Summary Of the Markets Today:

- The Dow closed down 49 points or 0.12%,

- Nasdaq closed up 0.07%,

- S&P 500 closed up 0.08%,

- Gold $2,381 up $0.30,

- WTI crude oil settled at $76 down $1.26,

- 10-year U.S. Treasury 4.170 down 0.029 points,

- USD index $104.56 up $0.240,

- Bitcoin $67,297 down $947 or 1.39%,

Today’s Highlights:

This week’s focus is on three major events:

- The Federal Reserve’s interest rate decision on Wednesday

- The July nonfarm payrolls report on Friday

- Earnings reports from major tech companies

While no change in interest rates is expected from the Fed meeting, investors are looking for signals about potential rate cuts later in the year. The jobs report is anticipated to show some weakening in the labor market, which could influence future rate decisions. Earnings reports from tech giants Apple, Microsoft, Amazon, and Meta are highly anticipated, especially given the recent stock sell-off following earlier “Magnificent Seven” results. Over 150 S&P 500 companies are set to report earnings this week, providing a broad view of the economic landscape. The market’s performance comes after a strong rally on Friday, driven by encouraging inflation data that bolstered expectations for future interest rate cuts. However, the recent volatility and tech sector sell-off have left investors cautious about potential surprises that could challenge the fragile market rally.

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our current Economic Forecast – July 2024 Economic Forecast: One Recession Flag Removed But Little Indication The Economy Is Strengthening

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

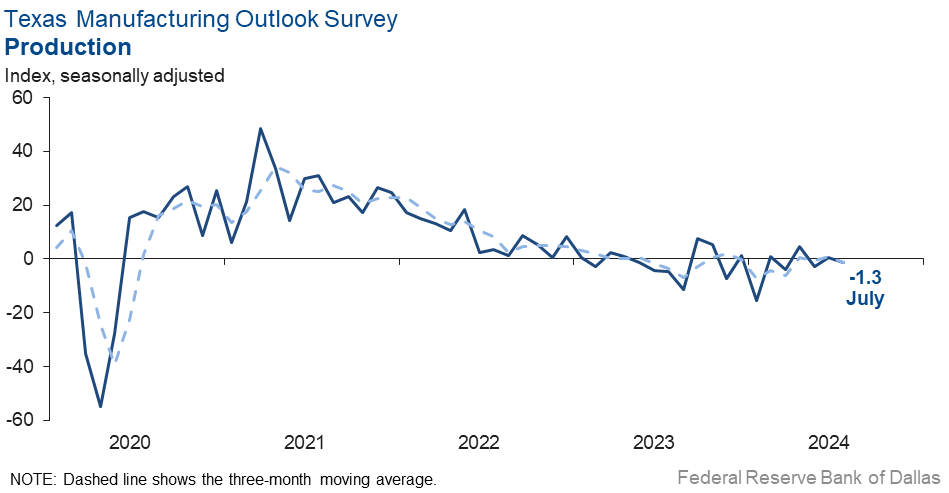

The Texas Manufacturing Outlook Survey’s production index, a key measure of state manufacturing conditions, held fairly steady at -1.3, with the near-zero reading signaling little change in output from June 2024. The new orders index dropped 12 points to -12.8 in July, signaling a pullback in demand. The capacity utilization and shipments indexes also slipped, falling to -10.0 and -16.3, respectively. Manufacturing in the U.S. continues to be weak – and likely will be in a recession in July 2024.

Here is a summary of headlines we are reading today:

- Has Global Oil Production Already Peaked?

- New Gas Discovery Brings Optimism for Bolivia’s Energy Future

- WTI Sheds Over 2% As Goldman Sachs Heralds U.S. Crude Output Growth

- Weak Demand in China Weighs on Middle East Oil Price Outlook

- Ukraine Targets Russian Energy Infrastructure in Retaliatory Drone Strikes

- China’s Top Grid Operator Plans Record $83 Billion Investment in 2024

- Apple releases first preview of its long-awaited iPhone AI

- Investors are punishing stocks that miss earnings more than normal this season

- Ford, GM, Stellantis face a daunting second half of 2024

- Bitcoin moves toward $70,000 then dips as investors digest political developments: CNBC Crypto World

- McDonald’s earnings, revenue miss estimates as consumer pullback worsens

- Treasury Estimates $1.3 Trillion In Borrowing Needs For The Remainder Of 2024

- Treasury sharply cuts third-quarter borrowing estimate

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Has Global Oil Production Already Peaked?The news agency Reuters has seen something the rest of us haven’t: Internal Mexican government estimates of that country’s future oil production which paint a gloomy picture of rapid decline after 2030. Is this admission just the tip of the iceberg? For many years those of us suggesting that a peak in worldwide oil production was in the offing kept pointing to several pieces of intelligence including the following: Leaks of information about lower-than-publicly-stated oil reserves among major oil producers. In 2005, leaked internal government documents… Read more at: https://oilprice.com/Energy/Crude-Oil/Has-Global-Oil-Production-Already-Peaked.html |

|

Thai EV Subsidies Wreak Havoc on Domestic Auto MarketIt isn’t just in Europe and the U.S. where the EV industry is seeing jolting effects of Chinese EVs entering their respective markets. It looks like the industry in Thailand has accidentally also set off chaos in their home market by offering subsidies to Chinese EV makers, a move that Nikkei Asia reports is “wreaking havoc” in Thailand. The unintended consequences of EV subsidies have also affected supply chains, with at least a dozen parts producers shutting down as subsidized Chinese EV makers avoid buying from most of them. Since the… Read more at: https://oilprice.com/Energy/Energy-General/Thai-EV-Subsidies-Wreak-Havoc-on-Domestic-Auto-Market.html |

|

New Gas Discovery Brings Optimism for Bolivia’s Energy FutureBolivia’s announcement last week of a sizeable gas discovery has stoked optimism that the landlocked South American nation can arrest declining production and boost reserves, although further exploration work is needed to assess reservoir potential, with a prognosed fast-track development in as little as two years appearing optimistic. State player YPFB last week announced successful completion of its stratigraphic research well, Mayaya Centro-X1 IE, which it said hit a significant hydrocarbon volume equivalent to around 1.7 trillion cubic… Read more at: https://oilprice.com/Energy/Natural-Gas/New-Gas-Discovery-Brings-Optimism-for-Bolivias-Energy-Future.html |

|

WTI Sheds Over 2% As Goldman Sachs Heralds U.S. Crude Output GrowthU.S. benchmark crude oil, West Texas Intermediate (WTI) shed over 2% on Monday, shortly after Goldman Sachs said US crude would account for 60% of non-OPEC output growth this year. At 1:13 p.m. ET on Monday, WTI was trading down 2.13% at $75.52, while Brent crude was trading down 2.02% at $79.49, moving away from its $80 marker. Oil prices are likely responding to the conflict in the Middle East, with Israel on Monday saying it would seek to avoid a full-blown regional war in the wake of a deadly Hezbollah strike on the Golan Heights… Read more at: https://oilprice.com/Latest-Energy-News/World-News/WTI-Sheds-Over-2-As-Goldman-Sachs-Heralds-US-Crude-Output-Growth.html |

|

UK’s Energy Market to Embrace Flexibility for a Cleaner FutureOfgem has pushed ahead with plans to increase the flexibility of the UK’s energy market as it becomes more reliant on intermittent sources of energy, like wind and solar. In a statement this morning, the energy regulator launched a consultation on a proposed Flexibility Market Asset Registration (FMAR), which would provide a single point of registration for flexible assets like EVs and heat pumps. Currently, Flexibility Service Providers must sign up multiple times for individual markets. Moving to a centralised system would eliminate a lot… Read more at: https://oilprice.com/Energy/Energy-General/UKs-Energy-Market-to-Embrace-Flexibility-for-a-Cleaner-Future.html |

|

Spain To Spend $18B on 300 Clean Energy ProjectsThe Spanish government has authorized the construction of nearly 300 clean energy projects with a capacity of more than 28 gigawatts, representing a combined investment worth over 17 billion euros ($18.4 billion). The projects are part of the country’s goal to raise the share of renewables in its energy mix to 81% of the total by 2030, up from about 50% now. Spain has set some of the ambitious clean energy targets in Europe. Last year, Spain reaffirmed its goal to close all its nuclear plants by 2035, with the management of radioactive… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Spain-To-Spend-18B-on-300-Clean-Energy-Projects.html |

|

Weak Demand in China Weighs on Middle East Oil Price OutlookThings have taken a bad turn for the Middle East. Asia, by far the largest demand hub for Saudi Arabia, Iraq or the United Arab Emirates, seems to be going through the same stage of weakness that Europe and the United States were in the spring. Not buying enough, depleting crude inventories and generally expecting flat prices to drop lower before they come back. Perhaps there is no better example of this than China, a country that was supposed to lead summer demand recovery yet ended up buying the least crude this year as its maritime imports dropped… Read more at: https://oilprice.com/Energy/Crude-Oil/Weak-Demand-in-China-Weighs-on-Middle-East-Oil-Price-Outlook.html |

|

India Plans To Raise Oil Refining Capacity to 6.2 Million Bpd by 2028India expects to boost its refining capacity by around one-fifth to have 6.19 million barrels per day (bpd) of crude processing capacity by 2028, according to its junior petroleum minister. The rise in refining capacity will be needed to meet growing domestic fuel demand, Reuters quoted on Monday junior petroleum minister Suresh Gopi as saying in a written reply to lawmakers. Separately, Gopi said that the country’s strategic petroleum reserve can cover India’s crude oil consumption for 9.5 days. India, the world’s third-largest… Read more at: https://oilprice.com/Latest-Energy-News/World-News/India-Plans-To-Raise-Oil-Refining-Capacity-to-62-Million-Bpd-by-2028.html |

|

Asian LNG Imports Set for Six-Month High in JulyAsia is on track to import this month the highest level of LNG since January as demand grows despite rising spot LNG prices in the region. Asia’s LNG imports are expected to stand at 24.85 million metric tons in July, the highest level in six months, and higher than the June imports, although prices have increased in recent months, per data compiled by Kpler and cited by Reuters columnist Clyde Russell. China and India are expected to see higher LNG imports in July compared to June, although Indian purchases tend to be much more price-sensitive… Read more at: https://oilprice.com/Energy/Energy-General/Asian-LNG-Imports-Set-for-Six-Month-High-in-July.html |

|

Ukraine Targets Russian Energy Infrastructure in Retaliatory Drone StrikesUkraine launched a wave of drone strikes deep inside Russian territory early on July 29, damaging energy facilities in two regions, Russia’s Defense Ministry and regional officials said a day after a reported Ukrainian attack set a Russian oil refinery on fire. In the western Russian region of Oryol, a power plant was damaged by falling debris from two downed Ukrainian drones over the Glazunovsky district, regional Governor Andrey Klychkov said on Telegram. “Emergency services are dealing with the consequences of the air attack, and law enforcement… Read more at: https://oilprice.com/Energy/Energy-General/Ukraine-Targets-Russian-Energy-Infrastructure-in-Retaliatory-Drone-Strikes.html |

|

OPEC: Oil Is Indispensable for Global ElectrificationOil and petroleum-based products are indispensable in the process of increasing electrification and expansion of power grids globally, OPEC Secretary General Haitham Al Ghais said on Monday, noting that the energy mix is not a zero-sum game. The head of OPEC criticized claims that there would be only one winner in the drive to “electrify everything”. “OPEC does not believe that energy sources are locked in a zero-sum game; nor can the history of energy be reduced to a succession of ‘energy replacement events,’”… Read more at: https://oilprice.com/Latest-Energy-News/World-News/OPEC-Oil-Is-Indispensable-for-Global-Electrification.html |

|

Texas Oil Regulator Opens Probe After Earthquakes Hit the PermianThe Railroad Commission of Texas, the oil regulator in America’s top oil-producing state, has opened a probe after a series of earthquakes hit the Permian basin last week. Last week, dozens of tremors were registered in counties close to oil and gas operations in Texas. West Texas was hit by several earthquakes, the largest measuring 5.1 on the Richter scale. After the series of quakes, the Railroad Commission is investigating wells in which operators have injected salty water that comes out of oil wells. The so-called disposal wells within… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Texas-Oil-Regulator-Opens-Probe-After-Earthquakes-Hit-the-Permian.html |

|

Traders Dump Oil as Bearish Sentiment BuildsGrowing concerns about China’s economy and oil demand prompted traders to head for the exit and reduce their net long positions in both key benchmarks last week. Speculators reduced their net long position – the difference between bullish and bearish bets – in ICE Brent by 37,541 lots over the latest reporting week to July 23, leaving them with a net long of 146,349 lots as of last Tuesday, ING’s commodities strategists Warren Patterson and Ewa Manthey wrote in a note on Monday. Traders also dumped WTI Crude, with the net… Read more at: https://oilprice.com/Energy/Energy-General/Traders-Dump-Oil-as-Bearish-Sentiment-Builds.html |

|

U.S. Freeport LNG Back to Full Output After Hurricane-Related ShutdownFreeport LNG, the second-largest U.S. liquefied natural gas export facility, is on track to return to full LNG production, pulling in more than 2 billion cubic feet (bcf) of natural gas on Sunday, according to data from LSEG reported by Reuters. The export plant has been offline for most of July after shutting down on July 7 ahead of the landfall of Hurricane Beryl in Texas. Since the export facility became first operational, Freeport LNG’s exports have been crucial for the market observers watching global LNG availability. Last week, Europe’s… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Freeport-LNG-Back-to-Full-Output-After-Hurricane-Related-Shutdown.html |

|

China’s Top Grid Operator Plans Record $83 Billion Investment in 2024The State Grid Corporation of China, which covers over 80% of the country’s power grid, has raised its planned investments for this year to a record-high of $82.7 billion (600 billion Chinese yuan) to boost transmission lines from the key renewable-generation centers to demand hotspots. The corporation has recently lifted by 13% its budget spending for 2024, according to the Economic Information Daily cited by Bloomberg. China is looking to ease grid bottlenecks as soaring capacity installations of solar and wind power need to be connected… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Chinas-Top-Grid-Operator-Plans-Record-83-Billion-Investment-in-2024.html |

|

Apple releases first preview of its long-awaited iPhone AIApple on Monday released the first version of Apple Intelligence. Read more at: https://www.cnbc.com/2024/07/29/apple-releases-apple-intelligence-its-long-awaited-ai-features.html |

|

McDonald’s executives admit diners think prices are too high, say they’re working to create valueMcDonald’s executives acknowledged that the company’s prices have been high and they are taking a “forensic approach” to evaluating offerings. Read more at: https://www.cnbc.com/2024/07/29/mcdonalds-earnings-executives-say-prices-are-too-high.html |

|

Investors are punishing stocks that miss earnings more than normal this seasonThe market is rewarding positive earnings surprises less than average and punishing negative surprises more than usual, according to FactSet. Read more at: https://www.cnbc.com/2024/07/29/investors-are-punishing-stocks-that-miss-earnings-more-than-normal-this-season.html |

|

Ford, GM, Stellantis face a daunting second half of 2024The U.S. market – a profit engine for most automakers – is normalizing after years of record high prices, low vehicle inventories and resilient demand. Read more at: https://www.cnbc.com/2024/07/29/ford-gm-stellantis-face-daunting-second-half.html |

|

Yields on cash are likely to drop. Put money to work here instead, Janus Henderson saysFor investors who need to get out of cash but have cold feet about adding duration, short-term bonds might be a nice incremental step. Read more at: https://www.cnbc.com/2024/07/29/yields-on-cash-are-likely-to-drop-invest-here-instead-janus-henderson-says.html |

|

The first Fed interest rate cut in years is on the horizon. Here’s what homeowners, buyers need to knowThe first Fed rate cut is becoming more certain, and rates are expected to decline throughout the year. Read more on what owners and buyers should know. Read more at: https://www.cnbc.com/2024/07/29/how-to-know-if-you-should-refinance-your-mortgage-or-buy-a-house.html |

|

New Vanguard CEO says improving customer experience is a ‘very high’ priority and AI could helpSalim Ramji comes to Vanguard from rival BlackRock, making him the first outsider CEO for the roughly $9 trillion asset manager. Read more at: https://www.cnbc.com/2024/07/29/new-vanguard-ceo-says-improving-customer-experience-is-a-very-high-priority.html |

|

Bitcoin moves toward $70,000 then dips as investors digest political developments: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, CNBC Crypto World brings you highlights from former President Donald Trump’s speech over the weekend at Bitcoin 2024 in Nashville and Rep. Ro Khanna discusses crypto regulation from the conference. Read more at: https://www.cnbc.com/video/2024/07/29/bitcoin-moves-toward-70000-then-dips-investors-digest-political-developments-cnbc-crypto-world.html |

|

AT&T, other phone companies sued over stolen nude images could face liability after court rulingCompanies like AT&T and T-Mobile have skirted liability when workers allegedly stole nude images from customer phones, but that may change after a court ruling. Read more at: https://www.cnbc.com/2024/07/29/att-sued-over-nude-images-from-customer-phone.html |

|

Temu and Shein’s soaring popularity has Wall Street eyeing China’s influence on tech earningsThough they’re not based in the U.S., Temu and Shein have captured the attention of Wall Street because of their potential impact on U.S. tech companies. Read more at: https://www.cnbc.com/2024/07/29/temu-shein-soaring-popularity-could-hit-amazon-meta-ebay-earnings.html |

|

McDonald’s earnings, revenue miss estimates as consumer pullback worsensMcDonald’s stock has fallen 15% year to date, dragging its market value down to $181.2 billion. Read more at: https://www.cnbc.com/2024/07/29/mcdonalds-mcd-q2-2024-earnings.html |

|

Fast-food chains battle for low-income diners with summer value mealsMcDonald’s, Burger King and Taco Bell are among the fast-food chains with $5 value meals this summer. Read more at: https://www.cnbc.com/2024/07/28/value-meals-mcdonalds-wendys-burger-king-vie-for-low-income-diners.html |

|

UK finance chief says public finances show $28 billion spending hole, cuts road and rail projectsBritain’s Finance Minister Rachel Reeves warned “difficult decisions” were still to come on spending, welfare and tax. Read more at: https://www.cnbc.com/2024/07/29/uk-finance-chief-says-public-finances-show-28-billion-spending-hole.html |

|

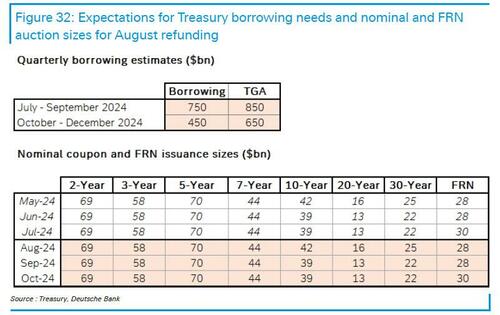

Treasury Estimates $1.3 Trillion In Borrowing Needs For The Remainder Of 2024Ahead of today’s big event – the Treasury borrowing estimates publication – we said not to expect any fireworks and also that unlike recent spikes, the most likely range of calendar Q3 and Q4 borrowing estimates is $750BN for the July-September quarter and $450BN for the October-December quarter (which assumes a year-end cash balance of $650 billion).

And at exactly 3:00pm the Treasury published the anticipated numbers, which came close to our estimates for Q3, but well above our forecast for Q4, specifically:

|

|

The Most Chilling Words Today: I’m From NewsGuard & I’m Here To Rate YouAuthored by Jonathan Turley, Recently, I wrote a Hill column criticizing NewsGuard, a rating operation being used to warn users, advertisers, educators and funders away from media outlets based on how it views the outlets’ “credibility and transparency.” Roughly a week later, NewsGuard came knocking at my door. My blog, Res Ipsa (jonathanturley.org), is now being reviewed and the questions sent by NewsGuard were alarming, but not surprising.

I do not know whether the sudden interest in my site was prompted by my column. Read more at: https://www.zerohedge.com/political/most-chilling-words-today-im-newsguard-im-here-rate-you |

|

Apple AI Release Reportedly Delayed Until After iOS 18 Update, Seen As ‘Atypical Strategy’Apple Intelligence will not be included in the September iOS 18 and iPadOS 18 update. Instead, according to Bloomberg, citing sources familiar with internal discussions at the world’s most valuable company, the new artificial intelligence features will be rolled in the weeks and months ahead.

It’s crucial to note that the new AI features will miss the all-important September update, signaling that engineers need additional time to fix bugs. Here’s more from Bloomberg:

|

|

Conservative Professor Disciplined For Criticizing DEI Gets $2.4 Million To Settle Lawsuit Against CollegeBy Jennifer Kabbany of The College Fix

A Bakersfield College professor who was investigated and disciplined after he questioned the use of grant money to fund social justice initiatives at his school has agreed to a $2.4 million settlement to resolve his lawsuit.

Matthew Garrett, formerly a tenured history professor at the California community college, will receive $2,245,480 divided into monthly payments for the next 20 years as well as an immediate one-time payment of $154,520 as “compensation for back wages and medical benefits since [his] dismissal,” according to the July 10 settlement agreement. Also under the ter … Read more at: https://www.zerohedge.com/political/conservative-professor-disciplined-criticizing-dei-gets-24-million-settle-lawsuit-against |

|

Winter fuel payments scrapped for millionsRachel Reeves says there is a “black hole” in the public finances due to “unfunded” overspends by the previous government. Read more at: https://www.bbc.com/news/articles/cx02zdd92zdo |

|

McDonald’s to ‘rethink’ prices after sales fallSales at the fast food giant slip 1% as cost-conscious customers spend less. Read more at: https://www.bbc.com/news/articles/c728313zkrjo |

|

Crackdown on scam calls imitating UK phone numbersThe regulator says new rules will help prevent millions of people falling victim to phone fraud. Read more at: https://www.bbc.com/news/articles/c29dwl5e5zjo |

|

UltraTech says it has no intention to delist India CementsUltraTech Cement does not intend to delist shares of India Cements after it acquires additional stake in the company through an open offer, the company said on Monday. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/ultratech-says-it-has-no-intention-to-delist-india-cements/articleshow/112113353.cms |

|

Adani to return to equity market with transmission business share sale, sources sayAdani Energy Solutions, led by billionaire Gautam Adani, is likely to launch a share sale this week to raise more than $600 million, two sources with direct knowledge of the matter told Reuters on Monday. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/adani-to-return-to-equity-market-with-transmission-business-share-sale-sources-say/articleshow/112112957.cms |

|

Technical Breakout Stocks: How to trade FDC, Bandhan Bank and Tata Motors on Tuesday?Indian markets witnessed profit taking on Monday after hitting fresh record highs. Benchmark indices pared gains to close flat but with a positive bias.The S&P BSE Sensex touched a high of 81,908 while the Nifty50 hit a record high of 24,999. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/technical-breakout-stocks-how-to-trade-fdc-bandhan-bank-and-tata-motors-on-tuesday/market-summary/slideshow/112112006.cms |

|

Treasury-market rally heads for longest monthly stretch since 2021U.S. government debt rallied on Monday, leaving Treasurys on pace for a third straight monthly gain, as traders braced for an anticipated start to the Federal Reserve’s rate-cutting cycle in September. Read more at: https://www.marketwatch.com/story/bond-yields-dip-as-crucial-week-for-fixed-income-market-kicks-off-4c869236?mod=mw_rss_topstories |

|

Oil prices settle lower, erasing brief jump sparked by Israel-Hezbollah tensionsOil futures settled lower Monday, stretching their losses in the wake of three consecutive weekly declines as prices failed to hold on to early gains stemming from fears of a wider conflict between Israel and Hezbollah. Read more at: https://www.marketwatch.com/story/oil-prices-drift-lower-erasing-brief-jump-sparked-by-israel-hezbollah-tensions-27d3cd72?mod=mw_rss_topstories |

|

Treasury sharply cuts third-quarter borrowing estimateThe Treasury Department said Monday it expects to borrow $740 billion in the third quarter, which is $106 billion less than estimated three months ago. Read more at: https://www.marketwatch.com/story/treasury-sharply-cuts-third-quarter-borrowing-estimate-1571436a?mod=mw_rss_topstories |