Summary Of the Markets Today:

- The Dow closed up 99 points or 0.24%,

- Nasdaq closed up 2.64%,

- S&P 500 closed up 1.58%,

- Gold $2,495 up $43.40,

- WTI crude oil settled at $78 up $3.70,

- 10-year U.S. Treasury 4.057 down 0.083 points,

- USD index $104.09 down $0.460,

- Bitcoin $65,224 down $946 or 1.43%,

Today’s Highlights:

Nvidia (NVDA) stock experienced a significant rally of nearly 13% on Wednesday, driven by several positive factors<:

- AMD’s strong performance: AMD’s better-than-expected quarterly results and optimistic guidance for the third quarter helped alleviate concerns about the sustainability of the AI trade.

- Morgan Stanley’s bullish call: Analysts at Morgan Stanley designated Nvidia as a ‘Top Pick’ following a recent pullback in the stock price. They maintained an Overweight rating with a price target of $144.

- Big Tech spending on AI infrastructure: Microsoft’s increased spending on data center infrastructure in its latest quarterly results signaled continued investment in AI technology, benefiting chip suppliers like Nvidia and AMD

- Industry-wide rally: Other semiconductor companies, including Broadcom, Micron, Taiwan Semiconductor, ASML, and Super Micro, also saw gains on Wednesday.

The rally came after a period of decline, with Nvidia’s stock having dropped more than 20% from its June peak. Morgan Stanley analysts identified five main factors contributing to the recent decline: spending strategies, competitive pressures, export limitations, supply chain anxieties, and valuation concerns. However, they believe that despite these issues, the earnings environment is likely to remain strong for Nvidia and the AI sector as a whole. Despite recent fluctuations, Nvidia’s stock has shown impressive growth in 2024, rising over 130% year-to-date and significantly outperforming the Nasdaq’s 17% increase. The company is scheduled to release its next quarterly earnings report on August 28, 2024

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our current Economic Forecast – August 2024 Economic Forecast: New Recession Flag

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

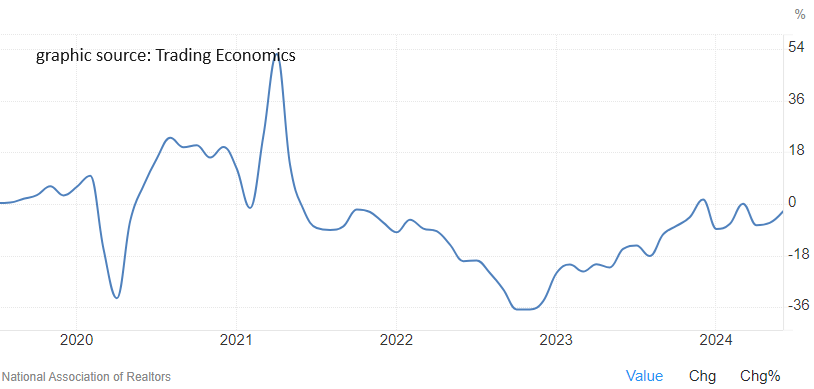

Pending home sales in June 2024 declined 2.6% from the previous year in June of 2024 but better than the 6.6% drop in May. Overall, home sales are down over 25% from 2001 levels. The household growth rate is slightly less than 1% per year since 2001 which means the need for housing should be up 25% from 2001 (not down 25%). NAR Chief Economist Lawrence Yun added:

The rise in housing inventory is beginning to lead to more contract signings. Multiple offers are less intense, and buyers are in a more favorable position.

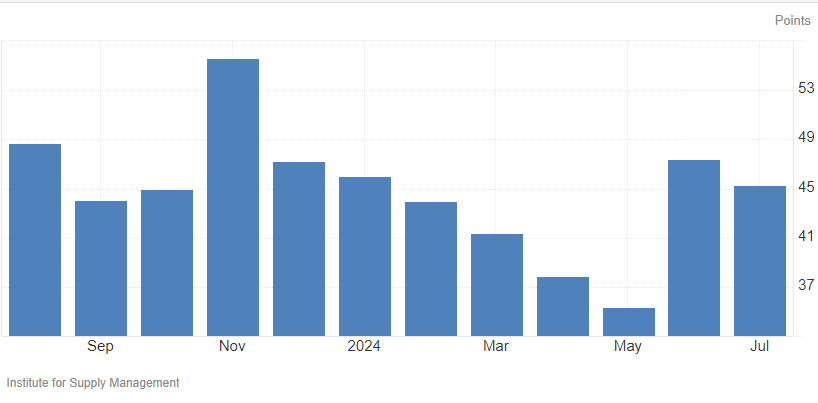

The Chicago Business Barometer, also known as the Chicago PMI, fell to 45.3 in July 2024 from a seven-month high of 47.4 in June. Readings below 50 indicate contraction. This index is viewed as an early indicator the the national ISM manufacturing index which will be released tomorrow. The bottom line is that data continues to indicate that July manufacturing is in a recession.

The Federal Reserve released their FOMC meeting statement for 31 July 2025. The meeting statement seems to suggest that the FOMC is closer to starting a reduction in the federal funds rate. Here is a portion of the statement and you can draw your own conclusion.

Recent indicators suggest that economic activity has continued to expand at a solid pace. Job gains have moderated, and the unemployment rate has moved up but remains low. Inflation has eased over the past year but remains somewhat elevated. In recent months, there has been some further progress toward the Committee’s 2 percent inflation objective.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. The Committee judges that the risks to achieving its employment and inflation goals continue to move into better balance. The economic outlook is uncertain, and the Committee is attentive to the risks to both sides of its dual mandate.

In support of its goals, the Committee decided to maintain the target range for the federal funds rate at 5-1/4 to 5-1/2 percent. In considering any adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks. The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent. In addition, the Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage‑backed securities. The Committee is strongly committed to returning inflation to its 2 percent objective.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals. The Committee’s assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Here is a summary of headlines we are reading today:

- China is Flooding Global Markets with Excess Steel Supply

- Texas Pipeline Congestion Could Throttle U.S. Oil Exports at Critical Time

- U.S. Oil & Gas Sector Methane Emissions 8X Above Industry Target

- Inventory Draw Pushes Oil Up

- Indian Oil’s Profit Tumbles by 81% on Weak Refining Margins

- Brent Breaks Above $80 on Fears of Middle East Escalation

- Powell says September rate cut ‘on the table’ if inflation data continues to cool

- S&P 500 posts best day since February, as Powell points to possible September rate cut: Live updates Live updates

- Nvidia shares soar 13% after Microsoft quells fears that AI buildout is too fast

- Boeing taps aerospace veteran Ortberg to replace Dave Calhoun as CEO

- Stocks making the biggest moves midday: Boeing, Vistra, Match Group and more

- “The Fed Did Not Tip A September Cut, By Any Stretch”: Wall Street Reacts To The FOMC Statement

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Alleged Iranian Arms Deal with Armenia Sparks Controversy in the CaucasusAllegations of Iranian double-dealing are setting the South Caucasus on edge, threatening to disrupt the Armenia-Azerbaijan peace process at a delicate stage. A tangled web of interests among all the players concerned is making it particularly difficult to separate fact from fiction in a supposed arms sale. The intrigue traces its origins to a July 24 report by a UK-based Iranian opposition media outlet, Iran International, alleging that Tehran has sold $500 million worth of arms, including suicide drones, to Armenia. The source for the piece was… Read more at: https://oilprice.com/Geopolitics/International/Alleged-Iranian-Arms-Deal-with-Armenia-Sparks-Controversy-in-the-Caucasus.html |

|

Rio Tinto Eyes Copper Takeover as First-Half Profit RisesRio Tinto’s profit edged up 1.8 percent during the first half of the year, as the miner has begun to consider a takeover in the copper space. While the miner derives most of its profit from iron, it is increasingly focusing on copper thanks to its strong prices. Iron prices have dropped 15 percent since the start of the year, while copper prices have jumped 12 percent. The group’s copper production is on track to grow about two per cent this year, and it aims to deliver a three per cent growth in the field annually until 2028, it said… Read more at: https://oilprice.com/Metals/Commodities/Rio-Tinto-Eyes-Copper-Takeover-as-First-Half-Profit-Rises.html |

|

China is Flooding Global Markets with Excess Steel SupplyVia Metal Miner Would it be an exaggeration to say that the world’s steel narrative is unfolding in China? Everywhere one looks, there are steel industry experts complaining about Chinese steelmakers unloading their excess steel products. Take this report published at nikkei.com, which predicts that China could end the calendar year with a record-high export total, somewhere over 110 million tons (MT). If true, this would be the highest figure since 2015. As the report points out, the country already shipped 53 MT of steel in the first… Read more at: https://oilprice.com/Metals/Commodities/China-is-Flooding-Global-Markets-with-Excess-Steel-Supply.html |

|

Russia To Extend Ban On Gasoline ExportsMoscow has announced it will extend its ban on gasoline exports from August to October, in a bid to offset the growth in domestic demand in spring and summer. “In order to avoid any problems in these months, there will be no lifting of the (gasoline) export ban in August. It was also a fundamental decision for September-October that exports will be limited in order to be insured,” Russian Deputy Energy Minister Pavel Sorokin was quoted by the TASS news agency as saying. Earlier, Bloomberg reported that Russia’s four-week average seaborne… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russia-To-Extend-Ban-On-Gasoline-Exports.html |

|

Texas Pipeline Congestion Could Throttle U.S. Oil Exports at Critical TimePipelines transporting crude from America’s top-producing shale basin to major export hubs in Texas are nearing capacity limits. With US crude production hitting record highs, these pipeline constraints could throttle US oil exports at a time when uncertainty looms in the energy and geopolitical spaces. Bloomberg cites new data from energy researcher East Daley Analytics, which says major pipelines between the Permian Basin and the Port of Corpus Christi pipeline are currently more than 90% full. That number could easily rise to 94% or 95% by the… Read more at: https://oilprice.com/Energy/Crude-Oil/Texas-Pipeline-Congestion-Could-Throttle-US-Oil-Exports-at-Critical-Time.html |

|

Hess Beat Earnings Estimates On Robust Guyana OutputHess Corp. (NYSE:HES) has posted an impressive second-quarter earnings report with its stake in prolific Guyana helping it exceed estimates. Hess reported Q2 2024 non-GAAP EPS of $2.62, beating the Wall Street consensus by $0.07 while revenue of $3.26B was good for a robust 40.5% Y/Y growth although it missed the consensus by $30M. The company saw a large increase in profits: Q2 net income was $757 million, or $2.46 per share, compared with net income of $119 million, or $0.39 per share for Q2 2023 while adjusted net income clocked… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Hess-Beat-Earnings-Estimates-On-Robust-Guyana-Output.html |

|

Russia and Iran to Start Work on Game-Changing Energy CorridorWork on the ‘energy corridor’ that will provide a direct link from Russia to Iran (for gas in the first instance) will begin soon, according to Iran’s Petroleum Minister, Javad Owji, last week. The corridor is now an adjunct project of the US$40 billion four-pronged deal agreed in principle between Russian gas giant Gazprom and the state-owned National Iranian Oil Company (NIOC) in July 2022. This in turn is part of the far-reaching new 20-year comprehensive cooperation deal between Iran and Russia approved on 18 January this… Read more at: https://oilprice.com/Energy/Energy-General/Russia-and-Iran-to-Start-Work-on-Game-Changing-Energy-Corridor.html |

|

U.S. Oil & Gas Sector Methane Emissions 8X Above Industry TargetThe U.S. Oil & Gas sector is producing 8x above the volume of methane many operators have pledged to achieve by 2030 to reach their climate goals, a fresh study by the non-profit Environmental Defense Fund has revealed, as reported by Bloomberg. The environmental advocacy group conducted ~30 flights between June and October of last year, covering oil and gas basins that account for nearly three-quarters of onshore production. The data collected showed that, on average, around 1.6% of gross gas production is released as methane into… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Oil-Gas-Sector-Methane-Emissions-8X-Above-Industry-Target.html |

|

Inventory Draw Pushes Oil UpCrude oil prices today moved slightly higher, after the Energy Information Administration reported an inventory draw of 3.4 million barrels for the week to July 26. The inventory change compared with a draw of 3.7 million barrels for the previous week, when fuel inventories also declined substantially. For the week to July 26, the EIA estimated mixed changes in fuel inventories. Gasoline stocks shed 3.7 million barrels in the period, with production averaging 10 million barrels daily. This compared with a stock draw of 5.6 million barrels for the… Read more at: https://oilprice.com/Energy/Crude-Oil/Inventory-Draw-Pushes-Oil-Up.html |

|

Indian Oil’s Profit Tumbles by 81% on Weak Refining MarginsIndian Oil Corporation, the state-held refining giant, saw its net profit plummet by 81% for the first quarter of the 2024/2025 fiscal year compared to year-ago levels, as lower refining and marketing margins weighed on the financial performance. IndianOil reported a net profit of around $316 million (26.43 billion Indian rupees) for the April to June 2024 quarter, down from $1.64 billion (137.5 billion rupees) for the same quarter of 2023. The state-held company attributed the slump in profits mainly to “reduced refining margins affected… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Indian-Oils-Profit-Tumbles-by-81-on-Weak-Refining-Margins.html |

|

German Energy Giant Uniper Raises Earnings OutlookGerman energy giant Uniper raised on Wednesday its earnings outlook for 2024 after reporting stronger-than-expected financial figures for the first half of the year. Uniper, which the German government had to bail out at the start of the energy crisis in Europe in 2022, said today that it anticipates stronger than previously expected results for the first half of the financial year 2024. Based on preliminary and unaudited figures, Uniper’s adjusted core earnings, or EBITDA, are expected to be in the range of $2 billion-$2.6 billion (1.9 billion… Read more at: https://oilprice.com/Latest-Energy-News/World-News/German-Energy-Giant-Uniper-Raises-Earnings-Outlook.html |

|

Biggest Malaysian State Set to Take Control of Its Natural Gas AssetsSarawak, the biggest state in oil and gas producer Malaysia, is set to take control of its natural gas assets as the state on the Borneo island is now looking for more autonomy from the federal government. The state of Sarawak has long sought more royalties from the government of Malaysia and the government-controlled oil giant Petronas. However, Sarawak hasn’t had much success in this, until the election in 2022, which now makes the federal government coalition dependent on the support of Sarawak Premier Abang Johari Openg. Petroleum Sarawak… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Biggest-Malaysian-State-Set-to-Take-Control-of-Its-Natural-Gas-Assets.html |

|

Saudi Economy Contracts Again as OPEC+ Cuts Weigh on GDPSaudi Arabia’s gross domestic product contracted again in the second quarter compared to year-ago levels, pushed down by an 8.5% dip in oil activities as the Kingdom is cutting oil production as part of the OPEC+ agreement and additional voluntary output curbs. The Saudi economy shrank by 0.4% in the second quarter versus the second quarter of 2023, the flash estimate by the General Authority for Statistics of Saudi Arabia showed on Wednesday. The second quarter saw the fourth consecutive quarter of contraction of Saudi GDP as the world’s… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Saudi-Economy-Contracts-Again-as-OPEC-Cuts-Weigh-on-GDP.html |

|

Brent Breaks Above $80 on Fears of Middle East EscalationBrent Crude prices spent just a few hours below the $80 a barrel mark as tensions in the Middle East flared up again, pushing oil prices up by 2.5% early on Wednesday after the killing of the Hamas political leader in Iran. In morning trade in Europe, Brent Crude prices were rising by 2.51% at $80.50, while the U.S. benchmark, WTI Crude, was rallying by 2.62% to $76.70. Brent had fallen below the $80 per barrel threshold on Tuesday amid continued concerns about oil demand in China. But oil prices rebounded on Wednesday, rallying in morning trade… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Brent-Breaks-Above-80-on-Fears-of-Middle-East-Escalation.html |

|

Oil Prices Soar After Israel Kills Hamas Leader and Hezbollah Senior CommanderGeopolitical risk has well and truly returned to oil markets after Israeli strikes killed Hamas leader Ismail Haniyeh and senior Hezbollah military commander Fuad Shukr. Oil prices spiked immediately on the news and have continued to climb, with WTI rising past $77 and Brent nearing $81. The first of Israel’s two strikes on Tuesday was an airstrike on Beirut targeting Fuad Shukr who Israel claimed was responsible for Saturday’s rocket attack on the Golan Heights which killed 12 civilians, most under the age of 16. Israel’s… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Prices-Soar-After-Israel-Kills-Hamas-Leader-and-Hezbollah-Senior-Commander.html |

|

Powell says September rate cut ‘on the table’ if inflation data continues to coolFed Chair Jerome Powell said Wednesday that central bankers would consider the “totality” of data in determining when to cut. Read more at: https://www.cnbc.com/2024/07/31/powell-says-september-rate-cut-on-the-table-if-inflation-data-continues-to-cool.html |

|

S&P 500 posts best day since February, as Powell points to possible September rate cut: Live updates Live updatesStocks rose Wednesday as investors digested the latest Federal Reserve monetary policy decision. Read more at: https://www.cnbc.com/2024/07/30/stock-market-today-live-updates.html |

|

Meta set to report second-quarter earnings after the bellMeta is expected to show continued improvement in its digital ads business when the company reports earnings on Wednesday. Read more at: https://www.cnbc.com/2024/07/31/meta-earnings-q2-2024.html |

|

Bill Ackman’s Pershing Square withdraws IPO as demand for offering wanedBill Ackman’s Pershing Square USA withdrew its plans for an initial public offering after demand fell below original expectations. Read more at: https://www.cnbc.com/2024/07/31/bill-ackmans-pershing-square-withdraws-ipo-as-demand-for-offering-waned.html |

|

Trading the Fed decision: These stocks could get the biggest boost from lower ratesThese stocks win when short-term interest rates decline, history shows. Read more at: https://www.cnbc.com/2024/07/31/trading-the-fed-decision-these-stocks-could-get-the-biggest-boost-from-lower-rates.html |

|

Nvidia shares soar 13% after Microsoft quells fears that AI buildout is too fastMicrosoft plans to spend even more on Nvidia-based infrastructure next year than it did in 2024. Read more at: https://www.cnbc.com/2024/07/31/nvidia-stock-up-after-microsoft-amd-quell-fears-ai-buildout-too-fast.html |

|

Boeing taps aerospace veteran Ortberg to replace Dave Calhoun as CEOBoeing announced in March that Calhoun would step down by year’s end, part of a broader company shake-up following a door plug blowout in January. Read more at: https://www.cnbc.com/2024/07/31/boeing-taps-former-collins-aerospace-ceo-kelly-ortberg-to-replace-dave-calhoun.html |

|

UAW union endorses Vice President Kamala Harris for president over TrumpUAW President Fain and Trump have been at odds – publicly trading remarks – since the union leader was elected early last year. Read more at: https://www.cnbc.com/2024/07/31/uaw-union-endorses-vice-president-kamala-harris-over-trump.html |

|

Stocks making the biggest moves midday: Boeing, Vistra, Match Group and moreThese are the stocks posting the largest moves in midday trading. Read more at: https://www.cnbc.com/2024/07/31/stocks-making-the-biggest-moves-midday-ba-vst-mtch-and-more.html |

|

Kamala Harris gets support of more than 100 VCs and tech execs in online pledgeIn an online pledge on Wednesday, more than 100 tech investors and entrepreneurs said they are supporting Vice President Kamala Harris in her presidential bid. Read more at: https://www.cnbc.com/2024/07/31/more-than-100-techies-sign-vcs-for-kamala-pledge-backing-vp-harris.html |

|

Trump questions if Harris is Black, downplays Vance pick at Black journalists conventionTrump claimed Harris “became a Black person” and, when asked about his running mate JD Vance, said, “The choice of a vice president makes no difference.” Read more at: https://www.cnbc.com/2024/07/31/trump-black-journalist-convention-nabj.html |

|

Here’s what changed in the new Fed statementThis is a comparison of Wednesday’s Federal Open Market Committee statement with the one issued after the Fed’s previous policymaking meeting in June. Read more at: https://www.cnbc.com/2024/07/31/july-fed-meeting-heres-what-changed-in-the-new-statement.html |

|

The Federal Reserve sets the stage for a rate cut — here’s what that means for your moneyThe Federal Reserve will keep rates where they are, for now — but the first cut in four years is on deck. Read more at: https://www.cnbc.com/2024/07/31/federal-reserve-sets-the-stage-for-rate-cuts-what-that-means-for-you.html |

|

“I’m Not Sure If She’s Indian Or Black”: Trump Zings Kamala, Dodges Barbs As Audience Laughs At Black Journalists ConventionClips are going viral after Donald Trump sat down for an appearance before the National Association of Black Journalists – where he fielded extremely hostile questions from ABC News’ Rachel Scott, and got a rise out of the audience with several answers. “I want to start by addressing the elephant in the room, sir. A lot of people did not think it was appropriate for you to be here today,” said Scott, who then launched into an attack: “You attack Black journalists calling them ‘a loser,’ saying the questions that they asked our quote, ‘stupid and racist.’ You’ve had dinner with a white supremacist at Mar a Lago resort. So my question, sir, now that you were asking black supporters to vote for you, why should black voters trust you, after you have used language like that?” Scott continued. To which Trump replied: “Well, first of all, I don’t think I’ve ever been asked the questi … Read more at: https://www.zerohedge.com/political/im-not-sure-if-shes-indian-or-black-trump-zings-kamala-dodges-barbs-audience-laughs-black |

|

Iran Says Hamas Chief’s Killing Had US Involvement, Blinken Denies ForeknowledgeIran’s Foreign Ministry has issued a fiery statement saying that Washington must also bear responsibility for the Israeli attack which killed Hamas leader Ismail Haniyeh in Tehran in the overnight and early morning hours of Wednesday. “This terrorist act is not only a flagrant violation of the principles and rules of international law and the United Nations Charter, but also a serious threat to regional and international peace and security,” the Iranian Foreign Ministry statement began. “The Islamic Republic of Iran emphasizes the responsibility of the US government as a supporter and accomplice of the Zionist regime in the continuation of the occupation and genocide of the Palestinians, in committing this heinous act of terrorism,” it added.

Hamas leader Ismail Haniyeh and Iranian Supreme Leader Ali Khamenei within 24 hours of the former’s death, Reuters The vague language of general ‘support’ t … Read more at: https://www.zerohedge.com/geopolitical/iran-says-hamas-chiefs-killing-had-us-involvement-blinken-denies-foreknowledge |

|

What’s The Ideal Oil Price For A US President?Authored by Simon Watkins via OilPrice.com,

The world has probably not been in such a pervasively dangerous position since the end of the Second World War, so the question of who leads the world’s leading power has never been more critical. As oil is a crucial determinant of every country’s financial and economic future, it plays a vital role in shaping the domestic and international politics of the world’s major oil producing and consuming countries. And because the stakes are so high, the energy policies of the new U.S. president – Kamala Harris or Donald Trump – will be critical to how wider global events play out in the coming four years. Read more at: https://www.zerohedge.com/energy/whats-ideal-oil-price-us-president |

|

“The Fed Did Not Tip A September Cut, By Any Stretch”: Wall Street Reacts To The FOMC StatementAs the market tries to digest Fed speak, here are some of the fastest Wall Street commentators and strategists piling on with their initial reactions to the FOMC statement, if not Powell’s presser. UBS trader Leo He:

Derek Tang, economist with LH Meyer/Monetary Policy Analytics:

Win Thin, global head of … Read more at: https://www.zerohedge.com/markets/fed-did-not-tip-september-cut-any-stretch-wall-street-reacts-fomc-statement |

|

We’ll have to increase taxes, says ReevesThe chancellor says she will have to raise money through tax after claims of a £22bn hole in the public purse. Read more at: https://www.bbc.com/news/articles/c7290yxw8q4o |

|

Fed holds rates steady as pressure mounts for a cutThe US Federal Reserve said the fight to stabilise prices had made “some” progress. Read more at: https://www.bbc.com/news/articles/cne49gj44w7o |

|

‘I’ll miss winter fuel payments by £2 a week’Pensioners have told of their dismay about missing out on their winter fuel allowance under new rules. Read more at: https://www.bbc.com/news/articles/cv2gykdxvyvo |

|

Tata Motors Q1 Preview: PAT may jump 48% YoY; JLR to put up a decent showTata Motors Q1 Expectations Preview: Analysts expect JLR volumes (excluding China JV) to increase by 9% YoY led by strong growth in Range Rover, Range Rover Sport and Defender model volumes. Overall, revenues (ex China JV) to increase by 6% YoY in 1QFY25. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tata-motors-q1-preview-pat-may-jump-48-yoy-jlr-to-put-up-a-decent-show/articleshow/112166272.cms |

|

Technical Breakout Stocks: How to trade Torrent Power, Suven Pharma and Granules India on ThursdayIndian markets ended higher for the fourth consecutive day, buoyed by positive global signals. Sector-wise, there was buying interest in healthcare, metal, power, and utilities, while energy and real estate stocks experienced selling pressure. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/technical-breakout-stocks-how-to-trade-torrent-power-suven-pharma-and-granules-india-on-thursday/slideshow/112171242.cms |

|

Derivative death trap? 78 lakh F&O traders lost Rs 52,000 crore in FY24, shows Sebi dataTwo decades ago, Warren Buffett had warned that derivatives are nothing but time bombs, both for the parties that deal in them and the economic system. And now Sebi data has proved the ‘God of stocks’ right once again. Read more at: https://economictimes.indiatimes.com/markets/options/derivative-death-trap-78-lakh-fo-traders-lost-rs-52000-crore-in-fy24-shows-sebi-data/articleshow/112169251.cms |

|

Powell says interest-rate cut ‘on the table’ in September if inflation eases againThe Federal Reserve on Wednesday held its benchmark interest rate steady in a range of 5.25% to 5.5%. Read more at: https://www.marketwatch.com/story/fed-holds-rates-steady-wanting-to-see-more-progress-on-inflation-before-cutting-8b0849d5?mod=mw_rss_topstories |

|

Treasury yields end at lowest levels in months after Powell puts possible September rate cut on tableYields on U.S. government debt finished broadly lower on Wednesday, with 2- and 10-year yields reaching their lowest levels in more than four months, after Federal Reserve officials left interest rates unchanged and appeared to lay the groundwork for an interest-rate cut in September. Read more at: https://www.marketwatch.com/story/treasury-yields-steady-ahead-of-federal-reserve-policy-decision-78a0fb3f?mod=mw_rss_topstories |

|

What cash savers and credit-card users can expect if the Fed cuts rates in SeptemberThe Fed stayed put for now, but many see a rate cut coming in September. Read more at: https://www.marketwatch.com/story/what-cash-savers-and-credit-card-users-can-expect-if-the-fed-cuts-rates-in-september-7ddf738f?mod=mw_rss_topstories |