Summary Of the Markets Today:

- The Dow closed up +0.60% +192 points,

- Nasdaq closed up +1.51%,

- S&P 500 closed up +0.95%,

- WTI crude oil settled at 111, up 0.55%,

- USD $102.12 up 0.34%,

- Gold 1854 up 0.21%,

- Bitcoin down 0.80% to $29620,

- 10-year U.S. Treasury down 0.004% / 2.756%

Today’s Economic Releases:

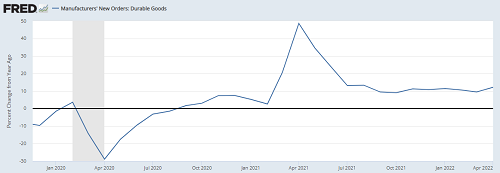

New orders for manufactured durable goods in April 2022 increased 12.2% year-over-year. This is a modest increase over the 9.4% reported for March 2022.

The Federal Reserve’s FOMC May 3-4 2022 meeting minutes were published today. It is interesting that the minutes avoided quantifying future increases to the federal funds rate. A paragraph from the minutes which is a good summary:

Participants agreed that the economic outlook was highly uncertain and that policy decisions should be data dependent and focused on returning inflation to the Committee’s 2 percent goal while sustaining strong labor market conditions. At present, participants judged that it was important to move expeditiously to a more neutral monetary policy stance. They also noted that a restrictive stance of policy may well become appropriate depending on the evolving economic outlook and the risks to the outlook. Participants observed that developments associated with Russia’s invasion of Ukraine and the COVID-related lockdowns in China posed heightened risks for both the United States and economies around the world. Several participants commented on the challenges that monetary policy faced in restoring price stability while also maintaining strong labor market conditions. In light of the high degree of uncertainty surrounding the economic outlook, participants judged that risk-management considerations would be important in deliberations over time regarding the appropriate policy stance. Many participants judged that expediting the removal of policy accommodation would leave the Committee well positioned later this year to assess the effects of policy firming and the extent to which economic developments warranted policy adjustments.

A summary of headlines we are reading today:

- One Billion People Are At Risk Of Rolling Blackouts This Summer

- Dick’s shares rally despite lower forecast; company says outdoor hobbies will outlast pandemic

- Stocks Soar After Dismal Macro Data, Hawkish Fed Minutes

- Iran Deal Has Sunk As Biden Keeps IRGC On Terror List; Tehran “Evaded” Nuclear Inspectors For Years

These and other headlines and news summaries moving the markets today are included below.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Iranian-Russian Oil Smuggling Network Hit With U.S. SanctionsWashington has imposed sanctions on an oil smuggling network led by figures connected to Irans Revolutionary Guards and allegedly backed by the Russian government. Today, the U.S. is sanctioning an international oil-smuggling and money laundering network used to generate revenue for Iran. Anyone purchasing oil from Iran faces the prospect of U.S. sanctions, the U.S. Department of Treasury tweeted Wednesday. Among the sanctioned are current and former members of Irans Revolutionary Guards Quds force, along with Read more at: https://oilprice.com/Latest-Energy-News/World-News/Iranian-Russian-Oil-Smuggling-Network-Hit-With-US-Sanctions.html |

|

Middle East Producers Move To Cut Prices As Extreme Backwardation EasesRecently, China made it clear that it plans to move away from its rigid string of lockdowns, arguably the main demand-curbing trend in Asia over the course of 2022. When setting their June 2022 official selling prices (OSP), most Middle Eastern oil producers did not know that the restrictions were set to be relaxed on June 01, though they could have anticipated it. At the same time, the likes of Saudi Aramco or SOMO already understood the general trend of oil markets the European Union has been closing in on a Russian oil ban, Asia is heading Read more at: https://oilprice.com/Energy/Energy-General/Middle-East-Producers-Move-To-Cut-Prices-As-Extreme-Backwardation-Eases.html |

|

White House Advisors Had Secret Meeting With Saudi Arabia To Discuss EnergyTwo senior White House advisors on Tuesday met in secret with senior Saudi officials to discuss a deal to increase oil production, three current and former U.S. officials told Axios. The meeting, which was not made public, comes prior to another possible meeting between U.S. President Joe Biden and the Crown Prince of Saudi Arabia, Mohammad bin Salman, that could take place at the end of June. Other items that were discussed were a possible arrangement between Egypt, Israel, and Saudi Arabia, and Saudi Arabia and the United States relationship, Read more at: https://oilprice.com/Latest-Energy-News/World-News/White-House-Advisors-Had-Secret-Meeting-With-Saudi-Arabia-To-Discuss-Energy.html |

|

One Billion People Are At Risk Of Rolling Blackouts This SummerThis summer, power grids worldwide won’t produce enough electricity to meet the soaring demand, threatening more than one billion people with rolling blackouts. Grids are stretched thin by fossil fuel shortages, drought and heatwaves, commodity disruptions and soaring prices due to the war in Ukraine, and the failed green energy transition where grid operators retired too many fossil fuel generation plants. Combine this all together, and a perfect storm of blackouts threatens much of the Northern Hemisphere. The power crisis, affecting a Read more at: https://oilprice.com/Energy/Energy-General/One-Billion-People-Are-At-Risk-Of-Rolling-Blackouts-This-Summer.html |

|

Hungary Imposes Windfall Tax On Energy CompaniesA day after declaring a state of emergency, Hungarian leader Viktor Orban said on Wednesday that big companies operating in the country, including energy companies, would be forced to turn over extra profits to the state to fund subsidies. Banks, retailers, airlines, energy companies and all other large corporations in Hungary will be obliged to pay a large part of their extra profits to the state this year and next, Orban said in an announcement made on Facebook. The windfall taxes would be Read more at: https://oilprice.com/Latest-Energy-News/World-News/Hungary-Imposes-Windfall-Tax-On-Energy-Companies.html |

|

U.S. Sees Chances Of Iran Nuclear Deal As SlimThe chances of the world powers reaching a deal with Iran on its nuclear activities that would pave the way toward the removal of the U.S. sanctions on Iranian oil exports are, at best, tenuous, Robert Malley, Special Envoy for Iran, told the Senate Foreign Relations Committee on Wednesday. As I speak to you today, we do not have a deal with Iran and prospects for reaching one are, at best, tenuous, Malley said in prepared testimony to the committee. Moreover, the U.S. is even ready to tighten the sanctions against Iran Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Sees-Chances-Of-Iran-Nuclear-Deal-As-Slim.html |

|

McDonald’s shareholders to vote on proxy fight with Carl Icahn over animal welfare practicesMcDonald’s shareholder’s meeting on Thursday morning will mark the climax of a proxy fight waged by activist investor Carl Icahn. Read more at: https://www.cnbc.com/2022/05/25/mcdonalds-shareholders-vote-on-carl-icahn-proxy-fight-over-animal-welfare.html |

|

Kohl’s stock surges on report bidders are still competing for company amid market volatilityKohl’s shares rose on hopes that the retailer could still be bought amid a volatile market and a recent disappointing earnings report. Read more at: https://www.cnbc.com/2022/05/25/kohls-stock-bidders-are-still-competing-for-company.html |

|

Tom Cruise sets his sights on his first $100 million domestic opening with ‘Top Gun: Maverick’This weekend Tom Cruise has a chance to do something he’s never done before — have a film open to more than $100 million at the domestic box office. Read more at: https://www.cnbc.com/2022/05/25/top-gun-maverick-could-be-tom-cruise-first-100-million-opening-weekend.html |

|

Satellite-imagery firms Maxar, Planet and BlackSky awarded billions of dollars in government contractsThe National Reconnaissance Office announced contracts worth billions of dollars over the next decade to satellite-imagery companies Maxar, Planet and BlackSky. Read more at: https://www.cnbc.com/2022/05/25/nro-announces-satellite-imagery-contracts-to-maxar-planet-blacksky.html |

|

SEC unveils rules to prevent misleading claims and enhance disclosures by ESG fundsThe proposals come after the SEC in March debuted rules that would require publicly traded companies to disclose how climate change risks affect their business. Read more at: https://www.cnbc.com/2022/05/25/sec-unveils-rules-to-prevent-misleading-claims-by-esg-funds-.html |

|

Dick’s shares rally despite lower forecast; company says outdoor hobbies will outlast pandemicDick’s trimmed its outlook for the year amid uncertain economic conditions, but the retailer said it isn’t yet seeing any dramatic shifts in its business. Read more at: https://www.cnbc.com/2022/05/25/dicks-sporting-goods-dks-q1-2022-earnings-top-estimates-outlook-cut.html |

|

Mortgage demand slides further, even as interest rates pull back slightlyMortgage rates turned lower for the second straight week, according to the Mortgage Bankers Association. Read more at: https://www.cnbc.com/2022/05/25/mortgage-demand-slides-further-even-as-interest-rates-pull-back-slightly.html |

|

Here’s the best way to use a health savings account, which offers a triple-tax advantageHealth savings accounts can be a powerful way to build wealth and save for medical costs in old age, according to financial advisors. Read more at: https://www.cnbc.com/2022/05/25/the-best-way-to-use-a-health-savings-account-hsa.html |

|

Stocks making the biggest moves midday: Dick’s Sporting Goods, Nordstrom, Wendy’s and moreThese are the stocks posting the largest moves in midday trading. Read more at: https://www.cnbc.com/2022/05/25/stocks-making-the-biggest-moves-midday-dicks-sporting-goods-nordstrom-wendys-and-more.html |

|

Capital gains may have triggered hundreds of billions more in individual taxes for 2021, analysis shows. How to trim your tax billIndividuals paid significantly more taxes this season, and the surge in capital gains in 2021 may be to blame, according to the Penn Wharton Budget Model. Read more at: https://www.cnbc.com/2022/05/25/capital-gains-may-have-triggered-more-individual-taxes-for-2021.html |

|

Wendy’s shares surge as Trian, its largest shareholder, explores potential dealThe hedge fund said it was seeking a deal to “enhance shareholder value” that could include an acquisition or merger, according to the filing. Read more at: https://www.cnbc.com/2022/05/24/wendys-shares-surge-as-trian-its-largest-shareholder-explores-potential-deal.html |

|

Electric vehicles are in short supply. Here’s what you can find as gas prices soarIf consumers don’t want to wait for a new EV, some models may be easier to find than others, according to industry data compiled by CNBC. Read more at: https://www.cnbc.com/2022/05/24/electric-vehicles-are-in-short-supply-heres-what-you-can-find-as-gas-prices-soar-.html |

|

Warriors coach Steve Kerr angrily condemns senators for inaction on guns after Texas school shooting“When are we going to do something?” Warriors head coach Steve Kerr shouted at a press conference before his team was set to take on the Dallas Mavericks. Read more at: https://www.cnbc.com/2022/05/24/uvalde-texas-school-shooting-steve-kerr-condemns-senators-for-inaction-on-guns.html |

|

The Consent Of The Governed Is Slipping AwayThe Consent Of The Governed Is Slipping AwayAuthored by Charles Hugh Smith via OfTwoMinds blog, The realization that we’re not actually being represented at the federal level has eroded the consent of the governed for the national government.

The foundation of any government is the consent of the governed. Democracies and republics are founded on the consent of the governed earned via representational or direct democracy: those who have a say and a stake in the system will give their consent to the government, even if an opposing view is in the majority because their opinion is part of the governance structure. Even totalitarian states ultimately depend on the consent of the governed, as repressive states that lose legitimacy cannot imprison or kill a majority of their populaces, or restore legitimacy via coercion once the populace has nothing left to lose and the organs of state oppression realize the regime i … Read more at: https://www.zerohedge.com/political/consent-governed-slipping-away |

|

Stocks Soar After Dismal Macro Data, Hawkish Fed MinutesStocks Soar After Dismal Macro Data, Hawkish Fed MinutesAnother day, another disappointing US macro data point (durable goods orders printed less than expectations)…

Source: Bloomberg Other than April 2020 – when the entire economy was closed – May’s serial disappointment in US Macro data is the worst since Lehman No new news is good news for stocks as The Fed Minutes – which are as hawkish as they have been at any time in the last 30 years… Read more at: https://www.zerohedge.com/markets/stocks-soar-hawkish-fed-minutes-dismal-data |

|

Fool Me Twice: Former WeWork CEO Adam Neumann Raises $70 Million For New “Crypto Carbon Credit” StartupFool Me Twice: Former WeWork CEO Adam Neumann Raises $70 Million For New “Crypto Carbon Credit” StartupIn the long line of annoying, inefficient, Silicon Valley-like CEOs we’ve been presented with over the last couple of years (names like Vlad Tenev and Jack Dorsey come to mind), none have held a candle to WeWork’s Adam Neumann. And Neumann, who is most famous for being paid more than $2 billion from WeWork as its valuation plunged from nearly $50 billion to less than $10 billion amidst reports of his erratic behavior, is back at it again. He is now listed as “both a founder and an investor in the climate startup Flowcarbon,” a new report from Bloomberg said this week. And Flowcarbon had no problem raising $70 million from venture capitalists that included Andreessen Horowitz, the report says. Flowcarbon is a 35 employee company based in Berlin that sells carbon credits and keeps a record on the blockchain. Read more at: https://www.zerohedge.com/markets/former-wework-ceo-adam-neumann-raises-70-million-new-crypto-carbon-credit-startup |

|

Iran Deal Has Sunk As Biden Keeps IRGC On Terror List; Tehran “Evaded” Nuclear Inspectors For YearsIran Deal Has Sunk As Biden Keeps IRGC On Terror List; Tehran “Evaded” Nuclear Inspectors For YearsAt this point it looks like hopes for a restored Iran nuclear deal have effectively sunk, given that Politico is reporting President Biden has decided against taking the Islamic Revolutionary Guard Corps (IRGC) off the designated terrorist list. “President Joe Biden has finalized his decision to keep Iran’s Islamic Revolutionary Guard Corps on a terrorist blacklist, according to a senior Western official, further complicating international efforts to restore the 2015 Iran nuclear deal,” Politico writes Wednesday. The Israeli government has already been informed: “Another person familiar with the matter said Biden conveyed his decision during an April 24 phone call with Israeli Prime Minister Naftali Bennett, adding that the decision was conveyed as absolutely final and that the window for Iranian concessions had closed,” according to the report. Read more at: https://www.zerohedge.com/geopolitical/iran-deal-sunk-biden-keep-irgc-terror-list-amid-report-tehran-deceived-nuclear |

|

Energy bill support of £10bn set to be unveiledA new package to help people with energy bills is expected to be funded by a windfall tax on firms. Read more at: https://www.bbc.co.uk/news/business-61584546?at_medium=RSS&at_campaign=KARANGA |

|

Volkswagen to pay out £193m in ‘dieselgate’ settlementMore than 90,000 people will get payouts over the installation of emissions cheating devices. Read more at: https://www.bbc.co.uk/news/business-61581251?at_medium=RSS&at_campaign=KARANGA |

|

Marks & Spencer shifts from town centres as online sales growThe retail giant says it is relocating some stores from older buildings with poor access and parking. Read more at: https://www.bbc.co.uk/news/business-61575556?at_medium=RSS&at_campaign=KARANGA |

|

Export duty on steel puts pressure on capex returns; Tata Steel, SAIL may see lower realizations“The 15% export tax will reduce the margins on steel exports, which were attractive for the last year due to lower exports from China (due to its de-carbonisation drive) and higher energy prices in Europe,” the brokerage said. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/export-duty-on-steel-puts-pressure-on-capex-returns-tata-steel-sail-may-see-lower-realizations/articleshow/91796490.cms |

|

Confused over sector allocation after market correction? Here’s what experts suggestMarket analysts suggest that investors should pick the stocks and sectors according to their risk appetite but should use this correction to rebalance their portfolio and allocate resources, responsibly. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/confused-over-sector-allocation-after-market-correction-heres-what-experts-suggest/articleshow/91785366.cms |

|

Sri Lankan crisis sent this debutant stock tumbling. Analysts see up to 72% upside!Motilal Oswal has initiated coverage on the stock with a target of Rs 1,420 that suggests a 44 per cent potential upside. The brokerage has assigned an FY24 EV/Ebitda multiple of 27 times to the KFC business on account of its robust metrics including average daily sales (ADS) and brand contribution margin, and 17 times to the PH business. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/sri-lankan-crisis-sent-this-debutant-stock-tumbling-analysts-see-up-to-72-upside/articleshow/91782733.cms |

|

Brett Arends’s ROI: Guess who’s buying stocks?Insider stock purchases have surged as share prices have plunged Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7DBB-71D47219EAC0%7D&siteid=rss&rss=1 |

|

George Floyd’s death spurred promises to support Black-owned businesses. Two years later, was it all talk?‘I would not have gone that fast without him,’ a wine company founder tells MarketWatch. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7DC0-F23651104702%7D&siteid=rss&rss=1 |

|

Outside the Box: Don’t believe the hype: The economy isn’t headed toward a recession, and the Fed isn’t ‘behind the curve’ on interest ratesThe stock and bond markets may be tumbling, but the economy has been holding up exceptionally well since its emergence from the pandemic shock. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7DC6-8A9D921A1E0B%7D&siteid=rss&rss=1 |