agreement to cut… Read more at: https://oilprice.com/Latest-Energy-News/World-News/OPEC-Members-Achieve-High-Conformity-with-Oil-Production-Cuts.html |

|

The 10 Most Exciting Technologies of 2024Emerging technologies of today have the power to reshape industries, achieve significant scale, and shift the economic landscape. As Visual Capitalist’s Dorothy Neufeld details below, from AI-driven advancements in disease detection to carbon-capturing microbes, these technologies stand to improve future society. Meanwhile, greater efficiencies in wireless connectivity allow networks to drive higher data rates and enhance robust communications across 6G networks and the industrial internet-of-things. The above graphic shows the top 10 emerging… Read more at: https://oilprice.com/Energy/Energy-General/The-10-Most-Exciting-Technologies-of-2024.html |

|

China’s Energy Revolution: Wind and Solar Surpass Coal in Historic MilestoneChina is undergoing a transformative shift in its energy landscape. For the first time ever, wind and solar energy have as of June this year collectively eclipsed coal in capacity, according to the latest data from the country’s National Energy Administration (NEA). Rystad Energy’s analysis forecasts that by 2026, solar power alone will surpass coal as China’s primary energy source, with a cumulative capacity exceeding 1.38 terawatts (TW)—150 gigawatts (GW) more than coal. This shift stems from a growing emphasis on cleaner energy… Read more at: https://oilprice.com/Energy/Energy-General/Chinas-Energy-Revolution-Wind-and-Solar-Surpass-Coal-in-Historic-Milestone.html |

|

Ecopetrol Pulls Out Of Deal to Buy Occidental’s CrownRock AssetsOccidental Petroleum (NYSE:OXY) has disclosed that Colombia’s Ecopetrol S.A. (NYSE:EC) has pulled out of a deal to buy a 30% stake in Occidental’s CrownRock assets. Last year, Occidental announced a deal to acquire CrownRock and its significant Permian Basin assets in a cash and stock deal valued at ~$12B. In May, Occidental reaffirmed plans to sell $4.5B-$6B of CrownRock assets within 18 months of closing the purchase, set to be completed by August. Occidental hoped to use part of the proceeds from the Ecopetrol deal to pay down debt,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Ecopetrol-Pulls-Out-Of-Deal-to-Buy-Occidentals-CrownRock-Assets.html |

|

Shell Initiates £2 Billion Share Buyback ProgramShell kicked off a $3.5bn (£2.74bn) share buyback program today as it posted better-than-expected numbers for the second quarter despite a previously announced $2bn (£1.6bn) impairment and a slide in revenue. The London-listed oil major reported adjusted earnings of $6.3bn (£4.91bn) for the three months to June 30, beating analyst consensus of $5.9bn (£4.6bn). Revenue was down quarter-on-quarter, falling 19 percent from $7.7bn in the first quarter, as lower liquified natural gas trading and refining margins and a weaker… Read more at: https://oilprice.com/Energy/Energy-General/Shell-Initiates-2-Billion-Share-Buyback-Program.html |

|

After Campaigning on Free Natural Gas, Erdogan Hikes Prices by 38%Turkey’s state energy operator BOTA? Petroleum Pipeline Corporation has announced that it will increase natural gas prices for residential use by 38%, starting 1st August. BOTA? will also increase gas prices to small to medium-sized industrial customers whose annual natural gas consumption is 300,000 cubic meters or less by 33.1%. The company says it reached its decision “taking into account market conditions, market price stability, the Energy Market Regulatory Authority’s (EPDK) decisions regarding tariffs and changes in purchasing-operating… Read more at: https://oilprice.com/Energy/Energy-General/After-Campaigning-on-Free-Natural-Gas-Erdogan-Hikes-Prices-by-38.html |

|

New Russian Law Permits Use of Crypto in Global Trade SettlementsAuthored by Nik Hoffman via BitcoinMagazine.com, In a significant legislative move, Russian lawmakers have passed a bill permitting businesses to use Bitcoin and other cryptocurrencies in international trade, according to a report by Reuters. This development is part of Russia’s strategy to circumvent Western sanctions imposed following the invasion of Ukraine. The new law, expected to take effect in September, aims to address delays in international payments, particularly with key trading partners like China, India, and the UAE. Central Bank Governor… Read more at: https://oilprice.com/Energy/Energy-General/New-Russian-Law-Permits-Use-of-Crypto-in-Global-Trade-Settlements.html |

|

Record Production Helps ConocoPhillips Beat Q2 Profit EstimateConocoPhillips (NYSE: COP) booked higher-than-expected earnings for the second quarter as its oil and gas production rose to a record and oil prices increased. The U.S. oil and gas firm reported on Thursday adjusted earnings of $2.3 billion, or $1.98 per share, beating the analyst consensus estimate of $ 1.96 per share earnings compiled by The Wall Street Journal. The adjusted earnings were higher than the Q2 2023 result of $1.84 EPS. ConocoPhillips’s production was 1.945 million barrels of oil per day (boepd) for the second quarter of 2024,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Record-Production-Helps-ConocoPhillips-Beat-Q2-Profit-Estimate.html |

|

Cenovus Q2 Profit Rises on Higher Oil Output and Refining VolumesCenovus Energy (NYSE: CVE) booked a second-quarter net profit that was higher than year-ago levels on the back of increased oil and gas production and higher refining throughput at its U.S. refineries. Cenovus reported on Thursday a net income of US$723 million (C$1 billion) for the second quarter of 2024, up from US$626 million (C$866 million) for the same period last year. Cash from operating activities and free funds flow also rose in the quarter of April to June 2024 compared to the second quarter of 2023. Cenovus attributed the higher net… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Cenovus-Q2-Profit-Rises-on-Higher-Oil-Output-and-Refining-Volumes.html |

|

High Energy Costs Prompt German Firms to Consider RelocatingHigh energy costs and uncertainty about energy supply have prompted four out of ten German manufacturing firms to consider either relocating production abroad or limiting it in Germany, a new survey showed on Thursday. In addition, more than half of Germany’s industrial firms employing 500 people or more are now considering moving production outside Germany or limiting production in Germany, according to the Energy Transition Barometer 2024 published by the Association of German Chambers of Industry and Commerce, IHK. German manufacturing… Read more at: https://oilprice.com/Latest-Energy-News/World-News/High-Energy-Costs-Prompt-German-Firms-to-Consider-Relocating.html |

|

Traders Bet on $130 Oil as Middle East Tensions SpikeSome traders are betting this week that oil prices could hit $110-$130 in November as Middle East risks reached a boiling point amid escalating tensions between Israel and Iran. Oil prices rallied on Tuesday and Wednesday, and were also rising on Thursday morning, following the news of Israel assassinating Hamas’s political leader Ismail Haniyeh in Iran and a senior Hezbollah official in Lebanon. Brent Crude prices soared past the $80 a barrel mark this week as tensions in the Middle East flared up again, with Iran vowing to retaliate for… Read more at: https://oilprice.com/Energy/Energy-General/Traders-Bet-on-130-Oil-as-Middle-East-Tensions-Spike.html |

|

Shell Begins New Share Buyback as Earnings Beat EstimatesShell (NYSE: SHEL) is launching yet another $3.5 billion share buyback program after booking better-than-expected earnings for the second quarter of the year. The UK-based supermajor reported on Thursday adjusted earnings of $6.3 billion, down from $7.7 billion for the first quarter of the year, on the back of lower prices and volumes and lower trading results due to seasonality and reduced volatility. The second-quarter result, however, easily beat the market expectation of earnings of $6 billion. Lower refining margins, driven by a stabilizing… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Shell-Begins-New-Share-Buyback-as-Earnings-Beat-Estimates.html |

|

Court Seeks More Time to Evaluate Bids in Citgo AuctionThe U.S. court overseeing the court-ordered auction of Venezuela’s PDV Holding, the parent company of refiner Citgo Petroleum, has requested an additional three weeks to evaluate the bids for the seventh-largest refiner in the United States. The U.S. federal court in Delaware accepted, until mid-June, binding bids in the second bidding round for the shares of Citgo’s parent company, as creditors and claimants seek compensation for asset nationalization under Hugo Chavez and failure to repay debts under Nicolas Maduro. The deadline for… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Court-Seeks-More-Time-to-Evaluate-Bids-in-Citgo-Auction.html |

|

Saudi Arabia Expected to Raise Oil Prices to AsiaSaudi Arabia could raise the price of its crude grades loading for Asia in September, on the back of higher benchmark prices in the Middle East, but weak refining margins could limit the potential hikes. Saudi Aramco, the world’s top crude oil exporter, is expected to raise the official selling price (OSP) of all its crude grades loading for Asia next month, according to a Reuters survey of four refining sources. The Kingdom could raise the price of its flagship Arab Light grade by between $0.50 and $0.80 per barrel for September… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Saudi-Arabia-Expected-to-Raise-Oil-Prices-to-Asia.html |

|

Dow closes nearly 500 points lower Thursday as investors’ recession fears awaken: Live updatesStocks dropped Thursday as investors weighed the latest corporate earnings reports and economic data. Read more at: https://www.cnbc.com/2024/07/31/stock-market-today-live-updates.html |

|

Apple set to report fiscal third-quarter earnings after the bellThis year, the “main event” won’t be Apple’s earnings, it’s what Apple says about the September quarter. Read more at: https://www.cnbc.com/2024/08/01/apple-aapl-earnings-report-q3-2024.html |

|

Amazon earnings are out – here are the numbersAmazon reported earnings after the bell. Here are the results. Read more at: https://www.cnbc.com/2024/08/01/amazon-amzn-q2-earnings-report-2024.html |

|

Markets are clamoring for the Fed to start cutting soon: ‘What is it they’re looking for?’Markets are pricing in an aggressive path for interest rate cuts starting in September. Read more at: https://www.cnbc.com/2024/08/01/markets-are-clamoring-for-the-fed-to-start-cutting-soon-what-is-it-theyre-looking-for.html |

|

Pennsylvania Gov. Shapiro cancels Hamptons trip, days before expected Harris VP revealPennsylvania Gov. Josh Shapiro has canceled a trip to the Hamptons just days before Harris is expected to reveal her VP pick. Read more at: https://www.cnbc.com/2024/08/01/shapiro-harris-vp-reveal-plans.html |

|

Apple reports results after the bell. Here’s what Wall Street is watchingApple’s earnings out after the bell Thursday mark the next big test for a market struggling to recover from its recent tech wreck. Read more at: https://www.cnbc.com/2024/08/01/apple-reports-results-after-the-bell-heres-what-wall-street-is-watching.html |

|

WSJ reporter Evan Gershkovich, ex-Marine Whelan released in U.S., Russia prisoner swapThe swap of American, Russian and German prisoners is the largest such exchange since the Cold War. Read more at: https://www.cnbc.com/2024/08/01/wsj-reporter-evan-gershkovich-ex-marine-whelan-released-in-us-russia-prisoner-swap.html |

|

Putin’s Trader: How Russian hackers stole millions from U.S. investorsThis CNBC documentary is about the rise and fall of Vladislav Klyushin and his business empire. Klyushin was just released from a U.S. prison in a prisoner swap. Read more at: https://www.cnbc.com/2024/08/01/putins-trader-how-russian-hackers-stole-millions-from-us-investors.html |

|

Stocks making the biggest moves midday: Shake Shack, C.H. Robinson, Mobileye Global and moreThese are the stocks posting the largest moves in midday trading. Read more at: https://www.cnbc.com/2024/08/01/stocks-making-the-biggest-moves-midday-shak-chrw-mbly-and-more.html |

|

Kamala Harris has a murky antitrust record. Wall Street sees an opportunityKamala Harris served as California’s attorney general and a senator before becoming the vice president. Read more at: https://www.cnbc.com/2024/08/01/kamala-harris-joe-biden-corporate-regulation-antitrust-election.html |

|

Venu, a $42.99 per month sports streamer, has a tough marketing challenge to find an audienceVenu Sports needs a user who’s willing to pay a hefty monthly subscription, for a narrow segment of media. It’s not clear that user base would materialize. Read more at: https://www.cnbc.com/2024/08/01/venu-sports-challenge-to-find-an-audience.html |

|

Kohl’s bets on Babies R Us as it tries to attract younger families, higher salesKohl’s wants to cater more to young families and give them another reason to visit its stores through the Babies R Us shops. Read more at: https://www.cnbc.com/2024/08/01/babies-r-us-is-back-why-kohls-is-betting-on-babies.html |

|

Elon Musk sued by ex-CNN anchor Don Lemon over canceled X dealThe deal to host “The Don Lemon Show” on X was scrapped after the taping of its premiere episode, a one-on-one interview with Elon Musk. Read more at: https://www.cnbc.com/2024/08/01/elon-musk-don-lemon-lawsuit.html |

|

Stocks & Bond Yields Puke Amid ‘Most Volatile Earnings Season’ Since GFC…well that escalated quickly…

Bad (macro) news was bad news today as jobless claims surged, manufacturing surveys slumped, and construction spending tanked, sending rate-cut expectations higher…

Source: Bloomberg …but apparently prompting growth-scare anxiety that punched US equity markets in the face. Small Caps crashed 4%, Nasdaq 3% and The Dow and S&P down 2%… < … Read more at: https://www.zerohedge.com/markets/stocks-bond-yields-puke-amid-most-volatile-earnings-season-gfc |

|

Hezbollah Chief Vows ‘New Phase’ Of War During Slain Commander’s FuneralHezbollah chief Hassan Nasrallah in a Thursday speech coming on the same day as the funeral of Hezbollah military commander Fuad Shukr – who was slain in an Israeli airstrike on south Beirut on Tuesday – warned that Israel has crossed all “red lines” and thus the war has entered a “new phase”. “The enemy, and those who are behind the enemy, must await our inevitable response,” he said in a speech video link broadcast at Shukr’s funeral. Nasrallah starting years ago broadcasts his messages from secret, high-secure locations, given Israeli intelligence has long sought to track his whereabouts. “You do not know what red lines you crossed,” the Hezbollah leader said in reference to the separate strikes in Beirut and Tehran, the latter which killed Hamas political leader Ismail Haniyeh on Wednesday. Read more at: https://www.zerohedge.com/geopolitical/hezbollah-chief-vows-new-phase-war-during-slain-commanders-funeral |

|

70% Of Students ‘Believe Speech Can Be As Damaging As Physical Violence’: SurveyAuthored by Daniel Isfresne via Campus Reform, A new Knight Foundation-Ipsos study shows a decline in students’ views concerning the state of free speech on college campuses.

The study, released on Tue … Read more at: https://www.zerohedge.com/political/70-students-believe-speech-can-be-damaging-physical-violence-survey |

|

New Video Emerges Of Shooter Running Across Roof As Trump Is SpeakingAuthored by Steve Watson via modernity.news,

A video has emerged of wannabe assassin Thomas Matthew Crooks literally running across the infamous sloped rooftop from which he would subsequently try to kill Donald Trump while the former President was speaking. Rather than army crawling, Crooks can be seen standing straight up and running across the top of the American Glass Research (AGR) building.

|

|

‘Important moment’ as interest rates cut to 5%The Bank of England cuts borrowing costs from 5.25% to 5% in the first drop for more than four years. Read more at: https://www.bbc.com/news/articles/cx72dpxy25do |

|

Interest rates cut… but don’t expect more straight awayRates have been cut, but the message from the Bank of England is not to expect more reductions immediately. Read more at: https://www.bbc.com/news/articles/cz47x527v12o |

|

Royal Mail deal to be probed over potential Russia linksBillionaire Daniel Kretinsky’s takeover will be investigated under the National Security and Investment Act. Read more at: https://www.bbc.com/news/articles/cg647wnypxvo |

|

Ratan Tata to make 450% profit from FirstCry IPO but loss for Sachin TendulkarBillionaire business tycoon Ratan Tata is all set to make multibagger returns of 448.9% or a handsome profit of Rs 2.96 crore in the initial public offering (IPO) of kidswear startup FirstCry. Read more at: https://economictimes.indiatimes.com/markets/ipos/fpos/ratan-tata-to-make-450-profit-from-firstcry-ipo-but-loss-for-sachin-tendulkar/articleshow/112197675.cms |

|

How Nifty gained 1,000 points in just 24 sessionsNifty surged 1,000 points in just 24 sessions as it moved from 24,000 to 25,000. According to ETMarket analysis, it took Nifty roughly 863 trading sessions to gain the last 10,000 points. The slowest 1,000-point increase occurred between 18,000 and 19,000, spanning about 426 sessions. Interestingly, Nifty accumulated the last 2,000 points in only 47 days. (Data Source: ACE Equity) Read more at: https://economictimes.indiatimes.com/markets/stocks/news/nifty-hits-25k-climbs-1000-points-in-just-24-sessions-story-behind-last-10000-points/nifty-surge/slideshow/112188494.cms |

|

Nifty remained positive on 6 occasions in August over past decade; FIIs & DIIs net buyers on seven countsOver the decade spanning 2014 to 2023, the Nifty 50 closed positive on six occasions (2014, 2016, 2018, 2020, 2021, 2022) and negative in the remaining four (2015, 2017, 2019, 2023). The highest gains were seen in 2021 (8.7%), followed by 2022 (3.5%) and 2014 (3%). Conversely, the steepest decline occurred in 2015 (-6.6%), with lesser dips in 2017 (-1.6%), 2019 (-0.9%), and 2023 (-2.5%). Read more at: https://economictimes.indiatimes.com/markets/stocks/news/nifty-remained-positive-on-6-occasions-in-august-over-past-decade-fiis-diis-net-buyers-on-seven-counts/articleshow/112201556.cms |

|

The Dow is dropping. Is bad news on the economy no longer good news for stocks?Bad news for the economy appeared to no longer be good news for stocks. Here’s what changed. Read more at: https://www.marketwatch.com/story/the-dow-is-dropping-is-bad-news-on-the-economy-no-longer-good-news-for-stocks-b0c6611c?mod=mw_rss_topstories |

|

Sinking Treasury yields signal growing jitters about `everything’ ahead of Friday jobs reportYields on U.S. government debt continued to sink on Thursday in a sign of the bond market’s growing nervousness about the overall strength of the economy ahead of Friday’s nonfarm payrolls report for July. Read more at: https://www.marketwatch.com/story/sinking-treasury-yields-signal-growing-jitters-about-everything-ahead-of-friday-jobs-report-a1e43335?mod=mw_rss_topstories |

|

10-year Treasury yield ends below 4% for first time since February after weak ISM manufacturing dataTreasury yields finished at their lowest levels in months on Thursday after a weak reading from the Institute for Supply Management’s manufacturing index gave rise to growth scares in the market. Read more at: https://www.marketwatch.com/story/treasury-yields-nudge-up-from-4-month-lows-as-fed-comments-absorbed-jobs-data-loom-73fc30cf?mod=mw_rss_topstories |