Summary Of the Markets Today:

- The Dow closed up 203 points or 0.50%,

- Nasdaq closed down 1.28%,

- S&P 500 closed down 0.50%,

- Gold $2,405 up $27.50,

- WTI crude oil settled at $75 down $0.69,

- 10-year U.S. Treasury 4.142 down 0.034 points,

- USD index $104.55 down $0.010,

- Bitcoin $65,705 down $1,066 or 1.60%,

Today’s Highlights:

This week’s focus is on three major events:

This week is crucial for investors, featuring the Fed’s interest-rate decision, the July jobs report, and earnings from four of the “Magnificent Seven” mega cap companies. Investors are particularly focused on whether the recent stock pullback has ended and are weighing expectations for rate cuts against concerns about Big Tech’s AI-driven performance. Semiconductor stocks, especially Nvidia, lagged, with Nvidia’s shares dropping significantly. Investors are closely watching Microsoft’s quarterly report, which will be followed by earnings from Apple, Amazon, and Meta. The market is keen to see if substantial AI investments are beginning to yield returns, especially after a volatile July that saw investors shift from Big Tech to small caps. Additionally, Starbucks and AMD are set to report their earnings after the market close. Despite uncertainties surrounding AI, a trend has emerged where investors support companies that post weak results but indicate a positive business outlook. The Fed began its July policy meeting, with expectations that there will be no immediate change in borrowing costs but potential groundwork for a rate cut in September, following encouraging June inflation data.

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our current Economic Forecast – August 2024 Economic Forecast: New Recession Flag

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

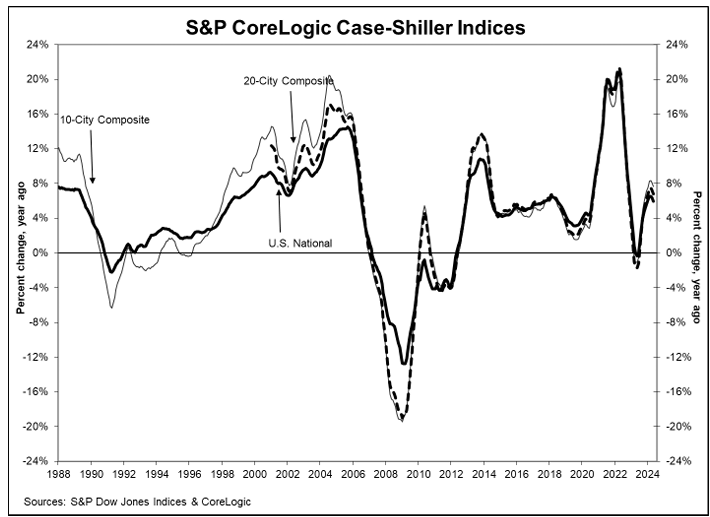

The S&P CoreLogic Case-Shiller U.S. 20-City Composite posted a year-over-year increase of 6.8% in May 2024, dropping from a 7.3% increase in the previous month. New York reported the highest annual gain among the 20 cities with a 9.4% increase in May, followed by San Diego and Las Vegas with increases of 9.1% and 8.6%, respectively. Portland once again held the lowest rank for the smallest year-over-year growth, notching a 1.0% annual increase in May. From CoreLogic’s Dr. Selma Hepp:

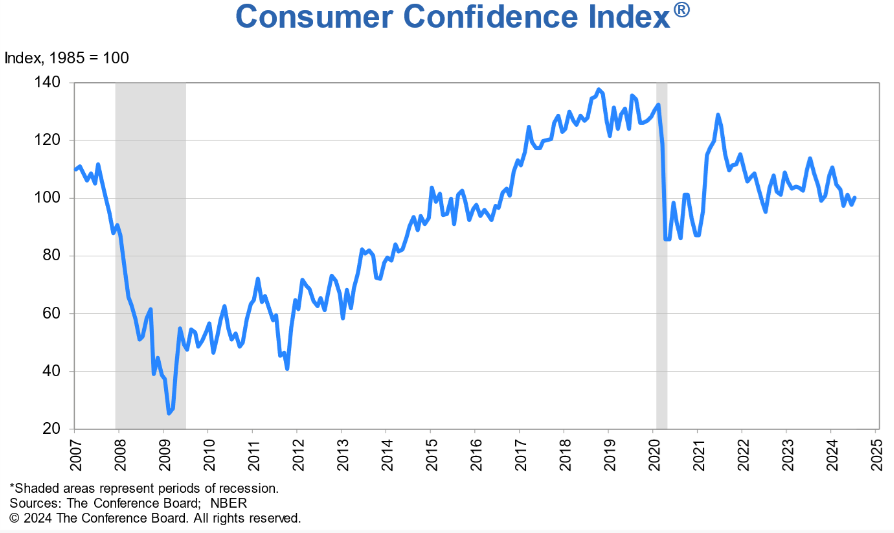

The Conference Board Consumer Confidence Index® rose in July 2024 to 100.3 (1985=100), from a downwardly revised 97.8 in June. Consumer confidence has been little changed over the last 2 years. Dana M. Peterson, Chief Economist at The Conference Board added:

Confidence increased in July, but not enough to break free of the narrow range that has prevailed over the past two years. Even though consumers remain relatively positive about the labor market, they still appear to be concerned about elevated prices and interest rates, and uncertainty about the future; things that may not improve until next year.

The number of job openings was unchanged at 8.2 million on the last business day of June 2024. As the graph below shows, there is a correlation between job openings and employment gains. As the number of job openings is little changed – one would expect little change in employment growth when the July data is released later this week. Over the month, both the number of hires and total separations were little changed at 5.3 million and 5.1 million, respectively.

Here is a summary of headlines we are reading today:

- Aluminum Prices Plummet Despite Green Energy Hype

- Ukraine Targets Another Russian Oil Depot Amid Escalating Conflict

- Phillips 66 Tops Forecasts Despite Profit Slump

- Russia’s Crude Oil Shipments Plunge to 11-Month Low

- Microsoft shares drop as cloud miss overshadows better-than-expected revenue and earnings

- Here’s everything you need to know about the Fed decision coming Wednesday

- JetBlue shares jump 12% after surprise profit, $3 billion aircraft spending deferral

- Three Palestinian Terror Suspects Detained At Southern Border As Agents Lament Lack Of Resources

- Cannabis company Tilray made a huge bet on craft beer. It’s already paying off.

- ‘Social-media companies have failed’: Senate passes bills to protect kids online

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Colombia Struggles With Energy Crisis, Delays in Gas ProjectsColombia’s state oil company, Ecopetrol SA, announced that natural gas from its Caribbean offshore projects is unlikely to start flowing before 2029, two years later than initially expected. This delay is a significant concern for the country, which anticipates a substantial natural gas shortfall beginning next year. The current supply-demand gap is around 12% and is projected to increase to 30% by 2026, exacerbating the energy crisis. To address this, Ecopetrol is investing $300 million this year in offshore drilling, marking its highest annual… Read more at: https://oilprice.com/Energy/Natural-Gas/Colombia-Struggles-With-Energy-Crisis-Delays-in-Gas-Projects.html |

|

Ceres Power’s Fuel Cell Tech Set for Mass Production Through New PartnershipGreen hydrogen and fuel cell specialist Ceres Power has raised its revenue guidance for the year after signing a bumper manufacturing contract with an Asian original equipment manufacturer. The contract, which will see new partner manufacture the Ceres’s patented fuel cell tech in return for a licence fee, will boost revenue at the London listed firm “considerably”, it said. Ceres now expects to post full year earnings of between £50m and 60m when it reports its interim results in September. Revenue for the first half of… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Ceres-Powers-Fuel-Cell-Tech-Set-for-Mass-Production-Through-New-Partnership.html |

|

Aluminum Prices Plummet Despite Green Energy HypeVia Metal Miner After aluminum prices increased in the spring and early summer, bulls became exuberant, believing that “green” initiatives like EVs, renewables, and associated power transmission technology would push the metal price higher. However, contrary to their expectations, the LME price continued to fall steadily since early June, a trend mirrored on China’s SHFE. This decline leaves aluminum buyers unsure about future prices. In fact, many must now question what factors are really driving the market if demand from… Read more at: https://oilprice.com/Metals/Commodities/Aluminum-Prices-Plummet-Despite-Green-Energy-Hype.html |

|

9 of 10 of the World’s Busiest Ports Are in AsiaIn 2024, nine of the world’s 10 busiest ports are located in Asia, underscoring the eastward shift in global trade flows. Due to supply chain shifts and deeper integration, intraregional trade within Asia has grown significantly. In the 1990s, over 70% of Asian exports by value went beyond the region, with containers being shipped back mostly empty. By comparison, roughly 60% of exports in Asia are traded within the region today. This graphic, via Visual Capitalist’s Dorothy Neufeld, shows the busiest ports in the world in 2024, based on… Read more at: https://oilprice.com/Finance/the-Economy/9-of-10-of-the-Worlds-Busiest-Ports-Are-in-Asia.html |

|

Ukraine Targets Another Russian Oil Depot Amid Escalating ConflictIn a continued escalation of hostilities, Ukrainian forces have reportedly targeted another Russian oil depot, this time in the Kursk region. The attack, confirmed by Ukraine’s General Staff, resulted in a significant fire at the facility located in Vozy settlement. This strike follows a pattern of Ukrainian military actions aimed at disrupting Russia’s energy infrastructure. According to reports, the operation involved a coordinated effort by Ukraine’s Security Service and other forces. The Kursk region, known for its strategic importance in Russia’s… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Ukraine-Targets-Another-Russian-Oil-Depot-Amid-Escalating-Conflict.html |

|

Pew Research: Americans Divided on U.S. Role in Russia-Ukraine WarThe United States on July 29 announced two assistance packages for Ukraine valued at $1.7 billion. White House National Security Council spokesman John Kirby said the presidential package, valued at up to $200 million, will include air-defense interceptors, munitions for HIMARS, artillery and mortar rounds, and Javelin and other anti-tank missiles. The U.S. Defense Department also announced $1.5 billion through the security-assistance-initiative funds. The resources will “augment Ukraine’s air defense” through long-range firing capability and anti-tank… Read more at: https://oilprice.com/Geopolitics/International/Pew-Research-Americans-Divided-on-US-Role-in-Russia-Ukraine-War.html |

|

Glencore To Announce Decision on Potential Coal Demerger Next WeekGlencore expects to announce next week its decision on whether it would spin off its coal and carbon steel materials business, the mining and commodity trading giant said on Tuesday. Earlier this month, after receiving the final regulatory approval for the acquisition of Elk Valley Resources (EVR), the coal business of Teck Resources, Glencore said that “we will shortly commence a consultation process to assess shareholder views regarding the potential demerger of the combined coal and carbon steel materials business.” In Glencore’s… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Glencore-To-Announce-Decision-on-Potential-Coal-Demerger-Next-Week.html |

|

What’s the Ideal Oil Price for a U.S. President?The world has probably not been in such a pervasively dangerous position since the end of the Second World War, so the question of who leads the world’s leading power has never been more critical. As oil is a crucial determinant of every country’s financial and economic future, it plays a vital role in shaping the domestic and international politics of the world’s major oil producing and consuming countries. And because the stakes are so high, the energy policies of the new U.S. president – Kamala Harris or Donald Trump… Read more at: https://oilprice.com/Energy/Energy-General/Whats-the-Ideal-Oil-Price-for-a-US-President.html |

|

Phillips 66 Tops Forecasts Despite Profit SlumpAs widely expected, the second-quarter profit of Phillips 66 (NYSE: PSX) came in significantly lower than the year-ago period, but one of the biggest U.S. refiners beat analyst estimates as high capacity utilization and strong midstream and chemicals earnings partially offset weaker refining margins. Phillips 66 reported on Tuesday adjusted earnings of $984 million for the second quarter, down from $1.77 billion for the same period of 2023. Adjusted earnings per share fell to $2.31 in Q2 2024 from $3.87 EPS for the second quarter last year. Despite… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Phillips-66-Tops-Forecasts-Despite-Profit-Slump.html |

|

BP Scales Back Biofuels Projects, Focuses on High Oil Demand into the 2040sOil giant BP reported a stronger-than-expected net profit for the second quarter and raised its divided despite earlier warnings of lower refining margins. The oil major posted underlying replacement profit – a sign of the firm’s profit were it not for unexpected or unusual expenses – of $2.8 (£2.2bn), beating analyst expectations of $2.6bn (£2bn). As a result the energy firm announced an increase to its dividend of 10 per cent and hiked its share buyback programme to the fourth quarter. The results come despite what… Read more at: https://oilprice.com/Energy/Crude-Oil/BP-Scales-Back-Biofuels-Projects-Focuses-on-High-Oil-Demand-into-the-2040s.html |

|

UAE Raises Capacity at Offshore Oilfield as It Aims for 5 Million Bpd by 2027Abu Dhabi’s national oil company ADNOC has raised the production capacity at one of its offshore oilfields by 25% using AI technology as the United Arab Emirates looks to boost its total crude oil production capacity to 5 million barrels per day (bpd) by 2027. ADNOC’s offshore Satah Al Razboot (SARB) field has seen a 25% jump in production capacity to 140,000 bpd, through the implementation of advanced digital technologies, the state company of the UAE, one of OPEC’s largest producers, said on Tuesday. ADNOC has implemented remote… Read more at: https://oilprice.com/Latest-Energy-News/World-News/UAE-Raises-Capacity-at-Offshore-Oilfield-as-It-Aims-for-5-Million-Bpd-by-2027.html |

|

Russia’s Crude Oil Shipments Plunge to 11-Month LowRussian seaborne crude oil exports have dropped to their lowest level since August 2023, as Russia’s refinery runs are rising and Moscow is working to comply with its OPEC+ production quota, tanker-tracking data monitored by Bloomberg showed on Tuesday. The four-week average crude shipments from Russia’s export terminals dropped in the four weeks to July 21 to the lowest level since August of 2023, according to the data reported by Bloomberg’s Julian Lee. The estimated four-week average of the shipments in the week to July 21… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russias-Crude-Oil-Shipments-Plunge-to-11-Month-Low.html |

|

Brent Breaks Below $80 as Bearish Sentiment Continues to Dominate Oil MarketsOil prices continued to fall on Tuesday morning, ignoring the rising geopolitical risk in the Middle East and the potential of a supply disruption in Venezuela. Concerns about global demand continue to drive bearish sentiment in oil markets. – The Q2 quarterly earnings season has continued this week with most of oil majors reporting their performance results, with TotalEnergies and BP providing no clear direction for where oil firms are headed.- Total’s net income underperformed market expectations of $4.95 billion and came in at $4.7… Read more at: https://oilprice.com/Energy/Energy-General/Brent-Breaks-Below-80-as-Bearish-Sentiment-Continues-to-Dominate-Oil-Markets.html |

|

BP Boosts Dividend as Q2 Earnings Top EstimatesBP (NYSE: BP) raised its dividend by 10% and extended its buyback program as it booked better-than-expected earnings for the second quarter of the year. The UK-based supermajor reported on Tuesday $2.8 billion in underlying replacement cost profit – the metric closest to net profit – for April to June, up from $2.7 billion for the previous quarter. The earnings were also higher than the $2.59 billion for the second quarter of 2023, and ahead of the analyst consensus of $2.54 billion. Compared with the first quarter of 2024, the result… Read more at: https://oilprice.com/Latest-Energy-News/World-News/BP-Boosts-Dividend-as-Q2-Earnings-Top-Estimates.html |

|

Motiva to Restart Gasoline-Producing Unit at Port Arthur RefineryMotiva Enterprises, the owner of the second biggest refinery in the United States – Port Arthur in Texas – expects to restart the gasoline-producing fluidic catalytic cracker (FCC) at the facility on Tuesday, sources with knowledge of the plant operations told Reuters. Last week, Motiva Enterprises shut on Wednesday the 81,000-barrel-per-day FCC unit to repair a leak. The unit is just one of several cracker and distillation units at the 626,000-bpd refinery. On Monday, Motiva Enterprises restarted production at the 200,000-bpd VPS-4… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Motiva-to-Restart-Gasoline-Producing-Unit-at-Port-Arthur-Refinery.html |

|

Microsoft shares drop as cloud miss overshadows better-than-expected revenue and earningsMicrosoft reported earnings after the bell. Here are the results. Read more at: https://www.cnbc.com/2024/07/30/microsoft-msft-q4-earnings-report-2024.html |

|

S&P 500, Nasdaq close lower Tuesday as investors dump tech before big earnings reports: Live updatesInvestors digested numerous key earnings releases and looked to the beginning of the Federal Reserve’s policy meeting. Read more at: https://www.cnbc.com/2024/07/29/stock-market-today-live-updates.html |

|

Stellantis to offer broad buyouts to U.S. salaried workers, warns of possible layoffsThe automaker, which reported disappointing first-half results, said that if not enough its employees take buyouts, involuntary terminations could follow. Read more at: https://www.cnbc.com/2024/07/30/stellantis-buyouts-us-salaried-workers.html |

|

Here’s everything you need to know about the Fed decision coming WednesdayThis week’s Federal Reserve meeting is not much about the present but potentially very much about the future. Read more at: https://www.cnbc.com/2024/07/30/federal-reserve-decision-on-wednesday-what-you-need-to-know.html |

|

Surging AI data center demand will benefit these dividend-paying real estate stocks, says Moody’sMoody’s says data center capacity will need to more than double by 2028 to meet its forecast. Read more at: https://www.cnbc.com/2024/07/30/surging-ai-data-center-demand-will-benefit-these-dividend-paying-real-estate-stocks-says-moodys.html |

|

Starbucks is about to report earnings. Here’s what to expectStarbucks’ stock has tumbled 21% this year, fueled by concerns about weaker demand for its coffee in the U.S. and China. Read more at: https://www.cnbc.com/2024/07/30/starbucks-sbux-q3-2024-earnings.html |

|

Harris Atlanta rally will test her momentum on the ground in a key swing stateVice President Kamala Harris’ rally in Atlanta at 7:00 p.m. ET could be her biggest presidential campaign event since President Joe Biden dropped out. Read more at: https://www.cnbc.com/2024/07/30/harris-atlanta-rally-rsvp-megan-thee-stallion.html |

|

CrowdStrike shares plunge 11% to lowest level of the year on report that Delta may seek damagesCrowdStrike shares fell after CNBC reported on Monday that Delta hired an attorney to seek compensation following the July 19 global IT outage. Read more at: https://www.cnbc.com/2024/07/30/crowdstrike-shares-plunge-11percent-on-report-that-delta-may-seek-damages.html |

|

JetBlue shares jump 12% after surprise profit, $3 billion aircraft spending deferralJetBlue is deferring more Airbus planes to save money Read more at: https://www.cnbc.com/2024/07/30/jetblue-shares-second-quarter-surprise-profit.html |

|

Shapiro backs ‘aggressive’ corporate tax cuts in Pennsylvania as Harris campaign vets him for VPVice President Kamala Harris is vetting Pennsylvania Gov. Josh Shapiro to be her running mate against Donald Trump and Ohio Sen. JD Vance. Read more at: https://www.cnbc.com/2024/07/30/shapiro-harris-veepstakes-yellen-tax-filing.html |

|

Extreme heat is prompting higher home cooling costs. It is also putting some individuals at riskSummer heat recently brought a new hottest day on record. Experts say adapting to new higher temperatures won’t be easy. Read more at: https://www.cnbc.com/2024/07/30/record-breaking-summer-heat-waves-prompt-higher-home-cooling-costs.html |

|

The 10 worst states to retire in the U.S.—No. 1 isn’t California or New YorkOne state ranks as the worst state to retire for the third year in a row, according to Bankrate’s latest study. Here are the 10 worst states to retire in 2024. Read more at: https://www.cnbc.com/2024/07/30/worst-states-to-retire-in-the-us.html |

|

Bella Hadid ‘shocked’ at ‘lack of sensitivity’ in Adidas ad campaign linked to 1972 Munich OlympicsHadid said that she was not aware of the historical events of the 1972 Munich Olympics, and that she would not have taken part in the campaign had she known. Read more at: https://www.cnbc.com/2024/07/30/bella-hadid-breaks-silence-on-adidas-campaign-linked-to-1972-munich-olympics.html |

|

The Global Backdrop Is BananasBy Michael Every of Rabobank The market focus is this week’s confluence of Fed, BOJ, and BOE meetings. However, if you think there is room for uncertainty there, consider the global backdrop which they operate in – which is bananas, both in terms of the headlines and the banana skins it presents for policymakers. In Europe, it’s ongoing sabotage in France and Germany, and self-sabotage in Brussels. EU trade negotiators are planning for a ‘tariff-ic’ Trump presidency by offering a quick deal to buy more –(checks notes) “lobsters”– to put a dent in the vast bilateral trade deficit; or the EU will slap up to 50% tariffs on US imports – faster and higher than vs. China. Yet in a three-way Mexican stand-off between the US, EU, and China, a two-gunned EU is pointing one pistol at the US, and the other at its own head: The Good, The Bad, and the Smugly. As Michael Pettis notes, the EU trade surplus with the US is structural, so more US lobsters means fewer other imports as demand is fixed. Moreover, the US exports commodities to Europe –is the EU going to tariff LNG?!– while Europe exports luxuries, and autos and pharma that can be Made in America. Europe could shift to military Keynesianism and import US weapons to re-arm – but oddly won’t; yet Trump also decides whether to back NATO or leave a defenseless Europe to fend for itself. Does one need special training as a trade negotiator not to see these obvious facts, or th … Read more at: https://www.zerohedge.com/markets/global-backdrop-bananas |

|

Kremlin Tells Venezuelan Opposition To ‘Accept Defeat’, Warns Against US InterferenceThe Kremlin on Tuesday issued a message to the Venezuelan opposition, saying it must accept that its candidate Edmundo Gonzalez lost the election that Nicolas Maduro has won a third term, after the results were certified by the country’s National Electoral Council. No less than nine Latin American countries, including Argentina, Brazil, and Mexico have questioned the result or at least have shown some hesitancy to immediately recognize it. But Moscow has responded: “We see that the opposition does not want to accept its defeat. But we believe it must do so,” according to the words of Putin spokesman Dmitry Peskov. Peskov further warned other global power against interfering in Venezuela’s internal politics. The statement came within 24 hours of Maduro delivering a televised speech wherein he warned an externally-sponsored ‘color revolution’ is afoot. Read more at: https://www.zerohedge.com/geopolitical/kremlin-tells-venezuelan-opposition-accept-defeat-warns-against-us-interference |

|

Maduro Tells Brazil He’ll Soon Release Ballot Records To World; Opposition Official ArrestedUpdate(1425ET): The Brazilian administration of Luiz Inácio Lula da Silva had as of Monday said he wouldn’t congratulate Venezuela’s Maduro for now following Sunday’s election. “The Brazilian government welcomes the peaceful nature of yesterday’s [Sunday’s] elections in Venezuela and is following the counting process closely,” a statement had said. Maduro has responded to the leftist leader, saying he’ll release election data with full transparency to the world:

At this moment, no less than nine … Read more at: https://www.zerohedge.com/geopolitical/venezuela-election-protests-spread-maduro-claims-us-backed-color-revolution-driving |

|

Three Palestinian Terror Suspects Detained At Southern Border As Agents Lament Lack Of ResourcesThree Palestinian terror suspects were detained at the Southern Border earlier this month, the New York Post reported this week. The report says the terrorists were “found to have possible ties to terrorist organizations”. One migrant had photos on his phone that included a “masked man holding an AK-47 rifle”, according to law enforcement. The Post stated that Federal authorities in the San Diego sector apprehended three Palestinians and a Turkish migrant, all suspected of terror group ties. These individuals were among dozens of migrants who surrendered to border agents, sources said. An investigation into the migrants is ongoing. They have been transferred to ICE, and the FBI’s Joint Terrorism Task Force is involved. This incident highlights security threats entering the US via the southern border, especially in San Diego, according to the Post. Overwhelmed Border Patrol agents, lacking tools to fully vet migrants, rely mainly on US terror watchlists and resources, without access to international databases. One agent said: “Knowing who these guys are, we have, like, no access to anything international. Like, we really don’t and it kind of sucks.” Read more at: https://www.zerohedge.com/markets/three-palestinian-terror-suspects-detained-southern-border-agents-lament-lack-resources |

|

‘We’ll have to increase taxes’, says ReevesThe chancellor says she will have to raise money through tax after claims of a £22bn hole in the public purse. Read more at: https://www.bbc.com/news/articles/c7290yxw8q4o |

|

Wrongly convicted postmasters set for immediate £200k under new dealNew scheme offers immediate redress to those impaced by the Post Office scandal. Read more at: https://www.bbc.com/news/articles/c51yd9qg7qyo |

|

Microsoft apologises after thousands report new outageMicrosoft said it was looking at a ‘network infrastructure’ issue impacting its services. Read more at: https://www.bbc.com/news/articles/c903e793w74o |

|

Breakout Stocks: How to trade Colgate, BPCL and Jindal Saw in next sessionThe Indian stock markets experienced volatility throughout the trading session on Tuesday, but bulls drove the index higher toward the close. The S&P BSE Sensex gained 100 points, and the Nifty50 finished 21 points higher at 24,857 Read more at: https://economictimes.indiatimes.com/markets/stocks/news/technical-breakout-stocks-how-to-trade-colgate-palmolive-india-bpcl-and-jindal-saw-on-wednesday/slideshow/112145167.cms |

|

Mahindra and Mahindra Q1 Preview: Revenue may rise 16% YoY, but profit seen mutedMahindra and Mahindra experienced strong revenue growth in Q1 FY25, driven by impressive results in the tractor and automotive sectors. While revenues increased by 16% year-on-year, profits remained flat or declined by up to 14%. Analysts noted better EBITDA margins due to a favorable mix, despite higher advertisement expenses for new model launches. Read more at: https://economictimes.indiatimes.com/markets/stocks/earnings/mahindra-and-mahindra-q1-preview-revenue-may-rise-16-yoy-but-profit-seen-muted/articleshow/112133473.cms |

|

Households losing Rs 60,000 cr a year on derivative bets: BuchA Sebi study had earlier pointed to 90 per cent of the trades resulting in losses. The capital markets regulator also came up with a consultation paper on Tuesday proposing ways to limit the activity. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/households-losing-rs-60000-cr-a-year-on-derivative-bets-buch/articleshow/112144272.cms |

|

AMC, buoyed by Taylor Swift and Beyoncé success, will show Usher’s concert filmAMC Entertainment Holdings Inc. will again look to tap into customer appetite for concert films when the movie-theater chain shows “Usher: Rendezvous in Paris” in September. Read more at: https://www.marketwatch.com/story/amc-buoyed-by-taylor-swift-andbeyonce-success-will-show-ushers-concert-film-ad6aa03a?mod=mw_rss_topstories |

|

Cannabis company Tilray made a huge bet on craft beer. It’s already paying off.Tilray’s U.S.-listed stock rallied 10% after better-than-expected quarterly sales and a 2025 revenue outlook that’s ahead of estimates. Read more at: https://www.marketwatch.com/story/tilray-placed-a-huge-bet-on-craft-beers-heres-how-thats-going-for-the-cannabis-company-5e316415?mod=mw_rss_topstories |

|

‘Social-media companies have failed’: Senate passes bills to protect kids onlineThe Senate passed two child online-safety bills Tuesday with an unusual degree of bipartisan support, but they may not pass the House for a while. Read more at: https://www.marketwatch.com/story/social-media-companies-have-failed-senate-passes-bills-to-protect-kids-online-fe6141fc?mod=mw_rss_topstories |