Summary Of the Markets Today:

- The Dow closed down 533 points or 1.29%, (Closed at 40,665, New Historic high 41.376)

- Nasdaq closed down 0.70%,

- S&P 500 closed down 0.78%,

- Gold $2,446 down $14.30,

- WTI crude oil settled at $82 down $0.61,

- 10-year U.S. Treasury 4.197 up 0.052 points,

- USD index $104.19 up $0.44,

- Bitcoin $63,589 down $502 or 0.78%,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our current Economic Forecast – July 2024 Economic Forecast: One Recession Flag Removed But Little Indication The Economy Is Strengthening

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

The July 2024 Philly Fed Manufacturing Business Outlook Survey‘s indicator for general activity rose 13 points to 13.9, and the indexes for shipments and new orders turned positive. The employment index also turned positive, suggesting an overall increase in employment levels. Both price indexes continued to indicate overall price increases. Most future activity indicators rose, suggesting more widespread expectations for overall growth over the next six months. If you are a fan of surveys, then you gotta believe manufacturing activity is growing. I am a skeptic as I see retail sales flat and imports rising – these as significant headwinds to manufacturing.

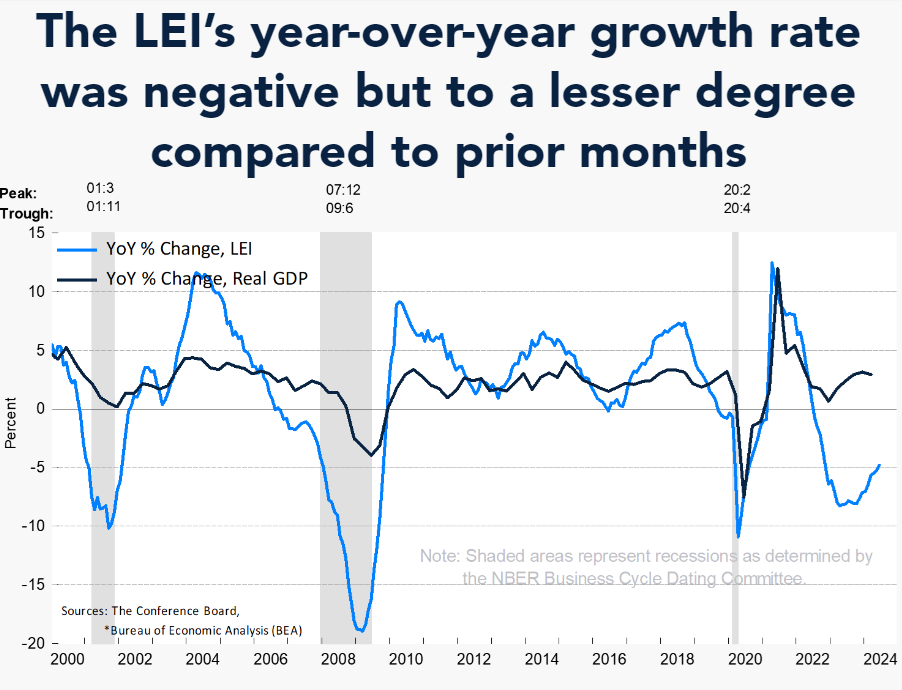

The Conference Board Leading Economic Index® (LEI) for the U.S. declined by 0.2 percent in June 2024 to 101.1 (2016=100), following a decline of 0.4 percent (upwardly revised) in May. Over the first half of 2024, the LEI fell by 1.9 percent, a smaller decrease than its 2.9 percent contraction over the second half of last year. Note that The Conference Board lately has been providing the doomiest view of the economy. An explanation by Justyna Zabinska-La Monica, Senior Manager, Business Cycle Indicators, at The Conference Board:

The US LEI continued to trend down in June, but the contraction was smaller than in the past three months. The decline continued to be fueled by gloomy consumer expectations, weak new orders, negative interest rate spread, and an increased number of initial claims for unemployment. However, due to the smaller month-on-month rate of decline, the LEI’s long-term growth has become less negative, pointing to a slow recovery. Taken together, June’s data suggest that economic activity is likely to continue to lose momentum in the months ahead. We currently forecast that cooling consumer spending will push US GDP growth down to around 1 percent (annualized) in Q3 of this year.

In the week ending July 13, the advance figure for seasonally adjusted initial unemployment claims 4-week moving average was 234,750, an increase of 1,000 from the previous week’s revised average. The previous week’s average was revised up by 250 from 233,500 to 233,750. Although initial claims are modestly trending up, it is well within the values expected in a growing economy.

CoreLogic’s US Annual Rental Price Growth Rate for single-family rents rose by 3.2% year over year in May 2024, the highest rate of growth since April 2023. May’s annual rent growth was generally in line with numbers recorded over the decade before the pandemic.

Here is a summary of headlines we are reading today:

- SunPower Shares Crash Nearly 40% On Work Stoppage

- China’s Grip on Rare Earth Industry Tightens as Prices Drop

- Oil Prices Hold Gains As US Jobs Data Appears to Support Rate Cuts

- Can the U.S. Avoid an Energy Crisis?

- China’s Surging Commodity Exports Suggest Weak Domestic Demand

- Netflix beats estimates as ad-supported memberships rise 34%

- Bye-bye bitcoin, hello AI: Texas miners leave crypto for next new wave

- New multi-billion dollar deal adds to rising trend of bitcoin miners moving to AI: CNBC Crypto World

- NBA sends media terms to Warner Bros. Discovery, officially starting five-day match period

- OpenAI debuts mini version of its most powerful model yet

- ‘Inflationary’ tariffs by U.S. could upset expectations for multiple Fed rate cuts

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

NATO Wrestles with Chinese Influence in Member StatesIn a NATO summit in Washington centered on the war in Ukraine and extending support to Kyiv, the Western military alliance also took aim at China for being “a decisive enabler of Russia’s war” by supplying Moscow with dual-use products. Finding Perspective: Beijing promptly batted away the label as “lies and smears” but the criticism continued to mount in Washington. NATO has steadily increased its focus on China over the last several years, with Beijing’s support for Moscow amid its full-scale invasion of Ukraine marking a tipping point for the… Read more at: https://oilprice.com/Energy/Energy-General/NATO-Wrestles-with-Chinese-Influence-in-Member-States.html |

|

SunPower Shares Crash Nearly 40% On Work StoppageSunPower Corp. has suspended new solar installations and halted shipments, causing its stock to plunge by nearly 40% in afternoon trading. The solar company informed dealers that starting September 17, it will not support new leases, power purchase agreements (PPA) sales, or new project installations. This decision, outlined in a letter included in a research note from Roth MKM, signals severe operational challenges for SunPower. Analysts and market observers reacted sharply to the announcement. Pol Lezcano, an analyst with BloombergNEF, remarked,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/SunPower-Shares-Crash-Nearly-40-On-Work-Stoppage.html |

|

Canada’s Climate Policies Criticized by Oil Sector and Environmentalists AlikeCanada is trying to perform a high wire act between maintaining its reputation as one of the world’s most climate-conscious superpowers on one side, and its position as one of the world’s largest and most powerful producers of fossil fuels on the other side. Canada has set some of the most ambitious decarbonization targets of any country on Earth. But it is also the fourth-largest oil producing nation, and actively expanding the industry’s reach and production. Indeed, the Canadian oil industry is having a banner… Read more at: https://oilprice.com/Energy/Crude-Oil/Canadas-Climate-Policies-Criticized-by-Oil-Sector-and-Environmentalists-Alike.html |

|

China Pulls out of Cyprus’ First LNG Import Terminal Under Cash CrunchChina-based CPP-Metron Consortium has pulled out of a contract with the government of Cyprus for the construction of what was to be the island’s first natural gas import terminal, claiming non-payment by the government, the Associated Press reported on Thursday. According to the consortium, the government has failed to honor its commitments despite promising to do so in a March meeting chaired by President Nikos Christodoulides. “No contractor can be expected to work indefinitely on credit,” the consortium said, as cited… Read more at: https://oilprice.com/Latest-Energy-News/World-News/China-Pulls-out-of-Cyprus-First-LNG-Import-Terminal-Under-Cash-Crunch.html |

|

China’s Grip on Rare Earth Industry Tightens as Prices DropRare earth mineral companies in China have been stung by declining prices at the same time the government “tightens its grip” on the industry, according to Nikkei Asia. Companies like Rising Nonferrous Metals, a rare-earth miner listed in Shanghai, are losing money this year, a stark contrast to last year’s profitability. The company is blaming “drastic slide in sales prices of its major rare-earth products,” according to the report. They sell dysprosium, terbium and didymium, a mix of neodymium and praseodymium. This company belongs to central… Read more at: https://oilprice.com/Energy/Energy-General/Chinas-Grip-on-Rare-Earth-Industry-Tightens-as-Prices-Drop.html |

|

Hurricane Beryl Aftermath Sees 10 Cargoes Canceled at Freeport LNGUnnamed trading sources told Bloomberg on Thursday that loading through August had been canceled for at least 10 cargoes at Freeport LNG’s gas export terminal in Texas after the facility was shut down following Hurricane Beryl. Traders not authorized to speak publicly on the matter told Bloomberg that the figure could rise further since the facility is not yet operating at full capacity. Preliminary data from BloombergNEF revealed that gas flows delivered by pipeline into Freeport on Tuesday were less than a third of normal volumes.… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Hurricane-Beryl-Aftermath-Sees-10-Cargoes-Canceled-at-Freeport-LNG.html |

|

UK Government Invests £2.5 Billion in Sustainable Steel ManufacturingVia Metal Miner According to an official with the country’s new government, an additional £2.5 billion ($3.2 billion) will be made available for the UK steel manufacturing sector. This is in addition to the amount the government has already pledged for new furnaces at Tata Steel’s Port Talbot site. “There is a better deal available for Port Talbot and for the steel industry as a whole, I’m sure of that,” newly appointed Business Secretary John Reynolds said on July 7 during the BBC political show “Sunday… Read more at: https://oilprice.com/Metals/Commodities/UK-Government-Invests-25-Billion-in-Sustainable-Steel-Manufacturing.html |

|

Oil Prices Hold Gains As US Jobs Data Appears to Support Rate CutsOil was trading down slightly on Thursday but largely holding onto its gains from the previous day, which saw the U.S. benchmark rally over 2.9%. American jobs data are feeding cautiously into optimism that the Federal Reserve remains on track for rate cuts, and another big drawdown in U.S. crude inventories lends further support to crude prices. On Thursday at 11:19 a.m. ET, Brent crude was trading at $84.63, down 0.53%, while WTI was holding onto its gains for the most part at $82.46, down 0.47%, maintaining the narrowing Brent-WTI… Read more at: https://oilprice.com/Energy/Oil-Prices/Oil-Prices-Hold-Gains-As-US-Jobs-Data-Appears-to-Support-Rate-Cuts.html |

|

First Major Windfarm in U.S. Shut After IncidentThe Vineyard Wind offshore project has been temporarily shut down following a turbine blade failure that resulted in debris washing ashore on Nantucket Island. The U.S. Bureau of Safety and Environmental Enforcement (BSEE) is collaborating with Vineyard Wind to determine the cause of the incident, which has posed potential hazards to beachgoers during the peak summer tourist season. A BSEE spokesperson confirmed that no injuries were reported, but operations have been halted until further notice. This incident is a significant setback for Vineyard… Read more at: https://oilprice.com/Latest-Energy-News/World-News/First-Major-Windfarm-in-US-Shut-After-Incident.html |

|

Utilities Must Adapt, Not Just Respond To Extreme WeatherAfter electricity is restored in Houston, people may ask with respect to future electricity reliability: what’s next? Well, in Houston we would characterize Centerpoint’s response as being more or less typical for a regulated utility. The hurricane disrupted and damaged the local grid and the utility moved to restore power with much outside assistance asap in line with standard industry practice. So what’s the problem? The problem is: what happens after the next hurricane or the one after that? Utility executives all around the… Read more at: https://oilprice.com/Energy/Energy-General/Utilities-Must-Adapt-Not-Just-Respond-To-Extreme-Weather.html |

|

Is It Time for National Oil Companies to Renter the M&A Game?National oil companies (NOCs) have been sitting on the sidelines of the latest merger frenzy in the industry, but the time may be right for these state-owned giants to return to spending on expansion via acquisitions, Wood Mackenzie said in a new report. The NOCs have seen their share of spending on mergers and acquisitions (M&As) collapse to the lowest level in 20 years, but a push for diversification among Middle Eastern state oil giants and energy security issues in China may prompt state-held players to look at international expansion… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Is-It-Time-for-National-Oil-Companies-to-Renter-the-MA-Game.html |

|

Can the U.S. Avoid an Energy Crisis?Authored by Danny Ervin via RealClearEnergy, I am generally pessimistic about the future of the U.S. due to recent energy policies at the federal and state levels that favor “green” energy technologies, primarily solar and wind. These policies often distort the economics of power production, leading to a massive misallocation of capital and overinvestment in unreliable solar and wind projects. Reliable electricity supply requires consistency every second of the day, not just minute-by-minute, but also over weeks, months, and years. My past… Read more at: https://oilprice.com/Energy/Energy-General/Can-the-US-Avoid-an-Energy-Crisis.html |

|

OPEC+ Panel Not Expected to Propose Changes to Oil Output PolicyThe Joint Ministerial Monitoring Committee (JMMC), the OPEC+ panel monitoring the oil market, is not expected to recommend in August any changes to the current production policy plan of the group, OPEC+ delegates told Bloomberg on Thursday. The JMMC panel meets more frequently than the OPEC+ ministers and typically observes the most recent market developments and, if necessary, recommends a course of action to the ministerial meetings. The JMMC meetings are currently being held every two months, with the previous taking place… Read more at: https://oilprice.com/Latest-Energy-News/World-News/OPEC-Panel-Not-Expected-to-Propose-Changes-to-Oil-Output-Policy.html |

|

China’s Surging Commodity Exports Suggest Weak Domestic DemandChina’s copper, diesel, and alumina exports soared in June compared to the same month of 2023, with copper exports surging to a record high as sluggish domestic demand amid weaker-than-expected economic growth is weighing on Chinese commodities consumption. Last month, Chinese copper exports jumped by 187% to an all-time high, per official Chinese data reported by Bloomberg. Diesel exports soared by 180% as domestic demand is weak on the back of the property crisis with tepid demand in the construction sector and sluggish fuel demand… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Chinas-Surging-Commodity-Exports-Suggest-Weak-Domestic-Demand.html |

|

Russia Discusses Boosting Electricity Exports to ChinaRussia and China are discussing the possibility of Russia increasing its electricity exports to China, but taking into account the growing power demand in Russia’s Far East, the Russian Energy Ministry has said. A Russian-Chinese working group for cooperation on electricity and renewable energy met on Wednesday and discussed the idea of Russia boosting its power supply to China, as reported by Russian news agency Interfax on Thursday. Russia and China have strengthened energy ties in recent years, especially after the Russian invasion of… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russia-Discusses-Boosting-Electricity-Exports-to-China.html |

|

Biden under intense pressure from Democrats to drop out of election against TrumpPresident Joe Biden to date has flatly rejected calls to exit the 2024 election contest against Donald Trump. Read more at: https://www.cnbc.com/2024/07/18/biden-under-democrat-pressure-to-drop-out-against-trump.html |

|

Netflix beats estimates as ad-supported memberships rise 34%Netflix reported earnings after the bell. Here are the results. Read more at: https://www.cnbc.com/2024/07/18/netflix-nflx-earnings-q2-2024.html |

|

Dow slides more than 500 points, S&P 500 closes lower in sharp sell-off Thursday: Live updatesThe Nasdaq Composite slipped Thursday, as the tech-heavy benchmark failed to rebound from its worst session since 2022. Read more at: https://www.cnbc.com/2024/07/17/stock-market-today-live-updates.html |

|

Can Boeing get back to its glory days?Boeing’s leaders say they have charted a path forward to fix the company. They still have plenty of people to convince. Read more at: https://www.cnbc.com/2024/07/18/boeing-path-forward.html |

|

Greater risk is paying off for these tax-free bonds. Here’s how they may fit into your portfolioHigh-yield municipal bonds had a strong first half, according to Bank of America. Read more at: https://www.cnbc.com/2024/07/18/greater-risk-is-paying-off-for-these-tax-free-bonds.html |

|

Federal appeals court blocks Biden’s new student loan relief planA federal appeals court issued an order temporarily halting the Biden administration from implementing its new student loan repayment plan. Read more at: https://www.cnbc.com/2024/07/18/federal-appeals-court-blocks-bidens-new-save-student-loan-relief-plan.html |

|

Bye-bye bitcoin, hello AI: Texas miners leave crypto for next new waveIn the race to power AI, bitcoin miners are teaming up with energy infrastructure companies in search of new ways to generate returns on their hefty investments. Read more at: https://www.cnbc.com/2024/07/18/bye-bye-bitcoin-hello-ai-texas-miners-leave-crypto-for-next-new-wave.html |

|

New multi-billion dollar deal adds to rising trend of bitcoin miners moving to AI: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Ryan Condron, CEO of Lumerin, discusses the role bitcoin mining plays in stabilizing power grids strained by AI data centers. Read more at: https://www.cnbc.com/video/2024/07/18/new-multi-billion-dollar-deal-adds-to-rising-trend-of-bitcoin-miners-moving-to-ai-cnbc-crypto-world.html |

|

Ford to spend $3 billion to expand large truck production to a plant previously set for EVsThe new plans include investing about $3 billion to expand Super Duty production, including $2.3 billion at the Canadian plant, Ford said Thursday. Read more at: https://www.cnbc.com/2024/07/18/ford-canada-large-truck-production.html |

|

Penn lays off about 100 employees as it focuses on ESPN Bet growthInvestors are impatient for Penn to demonstrate its muscle with the rebranded sportsbook — a $2 billion partnership with Disney’s ESPN. Read more at: https://www.cnbc.com/2024/07/18/penn-layoffs-espnbet-growth.html |

|

Inside evolving FIFA 2026 World Cup plan to cash in on the rise of high-end sports tourismThe 2026 World Cup is expected to be one of the most in-demand sports tickets of all-time, and there will be plenty of high-end hospitality packages available. Read more at: https://www.cnbc.com/2024/07/18/fifa-2026-world-cup-plan-to-cash-in-on-high-end-sports-tourism.html |

|

NBA sends media terms to Warner Bros. Discovery, officially starting five-day match periodWarner Bros. Discovery has received the terms of the NBA’s new media rights framework, allowing the company to use its matching rights on a package of games. Read more at: https://www.cnbc.com/2024/07/18/nba-media-rights-warner-bros-discovery-match-period.html |

|

OpenAI debuts mini version of its most powerful model yetOpenAI on Thursday launched a new AI model, “GPT-4o mini,” the artificial intelligence startup’s latest effort to expand use of its popular chatbot. Read more at: https://www.cnbc.com/2024/07/18/openai-4o-mini-model-announced.html |

|

Secret Service ‘Appalled’ By Criticism Of Female Agents After Attempted Trump AssassinationInstead of admitting to facilitating an assassination attempt on Donald Trump last Saturday, either through ‘malice or massive incompetence,’ the US Secret Service is ‘appalled’ that people are criticizing their decision to place short, incompetent women on Trump’s security detail.

Evan Vucci / AP In a statement to NBC News, Secret Service spox Anthony Guglielmi lashed out at critics, saying “We stand united against any attempt to discredit our personnel and their invaluable contributions to our mission and are appalled by the disparaging and disgusting comments against any of our personnel.” “It is an insult to the women of our agency to imply that the … Read more at: https://www.zerohedge.com/political/secret-service-appalled-anti-dei-rhetoric-over-female-agents-after-attempted-trump |

|

China Had Persistent Access to US, Allied Networks For Years: White House OfficialAuthored by Andrew Thornebrooke via The Epoch Times (emphasis ours), Hackers in communist China maintained persistent access to U.S. and allied systems for multiple years, a Biden administration official has said.

An unnamed Chinese hacker uses a computer at an office in Dongguan, in Guangdong Province, China, on Aug. 4, 2020. (Nicolas Asfouri/AFP via Getty Images) The cyber campaign appears to be part of a wider effort by the Chinese Communist Party (CCP) to prepare attacks on critical infrastructure, according to Israel Soong, director for East Asia and Pacific cyber policy at the National Security Council. In the event of a conflict, China intended to use its cyber access to “ … Read more at: https://www.zerohedge.com/geopolitical/china-had-persistent-access-us-allied-networks-years-white-house-official |

|

CBDC: Creating Shortages With Full ShelvesAuthored by Paul Cwik via The Mises Institute, Of all the areas that economics students need to master, counterfactual reasoning is near the top of the list. Counterfactual reasoning is outlining and comparing the differences and similarities between two alternatives. While everyone uses counterfactual reasoning, such as choosing what to have for lunch, economists look at deeper and more remote consequences. A typical example that students are asked to examine is the effects of price controls — what happens when a price ceiling is imposed below the equilibrium price versus what happens in a free market? The most obvious answer is that shortages develop. People quickly buy as many items as possible while suppliers hesitate to restock. Shortages are politically unpopular. A cause of permanent shortages is the price ceiling. Price ceilings are often imposed on markets because something even more unpopular is occurring — rapid price inflation. As prices jump up, people want to blame someone for their misfortune. Easy scapegoats are the shopkeepers who are asking for ever-higher prices. Politicians looking to score some quick political points advocate for price ceilings as the solution. There is a clear causal chain of events.

|

|

Leading ‘Trump Russia Hoax’ Propagandist’s Wife Indicted As Foreign SpyMax Boot – a big fan of ‘forever wars’ who laundered Trump-Russia conspiracy theories through the Washington Post – is married to a South Korean spy who used to work for the CIA, and is a senior fellow at the Council on Foreign Relations (now on ‘administrative leave) – according to a new indictment revealed on Wednesday. Boot’s wife, Sue Mi Terry, 54, a native of Seoul living in Manhattan, used her position as a foreign policy expert to trade access to top US officials in exchange for luxury goods and ‘high-end sushi dinners,’ according to the indictment. Terry allegedly began spying for South Korea in October 2013, five years after she left the CIA, and three years before Boot began calling Donald Trump a Russian asset. Read more at: https://www.zerohedge.com/political/ex-cia-wife-wapos-spy-hunter-max-boot-indicted-foreign-spy |

|

Probe started into House purchase payments delayAn incident with a global system delayed some major payments on Thursday, such as house purchases. Read more at: https://www.bbc.com/news/articles/cq5xql07n29o |

|

‘I’m owed £10,870 for liposuction’: What went wrong at SK:N?Customers tell the BBC they have no idea if they will be refunded for treatments they paid for in advance. Read more at: https://www.bbc.com/news/articles/cw4yvxw9y5po |

|

Davey says he was ‘lied to’ about Horizon IT flawsFormer Post Office minister says he was lied to about “serious flaws” in the Horizon IT system. Read more at: https://www.bbc.com/news/articles/cw4yvg3p0m8o |

|

Paytm Q1 results preview: Revenue may fall by up to 36%, net loss likely to widenOne 97 Communications, operating Paytm, could report a net loss between Rs 1,013 crore and Rs 840 crore and a revenue between Rs 1,532 crore and Rs 1,490 crore for June 2024, according to estimates by two brokerages. Read more at: https://economictimes.indiatimes.com/markets/stocks/earnings/paytm-q1-results-preview-revenue-may-fall-by-up-to-36-net-loss-likely-to-widen/articleshow/111841268.cms |

|

Vodafone Idea approves Rs 615 crore of share allotment to Nokia, Ericsson via preferential issueVodafone Idea has approved the allotment of 41.52 crore shares worth Rs 615 crore to Nokia and Ericsson at Rs 14.80 per share. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/vodafone-idea-approves-rs-615-crore-of-share-allotment-to-nokia-ericsson-via-preferential-issue/articleshow/111841163.cms |

|

Tech View: Nifty bulls eye Mt 25K as support shifts higher; here’s how to trade on FridayAccording to Nagaraj Shetti of HDFC Securities, the Nifty index is approaching a significant resistance level at 24,960, calculated using a Fibonacci extension based on key market points from March to October 2023. This suggests that we may see increased volatility or consolidation around the 24,950-25,000 range in the near future. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-bulls-eye-mt-25k-as-support-shifts-higher-heres-how-to-trade-on-friday/articleshow/111838648.cms |

|

Biden is in line for a pension of up to $413,000 a year, analysis findsThat should help cushion the blow if the president’s plans change. Read more at: https://www.marketwatch.com/story/biden-is-in-line-for-a-pension-of-up-to-413-000-a-year-analysis-finds-740ca49e?mod=mw_rss_topstories |

|

‘Inflationary’ tariffs by U.S. could upset expectations for multiple Fed rate cutsIf the levying of tariffs causes inflation to jump higher, then the Fed “may not cut rates as aggressively” as estimated, a Wells Fargo team says. Read more at: https://www.marketwatch.com/story/inflationary-tariffs-by-u-s-could-upset-expectations-for-multiple-fed-rate-cuts-into-2025-f674d442?mod=mw_rss_topstories |

|

Amazon Prime Day set records this year — but TikTok’s foray into summer deals had a slower startThe e-commerce giant said its 2024 Amazon Prime Day event was its biggest ever. Read more at: https://www.marketwatch.com/story/amazon-says-2024-prime-day-set-records-ba1ae1d2?mod=mw_rss_topstories |